RNS Number:9855W

Renew Holdings PLC

22 May 2007

Renew Holdings plc

("Renew" or the "Group")

Interims Results for the half year ended 31 March 2007

Renew, the specialist construction services business, today announces a robust

set of interim results, with Group cash and profit before tax up more than 70%

and a 50% increase in the interim dividend.

Financial Highlights

H1 2007 H1 2006 % increase

Turnover (ongoing operations) #172.7m #162.4m 6

Operating profit #2.1m #1.4m 50

Profit before tax #3.1m #1.8m 72

Earnings per share 5.1p 3.0p 70

Dividend per share 0.6p 0.4p 50

Cash #27.0m #8.2m 229

Operational Highlights

* Strategy delivering higher quality work flow within specialist areas

* Specialist Engineering turnover up by 23%

* Specialist Building margins up by 50%

* Order book up to #228.7m, 67% of new orders from repeat business

* Two year #25m framework in Nuclear business

* Three new Social Housing frameworks

Roy Harrison, Chairman, commented:

"I am pleased to report that in the first half of the year the Group has

delivered a robust set of interim results, a testament to the excellent progress

being made across all of the Group's activities.

The quality of earnings has shown major improvement evidenced by an increase in

both profits and cash generation. This positive momentum has continued into the

second half and the Board is confident of sustaining this progress throughout

the remainder of the year."

22 May 2007

Enquiries:

Renew Holdings plc Tel: 020 7522 3200

Brian May, Chief Executive

John Samuel, Finance Director

College Hill Tel: 020 7457 2020

Matthew Gregorowski

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report that in the first half of the year the Group has

delivered a robust set of interim results, a testament to the excellent progress

being made across all of the Group's activities. As outlined at the end of last

year, in line with the Group's strategy, the business has been aligned into two

distinct business streams, namely Specialist Engineering and Specialist

Building. In these results we report revenues and profits accordingly for the

first time.

The focus on specialist markets within these two business streams, in which the

Group has excellent skills and experience and enjoys good market positions, is

resulting in higher profitability and cash flow as the quality of the Group's

earnings and work flow continues to improve. All the Group's businesses are

trading profitably and once again there are no exceptional items in these

results.

Further progress has been made in improving the control mechanisms in place

across the Group, which gives the Board confidence in its future performance. In

Health & Safety, a key area of focus for all of our businesses, we have

continued to make good progress during the period.

Results and dividend

Group turnover from ongoing operations for the six months ended 31 March 2007

was #172.7m (2006: #162.4m), a 6% increase over the corresponding period last

year. Profit before tax for the period was up 72% to #3.1m (2006: #1.8m) with

earnings per share up 70% to 5.1p (2006: 3.0p).

The Group's cash position as at 31 March was #27.0m, a major improvement over

the previous period which reflects the cash backed nature of our earnings and

the continuing realisation of surplus assets. Shareholders' funds have increased

by 31% since the end of the last financial year and now stand at #7.0m.

In accordance with the Group's progressive policy, the Board is declaring an

interim dividend of 0.6p per share (2006: 0.4p), an increase of 50%, to be paid

on 9 July 2007 to shareholders on the register as at 8 June 2007.

Group strategy

Under the sound leadership of our Chief Executive, Brian May, the Group is

making excellent progress in line with its strategic objectives. During the

period we have continued to improve margins in our Specialist Building

activities which have grown by 50% on similar levels of turnover. In Specialist

Engineering turnover has improved by 23%, whilst margins have been maintained at

target levels.

As previously indicated, part of the strategy of developing our Specialist

Engineering activities is to consider complementary acquisitions. The Group is

looking at a number of opportunities and has appointed a corporate development

officer to assist in this regard.

Outlook

The Group's focus on its two core business streams is bringing success. The

order book is slightly up on the same period last year at #228.7m (2006:

#223.2m) but the quality of earnings has shown major improvement evidenced by an

increase in both profits and cash generation. This positive momentum has

continued into the second half and the Board is confident of sustaining this

progress throughout the remainder of the year.

Roy Harrison, Chairman

22 May 2007

CHIEF EXECUTIVE'S REVIEW

Introduction

Our strategy of seeking growth in Specialist Engineering whilst increasing

margins in Specialist Building has resulted in improved results for the period.

New work flow in our Specialist Engineering activities increased to 25% of the

total order intake whilst Specialist Building has maintained a stable work

stream. Margins in Specialist Engineering have been maintained at target levels

with volumes increasing, whilst we are improving margins in Specialist Building

on steady volumes.

67% of our work is repeat business and 69% was generated from longer-term

framework agreements and negotiated contracts. 79% of orders received were in

our specialist markets. These are all well above our internal performance

targets.

