TIDMKITW

RNS Number : 8275E

Kitwave Group PLC

04 July 2023

4 July 2023

Kitwave Group plc

("Kitwave", the "Group" or the "Company")

Unaudited interim results for the six months ended 30 April

2023

Kitwave Group plc (AIM: KITW), the delivered wholesale business,

is pleased to announce its unaudited interim results for the six

months ended 30 April 2023 ("the period" or "H1 2023").

The tables and commentary below include comparatives for both

the six months ended 30 April 2022 (H1 2022) and the 12 months

ended 31 October 2022 (FY 2022).

Highlights

-- Revenues up 23% to GBP275.0 million (H1 2022: GBP223.3 million; FY 2022: GBP503.1 million) .

-- Consolidated gross margin improved to 21.6% (H1 2022: 19.8%; FY 2022: 20.4%) .

-- Profit before tax increased by 48% to GBP8.3 million (H1

2022: GBP5.6 million; FY 2022: GBP17.8 million) .

-- Cash generation from operating activities of GBP11.7 million

(H1 2022: GBP17.1 million; FY 2022: GBP26.5 million) leading to

pre-tax operational cash conversions of 87% (H1 2022: 166%; FY

2022: 105%) .

-- Trading since the period end has been strong across all

divisions and ahead of Board expectations at the time of the

trading update released in May 2023. The Board anticipates that the

Group's results for the full financial year will therefore be ahead

of market expectations that were established at the start of the

financial year.

-- Successful integration of Westcountry Food Holdings Ltd

("WestCountry"), a specialist fresh produce wholesaler to the

foodservice sector, acquired in December 2022, which complements

the Group's existing Foodservice division and enables further

expansion into the South West following the Group's acquisition of

M.J. Baker Foodservice Limited ("M.J. Baker") in February 2022.

-- Appointment of Teresa Octavio as an additional Non-Executive

Director to the Board in February 2023.

-- The Board has declared an interim dividend of 3.75 pence per

share for the six months to 30 April 2023. This dividend will be

paid on 4 August 2023 to shareholders on the register at the close

of business on 14 July 2023 and the ex-dividend date will be 13

July 2023.

Post-period end

-- Construction of a new 80,000 sq. ft distribution site to

fully integrate the Group's South West foodservice operations

commenced in June 2023 with a planned completion of Q3 2024.

Financial summary

H1 2023 H1 2022 FY 2022

Unaudited Unaudited Audited

GBPm GBPm GBPm

----------------------- ----------- ----------- ---------

Revenue 275.0 223.3 503.1

----------------------- ----------- ----------- ---------

Gross profit 59.3 44.1 102.6

Gross profit margin

% 21.6% 19.8% 20.4%

Operating profit 10.2 6.7 20.4

----------------------- ----------- ----------- ---------

Operating margin % 3.7% 3.0% 4.1%

Profit before tax 8.3 5.6 17.8

----------------------- ----------- ----------- ---------

Net cash inflow from

operating activities 11.7 17.1 26.5

Pre-tax operational

cash conversion * 87% 166% 105%

----------------------- ----------- ----------- ---------

*For more information on alternative performance measures please

see the glossary at the end of the announcement.

Paul Young, Chief Executive Officer of Kitwave, commented:

"We are pleased to report continued strong progress across the

Group in the six months ended 30 April 2023. With trading in the

wholesale sector typically weighted towards the second half of the

year, we are confident that this positive momentum will continue

throughout 2023, and results for the full financial year will be

ahead of market expectations that were established at the start of

the financial year.

"A significant highlight during the period was the Group's

successful acquisition and integration of WestCountry into our

Foodservice division, where we are now able to deliver high-quality

fresh produce throughout the South West. This acquisition

demonstrates the strong results that can be achieved when taking

advantage of the considerable opportunities available in the UK's

fragmented wholesale market.

"We believe that our unwavering focus on operational efficiency,

strategic investments, and customer satisfaction, means we are well

placed to drive sustainable growth, both organically and through

acquisitions to deliver value for the Group and its

shareholders."

- Ends -

For further information please contact:

Kitwave Group plc Tel: +44 (0) 191 259 2277

Paul Young, Chief Executive Officer

David Brind, Chief Financial Officer

www.kitwave.co.uk

Canaccord Genuity Limited Tel: +44 (0) 20 7523 8150

(Nominated Adviser and Sole Broker)

Bobbie Hilliam

Yellow Jersey PR Tel: +44 (0) 20 3004 9512

(Financial media and PR)

Sarah Hollins / Shivantha Thambirajah

/ Bessie Elliot

Company Overview

Founded in 1987, following the acquisition of a single-site

confectionery wholesale business based in North Shields, United

Kingdom, Kitwave is a delivered wholesale business, specialising in

selling and delivering impulse products, frozen, chilled and fresh

foods, alcohol, groceries and tobacco to approximately 42,000,

mainly independent, customers.

With a network of 29 depots, Kitwave is able to support delivery

throughout the UK to a diverse customer base, which includes

independent convenience retailers, leisure outlets, vending machine

operators, foodservice providers and other wholesalers, as well as

leading national retailers.

The Group's growth to date has been achieved both organically

and through a strategy of acquiring smaller, predominantly

family-owned, complementary businesses in the fragmented UK grocery

and foodservice wholesale market.

Kitwave Group plc (AIM: KITW) was admitted to trading on AIM of

the London Stock Exchange on 24 May 2021.

For further information, please visit: www.kitwave.co.uk.

Chief Executive Officer's statement

Introduction

I am pleased to report the Group's interim results for the six

months ended 30 April 2023. Despite the challenging macroeconomic

conditions facing the wider industry, Kitwave has delivered a

strong performance and has increased revenues across all divisions

of the business. While commodity-led price inflation contributed

significantly to the increased revenues, volume as measured by

cases delivered has also increased compared to H1 2022.

