RNS Number:2669F

International Greetings PLC

28 June 2006

INTERNATIONAL GREETINGS PLC

International expansion and product diversification

underpin solid results and future growth

International Greetings PLC ("International Greetings", "the Company" or "the

Group") (AIM: IGR), the global designer and manufacturer of greetings products,

film and television character based licensed stationery, books and gifts, today

announces preliminary results for the year ended 31 March 2006.

Financial Highlights:

* Turnover improved 37% to #196.6m (2005: #143.7m)

* Adjusted profit before tax* increased 30% to #18.0m (2005: #13.8m)

* European sales grew 29% to #22.7m (2005: #17.6m)

* US sales increased 34% to #47.2m (2005: #35.1m)

* Total overseas sales rose 36% to #74.1m (2005: #54.7m)

* Adjusted earnings per share* increased 18% to 28.9p (2005: 24.5p)

* Final dividend per share of 7p, increases the year's total dividend

20% to 9p (2005: total dividend: 7.5p)

Operational Highlights:

* Completion of the acquisition and integration of Anker International in May 2005

* Chinese manufacturing facility relocated to new purpose-built complex,

increasing in-house production and ability to monitor quality control

Post Period Events

* April 2006, acquisition of Alligator Books, for an initial #2.5m

* Board restructure - Keith James to assume chairman's role in September 2006

Commenting on the results, Nick Fisher, Joint Chief Executive, said: "These

results reflect our recent drive to establish efficient, low cost manufacturing

and distribution bases, and our expansion programmes in the US and European

markets.

"These initiatives, together with our latest acquisitions, further underpin our

strategy to diversify the Group's activities, and increase our product offering

to existing and new customers, whilst ensuring the success of our business for

the future."

Adjusted to exclude exceptional items of #3,310,000 (2005: #738,000), profit on

disposal of fixed assets of #1,838,000 (2005: #nil) and amortisation of goodwill

of #1,031,000 (2005: #443,000)

For further information:

Nick Fisher, Joint Chief Executive, International Greetings: 01707 630 630

Richard Sunderland/Rachel Drysdale, Tavistock Communications: 020 7920 3150

CHAIRMAN'S STATEMENT

I am delighted to report another significant year of progress for International

Greetings. The Group's existing businesses have performed well during the year

with growth in both profit and turnover. We also completed the purchase of Anker

International in May last year which, with a total cost of #35.4m, is our

largest acquisition to date. This acquisition has been a major development for

the Group, not only increasing turnover significantly, but also enhancing our

trading profile. It has taken the Group into new market sectors, extended our

product categories and reduced our seasonality of sales. Anker has fulfilled

expectations since it was acquired and we are encouraged by its performance.

Adjusted profit before tax* for the year ended 31 March 2006 increased by 30%

to #18.0m with turnover increasing by 37% to #196.6m. The success of our focus

on international expansion in recent years is again reflected in these figures

with sales in the US increasing 34% to #47.2m and sales in Europe growing 29% to

#22.7m. Total overseas sales now account for #74.1m or 38% of turnover, an

increase of 36% over last year's #54.7m.

Adjusted earnings per share* increased by 18% to 28.9p and in line with our

policy of increasing shareholder returns and reflecting our continued confidence

in our business, we are recommending a final dividend of 7p per share. This

makes a total for the year of 9p, an increase of 20% over last year.

Since the year end, we have made a further acquisition. Alligator Books,

acquired in April, creates and publishes children's licensed and generic books,

which it sells primarily in the UK, and we are delighted to have entered into

the mainstream publishing market. This acquisition met all of our criteria,

including introducing another new product category into the Group's portfolio.

After 10 years as chairman, I have decided to step down following the Company's

Annual General Meeting in September, but will remain on the Board as a

non-executive director. Keith James, currently a non-executive director, will

assume the position of chairman at that time. With his breadth of business

experience, together with his newly acquired knowledge of our business since

joining the board, I know that International Greetings will be in safe hands. He

looks forward to leading the Group during its next level of corporate

development and I wish him future success in the role.

