TIDMCML

RNS Number : 3095P

CML Microsystems PLC

09 June 2020

9 June 2020

CML Microsystems Plc

("CML" or the "Group")

Full Year Results

CML Microsystems Plc, which designs, manufactures and markets

semiconductors, primarily for global communication and solid state

storage markets, announces its Full Year Results for the year ended

31 March 2020.

Financial Highlights

-- Group revenues of GBP26.42m (2019: GBP28.14m)

-- Gross profit GBP19.57m (2019: GBP20.25m)

-- Profit before tax GBP1.37m (2019: GBP2.98m)

-- Basic EPS 8.98p (2019: 15.77p)

-- Net cash of GBP8.48m (31 March 2019: GBP12.81m) reflecting

record R&D investment, the acquisition of PRFI and two dividend

payments totaling GBP1.33m

-- Recommended final dividend of 2.0p equates to 4.0p for the

year (2019: 7.8p), reflects prudence in light of COVID-19

environment

Operational Highlights

-- Communications 57% of Group revenue (2019: 54%)

o Revenue GBP15.0m (2019: GBP15.2m)

o Solid gains in USA and Europe did not offset fall in Far

East

o Five new products released, including first Raspberry Pi

platform

o Market continues to exhibit a number of growth areas

-- Storage 43% of Group revenue (2019: 46%)

o Revenue GBP11.4m (2019: GBP12.9m)

o Sales in H2 up 12% on first half

o Three new products released

o M ass production availability of X1 SATA3 Controller IC

-- Acquisition of Plextek RFI Ltd

o Complements organic growth plans, adds new independent

services and consulting income stream

-- Record R&D investment of GBP8.46m (2018: GBP8.24m)

Chris Gurry, Group Managing Director of CML Microsystems

commented on the results :

" There is no hiding from the fact that the year under review

has been difficult, and the current environment is delaying

realisation of the benefits to come from the hard work taking place

behind the scenes.

The current financial year did commence with a healthier order

book than the prior year, although it remains to be seen how this

translates to actual market consumption as there may be an element

attributable to COVID-19 related supply concerns amongst the

customer base.

Nevertheless, following the operational adjustments made across

the prior year, the business is tuned to react swiftly to a revival

in demand and the Board remain convinced that a return to growth

will be secured as conditions improve. "

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Tel: +44(0)1621 875 500

Director Tel: +44(0)1621 875 500

Nigel Clark,

Group Non-Exec Chairman and

Financial Director

Shore Capital Tel: +44(0)20 7408 4090

Edward Mansfield

James Thomas

SP Angel Corporate Finance Tel: +44(0)20 3463 2260

LLP

Jeff Keating

Alma PR

Josh Royston Tel: +44 (0)20 3405 0206

Caroline Forde

About CML Microsystems PLC

CML designs and develops semiconductors for the industrial

storage and communications markets. The Group has trading

operations in Europe, the Far East and USA. CML targets niche

markets with strong growth profiles and high barriers to entry. It

has secured a diverse, blue chip customer base, including some of

the world's leading telecoms equipment providers and industrial

product manufacturers.

The spread of its customers and products largely protects the

business from the cyclicality usually associated with the

semiconductor industry. Growth in its end markets is being driven

by factors such as the ever increasing trend towards solid state

storage devices in the commercial and industrial sectors, the

upgrading of telecoms infrastructure around the world and the

growing prevalence of private commercial communications networks

for voice and/or data communications linked to the industrial

internet of things (IIoT).

The Group is cash-generative, has a net cash position and is

dividend paying.

CHAIRMAN'S STATEMENT

Introduction

As I look back over the year, I take pride in the resilience of

the Group; its people, operational structure and balance sheet

strength. We entered the year faced with the ongoing market-wide

challenges of extended raw material supply times and the US/China

trade war, and we closed the year facing the unprecedented

challenge presented by COVID-19. However, against this backdrop,

the Group has delivered a year of stabilisation. While COVID-19 may

impact a return to growth in the short term, the depth and quality

of our product portfolio, the breadth of our customer base and the

strength of our extended sales operation mean the long-term

opportunity for the Company is undiminished.

Results and dividend

Revenues for the year fell by 6.1% to GBP26.42m (2019:

GBP28.14m). With costs of GBP0.7m relating to M&A activities

and restructuring announced in November 2019, profit before

taxation fell by 54% to GBP1.37m (2019: GBP2.98m) and basic EPS by

43% to 8.98p (2019: 15.77p). Net cash at the year end was GBP8.48m,

a drop of GBP4.33m (2019:GBP12.81m), reflecting record R&D

investment, the acquisition of PRFI and two dividend payments

totalling GBP1.33m.

The Group continues to benefit from a strong balance sheet with

a healthy net cash position and operating cash generation. The

Board remains committed to its dividend policy of being progressive

in line with revenues and profitability. Despite the ongoing

uncertainty caused by the COVID-19 pandemic, the Board is confident

in the Group's ability to continue to generate cash underpinned by

a robust balance sheet. As such, the Board has recommended a final

dividend of 2.0p per ordinary 5p share, equating to a total for the

year of 4.0p (2019: 7.8p). If approved, this will be paid on 7

August 2020 to shareholders whose names appear on the register at

close of business 24 July 2020.

Strengthened operational structure

This has been a year of significant strategic activity across

the Group, to ensure our resources and capabilities are closely

aligned with our ambitions. This activity has resulted in global

operational changes that will improve our effectiveness and

efficiency as we enter the next financial year and help accelerate

delivery of the business strategy. The acquisition of

Cambridge-based specialist design house, Plextek RFI Ltd (" PRFI"),

in March 2020 was another important element of this activity,

complementing our plans for expansion within the Communications

markets.

COVID-19

Our primary focus since January has been the welfare of our

teams around the world in the face of the COVID-19 pandemic. We

have closed locations in a timely manner as government legislation

has required us to do so, and only maintained production activity

where it has been deemed possible to achieve within government

safety guidelines. At this time, our China operations based in Wuxi

and Shanghai are once again fully operational, in line with all

relevant government safeguarding legislation. Travel restrictions

within China are gradually being lifted. We have maintained a

reduced production team at our UK operations, with all office-based

staff working remotely. We have had no requirement to furlough any

staff. Supply chain disruptions to date are minimal and of a

short-term nature.

Given the nature of the professional markets in which we

operate, we anticipate our end customers being insulated from a

consumer downturn to some extent, although the roll-out of some new

products may be delayed, dampening demand for our semiconductors.

Our current order book is strong, however it is not yet clear as to

whether this will be a long-term trend or reflects a precautionary

increase in inventory by our customers.

Employees

The positive response by our teams to the changes we have been

required to implement to our working practices has been very

supportive. Once again, the CML teams across the world have proven

their resilience and dedication, for which we, the Board, are

extremely grateful. They have continued to work tirelessly under

difficult circumstances and their dedication both to CML and our

customers has not waivered. While many of us have not been able to

meet our new colleagues from PRFI face to face, they have

integrated well and we have enjoyed welcoming them into the Group.