During the period, our acquisition growth strategy continued to

deliver as we welcomed Westcountry Food Holdings Ltd

("WestCountry") into the Group. The acquisition has enabled us to

expand our product range to include high-quality fresh produce to

complement our existing presence in the South West. The integration

of WestCountry into the Group has been successful, and the business

is performing in line with our expectations.

Due to the seasonal nature of the wholesale business trading is

weighted to the second half of the financial year. We remain

confident that the positive momentum seen in the first six months

will continue throughout 2023.

Financial summary

In the six months to 30 April 2023, the Group achieved revenue

of GBP275.0 million ( H1 2022: GBP223.3 million) , resulting in a

52% increase in operating profit to GBP10.2 million ( H1 2022:

GBP6.7 million).

H1 2023 H1 2022 FY 2022

Unaudited Unaudited Audited

GBPm GBPm GBPm

Revenue 275.0 223.3 503.1

Gross profit 59.3 44.1 102.6

Gross profit margin

% 21.6% 19.8% 20.4%

Operating profit 10.2 6.7 20.4

Operating margin % 3.7% 3.0% 4.1%

Cash generation remained strong in the period with GBP11.7

million generated from operating activities.

The net cash outflow relating to the acquisition of WestCountry

was GBP19.6 million after taking into account cash and overdrafts

acquired. No further cash outflows in relation to the transaction

are expected. The acquisition was funded by a new GBP20.0 million

revolving credit facility that was drawn in full on the date of the

acquisition.

Allowing for cash outflows to satisfy debt service payments and

dividends paid, the Group's cash and cash equivalents decreased by

GBP2.2 million during the period. The majority of this cash

absorption is due to an increase in working capital, with GBP1.3

million of this relating to an outflow in working capital in

WestCountry post-acquisition as part of the normal annual cycle

from a seasonal low point in December 2022. Excluding this

part-year effect in WestCountry the Group achieved the targeted 95%

pre-tax operational cash conversion.

The Group's balance sheet as of 30 April 2023 had equity

reserves of GBP74.0 million (30 April 2022: GBP 63.3 million; 31

October 2022: GBP71.9 million ) and net debt of GBP64.4 million (30

April 2022: GBP47.4 million; 31 October 2022: GBP44.4 million). The

increase in debt relates to a new GBP20.0 million banking facility

utilised for the acquisition of WestCountry.

The acquisition of WestCountry resulted in an increase in

Goodwill of GBP14.4 million to GBP58.7 million (30 April 2022:

GBP44.3 million; 31 October 2022: GBP44.3 million ) and an increase

in intangible assets in the form of brand and customer

relationships of GBP5.0 million. The amortisation associated with

these intangible assets was GBP0.4 million in the period.

The increase in debt of GBP20.0 million since the year-end 31

October 2022 relates to the net cash outflow from the acquisition.

Leverage has increased to 1.9x since the year end and interest

costs have increased accordingly. It is expected that the strong

continued cash generation nature of the Group will drive the

principal debt down during the remainder of the current financial

year. The Board is committed to maintaining a prudent leverage

policy moving forward.

Divisional summary

Set out below is the financial performance of the business by

division:

H1 2023 H1 2022 FY 2022

Unaudited Unaudited Audited

GBPm GBPm GBPm

Group revenue 275.0 223.3 503.1

-------------------- ----------- ----------- ---------

Ambient 98.1 87.0 185.1

Frozen & Chilled 96.1 82.0 193.8

-------------------- ----------- ----------- ---------

Retail & wholesale 194.2 169.0 378.9

Foodservice 80.8 54.3 124.2

Corporate - - -

Group adjusted operating

profit** 11.7 7.3 21.5

-------------------------- ----- ------ ------

Ambient 3.8 2.6 6.8

Frozen & chilled 1.8 1.7 6.4

-------------------------- ----- ------ ------

Retail & wholesale 5.6 4.3 13.2

Foodservice 6.1 3.1 8.9

Corporate 0.0 (0.1) (0.6)

** Group operating profit / (loss) adjusted for restructuring,

acquisition, amortisation of intangible assets arising on

acquisition, share-based payments and compensation for post

combination costs and income. For more information on alternative

performance measures please see the glossary at the end of the

announcement.

The Group has demonstrated significant growth in both revenue

and operating profit during the period, with a 23% increase in

revenue to GBP275.0 million (H1 2022: GBP223.3 million) and a 52%

increase in operating profit to GBP10.2 million (H1 2022: GBP6.7

million). Group adjusted operating profit increased by 60% to

GBP11.7 million ( H1 2022: GBP7.3 million).

The Group's gross profit margin increased to 21.6% (H1 2022:

19.8%) representing both margin improvements within divisions and

the fact that a higher proportion of Group revenue is generated by

the Foodservice division compared to H1 2022 reflecting the impact

of recent acquisitions.

Excluding the acquisition of WestCountry revenue grew by 17% and

adjusted operating profit by 46% compared to H1 2022.

The Group's cost base has been affected by inflationary

pressures, with the majority of increases being reflected in labour

and delivery-based costs. We are continually striving to mitigate

such cost increases and as a result, the ratio of distribution

costs to revenue is only slightly ahead of the prior period. It is

expected that these cost pressure increases will ease over time, as

we anticipate lower levels of fuel pricing and lower wage inflation

compared to the last 18 months.

Retail & wholesale division

The Group's Ambient and Frozen & Chilled product businesses

both service the Retail & Wholesale sector of the grocery

market. To be consistent with the market view, these divisions are

considered together and saw combined revenue increase by 15% to

GBP194.2 million ( H1 2022: GBP169.0 million ).