Finally, I would like to thank all the staff of International Greetings and

everyone associated within the Group who have helped me in my role for the last

decade. It has been both a pleasure and privilege to serve as chairman of the

Company.

John Elfed Jones CBE DL

Chairman

*Adjusted to exclude exceptional items of #3,310,000 (2005: #738,000), profit on

disposal of fixed assets of #1,838,000 (2005: #nil) and amortisation of goodwill

of #1,031,000 (2005: #443,000)

CHIEF EXECUTIVE'S REPORT

Once again we have experienced a very active year due to our consistently

expanding business and the dynamic environment in which we operate. The Group is

now truly an international business, supported by our core strengths of best

design and product development, combined with efficient manufacturing and

distribution.

UK

During the past year, we have continued to rationalise our manufacturing and

distribution activities in the UK in order to maintain our competitiveness.

Following last year's relocation of card manufacturing to Latvia, additional

manufacturing equipment has been moved from the UK to Latvia this year. This has

resulted in redundancies and exceptional costs of closure during the year, but

was necessary in order to ensure we operate an efficient low cost manufacturing

base for the future.

The acquisition of Anker last year has significantly expanded the Group's UK

operations. It has performed well since acquisition and we have recently taken

the opportunity to merge our Copywrite licensed stationery division into Anker.

Although this has resulted in one-off exceptional costs during the current year,

we believe we will generate future cost savings as well as creating many new and

exciting opportunities for the merged business.

Our strategy for growth in the UK, a highly competitive and difficult market, is

to focus on those sales opportunities that provide us with the best return and

strategic long term benefits. These opportunities will be coupled with

acquisitions which will provide not only immediate benefits but also

opportunities for the further diversification of our activities. We are

confident this strategy will ensure we continue to be in the best competitive

position and are able to take advantage as and when UK market conditions

improve.

The acquisition of Alligator Books in April this year extends the Group's UK

business into children's licensed books and fun learning products. Alligator

distributes an extensive range of fiction and non-fiction books and recently

acquired from Chrysalis the world-wide publishing rights of 80 non-fiction

illustrated reference books that made up its children's book division. We

believe that as part of International Greetings, we can significantly expand

this business in the future, not only in the UK, but also in our other

geographical markets.

Europe

Following a period of acquisition and investment in Europe in recent years, a

highly focused European division has now been created. We have restructured the

European sales teams within our existing business, which will provide orders for

delivery from our manufacturing and distribution centre based in Holland. We

have achieved growth in European sales this year of 29% and are looking to

continue expansion by a strong sales and marketing effort across all Group

product categories in all European territories.

US

We remain committed to our expansion programme in the US market. Our efforts are

focussed on both our traditional supply channel to the department store and

independent sector, together with a continued push into the mass market and

own-brand sector for both seasonal and everyday products. We are also actively

ensuring that all of the Group's product categories are being offered to the

full breadth of US retailers identifying all sales opportunities available to

us. The Anker ranges, including the high quality Pepper Pot stationery brand,

are also being offered to the speciality retailer sector. The success of this

strategy is reflected in the growth of the US business this year, which has seen

like-for-like turnover increase by 22% to $50.5m and like-for-like operating

profit increase 18% to $3.1m. Overall, the Group's sales in the US now account

for 24% of total sales.

Far East

With the ever increasing importance of the Far East to the Group's business, we

have further extended our presence in this region.

Our Chinese manufacturing facility has recently been relocated to a new larger

purpose-built complex. This extra capacity will allow us to produce many more of

our product categories in-house under our direct control, ensuring standards of

product quality, productivity and on-time delivery to our customers is

maintained. At peak production we expect to employ some 1,300 people in the

facility.

We have also relocated the trading, sourcing and administration activities of

our Hong Kong operation into a new office suite of 10,000 sq feet. The

facilities include a new showroom displaying all the Group's products available

for sale in the global market place. We have also employed additional support

staff to ensure that all out-sourced products match the production and quality

criteria of our own in-house manufactured goods.

All trading divisions within the Group have the opportunity to benefit from this

facility and, where feasible, orders from different trading regions will be

consolidated to achieve manufacturing efficiencies and cost savings.

