TIDMKOO

RNS Number : 3579M

Kooth PLC

21 September 2021

Kooth plc

("Kooth or the "Company" or the "Group")

21 September 2021

Half year results

Momentum and growth; comfortably in line with FY

expectations

Kooth (AIM: KOO), a leading digital mental health platform

provider, announces unaudited half year results for the six months

ended 30 June 2021.

Strategic Highlights

-- Children and Young People: we are contracted by more than 90%

of NHS England CCGs (2020: 85%).

-- Kooth Adult (early intervention for adults, via NHS) 'whole

population' total contracts doubled in H1 vs 2020. Kooth Adult now

represents GBP1.5m ARR.

-- Kooth Work (employee wellbeing) growth into membership-based

businesses included, for example, the Chartered Management

Institute.

-- Ongoing investment in talent, technology, and outcome

measures to deliver personalised, effective care.

Financial Highlights

-- Revenues up 35% to GBP8.0m (H1 2020: GBP5.9m).

-- Robust balance sheet with net cash of GBP8.8m provides capacity for investment.

-- Annual Recurring Revenue (ARR) up 23% to GBP16.6m.

-- Adjusted EBITDA up 135% to GBP1.1m.

-- High quality of earnings:

o More than 90% revenues from contracts of 12 months or

longer.

o More than 95% customer retention by revenue.

Tim Barker, Chief Executive of Kooth said:

"With NHS waiting lists for mental health now totalling 1.8m

people, the imperative and opportunity to provide high quality

support via digital has never been clearer. Kooth's growth and

performance reflects good progress on our mission to make

effective, personalised digital mental health care available to

all. In the last six months, Kooth has further strengthened its

position as the leading digital platform supporting children and

young people via the NHS, and we are delivering on our objectives

to expand support to Adults via the NHS and Corporates.

"Our robust balance sheet enables us to invest to meet

long-term, increasing demand for Kooth's services. We will continue

this investment in our talent and technology to enable us to scale

up to tackle what is one of the world's biggest challenges. Looking

to the full year outturn, we expect Group revenue to be comfortably

in line with expectations."

For further information, please contact:

Kooth plc

Tim Barker, Chief Executive investorrelations@kooth.com

Sanjay Jawa, Chief Financial Officer

Panmure Gordon, Nominated Adviser and

Broker

Corporate Finance:

Dominic Morley, Ailsa MacMaster

Corporate Broking:

Erik Anderson +44 (0) 20 7886 2500

FTI Consulting

Jamie Ricketts / Alex Shaw / Usama Ali kooth@fticonsulting.com

Notes to Editors:

About Kooth

Kooth (AIM:KOO) is the UK's leading digital mental health

platform, established to provide accessible and safe spaces for

everyone to achieve better mental health. The Company's online

platform is clinically robust and accredited to provide a range of

therapeutic support and interventions. All services are predicated

on easy access to make early intervention and prevention a

reality.

Kooth offers three services:

-- Kooth is commissioned in over 90% of the NHS's clinical

commissioning group areas across the country. It is a fully

safeguarded and pre-moderated community with a library of peer and

professional created content, alongside access to experienced

online counsellors. There are no thresholds for support and no

waiting lists. Currently, Kooth sees over 3,000 logins a day.

-- Kooth Adult operates across distinct locations and serves

specific cohorts, including parents, teachers, victims of crime and

those who have suffered from or continue to experience domestic

violence.

-- Kooth Work is a corporate service, aimed specifically at

employers to support the wellbeing of their employees, providing

confidential and anonymous access to a wellbeing community,

counselling, content and self-help tools. Kooth Work provides

valuable, anonymous insights into the wellbeing of the workforce so

that employers can identify specific areas of improvement for their

wellbeing strategy.

Chief Executive's Review

Momentum and progress

The Group continues to make good progress against its strategic

priorities: growing its leadership position in supporting children

and young people via the NHS, and expanding to support Adults via

the NHS and Corporate market.

