Oxford Lane Capital Corp. Provides May Net Asset Value Update

07 Juin 2024 - 2:00PM

Oxford Lane Capital Corp. (NasdaqGS: OXLC) (NasdaqGS: OXLCM)

(NasdaqGS: OXLCP) (NasdaqGS: OXLCL) (NasdaqGS: OXLCO) (NasdaqGS:

OXLCZ) (NasdaqGS: OXLCN) (the “Company”) today announced the

following net asset value (“NAV”) estimate as of May 31, 2024.

-

Management’s unaudited estimate of the range of the NAV per share

of our common stock as of May 31, 2024, is between $5.02 and $5.12.

This estimate is not a comprehensive statement of our financial

condition or results for the month ended May 31, 2024. This

estimate did not undergo the Company’s typical quarter-end

financial closing procedures and was not approved by the Company’s

board of directors. We advise you that our NAV per share for the

quarter ending June 30, 2024, may differ materially from this

estimate, which is given only as of May 31, 2024.

- As of

May 31, 2024, the Company had approximately 266.3 million shares of

common stock issued and outstanding.

The fair value of the Company’s portfolio investments may be

materially impacted after May 31, 2024, by circumstances and events

that are not yet known. To the extent the Company’s portfolio

investments are impacted by market volatility in the U.S. or

worldwide, the Company may experience a material impact on its

future net investment income, the fair value of its portfolio

investments, its financial condition and the financial condition of

its portfolio investments. Investing in our securities involves a

number of significant risks. For a discussion of the additional

risks applicable to an investment in our securities, please refer

to the section titled “Risk Factors” in our prospectus and the note

titled “Risks and Uncertainties” in our most recent annual report

or semi-annual report, as applicable.

The preliminary financial data included in this press

release has been prepared by, and is the responsibility of,

Oxford Lane Capital

Corp.'s management. PricewaterhouseCoopers LLP has not

audited, reviewed, compiled, or applied agreed-upon procedures with

respect to the preliminary financial data. Accordingly,

PricewaterhouseCoopers LLP does not express an opinion or any other

form of assurance with respect thereto.

About Oxford Lane Capital Corp.

Oxford Lane Capital Corp. is a publicly-traded registered

closed-end management investment company principally investing in

debt and equity tranches of CLO vehicles. CLO investments may also

include warehouse facilities, which are financing structures

intended to aggregate loans that may be used to form the basis of a

CLO vehicle.

Forward-Looking Statements

This press release contains forward-looking statements subject

to the inherent uncertainties in predicting future results and

conditions. Any statements that are not statements of historical

fact (including statements containing the words “believes,”

“plans,” “anticipates,” “expects,” “estimates” and similar

expressions) should also be considered to be forward-looking

statements. These statements are not guarantees of future

performance, conditions or results and involve a number of risks

and uncertainties. Certain factors could cause actual results

and conditions to differ materially from those projected in these

forward-looking statements. These factors are identified from time

to time in our filings with the Securities and Exchange Commission.

We undertake no obligation to update such statements to reflect

subsequent events, except as may be required by law.

Contact:Bruce Rubin203-983-5280

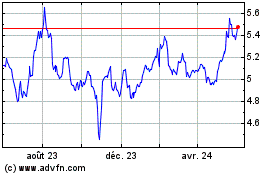

Oxford Lane Capital (NASDAQ:OXLC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Oxford Lane Capital (NASDAQ:OXLC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024