The retail & wholesale businesses performed ahead of

expectations during the period. The division benefitted from the

continued focus on gross margin improvement and operational

efficiency workstreams designed to reduce the cost to serve our

customer base, which together have generated an improvement in our

operating profit percentage compared to H1 2022. Inflation in the

marketplace contributed to an increase in revenue and gross profit

which assisted in covering any operating cost-based inflation.

Foodservice division

In December 2022, the division acquired the entire issued share

capital of Westcountry Food Holdings Ltd.

The acquisition of WestCountry has enabled the Group to expand

its product range to include high-quality fresh produce in the

South West. This complements Kitwave's existing foodservice

offering in the region, following the acquisition of M.J. Baker

Foodservice Limited ("M.J. Baker") in 2022.

The division saw revenue increase by 49% to GBP80.7 million ( H1

2022: GBP54.3 million ). Excluding the acquisition of WestCountry,

revenue increased by GBP13.7 million representing 25% growth

compared to H1 2022. This also included the full period effect of

M.J. Baker which was acquired in February 2022.

Overall, the division traded ahead of expectations for the

period, as customer numbers and volumes have not to date been

materially impacted by the cost-of-living crisis. The demand for

affordable socialising and eat-out occasions coupled with the

defensive nature of care homes and volumes from educational

establishments have served to maintain customer numbers and

volumes. While the division, like the rest of the Group, suffered

some operating cost-based inflation, the improvement in gross

margins and overall close control of costs ensured an improved

operating profit percentage.

Operational review

Following the investment in the Group's new web-based trading

platform, it has been rolled out across all businesses and

utilisation of the platform has increased month on month.

Electronic and online order capture now stands at 44% with average

order values compared to more traditional methods of order taking

remaining 8% ahead due to the additional e-commerce functionalities

that the web platform offers. The brand owner engagement has been

positive with a large proportion of our brand partners developing

mutually beneficial ecommerce partnerships resulting in an improved

customer experience and sales offering.

The acquisition of WestCountry together with M.J. Baker creates

an opportunity to fully integrate the Group's South West operations

and, in order to do this a new design and build 80,000 sq. ft

distribution site has been acquired on a leasehold. The

construction of the unit commenced in June 2023 with a planned

completion of Q3 2024. The integrated site will be able to offer a

full Kitwave wide product offering with a complete food service

range, ice cream, fresh produce, and on-trade into the South West

customer base. This is an important step for the Group as the

infrastructure will drive organic growth opportunities within the

Foodservice division. It is expected that the cost of the new build

will be cash neutral with the planned disposal of the existing

freehold property occupied by M.J. Baker.

We are also pleased that Tom Johnson, who joined the Group as

Health & Safety Director in early 2022, has brought

improvements to the Group's health and safety function and culture

alongside launching the new Kitwave health and safety digital

compliance and reporting platform. The role underlines the Group's

commitment to colleague safety and will drive that element of the

Group's environmental, social and governance (ESG) agenda.

Our commitment to carbon reduction is further demonstrated by

the Group's latest investment in solar with a new PHEV scheme at

the Luton distribution centre being installed in 2023.

In February 2023, the Group was delighted to welcome our new

Non-Executive Director, Teresa Octavio, to the Board. Teresa has

brought significant expertise from her experience in a host of

different executive roles in global businesses, including Kantar

Consulting and consumer-facing multinationals Diageo plc and

Procter & Gamble.

Strategy

We remain focused on executing our strategy, which targets both

organic growth and growth through acquisition. In line with this

strategy, the successful acquisition during the period of

WestCountry is our 12th wholesale distributor integrated into the

Group since 2011. We will continue to look for well-regarded,

financially-sound businesses with established operations and a

similar ethos to Kitwave.

Dividend

The final dividend of 6.75 pence per share for the financial

year ended 31 October 2022 was paid on 28 April 2023.

The Board is pleased to declare an interim dividend of 3.75

pence per share ( H1 2022: 2.50 pence per share) for the six months

to 30 April 2023. It will be paid on 4 August 2023 to shareholders

on the register at the close of business on 14 July 2023 and the

ex-dividend date will be 13 July 2023.

Summary and outlook

During the period, the Group continued to deliver strong

progress across all the core businesses, reflecting our focus on

providing an exceptionally high standard of service to our

customers through investment in systems, processes, and service

offerings.

Trading since the period end has continued to be ahead of

expectations. This is through a combination of strong order

volumes, sustained commodity price inflation, the determination to

maintain and improve gross margins and continued operational cost

control.

The recent WestCountry acquisition broadened our provision of

high-quality fresh produce in the South West and has been

successfully integrated into our Foodservice division. We will

continue to execute our buy-and-build strategy through further

targeted acquisitions, which we feel complements Kitwave's current

offering to our customer base.

Although trading in the wholesale sector is typically weighted

towards the second half of the year and being mindful of the

continuing wider macroeconomic challenges, we remain confident that

the positive momentum seen in the first six months of the year will

continue throughout 2023, and results for the full financial year

will be ahead of the market expectations established at the start

of the financial year.

We have built an excellent platform for growth within the UK

wholesale market. With our focused growth strategy, both

organically and through acquisitions, we believe that we are

well-placed to deliver value for the Group and its

shareholders.

