18. represents and warrants that it has only communicated or

caused to be communicated and will only communicate or cause to be

communicated any invitation or inducement to engage in investment

activity (within the meaning of section 21 of the FSMA) relating to

the Placing Shares in circumstances in which section 21(1) of the

FSMA does not require approval of the communication by an

authorised person;

19. represents and warrants that it has complied and will comply

with all applicable provisions of the FSMA with respect to anything

done by it in relation to the Placing Shares in, from or otherwise

involving, the United Kingdom;

20. if in a Member State of the European Economic Area, unless

otherwise specifically agreed with Numis in writing, represents and

warrants that it is a Qualified Investor within the meaning of the

Prospectus Directive;

21. if in the United Kingdom, represents and warrants that it is

a person (i) who has professional experience in matters relating to

investments falling within Article 19(1) of the Order; (ii) falling

within Article 49(2)(A) to (D) ("High Net Worth Companies,

Unincorporated Associations, etc") of the Order; or (iii) to whom

this Announcement may otherwise be lawfully communicated;

22. represents and warrants that it and any person acting on its

behalf is entitled to acquire the Placing Shares under the laws of

all relevant jurisdictions and that it has all necessary capacity

and has obtained all necessary consents and authorities and taken

any other necessary actions to enable it to commit to this

participation in the Placing and to perform its obligations in

relation thereto (including, without limitation, in the case of any

person on whose behalf it is acting, all necessary consents and

authorities to agree to the terms set out or referred to in this

Announcement) and will honour such obligations;

23. where it is acquiring Placing Shares for one or more managed

accounts, represents and warrants that it is authorised in writing

by each managed account: (a) to acquire the Placing Shares for each

managed account; (b) to make on its behalf the representations,

warranties, acknowledgements, undertakings and agreements in this

Appendix and the Announcement of which it forms part; and (c) to

receive on its behalf any investment letter relating to the Placing

in the form provided to it by Numis;

24. undertakes that it (and any person acting on its behalf)

will make payment for the Placing Shares allocated to it in

accordance with this Announcement on the due time and date set out

herein, failing which the relevant Placing Shares may be placed

with other subscribers or sold as Numis may in its sole discretion

determine and without liability to such Placee and it will remain

liable and will indemnify Numis and the Company on demand for any

shortfall below the net proceeds of such sale and the placing

proceeds of such Placing Shares and may be required to bear the

liability for any stamp duty or stamp duty reserve tax or security

transfer tax (together with any interest or penalties due pursuant

to or referred to in these terms and conditions) which may arise

upon the placing or sale of such Placee's Placing Shares on its

behalf;

25. acknowledges that none of Numis, any of its affiliates, or

any person acting on behalf of any of them, is making any

recommendations to it, advising it regarding the suitability of any

transactions it may enter into in connection with the Placing and

that participation in the Placing is on the basis that it is not

and will not be treated for these purposes as a client of Numis and

that Numis has no duties or responsibilities to it for providing

the protections afforded to their respective clients or customers

or for providing advice in relation to the Placing nor in respect

of any representations, warranties, undertakings or indemnities

contained in the Placing Agreement nor for the exercise or

performance of any of their rights and obligations thereunder

including any rights to waive or vary any conditions or exercise

any termination right;

26. undertakes that the person whom it specifies for

registration as holder of the Placing Shares will be (i) itself or

(ii) its nominee, as the case may be. Neither Numis nor the Company

will be responsible for any liability to stamp duty or stamp duty

reserve tax resulting from a failure to observe this requirement.