PPS Electrical, the acquisition made in June 2006 by our Nuclear business, has

been successfully integrated into the Group's activities and is performing in

line with expectations, delivering margins which are in line with our Specialist

Engineering activities.

We continue to make progress in settling outstanding legacy contract claims, and

remain confident that the level of provisions is sufficient and prudent in

respect of the potential risks of non-recovery.

Review of operations

Specialist Engineering

In Nuclear, we were recently awarded a third framework contract at Sellafield.

This Multi Disciplinary Site Wide contract, to provide mechanical and electrical

services and minor civil works across the site as a primary contractor, is worth

an expected #25m over the next two years, with an option for a further two year

extension thereafter. Due to the nature of this contract, we have elected to

include only half of the expected contract value in the current order book of

#228.7m.

In Land Remediation, we were re-awarded a three year framework contract worth

#10m per annum with National Grid Properties, to carry out remediation works on

a number of their redundant sites. We have also recently secured a three year

framework with the North West Development Agency.

Specialist Building

In Social Housing, we were awarded a #15.5m contract for Metropolitan Housing

Association, and were subsequently appointed to their framework contract, taking

the number of social housing frameworks awarded during the first half to three.

We now have framework agreements with six leading Housing Associations in the

South East for the delivery of their new build programmes.

In Retail, we secured contracts with Tesco in Didcot, Ilminster and Birmingham,

together with a #5m contract for a new store shell in Maesteg, further

strengthening our excellent relationship with this client. We also completed a

new B&Q store in Folkestone.

In Science & Education, we gained two further contract awards from

GlaxoSmithKline, our biggest repeat business customer in the science sector. We

were also awarded a #7.5m project for the University of London and projects at

Imperial College and South Bank University.

In Restoration and Refurbishment, we have seen strong demand for projects in the

high quality residential market. We secured a #7.6m high quality residential

refurbishment project for Cadogan Estates, a long established client,

incorporating works on the retained facade. Work also commenced on the #5.8m

refurbishment of the Queen Elizabeth law courts in Liverpool and a #2.6m project

at the Victoria & Albert Museum. We have also been appointed to upgrade two

London underground stations for Metronet.

Property and central activities

During the period, we completed the sale of our development project in

Lancashire to Wichford PLC for a consideration of #15.5m. The related

development loan was redeemed from the proceeds of the sale, leaving the Group

debt free.

The Group continues its strategy of selling its historic property portfolio both

in the UK and US. We realised over #3m from our UK and US property holdings

during the period.

Further to the sale of our head office building in London last year, the Group

will be relocating its head office to Yorkshire during the summer.

Prospects

I am pleased by the growth achieved by our Specialist Engineering business and

by the improvement in margins being delivered by our Specialist Building

business. The progress the Group is making is very satisfying. I remain

confident of delivering further improvement in the second half of this year and

in our prospects for the future.

Brian May, Chief Executive

22 May 2007

Group Profit and Loss Account

for the six months ended 31 March 2007

Notes Six months ended Year ended

31 March 30 September

2007 2006 2006

Unaudited Unaudited Audited

#000 #000 #000

Turnover: Group and share of joint ventures 173,085 179,363 365,266

Less share of joint ventures' turnover (114) (1,150) (2,823)

Ongoing operations 172,653 162,442 341,698

Discontinuing operations 1 318 15,771 20,745

Group turnover 2 172,971 178,213 362,443

Cost of sales (153,654) (160,613) (328,393)

Gross profit 19,317 17,600 34,050

Administrative expenses (17,246) (16,210) (30,577)

Profit on ordinary activities before interest 2 2,071 1,390 3,473

Interest receivable 895 569 1,561

Interest payable (239) (661) (1,437)

Other finance income - FRS 17 pension 350 505 1,042

Profit on ordinary activities before taxation 2 3,077 1,803 4,639

Taxation on profit on ordinary activities 4 - - 1,349

Profit for the period 3,077 1,803 5,988

Basic earnings per Ordinary Share 5 5.14p 3.01p 10.00p

Diluted earnings per Ordinary Share 5 5.07p 3.01p 9.95p

Proposed dividend 6 0.60p 0.40p 0.80p

Group Statement of Total Recognised Gains and Losses

for the six months ended 31 March 2007

Notes Six months ended Year ended

31 March 30 September

2007 2006 2006

Unaudited Unaudited Audited

#000 #000 #000

Profit for the period 3,077 1,803 5,988

Dividend paid (479) (120) (360)

Exchange movements in reserves (96) 64 (119)

Net movements relating to defined benefit pension scheme 3 (890) (1,126) (6,175)

