Wynnstay Group PLC Acquisition of Tamar Milling Limited (6794G)

17 Novembre 2022 - 8:00AM

UK Regulatory

TIDMWYN

RNS Number : 6794G

Wynnstay Group PLC

17 November 2022

17 November 2022

AIM: WYN

WYNNSTAY GROUP PLC

("Wynnstay" or "the Group" or "the Company")

Acquisition of Feed Manufacturer and Supplier, Tamar Milling

Limited

Expansion of the Group's presence in the south-west of

England

Wynnstay, the agricultural supplies group, is pleased to

announce that it has acquired the entire share capital of Tamar

Milling Limited ("Tamar"), a manufacturer and supplier of blended

feed products, for an initial consideration of GBP1.4m, with a

deferred consideration of up to GBP0.1m payable dependent on

performance. The acquisition is expected to be immediately earnings

enhancing.

Established in 1994, Tamar is based in Whitstone, Cornwall, and

manufactures and supplies a range of blended and coarse mix feed

rations for dairy cows, cattle, and sheep to approximately 250

farmers, mainly in the south-west of England. Approximately 25,000

tonnes of feed is supplied annually. Tamar also operates a

successful 'on-farm' grain milling service for farmers wanting to

use home-grown or purchased grain in their livestock rations.

Following its acquisition, Tamar's founder, Nick Furse, will join

Wynnstay in a senior commercial feed role and continue to lead

Tamar's operations.

In the year ended 30 September 2021, Tamar generated revenues of

GBP6.40m, and a profit before tax of GBP0.42m. Net assets at 30

September 2021 were GBP0.92m.

The acquisition of Tamar is in line with the Group's strategy of

acquiring businesses that complement its existing activities and

bring further benefits. Tamar significantly strengthens the

Company's presence in the south-west of England, adds a new farming

customer base, additional supply chain relationships and

significant cross-selling opportunities. It also establishes

Wynnstay with its first feed manufacturing facility in the region,

enabling it to provide its own bulk feed offering in the area.

The initial consideration of GBP1.4m paid on completion is

subject to a net asset adjustment to be calculated based on

completion accounts. The deferred consideration of up to GBP0.1m is

payable dependent on product volumes transacted in the first twelve

months following completion. The Group is funding the acquisition

from its existing resources.

The acquisition of Tamar is the potential acquisition referred

to in the Company's announcement of 17 August. The second larger

potential acquisition referred to in the same announcement is no

longer under consideration as commercially acceptable terms were

not reached. The Company continues to review a number of

acquisition opportunities that meet its strategic priorities.

Gareth Davies, Chief Executive Officer of Wynnstay Group plc,

commented:

"Tamar is a long-established, high-quality manufacturer and

supplier of blended animal feed and 'on-farm' grain milling

services to farmers in the south-west of England. Like Wynnstay, it

places a strong emphasis on customer service, and has a significant

customer base.

"Tamar is highly complementary and will be immediately earnings

enhancing. It fulfills multiple acquisition criteria. It increases

our presence in the south-west, adds new farmer customers and

provides us with our first feed manufacturing facility in the area.

We look forward to working with our new colleagues and to

continuing Tamar's successful growth."

Enquiries:

Wynnstay Group plc Gareth Davies, Chief T: 01691 827

Executive 118

Paul Roberts, Finance

Director

KTZ Communications Katie Tzouliadis / Dan T: 020 3178

Mahoney 6378

Shore Capital (Nomad Stephane Auton / John T: 020 7408

and Broker) More 4090

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFLFIDLTLRLIF

(END) Dow Jones Newswires

November 17, 2022 02:00 ET (07:00 GMT)

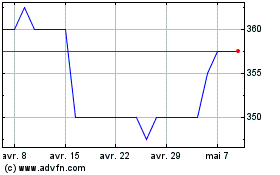

Wynnstay (LSE:WYN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Wynnstay (LSE:WYN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024