Analyst Research on New York Community Bancorp Inc. and Northwest Bancshares Inc. -- Savings and Loans Sector Sees Confusing M&A

29 Novembre 2010 - 2:57PM

Marketwired

www.stockcall.com/ offers investors comprehensive research on the

savings & loans industry and has completed analytical research

on

New York Community Bancorp Inc. (NYSE:

NYB) and

Northwest Bancshares Inc. (NASDAQ:

NWBI). Register with us today at www.stockcall.com/ to have free

access to these researches.

Many companies in the Savings and Loans sector have been raising

funds to buy other distressed or failing banks. With the FDIC

seizing and auctioning off the assets of around 140 banks so far

this year, the sector has an unusually large amount of available

and attractively priced assets up for grabs. While many mergers and

acquisitions have taken place, the FDIC has begun to cancel or

delay transactions most recently due to concerns about the

financial feasibility of some deals. As an example, Northwest

Bancshares Inc.'s acquisition of Nextier has been terminated as a

result of a lack of approval by the FDIC. This potential for

failure has many companies within the sector thinking twice before

they go down the expensive and time consuming road that leads to

consolidation. Investors looking for complimentary research on

Northwest Bancshares Inc. are welcome to sign

up at www.stockcall.com/NWBI291110.pdf for our new report.

www.stockcall.com/ is an online platform where investors doing

their due-diligence on the savings & loans industry can have

easy and free access to our analyst research and opinions on New

York Community Bancorp Inc. and Northwest Bancshares Inc.; all

investors need to do is register for a complimentary membership at

https://stockcall.com/development/stockcall/page.php?name=register.html

While the FDIC has increased the total number of banks on its

confidential list of trouble banks, the sector as a whole seems to

be growing healthier. Loan portfolios have been generally stronger

and banks are setting aside less money for loan losses. Register

now at

https://stockcall.com/development/stockcall/page.php?name=register.html

to have free access to our reports on the savings & loans

industry.

The sector has some cause for concern, however, due to a recent

court case that found a bank guilty of misrepresenting loan values

to its shareholders during the housing crisis. Jurors decided that

the company did not make shareholders adequately aware of the risks

they were taking and thus have to pay a certain percentage of their

stock price back to investors. The bank says the loss was not their

fault and is seeking a dismissal of the verdict based on the losses

simply being due to the collapse of the housing market. The Savings

and Loans sector could be in for some costly litigation if more

investors choose to file class-action lawsuits. Visit

www.stockcall.com/ to see how companies in this industry have grown

over the past years and how they are expected to perform in the

future.

For the third quarter 2010, savings & loans bank New York

Community Bancorp Inc. saw its operating earnings climb by 49% to

$134.4 million. Investors looking for free research on New York Community Bancorp Inc. are welcome to sign up

at www.stockcall.com/NYB291110.pdf for our new report.

About StockCall.com

StockCall.com is a financial website where investors can have

easy, precise and comprehensive research and opinions on stocks

making the headlines.

Contact Person: William T. Knight

stockcall2010@gmail.com

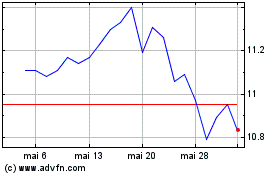

Northwest Bancshares (NASDAQ:NWBI)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Northwest Bancshares (NASDAQ:NWBI)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024