Design and Licensing

A key to our continued success is the strong commitment to the design and

development of our products.

During the year we have re-evaluated the design processes carried out throughout

the Group. This has culminated in the creation of a highly focused operating

structure to maximise the quality of design in each of our product categories.

In addition, a separate licensed studio has been formed to provide all of the

Group's trading divisions with the specialist design techniques utilised in this

area of intellectual property. The Alligator acquisition has further

strengthened our status within the licence industry and will improve our ability

to obtain additional licences for the future.

Following this year's results announcement are the launches of Disney's new

Pixar film "Cars" and "Pirates of the Caribbean II", for both of which we have

designed and created new ranges of products.

Conclusion

Our business has now been operating for over 25 years. We have the knowledge,

experience and ambition to continue to grow our business, and have created an

operating model that is flexible enough to adapt to the different and

ever-changing market conditions across all the geographical territories in which

we operate.

Acquisitions will continue to be an important part of our future strategy to

create a more diverse business by introducing new product categories to our

portfolio and extending the Group's international business.

We would also like to thank our outgoing chairman, John Elfed Jones, for his

invaluable support and guidance over what has been a very successful ten years

for the Company and welcome Keith James into the chair.

Anders Hedlund and Nick Fisher

Joint Chief Executives

FINANCE REVIEW

Group Performance

Turnover for the year to 31 March 2006 amounted to #196.6m, an increase of 37%

over last year. Excluding #34.8m attributable to the acquisition of Anker, Group

turnover amounted to #161.7m, an increase of 13% over last year. US sales

increased by 34% to #47.2m whilst European turnover rose 29% to #22.7m. Total

overseas sales increased 36% to #74.1m and represented 38% of total turnover.

Excluding Anker's sales, which are primarily made in the UK, overseas sales

represented 44% of the Group's total. This growth in the Group's overseas sales

over recent years represents a significant strategic development as the Group's

expansion and diversification into new markets continues.

Operating profit increased from #12.7m to #15.4m. Excluding Anker and

exceptional items, operating profit increased from #13.4m to #14.4m. The

exceptional items of #3.3m relate primarily to a number of restructuring changes

made to the Group's operations during the year in order to maintain our

competitiveness. These restructuring changes included the relocation of

production operations overseas, the integration and relocation of Copywrite's

operations into Anker and the merging of Hoomark's UK sales operation into the

Group's UK division.

Net interest payable increased from #36,000 to #1.8m, #1.0m of which arose as a

result of the acquisition of Anker. Other significant factors in this increase

were the full year effect, for the first time, of the #5.1m purchase of our new

factory and distribution facility in Holland, in November 2004, and the #4.5m

purchase of the Napier Christmas cracker business in January 2005.

The profit on disposal of fixed assets of #1.8m arose on the sale of the

freehold interest in property owned by Anker. Net profit before taxation

increased by 23% to #15.5m, with adjusted profit before tax* for the year

increasing 30% to #18m.

Earnings Per Share and Dividend

Adjusted basic earnings per share* for the year ended 31 March 2006 were

28.9p, an increase of 18% over last year. Basic earnings per share were 27.1p,

an increase of 21% over last year.

The final dividend proposed for the year of 7p (2005: 5.75p) makes a total

dividend for the year of 9p, an increase of 20% and is covered three times by

basic earnings per share.

Treasury Operations

The Board continues to assess and manage the risks associated with the treasury

function as the business develops. The Group's business has a strong seasonal

focus, resulting in large variations in working capital, with net funds for

certain periods of the year and net borrowings in other periods. As a result,

the Board considers that long term reduction of exposure to fluctuations in

interest rates on working capital is unlikely to be economically viable.

A significant proportion of the Group's purchases are denominated in US$. The

effect of exchange rate fluctuations is reduced through a combination of

measures including hedging and forward exchange contracts.