As we continue to face the challenges of COVID-19, we do so with

the support of a dedicated, talented team around the world.

Our Company has a rich culture having been in operation for over

50 years, which runs through all of our operations and with a

combined sense of purpose is evident in every facet of our

business.

The Board

As announced in November 2019, our CFO Neil Pritchard resigned

to pursue other business opportunities and the Board would like to

thank him for his service to the Company. Having previously held

the position of Group CFO, I re-assumed the role on an interim

basis until such time as we are able to commence a full recruitment

process, which at this stage we anticipate will be in the second

half of the current financial year. In the meantime, I have stepped

off the Audit Committee until such time as a replacement CFO has

been recruited.

Prospects and outlook

Clearly these are difficult times with a global pandemic,

geo-political trade issues and Brexit looming but, as a Board, even

in these difficult times, we still maintain the belief that the

Group is well placed to move positively forward in the medium to

long term. This belief is underpinned by a strong balance sheet and

no debt, coupled with a sound product portfolio that addresses

markets that have a positive outlook. The strategy in place, when

eventually these current global uncertainties and negative

influences subside, should mean, we are well placed to return a

meaningful uplift in the Group's performance.

Nigel Clark

Group Non-Executive Chairman

OPERATIONAL AND FINANCIAL REVIEW

Introduction

As we entered into the 2019/2020 financial year our strong

belief was that it would prove to be a year of stabilisation,

following previous periods of inventory correction, raw material

constraints and political headwinds. I'm pleased to report that

despite the highly challenging conditions, including the COVID-19

pandemic, this has proved to be the case. The first half of the

financial year confirmed our view that there was no further

deterioration in our end markets with sequential six-monthly order

bookings a little ahead. A shortening of the timescale between

customer order placement and requested delivery date was also

evidenced, which is another good indicator for our business.

Following the interim results announcement in November 2019,

order intake was improving before the outbreak of the coronavirus

hampered this progress as companies, firstly in China and then

globally, initiated their business continuity processes.

Nevertheless, overall revenues for the second half were similar to

those of the first half.

During the course of the year we have continually assessed the

resources and capabilities within CML to ensure that they are

aligned with the direction of travel for our business and a number

of operational changes have been made which will improve our

effectiveness and efficiency. These follow the investments made in

previous periods to broaden and augment our sales reach, which have

improved our pipeline of opportunities. In tandem with this, in

March we acquired Plextek RFI Ltd ("PRFI") a UK based design house

specialising in the design and development of RF, Microwave and

Millimetre-wave (mm-wave) ICs and modules. PRFI's design expertise

expands upon the Group's existing skills and provides a new

independent services and consulting income stream for CML. Most of

the costs associated with these operational changes and corporate

activities have been recognised in this year under review, which

impacted pre-tax profits for the year.

Financial review

Total revenues for the year fell by 6.1% to GBP26.42m (2019:

GBP28.14m) including a small one month contribution (GBP0.06m) from

the acquisition of PRFI Limited during March 2019. At the gross

profit level, an improved margin helped reduce the decline to just

over 3%, delivering a gross profit of GBP19.57m (2019:

GBP20.25m).

Geographically, the Far East region was the single largest

contributor to the overall drop in sales, delivering a reduction of

GBP2.17m (16%) and exceeding the overall Group revenue drop of

GBP1.72m. The remaining regions either grew or were robust by

comparison. The Far East accounted for 50% of Group revenues with

sales into Europe, the Americas and Others representing 30%, 19%

and 1% of Group revenues respectively.

Distribution and administration costs increased to GBP18.75m

(2019: GBP18.07m) driven by abnormal costs of GBP0.7m and higher

R&D amortisation charges. These abnormal costs result from a

combination of M&A activities, one of which resulted in the

acquisition of PRFI Ltd, along with global restructuring expenses

that were incurred following completion of an assessment of the

Group's resources and capabilities, first communicated to the

market in November 2019.

Total R&D spend for the year rose slightly to GBP8.46m

(2019: GBP8.24m) with associated amortisation of development costs

climbing GBP0.56m to GBP5.71m (2019: GBP5.15m).

The Group operated a tight cost control policy throughout the

year under review and aside from non-recurring expenses and the

increased R&D spend, underlying costs were relatively

stable.

The Group recorded a small loss of GBP0.05m from foreign

currency exchange compared to a gain of GBP0.26m in the prior year

although continues to have a somewhat natural hedge at the gross

profit line in respect of foreign currency exposure, given that the

majority of both revenues and raw material costs are US Dollar

denominated.

Other operating income for the year amounted to GBP0.69m (2019:

GBP0.64m) and was a result of rental income obtained from

ex-operational property assets, grant income received from R&D

activities and an element of profit on third-party product

re-sales.

Profit from operations fell by 44% to GBP1.50m (2019:

GBP2.81m).

After adjusting for the combined effects of share-based payments

and finance income, a profit before taxation figure of GBP1.37m was

achieved (2019: GBP2.98m) which included a small loss of GBP0.02m

from newly acquired PRFI Ltd.

An income tax credit of GBP0.16m was recorded for the year

against a charge of GBP0.29m in the preceding year reflecting lower

profitability for the year and the ongoing benefit of UK R&D

tax credits. Profit after tax was GBP1.54m (2019: GBP2.69m).

The Group, along with many other companies under IFRS GAAP,

adopted the new leasing standard (IFRS 16) with effect from 1 April

2019. The overall effect has been to record operating leases (such

as property, vehicle and office equipment rentals etc.) as an asset

on the balance sheet as if those items had been purchased, with the

corresponding lease payments recognised as a liability. The net

result of these changes is negligible. Rentals are now replaced by

depreciation and interest which has had little impact on net

profitability, but the EBITDA calculation shows the depreciation

for these 'right-of-use' assets as an additional add-back

adjustment of GBP0.46m for the period. Adjusted EBITDA was GBP8.28m

(2019: GBP8.75m) and assisted by an improved tax rate, the basic

earnings per share figure recorded was 8.98p (2019: 15.77p).

Cash management across the Group remained an important focus

area throughout the year. Net cash reserves at 31 March 2019 stood

at GBP8.48m (31 March 2019: GBP12.81m) following record R&D

investment, the acquisition of PRFI and two dividend payments

totalling GBP1.33m; being the final payment for the FY19 financial

year (GBP0.99m) and an interim payment in respect of FY20

(GBP0.34m).