This was reflected in revenue growth of 35% and adjusted EBITDA

growth of 135%.

We've seen further contract expansion and high customer

retention across the business, retaining 95% of our customers and

delivering net revenue retention of 116%. In the Children and Young

Persons market we now cover more than 90% of Clinical Commissioning

Groups (CCGs) in England, Our Adult platform via the NHS has seen

good momentum, doubling the total number of 'whole populations'

contracts we operate to 16. In the corporate market, new customer

partnerships with the Chartered Management Institute and Capita

demonstrate the opportunity for innovators to embed employee mental

wellbeing into their business model.

In addition, the London School of Economics published an

independent study which found that Kooth's self-help activities are

beneficial to 96% of users. Kooth's peer support community helps

reduce stigma, with 77% of users more likely to seek support for

their mental health after engaging.

Strategy

Kooth has a clear four-pillar growth strategy to support the

increasing demand for mental health services in the public and

private sector, all underpinned by investments in our technology

platform and clinical operating model:

1. Continue to scale Kooth to support young people

2. Replicate our success into the adult public sector market

3. Bring the benefits of Kooth to every workplace

4. Expand into international markets.

Children and Young People

Kooth is the Group's service for the provision of free at the

point of use services for children and young people (CYP)

Kooth is now contracted by more than 90% of NHS England CCGs to

support the mental health needs of children and young people (FY20:

85%). This includes full coverage across all 32 London boroughs,

seven Welsh Health Boards, and our first two contracts in

Scotland.

Kooth Adult

Kooth Adult provides early intervention support to adults via

the NHS .

The Group's focus on 'whole population' contracts is building

momentum, adding eight commissions in the first half of 2021 to the

five that were contracted in 2020. In addition, we have seen an

increase in average contract size. Adult ARR is now GBP1.5m.

Kooth Work

Kooth Work supports corporates with employee wellbeing

Kooth Work continues to expand to help employees reach their

full potential at work. As announced in April 2021, the Chartered

Management Institute has partnered with Kooth to provide free

mental health support to their UK members. In addition, Kooth has

been commissioned by Capita to provide mental health support to

job-seekers as part of Capita's programme to help those made

unemployed as a result of COVID find work. This demonstrates the

potential to integrate mental health support alongside other

services to reduce stigma, and increase reach and impact.

Investing for long-term growth

Kooth is investing in its talent and technology platforms to

drive its growth strategy and meet increasing demand for digital

mental health support and tools. This is intended to capture the

long-term market opportunity available both in the UK and

internationally.

Key progress in H1 includes:

Evidencing the therapeutic outcomes for Kooth is key in

advancing the business case for digital mental health care.

However, digital isn't just about mirroring traditional

face-to-face support, it enables entirely new care models, such as

a drop-in chat session. To prove the impact of this, Kooth

collaborated with the CORC (Child Outcomes Research Consortium) to

independently validate a new therapeutic measure called SWAN-0M

(Session Wants and Needs Outcome Measure) which shows that 72% of

users achieve a good outcome from a single chat session on

Kooth.

As a first step into supporting international markets, Kooth and

the Department of International Trade have developed and are

delivering a pilot project in South Africa, with support from the

Western Cape Education Department and British Council South Africa

to demonstrate the impact of the Kooth service in supporting Young

People and strengthening educational professionals' confidence in

managing mental health at school.

Current trading and outlook

Kooth will continue to invest in its technology platform,

systems and talent in the second half of 2021. This is part of

Kooth's strategy to meet long-term demand for digital mental health

services.

With closing annual recurring revenue at 30 June 2021 of

GBP16.6m the Board expects Kooth to be comfortably in line with

revenue expectations for the full year. This reflects Kooth's good

progress against its priorities for the first half which included

maintaining its leadership position in supporting children and

young people via the NHS as well as doubling the number of Kooth

Adult 'whole population' contracts.