Balance Sheet and Cash Flow

Net debt at 31 March 2006 amounted to #10.7m, compared to net funds of #3.8m

last year. The cost of acquiring Anker accounted for #13.1m of this #14.5m

movement. The sale of Anker's property, which has subsequently been leased back,

generated a net cash inflow of #18.8m and resulted in an overall cash inflow

from capital expenditure of #7.8m. This was offset by increases in stock and

debtors of #9.7m and #5.7m respectively, which were attributable to a number of

factors including the Anker acquisition, increased working capital to facilitate

the high growth rates being achieved in our overseas markets and a debtor of

#3.7m in relation to an outstanding insurance claim.

The #35.4m cost of the Anker acquisition was funded by #12.9m paid in cash,

#12.5m paid by the issue of new ordinary shares during the year, with a further

cash payment due of #10m, which has been paid subsequent to the year end.

Shareholder funds increased by #22.1m to #75.7m and with year-end gearing of 14%

and interest covered 8.6 times by operating profit, the Group's financial

position remains strong.

Mark Collini

Finance Director

*Adjusted to exclude exceptional items of #3,310,000 (2005: #738,000), profit on

disposal of fixed assets of #1,838,000 (2005: #nil) and amortisation of goodwill

of #1,031,000 (2005: #443,000)

Consolidated profit and loss account

for the year ended 31 March 2006

Note Continuing operations

Excluding acquisition Acquisition

Pre-exceptional Exceptional Pre-exceptional Exceptional Total Total

item item item item (Restated-

see Note 1)

2006 2006 2006 2006 2006 2005

#000 #000 #000 #000 #000 #000

Group turnover

including share of

joint venture turnover 161,706 - 36,433 - 198,139 143,689

Less: Share of joint

venture turnover - - (1,585) - (1,585) -

-----------------------------------------------------------------------------------

Group turnover 2 161,706 - 34,848 - 196,554 143,689

Cost of sales (111,834) - (23,287) - (135,121) (99,220)

-----------------------------------------------------------------------------------

Gross profit 49,872 - 11,561 - 61,433 44,469

Distribution expenses (14,005) - (2,476) - (16,481) (14,017)

Administrative expenses (21,462) (3,053) (4,747) (257) (29,519) (17,799)

-----------------------------------------------------------------------------------

Operating profit 2 14,405 (3,053) 4,338 (257) 15,433 12,653

Share of operating profit

of joint venture - - 7 - 7 -

-----------------------------------------------------------------------------------

14,405 (3,053) 4,345 (257) 15,440 12,653

------------------------------------------------------------

Profit on disposal of

fixed assets 1,838 -

Net interest payable (1,801) (36)

-----------------------

Profit on ordinary

activities before

taxation 2-3 15,477 12,617

Tax on profit on ordinary

activities 4 (3,146) (3,098)

-----------------------

Profit for the

financial year 12,331 9,519

-----------------------

Earnings per share 7

Basic 27.1p 22.4p

Diluted 26.6p 22.1p

=======================

Consolidated statement of total recognised gains and losses

for the year ended 31 March 2006

2006 2005

#000 #000

Profit for the financial year 12,331 9,519

Currency translation differences arising on foreign currency net investments 914 (160)

-----------------------

Total recognised gains and losses relating to the financial year 13,245 9,359

=======================

Consolidated balance sheet

at 31 March 2006

Note 2006 2005

(Restated-see Note 1)

#000 #000 #000 #000

Fixed assets

Intangible assets - goodwill 21,339 5,113

Tangible assets 37,134 30,853

Investments in joint venture

- share of gross assets 769 -

- share of gross liabilities (596) -

-------- --------

58,646 35,966

Current assets

Stocks 40,008 24,178

Debtors 29,863 16,477

Investments - unquoted 65 -

Cash at bank and in hand 11,825 6,490

-------- --------

81,761 47,145

Creditors: amounts falling due

within one year (56,382) (23,452)

-------- --------

Net current assets 25,379 23,693

-------- --------

Total assets less current

liabilities 84,025 59,659

Creditors: amounts falling due

after more than one year (6,352) (5,690)

Provisions for liabilities

and charges (1,950) (380)

