Altisource Portfolio Solutions S.A. (“Altisource” or the “Company”)

(NASDAQ: ASPS), a leading provider and marketplace for the real

estate and mortgage industries, announced the closing of its

previously announced exchange transaction with one hundred percent

(100%) of lenders under the Company’s senior secured term loans

(the “Lenders”) (the “Term Loan Exchange Transactions") and entered

into a $12.5 million super senior credit facility (the “Super

Senior Facility”).

“I am pleased that we executed and closed the

Term Loan Exchange Transactions and the Super Senior Facility. We

believe these transactions significantly strengthen Altisource’s

balance sheet which, combined with the Company’s improving

financial performance, should help position it for sustainable

long-term growth and value creation,” said Chairman and Chief

Executive Officer William B. Shepro.

Under the Term Loan Exchange Transactions, the

Lenders exchanged the Company’s senior secured term loans with an

outstanding balance of $232.8 million for a $160 million new first

lien loan (the “New Facility”) and the issuance of approximately

58.2 million common shares of Altisource (the “Debt Exchange

Shares”). The New Facility is comprised of a $110 million

interest-bearing loan (the “New Debt”) and a $50 million

non-interest-bearing exit fee (the “Exit Fee”). The following is a

summary of certain terms of the New Facility:

- $158.6 million

of the New Facility matures on April 30, 20301

- The interest

rate on the New Debt is Secured Overnight Financing Rate (“SOFR”)

plus 6.50% per annum with a 3.50% SOFR floor

- The interest

rate on the Exit Fee is 0%

- All mandatory

and voluntary prepayments under the New Facility are allocated

between the New Debt and the Exit Fee on a pro rata basis

- The principal

amortization of the New Facility is 1.0% of the New Debt per

year

- A minimum of 95%

of net proceeds the Company may receive from the exercise of Cash

Exercise Stakeholder Warrants (defined below) are to be used to

prepay the New Facility

- Beginning with

the fiscal year ending December 31, 2025, the lesser of (a) 75% of

the aggregate Excess Cash Flow (as defined in the credit agreement)

for the most recently ended fiscal year of the Company for which

financial statements have been delivered and (b) such amount which,

immediately after giving effect to such repayment, would result in

the Company having no less than $30 million of total cash on its

balance sheet, shall be applied first to the prepayment of the

Super Senior Facility (defined below) and, second, to the

prepayment of the New Facility

___________________________1 A portion of the

principal amount of the Exchange Term Loans in the amount of

approximately $1.4 million matures on January 15, 2029.

On February 19, 2025, Altisource also executed

and closed on the Super Senior Facility to fund transaction costs

related to the Term Loan Exchange Transaction and for general

corporate purposes. The following is a summary of certain terms of

the Super Senior Facility:

- The maturity

date of the Super Senior Facility is February 19, 2029

- The original

issue discount on the Super Senior Facility is 10.0%

- The interest

rate on the Super Senior Facility is SOFR plus 6.50% with a 3.50%

SOFR floor

- Beginning with

the fiscal year ending December 31, 2025, the lesser of (a) 75% of

the aggregate Excess Cash Flow (as defined in the credit agreement)

for the most recently ended fiscal year of the Company for which

financial statements have been delivered and (b) such amount which,

immediately after giving effect to such repayment, would result in

the Company having no less than $30 million of total cash on its

balance sheet, shall be applied first to the prepayment of the

Super Senior Facility and, second, to the prepayment of the New

Facility

On February 18, 2025, the Company’s shareholders

approved resolutions to enable, among other things, an issuance of

transferrable warrants to holders of the Company’s (i) common

stock, (ii) restricted share units and (iii) outstanding warrants

to purchase shares of Common Stock at an exercise price of $0.01

per share, (collectively, the “Stakeholders”), in each case, as of

5:00 p.m., New York City time, on February 14, 2025 (the

“Distribution Record Date”), to purchase approximately 114.5

million shares of Altisource common stock for $1.20 per share (the

“Stakeholder Warrants”). Subject to the right of the board of

directors of the Company (the “Board”) to change the Distribution

Record Date, the issuance of Stakeholder Warrants shall occur on a

date to be subsequently determined by the Board that will be within

60 days after the Distribution Record Date (i.e., by April 15,

2025). Once issued, the Stakeholder Warrants will provide

Stakeholders with the ability to purchase approximately 3.25 shares

of Altisource common stock for each share of or right to common

stock held. Fifty percent of the Stakeholder Warrants will expire

on April 2, 2029 and require settlement through the cash payment to

the Company of the exercise price of such Stakeholder Warrant

(“Cash Exercise Stakeholder Warrants”). The other fifty percent of

the Stakeholder Warrants will expire on April 30, 2032 and require

settlement through the forfeiture of shares to the Company equal to

the exercise price of such Stakeholder Warrant.