Overall inventory levels at the financial year end were 17%

lower than the beginning of the year at GBP2.39m (2019: GBP2.88m)

with finished goods stocks in particular at very low levels. The

policy that the Group had in place to mitigate certain supply chain

difficulties helped react promptly to the improving order intake

that was seen as we entered the current calendar year

The pension deficit associated with the Group's historic final

salary scheme, as calculated under IAS 19, increased to GBP4.70m

(2019: GBP3.55m). The assets of the scheme fell to GBP19.18m (2019:

GBP20.63m) with the present value of funded obligations reducing to

GBP23.87m (2019: GBP24.18m). The main reasons for the increased

deficit in the IAS 19 accounting position relate to (i) changes in

the assumptions in using a lower discount rate due to the fall in

corporate bond yields at the period end; and (ii) the Scheme's

investments return was lower than the IAS 19 mandated increase in

the obligation over the year.

Separately from the IAS 19 calculation, the most recent

triennial actuarial valuation on the scheme carried out by an

independent professionally qualified actuary, as at 31 March 2017,

resulted in a net pension surplus of GBP1.89m. An approximate

update of the funding position was carried out as at 31 March 2019

which, when viewed as a continuing scheme, showed a net surplus of

GBP3.15m (31 March 2018: GBP3.17m). The report further stated that

the scheme assets remained sufficient to cover 118% of the benefits

accrued to members, after allowing for future increases in these

benefits.

COVID-19

The welfare and safety of our employees has been of paramount

importance throughout the pandemic and remains a priority. Our

China-based operations were the first to be affected in January and

we were swift to implement the necessary precautions and measures

in line with guidance and were able to supply our workforce there

with personal protective equipment that was scarce locally. Our

experience in China helped us as we implemented similar processes

throughout our operations as the virus spread, again in line with

all local guidance.

Due to the nature of our work, our facilities, and indeed those

of our key suppliers, are clean and manufacturing facilities need

to meet strict hygiene regulations, with access limited to the

workforce. As at the time of publication of this report, our

operations are fully functional, albeit through a change in working

methodologies and it is comforting to note that we have had no

confirmed incidences of COVID-19 related ill health. Travel

restrictions, both within individual countries as well as

internationally, affect our sales teams' ability to mobilise and

physically meet with customers but they have reacted well to remote

working.

Strategy overview

The Group's strategy today remains consistent with that

previously communicated. Our business remains focused on two

important markets, namely industrial Communications and industrial

Storage, where our proprietary IP along with the quality and

reliability of our technology sets us apart from our peers and

makes us an integral part of our customers' products. We have

developed a strong reputation in both of these markets and we

continue to supply a growing world class customer base. This,

coupled with an extensive sales network and expanded presence

globally, will enable us to scale further once market conditions

ease.

Growth in both markets is continually being driven by the

persistent demand for increasing amounts of data to be delivered

faster and stored more reliably and securely. We remain committed

to generating a diverse revenue stream across a broad range of

customers. We are a single-source supplier to our customers,

meaning that once designed in, the displacement of our chips would

require our customers to undertake an element of product redesign.

This has served us particularly well recently as geo-political

issues have made international trade between certain countries more

difficult. Rather than sourcing locally produced goods as potential

replacements, the evidence is that customers are insisting on our

products due to their proven quality and reliability.

R&D remains a key tenet of our growth strategy. Our focus is

on developing products which will lead to design wins with new and

existing customers that we believe have the potential to develop

into long-term, significant revenue generators. Throughout the

difficult trading conditions, we have continued our investment into

R&D as we have no doubt that this approach will serve us best

in the long run and deliver superior, sustainable returns for our

shareholders. With that said, as a Board we are mindful of the

ongoing conditions and continue to monitor investment levels

carefully.

The acquisition of PRFI was a further example of our desire to

add businesses which can help us achieve our strategic goals and

complement our organic growth. The Company has a proven track

record of successful corporate activity and will continue to seek

and evaluate appropriate opportunities.

Communications

Our strategy within the Communications market is to grow

revenues through wider customer engagement and drive a larger

serviceable market from an expanded semiconductor product range

that builds upon an extensive intellectual property library.

The Group has been a key component supplier to major blue chip

OEMs within numerous sub-sectors of the global Communications

market for a number of decades. Product functionality over time has

evolved from tone switches and decoders through to signal

processing solutions, baseband processors and integrated modem

solutions for a variety of dedicated industrial wireless networks

around the world.

The feature sets of those products are generally radio frequency

("RF") agnostic, but over the last ten years or so, significant

investments have been made into engineering skills and associated

R&D activities to introduce a range of RF components. The

resulting combined chip-sets now cover customer functionality needs

from the antenna through to the microprocessor of choice. Initial

product releases focussed on operating frequency bands below 1GHz,

while more recently the range has been extended to encompass

frequencies up to 3.6GHz.

Sales revenues from applications within the Communications

sector were slightly down year on year and amounted to GBP14.94m

(2019: GBP15.14m). Shipments into wireless public safety customers

were generally quite robust while the situation across a wide range

of data-centric Industrial Internet of Things (IIoT) customers was

mixed and biased towards customer products prioritising high

performance and reliability. Revenues from the Americas and Europe

posted good gains but were unable to make up a significant

shortfall from the Far East customer base. Continued uncertainty

over the trade war with the USA remains, including expectations

that phase two of a trade agreement will not be in place ahead of

the US elections in the autumn. This is still impacting government

spending on some local infrastructure projects, such as railway and

power, whilst customers in surrounding countries who depend upon

exports into China are also affected.

Five new products were released across the year targeted at a

number of communications sub-markets including satellite

communications, wireless power telemetry networks and marine

collision avoidance. Associated demonstration and development

platforms were also released, including the Group's first Raspberry

Pi platform bringing the advanced features of the CMX655D audio

codec, launched during the prior year, to the Raspberry Pi

community. The Raspberry Pi is a series of small single-board

computers originally developed in the United Kingdom by the

Raspberry Pi Foundation to promote teaching of basic computer

science in schools and in developing countries. As time has

progressed, alongside traditional educational use, more serious

industrial and

commercial uses are foreseen making it a viable solution for "IIoT" applications.

The Communications market continues to exhibit a number of

growth areas including the transition to higher-capacity digital

networks within voice-centric markets and, in data-centric markets,

the increasing data throughput and reliability requirements from

terrestrial and satellite communications applications. The latter

is required to meet the needs of the growing Machine-to-Machine

("M2M") and IIoT sectors.

Storage

The focus within the Storage market sector has been on expanding

our product portfolio to include all major interface standards used

within the target industrial end-markets and to ensure

interoperation with all relevant third-party Flash Memory devices

from a number of leading global suppliers. This enables customers

to benefit from bill-of-materials cost efficiencies linked to new

flash technologies.

Over the last few years, the product portfolio has transitioned

from a narrow "Controller" product portfolio with only CompactFlash

as the available interface, to an enlarged product range that now

also includes USB, SD, SATA & MMC interface technologies. An

associated proprietary Application Programmers Interface ("API")

enables customers to either develop or "port" their own solutions

to the Group's standard Controller solutions and benefit from the

class-leading levels of reliability and durability that the Group's

Hyperstone brand is becoming increasingly recognised for

globally.