-------- --------

Net assets 75,723 53,589

======== ========

Capital and reserves

Called up share capital 2,308 2,140

Share premium account 2,386 2,704

Potential issue of shares 6(a) 1,052 926

Other reserves 13,964 21

Profit and loss account 56,013 47,798

-------- --------

Equity shareholders' funds 8 75,723 53,589

======== ========

Consolidated cash flow statement

for the year ended 31 March 2006

Note 2006 2005

#000 #000

Net cash inflow from operating

activities 10 2,706 14,398

Returns on investments and

servicing of finance 11 (1,232) (54)

Taxation (5,980) (3,600)

Capital expenditure 11 7,809 (8,793)

Acquisitions and disposals 11 (13,078) (5,984)

Equity dividends paid (3,578) (2,872)

-------- --------

Cash outflow before financing (13,353) (6,905)

Financing 11 (630) (1,180)

-------- --------

Decrease in cash in the year (13,983) (8,085)

======== ========

Reconciliation of net cash flow to movement in net (debt)/funds

for the year ended 31 March 2006

Note 2006 2005

#000 #000

Decrease in cash in the year (13,983) (8,085)

Cash outflow from debt and lease

financing 12 462 1,541

-------- --------

Change in net funds resulting

from cash flows (13,521) (6,544)

Translation differences 12 (1,013) 66

-------- --------

Movement in net funds in the year (14,534) (6,478)

Net funds at beginning of year 3,790 10,268

Net (debt)/funds at end of year 12 (10,744) 3,790

======== ========

Notes

1 Basis of preparation

The financial information set out above does not constitute the Company's

statutory financial statements for the years ended 31 March 2006 or 2005.

Statutory financial statements for 2005 have been delivered to the registrar of

companies, and those for 2006 will be delivered following the company's annual

general meeting. The auditors have reported on those accounts; their reports

were unqualified and did not contain statements under section 237(2) or (3) of

the Companies Act 1985.

The financial information has been prepared in accordance with applicable

accounting standards and under the historical cost accounting rules. In this

financial information the following new standards have been adopted for the

first time:

* FRS 21 'Events after the balance sheet date'

* FRS 22 'Earnings per share'

* FRS 25 'Financial instruments: presentation and disclosure' - presentation

requirements only

* FRS 28 'Corresponding amounts'

FRS 28 'Corresponding amounts' has had no material effect as it imposes the same

requirements for comparatives as hitherto required by the Companies Act 1985.

Following adoption of FRS 21 'Events after the balance sheet date' the

comparative figures as at 31 March 2005 and the opening reserves figures as at 1

April 2004 have been restated to exclude the proposed dividend of #2,461,000 and

#2,112,000 respectively.

FRS 22 dictates the measures of earnings per share which can be shown on the

face of the profit and loss account to ensure consistency in the presentation of

financial information.

The adoption of the presentation elements of FRS 25 means that dividends are no

longer shown as an expense in the profit and loss account - they are instead

presented as a movement on shareholders' funds (see note 8).

2 Segmental analysis

(a) Geographical area of operation

UK, Europe & Far East USA Group

2006 2005 2006 2005 2006 2005

#000 #000 #000 #000 #000 #000

Turnover 167,344 121,675 29,210 22,014 196,554 143,689

==================================================================================

Operating profit

before exceptional

items 16,947 12,003 1,796 1,388 18,743 13,391

Exceptional items

(see below) (3,310) (738) - - (3,310) (738)

----------------------------------------------------------------------------------

Operating profit

after exceptional items 13,637 11,265 1,796 1,388 15,433 12,653

Share of operating

profit of joint

venture 7 - - - 7 -

----------------------------------------------------------------------------------

13,644 11,265 1,796 1,388 15,440 12,653

Profit on disposal of

fixed assets 1,838 - - - 1,838 -

Net interest (1,108) 279 (693) (315) (1,801) (36)

----------------------------------------------------------------------------------

Profit on ordinary

activities before

taxation 14,374 11,544 1,103 1,073 15,477 12,617

==================================================================================

Net assets

(restated-note 1) 68,338 47,305 7,385 6,284 75,723 53,589

==================================================================================

The above results relate entirely to continuing operations.