Paul Young

Chief Executive Officer

4 July 2023

Condensed consolidated statement of profit and loss and other

comprehensive income

Note

6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 Unaudited 2022 Unaudited

GBP000 GBP000 GBP000

Revenue 3 274,950 223,312 503.088

Cost of sales (215,621) (179,195) (400,460)

Gross profit 59,329 44,117 102,628

Other operating income 4 157 42 374

Distribution expenses (26,262) (19,351) (44,010)

Administrative expenses (23,008) (18,119) (38,617)

Operating profit 10,216 6,689 20,375

Analysed as:

Adjusted EBITDA 16,017 11,125 29,477

Amortisation of intangible

assets 5 (66) (45) (99)

Amortisation of intangible

assets arising on acquisition 5 (383) - -

Depreciation 5 (4,210) (3,764) (7,897)

Acquisition expenses 5 (648) (148) (148)

Compensation for post

combination services 5 (48) (48) (95)

Share based payment

expense 5 (446) (431) (863)

Total operating profit 10,216 6,689 20,375

Finance expenses (1,956) (1,126) (2,534)

Analysed as:

Interest payable on

bank loans and bank

facilities (1,190) (443) (1,105)

Finance charges on leases (766) (683) (1,427)

Other interest - - (2)

Financial expenses (1,956) (1,126) (2,534)

Profit before tax 8,260 5,563 17,841

Tax on profit on ordinary

activities (1,901) (1,136) (3,501)

Profit for the financial

period 6,359 4,427 14,340

Other comprehensive - - -

income

Total comprehensive

income for the period 6,359 4,427 14,340

Basic earnings per

share (pence) 6 9.1 6.3 20.5

Diluted earnings per

share (pence) 6 8.7 6.3 20.5

Condensed consolidated balance sheet

30 April 30 April 31 October

2023 Unaudited 2022 Unaudited 2022

Audited

GBP000 GBP000 GBP000

Non-current assets

Goodwill 58,680 44,342 44,342

Intangible assets 5,384 535 737

Tangible assets 16,404 13,100 13,037

Right-of-use assets 26,575 27,346 26,452

Investments 45 35 35

107,088 85,358 84,603

Current assets

Inventories 45,769 39,718 31,846

Trade and other receivables 65,388 63,783 57,698

Cash and cash equivalents 3,288 6,111 5,511

114,445 109,612 95,055

Total assets 221,533 194,970 179,658

Current liabilities

Other interest bearing

loans and borrowings (16,816) (23,420) (20,354)

Lease liabilities (5,899) (5,204) (5,509)

Trade and other payables (77,767) (77,656) (57,891)

Tax payable (973) (573) (62)

(101,455) (106,853) (83,816)

Non-current liabilities

Other interest bearing

loans and borrowings (20,000) - -

Lease liabilities (24,092) (24,097) (23,240)

Deferred tax liabilities (2,019) (728) (715)

(46,111) (24,825) (23,955)

Total liabilities (147,566) (131,678) (107,771)

Net assets 73,967 63,292 71,887

Equity attributable to

equity holders of the

Parent Company

Called up share capital 700 700 700

Share premium account 64,183 64,183 64,183

Consolidation reserve (33,098) (33,098) (33,098)

Share based payment reserve 1,536 658 1,090

Retained earnings 40,646 30,849 39,012

Equity 73,967 63,292 71,887

Condensed consolidated statement of change in equity

Called Share Share Profit

up premium Consolidation based payment and loss Total

share account reserve reserve account equity

capital

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 November2021

(audited) 700 64,183 (33,098) 227 29,572 61,584

Total comprehensive income

for the 6 month period

Profit - - - - 4,427 4,427

Other comprehensive - - - - - -

income

Total comprehensive

income for

the 6 month period - - - - 4,427 4,427

Transaction with owners, recorded

directly in equity

Dividends - - - - (3,150) (3,150)

Share based payment

expense - - - 431 - 431

Total contribution

by and transactions

with the owners - - - 431 (3,150) (2,719)

Balance at 30 April

2022 (unaudited) 700 64,183 (33,098) 658 30,849 63,292

Total comprehensive income

for the 6 month period

Profit - - - - 9,913 9,913

Other comprehensive - - - - - -

income

Total comprehensive

income

for the 6 month period - - - - 9,913 9,913

Transaction with owners, recorded

directly in equity

Dividends - - - - (1,750) (1,750)

Share based payment

expense - - - 432 - 432

Total contribution

by and transactions

with the owners - - - 432 (1,750) (1,318)

Balance at 31 October

2021 (audited) 700 64,183 (33,098) 1,090 39,012 71,887

Total comprehensive income

for the 6 month period

Profit - - - - 6,359 6,359

Other comprehensive - - - - - -

income

Total comprehensive

income for

the 6 month period - - - - 6,359 6,359

Transaction with owners, recorded

directly in equity

Dividends - - - - (4,725) (4,725)

Share based payment

expense - - - 446 - 446

Total contribution

by and transactions

with the owners - - - 446 (4,725) (4,279)

Balance at 30 April

2023 (unaudited) 700 64,183 (33,098) 1,536 40,646 73,967

Condensed consolidated cash flow statement

Note 6 months 6 months Year ended

ended 30 ended 30 31 October

April 2023 April 2022 2022 Audited

Unaudited Unaudited

GBP000 GBP000 GBP000

Cash flow from operating

activities

Profit for the period 6,359 4,427 14,340

Adjustments for:

Depreciation and amortisation 4,659 3,809 7,996

Financial expense 1,956 1,126 2,534

Profit on sale of property,

plant and equipment (156) (39) (164)

Net gain on remeasurement

of right-of-use assets

and lease liabilities (1) - (8)

Compensation for post combination

services 48 48 95

Equity settled share based

payment expense 446 431 863

Taxation (1,901) 1,136 3,501

15,212 10,938 29,157

(Increase) in trade and

other receivables (5,555) (8,993) (2,909)

(Increase) in inventories (12,912) (12,040) (4,168)

Increase in trade and other

payables 16,489 28,260 8,450

13,234 18,165 30,530

Tax paid (1,528) (1,115) (4,005)

Net cash inflow from operating

activities 11,706 17,050 26,525

Cash flows from investing

activities

Acquisition of property,

plant and equipment (1,629) (1,140) (2,608)

