REIT's Large Dividends Under Pressure as Stimulus Measures Lower Spreads and Bond Yields

13 Novembre 2012 - 2:20PM

Marketwired

Shares of high yielding REITs have been relatively flat this month.

The Vanguard REIT ETF -- which tracks the performance of an index

that measures the performance of publicly traded equity REITs --

has stalled after the Federal Reserve in September announced plans

to purchase $40 billion in mortgage-backed securities a month. Five

Star Equities examines the outlook for diversified REITs and

provides equity research on American Capital Agency Corp. (NASDAQ:

AGNC) and ARMOUR Residential REIT, Inc. (NYSE: ARR).

Access to the full company reports can be found at:

www.FiveStarEquities.com/AGNC

www.FiveStarEquities.com/ARR

Investors have long been attracted to the high yields of

mortgage REITs, which currently averages around 13 percent, nearly

7 times the average dividend yield of the S&P 500. The Fed's

announcement has caused drops in spreads, bond yields and

homeowner's borrowing costs, and as a result company's earnings and

dividends have been under pressure.

"Through the use of leverage, these REITs have yields in the

midteens. At this time, mortgage REITs are benefiting from

historically low short-term rates, but tightening spreads, or a

sudden freeze in the credit markets, would have a significant

negative impact on these firms," Morningstar analyst Patricia Oey

wrote in a report.

Five Star Equities releases regular market updates on

diversified REITs so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.FiveStarEquities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

American Capital Agency Corporation pays an annual dividend of

five dollars per share for a yield of around 16.2 percent. The

company invests in residential mortgage pass-through securities and

collateralized mortgage obligations for which the principal and

interest payments are guaranteed by government-sponsored entities

or by the United States government agency.

ARMOUR Residential REIT invests primarily in residential

mortgage backed securities issued or guaranteed by a United States

Government-chartered entity, such as the Federal National Mortgage

Association and the Federal Home Loan Mortgage Corporation, or

guaranteed by the Government National Mortgage Administration, a

United States Government corporation (Ginnie Mae). The company

currently pays an annual dividend of $1.08 per share for a yield of

around 15.5 percent.

Five Star Equities provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.FiveStarEquities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

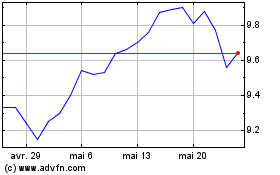

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024