Storage revenue for the majority of the year continued to feel

the combined effects of customer inventory over build and the

economic trade conflict between the USA and China. The challenges

associated with this environment resulted in a revenue decline of

11% for the year as a whole to GBP11.41m (2019: GBP12.87m). That

said, sales in the six months to March 31 2020 were up 12%

sequentially following a stronger period of order bookings and

subsequent shipments during the closing months of the year. As with

the Communications sector, uncertainties persist around US-China

trade relations but, encouragingly, there are one or two end

application areas that are bucking the trend.

At the interim stage, we reported that 4G/5G infrastructure

design wins and a number of industrial SATA SSD opportunities were

poised to drive growth in the future. It is therefore pleasing to

report that at the turn of the calendar year the situation began to

improve, evidenced by increased order bookings and subsequent

shipments related to a number of prior design wins in multi-year

growth application areas, including 5G infrastructure and data

security for point of sale applications.

In November 2019 we announced mass production availability of

the X1 SATA3 controller following its sampling availability in the

early part of the calendar year. The product has subsequently

achieved design-in status across a number of major industrial

customers with several customer designs ongoing including mSATA and

CFAST industrial form factors. Three new products were released

over the period, targeted at specific Compact-Flash and USB host

interface variants. Several new API customers were secured and the

evolution of the hyMap firmware continued, specifically related to

functionality and flash memory compatibility which are essential

factors in the success of the complete controller product range.

Advanced health monitoring and SMART tools were also developed to

optimise Controller solutions for specific applications and ensure

fail safe operation.

The industrial data storage market has several specific areas

which represent attractive growth opportunities playing to the core

strengths of the business. These include applications within

industrial automation, the telecoms/network infrastructure market

and an increasing number of security conscious sub-markets where

the Group's proprietary technology and bespoke programming

capabilities offer customers enhanced levels of security compared

to competitor products.

Market developments

The underlying growth trends within our two main industrial

application areas continue to strengthen and underpin confidence in

our strategy. The persistent demand for increasing amounts of data

to be transmitted and stored more quickly and securely remains. For

Communications markets this equates to more product opportunities

through higher speed requirements, enhanced error correction

techniques and operation at higher radio frequencies where wider RF

channels are permitted. Within industrial Storage markets, the

transition to solid state technology from hard disk drives is well

and truly underway at a time when our product portfolio has

expanded, positioning the business well to capture share over

time.

Operational developments

The performance of the business at an operational level has been

particularly encouraging given the environment created by the

COVID-19 pandemic. A new global Enterprise Resource Planning

("ERP") system that commenced live rollout in the prior calendar

year has been successfully deployed throughout the Group with the

exception of the China operations due to travel restrictions

associated with COVID-19. That aside, the Group benefited from the

efficiencies associated with running a unified system during the

year.

The Group has continued to perform well at an operational level

with disciplined execution across a number of areas. The operations

team overcame several challenges associated with a combination of

temporary and permanent supplier factory closures across the year

and it is a great credit to our operations team that impact on the

business was limited.

The investments made in sales and marketing capabilities during

prior years has helped to increase the pipeline of opportunities

and improved our overall reach and routes to market. As a

consequence, further enhancements and efficiencies were made to the

sales channels over the last year, resulting in the appointment of

additional distribution partners in the USA, the consolidation of

existing sales channels within Europe and the closing of our own

warehousing facility in North America.

We periodically assess the wider resource levels and

capabilities within the Group to ensure that they reflect the

direction of travel on which the Group is heading. As a result,

various changes have been made during the year, touching operations

in the UK, Asia and the Americas. The resulting structure and

associated capability mix positions us well for growth

Outlook

There is no hiding from the fact that the year under review has

been difficult, and the current environment is delaying realisation

of the benefits to come from the hard work taking place behind the

scenes.

The current financial year did commence with a healthier order

book than the prior year, although it remains to be seen how this

translates to actual market consumption as there may be an element

attributable to COVID-19 related supply concerns amongst the

customer base.

Nevertheless, following the operational adjustments made across

the prior year, the business is tuned to react swiftly to a revival

in demand and the Board remain convinced that a return to growth

will be secured as conditions improve.

Chris Gurry

Group Managing Director

Consolidated income statement for the year ended 31 March

2020

Unaudited Audited

2020 2019

Notes GBP'000 GBP'000

---------------------------------------------- ------ ---------- ---------

Continuing operations

Revenue 1,2 26,420 28,140

---------------------------------------------- ------ ---------- ---------

Cost of sales (6,855) (7,887)

---------------------------------------------- ------ ---------- ---------

Gross profit 19,565 20,253

Distribution and administration costs (18,762) (18,074)

---------------------------------------------- ------ ---------- ---------

803 2,179

Other operating income 689 635

---------------------------------------------- ------ ---------- ---------

Profit from operations 1,492 2,814

Share -- based payments (139) (117)

---------------------------------------------- ------ ---------- ---------

Profit after share -- based payments 1,353 2,697

Profit on disposal of property 7 - 222

Profit on disposal of property, plant and 11 -

equipment

Finance income 106 64

Finance expense (96) (1)

Profit before taxation 1,374 2,982

---------------------------------------------- ------ ---------- ---------

Income tax credit / (expense) 4 162 (288)

---------------------------------------------- ------ ---------- ---------

Profit after taxation 1,536 2,694

---------------------------------------------- ------ ---------- ---------

Profit after taxation attributable to equity

owners of the parent 1,536 2,694

---------------------------------------------- ------ ---------- ---------

Basic earnings per share

From profit for year 5 8.98p 15.77p

---------------------------------------------- ------ ---------- ---------

Diluted earnings per share

From profit for year 5 8.94p 15.36p

---------------------------------------------- ------ ---------- ---------

Adjusted EBITDA

Adjusted EBITDA for year 6 8,276 8,754

-------------------------- ------ ------

Consolidated statement of total comprehensive income for the

year ended 31 March 2020

Unaudited Unaudited Audited Audited

2020 2020 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ---------- ---------- -------- --------

Profit for the year 1,536 2,694

Other comprehensive (expense)/income:

Items that will not be reclassified

subsequently to profit or

loss:

Actuarial loss on retirement

benefit obligations (995) (1,317)

Deferred tax on actuarial

loss 187 224

----------------------------------------- ---------- ---------- -------- --------

Items reclassified subsequently

to profit or loss upon derecognition:

Foreign exchange differences 308 104

----------------------------------------- ---------- ---------- -------- --------

Other comprehensive expense

for the year net of taxation

attributable to equity owners

of the parent (500) (989)

----------------------------------------- ---------- ---------- -------- --------

Total comprehensive income

for the year attributable

to the equity owners of the

parent 1,036 1,705

----------------------------------------- ---------- ---------- -------- --------