Proceeds from sale of property,

plant and equipment 269 108 308

Acquisition of subsidiary

undertakings (including

overdrafts and cash acquired) 2 (19,593) (16,914) (16,914)

Net cash outflow from

investing activities (20,953) (17,946) (19,214)

Cash flows from financing

activities

Proceeds from new loan 20,000 - -

Net movement in invoice

discounting (3,538) 4,300 5,734

Interest paid (1,522) (1,126) (2,534)

Net movement in bank trade

loans - 4,500 -

Payment of lease liabilities (3,191) (2,485) (5,068)

Dividends paid (4,725) (3,150) (4,900)

Net cash inflow/(outflow)

from financing activities 7,024 2,039 (6,768)

Net (decrease)/increase

in cash and cash equivalents (2,223) 1,143 543

Opening cash and cash equivalents 5,511 4,968 4,968

Cash and cash equivalents

at period end 3,288 6,111 5,511

Notes

1 Accounting policies

Kitwave Group plc (the "Company") is a public company limited by

shares and incorporated, domiciled and registered in England in the

UK. The registered number is 9892174 and the registered address is

Unit S3, Narvik Way, Tyne Tunnel Trading Estate, North Shields,

Tyne and Wear, NE29 7XJ.

The Company's principal activity is to act as a holding company

for its subsidiaries (together "the Group"), which together make up

the Group's consolidated financial information.

The condensed consolidated financial information presented in

this statement for the six months ended 30 April 2023 and the

comparative figures for the six months ended 30 April 2022 are

unaudited.

The condensed consolidated financial information does not

constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The statutory accounts for the year ended 31

October 2022 have been delivered to the Registrar of Companies and

the report of the auditor was (i) unqualified, (ii) did not include

a reference to any matters to which the auditor drew attention by

way of emphasis without qualifying their report, and (iii) did not

contain a statement under Section 498 (2) or (3) of the Companies

Act 2006.

The condensed consolidated financial information does not

include all the information required for the full annual financial

statements, however, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last annual consolidated financial

statements.

The condensed consolidated financial information has been

prepared in accordance with IAS 34 Interim Financial Reporting and

should be read in conjunction the Group's last annual consolidated

financial statements.

The unaudited consolidated interim financial information has

been prepared under the historical cost convention and in

accordance with the recognition and measurement requirements of

UK-Adopted International Accounting Standards. The condensed

consolidated interim financial information does not constitute

financial statements within the meaning of Section 434 of the

Companies Act 2006 and does not include all of the information and

disclosures required for full annual financial statements. It

should therefore be read in conjunction with the Group's Annual

Report for the year ended 31 October 2022, which has been prepared

in accordance with UK-Adopted International Accounting Standards

and is available on the Group's investor website.

There have been no new accounting standards or changes to

existing accounting standards applied for the first time from 1

November 2021 which have a material effect on these interim

results.

1.1 Critical accounting estimates and judgements

The critical accounting estimates and judgements affecting the

Group are unchanged from those set out in the Group's last annual

consolidated financial statements for the year ended 31 October

2022.

The Directors have reviewed financial forecasts and are

satisfied that the Group has sufficient levels of financial

resources available to both fund operations and to pursue its

stated growth strategy. The Directors are confident that the Group

will have sufficient funds to meet its liabilities as they fall due

for the foreseeable future and therefore adopt the going concern

basis in preparing the condensed consolidated interim financial

information.

1.2 Accounting policies

The accounting policies applied in preparing the condensed

consolidated interim financial information are the same as those

applied in the preparation of the consolidated financial statements

for the year ended 31 October 2022, as described in those financial

statements.

2 Acquisitions

Acquisitions in the 6 month period ended 30 April 2023

Westcountry Food Holdings Ltd

On 9 December 2022, the Group acquired the entire share capital

of Westcountry Food Holdings Ltd for a total consideration of

GBP28,485,811. After recognition of acquired intangible assets and

associated deferred tax liabilities, the resulting goodwill of

GBP14,338,000 was capitalised and is subject to annual impairment

testing under IAS 36.

The acquisition had the following effect on the Group's assets

and liabilities:

Book value Recognised Fair value

on acquisition

GBP000 GBP000 GBP000

Non-current assets

Tangible assets 2,146 - 2,146

Intangible assets - 4,992 4,992

Right-of-use assets 262 - 262

Investments 7 - 7

Current assets

Inventories 1,011 - 1,011

Trade and other receivables 2,135 - 2,135

Cash and cash equivalents 8,893 - 8,893

Total assets 14,454 4,992 19,446

Current liabilities

Lease liabilities (49) - (49)

Trade and other payables (2,908) - (2,908)

Corporation tax (453) - (453)

Non-current liabilities

Lease liabilities (499) - (499)

Deferred tax liabilities (163) (1,226) (1,389)

Total liabilities (4,072) (1,226) (5,298)

Net identifiable assets

and liabilities 10,382 3,766 14,148

Goodwill 14,338

Total net assets acquired 28,486

Headline purchase consideration 29,000

Net asset adjustment refunded (514)

Purchase consideration

paid 28,486

Cash acquired (8,893)

Purchase consideration

net of cash acquired 19,593

The business and its trading subsidiary, Westcountry Fruit Sales

Limited, were acquired as part of the Group's growth strategy.

Significant control was obtained through the acquisition of 100% of

the share capital of Westcountry Food Holdings Ltd.

An independent valuation was performed to identify the

intangible assets on acquisition per IFRS 3. As a result of this

valuation, intangible assets in relation to brand and customer

relationships were identified, and recognised, with attributable

fair values of GBP260,000 and GBP4,732,000 respectively. The

recognition of these intangible assets resulted in deferred tax

liabilities of GBP63,000 for the brand intangible and GBP1,163,000

for the customer intangible also being recognised at

acquisition.

