Eton Pharmaceuticals, Inc (“Eton” or the “Company”) (Nasdaq: ETON),

an innovative pharmaceutical company focused on developing and

commercializing treatments for rare diseases, today reported

financial results for the quarter and year ended December 31, 2023.

“We finished 2023 by delivering our twelfth

straight quarter of sequential product sales growth and another

quarter of positive operating cash flow. The growth trajectory

continues for ALKINDI SPRINKLE® and Carglumic Acid, and we are

excited for the Company’s prospects for 2024 and beyond,” said Sean

Brynjelsen, CEO of Eton Pharmaceuticals.

“In addition to the strong performance of our

commercial products, we are pleased to report favorable

developments in our pipeline. In recent weeks, we received positive

study results for both ET-400 and ET-600, which brings both

products one step closer to NDA submission. We look forward to

submitting our NDA for ET-400 in the second quarter of this year

and ET-600 early next year,” concluded Brynjelsen.

Fourth Quarter and Recent Business

Highlights

Twelfth straight quarter of sequential

growth in product sales. Eton reported fourth quarter 2023

product sales and royalty revenue of $7.3 million, representing a

109% year-over-year increase and 4% growth over the third quarter

of 2023, driven primarily by the ongoing momentum of ALKINDI

SPRINKLE and Carglumic Acid. The Company anticipates continued

growth of product sales in 2024.

Recorded positive cash flow from

operations. Eton generated $0.4 million of operating cash

during the fourth quarter of 2023, with total cash and cash

equivalents of $21.4 million as of December 31, 2023.

Passed pivotal bioequivalence study for

ET-400. In February, Eton received preliminary data

showing that ET-400, its proprietary formulation of oral

hydrocortisone, passed its pivotal bioequivalence study. All other

major filing pre-requisites have been completed, and the Company

expects to submit the NDA to the FDA for ET-400 when the final

clinical study report is available in the second quarter of 2024.

This would allow for a potential FDA approval as early as the first

quarter of 2025.

Awarded U.S. patent for ET-400.

The patent, which covers the Company’s proprietary formulation,

expires in 2043 and is expected to be listed in the FDA’s Orange

Book upon the product’s approval. The Company has additional patent

applications related to the product under review with the United

States Patent and Trademark Office.

Passed pilot bioequivalence study for

ET-600. The Company plans to run the pivotal study in the

second half of 2024, which would allow for a potential NDA

submission in early 2025.

Initiated ALKINDI SPRINKLE sampling

program. The Company’s sampling program went live in

February 2024, allowing pediatric endocrinology offices to stock

ALKINDI SPRINKLE samples so that newly diagnosed or converting

patients can immediately start therapy on ALKINDI SPRINKLE in the

presence of their physician. Eton has already seen strong demand

for samples from physicians and expects the sampling program to

have a positive impact on adoption and 2024 revenue growth.

Launched ultra-rare disease product

Nitisinone capsules. The product was launched in February

2024 with full patient and provider support services. Eton believes

its commercial advantages, existing relationships with prescribers,

and experienced sales force will allow the Company to capture a

meaningful percentage of the $50 million market.

Fourth Quarter Financial

Results

Net Revenue: Net product sales

and royalty revenues for the fourth quarter of 2023 increased by

109% to $7.3 million compared to $3.5 million in the prior year

period, driven primarily by growth in ALKINDI SPRINKLE and

Carglumic Acid. Total net revenues were $7.3 million for the fourth

quarter of 2023, compared to $8.5 million for the fourth quarter of

2022. The prior year period included $5.0 million in licensing

revenue resulting from a milestone payment received from Azurity

Pharmaceuticals.

Gross Profit: Gross profit for

the fourth quarter of 2023 was $3.6 million. Fourth quarter 2023

gross profit was negatively impacted by a $1.0 million one-time

payment to Diurnal PLC as a result of ALKINDI SPRINKLE net sales

triggering a commercial success-based milestone under terms of the

product’s licensing agreement. Gross profit for the fourth quarter

of 2022 was $6.4 million and benefited from a $5.0 million

milestone payment received from Azurity Pharmaceuticals.