Movement on deferred tax relating to the defined pension scheme - - 1,186

Total recognised gains and losses since last annual report 1,612 621 520

Group Balance Sheet

at 31 March 2007

Notes 31 March 30 September

2007 2006 2006

Unaudited Unaudited Audited

#000 #000 #000

Fixed assets

Intangible assets: Goodwill 4,368 4,450 4,527

Tangible assets 3,513 14,663 3,819

Investments in joint ventures:

Loans to joint ventures 645 439 561

Share of gross assets 4,246 8,361 4,429

Share of gross liabilities (1,664) (4,805) (1,722)

3,227 3,995 3,268

11,108 23,108 11,614

Current assets

Stocks and work in progress 5,222 13,651 18,673

Debtors:

due after more than one year 4,298 5,850 4,346

due within one year 70,666 73,655 77,093

Current asset investments - assets held for - 3,182 -

resale

Cash at bank and in hand 27,022 8,194 19,735

107,208 104,532 119,847

Creditors: amounts falling due within one (106,965) (109,608) (121,555)

year

Net current assets/(liabilities) 243 (5,076) (1,708)

Total assets less current liabilities 11,351 18,032 9,906

Creditors: amounts falling due after more

than one year

Long-term debt - (8,363) -

Other creditors (1,605) (4,252) (1,821)

Net assets excluding pension liability 9,746 5,417 8,085

Pension liability 3 (2,769) - (2,769)

Net assets 6,977 5,417 5,316

Capital and reserves

Share capital 5,990 5,990 5,990

Share premium account 5,893 5,893 5,893

Capital redemption reserve 3,896 3,896 3,896

Revaluation reserve 73 73 73

Share based payments reserve 7 49 - -

Profit and loss account (8,924) (10,435) (10,536)

Equity shareholders' funds 8 6,977 5,417 5,316

Group Cash Flow Statement

for the six months ended 31 March 2007

Notes Six months ended Year ended

31 March 30 September

2007 2006 2006

Unaudited Unaudited Audited

#000 #000 #000

Net cash inflow/(outflow) from operating 9 18,028 (5,631) 10,661

activities

Returns on investments and servicing of finance

Interest received 895 569 1561

Interest paid (239) (661) (1,437)

656 (92) 124

Taxation

Net corporation tax paid - - (36)

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (365) (507) (1,291)

Proceeds on sale of tangible fixed assets 145 58 393

Loans (advanced to)/repaid by joint ventures (110) 871 (149)

(330) 422 (1,047)

Acquisitions and disposals

Acquisition of a subsidiary, net of cash - - (664)

acquired

Cash obtained on acquisition of subsidiaries - - 65

and businesses

- - (599)

Equity dividends paid to shareholders (479) (120) (360)

Cash inflow/(outflow) before financing 17,875 (5,421) 8,743

Financing

Short term development funding (9,795) 3,953 9,795

Repayment of mortgage - - (8,363)

Movement in short-term borrowings (298) (3,600) (3,600)

Finance lease payments (318) (328) (686)

(10,411) 25 (2,854)

Increase/(decrease) in cash during the period 7,464 (5,396) 5,889

NOTES TO THE ACCOUNTS

Note 1: Discontinuing operations

Discontinuing operations relate to the activities of YJL Construction which are

in the process of being closed down.

Note 2: Segmental analysis

Six months ended Year ended

31 March 30 September

2007 2006 2006

Unaudited Unaudited Audited

#000 #000 #000

Turnover is analysed as follows:

Building 120,943 128,185 262,889

Engineering 34,501 28,086 54,553

Property and central activities 17,323 7,321 27,079

Discontinuing operations 318 15,771 20,745

Turnover: Group and share of joint ventures' turnover 173,085 179,363 365,266

Less: Share of joint ventures' turnover (114) (1,150) (2,823)

Group turnover 172,971 178,213 362,443

Analysed as to:

Ongoing operations 172,653 162,442 341,698

Discontinuing operations 318 15,771 20,745

Group turnover 172,971 178,213 362,443

Analysis of profit on ordinary activities before interest:

Building 1,513 1,038 2,603

Engineering 1,717 1,413 2,810

Property and central activities (1,159) (1,061) (1,940)

Discontinuing operations - - -

Profit on ordinary activities before interest 2,071 1,390 3,473

Net financing income 413 1,166

1,006

Profit on ordinary activities before taxation 3,077 1,803 4,639

Note 3: Defined benefit pension scheme

As at 30 September 2006, the FRS 17 valuation, prepared by Barnett Waddingham,

Consulting Actuaries, showed a net deficit of #2,769,000 after a deferred tax

credit of #1,186,000, which was recorded as a liability in the accounts in

accordance with the requirements of FRS 17. No updating FRS 17 valuation has

been performed for these interim accounts and the Directors consider that the

position shown at 30 September 2006 should be maintained in the accounts at 31

March 2007.