The acquired undertakings made a profit of GBP3,479,000 from the

beginning of its financial year on 2 January 2022 to the date of

acquisition. In its previous financial year for the year ended 1

January 2022 the profit after tax was GBP3,112,000.

Following acquisition, the business contributed revenue of

GBP12,714,000 and operating profit of GBP674,000 to the Group for

the six months ended 30 April 2023.

If the business had been acquired at the start of the Group's

financial period, being 1 November 2021, it would have added

GBP14,897,000 to Group revenue and GBP790,000 to Group operating

profit for the six months ended 30 April 2023.

On acquisition an independent assessment was made regarding the

fair value of tangible assets which includes two freehold

properties. The result of this independent assessment was no change

to the net book value held in Westcountry Food Holdings Ltd's

accounts.

3 Segmental information

The following analysis by segment is presented in accordance

with IFRS 8 on the basis of those segments whose operating results

are regularly reviewed by the Executive Board (the Chief Operating

Decision Maker as defined by IFRS 8) to assess performance and make

strategic decisions about allocation of resources

The Group has the following operating segments:

-- Ambient: Provides delivered wholesale of ambient food, drink and tobacco products;

-- Frozen & Chilled: Provides delivered wholesale of frozen and chilled food products; and

-- Foodservice: Provides delivered wholesale of alcohol, frozen

and chilled food to trade customers.

Corporate contains the central functions that are not devolved

to the business units

These segments offer different products and services to

different customer types, attracting different margins. They each

have separate management teams.

The segments share a commonality in service being delivered

wholesale of food and drink products. The Group therefore benefits

from a range of expertise, cross selling opportunities and

operational synergies in order to run each segment as competitively

as possible.

The Group's forward look strategy is to provide an enhanced

customer service by making available the wider Group product range

to its existing customer base. As a result, the Board will be

assessing the segments based on customer type going forward with

the customers in the Ambient and Frozen & Chilled divisions

operating in the retail and wholesale channel.

The following analysis shows how this development is now being

monitored whilst demonstrating the link to the previously reported

segmental information for reference.

The presentation convention adopted in these financial

statements is to show the three operating segments as this is how

the Board of Directors has assessed performance during the

period.

Each segment is measured on its EBITDA, adjusted for acquisition

costs and reconstruction costs, and internal management reports are

reviewed monthly by the Board. This performance measure is deemed

the most relevant by the Board to evaluate the results of the

segments relative to entities operating in the same industry.

3 Segmental information (continued)

Six months ended Ambient Frozen Total Foodservice Corporate Total

30 April 2023 & retail

Chilled & wholesale

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 98,124 96,096 194,220 80,730 - 274,950

Inter-segment revenue 6,925 1,334 8,259 322 - 8,581

Segment revenue 105,049 97,430 202,479 81,052 - 283,531

Adjusted EBITDA* 4,689 3,764 8,453 7,461 103 16,017

Amortisation of intangibles - (40) (40) (3) (23) (66)

Depreciation (822) (1,944) (2,766) (1,398) (46) (4,210)

Adjusted operating

profit* 3,867 1,780 5,647 6,060 34 11,741

Amortisation of intangible

assets arising on

acquisition - - - - (383) (383)

Acquisition expense - - - - (648) (648)

Compensation for post

combination services - (48) (48) - - (48)

Share based payment

expense - - - - (446) (446)

Interest expense (433) (623) (1,056) (355) (565) (1,956)

Segment profit/(loss)

before tax 3,434 1,109 4,543 5,725 (2,008) 8,260

Segment assets 43,807 65,532 109,339 46,140 66,054 221,533

Segment liabilities (32,356) (58,449) (90,805) (31,605) (25,156) (147,566)

Segment net assets 11,451 7,083 18,534 14,535 40,898 73,967

Within Corporate assets is GBP58,680,000 of goodwill on consolidation.

This is allocated to the trading segments as follows:

Goodwill by segment 13,516 12,499 26,015 32,665 - 58,680

--------

3 Segmental information (continued)

Six months ended Ambient Frozen Total Foodservice Corporate Total

30 April 2022 & retail

Chilled & wholesale

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 87,043 81,983 169,026 54,286 - 223,312

Inter-segment revenue 6,023 935 6,958 120 - 7,078

Segment revenue 93,066 82,918 175,984 54,406 (62) 230,390

Adjusted EBITDA* 3,428 3,612 7,040 4,147 (7) 11,125

Amortisation of intangibles - (32) (32) (6) - (45)

Depreciation (779) (1,934) (2,713) (1,051) - (3,764)

Adjusted operating

profit* 2,649 1,646 4,295 3,090 (69) 7,316

Acquisition expense - - - - (148) (148)

Compensation for post

combination services - (48) (48) - - (48)

Share based payment

expense - - - - (431) (431)

Interest expense (322) (470) (792) (226) (108) (1,126)

Segment profit/(loss)

before tax 2,327 1,128 3,455 2,864 (756) 5,563

Segment assets 42,230 68,397 110,627 39,712 44,631 194,970

Segment liabilities (35,850) (63,888) (99,738) (29,377) (2,563) (131,678)

Segment net assets 6,380 4,509 10,889 10,335 42,068 63,292

Within Corporate assets is GBP44,342,000 of goodwill on consolidation.