Research and Development (R&D)

Expenses: R&D expenses for the fourth quarter of 2023

were $1.0 million compared to $0.9 million in the prior year

period.

General and Administrative (G&A)

Expenses: G&A expenses for the fourth quarter of 2023

were $4.6 million compared to $4.4 million in the prior year

period. The slight increase in G&A expenses was primarily due

to personnel additions.

Net Loss: Net loss for the

fourth quarter of 2023 was $2.3 million or $0.09 per basic and

diluted share compared to net income of $0.9 million or $0.04 per

diluted share in the prior year period.

Cash Position: As of December

31, 2023, the Company had cash and cash equivalents of $21.4

million.

Conference Call and Webcast

Information

As previously announced, Eton Pharmaceuticals

will host its fourth quarter 2023 conference call as follows:

| Date |

|

March 14,

2024 |

| |

|

|

| Time |

|

4:30 p.m. ET (3:30 p.m. CT) |

| |

|

|

| Register* (Audio Only) |

|

Click here |

| |

|

|

In addition to taking live questions from

participants on the conference call, management will be answering

emailed questions from investors. Investors can email questions to:

investorrelations@etonpharma.com.

The live webcast can be accessed on the

Investors section of Eton’s website at https://ir.etonpharma.com/.

An archived webcast will be available on Eton’s website

approximately two hours after the completion of the event and for

30 days thereafter.

* Conference call participants should register

to obtain their dial-in and passcode details. Please be sure to

register using a valid email address.

About Eton

Pharmaceuticals

Eton is an innovative pharmaceutical company

focused on developing and commercializing treatments for rare

diseases. The Company currently has four FDA-approved rare disease

products: ALKINDI SPRINKLE®, Carglumic Acid, Betaine Anhydrous, and

Nitisinone. The Company has three additional product candidates in

late-stage development: ET-400, ET-600, and ZENEO® hydrocortisone

autoinjector. For more information, please visit our website

at www.etonpharma.com.

Forward-Looking Statements

Statements contained in this press release

regarding matters that are not historical facts are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements

associated with the expected ability of Eton to undertake certain

activities and accomplish certain goals and objectives. These

statements include but are not limited to statements regarding

Eton’s business strategy, Eton’s plans to develop and commercialize

its product candidates, the safety and efficacy of Eton’s product

candidates, Eton’s plans and expected timing with respect to

regulatory filings and approvals, and the size and growth potential

of the markets for Eton’s product candidates. Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements. Words such as “believes,”

“anticipates,” “plans,” “expects,” “intends,” “will,” “goal,”

“potential” and similar expressions are intended to identify

forward-looking statements. These forward-looking statements are

based upon Eton’s current expectations and involve assumptions that

may never materialize or may prove to be incorrect. Actual results

and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of

various risks and uncertainties, which include, without limitation,

risks associated with the process of discovering, developing and

commercializing drugs that are safe and effective for use as human

therapeutics, and in the endeavor of building a business around

such drugs. These and other risks concerning Eton’s development

programs and financial position are described in additional detail

in Eton’s filings with the Securities and Exchange Commission. All

forward-looking statements contained in this press release speak

only as of the date on which they were made. Eton undertakes no

obligation to update such statements to reflect events that occur

or circumstances that exist after the date on which they were

made.

Investor Relations:

Lisa M. Wilson, In-Site Communications, Inc.