Consolidated statement of financial position as at 31 March

2020

Unaudited Unaudited Audited Audited

2020 2020 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ---------- ---------- -------- --------

Assets

Non -- current assets

Goodwill 10,741 9,235

Other intangible assets 1,823 1,775

Development costs 16,930 14,495

Property, plant and equipment 4,976 5,307

Right-of-use assets 1,184 -

Investment properties 3,170 3,170

Investments 83 83

Deferred tax assets 1,343 908

------------------------------------ ---------- ---------- -------- --------

40,250 34,973

Current assets

Inventories 2,390 2,882

Trade receivables and prepayments 5,075 3,430

Current tax assets 1,044 1,118

Cash and cash equivalents 8,479 13,471

------------------------------------ ---------- ---------- -------- --------

16,988 20,901

----------------------------------- ---------- ---------- -------- --------

Total assets 57,238 55,874

------------------------------------ ---------- ---------- -------- --------

Liabilities

Current liabilities

Bank loans and overdrafts - 662

Trade and other payables 4,036 4,634

Lease liabilities 502 -

Current tax liabilities 85 77

Provisions - current - 195

------------------------------------ ---------- ---------- -------- --------

4,623 5,568

Non -- current liabilities

Deferred tax liabilities 4,960 4,420

Lease liabilities 568 -

Retirement benefit obligation 4,697 3,548

Provisions - non current - 16

------------------------------------ ---------- ---------- -------- --------

10,225 7,984

----------------------------------- ---------- ---------- -------- --------

Total liabilities 14,848 13,552

------------------------------------ ---------- ---------- -------- --------

Net assets 42,390 42,322

------------------------------------ ---------- ---------- -------- --------

Capital and reserves attributable to equity owners

of the parent

Share capital 859 859

Share premium 9,286 9,279

Capital redemption reserve 9 9

Treasury shares - own share

reserve (80) (342)

Share -- based payments reserve 582 507

Foreign exchange reserve 1,714 1,406

Accumulated profits reserve 30,020 30,604

------------------------------------ ---------- ---------- -------- --------

Total shareholders' equity 42,390 42,322

------------------------------------ ---------- ---------- -------- --------

Consolidated cash flow statement for the year ended 31 March

2020

Unaudited Audited

2020 2019

GBP'000 GBP'000

---------------------------------------- -------- ----------------- ----------

Operating activities

Profit for the year before

taxation 1,374 2,982

Adjustments for:

Depreciation - on property,

plant and equipment 397 400

Depreciation - on right-of-use 456 -

assets

Amortisation of development

costs 5,708 5,146

Amortisation of intangibles

recognised on acquisition and

purchased 212 172

Profit on disposal of property,

plant and equipment (5) (222)

Movement in non-cash items

(pension) 154 161

Share -- based payments 139 117

Movement in provisions - (193)

Finance income (106) (64)

Finance expense 96 1

Movement in working capital (1,868) (1,743)

-------------------------------------------------- ----------------- ----------

Cash flows from operating activities 6,557 6,757

Income tax received 526 454

-------------------------------------------------- ----------------- ----------

Net cash flows from operating

activities 7,083 7,211

-------------------------------------------------- ----------------- ----------

Investing activities

Acquisition of subsidiary, (1,295) -

net of cash acquired

Purchase of property, plant

and equipment (57) (294)

Lease liability repayments (682) -

Investment in development costs (7,936) (7,169)

Investment in intangibles (28) (368)

Investment in loan note (323) -

Proceeds from disposal of property 11 750

Finance income 106 64

Finance expense (34) (1)

Net cash flows used in investing

activities (10,238) (7,018)

-------------------------------------------------- ----------------- ----------

Financing activities

Issue of ordinary shares 7 214

Purchase of own shares for

treasury - (152)

Dividends paid to shareholders (1,332) (1,332)

-------------------------------------------------- ----------------- ----------

Net cash flows used in financing

activities (1,325) (1,270)

-------------------------------------------------- ----------------- ----------

Decrease in cash and cash equivalents (4,480) (1,077)

-------------------------------------------------- ----------------- ----------

Movement in cash and cash equivalents:

At start of year 12,809 13,816

Decrease in cash and cash equivalents (4,480) (1,077)

Effects of exchange rate changes 150 70

-------------------------------------------------- ----------------- ----------

At end of year 8,479 12,809

-------------------------------------------------- ----------------- ----------

Cash flows presented exclude sales taxes.

Consolidated statement of changes in equity for the year ended

31 March 2020

Capital Share --

Share Share Treasury based Foreign Accumulated

capital premium redemption shares payments exchange profits

reserve reserve reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

At 31 March 2018 -

audited 856 9,068 9 (190) 443 1,302 30,282 41,770

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

Profit for year 2,694 2,694

Other comprehensive income

Foreign exchange

differences 104 104

Net actuarial gain

recognised directly

to equity on

retirement benefit

obligations (1,317) (1,317)

Deferred tax on

actuarial gain 224 224

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

Total comprehensive

income for year - - - - - 104 1,601 1,705

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

856 9,068 9 (190) 443 1,406 31,883 43,475

Transactions with

owners in

their capacity as

owners

Issue of ordinary

shares 3 211 214

Purchase of own shares

- treasury (152) (152)

Dividend paid (1,332) (1,332)

Total transactions

with owners in their

capacity as owners 3 211 - (152) - - (1,332) (1,270)

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

Share -- based

payments in year 117 117

Cancellation/transfer

of share -- based

payments (53) 53 -

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

At 31 March 2019 -

audited 859 9,279 9 (342) 507 1,406 30,604 42,322

Changes in accounting

policy- IFRS 16 (30) (30)

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

Restated at 31 March

2019 859 9,279 9 (342) 507 1,406 30,574 42,292

Profit for year 1,536 1,536

Other comprehensive

income

Foreign exchange

differences 308 308

Net actuarial gain

recognised directly

to equity on

retirement benefit

obligations (995) (995)

Deferred tax on

actuarial gain 187 187

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

Total comprehensive

income for year - - - - - 308 728 1,036

859 9,279 9 (342) 507 1,714 31,302 43,328

Transactions with owners

in their capacity as owners

Issue of ordinary

shares - exercise of

share options 7 7

Purchase of own shares

- treasury 262 (14) 248

Dividend paid (1,332) (1,332)

Total transactions

with owners in their

capacity as owners - 7 - 262 - - (1,346) 1,077

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

Share -- based payment

charge 139 139

Cancellation/transfer

of share -- based

payments (64) 64 -

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

At 31 March 2020 -

unaudited 859 9,286 9 (80) 582 1,714 30,020 42,390

----------------------- -------- -------- ----------- --------- --------- --------- ------------ ------------

1 Segmental analysis

Reported segments and their results in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the chief operating decision maker (C. A.

Gurry). The measurement policies the Group uses for segmental

reporting under IFRS 8 are the same as those used in its financial

statements.