This is allocated to the trading segments as follows:

Goodwill by segment 13,516 12,499 26,015 18,327 - 44,342

--------

3 Segmental information (continued)

Year ended 31 October Ambient Frozen Total Foodservice Corporate Total

2022 & retail

Chilled & wholesale

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 185,132 193,810 378,942 124,146 - 503,088

Inter-segment revenue 13,813 2,551 16,364 572 - 16,936

Segment revenue 198,945 196,361 395,306 124,718 - 520,024

Adjusted EBITDA* 8,382 10,382 18,764 11,263 (550) 29,477

Amortisation of intangibles - (71) (71) (6) (22) (99)

Depreciation (1,584) (3,911) (5,495) (2,345) (57) (7,897)

Adjusted operating

profit* 6,798 6,400 13,198 8,912 (629) 21,481

Acquisition expense - - - - (148) (148)

Compensation for post

combination services - (95) (95) - - (95)

Share based payment

expense - - - - (863) (863)

Interest expense (736) (1,057) (1,793) (520) (221) (2,534)

Segment profit/(loss)

before tax 6,062 5,248 11,310 8,392 (1,861) 17,841

Segment assets 43,029 52,441 95,470 39,106 45,082 179,658

Segment liabilities (33,501) (45,218) (78,719) (27,886) (1,166) (107,771)

Segment net assets 9,528 7,223 16,751 11,220 43,916 71,887

Within Corporate assets is GBP44,342,000 of goodwill on consolidation.

This is allocated to the trading segments as follows:

Goodwill by segment 13,516 12,499 26,015 18,327 - 44,342

--------

An analysis of revenue by destination is given below:

Geographical information:

6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

GBP000 GBP000 GBP000

United Kingdom 272,280 221,167 497,842

Overseas 2,670 2,145 5,246

Group revenue 274,950 223,312 503,088

No one customer accounts for more than 10% of Group revenue.

4 Other operating income

6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

GBP000 GBP000 GBP000

Net gain on disposal of

fixed assets 156 39 164

Net gain on foreign exchange - 2 33

Net gain on remeasurement

of right-of-use assets

and lease liabilities 1 - 8

Grant income - 1 169

157 42 374

Grant income in the year ended 31 October 2022 comprised of

amounts received from the Government with respect to the Additional

Restrictions Grant and COVID-19 Additional Relief Fund Schemes,

which totalled GBP169,000.

5 Expenses

Included in profit/loss are the following:

6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

GBP000 GBP000 GBP000

Depreciation of tangible

assets:

Owned 1,138 1,099 1,946

Right-of-use assets 3,072 2,665 5,951

Amortisation of intangible

assets 66 45 99

Amortisation of intangible

assets arising on acquisition 383 - -

Expenses relating to short

term and low value assets 1,018 487 1,255

Impairment loss on trade

receivables 237 475 871

Dilapidation provision 6 50 48

The Group incurred a number of expenses not relating to the

principal trading activities of the Group as follows:

6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

Exceptional expenses GBP000 GBP000 GBP000

Acquisition expenses 648 148 148

Compensation for post combination

services 48 48 95

Total exceptional expenses 696 196 243

Share based payment expense 446 431 863

Total exceptional expenses

and share based payments 1,142 627 1,106

The Board consider the exceptional items to be non-recurring in

nature. Both exceptional and share based payment expenses are

adjusted for in the statement of profit and loss to arrive at the

adjusted EBITDA. This measure provides the Board with a better

understanding of the Group's operating performance.

Acquisition expenses include the legal and professional fees

connected to the acquisition of Westcountry Food Holdings Ltd

completed on 9 December 2022. In the six month period ended 30

April 2022 and the year ended 31 October 2021 these expenses were

incurred in connection with the acquisition of M.J.Baker

Foodservice Limited completed on 10 February 2022.

Compensation for post combination services relates to the value

of a liability in connection the acquisition of the remaining share

capital of Central Supplies (Brierley Hill) Ltd which is subject to

an agreement to acquire which can now be called at any time.

Share based payments relate to the Management Incentive Plan and

Long term Incentive Plan and are non cash expenses.

6 Earnings per share

Basic earnings per share

Basic earnings per share for the six month period ending 30

April 2023, and the previous six month period ending 30 April 2022

and the year ended 31 October 2022 is calculated by dividing profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during each period as

calculated below.

Diluted earnings per share

Diluted earnings per share for the six month period ending 30

April 2023, and the previous six month period ending 30 April 2022

and the year ended 31 October 2022 is calculated by dividing profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares, adjusted for the effects of all dilutive

potential ordinary shares, in this case issued equity warrants,

outstanding during each period and for the six month period ended

31 October 2023, shares that may vest under the terms of equity

incentive plans , as calculated below.

Profit attributable to ordinary shareholders

6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

GBP000 GBP000 GBP000

Profit attributable to

all shareholders 6,359 4,427 14,340

Pence Pence Pence

Basic earnings per ordinary

share 9.1 6.3 20.5

Diluted earnings per ordinary

share 8.7 6.3 20.5

Weighted average number of ordinary shares

6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

Number Number Number

Weighted average number

of ordinary shares (basic)

during the period 70,146,766 70,000,000 70,033,033

Weighted average number

of ordinary shares (diluted)

during the period 72,946,766 70,000,000 70,033,033

Alternative performance measure glossary

This report provides alternative performance measures ("APMs"),

which are note defined or specified under the requirements of

International Financial Reporting Standards. The Board believes

that these APMs provide readers with important additional

information on the Group.

Alternative Definition and purpose

performance

measure

------------ ----------------------------------------------------------------------------------------------------------------------

Existing Existing operations are disclosed separately

operations from acquisitions in the statement of profit

and loss in order to provide greater comparison

between the current and prior periods which do

not include current period acquisitions.

------------ ----------------------------------------------------------------------------------------------------------------------

Adjusted Represents the operating profit prior to exceptional

operating (income) / expenses and share based payment expenses.

profit This measure is consistent with how the Group

measures performance and is reported to the Board. 6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

GBP000 GBP000 GBP000

Total operating

profit 10,216 6,689 20,375

Amortisation

of intangible

assets arising 383 - -

on acquisition

Acquisition expenses 648 148 148

Compensation

for post combination

services 48 48 95

Share based payment

expense 446 431 863

Adjusted operating

profit 11,741 7,316 21,481

Adjusted Represents the operating profit prior to exceptional

EBITDA (income) / expenses, share based payment expenses,

fixed asset depreciation and intangible amortisation.

