Xaar PLC Trading Update (4114S)

14 Juillet 2022 - 8:00AM

UK Regulatory

TIDMXAR

RNS Number : 4114S

Xaar PLC

14 July 2022

Xaar plc

Trading Update

Xaar plc ("Xaar", the "Group" or the "Company"), the leading

inkjet printing technology group, today announces a trading update

for the six months ended 30 June 2022.

TRADING

Continued strong trading and momentum

-- Revenue for the period is expected to be approximately GBP37

million, representing an increase of 41% relative to H1 2021 (14%

organic excluding FFEI and Megnajet) and 12% relative to H2 2021

(11% organic excluding Megnajet)

-- Strong revenue growth with improved gross margins and

successful cost management actions mean the Board expects the Group

to be on track to report an adjusted profit for the current year in

line with its expectations

Further operational and strategic progress across the Group

-- Printhead division performed well with strong growth in

Europe and US offsetting a Covid-related slowdown in China. We

remain on track for the aqueous printhead launch in Q4 2022

-- The new printbar product developed by FFEI, Xaar Versatex,

was successfully launched, whilst the acquisition of Megnajet

further strengthens the Group's vertical integration capability

-- Product Print Systems business ("EPS") delivered a strong,

improved performance with revenue and margin growth

Successfully mitigating cost inflation

-- Further investment in inventory has allowed the Group to

successfully mitigate cost inflation and increases supply chain

resilience

-- Sales price increases have further assisted in off-setting the effects of cost inflation

-- Additional management initiatives are helping in reducing

costs and increasing operational efficiency while cutting energy

use supporting Xaar's 'net zero' commitments

BALANCE SHEET AND LIQUIDITY

The Group remains well capitalised with a strong balance sheet

and cash position. Investment has been made in acquiring Megnajet

and key capital projects together with increasing working capital

to protect the Group's supply chain and ability to deliver products

on time. Net cash at 30 June 2022, was GBP12.6 million, in line

with management expectations.

John Mills, Chief Executive Officer, commented:

"We are really pleased to have achieved a strong performance in

the first half of the year in line with our expectations. We are on

target, seeing positive momentum continuing to improve performance

across the Group.

We continue to make strategic and operational progress and

remain on track to delivering long-term profitable growth.

Despite a continued uncertain macro-economic outlook, we remain

confident and excited by the future and look forward to the launch

of our aqueous printhead later in the year."

Enquiries :

Xaar plc

+44 (0) 1223 423 663

Ian Tichias, Chief Financial Officer

John Mills, Chief Executive Officer

Tulchan Communications

Giles Kernick

Olivia Lucas

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKNBKCBKDCOD

(END) Dow Jones Newswires

July 14, 2022 02:00 ET (06:00 GMT)

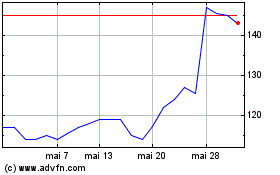

Xaar (LSE:XAR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Xaar (LSE:XAR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025