As the balance sheet position of the pension scheme has been maintained at #

(2,769,000) during the period, contributions to reduce the deficit have been

shown as part of the movements in the group statement of total recognised gains

and losses.

Note 4: Taxation on profit on ordinary activities

Six months ended Year ended

31 March 30 September

2007 2006 2006

Unaudited Unaudited Audited

#000 #000 #000

Current tax:

UK corporation tax on profits for the period - - -

Adjustments in respect of previous periods - - (74)

- - (74)

Foreign tax - - (2)

Total current tax - - (76)

Deferred tax - - 1,425

Taxation credit on profit on ordinary - - 1,349

activities

The Group and Company have unused tax losses available to carry forward against

future taxable profits, although a significant element of these losses relates

to activities which are not forecast to generate the level of profits needed to

utilise these losses. A deferred tax asset of #2,899,000 has been recognised to

the extent considered reasonable by the directors and included in Debtors: due

within one year. This is in respect of losses where recovery can be reasonably

expected within twelve months of the balance sheet date. The amount has been

maintained at the same level as 30 September 2006.

Note 5: Earnings per ordinary share

Six months ended Year ended

2007 2006 2006

31 March 31 March 30 September

Weighted Weighted Weighted

average average average

number number number

Earnings of shares EPS Earnings of shares EPS Earnings of shares EPS

#000 '000 Pence #000 '000 Pence #000 '000 Pence

Basic earnings per 3,077 59,899 5.14 1,803 59,899 3.01 5,988 59,899 10.00

share

Dilutive effect of - 765 (0.07) - - - - 254 (0.05)

share options

Diluted earnings 3,077 60,664 5.07 1,803 59,899 3.01 5,988 60,153 9.95

per share

Note 6: Dividends

The proposed interim dividend is 0.6p per share (2006: 0.4p). This will be paid

out of the Company's available distributable reserves to shareholders on the

register on 8 June 2007, payable on 9 July 2007. In accordance with FRS21

dividends are recorded only when paid and are shown as a movement in equity

rather than as a charge in the profit and loss account.

Note 7: Share based payments reserve

FRS 20 Share based payments requires a fair value to be established for any

equity settled share based payments. Fair value has been independently measured

using a Black-Scholes valuation model. The fair value determined at the grant

date of the equity settled share based payments is expensed on a straight-line

basis over the vesting period, based on the Group's estimate of shares that will

eventually vest. In total 1,284,196 share options are in issue with a vesting

period of 3 years. 522,292 of these options were issued during the period and

#49,000 has been charged to administrative expenses. There is no impact on net

assets since an equivalent amount is credited to the share based payments

reserve.

Note 8: Reconciliation of movements in Group shareholders' funds

Six months ended Year ended

31 March 30 September

2007 2006 2006

Unaudited Unaudited Audited

#000 #000 #000

Profit for the period 3,077 1,803 5,988

Dividends (479) (120) (360)

2,598 1,683 5,628

Movement in share based payments reserve 49 - -

Other recognised gains and losses for the period (986) (1,062) (5,108)

Net movement in shareholders' funds 1,661 621 520

Opening shareholders' funds 5,316 4,796 4,796

Closing shareholders' funds 6,977 5,417 5,316

Note 9: Net cash inflow/(outflow) from operating activities

Six months ended Year ended

31 March 30 September

2007 2006 2006

Unaudited Unaudited Audited

#000 #000 #000

Operating profit 2,071 1,390 3,473

Depreciation 563 735 1,523

Amortisation of subsidiary goodwill 159 152 306

Share based payments 49 - -

Profit on sale of fixed assets (37) (19) -

Decrease/(increase) in stocks and work in progress 13,170 (4,078) (9,551)

Decrease/(increase) in operating debtors and 6,460 (918) (866)

prepayments

Decrease in current asset investments - 2,907 16,643

Decrease in creditors and accruals (3,867) (5,179) (1,152)

Defined benefit pension scheme contributions charged 48 - 68

to operating profit

Contributions to defined benefit scheme (588) (621) (1,246)

Realisation of joint venture assets - - 1,463

Net cash inflow/(outflow) from operating activities 18,028 (5,631) 10,661

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEAFWFSWSEFI

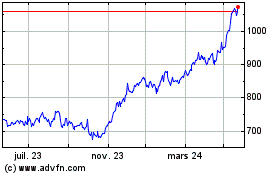

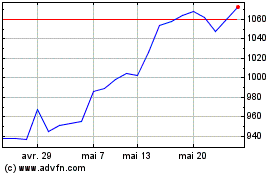

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Renew (LSE:RNWH)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024