Tim Barker

Chief Executive

21 September 2021

Chief Financial Officer's review

The Group has had a positive first half of the year and as

reported we expect revenue to be comfortably in line with market

expectations for the full year.

The Group has seen an increase across revenue, annual recurring

revenue, gross margin, EBITDA and operating profit for the half

year ended 30 June 2021 in comparison to the six months ended 30

June 2020.

Revenue

Revenue increased by 35% to GBP8.0 million (2020 H1: GBP5.9

million), Annual Recurring Revenue grew by 23% to GBP16.6 million

(2020 H1: GBP13.5 million), with 22 new contracts obtained in the

first half of 2021 across all service types in addition to a number

of contract uplifts. Churn for the period was less than 5%.

Gross Profit

Gross Profit as a percentage of turnover increased during the

period by 3.6 percentage points from 59.7% to 63.3%. This was

primarily an accounting change (2.5 percentage points)

reclassifying certain clinical costs from direct to indirect costs.

This is an ongoing change. To a lesser extent we continued to see

some lower direct costs as a result of lockdown as most engagement

meetings continued to be conducted virtually. This led to a

reduction in travel and subsistence costs as well as allowing the

team to reach more users.

Adjusted EBITDA

Adjusted EBITDA in the period increased from GBP0.5m to GBP1.1m

with increased gross profit offset by higher administrative

expenses including the costs of being a public company and the

receipt in 2020 of GBP0.5m of other operating income relating to a

government research grant. The total charge for share based

payments in the period was GBP0.3m (2020 H1: GBP0.1m). This

increase reflects the awards made under the senior and all staff

2020 Long Term Incentive Plan following our IPO.

Exceptional items

No exceptional costs were incurred during the period (2020 H1:

GBP0.4m). Prior year costs in the period to 30 June related to pre

IPO related expenses.

Taxation

There has been no corporation tax charge recognised in the six

months to 30 June 2021 due to accumulated losses combined with the

overall current year position (2020 H1: GBPnil). The tax credit for

the six months ended 30 June 2021 and 2020 relate to Research and

Development expenditure credits in addition to the movement in the

deferred tax asset.

Profit after tax

The Group achieved a profit after tax for the period of GBP0.04

million (2020 H1: GBP0.8 million loss).

Headcount

Headcount has increased from the year end by 46 staff members

across the Group to 352, with an investment drive to build out our

Service Delivery and Product and Technology teams as well as

clinical and commercial staff across the wider business to drive

our growth strategies.

Balance Sheet

Kooth has maintained a robust balance sheet following the

successful IPO in September 2020 which raised GBP16m prior to

expenses and repayment of debt, with net cash at 30 June 2021 of

GBP8.8m (2020 H1: GBP0.6m), demonstrating good underlying cash

generation and ensuring capacity to invest in the Group's long-term

growth.

Cash flow and financing

Cash generation during the six months was GBP1.0 million (2020

H1: GBP0.4 million), driven by increased revenues and gross profit

including an increased number of customers paying in advance.

After repaying all debts in the second half of 2020, the Group

is debt free (2020 H1: GBP6.4 million).

The Group is committed to investment following the IPO listing

and as a result capital expenditure increased 96% to GBP1.5 million

(2020 H1: GBP0.8 million), with increases to our Product and

Technology teams and project costs.

Sanjay Jawa

Chief Financial Officer

21 September 2021

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2021

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

Note Unaudited Unaudited Audited

Continuing operations GBP'000 GBP'000 GBP'000

Revenue 9 7,964 5,901 13,012

Cost of sales (2,925) (2,380) (5,091)

Gross profit 5,039 3,521 7,921

Administrative expenses (5,184) (4,715) (10,049)

Other operating income - 497 497

Operating Loss (145) (697) (1,631)

Analysed as:

Adjusted EBITDA 1,130 477 934

Depreciation & amortisation 13 (970) (682) (1,498)

Exceptional items - (411) (580)

Share based payment expense (305) (101) (507)