The Group is focused for management purposes on one primary

reporting segment, being the semiconductor segment, with similar

economic characteristics, risks and returns and the Directors

therefore consider there to be one business segment

classification.

Information about revenue, profit/loss, assets and

liabilities

Unaudited 2020 Audited 2019

------------------------ ------------------------

Semiconductor Semiconductor

components Group components Group

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- -------------- -------- -------------- --------

Total segmental revenue 26,420 26,420 28,140 28,140

----------------------------------- -------------- -------- -------------- --------

Profit

Segmental result 1,353 1,353 2,697 2,697

----------------------------------- -------------- -------- -------------- --------

Finance income 106 64

Finance expense (96) (1)

Profit on disposal of property,

plant and equipment 11 222

Income tax expense 162 (288)

----------------------------------- -------------- -------- -------------- --------

Profit after taxation 1,536 2,694

----------------------------------- -------------- -------- -------------- --------

Assets and liabilities

Segmental assets 51,681 50,678

-------------- --------------

51,681 50,678

Unallocated corporate assets

Investment properties 3,170 3,170

Deferred tax assets 1,343 908

Current tax assets 1,044 1,118

----------------------------------- -------------- -------- -------------- --------

Consolidated total assets 57,238 55,874

----------------------------------- -------------- -------- -------------- --------

Segmental liabilities 5,106 5,507

-------------- --------------

5,106 5,507

Unallocated corporate liabilities

Deferred tax liabilities 4,960 4,420

Current tax liabilities 85 77

Retirement benefit obligation 4,697 3,548

----------------------------------- -------------- -------- -------------- --------

Consolidated total liabilities 14,848 13,552

----------------------------------- -------------- -------- -------------- --------

Other segmental information

Unaudited 2020 Audited 2019

------------------------ ------------------------

Semiconductor Semiconductor

components Group components Group

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------- -------------- -------- -------------- --------

Property, plant and equipment additions 57 57 294 294

----------------------------------------- -------------- -------- -------------- --------

Right-of-use assets additions 86 86 - -

----------------------------------------- -------------- -------- -------------- --------

Development cost additions 7,936 7,936 7,169 7,169

----------------------------------------- -------------- -------- -------------- --------

Intangible asset additions 28 28 368 368

----------------------------------------- -------------- -------- -------------- --------

Depreciation 397 397 400 400

----------------------------------------- -------------- -------- -------------- --------

Depreciation - right-of-use assets 456 456 - -

----------------------------------------- -------------- -------- -------------- --------

Amortisation of development costs 5,708 5,708 5,146 5,146

----------------------------------------- -------------- -------- -------------- --------

Amortisation of acquired and purchased

intangibles 212 212 172 172

----------------------------------------- -------------- -------- -------------- --------

Other non -- cash expenditure (pension) 154 154 161 161

----------------------------------------- -------------- -------- -------------- --------

Geographical information (by origin)

Rest of

UK Europe Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ----------- -------- --------- --------- --------

Year ended 31 March 2020

- unaudited

---------------------------------- ------- -------- --------- --------- --------

Revenue to third parties

- by origin 6,793 5,903 4,856 8,868 26,420

---------------------------------- ------- -------- --------- --------- --------

Property, plant and equipment 4,724 182 30 40 4,976

---------------------------------- ------- -------- --------- --------- --------

Right -of-use assets 164 244 547 229 1,184

---------------------------------- ------- -------- --------- --------- --------

Investment properties 3,170 - - - 3,170

---------------------------------- ------- -------- --------- --------- --------

Development costs 6,161 9,793 - 976 16,930

---------------------------------- ------- -------- --------- --------- --------

Intangibles - software and

intellectual property 596 - - 118 714

---------------------------------- ------- -------- --------- --------- --------

Goodwill 1,531 3,512 - 5,698 10,741

---------------------------------- ------- -------- --------- --------- --------

Other intangible assets

arising on acquisition 235 - - 874 1,109

---------------------------------- ------- -------- --------- --------- --------

Total assets 24,606 16,984 2,203 13,445 57,238

---------------------------------- ------- -------- --------- --------- --------

Year ended 31 March 2019

- audited

Revenue to third parties

- by origin 7,419 6,051 5,207 9,463 28,140

---------------------------------- ------- -------- --------- --------- --------

Property, plant and equipment 4,941 260 66 40 5,307

---------------------------------- ------- -------- --------- --------- --------

Investment properties 3,170 - - - 3,170

---------------------------------- ------- -------- --------- --------- --------

Development costs 5,359 9,136 - - 14,495

---------------------------------- ------- -------- --------- --------- --------

Intangibles - software and

intellectual property 611 - - - 611

---------------------------------- ------- -------- --------- --------- --------

Goodwill - 3,512 - 5,723 9,235

---------------------------------- ------- -------- --------- --------- --------

Other intangible assets

arising on acquisition - - - 1,164 1,164

Total assets 25,174 16,070 1,594 13,036 55,874

---------------------------------- ------- -------- --------- --------- --------

2 Revenue

The geographical classification of business turnover

(by destination) is as follows:

Unaudited Audited

2020 2019

Continuing business GBP'000 GBP'000

--------------------------------------------------- ------------ ---------

Europe 7,844 7,201

Far East 13,182 15,348

Americas 4,907 5,251

Others 487 340

--------------------------------------------------- ------------ ---------

26,420 28,140

--------------------------------------------------- ------------ ---------

3 Dividend - paid and proposed

During the year a final dividend of 5.8p per ordinary share of

5p was paid in respect of the year ended 31 March 2019. An interim

dividend of 2.0p per ordinary was paid on 13 December 2019 to

shareholders on the Register on 29 November 2019.

It is proposed to pay a final dividend of 2.0p per ordinary

share of 5p, taking the total dividend amount in respect of the

year ended 31 March 2020 to 4.0p. It is proposed to pay the final

dividend of 2.0p, if approved, on 7 August 2020 to shareholders

registered on 24 July 2020 (2019: paid 5 August 2019 to

shareholders registered on 5 July 2019).

4 Income tax expense

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of a subsidiary and have

provided on that basis.

