TIDMEMG

RNS Number : 5920Q

Man Group plc

19 October 2023

Press Release

19 October 2023

TRADING STATEMENT FOR THE QUARTERED 30 SEPTEMBER 2023

Assets under management (AUM) of $161.2 billion as at 30

September 2023 (30 June 2023: $151.7 billion).

AUM movements

AUM at AUM at

30 Jun 2023 Investment FX & other 30 Sep

$bn Net flows performance (1) 2023

---------------------- ------------- ---------- ------------- ----------- --------

Absolute return 47.3 1.1 0.4 (0.8) 48.0

Total return 29.4 0.0 (0.3) 10.5 39.6

Multi-manager

solutions 20.3 (0.4) 0.2 0.2 20.3

---------------------- ------------- ----------

Alternative 97.0 0.7 0.3 9.9 107.9

---------------------- ------------- ---------- ------------- ----------- --------

Systematic long-only 35.7 (0.5) (0.7) (0.5) 34.0

Discretionary

long-only 19.0 0.5 0.5 (0.7) 19.3

---------------------- ------------- ----------

Long-only 54.7 0.0 (0.2) (1.2) 53.3

---------------------- ------------- ---------- ------------- ----------- --------

Total 151.7 0.7 0.1 8.7 161.2

---------------------- ------------- ---------- ------------- ----------- --------

AUM by product category

$bn 30 Sep 31 Dec 31 Mar 30 Jun 30 Sep

2022 2022 2023 2023 2023

---------------------------------- ------ ------ ------ ------ ------

Absolute return 49.0 46.0 44.7 47.3 48.0

---------------------------------- ------ ------ ------ ------ ------

Man Institutional Solutions(2) 12.5 14.4 13.4 14.7 15.5

AHL Alpha 11.6 7.7 8.2 9.0 8.8

AHL Dimension 6.1 5.9 5.4 6.0 5.8

AHL Evolution 5.5 5.4 5.1 5.3 5.4

GLG equity 4.7 4.9 4.9 4.7 4.5

AHL Diversified 1.6 1.5 1.3 1.4 1.3

Other(3) 7.0 6.2 6.4 6.2 6.7

---------------------------------- ------ ------ ------ ------ ------

Total return 29.0 28.8 29.4 29.4 39.6

---------------------------------- ------ ------ ------ ------ ------

AHL TargetRisk 13.9 13.4 13.7 13.2 12.4

US private credit - - - - 10.7

Alternative Risk Premia 7.6 7.8 8.3 8.9 9.2

CLOs and other 3.7 3.9 3.6 3.5 3.7

Global Private Markets 3.0 3.0 3.2 3.2 3.1

Emerging markets fixed

income 0.8 0.7 0.6 0.6 0.5

---------------------------------- ------ ------ ------ ------ ------

Multi-manager solutions 19.8 20.2 20.0 20.3 20.3

---------------------------------- ------ ------ ------ ------ ------

Infrastructure & direct

access 12.9 12.7 12.5 12.7 12.8

Segregated 6.2 6.9 6.9 7.0 6.9

Diversified and thematic

FoHF 0.7 0.6 0.6 0.6 0.6

---------------------------------- ------ ------ ------ ------ ------

Systematic long-only 25.8 31.6 33.0 35.7 34.0

---------------------------------- ------ ------ ------ ------ ------

Global equity 12.8 16.9 17.5 19.2 18.4

Emerging markets equity 5.8 6.4 6.7 7.7 7.3

International equity 6.2 7.1 7.5 7.5 7.1

US equity 1.0 1.2 1.3 1.3 1.2

---------------------------------- ------ ------ ------ ------ ------

Discretionary long-only 14.8 16.7 17.6 19.0 19.3

---------------------------------- ------ ------ ------ ------ ------

Credit and convertibles 4.3 5.2 5.7 6.6 6.6

Japan equity 3.6 4.1 4.3 4.8 5.3

UK equity 3.3 3.8 3.9 3.9 3.8

Europe ex-UK equity 1.2 1.3 1.3 1.3 1.2

Emerging markets fixed

income 1.2 0.9 1.0 1.0 0.9

Other(4) 1.2 1.4 1.4 1.4 1.5

---------------------------------- ------ ------ ------ ------ ------

Total 138.4 143.3 144.7 151.7 161.2

---------------------------------- ------ ------ ------ ------ ------

Investment performance

Return (net of fees) Annualised return (net of fees)

---------------------------- ------------------------------------------------------