The foregoing descriptions of each of the Term

Loan Exchange Transactions and the Super Senior Facility are not

complete and are to be described in more detail in a Current Report

on Form 8-K to be filed by Altisource in connection with the

transactions described herein. The transactions described above

were undertaken pursuant to the Transaction Support Agreement dated

December 16, 2024, a copy of which is attached as Exhibit 10.1 to

Altisource’s Current Report on Form 8-K filed with the Securities

and Exchange Commission on December 17, 2024.

Disclaimer

This press release does not constitute an offer

to sell or buy, nor the solicitation of an offer to sell or buy,

any securities nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

In particular, this communication is not an offer of securities for

sale into the United States or any other jurisdiction. No offer of

securities shall be made absent registration under the Securities

Act of 1933, as amended, or pursuant to an exemption from, or in a

transaction not subject to, such registration requirements.

Forward-Looking Statements

This press release contains forward-looking

statements that involve a number of risks and uncertainties. These

forward-looking statements include all statements that are not

historical fact, including statements that relate to, among other

things, future events or our future performance or financial

condition, including without limitation, statements relating to the

potential for the Term Loan Exchange Transactions and the Super

Senior Facility to improve the Company’s financial performance and

impact thereof on the Company’s long-term growth and value

creation, the issuance of Stakeholder Warrants and the Distribution

Date for the Stakeholder Warrants. These statements may be

identified by words such as “anticipate,” “intend,” “expect,”

“may,” “could,” “should,” “would,” “plan,” “estimate,” “seek,”

“believe,” “potential” or “continue” or the negative of these terms

and comparable terminology. Such statements are based on

expectations as to the future and are not statements of historical

fact. Furthermore, forward-looking statements are not guarantees of

future performance and involve a number of assumptions, risks and

uncertainties that could cause actual results to differ materially.

Important factors that could cause actual results to differ

materially from those suggested by the forward-looking statements

include, but are not limited to, the risks discussed in Item 1A of

Part I “Risk Factors” in our Form 10-K filed with the Securities

and Exchange Commission on March 7, 2024, as updated by the

information in Item 1A. of Part II “Risk Factors” in our

subsequently filed quarterly reports on Form 10-Q filings. We

caution you not to place undue reliance on these forward-looking

statements which reflect our view only as of the date of this

report. We are under no obligation (and expressly disclaim any

obligation) to update or alter any forward-looking statements

contained herein to reflect any change in our expectations with

regard thereto or change in events, conditions or circumstances on

which any such statement is based. The risks and uncertainties to

which forward looking statements are subject include, but are not

limited to, risks related to customer concentration, the timing of

the anticipated increase in default related referrals following the

expiration of foreclosure and eviction moratoriums and forbearance

programs, and any other delays occasioned by government, investor

or servicer actions, the use and success of our products and

services, our ability to retain existing customers and attract new

customers and the potential for expansion or changes in our

customer relationships, technology disruptions, our compliance with

applicable data requirements, our use of third party vendors and

contractors, our ability to effectively manage potential conflicts

of interest, macro-economic and industry specific conditions, our

ability to effectively manage our regulatory and contractual

obligations, the adequacy of our financial resources, including our

sources of liquidity and ability to repay borrowings and comply

with our debt agreements, including the financial and other

covenants contained therein, as well as Altisource’s ability to

retain key executives or employees, behavior of customers,

suppliers and/or competitors, technological developments,

governmental regulations, taxes and policies. The financial

projections and scenarios contained in this press release are

expressly qualified as forward-looking statements and, as with

other forward-looking statements, should not be unduly relied upon.

We undertake no obligation to update these statements, scenarios

and projections as a result of a change in circumstances, new

information or future events, except as required by law.

About Altisource

Altisource Portfolio Solutions S.A. is an

integrated service provider and marketplace for the real estate and

mortgage industries. Combining operational excellence with a suite

of innovative services and technologies, Altisource helps solve the

demands of the ever-changing markets we serve. Additional

information is available at www.Altisource.com.

FOR FURTHER INFORMATION CONTACT:

Michelle D. EstermanChief Financial OfficerT: (770) 612-7007E:

Michelle.Esterman@altisource.com

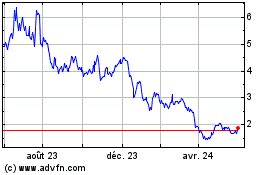

Altisource Portfolio Sol... (NASDAQ:ASPS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

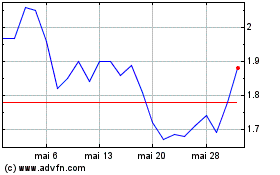

Altisource Portfolio Sol... (NASDAQ:ASPS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025