Each Placee and any person acting on behalf of such Placee agrees

to participate in the Placing and it agrees to indemnify the

Company and Numis in respect of the same on the basis that the

Placing Shares will be allotted to the CREST stock account of Numis

who will hold them as nominee on behalf of such Placee until

settlement in accordance with its standing settlement

instructions;

27. acknowledges that these terms and conditions and any

agreements entered into by it pursuant to these terms and

conditions and any non-contractual obligations arising out of or in

connection with such agreement shall be governed by and construed

in accordance with the laws of England and Wales and it submits (on

behalf of itself and on behalf of any person on whose behalf it is

acting) to the exclusive jurisdiction of the English courts as

regards any claim, dispute or matter (including non-contractual

matters) arising out of any such contract, except that enforcement

proceedings in respect of the obligation to make payment for the

Placing Shares (together with any interest chargeable thereon) may

be taken by the Company or Numis in any jurisdiction in which the

relevant Placee is incorporated or in which any of its securities

have a quotation on a recognised stock exchange;

28. acknowledges that time shall be of the essence as regards to

obligations pursuant to this Appendix;

29. agrees that the Company, Numis and their respective

affiliates and others will rely upon the truth and accuracy of the

foregoing representations, warranties, acknowledgements and

undertakings which are given to Numis on its own behalf and on

behalf of the Company and are irrevocable and are irrevocably

authorised to produce this Announcement or a copy thereof to any

interested party in any administrative or legal proceeding or

official inquiry with respect to the matters covered hereby;

30. agrees to indemnify on an after-tax basis and hold the

Company, Numis and their respective affiliates harmless from any

and all costs, claims, liabilities and expenses (including legal

fees and expenses) arising out of or in connection with any breach

of the representations, warranties, acknowledgements, agreements

and undertakings in this Appendix and further agrees that the

provisions of this Appendix shall survive after completion of the

Placing;

31. acknowledges that no action has been or will be taken by any

of the Company, Numis or any person acting on behalf of the Company

or Numis that would, or is intended to, permit a public offer of

the Placing Shares in any country or jurisdiction where any such

action for that purpose is required;

32. acknowledges that it is an institution that has knowledge

and experience in financial, business and international investment

matters as is required to evaluate the merits and risks of

subscribing for the Placing Shares. It further acknowledges that it

is experienced in investing in securities of this nature and in

this sector and is aware that it may be required to bear, and it,

and any accounts for which it may be acting, are able to bear, the

economic risk of, and is able to sustain, a complete loss in

connection with the Placing. It has relied upon its own examination

and due diligence of the Company and its associates taken as a

whole, and the terms of the Placing, including the merits and risks

involved;

33. acknowledges that its commitment to subscribe for Placing

Shares on the terms set out herein and in the trade confirmation or

contract note will continue notwithstanding any amendment that may

in future be made to the terms of the Placing and that Placees will

have no right to be consulted or require that their consent be

obtained with respect to the Company's conduct of the Placing;

34. acknowledges that Numis or any of its affiliates acting as

an investor for its own account may take up shares in the Company

and in that capacity may retain, purchase or sell for its own

account such shares and may offer or sell such shares other than in

connection with the Placing;

35. represents and warrants that, if it is a pension fund or

investment company, its purchase of Placing Shares is in full

compliance with all applicable laws and regulation; and

36. to the fullest extent permitted by law, it acknowledges and

agrees to the disclaimers contained in the Announcement including

this Appendix.

The representations, warranties, acknowledgments and

undertakings contained in this Appendix are given to Numis and the

Company and are irrevocable and shall not be capable of termination

in any circumstances.

The agreement to settle a Placee's subscription (and/or the

subscription of a person for whom such Placee is contracting as

agent) free of stamp duty and stamp duty reserve tax depends on the

settlement relating only to a subscription by it and/or such person

direct from the Company for the Placing Shares in question. Such

agreement assumes that the Placing Shares are not being subscribed

for in connection with arrangements to issue depositary receipts or

to transfer the Placing Shares into a clearance service. If there

are any such arrangements, or the settlement relates to any other

subsequent dealing in the Placing Shares, stamp duty or stamp duty

reserve tax may be payable, for which neither the Company nor Numis

will be responsible, and the Placee to whom (or on behalf of whom,

or in respect of the person for whom it is participating in the

Placing as an agent or nominee) the allocation, allotment, issue or

delivery of Placing Shares has given rise to such UK stamp duty or

stamp duty reserve tax undertakes to pay such UK stamp duty

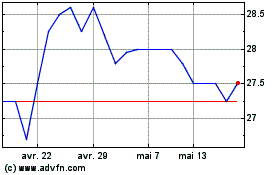

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024