Affirm Holdings, Inc. (NASDAQ: AFRM), the payment network that

empowers consumers and helps merchants drive growth, and Liberty

Mutual Investments (“LMI”), the investment firm of the Liberty

Mutual Group of Insurance Companies (“LMIG”), announced the upsize

of their forward flow loan purchase program. Over the program term

through June of 2027, LMI will purchase Affirm’s installment loans

on a forward flow basis, in amounts up to $750 million outstanding.

Over time, LMI expects to invest up to $5 billion in the

program.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250124472065/en/

(Graphic: Business Wire)

The program provides an aligned funding partner that is

committed to providing capital to increase access to Affirm’s

flexible payment options. Affirm and LMI began their long-term

capital partnership in 2019, followed by their forward flow loan

purchase program in 2023.

“Affirm’s mission to deliver honest financial products that

improve lives is premised on driving positive credit outcomes,

having access to deep and diverse pools of committed capital, and

leveraging the power of partnerships across our network,” said

Brooke Major-Reid, Chief Capital Officer at Affirm. “With a strong

partnership spanning six years, we are excited to take this next

step with Liberty Mutual Investments. We will continue to invest in

our long-term capital partnerships as we advance our ambitious

growth plans.”

“Liberty Mutual Investments’ ability to invest across the

capital structure with a single-client focus allows us to flexibly

provide solutions and scale to our long-term partners, like

Affirm,” said John Kim, managing director and head of Alternative

Credit at Liberty Mutual Investments. “We look forward to further

strengthening our partnership as this collaboration expands.”

As an industry-leading underwriter, Affirm offers easy-to-use

solutions for merchant partners and access to transparent and

flexible financing options for consumers, creating attractive

risk-adjusted assets.

Affirm maintains a diverse and durable funding model across

multiple channels, including through warehouse facilities, forward

flow agreements, and asset-backed securitizations. With more than

130 distinct investors representing a broad range of institution

types, Affirm intends to continue its approach of regularly adding

capacity across channels and building upon its relationships with

its long-term capital partners. As of September 30, 2024, Affirm’s

total funding capacity was $16.8 billion, which has grown by more

than 50% over the last two years.

Affirm empowers more than 19 million active consumers with a

transparent and flexible way to pay over time without late or

hidden fees. The company generated over $28 billion in gross

merchandise volume (GMV) for the last twelve months ending

September 30, 2024.

LMI invests more than $100B of assets globally across an

integrated platform on behalf of LMIG.

About Affirm Affirm’s mission is to deliver honest

financial products that improve lives. By building a new kind of

payment network – one based on trust, transparency and putting

people first – we empower millions of consumers to spend and save

responsibly, and give thousands of businesses the tools to fuel

growth. Unlike most credit cards and other pay-over-time options,

we never charge any late or hidden fees. Follow Affirm on social

media: LinkedIn | Instagram | Facebook | X.

About Liberty Mutual Investments Liberty Mutual

Investments (LMI) is the investment firm of the Liberty Mutual

Group of Insurance Companies (LMIG). LMI invests more than $100B of

assets globally across an integrated platform. LMIG’s mutual

structure, and LMI’s deep expertise spanning fixed income, equity,

and alternative markets, make LMI a flexible, long-term investor

and partner. The portfolio managed by LMI and the capital it

creates have a clear purpose: to secure LMIG’s promises to

policyholders and build enduring businesses side-by-side with our

partners. Liberty Mutual Group Asset Management Inc. does business

under the name Liberty Mutual Investments.

For more information, visit

https://www.libertymutualinvestments.com/.

Forward Looking Statement from Affirm This press release

contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as

amended, that involve risks and uncertainties. All statements other

than statements of historical fact contained in this press release,

including statements regarding Affirm’s future results of

operations and financial condition, business strategy, and plans

and objectives of management for future operations, are

forward-looking statements. In some cases, forward-looking

statements may be identified by words such as “anticipate,”

“believe,” “continue,” “could,” “design,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potentially,” “predict,” “project,”

“should,” “will,” “would,” or the negative of these terms or other

similar expressions. Forward-looking statements are based on

management’s beliefs and assumptions and on information currently

available. These forward-looking statements are subject to a number

of known and unknown risks, uncertainties and assumptions,

including risks described under “Risk Factors” in Affirm’s Annual

Report on Form 10-K for the fiscal year ended June 30, 2024. Except

as required by law, Affirm undertakes no obligation to update

publicly any forward-looking statements for any reason after the

date of this press release or to conform these statements to actual

results or to changes in our expectations.

Cautionary Statement Regarding Forward Looking Statements

This press release may contain forward looking statements that are

intended to enhance the reader’s ability to assess the future

financial and business performance of Liberty Mutual Holding

Company Inc. and its subsidiaries (“LMIG”). Forward looking

statements include, but are not limited to, statements that

represent LMIG’s beliefs concerning future operations, strategies,

financial results, investment market fluctuations, or other

developments, and contain words and phrases such as “may,”

“expects,” “should,” “believes,” “anticipates,” “estimates,”

“intends” or similar expressions. Because these forward-looking

statements are based on estimates and assumptions that are subject

to significant business, economic and competitive uncertainties,

many of which are beyond LMIG’s control or are subject to change,

actual results could be materially different. LMIG’s

forward-looking statements speak only as of the date they are made

and should be regarded solely as LMIG’s current plans, estimates

and beliefs. For a detailed discussion of these and other

cautionary statements, visit LMIG’s Investor Relations website at

www.libertymutualgroup.com/investors. LMIG undertakes no obligation

to update these forward-looking statements.

AFRM-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124472065/en/

Affirm Investor Relations ir@affirm.com

Affirm Media press@affirm.com

Liberty Mutual Investments press@lmi.com

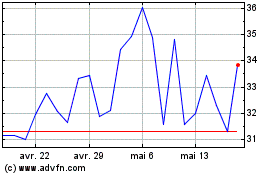

Affirm (NASDAQ:AFRM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Affirm (NASDAQ:AFRM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025