3 months to 9 months to 3 years to 5 years to Inception to 30 Sep

30 Sep 2023 30 Sep 2023 30 Sep 2023 30 Sep 2023 2023

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

Absolute return

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

AHL Alpha 5 1.0% 3.0% 8.3% 7.5% 10.3%

AHL Dimension 6 -0.9% 2.7% 6.0% 3.8% 4.7%

AHL Evolution 7 4.3% 2.7% 9.8% 8.3% 12.0%

AHL Diversified 8 0.4% 1.3% 9.3% 8.4% 10.5%

GLG Alpha Select

Alternative 9 1.6% 7.0% 6.9% 6.6% 4.9%

GLG Event Driven

Alternative 10 3.2% 4.6% 6.2% - 6.6%

GLG Global Credit Multi 11 1.2%* 1.4%* 3.1%* 3.7%* 10.8%*

Strategy

Man Strategies 1783 12 0.3% 1.9% 7.3% - 5.0%

------------------------- --- -------------

Total return

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

AHL TargetRisk 13 -1.3% 5.9% 2.0% 5.5% 6.9%

Alternative Risk Premia 14 1.2% 3.0% 9.2% 3.0% 4.3%

GLG Global Emerging

Markets Debt Total

Return 15 -0.4% -4.1% -2.3% -0.2% 1.0%

------------------------- ---

Multi-manager solutions

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

FRM Diversified II 16 1.1%* 2.3%* 7.3%* 3.4%* 4.0%*

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

Systematic long-only

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

Numeric Global Core 17 -3.0% 9.6% 8.9% 6.0% 9.3%

Relative return 0.5% -1.5% 0.8% -1.2% 0.5%

Numeric Europe Core 18 -1.9% 9.8% 11.3% 5.7% 8.4%

Relative return 0.2% 1.0% 0.3% -0.2% 2.1%

Numeric Emerging Markets

Core 19 -3.9% 3.3% 0.2% 1.7% 4.1%

Relative return -1.0% 1.5% 1.9% 1.2% 2.2%

------------------------- ---

Discretionary long-only

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

GLG Continental European

Growth 20 -6.7% 6.0% 1.2% 5.2% 8.8%

Relative return -5.2% -1.5% -7.4% -1.3% 2.9%

GLG Japan CoreAlpha

Equity 21 8.1% 33.3% 32.2% 9.3% 6.1%

Relative return 5.6% 7.6% 16.8% 1.7% 2.2%

GLG Undervalued Assets 22 5.8% 9.5% 18.0% 2.8% 6.7%

Relative return 3.9% 5.0% 6.2% -0.8% 1.5%

GLG High Yield

Opportunities 23 2.1% 5.9% 6.1% - 6.0%

Relative return 1.8% 2.0% 6.9% - 5.2%

------------------------- --- -------------

Indices

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

HFRX Global Hedge Fund

Index 24 0.7% 1.4% 1.8% 1.9%

HFRI Fund of Funds

Conservative Index 24 1.8% 3.8% 5.8% 4.1%

HFRI Equity Hedge

(Total) Index 24 0.4% 1.8% 3.8% 2.0%

HFRX EH: Equity Market

Neutral Index 24 0.9% 1.8% 2.0% -1.1%

Barclay BTOP 50 Index 25 3.3% 2.9% 11.4% 7.4%

------------------------- --- ------------- ------------- ------------- ------------- ------------------------

*Estimated

Past or projected performance is no indication of future

results. Financial indices are used for illustrative purposes only

and are provided for the purpose of making a comparison to general

market data as a point of reference and should not be construed as

a true comparison to the strategy.

The information herein is being provided solely in connection

with this press release and is not intended to be, nor should it be

construed or used as, investment, tax or legal advice, any

recommendation or opinion regarding the appropriateness or

suitability of any investment or strategy, or an offer to sell, or

a solicitation of an offer to buy, an interest in any security,

including an interest in any fund or pool described herein.

About Man Group

Man Group is a global, technology-empowered active investment

management firm focused on delivering alpha and portfolio solutions

for clients. Headquartered in London, we manage $161.2 billion(26)

and operate across multiple offices globally.

We invest across a diverse range of strategies and asset

classes, with a mix of long-only and alternative strategies run on

a discretionary and quantitative basis, across liquid and private

markets. Our investment teams work within Man Group's single

operating platform, enabling them to invest with a high degree of

empowerment while benefiting from the collaboration, strength and

resources of the entire firm. Our platform is underpinned by

advanced technology, supporting our investment teams at every stage

of their process, including alpha generation, portfolio management,

trade execution and risk management.

