TIDMIII

RNS Number : 5790G

3i Group PLC

20 July 2023

20 July 2023

3i Group plc

FY2024 Q1 performance update

A good start to FY2024

* Increase in NAV per share to 1,814 pence (31 March

2023: 1,745 pence) and total return of 4.1% for the

three months to 30 June 2023, after the negative

translation effect of sterling strengthening in the

quarter (GBP331 million or 34 pence)

* Very strong performance from Action in the quarter

(P4-P6 2023), with net sales and operating EBITDA of

EUR2,701 million and EUR374 million (P4-P6 2022:

EUR2,061 million and EUR263 million)

* In the six months to the end of Action's P6 (ending 2

July 2023), li ke-for-like ("LFL") sales growth was

21.8% primarily driven by high customer footfall, and

Action's LTM operating EBITDA to the end of P6 was

EUR1,439 million (LTM operating EBITDA to the end of

P6 2022: EUR991 million), 45% ahead of the same

period last year

* Resilient performance from the majority of the

remaining Private Equity portfolio, with notable

contributions from Royal Sanders, AES, European

Bakery Group and MAIT, offsetting softer performance

in Tato, Luqom and Mepal

* Investment activity focused on bolt-on transactions

in the period including transformational transactions

for the European Bakery Group

* Successfully issued a EUR500 million euro bond,

ending the quarter with gross cash of GBP660 million

and gearing of 3%

Simon Borrows, Chief Executive, commented:

"3i has made a good start to its new financial year with the

Private Equity and Infrastructure portfolios trading resiliently.

Action has achieved significant growth in its first half and

generated impressive LFL sales growth with strong footfall and

sales across all countries.

The macroeconomic environment is challenging at present and we

remain cautious about the economic outlook. We will maintain our

focus on active management of our portfolios and selective

investment and realisation activity."

Private Equity

Portfolio performance and valuation at 30 June 2023

Action continues to outperform our expectations. In the six

months ending 2 July 2023, Action generated net sales of EUR5,186

million (2022: EUR3,885 million) and operating EBITDA of EUR683

million (2022: EUR449 million), 33% and 52% ahead of the same

period last year. Over the same period, LFL sales growth was 21.8%,

primarily driven by high customer footfall. The significant

outperformance of sales in the first half of 2023 has resulted in a

higher than budgeted EBITDA margin for the same period. Action

added 90 net new stores in the six months to 2 July 2023 (P6 2022:

77 stores), and remains on track to add c.300 new stores in 2023.

The business continues to be highly cash generative, ending the

period with a cash balance of EUR681 million. Action is set for

another good year, even if LFL performance comparisons will be more

challenging in the second half than the first.

At 30 June 2023, Action was valued using the LTM run-rate

earnings to 2 July 2023 of EUR1,556 million and an unchanged

multiple of 18.5x net of the liquidity discount, resulting in a

valuation of GBP11,953 million (31 March 2023: GBP11,188 million)

for 3i's 52.9% equity stake.

The majority of the remaining portfolio continues to demonstrate

its resilience against challenging trading conditions, with strong

performance in the period from Royal Sanders, AES, European Bakery

Group and MAIT. Our travel assets continue to demonstrate good

booking momentum.

Weak end-market demand and price inflation for key inputs have

resulted in continued pressure on Tato's margins in the period, and

we also continue to see softer performance for several of our

discretionary consumer assets including Luqom and Mepal. As a

result, we recorded a combined unrealised value loss for the three

assets of GBP84 million in the period.

The ratio of net debt to EBITDA across the Private Equity

portfolio reduced from 2.5x at 31 March 2023 to 2.3x at 30 June

2023. The Private Equity portfolio leverage excluding Action

decreased from 4.0x to 3.9x.

Private Equity investments

We continue to grow portfolio value through our buy-and-build

strategy. Royal Sanders completed the acquisition of Lenhart, a

manufacturer of private label products for the personal care

industry in April 2023.

In the period, Dutch Bakery agreed to combine with coolback, a

German bakery group specialised in bake-off bread, to create the

European Bakery Group, a pan-European bakery platform. Panelto, a

manufacturer of bake-off artisan breads, subsequently agreed to

join the European Bakery Group, establishing the UK and Ireland

platform within the group. These transformational acquisitions, the

third and fourth since our initial investment, will further expand

European Bakery Group's product assortment and customer base across

Europe. In July 2023, the bolt-on acquisition of coolback completed

with 3i contributing GBP38 million to the acquisition. The

completion of Panelto is expected in Q2 FY2024.

Infrastructure

3i Infrastructure plc's ("3iN") share price closed flat in the

quarter to 30 June 2023 at a share price of 313 pence (31 March

2023: 313 pence), valuing 3i's 29% stake at GBP841 million (31

March 2023: GBP841 million). We also recognised dividend income of

GBP15 million from 3iN in the quarter.

Smarte Carte continued to deliver strong performance across all

business lines, with both revenue and earnings outperforming our

most recent expectations.

Scandlines

Scandlines continues to see good leisure performance entering

into the summer peak period, whilst freight volumes are slightly

down compared to last year, driven by the current macroeconomic

backdrop.

