Arch Capital Group Ltd. Announces Mark Lyons to Succeed Ralph Jones as Chairman and CEO of Arch Worldwide Insurance Group

15 Mai 2008 - 5:45PM

Business Wire

Arch Capital Group Ltd. [NASDAQ: ACGL] today announced that Mark

Lyons has been promoted to the position of Chairman and Chief

Executive Officer of Arch Worldwide Insurance Group, effective July

2, 2008. Mr. Lyons, who joined Arch in 2002 and currently serves as

President and Chief Operating Officer of Arch�s U.S.-based

insurance group, will succeed Ralph Jones, who will be retiring at

the end of his five-year employment term on July 1, 2008. Dinos

Iordanou, President and Chief Executive Officer of Arch Capital

Group Ltd., said, �With Ralph�s guidance over the past five years,

our insurance business has continued to establish itself as a

significant participant in the worldwide insurance marketplace. We

are very appreciative and thankful for Ralph�s contributions and

wish him well in his retirement. We are also confident that Mark

will continue to provide the strong leadership necessary to sustain

our insurance group�s success. Our ability to promote from within

Arch is another indication of the depth and strength of our

management team. Under the continuing senior team led by Mark, the

strategic direction of Arch Insurance will not change.� Ralph Jones

added, �It has been a pleasure to be part of the Arch success story

during the past five years. After 30 years in the industry, it will

be nice to hand over the reigns to my very capable successor, Mark

Lyons.� Mr. Lyons, age 51, has served as President and Chief

Operating Officer of Arch Insurance Group since June 2006. Prior

thereto, he served in various senior executive positions for Arch

Insurance Group, including Senior Vice President of group

operations and Chief Actuary. Prior to joining Arch, Mr.�Lyons was

Executive Vice President of product services at Zurich U.S. and

Vice President and Actuary at Berkshire Hathaway Insurance Group.

Mr.�Lyons holds a B.S. degree from Elizabethtown College. He is

also an Associate of the Casualty Actuarial Society and a member of

the American Academy of Actuaries. Arch Capital Group Ltd., a

Bermuda-based company with over $4.3 billion in capital at March

31, 2008, provides insurance and reinsurance on a worldwide basis

through its wholly owned subsidiaries. Cautionary Note Regarding

Forward-Looking Statements The Private Securities Litigation Reform

Act of 1995 provides a "safe harbor" for forward?looking

statements. This release or any other written or oral statements

made by or on behalf of Arch Capital Group Ltd. and its

subsidiaries may include forward?looking statements, which reflect

our current views with respect to future events and financial

performance. All statements other than statements of historical

fact included in or incorporated by reference in this release are

forward?looking statements. Forward?looking statements can

generally be identified by the use of forward?looking terminology

such as "may," "will," "expect," "intend," "estimate,"

"anticipate," "believe" or "continue" or their negative or

variations or similar terminology. Forward?looking statements

involve our current assessment of risks and uncertainties. Actual

events and results may differ materially from those expressed or

implied in these statements. A non-exclusive list of the important

factors that could cause actual results to differ materially from

those in such forward-looking statements includes the following:

adverse general economic and market conditions; increased

competition; pricing and policy term trends; fluctuations in the

actions of rating agencies and our ability to maintain and improve

our ratings; investment performance; the loss of key personnel; the

adequacy of our loss reserves, severity and/or frequency of losses,

greater than expected loss ratios and adverse development on claim

and/or claim expense liabilities; greater frequency or severity of

unpredictable natural and man-made catastrophic events;�the impact

of acts of terrorism and acts of war; changes in regulations and/or

tax laws in the United States or elsewhere; our ability to

successfully integrate, establish and maintain operating procedures

as well as integrate the businesses we have acquired or may acquire

into the existing operations; changes in accounting principles or

policies; material differences between actual and expected

assessments for guaranty funds and mandatory pooling arrangements;

availability and cost to us of reinsurance to manage our gross and

net exposures; the failure of others to meet their obligations to

us; and other factors identified in our filings with the U.S.

Securities and Exchange Commission. The foregoing review of

important factors should not be construed as exhaustive and should

be read in conjunction with other cautionary statements that are

included herein or elsewhere. All subsequent written and oral

forward?looking statements attributable to us or persons acting on

our behalf are expressly qualified in their entirety by these

cautionary statements. We undertake no obligation to publicly

update or revise any forward?looking statement, whether as a result

of new information, future events or otherwise.

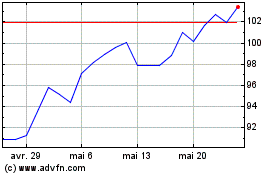

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024