Our clients and the millions of retirees and savers they

represent are at the heart of everything we do. We form deep and

long-lasting relationships and create tailored solutions to help

meet their unique needs. We recognise that responsible investing is

intrinsically linked to our fiduciary duty to our clients, and we

integrate this approach broadly across the firm.

We are committed to creating a diverse and inclusive workplace

where difference is celebrated and everyone has an equal

opportunity to thrive, as well as giving back and contributing

positively to our communities. For more information about Man

Group's global charitable efforts, and our diversity and inclusion

initiatives, please visit:

https://www.man.com/corporate-responsibility

Man Group plc is listed on the London Stock Exchange under the

ticker EMG and is a constituent of the FTSE 250 Index. Further

information can be found at: www.man.com

Important information

The content of the websites referred to in this announcement is

not incorporated into and does not form part of this announcement.

Nothing in this announcement should be construed as or is intended

to be a solicitation for or an offer to provide investment advisory

services or to invest in any investment products mentioned

herein.

Enquiries

Karan Shirgaokar

Head of Investor Relations

+44 20 7144 1434

investor.relations@man.com

Georgiana Brunner

Head of Communications

+44 20 7144 1000

communications@man.com

Neil Doyle

FTI Consulting

+44 77 7197 8220

man@fticonsulting.com

Notes

1 Other movements relate to fee-paying assets under management

added following the acquisition of Varagon Capital Partners,

maturities and leverage movements.

2 Man Institutional Solutions includes AHL Institutional

Solutions, which invests into a range of AHL strategies including

AHL Alpha, AHL Dimension and AHL Evolution.

3 Includes other AHL absolute return, Numeric absolute return

and GLG credit absolute return strategies.

4 Includes other equity and multi-asset strategies.

5 Represented by AHL Alpha plc from 17 October 1995 to 30

September 2012, and by AHL Strategies PCC Limited: Class Y AHL

Alpha USD Shares from 1 October 2012 to 30 September 2013. The

representative product was changed at the end of September 2012 due

to the provisioning of fund liquidation costs in October 2012 for

AHL Alpha plc, which resulted in a tracking error compared with

other Alpha Programme funds. Both funds are valued weekly; however,

for comparative purposes, statistics have been calculated using the

best quality price that is available at each calendar month end,

using estimates where a final price is unavailable. Where a price,

either estimate or final is unavailable on a calendar month end,

the price on the closest date prior to the calendar month end has

been used. Both of the track records have been adjusted to reflect

the fee structure of AHL Alpha (Cayman) Limited - USD Shares. From

30 September 2013, the actual performance of AHL Alpha (Cayman)

Limited - USD Shares is displayed.

6 Represented by AHL Strategies PCC Limited: Class B AHL

Dimension USD Shares from 3 July 2006 to 31 May 2014, and by AHL

Dimension (Cayman) Ltd - F USD Shares Class from 1 June 2014 until

28 February 2015 when AHL Dimension (Cayman) Ltd - A USD Shares

Class is used. Representative fees of 1.5% Management Fee and 20%

Performance Fee have been applied.

7 Represented by AHL Evolution Limited adjusted for the fee

structure (2% management fee and 20% performance fee) from

September 2005 to 31 October 2006; and by AHL Strategies PCC: Class

G AHL Evolution USD from 1 November 2006 to 30 November 2011; and

by the performance track record of AHL Investment Strategies SPC:

Class E AHL Evolution USD Notes from 1 December 2011 to 30 November

2012. From 1 December 2012, the track record of AHL (Cayman) SPC:

Class A1 Evolution USD Shares has been shown. All returns shown are

net of fees.

8 Represented by Man AHL Diversified plc from 26 March 1996 to

29 October 2012, and by Man AHL Diversified (Guernsey) USD Shares -

Class A from 30 October 2012 to date. The representative product

was changed at the end of October 2012 due to legal and/or

regulatory restrictions on Man AHL Diversified plc preventing the

product from accessing the Programme's revised target allocations.

Both funds are valued weekly; however, for comparative purposes,

statistics have been calculated using the best quality price that

is available at each calendar month end, using estimates where a

final price is unavailable. Where a price, either estimate or final

is unavailable on a calendar month end, the price on the closest

date prior to the calendar month end has been used.

9 Represented by Man GLG Alpha Select Alternative IL GBP; AUM

included within GLG equity under the absolute return product

category.

10 Represented by Man GLG Event Driven Alternative IN USD; AUM

included within GLG equity under the absolute return product

category.

11 Represented by GLG Market Neutral Fund - Class Z Restricted -

USD until 31 August 2007. From 1 September 2007, Man GLG Global

Credit Multi Strategy CL IL XX USD unrestricted; AUM included

within Other under the absolute return product category.