(b) Exceptional items

2006 2005

#000 #000

Restructuring costs (see (i) below) 2,906 738

Other (see (ii) below) 404 -

--------------------

3,310 738

====================

i) During the year ended 31 March 2006, the Group made a number of

restructuring changes to its operations in order to maintain competitiveness.

These consisted of (a) the relocation of UK production operations overseas

(including the cracker manufacturing operation forming part of the business and

assets of Napier Industries Ltd acquired in January 2005), (b) the relocation

and integration of the Copywrite licensed stationery division into Anker's

operations and (c) the integration of Hoomark's UK sales operation into the

Group's UK division. The cost of these restructuring changes, primarily

redundancy and other personnel related items, amounted to #2,906,000.

During the year ended 31 March 2005, the Group transferred the manufacturing of

greetings cards and tags from Hatfield to a new facility in Latvia. The

exceptional item of #738,000 represented the costs, primarily redundancy and

machinery re-location, associated with this transfer.

ii) These represent one-off product safety recall and rectification costs

incurred in connection with one of the Group's products.

(c) Geographical analysis of turnover by destination

2006 2005

#000 #000

UK 122,443 89,004

USA 47,191 35,132

Europe 2,665 17,637

Rest of world 4,255 1,916

----------------------

196,554 143,689

======================

3 Profit on ordinary activities before taxation

2006 2005

#000 #000

Profit on ordinary activities before taxation

is stated after charging/(crediting)

Auditors' remuneration - audit fees paid to the

company's auditor and

its associates 116 86

- non audit fees paid to

the company's auditor and

its associates 197 36

Hire of plant and machinery - rentals payable under

operating leases 410 343

Hire of other assets - operating leases 1,249 746

Release of deferred grant income (498) (554)

Depreciation - owned 5,469 4,217

- leased 276 255

Amortisation of goodwill 1,031 443

======================

Audit fees payable by the company for the year were #31,000 (2005: #21,000).

Non audit fees payable by the Group relate to advice given on taxation, and in

relation to the relocation of the Group's Chinese facility. The 2005 non audit

fees relate mainly to tax advice.

4 Taxation

2006 2005

#000 #000 #000 #000

Current tax

UK corporation tax on profits

of the year 2,885 2,240

Adjustments in respect of

previous periods 22 (235)

------- -------

2,907 2,005

Foreign tax

On profits of the year 1,369 1,237

Adjustments in respect of

previous periods 14 (51)

------- -------

1,383 1,186

------- -------

Total current tax 4,290 3,191

Deferred taxation

Origination and reversal of

timing differences (1,231) (95)

Adjustments in respect of

previous periods 87 2

------- -------

Total deferred tax (1,144) (93)

------- -------

Tax on profits on ordinary

activities 3,146 3,098

======= =======

Factors affecting tax charge for period

2006 2005

#000 #000

Profit on ordinary activities before tax 15,477 12,617

====== ======

Profit on ordinary activities multiplied by

standard rate of corporation tax in the UK of 30% 4,643 3,785

Effects of:

Current tax charge/(credit)

---------------------------

Difference between accounting and taxable profits

on sale of fixed assets 88 -

Goodwill arising on consolidation 265 85

Fair value adjustment arising on consolidation (202) -

Notional interest expense disallowed 120 -

Expenses not deductible for corporation tax purposes 191 147

Tax deductions for gains on employee share options (88) (155)

Difference between UK and overseas tax rates (427) (424)

Release of grant (142) (161)

Difference between capital allowances and depreciation (187) 167

Provisions not deductible until paid 82 1

Other timing differences (89) 32

Adjustments in respect of previous periods 36 (286)

---------------------

(353) (594)

---------------------

Total current tax 4,290 3,191

Deferred tax charge/(credit)

----------------------------

Credit in relation to the disposal of fixed assets (1,305) -

Origination and reversal of timing differences 336 (95)

Difference between UK and overseas tax rates (262) -

Adjustments in respect of prior periods 87 2

---------------------

Total deferred tax (1,144) (93)

---------------------

Total tax charge for the period 3,146 3,098

=====================

5 Dividends paid

2006 2005

(Restated -

see note 1)