Unaudited Audited

2020 2019

GBP'000 GBP'000

------------------------------------------------------- ---------- --------

Current tax

UK corporation tax on results of the year (588) (722)

Adjustment in respect of previous years - 4

------------------------------------------------------- ---------- --------

(588) (718)

Foreign tax on results of the year 245 92

Foreign tax - adjustment in respect of previous

years 1 4

------------------------------------------------------- ---------- --------

Total current tax (342) (622)

------------------------------------------------------- ---------- --------

Deferred tax

Deferred tax - Origination and reversal of temporary

differences 97 913

Deferred tax - relating to changes in rates 106 -

Adjustments to deferred tax charge in respect

of previous years (23) (3)

------------------------------------------------------- ---------- --------

Total deferred tax 180 910

------------------------------------------------------- ---------- --------

Tax (income)/ charge on profit on ordinary activities (162) 288

------------------------------------------------------- ---------- --------

5 Earnings per share

Unaudited Audited

2020 2019

Basic earnings per share

From profit for year 8.98p 15.77p

Diluted earnings per share

From profit for year 8.94p 15.36p

---------------------------- ---------- --------

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders, divided by the

weighted average number of shares in issue during the year, as

shown below:

Unaudited 2020 Audited 2019

---------------------------------- ------------------------------------

Weighted Weighted

average Earnings average Earnings

number per number per

Profit of shares share Profit of shares share

Basic earnings per

share GBP'000 Number p GBP'000 Number p

----------------------------- -------- ------------- --------- -------- ------------- -----------

Basic earnings per

share

- from profit for

year 1,536 17,099,216 8.98 2,694 17,087,788 15.77

----------------------------- -------- ------------- --------- -------- ------------- -----------

Diluted earnings per

share

----------------------------- -------- ------------- --------- -------- ------------- -----------

Basic earnings per

share 1,536 17,099,216 8.98 2,694 17,087,788 15.77

Dilutive effect of

share options - 88,355 (0.04) - 448,311 (0.41)

----------------------------- -------- ------------- --------- -------- ------------- -----------

Diluted earnings per

share

* from profit for year 1,536 17,187,571 8.94 2,694 17,536,099 15.36

----------------------------- -------- ------------- --------- -------- ------------- -----------

6 Adjusted EBITDA

Adjusted earnings before interest, tax, depreciation and

amortisation ('Adjusted EBITDA') is defined as profit from

operations before all interest, tax, depreciation and amortisation

charges and before share-based payments. The following is a

reconciliation of the Adjusted EBITDA for the years presented:

Unaudited Audited

2020 2019

GBP'000 GBP'000

---------------------------------------------------- ---------- --------

Profit after taxation (earnings) 1,536 2,694

Adjustments for:

Finance income (106) (64)

Finance expense 96 1

Income tax (expense)/credit (162) 288

Depreciation 397 400

Depreciation - right-of-use assets 456 -

Amortisation of development costs 5,708 5,146

Amortisation of acquired and purchased intangibles

recognised on acquisition 212 172

Share-based payments 139 117

---------------------------------------------------- ---------- --------

Adjusted EBITDA 8,276 8,754

---------------------------------------------------- ---------- --------

7 Investment properties

Investment properties are measured at fair value and are

revalued annually by the Directors and in every third year by

independent Chartered Surveyors on an open market basis. No

depreciation is provided on freehold investment properties or on

leasehold investment properties. In accordance with IAS 40, gains

and losses arising on revaluation of investment properties are

shown in the income statement. No formal market valuation was

conducted in the year.

8 Principal risks and uncertainties

Key risks of a financial nature

The principal risks and uncertainties facing the Group are with

foreign currencies and customer dependency. With the majority of

the Group's earnings being linked to the US Dollar, a decline in

this currency will have a direct effect on revenue, although since

the majority of the cost of sales are also linked to the US Dollar,

this risk is reduced at the gross profit line. The Group does

however have significant Euro-denominated fixed costs.

Additionally, though the Group has a very diverse customer base in

certain market sectors, key customers can represent a significant

amount of revenue though their end-customers may be a diversified

portfolio. Key customer relationships are closely monitored;

however changes in buying patterns of a key customer could have an

adverse effect on the Group's performance.

Key risks of a non-financial nature

The Group is a small player operating in a highly competitive

global market that is undergoing continual and geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to, pricing, technological innovations,

product quality, customer service, raw material availabilities,

manufacturing capabilities and employment of qualified personnel

will be key in the achievement of its objectives, but its ultimate

success will depend on the demand for its customers' products since

the Group is a component supplier.

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements (including

the UK's withdrawal from the European Union, or 'Brexit'),

political risk, the enforceability of laws and contracts, changes

in the tax laws, terrorist activities, natural disasters or health

epidemics.

Brexit

The Group has assessed the risks relating to Brexit and the

impact it will have on its customer base and supply chain. Brexit

developments are being monitored, and the risks status regularly

assessed to respond to any market effects of uncertainty that may

be caused by the outcome of the negotiations between the UK

Government and the EU.

COVID-19

During the period leading up to the date of this report the

global impact of COVID-19 escalated. The Board have considered

possible impacts of the COVID-19 outbreak on the Group's trading

and cashflow forecasts. In preparing this analysis a number of

scenarios were modelled based on the management's current

understanding of potential income. In each scenario, mitigating

actions within the control of management, including reductions in

discretionary spend and tighter internal controls, have been

modelled, but no fixed costs reductions have been assumed.

Given the nature of the markets we operate within, we anticipate

our end customers being insulated from a consumer downturn to some

extent, although the roll-out of some of the new products may be

delayed, dampening demand for our semiconductors. Even in these

difficult times, we still maintain the belief that the Group is

well placed to move positively forward in the medium to long term.

This belief is underpinned by a strong balance sheet and no debt,

along with product portfolio that addresses markets that have a

positive outlook.

9 Significant accounting policies

The accounting policies used in preparation of the annual

results announcement are the same accounting policies set out in

the year ended 31 March 2019 financial statements with the

exception of the adoption of IFRS 16 - Leases. The impact of the

adoption is set out below:

(i ) IFRS 16 Leases

The Group has adopted IFRS 16 Leases for the financial year

ending 31 March 2020, and it has chosen to use a modified

retrospective approach to adoption. The approach adopted does not

require the restatement of prior year figures. As a result of the

fact the right-of-use assets are measured based on the lease

commencement date compared to the lease liabilities being

calculated based on the initial application date, there is an

adjustment to brought forward reserves as shown in the condensed

consolidated statement of changes in equity.

-- Property leases

-- Office equipment leases

-- Motor Vehicle leases

-- Other leases

These leases have been recognised on the balance sheet, in

financial liabilities, by recognising the future cash-flows of the

lease obligation, discounted using an implicit interest rate of 4%

for property leases, for office equipment and 7% for motor

vehicles. These rates are in line with industry published discount

rates.

Corresponding right-of-use assets have been recognised in the

Group balance sheet for right-of-use assets property, office

equipment and motor vehicles and have been measured as being equal

to the discounted lease liability at the date of inception plus any

lease payments made at or before the inception of the lease.

Cash-flows from these leases have been recognised by including the

lease payments in cash-flows from investing activities

As the Group has chosen to adopt IFRS 16 using the modified

retrospective approach, comparatives have not been restated and are

accounted for under the Group's previous lease accounting

policy:

Under this approach, prior year figures have not been restated

to reflect leases that were in effect at that time. On transition

to IFRS 16, the group has applied the practical expedient of using

a single discount rate to a portfolio of leases with reasonably

similar characteristics:

-- Using a single discount rate to a portfolio of leases with

reasonably similar characteristics.