Gain on disposal of subsidiary - 20 20

Operating Loss (145) (697) (1,631)

------------------------------------------- ---- ---------- ---------- ------------

Interest paid - (224) (314)

Loss before tax (145) (921) (1,945)

Tax 183 150 467

Profit/(Loss) after tax from continuing

operations 38 (771) (1,478)

---------- ---------- ------------

Profit/(Loss) after tax from discontinued

operations - 1 1

Total comprehensive profit/(loss)

for the period 38 (770) (1,477)

---------- ---------- ------------

Profit/(Loss) per share - basic

(GBP) 11 0.00 (0.04) (0.06)

On continuing operations 0.00 (0.04) (0.06)

On discontinued operations - 0.00 0.00

Profit/(Loss) per share - diluted

(GBP) 0.00 (0.03) (0.06)

On continuing operations 0.00 (0.03) (0.06)

On discontinued operations - 0.00 0.00

Condensed Consolidated Balance Sheet

As at 30 June 2021

30 June 30 June 31 December

2021 2020 2020

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Goodwill 511 511 511

Development costs 13 3,131 2,473 2,615

Right of use asset 10 20 14

Property, plant and

equipment 139 164 157

Deferred tax 156 - 133

Total non-current

assets 3,947 3,168 3,430

Current assets

Trade & other receivables 2,083 3,451 2,097

Contract assets 190 362 107

Cash & cash equivalents 8,799 601 7,823

Total current assets 11,072 4,414 10,027

Total assets 15,019 7,582 13,457

Liabilities

Current liabilities

Trade payables (327) (634) (275)

Contract liabilities (1,838) (723) (619)

Borrowings - (6,402) -

Lease liability (10) (22) (17)

Accruals and other

creditors (808) (1,716) (866)

Deferred tax - (31) -

Tax liabilities (859) (1,556) (827)

Total current liabilities (3,842) (11,084) (2,604)

Net current assets 7,230 (6,670) 7,423

Net Assets / (Liabilities) 11,177 (3,502) 10,853

---------- ---------- -----------

(continued)

Equity

Share capital 1,653 - 1,653

Share premium Account 14,229 4 14,229

P&L reserve (1,531) (3,607) (1,569)

Share-based payment

reserve 815 101 529

Capital redemption

reserve 115 - 115

Merger reserve (4,104) - (4,104)

Total equity 11,177 (3,502) 10,853

------- ------- -------

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2021

Six months Six months Year ended

ended 30 ended 30 June 31 December

June 2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit/(Loss) for the period

from continuing operations 38 (771) (1,478)

Profit/(Loss) for the period

from discontinued operations - 1 1

Adjustments:

Depreciation & amortisation 970 682 1,498

Income tax received - - 268

Share based payment expense 305 101 507

Interest expense - 224 314

Tax income recognised (183) (150) (466)

Gain on Disposal - (20) (20)

Movements in working capital:

(Increase)/decrease in trade

and other receivables 69 (1,530) 132

Increase/(decrease) in trade

and other payables 1,245 1,557 (396)

---------- -------------- ------------

Net cashflow from operating activity 2,444 94 360

Cash flows from investing activities

Purchase of property, plant and

equipment (34) (68) (107)

Additions to intangible assets (1,430) (684) (1,505)

---------- -------------- ------------

Net cash used in investing activities (1,464) (752) (1,612)

Cash flows from financing activities

Proceeds from issue of capital - 2 16,000

Cost incurred on issue of capital - - (1,378)

Receipt/(Repayment) of borrowings - 1,044 (4,249)

Interest paid - - (1,444)

Lease payments (4) (16) (81)

---------- -------------- ------------

Net cash from financing activities (4) 1,030 8,848

Net increase/(decrease) in cash

and cash equivalents 976 372 7,596

Cash and cash equivalents at

the beginning of the period 7,823 229 227

---------- -------------- ------------

Cash and cash equivalents at

the end of the period 8,799 601 7,823

---------- -------------- ------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2021

