TIDMWSBN

RNS Number : 9655A

Wishbone Gold PLC

28 September 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR

28 September 2022

Wishbone Gold Plc

("Wishbone" or the "Company")

Wishbone Gold Plc / Index: AIM: WSBN / Sector: Natural Resources

/ AQSE: WSBN

Unaudited Interim Results

Chairman's Statement

Wishbone Gold Plc has pleasure in announcing its interim results

for the period ended 30 June 2022. Shareholders are reminded that

these results are unaudited and based on the Company's management

accounts.

General Background

We continued our expansion into Western Australia with the

acquisition of the Cottesloe EPM in March 2021. This expanded our

portfolio in WA to just under 160 sqkm. We also added a southern

extension to the Wishbone EPMs (Wishbone VI) in Queensland ("QLD")

in August 2021 bringing the Wishbone portfolio in the Ravenswood

area to 174 sqkm. We also retain the 37.2 sqkm at White Mountains

in QLD further north from Ravenswood.

We are now drilling our main exploration targets at Red Setter

in Western Australia and our Wishbone tenements in Queensland.

Interim Operation Highlights

Heritage Surveys

After almost two years, the WA border reopened on March 2022.

Following the reopening, we managed to get Heritage surveys

completed on target drilling areas at Red Setter and commenced

surveys at Cottesloe. We also completed all necessary Heritage

surveys in Queensland. Heritage Surveys are a continuing process

but we are now well ahead of requirements.

Drilling In Western Australia

Before the reopening of WA we managed only a limited amount of

exploration work at Red Setter so the full program did not start

until May 2022. This is now going well and the combination of the

recent gravity survey with the earlier magnetic survey will enable

improved focusing on future drill targets.

Drilling In Queensland

The completion of all necessary Heritage surveys in Queensland

enabled drilling to start at Wishbone II in June. Initial results

from this program were announced in the RNS dated xx

Interim Financial Highlights

At the end of the period under review, the accounts show that

Wishbone held cash balances totalling GBP2,375,022 (December 2021:

GBP3,002,547). Administrative costs, excluding interest during the

period, were GBP384,823 (June 2021: GBP510,378).

The Company continues its strategy of exploration on its

properties in Australia. In conclusion I would like to thank you

all: staff, shareholders and advisers for your hard work and

support. We will continue to announce news as soon as we are

allowed by regulations to do so.

Richard Poulden

Chairman

28 September 2022

For more information on Wishbone, please visit the Company's

website.

www.wishbonegold.com .

For further information, please contact:

Wishbone Gold PLC

Richard Poulden, Chairman Tel: +971 4 584

6284

Beaumont Cornish Limited

(Nominated Adviser and AQUIS Exchange

Corporate Adviser)

Roland Cornish/Rosalind Hill Abrahams Tel: +44 20 7628

3396

Peterhouse Capital Limited

(Broker)

Lucy Williams and Duncan Vasey Tel: +44 20 7469

0930

Wishbone Gold PLC

Consolidated Income Statement

for the period 1 January 2022 to 30 June 2022

Unaudited Unaudited Audited

Six Months Six Months Year Ended

Ended 30 Ended 30 31 December

June 2022 June 2021 2021

GBP GBP GBP

Interest Income - - 17,605

Administration expenses - - (9,901)

--------------------------- ----------------------- ---------------------------

Income/(Loss) from discontinued

operations - - 7,704

Continuing Operations

Other Income - 28,932 -

Interest Income - - 16,340

Administration expenses (384,823) (510,378) (1,184,152)

--------------------------- ----------------------- ---------------------------

Operating loss (384,823) (481,446) (1,167,812)

Foreign exchange gains/(loss) (1,065) 5,742 (80,049)

Loss from continuing operations

- before taxation (385,888) (475,705) (1,247,861)

Tax on loss - - -

Loss from continuing operations (385,888) (475,705) (1,247,861)

--------------------------- ----------------------- ---------------------------

Loss for the financial year (385,888) (475,705) (1,240,157)

--------------------------- ----------------------- ---------------------------

Wishbone Gold PLC

Consolidated Statement of Financial Position

as at 30 June 2022

Unaudited Unaudited Audited Year

Six Months Six Months Ended 31 December

Ended 30 Ended 30 2021

June 2022 June 2021

GBP GBP GBP

Current assets

Trade and other receivables 82,264 36,043 33,135

Cash and cash equivalents 2,375,022 3,609,557 3,002,547

2,457,286 3,645,600 3,035,682

------------------ ----------------------- -------------------

Non-current assets

Other intangible assets 1,963,431 1,241,675 1,460,055

1,963,431 1,241,675 1,460,055

------------------ ----------------------- -------------------

Total assets 4,420,717 4,887,275 4,495,737

================== ======================= ===================

Current liabilities 343,489 76,335 135,752

Equity

Share capital 2,991,216 2,861,740 2,991,216

Share premium 11,698,892 11,032,072 11,698,892

Share payment reserve 72,987 - 72,987

Translation Adjustment (411,419) - (411,419)

Foreign exchange reserve (109,127) (156,114) (212,258)

Accumulated losses (10,165,321) (8,926,757) (9,779,433)

Total equity and liabilities 4,420,717 4,887,275 4,495,737

================== ======================= ===================

Wishbone Gold PLC

Consolidated Statement of Cash Flows

for the period from 1 January 2022 to 30 June 2022

Unaudited Unaudited Audited

Six Months Six Months Year Ended

Ended 30 Ended 30 31 December

June 2022 June 2021 2021

GBP GBP GBP

Cash flows from operating

activities

Loss before tax (385,888) (475,705) (1,240,157)

Reconciliation to cash generated

from operations:

Foreign exchange (gain)/loss 1,065 (5,742) 80,049

Administrative expenses

under share option scheme - - 72,987

Operating cash flow before

changes in working capital (384,823) (481,446) (1,087,121)

----------------- -------------- ----------------

Decrease/(increase) in receivables (49,129) 374,047 325,420

Increase/(decrease) in payables 207,737 (197,947) (164,720)

Cash outflow from operations (226,215) (305,347) (926,421)

----------------- -------------- ----------------

Cash flows from investing

activities

(Increase)/Decrease in Assets (503,376) (233,142) (217,125)

Net cash flow from investing

activities (503,376) (233,142) (217,125)

----------------- -------------- ----------------

Cash flows from financing

activities

Issue of shares for cash - 2,556,885 2,556,885

Net cash flow from financing

activities - 2,556,885 2,556,885

----------------- -------------- ----------------

Effects of exchange rates

on cash and cash equivalents 102,066 (10,938) (12,891)

Net increase/(decrease)

in cash (627,525) 2,007,458 1,400,448

Cash at bank at 1 Jan 3,002,547 1,602,099 1,602,099

Cash at bank at period end 2,375,022 3,609,557 3,002,547

----------------- -------------- ----------------

Note: The full year figures for the year ended 31 December 2021

are derived from the Company's statutory accounts for that period

on which the auditors provided an unqualified report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKFBNPBKKCCB

(END) Dow Jones Newswires

September 28, 2022 02:02 ET (06:02 GMT)

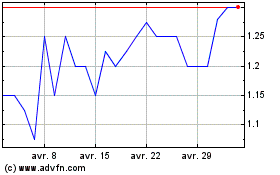

Wishbone Gold (LSE:WSBN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

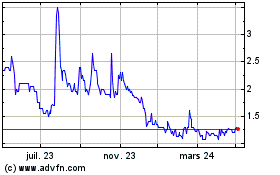

Wishbone Gold (LSE:WSBN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024