--------- ---------- -------- --------- --------------- ---------

Total Gross 260,243 98,397 15,329 18,623 6,753 399,345

--------- ---------- -------- --------- --------------- ---------

Net 141,061 88,635 13,900 17,722 6,753 268,071

--------- ---------- -------- --------- --------------- ---------

(c) General insurance risks

Property classes

Property cover mainly compensates the policyholder for damage

suffered to their properties or for the value of property lost.

Property insurance may also include cover for pecuniary loss

through the inability to use damaged insured commercial

properties.

For property insurance contracts, there can be variability in

the nature, number and size of claims made in each period.

The nature of claims may include fire, business interruption,

weather damage, subsidence, accidental damage to insured vehicles

and theft. Subsidence claims are difficult to predict because the

damage is often not apparent for some time. Changes in soil

moisture conditions can give rise to changes in claim volumes over

time. The ultimate settlements can be small or large with a greater

risk of a settled claim being re-opened at a later date.

The number of claims made can be affected by weather events,

changes in climate and crime rates. Climate change may give rise to

more frequent and severe extreme weather events, such as river

flooding, hurricanes and drought, and their consequences, for

example, subsidence claims. If a weather event happens near the end

of the financial year then the uncertainty about ultimate claims

cost in the financial statements is much higher because there is

insufficient time for adequate data to be received to assess the

final cost of claims.

Individual claims can vary in amount since the risks insured are

diverse in both size and nature. The cost of repairing property

varies according to the extent of damage, cost of materials and

labour charges.

Contracts are underwritten on a reinstatement basis or repair

and renovation basis as appropriate. Costs of rebuilding

properties, of replacement or indemnity for contents and time taken

to restart operations for business interruption are the key factors

that influence the level of claims. Individual large claims are

more likely to arise from fire, storm or flood damage. The greatest

likelihood of an aggregation of claims arises from earthquake,

weather or fire events.

Claims payment, on average, occurs within a year of the event

that gives rise to the claim. However, there is variability around

this average with larger claims typically taking longer to

settle.

Liability classes

The main exposures are in respect of liability insurance

contracts which protect policyholders from the liability to

compensate injured employees (employers' liability) and third

parties (public liability).

Claims that may arise from the liability portfolios include

damage to property, physical injury, disease and psychological

trauma. The Group has a different exposure profile to most other

commercial lines insurance companies as it has lower exposure to

industrial risks. Therefore, claims for industrial diseases are

less common for the Group than injury claims such as slips, trips

and back injuries.

The frequency and severity of claims arising on liability

insurance contracts, including the liability element of motor

contracts, can be affected by several factors. Most significant are

the increasing level of awards for damages suffered, the courts'

move to periodic payments awards and the increase in the number of

cases that have been latent for a long period of time.

The severity of bodily injury claims is highly influenced by the

value of loss of earnings and the future cost of care. The

settlement value of claims arising under public and employers'

liability is particularly difficult to predict. There is

uncertainty as to whether any payments will be made and, if they

are, the amount and timing of the payments. Key factors driving the

high levels of uncertainty include the late notification of

possible claim events and the legal process.

Late notification of possible claims necessitates the holding of

provisions for incurred claims that may only emerge some years into

the future. In particular the effect of inflation over such a long

period can be considerable and is uncertain. A lack of comparable

past experience makes it difficult to quantify the number of claims

and, for certain types of claims, the amounts for which they will

ultimately settle. The legal and legislative framework continues to

develop which has a consequent impact on the uncertainty as to the

length of the claims settlement process and the ultimate settlement

amounts.

Claims payment, on average, occurs about three to four years

after the event that gives rise to the claim. However, there is

significant variability around this average.

Provisions for latent claims

The public and employers' liability classes can give rise to

very late reported claims, which are often referred to as latent

claims. These can vary in nature and are difficult to predict. They

typically emerge slowly over many years. The Group has reflected

this uncertainty and believes that it holds adequate reserves for

latent claims that may result from exposure periods up to the

reporting date.

Note 27 to the full financial statements presents the

development of the estimate of ultimate claim cost for public and

employers' liability claims occurring in a given year. This gives

an indication of the accuracy of the estimation technique for

incurred claims.

(d) Life insurance risks

The Group provides whole-of-life insurance policies to support

funeral planning products, for most of which the future benefits

are linked to inflation and backed by index-linked assets. The risk

that actual claims payments exceed the carrying amount of the

insurance liabilities may occur if the timing of claims is

different from assumed.

Uncertainty in the estimation of the timing of future claims

arises from the unpredictability of long-term changes in overall

levels of mortality. The Group bases these estimates on standard

industry and national mortality tables. The most significant

factors that could alter the expected mortality rates profile are

epidemics, widespread changes in lifestyle and continued

improvement in medical science and social conditions. The primary

risk on these contracts is the level of future investment returns

on the assets backing the liabilities over the life of the

policyholders. The interest rate and inflation risk within this has

been largely mitigated by holding index-linked assets of a similar

term to the expected liabilities profile. The main residual risk is

the spread risk attaching to corporate bonds held to match the

liabilities. The small mortality risk is retained by the Group and

directly impacts shareholders' equity.

Finance risk and capital management

The Group is exposed to financial risk through its financial

assets, financial liabilities, reinsurance assets and insurance

liabilities. In particular the key financial risk is that the

proceeds from its financial assets are not sufficient to fund the

obligations arising from its insurance contracts. The most

important components of financial risk are interest rate risk,

credit risk, currency risk and equity price risk.

There has been no change from the prior period in the nature of

the financial risks to which the Group is exposed. The Group's

management and measurement of financial risks is informed by either

stochastic modelling or stress testing techniques.

(a) Categories of financial instruments

Financial assets

------------------------------------------

Designated Held Loans and Financial Other assets

for

at fair trading receivables* liabilities** and Total

value liabilities

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 31 December

2014

Financial

investments 886,170 - 16 - - 886,186

Other assets - - 116,485 - 2,909 119,394

Cash and cash

equivalents - - 107,526 - - 107,526

Assets classified

as held for sale - - ***6,204 - - 6,204

Other liabilities - - - (40,338) (4,277) (44,615)

Net other - - - - (580,062) (580,062)

------------- ---------- --------------- -------------- -------------- -------------

Total 886,170 - 230,231 (40,338) (581,430) 494,633

------------- ---------- --------------- -------------- -------------- -------------

At 31 December

2013

Financial

investments 938,383 158 ***7,911 - - 946,452

Other assets - - 121,411 - 3,053 124,464

Cash and cash

equivalents - - 107,241 - - 107,241

Other liabilities - - - (31,571) (6,397) (37,968)

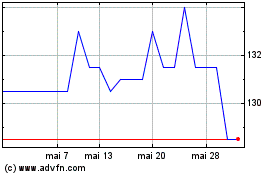

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ecclesiastl.8fe (LSE:ELLA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025