#000 #000

Final for year ended 31 March 2005

- 5.75p per share (2004: 5p) 2,652 2,126

Interim for year ended 31 March 2006

- 2p per share (2005: 1.75p) 926 746

----------------------

Dividends paid 3,578 2,872

======================

6 Acquisitions

(a) On 19 November 2003, the Group acquired 100% of the issued share capital of

Hoomark Gift-Wrap Partners BV. The purchase agreement provided for future

payments of deferred consideration, based on Hoomark's profits for the 3

years ended March 2007. At 31 March 2005, the future consideration payable

was estimated at #926,000, of which up to 100% was payable by the issuance

of new ordinary shares at the company's option. During the year ended

31 March 2006, #255,000 of this amount was paid in cash. Based on Hoomark's

results for the year ended 31 March 2006, and future projections, the

estimated future consideration has been increased by #381,000 including

#16,000 accounted for by exchange differences. Up to 100% of the total

unpaid consideration of #1,052,000 at 31 March 2006 may be payable by the

issue of new ordinary shares, at the company's option.

(b) On 27 May 2005, the Group acquired 100% of the issued share capital of Anker

International PLC, an international design, import and distribution

business for a total cost of #35.4m. #25.4m was paid on

completion, of which #12.5m was represented by the issue of 3,294,242

ordinary shares and #12.9m in cash. The remaining cost of

#10.0m plus #0.5m accounted for as notional interest payable

on the deferred purchase consideration, was paid in cash on 31 May 2006.

The book value and provisional fair value of assets purchased was as follows:

Book value Provisional fair Provisional fair

value value at date

adjustments of acquisition

#000 #000 #000

Tangible fixed assets 14,579 (473) 14,106

Investments 224 - 224

Stock 5,932 (642) 5,290

Debtors 6,379 - 6,379

Creditors (6,689) (784) (7,473)

Bank overdraft (31) - (31)

----------------------------------------------

20,394 (1,899) 18,495

====== =======

Goodwill (estimated useful

life of 30 years) 16,881

------

Total consideration 35,376

======

The latest available audited accounts of Anker International PLC were prepared

at 31 December 2004 and reflect turnover of #40.0m, operating profit of

#4.1m and interest payable of #0.3m, resulting in a profit before

taxation of #3.8m.

The provisional fair value adjustment to fixed assets represents an adjustment

to bring freehold property into line with market value. The provisional

adjustment to stock represents an adjustment to reflect the sterling value of

stock purchased in US$ at actual cost. The provisional adjustment to creditors

represents (a) an adjustment of #430,000 to decrease the sterling value of US$

denominated trade creditors to the rate of exchange prevailing at the date of

acquisition, (b) a provision of #1,278,000 in respect of onerous forward foreign

exchange contracts, being the difference between the contracted rate and the

prevailing spot rate at the date of acquisition and (c) the tax effect of

#64,000 in relation to the above adjustments to stock and trade creditors.

7 Earnings per share

2006 2005

Adjusted basic earnings per share excluding

exceptional items, profit on disposal of fixed

assets and goodwill 28.9p 24.5p

Loss per share on goodwill (2.2p) (0.9p)

Loss per share on exceptional items (5.1p) (1.2p)

Earnings per share on profit on disposal of fixed assets 5.5p -

-------------------

Basic earnings per share 27.1p 22.4p

===================

Diluted earnings per share 26.6p 22.1p

===================

The basic earnings per share is based on the earnings of #12,331,000 (2005:

#9,519,000) and the weighted average number of ordinary shares in issue of

45,536,856 (2005: 42,529,155). The calculation of diluted earnings per share is

based on 46,304,602 (2005: 43,088,426) ordinary shares. The difference of

767,746 (2005: 559,291) represents the dilutive effect of outstanding employee

share options which has been calculated in accordance with FRS 22.

Adjusted basic earnings per share excluding exceptional items, profit on

disposal of fixed assets and goodwill is calculated after adjusting for

exceptional items of #3,310,000 (2005: #738,000), the profit on disposal of

fixed assets of #1,838,000 (2005: #nil), amortisation of goodwill of #1,031,000

(2005: #443,000), and the tax relief attributable to these items of #1,691,000

(2005: #269,000).