Share Capital Share Premium Share Based P&L Reserve Capital Merger reserve Total Equity

Payment Redemption

Reserve Reserve

Balance at 1

January 2020 - 4 - (2,837) - - (2,833)

Share based

payments - - 101 - - - 101

Total

comprehensive

income

for the period - - - (770) - - (770)

------------- ------------- ----------- ----------- ----------- -------------- ------------

As at 30 June

2020 - 4 101 (3,607) - - (3,502)

Balance at 1 July

2020 - 4 101 (3,607) - - (3,502)

Issue of share

capital 400 14,225 - - - 14,625

Share for share

exchange 3,989 - - - 115 (4,104) -

Capital reduction (2,736) - - 2,736 - - -

Share based

payments - - 428 - - - 428

Deferred tax - - - 10 - - 10

Total

comprehensive

income

for the period - - - (708) - - (708)

------------- ------------- ----------- ----------- ----------- -------------- ------------

As at 31 December

2020 1,653 14,229 529 (1,569) 115 (4,104) 10,853

Balance at 1

January 2021 1,653 14,229 529 (1,569) 115 (4,104) 10,853

Share based

payments - - 286 - - - 286

Total

comprehensive

income

for the period - - - 38 - - 38

------------- ------------- ----------- ----------- ----------- -------------- ------------

As at 30 June

2021 1,653 14,229 815 (1,531) 115 (4,104) 11,177

Notes to the half year financial statements

1. General information

The unaudited interim consolidated financial statements for the

six months ended 30 June 2021 and the six months ended 30 June 2020

do not constitute statutory accounts within the meaning of Section

434 of the Companies Act 2006. Statutory accounts for the year

ended 31 December 2020 were approved by the Board of Directors on

13 April 2021 and delivered to the Registrar of Companies. The

auditor's report on those accounts was unqualified, did not contain

an emphasis of matter paragraph and did not contain any statement

under Section 498 (2) or (3) of the Companies Act 2006.

These condensed half year financial statements were approved for

issue by the Board of Directors on 21 September 2021.

2. Basis of preparation

The interim condensed consolidated financial statements do not

include all the information and disclosures required in the annual

financial statements, and should be read in conjunction with the

Group's annual consolidated financial statements prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 for the year ended

31 December 2020.

Trading for the half year ended 30 June 2021 was comfortably in

line with the Board's expectations, and this is expected to be the

case for the full year. Further details are given in the Chief

Executive report.

The Group is in a net asset position of GBP11.2 million as at 30

June 2021 (2020: net liabilities of GBP3.5 million) and has no debt

facilities in place. Management have prepared forecasts up until 12

months from the date of approval of these financial statements

which have been approved by the Board, and after enquiry and review

of these forecasts and other available financial information, the

Directors have formed the conclusion that the Group has adequate

resources to continue to operate for the foreseeable future and

that it is therefore appropriate to continue to adopt the going

concern basis of accounting in the preparation of these interim

condensed consolidated half year financial statements.

The financial information is presented in sterling, which is the

functional currency of Kooth Group. All financial information

presented has been rounded to the nearest thousand.

3. Accounting policies

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's annual

report and accounts for the year ended 31 December 2020.

Current taxes on income in the half year period are accrued

using the tax rates that would be applicable to expected total

annual profits.

Deferred taxes on income are calculated based on the standard

rates that are enacted as at the balance sheet date.

4. Critical accounting judgements and key sources of estimation

uncertainty

Any critical accounting judgements and key sources of estimation

uncertainty that carry a significant risk of material change to the

carrying value of assets and liabilities within the next year are

the same as those applied in the 2020 Group annual report.

5. Principal risks and uncertainties

The 2020 Group annual report and accounts describes the

principal risks and uncertainties that could impact the Group's

performance. These risks primarily relate to cyber security and

clinical safety, with any risks relating to COVID-19 deemed to be

not material given the industry in which the Group operates and the

Group's business model. These remain unchanged since the annual

report was published and are not expected to change for the

remaining six months of the financial year.

