Turning to our overseas businesses, the Ireland team has

instituted extensive change over the last two years after the

liability account drove significant losses in the territory. The

early 2014 storms affected the profitability of the property

account but due to the initiatives pursued, the Irish business has

contributed consistent profits over the last three quarters and

reported a positive return for the year. This is a remarkable

achievement in such a short time for a territory that reported

losses of GBP15.3m over the past two years.

Our Australian business achieved an underlying underwriting

profit in the year, when excluding the impact of movements in

discount rates. This is again a transformation given underwriting

losses of GBP9.4m over the last two years and is testimony to the

development and execution of a business-wide change programme by

the new leadership team. Both the property and liability portfolios

have performed as expected in 2014, and although falling discount

rates led to a reported underwriting loss overall; this latter

component was offset by corresponding positive asset growth.

In Canada we also saw a return to underwriting profits as the

territory did not suffer the same level of weather events it

experienced in 2013. Work to deliver a new administration platform

continues at pace. Premiums grew 7% before translation as

good-quality business continues to be identified and won by the

team.

Gross written premiums have fallen by 16% in the year across the

Group following the actions we have taken to address underwriting

performance. Retention of business in our core niches remained

strong and we are strengthening our relationships with customers

and brokers to support our aim for controlled profitable growth

over the medium term.

Best ethical investment provider

Our Investment Management division continues to go from strength

to strength, with both our funds and our managers winning awards

for investment performance and our ethical approach. Gross inflows

for 2014 totalled GBP292m, a record figure for a single year. Our

performance was strong within a volatile investment market and this

has been demonstrated by our 2014 net inflows totalling close to

GBP100m for a second year in a row. Funds under management have now

passed GBP2.3 billion.

During 2014 we delivered a new IT back-office platform and also

worked with our outsource partners to improve the way we work

together. The cost and efficiency savings captured by these

initiatives helped to drive the strong profit before tax of GBP3.2m

in 2014, a new record. Our investment management team moved into

new offices in the City of London at the start of 2015 which will

provide a better environment for growing the business.

In parallel, the investment returns on our general insurance

funds were GBP33m. This was down on last year (GBP65m), when world

markets saw particularly strong returns (FTSE All Share Index

return of 20.8% compared to 1.2% in 2014), and we believe this

reflects a more normal return on our portfolio.

Most trusted specialist adviser

South Essex Insurance Brokers (SEIB), our insurance broker,

continued to grow and provide a stable flow of income for the

Group. We acquired the specialist broking firm Lansdown Insurance

Brokers, which has widened our broker proposition to include new

specialist areas. Profit before tax grew to just over GBP3m for

2014, supported in part by this successful acquisition and the

synergies that are starting to flow.

Our team of fully independent advisors, Ecclesiastical Financial

Advisory Services (EFAS), continues to review and refine their

offering to the Anglican clergy, and closer operational links are

being developed between our advisory and broking businesses.

For a more detailed analysis of our financial results, please

see the Financial Performance section.

Working together for the greater good

Our vision, goals and how we intend to achieve them sets us

apart from other financial services companies. We wish to work

together, for the greater good, by living up to the highest

standards of values and ethics. We share the same values as our

charitable owner, which allows us to work towards these goals in a

way that delivers real benefit to our colleagues, our customers,

our charities and our communities.

We are not driven by growth; we are driven by doing the right

thing. In the long term, we believe this approach will drive

ethical and sustainable growth. This belief is being encapsulated,

for the first time in 2015, by including ethical conduct measures

as a material element of our Group bonus calculation, as well as

incorporating them into our long-term incentive plan (LTIP). We

have set a high bar for the behaviour we expect from ourselves and

our colleagues and recognise that achieving these standards should

be rewarded.

We are also launching a 'Greater Giving Programme' in early 2015

to build on the best of what Ecclesiastical already does, to tie us

more closely to our markets and to encompass our new approach to

life. This framework will highlight and emphasise our giving to our

charitable owner, our giving to good causes, our giving to our

customers (in terms of the ethical and fair products and services

we provide), our giving to our communities (via opportunities for

our employees to volunteer), and our giving to our employees (in

terms of reward, training, development and our working

environment). More information on our new Greater Giving Programme

can be found in the Corporate Responsibility Report in the full

financial statements.

In addition, it was pleasing to see that our Canadian business

was recognised as being one of Canada's Top 100 Employers for Young

People for the third successive year. This highlights the Group's

philosophy of seeking to invest heavily in the development and

training of our employees, ensuring we have a high calibre

professional workforce aligned behind our goals. Our doors are

always open to talented like-minded individuals who share these

aspirations.

Looking ahead to 2015

Our capital strength has been maintained throughout the

challenges of the last few years and our net assets have ended the

year at GBP495m, after payment of grants to ATL. Available capital

relative to our regulatory capital requirements remains very

strong.

This financial strength, alongside our committed ethical

approach, gives us robust foundations upon which we can build and

invest, as well as face challenges from the competitive environment

in which we operate.

The transformation delivered in 2014 represents an important

step in Ecclesiastical's history. It is a moment where the Group

has successfully changed the course of its underwriting

performance, and there is increasing energy and passion around our

new vision, both from within and outside the Group.

In 2015 we wish to build on this success and increase our

momentum. We have clear and consistent business plans. We have an

ambitious Group-wide change programme part implemented, and we have

an increasingly high-performing, aligned team, with ethics running

through their bloodstream, working hard to make a difference. We

thank all our employees for their enormous contribution and

commitment throughout what has been a year of extensive and, at

times, unsettling change. They complete the year knowing that their

efforts are already reaping rewards for those in need.

Equally, we thank our customers and our business partners whom

we seek to serve, and serve extremely well. It is only with their

ongoing loyal support that we can give so much to good causes and

build our combined momentum, working together for the greater

good.

Business Review

Financial Performance

In 2014 we achieved a pre-tax profit of GBP48.2m (2013:

GBP66.9m). We saw the benefit of the actions taken over the last

two years to turn around our general insurance business performance

and report our first underwriting profit since 2009. Our investment

and broker businesses also continued to grow their contribution to

our profits.

General insurance

Our underwriting performance for the year was a profit of

GBP9.2m (2013: GBP8.2m loss), resulting in a Group COR of 95.9%

(2013: 102.9%). As already discussed in the Group Chief Executive's

Review, each of our core underwriting areas saw an improvement in

performance this year with every territory making a positive

contribution to the turnaround in performance.

United Kingdom

Our insurance businesses in the UK reported an underwriting

profit of GBP9.8m (2013: GBP9.8m).

Refocusing on our core niches and putting into place our new

regional structure has seen the core UK business improve its

performance over recent years, and this performance was sustained

in 2014.

The storms and floods that hit the UK at the start of 2014 had a

net cost to our property account of GBP8m. However, with no further

significant weather events during 2014, the profitability of our

property account exceeded expectations over the year as a

whole.

Having withdrawn from the non-charitable care sector and focused

on pricing risks appropriately, the performance of the non-abuse

related liability account has improved considerably. However, we

have taken the opportunity to strengthen reserves in respect of

physical and sexual abuse claims during the year. We recognise and

welcome the increase in transparency and openness that means

victims of abuse feel able to come forward, and believe we are now

appropriately reserved for potential claims. This action has,

however, resulted in the overall liability account remaining

loss-making despite the turnaround in underlying performance.

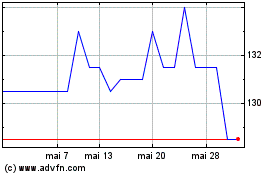

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025