8 Reconciliations of movements in shareholders' funds

2006 2005

(restated-see

note 1)

#000 #000

Profit for the financial year 12,331 9,519

Dividends paid in the year (note 5) (3,578) (2,872)

----------------------

Retained profit for the financial year 8,753 6,647

Other recognised gains and losses relating to

the year (net) 914 (160)

New share capital subscribed 12,879 1,029

Potential issue of shares (note 6(a)) 126 (154)

Purchase of own shares (538) -

----------------------

Net addition to shareholders' funds 22,134 7,362

Opening shareholders' funds - as previously reported 51,128 44,115

Prior year adjustment - proposed dividend 2,461 2,112

----------------------

Closing shareholders' funds 75,723 53,589

9 Post balance sheet event

On 6 April 2006 the company acquired 100% of the issued share capital of

Alligator Books Limited, a publisher and distributor of children's books and

stationery, for an initial consideration of #2.5m, of which #2.25m

was paid in cash and #250,000 by the issue of 62,703 new ordinary shares.

Additional consideration may become payable, depending on the level of

profitability for the year ended 31 March 2007, in a mixture of cash and new

ordinary shares.

10 Reconciliation of operating profit to net cash inflow from operating

activities

2006 2005

#000 #000

Operating profit 15,433 12,653

Depreciation charge 5,745 4,472

(Increase) in stocks (9,650) (1,251)

(Increase) in debtors (5,715) (3,366)

(Decrease)/increase in creditors (2,833) 2,001

Deferred income (632) (554)

Goodwill amortisation 1,031 443

Utilisation of provision (673) -

----------------------

Net cash inflow from operating activities 2,706 14,398

11 Gross cash flows

Cash inflow/(outflow)

2006 2005

#000 #000

Returns on investment and servicing of finance

Interest paid (1,668) (662)

Interest received 455 649

Interest element of finance lease repayments (19) (41)

----------------------

Net cash (outflow) for returns on investment and

servicing of finance (1,232) (54)

======================

Capital expenditure

Purchase of tangible fixed assets (11,225) (11,262)

Disposal of tangible fixed assets 19,034 146

Grants received in relation to capital expenditure - 2,323

----------------------

Net cash inflow/(outflow) from capital expenditure 7,809 (8,793)

======================

Acquisitions and disposals

Acquisition of businesses - (5,978)

Acquisition of subsidiaries (13,047) (6)

Net overdraft acquired with subsidiary (31) -

----------------------

Net cash (outflow) for acquisitions and disposals (13,078) (5,984)

======================

Financing

New shares issued 379 361

Purchase of own shares (538) -

Repayment of amounts borrowed (99) (1,256)

Capital element of finance lease payments (363) (285)

Purchase of investments (9) -

----------------------

Net cash (outflow) from financing (630) (1,180)

======================

12 Analysis of changes in net (debt)/funds

At 1 April Cash flow Exchange Acquisition of Other At 31 March

2005 movement subsidiary changes 2006

#000 #000 #000 #000 #000 #000

Cash at bank and in hand 6,490 5,070 265 - - 11,825

Overdrafts (672) (19,022) (1,125) (31) - (20,850)

--------------------------------------------------------------------------------------

5,818 (13,952) (860) (31) - (9,025)

Debt due after one year (1,143) - (106) - 102 (1,147)

Debt due within one year (90) 99 (8) - (102) (101)

Finance leases (795) 363 (39) - - (471)

--------------------------------------------------------------------------------------

(2,028) 462 (153) - - (1,719)

--------------------------------------------------------------------------------------

Total net (debt)/funds 3,790 (13,490) (1,013) (31) - (10,744)

======================================================================================

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR AKOKNOBKDQAB

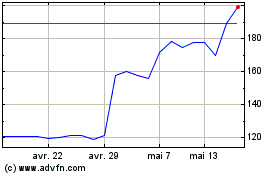

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024