This measure is consistent with how the Group

measures trading and cash generative performance

and is reported to the Board. 6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

GBP000 GBP000 GBP000

Total operating

profit 10,216 6,689 20,375

Amortisation of

intangible assets 66 45 99

Amortisation of

intangible assets

arising on acquisition 383 - -

Depreciation 4,210 3,764 7,897

Acquisition expenses 648 148 148

Compensation for

post combination

services 48 48 95

Share based payment

expense 446 431 863

Adjusted EBITDA 16,017 11,125 29,477

Pre tax Represents the cash generated from operating

operational activities pre tax as a proportion of cash flow

cash from operating activities pre movements in working

conversion capital and tax. This measure informs the Board

of the Group's cash conversion from operating

activities and is used to monitor liquidity by

the Board. 6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 2022 Unaudited

Unaudited

GBP000 GBP000 GBP000

Net cash inflow

from operating

activities 11,706 17,050 26,525

Tax paid 1,528 1,115 4,005

Cash flow from

operating activities

pre tax and compensation

for post combination

services (1) 13,234 18,165 30,530

Movement in working

capital 1,978 (7,227) (1,373)

Cash flow from

operating activities

pre tax and compensation

for post combination

services and movement

in working capital

(2) 15,212 10,938 29,157

Pre tax operational

cash conversion

(1) divided by

(2) 87% 166% 105%

After tax return Represents adjusted profit after tax for the

on invested capital 12 months ending on the period end date as a

proportion of invested capital as at the period

end date. This measure informs the Board of how

effective the Group is in generating returns

from the capital invested.

30 April 2023 30 April 31 October

Unaudited 2022 Unaudited 2022 Audited

GBP000 GBP000 GBP000

Adjusted operating profit 25,906 14,583 21,481

Operating lease interest 766 (683) (1,427)

26,672 13,900 20,054

Tax charge at effective rate of tax of

22.5% (FY22: 18.4%) (6,001) (2,558) (3,690)

Adjusted operating profit after tax (1) 20,671 11,343 16,364

Invested capital comprising:

Interest bearing loans and borrowings 36,816 23,420 20,354

Lease liabilities 29,991 29,301 28,749

Share capital 700 700 700

Share premium 64,143 64,183 64,183

Less cash at bank and in hand (3,288) (6,111) (5,511)

Total invested capital (2) 128,402 111,493 108,475

After tax return on invested capital (1)

divided by (2) 16% 10% 15%

--------------------- ------------------------------------------------------------------------------------------

Leverage (including Management assess leverage by reference to adjusted

IFRS 16 debt) EBITDA for the 12 months ending on the period

& end date against net debt including and excluding

Leverage (excluding IFRS 16 lease liabilities and including the liability

IFRS 16 debt) for post combination services held within other

creditors, as at the period end date. This indicates

how much income is available to service debt

before interest, tax, depreciation and amortisation.

30 April 2023 30 April 2022 31 October 2022 Audited

Unaudited Unaudited

GBP000 GBP000 GBP000

Adjusted EBITDA (1) 34,369 22,344 29,477

Interest bearing loans

and borrowings 36,816 23,420 20,354

Lease liabilities 29,991 29,301 28,749

Liability for post

combination services 854 759 807

Cash at bank and in

hand (3,288) (6,111) (5,511)

Net debt (2) 64,373 47,369 44,399

Leverage (including

IFRS 16 debt) (2)

divided by (1) 1.9x 2.1x 1.5x

IFRS 16 lease

liabilities (26,329) (26,459) (25,902)

Net debt excluding IFRS

16 lease liabilities

(3) 38,044 20,910 18,497

Leverage (excluding

IFRS 16 lease debt)

(3) divided by (1) 1.1x 0.9x 0.6x

Reconciliation between existing and acquired operating profit

for the period

Note Existing Acquisitions Total

operations 6 months 6 months Year ended

ended ended 31 October

30 April 30 April 2022 Audited

2023 Unaudited 2022 Unaudited

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 3 262,282 12,668 274,950 223,312 503.088

Cost of sales (207,579) (8,042) (215,621) (179,195) (400,460)

Gross profit 54,703 4,626 59,329 44,117 102,628

Other operating income/

(expense) 4 166 (9) 157 42 374

Distribution expenses (24,023) (2,239) (26,262) (19,351) (44,010)

Administrative expenses (21,304) (1,704) (23,008) (18,119) (38,617)

Operating profit 9,542 674 10,216 6,689 20,375

Analysed as:

Adjusted EBITDA 14,825 1,192 16,017 11,125 29,477

Amortisation of intangible

assets 5 (66) - (66) (45) (99)

Amortisation of intangible

assets arising on acquisition 5 - (383) (383) - -

Depreciation 5 (4,075) (135) (4,210) (3,764) (7,897)

Acquisition expenses 5 (648) - (648) (148) (148)

Compensation for post

combination services 5 (48) - (48) (48) (95)

Share based payment

expense 5 (446) - (446) (431) (863)

Total operating profit 9,542 674 10,216 6,689 20,375

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKNBKFBKDPOK

(END) Dow Jones Newswires

July 04, 2023 02:00 ET (06:00 GMT)

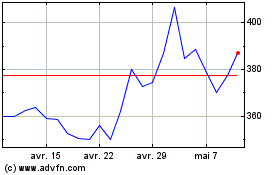

Kitwave (LSE:KITW)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Kitwave (LSE:KITW)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024