TJC Closes Second Continuation Fund of $2.1 Billion Led by AlpInvest

01 Octobre 2024 - 2:00PM

Business Wire

TJC LP (“TJC” or “the Firm”), a middle-market private equity

firm investing primarily in North American businesses, today

announced the close of its second continuation fund (the

“Continuation Fund”) at $2.1 billion, which will be an extension of

The Resolute Fund III, L.P. (“Resolute III”) and include an asset

jointly owned with The Resolute Fund IV, L.P. (“Resolute IV”).

The Continuation Fund purchased a total of five portfolio

companies including assets from Resolute III, a 2013 vintage fund

with approximately $3.2 billion in capital commitments and a

portfolio company Resolute III jointly owned with Resolute IV, a

2018 vintage fund with approximately $3.6 billion in capital

commitments. The Continuation Fund will give TJC time and capital

to accelerate growth of core portfolio assets, while offering

limited partners from Resolute III and Resolute IV an opportunity

to achieve liquidity in a timely manner.

“As we drive ongoing acquisition integration and operational

initiatives within the Continuation Fund portfolio, we believe this

transaction will enable us to provide the Fund’s portfolio

companies with greater resources, time and flexibility to execute

on these strategies which will continue to build shareholder

value,” said Rich Caputo, Chairman and Chief Executive Partner of

TJC. “We have given our investors an option to take accelerated

liquidity at a market-driven price while allowing the portfolio

companies the opportunity to continue to pursue their long-term

growth plans.”

“This is the second consecutive transaction that earned

overwhelming support from limited partners, and was oversubscribed

by new investors,” said Kristin Custar, Partner and Head of TJC’s

Global Investor Capital Group. “We are thankful for the partnership

of the investors who supported the Continuation Fund and appreciate

their continued support.”

The transaction was led by AlpInvest, a subsidiary of global

investment firm Carlyle (NASDAQ: CG), and included a diverse

group of secondary and primary investors, including Resolute III

and Resolute IV limited partners. TJC offered all existing Resolute

III and Resolute IV limited partners the opportunity to exercise a

full liquidity option, a rollover option, and an option to seek to

make additional capital commitments to the Continuation Fund.

“AlpInvest is pleased to have the opportunity to expand our

partnership with TJC in leading the Resolute III Continuation Fund

transaction,” said Eric Anton, Managing Director at AlpInvest. “The

transaction is strongly aligned with our strategy, and we look

forward to continuing to support TJC in driving value creation

initiatives across the portfolio.”

William Blair served as exclusive financial advisor to TJC and

placed the Continuation Fund. Latham & Watkins LLP acted as

legal advisor to TJC.

About TJC TJC LP, formerly known as The Jordan Company,

has worked for more than 40 years with CEOs, founders and

entrepreneurs across a range of industries including Consumer &

Healthcare, Diversified Industrials, Industrial Technology,

Logistics & Supply Chain and Technology & Infrastructure.

With $31.4 billion of assets under management as of June 30, 2024,

TJC is managed by a senior leadership team that has invested

together for over 22 years on over 80 investments. TJC has offices

in New York, Chicago, Miami and Stamford. For more information,

please visit www.tjclp.com.

About AlpInvest AlpInvest, a subsidiary of Carlyle

(NASDAQ: CG), is a leading global private equity investor

with $80+ billion of assets under management and more than 500

investors as of June 30, 2024. It has invested with over 360

private equity managers and committed approximately $100 billion

across primary commitments to private equity funds, secondary and

portfolio finance transactions and co-investments. AlpInvest

employs more than 230 people in New York, Amsterdam, Hong Kong,

London, and Singapore. For more information, please visit

www.carlyle.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001765764/en/

AlpInvest Isabelle Jeffrey

Isabelle.jeffrey@carlyle.com

Brittany Berliner Brittany.Berliner@carlyle.com

TJC Jonathan Marino Prosek Partners

jmarino@prosek.com

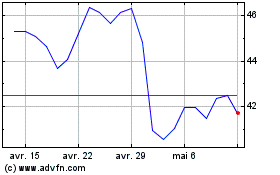

Carlyle (NASDAQ:CG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Carlyle (NASDAQ:CG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024