T: 212-452-2793

E: lwilson@insitecony.com

|

Eton Pharmaceuticals, Inc.STATEMENTS OF

OPERATIONS(In thousands, except per share

amounts) |

|

|

|

|

|

For the three months ended |

|

|

For the years ended |

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensing revenue |

|

$ |

— |

|

|

$ |

5,000 |

|

|

$ |

5,500 |

|

|

$ |

10,000 |

|

|

Product sales and royalties, net |

|

|

7,313 |

|

|

|

3,498 |

|

|

|

26,142 |

|

|

|

11,251 |

|

|

Total net revenues |

|

|

7,313 |

|

|

|

8,498 |

|

|

|

31,642 |

|

|

|

21,251 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensing revenue |

|

|

1,000 |

|

|

|

650 |

|

|

|

1,000 |

|

|

|

1,640 |

|

|

Product sales and royalties |

|

|

2,683 |

|

|

|

1,488 |

|

|

|

9,581 |

|

|

|

5,293 |

|

| Total cost of

sales |

|

|

3,683 |

|

|

|

2,138 |

|

|

|

10,581 |

|

|

|

6,933 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit

(loss) |

|

|

3,630 |

|

|

|

6,360 |

|

|

|

21,061 |

|

|

|

14,318 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

1,047 |

|

|

|

944 |

|

|

|

3,322 |

|

|

|

3,996 |

|

|

General and administrative |

|

|

4,575 |

|

|

|

4,354 |

|

|

|

18,931 |

|

|

|

18,582 |

|

| Total operating

expenses |

|

|

5,622 |

|

|

|

5,298 |

|

|

|

22,253 |

|

|

|

22,578 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

operations |

|

|

(1,992 |

) |

|

|

1,062 |

|

|

|

(1,192 |

) |

|

|

(8,260 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (expense)

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other (expense) income, net |

|

|

(17 |

) |

|

|

(150 |

) |

|

|

503 |

|

|

|

(761 |

) |

|

Gain on PPP loan forgiveness |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Gain on equipment sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before

income tax expense |

|

|

(2,008 |

) |

|

|

912 |

|

|

|

(689 |

) |

|

|

(9,021 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

247 |

|

|

|

— |

|

|

|

247 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

$ |

(2,256 |

) |

|

$ |

912 |

|

|

$ |

(936 |

) |

|

$ |

(9,021 |

) |

| Net loss per share,

basic |

|

$ |

(0.09 |

) |

|

$ |

0.04 |

|

|

$ |

(0.04 |

) |

|

$ |

(0.36 |

) |

| Net loss per share,

diluted |

|

$ |

(0.09 |

) |

|

$ |

0.04 |

|

|

$ |

(0.04 |

) |

|

$ |

(0.36 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding, basic |

|

|

25,741 |

|

|

|

25,381 |

|

|

|

25,645 |

|

|

|

25,146 |

|

| Weighted average number of

common shares outstanding, diluted |

|

|

25,741 |

|

|

|

25,691 |

|

|

|

25,645 |

|

|

|

25,146 |

|

|

Eton Pharmaceuticals, Inc.BALANCE

SHEETS(in thousands, except share and per share

amounts) |

| |

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

21,388 |

|

|

$ |

16,305 |

|

|

Accounts receivable, net |

|

|

3,411 |

|

|

|

1,852 |

|

|

Inventories |

|

|

911 |

|

|

|

557 |

|

|

Prepaid expenses and other current assets |

|

|

1,129 |

|

|

|

1,290 |

|

| Total current

assets |

|

|

26,839 |

|

|

|

20,004 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

58 |

|

|

|

72 |

|

|

Intangible assets, net |

|

|

4,739 |

|

|

|

4,754 |

|

|

Operating lease right-of-use assets, net |

|

|

92 |

|

|

|

188 |

|

|

Other long-term assets, net |

|

|

12 |

|

|

|

12 |

|

| Total

assets |

|

$ |

31,740 |

|

|

$ |

25,030 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,848 |

|

|

$ |

1,766 |

|

|

Current portion of long-term debt |

|

|

5,380 |

|

|

|

1,033 |

|

|

Accrued liabilities |

|

|

9,013 |

|

|

|

3,662 |

|

| Total current

liabilities |

|

|

16,241 |

|

|

|

6,461 |

|

| |

|

|

|

|

|

|

|

|

| Long-term debt, net of

discount and including accrued fees |

|

|

— |

|

|

|

5,384 |

|

| Operating lease liabilities,

net of current portion |

|

|

22 |

|

|

|

107 |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

16,263 |

|

|

|

11,952 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies (Note 14) |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