-- The Group has chosen to transition all leases previously

identified under IAS 17 to IFRS 16 and has not reassessed whether

these contracts are leases.

-- Reliance on the assessment of onerous leases at the 31(st)

March 2019 instead of performing an impairment review on transition

at 1(st) April 2019.

-- In assessing the length of the lease, where options to extend

or terminate the contract exist at the transition date these have

been taken into account or the known length of the lease has been

used.

Key judgements and estimates

The Group determines the lease term as the non-cancellable term

of the lease together with any periods covered by an option to

extend the lease it is reasonable certain to be exercised, or any

periods covered by an option to terminate the lease, if it is

reasonable certain not to be exercised.

Where the implicit rate of interest relating to a lease is not

readily available, the Group has used a discounted rate of 4% for

property leases and 7% for motor vehicles.

GBP'000

------------------------------------------------ --------

Undiscounted operating lease obligations as at

31 March 2019 1,038

Discounting (48)

Lease Liabilities at 1 April 2019 990

------------------------------------------------- --------

The effect of adoption of IFRS 16 as at 1st April 2019

increase/(decrease) is as follows:

GBP'000

--------------------- --------

Non-current assets

Right of use assets 960

---------------------- --------

Total assets 960

---------------------- --------

Liabilities

Lease liabilities 990

---------------------- --------

Total liabilities 990

---------------------- --------

Equity

Reserves (30)

---------------------- --------

Total Equity (30)

---------------------- --------

10 Acquisition of Plextek RFI Limited

Following the acquisition announced on the 3 March 2020 and

having satisfied the principal regulatory conditions and other

transaction closing conditions, the Group took control (100% of

voting rights) of UK based Plextek RFI Limited ("PRFI"). The total

consideration was GBP1.9m, payable in cash and from issuing of

treasury shares.

Founded in 2015, PRFI is a UK based design house specialising in

the design and development of RF, Microwave and Millimetre-wave

(mm-wave) ICs and modules.

The acquisition expands and strengthens the Group's product

design capabilities. For this reason combined with the anticipated

synergies to arise from integrating the PRFI business into existing

Group businesses, the Group paid a premium over the acquisition net

assets, giving rise to goodwill. All intangible assets in

accordance with IFRS 3 Business Combinations were recognised at

their provisional fair values on the date of acquisition, with the

residual excess over net assets being recognised as goodwill.

Intangibles arising from the acquisition consist of brand values,

customer relationships and intellectual property and have been

independently valued by professional advisors.

The following table summarises the consideration and provisional

fair values of assets acquired and liabilities assumed at the date

of acquisition:

GBP'000

----------------------------------- --------

Property, plant and equipment 25

Intangible fixed assets:

Brands 37

Customer relationships 25

Intellectual property 175

Trade receivables and prepayments 187

Cash and cash equivalents 105

Trade and other payables (101)

Deferred tax liabilities (43)

Net assets acquired 410

Goodwill 1,531

------------------------------------ --------

Consideration 1,941

------------------------------------ --------

There are no non-controlling interests in relation to the PRFI

acquisition. Fair values in the above table have only been

determined provisionally and may be subject to change in the light

of any subsequent new information becoming available in time. The

review of the fair value of assets and liabilities acquired will be

completed within twelve months of the acquisition date. Receivables

at the acquisition date are expected to be collected in accordance

with the gross contractual amounts.

The acquisition cost was satisfied by:

GBP'000

----------------------------------- --------

Cash 1,693

Treasury shares issued 248

Lease Liabilities at 1 April 2019 1,941

------------------------------------ --------

Net cash outflow arising on acquisition:

GBP'000

------------------------------------------------ --------

Cash consideration paid (less cash retention) 1,400

Cash and cash equivalents within PRFI business

on acquisition (105)

Total net cash outflow on acquisition 1,295

------------------------------------------------- --------

The cash consideration excludes a GBP100,000 retention which is

included in other payables. Other costs relating to the acquisition

have not been included in the consideration cost. Directly

attributable acquisition costs include external legal and

accounting costs incurred in compiling the acquisition legal

contracts and the performance of due diligence activity and amount

to GBP145,000. These costs have been charged in distribution and

administrative expenses in the consolidated income statement.

PRFI has a 29 February 2020 financial period end, in the one

month period to 31 March 2020, PRFI contributed revenue of

GBP64,000 and net loss before taxation of GBP15,000. If PRFI was

part of the group for the full reporting period the contributed

revenue would have been GBP790,000 and net loss before taxation of

GBP187,000.

11 General

The results for the year have been prepared using the

recognition and measurement principles of international financial

reporting standards as adopted by the EU. Whilst the financial

information included in this preliminary announcement has been

prepared in accordance with the recognition and measurement

criteria of International Financial Reporting Standards (IFRSs), as

adopted for use in the EU, this announcement does not itself

contain sufficient information to comply with IFRSs.

The audited financial information for the year ended 31 March

2019 is based on the statutory accounts for the financial year

ended 31 March 2019 that has been filed with the Registrar of

Companies. The auditor reported on those accounts: their report was

(i) unqualified, (ii) did not include references to any matters to

which the auditor drew attention by way of emphasis without

qualifying the reports and (iii) did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

The statutory accounts for the year ended 31 March 2020 are

expected to be finalised on the basis of the financial information

presented by the Directors in this preliminary announcement and

signed following approval by the Board of Directors on 19 June 2020

and delivered to the Registrar of Companies following the Company's

Annual General Meeting on 29 July 2020.

The financial information contained in this announcement does

not constitute statutory accounts for the year ended 31 March 2020

or 2019 as defined by Section 434 of the Companies Act 2006.

A copy of this announcement can be viewed on the company website

http://www.cmlmicroplc.com .

12 Approval

The Directors approved this preliminary results announcement on

8 June 2020.

Glossary

5G Fifth Generation Cellular Network Technology

API Application Programmers Interface

EBITDA Earnings before interest, tax, depreciation and amortisation

EU European Union

DMR Digital Mobile Radio

GMP Guaranteed Minimum Pension

GPS Global Positioning System

IAS International Accounting Standard

IC Integrated Circuit

IFRS International Financial Reporting Standards

IIoT Industrial Internet of Things

IP Intellectual Property

M2M Machine -- to -- machine

NAND Not And

OEM Original Equipment Manufacturer

P25 Project 25 digital mobile radio public safety standard

R&D Research and Development

RF Radio Frequency

RTK Real-Time Kinematic

SATA Serial ATA interface

SD Secure Digital

TETRA Terrestrial Trunked Radio

VP Vice-President

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SSAFIAESSEDM

(END) Dow Jones Newswires

June 09, 2020 02:00 ET (06:00 GMT)

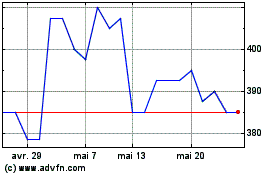

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Cml Microsystems (LSE:CML)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024