The Group actively manages these risks through risk management

procedures and actions are taken to mitigate risk wherever

possible.

6. Financial risk management

The Group is exposed to financial risks including market risk,

credit risk & liquidity risk. These interim condensed

consolidated financial statements do not include all financial risk

management information and disclosures required in the annual

financial statements and therefore should be read in conjunction

with the 2020 Group annual report and accounts.

7. Forward-looking statements

Certain statements in this half year report are forward looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to have been correct.

Because these statements involve risks and uncertainties, actual

results may differ materially from those expressed or implied by

these forward-looking statements.

8. Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the executive directors that make

strategic decisions.

As Kooth plc's operations are all in one location within the

United Kingdom, the Directors are of the opinion that the Group has

only one reportable operating segment, this is in line with

internal reporting provided to the executive directors.

9. Revenue analysis

Revenue has been derived from its principal activity wholly

undertaken in the United Kingdom, and relates to the provision of

online counselling services.

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue generated from counselling

platform 7,964 5,901 13,012

10. Income tax expense

The income tax expense recognised reflects management estimates

of the tax charge for the period and has been calculated using the

estimated average tax rate of UK corporate tax for the financial

year of 19% (2020: 19%).

11. Earnings per share (EPS)

The calculation of basic and diluted EPS is based on the

following earnings and number of shares:

Year ended

Six months ended Six months ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Unaudited Audited

Basic GBP'000 GBP'000 GBP'000

Earnings used in calculation

of earnings per share:

On total losses attributable

to equity holders of

the parent 38 (770) (1,477)

On continuing operations 38 (771) (1,478)

On discontinued operations 1 1

Weighted average no.

of shares (basic) 33,055,776 20,000,000 24,351,925

Weighted average no.

of shares (diluted) 34,023,265 23,865,304 24,685,152

Shares in issue 2021 2020 2020

B shares in issue - 5,055,776 -

Ordinary shares in issue 33,055,776 20,000,000 33,055,776

LTIP 967,489 - 999,681

Loss per share - Basic

(GBP)

On total profits attributable

to equity holders of

the parent 0.00 (0.04) (0.06)

On continuing operations 0.00 (0.04) (0.06)

On discontinued operations - 0.00 0.00

Loss per share - Diluted

(GBP)

On total profits attributable

to equity holders of

the parent 0.00 (0.03) (0.06)

On continuing operations 0.00 (0.03) (0.06)

On discontinued operations - 0.00 0.00

12. Dividends

The Group's intention in the short to medium term is to invest

in order to deliver capital growth for shareholders. The Board has

not recommended an interim dividend payment in respect of the six

months ended 30 June 2021 (2020: GBPnil) and does not anticipate

recommending a dividend within the next year, but may do so in

future years.

13. Development costs

Development

costs

GBP'000

Cost

At 1 January 2020 3,297

Additions 684

At 30 June 2020 3,981

Additions 846

At 31 December 2020 4,827

Additions 1,430

-----------

At 30 June 2021 6,257

Amortisation

At 1 January 2020 (895)

Amortisation (613)

At 30 June 2020 (1,508)

Amortisation (705)

At 31 December 2020 (2,213)

Amortisation (913)

-----------

At 30 June 2021 (3,126)

Carrying amount

At 1 January 2020 2,402

At 30 June 2020 2,473

At 31 December 2020 2,615

-----------

At 30 June 2021 3,131

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BSGDCLUDDGBG

(END) Dow Jones Newswires

September 21, 2021 01:59 ET (05:59 GMT)

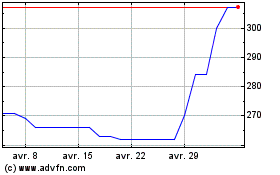

Kooth (LSE:KOO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Kooth (LSE:KOO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024