false000090765400009076542023-10-182023-10-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 18, 2023 |

ARCA biopharma, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-22873 |

36-3855489 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

10170 Church Ranch Way Suite 100 |

|

Westminster, Colorado |

|

80021 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (720) 940-2200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common |

|

ABIO |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 — Financial Information

Item 2.02 Results of Operations and Financial Condition.

On October 18, 2023, ARCA biopharma, Inc., or ARCA, issued a press release reporting financial results for the quarter ended September 30, 2023.

The press release is attached hereto as Exhibit 99.1, which is furnished under Item 2.02 of this report and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

Section 9 — Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ARCA biopharma, Inc.

(Registrant) |

|

|

|

|

Date: |

October 18, 2023 |

By: |

/s/ C. Jeffrey Dekker |

|

|

|

Name: C. Jeffrey Dekker

Title: Chief Financial Officer |

Exhibit 99.1

ARCA biopharma Announces Third Quarter 2023 Financial Results

------------------------------------------------------------------------------------------------------------

•Company is currently engaged in a strategic review process, evaluating additional development of its assets, collaborations and other strategic options

Westminster, CO, October 18, 2023 – ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company applying a precision medicine approach to developing genetically targeted therapies for cardiovascular diseases, today reported third quarter 2023 financial results and provided a corporate update.

In April 2022, the Board of Directors established a Special Committee and, in May 2022, retained Ladenburg Thalmann & Co. Inc. (“Ladenburg”) to evaluate strategic options, including transactions involving a merger, sale of all or part of the Company’s assets, or other alternatives with the goal of maximizing stockholder value. The Company and Ladenburg have reviewed several potential strategic transactions and continue to evaluate further potential development of the Company’s existing assets, in order to maximize stockholder value. The Company does not have a defined timeline for the strategic review process and the review may not result in any specific action or transaction.

Third Quarter 2023 Summary Financial Results

Cash and cash equivalents were $38.5 million as of September 30, 2023, compared to $42.4 million as of December 31, 2022. ARCA believes that its current cash and cash equivalents, consisting primarily of money market funds, will be sufficient to fund its operations through the end of 2024.

General and administrative (G&A) expenses were $1.6 million for the quarter ended September 30, 2023, consistent with $1.5 million for the corresponding period in 2022. G&A expenses in 2023 are expected to be consistent with those in 2022 as the Company maintains administrative activities to support our ongoing operations.

Research and development (R&D) expenses were $0.3 million for the quarter ended September 30, 2023, compared to $1.0 million for the corresponding period in 2022, a $0.7 million decrease. R&D personnel costs decreased approximately $0.6 million for the quarter ended September 30, 2023, as compared to the corresponding period in 2022, due to decreased headcount. In July 2022, we implemented a strategic reduction of our workforce by approximately 67%, or 12 employees. Personnel reductions were primarily focused in research and development and general and administrative functions. The restructuring was a result of our decision to manage our operating costs and expenses. During the nine months ended September 30, 2022, we recorded total restructuring charges of approximately $790,000, of which $490,000 and $300,000 were recognized in research and development and general and administrative expenses, respectively, in

connection with the restructuring, all in the form of one-time termination benefits. R&D expenses in 2023 are expected to be lower than 2022.

Total operating expenses for the quarter ended September 30, 2023 were $2.0 million compared to $2.6 million for the third quarter 2022.

Net loss for the quarter ended September 30, 2023 was $1.4 million, or $0.10 per basic and diluted share, compared to $2.3 million, or $0.16 per basic and diluted share in the third quarter of 2022.

About ARCA biopharma

ARCA biopharma is dedicated to developing genetically and other targeted therapies for cardiovascular diseases through a precision medicine approach to drug development. At present, ARCA is evaluating options for development of its assets, including partnering and other strategic options. For more information, please visit www.arcabio.com or follow the Company on LinkedIn.

Safe Harbor Statement

This press release contains "forward-looking statements" for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements regarding potential future development plans for Gencaro and rNAPc2, if any, and the Company’s review of strategic options. Such statements are based on management's current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, the risks and uncertainties associated with: ARCA’s financial resources and whether they will be sufficient to meet its business objectives and operational requirements; ARCA’s ability to raise sufficient capital on acceptable terms, or at all; the Company’s ability to continue development of Gencaro or rNAPc2 or to otherwise continue operations in the future; the Company’s ability to complete a strategic transaction; results of earlier clinical trials may not be confirmed in future clinical trials; the protection and market exclusivity provided by ARCA’s intellectual property; risks related to the drug discovery and the regulatory approval processes; and the impact of competitive products and technological changes. These and other factors are identified and described in more detail in ARCA’s filings with the Securities and Exchange Commission, including, without limitation, in ARCA’s Annual Report on Form 10-K for the year ended December 31, 2022, and subsequent filings. ARCA disclaims any intent or obligation to update these forward-looking statements.

All forward-looking statements in this press release are current only as of the date hereof and, except as required by applicable law, ARCA undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are qualified in their entirety by this cautionary statement.

Investor & Media Contact:

Jeff Dekker

720.940.2122

ir@arcabio.com

(Tables follow)

###

ARCA BIOPHARMA, INC.

BALANCE SHEET DATA

(in thousands)

(unaudited)

|

|

|

|

September 30, 2023 |

December 31, 2022 |

Cash and cash equivalents |

$38,487 |

$42,445 |

Working capital |

$37,900 |

$41,567 |

Total assets |

$39,184 |

$43,085 |

Total stockholders’ equity |

$37,968 |

$41,673 |

ARCA BIOPHARMA, INC.

STATEMENTS OF OPERATIONS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

September 30, |

|

|

September 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

(in thousands, except share and per share amounts) |

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

$ |

1,615 |

|

|

$ |

1,528 |

|

|

$ |

4,740 |

|

|

$ |

4,360 |

|

Research and development |

|

322 |

|

|

|

1,024 |

|

|

|

966 |

|

|

|

4,688 |

|

Total costs and expenses |

|

1,937 |

|

|

|

2,552 |

|

|

|

5,706 |

|

|

|

9,048 |

|

Loss from operations |

|

(1,937 |

) |

|

|

(2,552 |

) |

|

|

(5,706 |

) |

|

|

(9,048 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income |

|

513 |

|

|

|

222 |

|

|

|

1,456 |

|

|

|

301 |

|

Other loss |

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

(5 |

) |

Net loss |

$ |

(1,424 |

) |

|

$ |

(2,333 |

) |

|

$ |

(4,250 |

) |

|

$ |

(8,752 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.10 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.61 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

14,410,143 |

|

|

|

14,410,143 |

|

|

|

14,410,143 |

|

|

|

14,410,143 |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

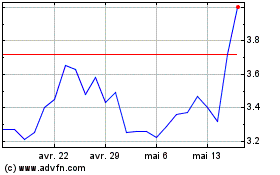

ARCA Biopharma (NASDAQ:ABIO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

ARCA Biopharma (NASDAQ:ABIO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024