12 Represented by Man Strategies 1783 Class F1 USD until 31st

December 2021. From 1 January 2022 Man Strategies 1783 Class A USD;

AUM included within the corresponding product category.

13 Represented by Man AHL TargetRisk class I USD.

14 Represented by Man Alternative Risk Premia Class A USD.

15 Represented by Man GLG Global Emerging Markets Debt Total

Return Class I USD; AUM included within Emerging markets fixed

income under the total return product category.

16 Represented by FRM Diversified II Fund SPC - Class A USD

('the fund') until April 2018 then Class A JPY hedged to USD

thereafter. However, prior to Jan 2004, FRM has created the FRM

Diversified II pro forma using the following methodology: i) for

the period Jan 1998 to Dec 2003, by using the returns of Absolute

Alpha Fund PCC Limited - Diversified Series Share Cell ('AA

Diversified - USD') adjusted for fees and/or currency, where

applicable. For the period Jan 2004 to Feb 2004, the returns of the

fund's master portfolio have been used, adjusted for fees and/or

currency, where applicable. Post Feb 2004, the fund's actual

performance has been used, which may differ from the calculated

performance of the track record. There have been occasions where

the 12-months' performance to date of FRM Diversified II has

differed materially from that of AA Diversified. Strategy and

holdings data relates to the composition of the master portfolio;

AUM included within Diversified and thematic FoHF under the

multi-manager product category.

17 Performance relative to the MSCI World. This reference index

is intended to best represent the strategy's universe. Investors

may choose to compare returns for their accounts to different

reference indices, resulting in differences in relative return

information. Comparison to an index is for informational purposes

only, as the holdings of an account managed by Numeric will differ

from the securities which comprise the index and may have greater

volatility than the holdings of an index.

18 Performance relative to the MSCI Europe (EUR). This reference

index is intended to best represent the strategy's universe.

Investors may choose to compare returns for their accounts to

different reference indices, resulting in differences in relative

return information. Comparison to an index is for informational

purposes only, as the holdings of an account managed by Numeric

will differ from the securities which comprise the index and may

have greater volatility than the holdings of an index; AUM included

within International equity under the systematic long-only product

category.

19 Performance relative to MSCI Emerging Markets. This reference

index is intended to best represent the strategy's universe.

Investors may choose to compare returns for their accounts to

different reference indices, resulting in differences in relative

return information. Comparison to an index is for informational

purposes only, as the holdings of an account managed by Numeric

will differ from the securities which comprise the index and may

have greater volatility than the holdings of an index.

20 Represented by Man GLG Continental European Growth Fund Class

C Accumulation Shares. Relative return shown vs FTSE World Europe

Ex UK (GBP, GDTR); AUM included within Europe ex-UK equity under

the discretionary long-only product category.

21 Represented by Man GLG Japan CoreAlpha Fund - Class C

converted to JPY until 28 January 2010. From 1 February 2010 Man

GLG Japan CoreAlpha Equity Fund - Class I JPY is displayed.

Relative return shown vs TOPIX (JPY, GDTR); AUM included within

Japan equity under the discretionary long-only product

category.

22 Represented by Man GLG Undervalued Assets Fund - C

Accumulation Shares. Relative return shown vs FTSE All Share (GBP,

NDTR); AUM included within UK equity under the discretionary

long-only product category.

23 Represented by Man GLG High Yield Opportunities I EUR.

Relative return is shown vs ICE BofA Global High Yield Index (EUR,

TR) Hedged benchmark. AUM included within Credit and convertibles

under the discretionary long-only product category.

24 HFRI and HFRX index performance over the past 4 months is subject to change.

25 The historical Barclay BTOP 50 Index data is subject to change.

26 As at 30 September 2023. All investment management and

advisory services are offered through the investment engines of Man

AHL, Man Numeric, Man GLG, Man FRM, Man Varagon, Man Global Private

Markets and Man Solutions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPGRGUUPWGRR

(END) Dow Jones Newswires

October 19, 2023 02:00 ET (06:00 GMT)

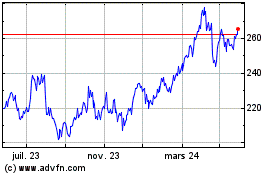

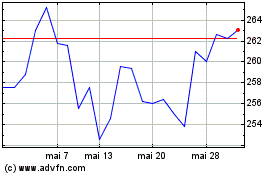

Man (LSE:EMG)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Man (LSE:EMG)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024