| Common stock, $0.001 par

value; 50,000,000 shares authorized; 25,688,062 and 25,353,119

shares issued and outstanding at December 31, 2023 and 2022,

respectively |

|

|

26 |

|

|

|

25 |

|

| Additional paid-in

capital |

|

|

119,521 |

|

|

|

116,187 |

|

| Accumulated deficit |

|

|

(104,070 |

) |

|

|

(103,134 |

) |

| Total stockholders’

equity |

|

|

15,477 |

|

|

|

13,078 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

31,740 |

|

|

$ |

25,030 |

|

|

Eton Pharmaceuticals, Inc.STATEMENTS OF

CASH FLOWS(In thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(936 |

) |

|

$ |

(9,021 |

) |

| |

|

|

|

|

|

|

|

|

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

3,137 |

|

|

|

4,218 |

|

|

Common stock issued for product candidate licensing rights |

|

|

— |

|

|

|

— |

|

|

Depreciation and amortization |

|

|

901 |

|

|

|

1,774 |

|

|

Debt discount amortization |

|

|

117 |

|

|

|

127 |

|

|

Gain on forgiveness of PPP loan |

|

|

— |

|

|

|

— |

|

|

Gain on sale of equipment |

|

|

— |

|

|

|

— |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,559 |

) |

|

|

3,619 |

|

|

Inventories |

|

|

(354 |

) |

|

|

(7 |

) |

|

Prepaid expenses and other assets |

|

|

161 |

|

|

|

1,902 |

|

|

Accounts payable |

|

|

53 |

|

|

|

(8 |

) |

|

Accrued liabilities |

|

|

5,295 |

|

|

|

2,217 |

|

| Net cash provided by

(used in) operating activities |

|

|

6,815 |

|

|

|

4,821 |

|

| |

|

|

|

|

|

|

|

|

| Cash used in investing

activities |

|

|

|

|

|

|

|

|

|

Proceeds from sale of equipment |

|

|

— |

|

|

|

— |

|

|

Purchases of property and equipment |

|

|

— |

|

|

|

(38 |

) |

|

Purchase of product licensing rights |

|

|

(775 |

) |

|

|

(2,750 |

) |

| Net cash used in

investing activities |

|

|

(775 |

) |

|

|

(2,788 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of long-term debt, net of issuance

costs |

|

|

— |

|

|

|

— |

|

|

Proceeds from sales of common stock, net of offering costs |

|

|

— |

|

|

|

— |

|

|

Proceeds from PPP and EIDL loans |

|

|

— |

|

|

|

— |

|

|

Debt paydown |

|

|

(1,155 |

) |

|

|

(385 |

) |

|

Proceeds from employee stock purchase plan and stock option and

stock warrant exercises |

|

|

198 |

|

|

|

251 |

|

|

Net cash (used in) provided by financing

activities |

|

|

(957 |

) |

|

|

(134 |

) |

| |

|

|

|

|

|

|

|

|

|

Change in cash and cash equivalents |

|

|

5,083 |

|

|

|

1,899 |

|

| Cash and cash equivalents at

beginning of year |

|

|

16,305 |

|

|

|

14,406 |

|

| Cash and cash equivalents at

end of year |

|

$ |

21,388 |

|

|

$ |

16,305 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

842 |

|

|

$ |

730 |

|

| Cash paid for income

taxes |

|

$ |

247 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosures of non-cash investing and

financing activities: |

|

|

|

|

|

|

|

|

|

Adjustment of operating lease right-of-use assets and liabilities

due to tenant allowance |

|

$ |

29 |

|

|

$ |

— |

|

|

Right-of-use assets obtained in exchange for lease liabilities |

|

$ |

— |

|

|

$ |

188 |

|

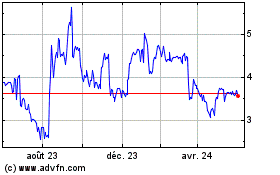

Eton Pharmaceuticals (NASDAQ:ETON)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

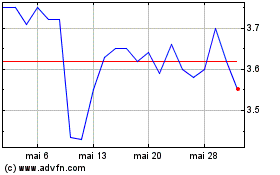

Eton Pharmaceuticals (NASDAQ:ETON)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025