Top 10 investments by value(1) at 30 June 2023

Valuation Valuation

Valuation Valuation Mar-23 Jun-23

basis currency GBPm GBPm Activity in the quarter

----------------- ----------- ----------- ---------- ---------- ---------------------------------------------

Action Earnings EUR 11,188 11,953

----------- ----------- ---------- ---------- ---------------------------------------------

3iN Quoted GBP 841 841 Recognised GBP15 million of dividend income

----------- ----------- ---------- ---------- ---------------------------------------------

Scandlines DCF EUR 554 541 Recognised GBP10 million of dividend income

----------- ----------- ---------- ---------- ---------------------------------------------

Cirtec Medical Earnings USD 552 530

----------- ----------- ---------- ---------- ---------------------------------------------

Royal Sanders Earnings EUR 369 405 Completed the bolt-on acquisition of Lenhart

----------- ----------- ---------- ---------- ---------------------------------------------

nexeye Earnings EUR 393 383

----------- ----------- ---------- ---------- ---------------------------------------------

AES Engineering Earnings GBP 351 382

----------- ----------- ---------- ---------- ---------------------------------------------

SaniSure Earnings USD 389 379

----------- ----------- ---------- ---------- ---------------------------------------------

Tato Earnings GBP 411 364

----------- ----------- ---------- ---------- ---------------------------------------------

Smarte Carte DCF USD 300 316

----------- ----------- ---------- ---------- ---------------------------------------------

1. The valuations are translated at the spot rate of the balance

sheet date. Sterling strengthened by 2.4% against the euro and by

2.9% against the US dollar in the quarter to 30 June 2023.

Individual valuations exclude the benefit of the foreign exchange

hedges.

The 10 investments in the table above comprised 84% (31 March

2023: 83%) of the total investment portfolio value of GBP19,116

million (31 March 2023: GBP18,388 million).

Total return and NAV position

We recorded a total foreign exchange translation loss of GBP331

million including a gain on foreign exchange hedging in the period.

Movements in interest rates had a negative impact on the

mark-to-market valuation of the hedges in the period.

Based on the net assets at 30 June 2023 and including the impact

of hedging, a 1% movement in the euro and US dollar would result in

a net total return movement of GBP113 million and GBP12 million

respectively. The diluted NAV per share increased to 1,814 pence

(31 March 2023: 1,745 pence) or 1,784.25 pence after deducting the

29.75 pence per share (GBP286 million) second FY2023 dividend,

which will be paid on 28 July 2023.

Balance sheet

On 14 June 2023, we successfully issued a six-year EUR500

million euro bond at a coupon of 4.875%, further strengthening our

liquidity profile. At 30 June 2023, gross debt was GBP1,204 million

(31 March 2023: GBP775 million), net debt was GBP544 million and

gearing was 3% (31 March 2023: GBP363 million and 2%). At 30 June

2023, cash was GBP660 million (31 March 2023: GBP412 million), and,

including our undrawn GBP900 million revolving credit facility,

liquidity was GBP1,560 million (31 March 2023: GBP1,312

million).

-S -

Notes

1. Balance sheet values are stated net of foreign exchange translation. Where applicable, the

GBP equivalents

at 30 June 2023 in this update have been calculated at a currency exchange rate of EUR1.1652:

GBP1 and $1.2715: GBP1 respectively.

2. At 30 June 2023 3i had 967 million diluted shares.

3. Action was valued using a post-discount run-rate EBITDA multiple of 18.5x based on its LTM

run-rate earnings to 2 July 2023 of EUR1,556 million. The LTM run-rate earnings used include

our normal adjustment to reflect stores opened in the year.

4. As at 30 June 2023, the notional amount of the forward foreign exchange contracts held by

the Group was EUR2.6 billion (including EUR600 million associated with Scandlines) and $1.2

billion.

For further information, please contact:

Silvia Santoro

Group Investor Relations Director

Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director

Tel: 020 7975 3021

About 3i Group

3i is a leading international investment manager focused on

mid-market Private Equity and Infrastructure. Our core investment

markets are northern Europe and North America. For further

information, please visit: www.3i.com .

All statements in this performance update relate to the

three-month period ended 30 June 2023 unless otherwise stated. The

financial information is unaudited and is presented on 3i's

non-GAAP Investment basis in order to provide users with the most

appropriate description of the drivers of 3i's performance. Net

asset value ("NAV") and total return are the same on the Investment

basis and on an IFRS basis. Details of the differences between 3i's

consolidated financial statements prepared on an IFRS basis and

under the Investment basis are provided in the 2023 Annual report

and accounts. There have been no material changes to the financial

position of 3i from the end of this quarter to the date of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUKAWRONUBAAR

(END) Dow Jones Newswires

July 20, 2023 02:00 ET (06:00 GMT)

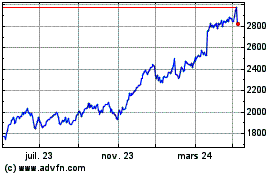

3i (LSE:III)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

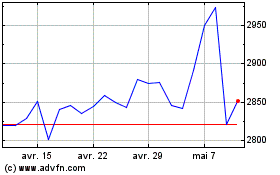

3i (LSE:III)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024