false

0000908937

0000908937

2025-01-02

2025-01-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 3, 2025 (January 2, 2025)

SIRIUS XM HOLDINGS INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-34295 |

93-4680139 |

|

(State or Jurisdiction

of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

| 1221 Avenue of the Americas, 35th Fl., New York, NY |

10020 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| Registrant's

telephone number, including area code: (212)

584-5100 |

| |

| N/A |

| (Former

Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| |

|

|

| Common Stock, par value $0.001 per share |

SIRI |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers |

Patrick L. Donnelly, our Executive Vice President,

General Counsel and Secretary, has informed us that he intends to retire in early 2025. The existing Employment Agreement between Mr. Donnelly

and our subsidiary, Sirius XM Radio LLC (the successor to Sirius XM Radio Inc.) (the “Employment Agreement”), was scheduled

to end on January 2, 2025, and will not be renewed after the term of Mr. Donnelly’s employment ends. In connection with

Mr. Donnelly’s upcoming retirement, we entered into a transition letter with him on January 2, 2025.

In order to facilitate an orderly transition, Mr. Donnelly

has agreed to remain a full-time employee of Sirius XM Radio LLC until April 4, 2025 (such period, the “Full-Time Term”).

At the end of the Full-Time Term, Mr. Donnelly will become a part-time employee through December 31, 2025 to assist with the

transition of his duties and responsibilities. During the Full-Time Term, Mr. Donnelly will remain our Executive Vice President,

General Counsel and Secretary until we hire a new officer to assume his duties and responsibilities. Once we have hired such new officer,

Mr. Donnelly will become an advisor to the General Counsel through December 31, 2025.

During the Full-Time Term, Mr. Donnelly will

continue to receive his existing annual base salary and employee benefits and will be eligible to earn a pro-rated 2025 annual bonus in

respect of such period.

If, during the Full-Time, Term Mr. Donnelly’s

employment is terminated by us without “cause” (as defined in the Employment Agreement, which does not include the occurrence

of the full-time end date, April 4, 2025), then, subject to his execution of a release of claims and his compliance with certain

restrictive covenants contained in the Employment Agreement, he will be entitled to receive the severance payments and benefits described

in the Employment Agreement; provided that his 2025 pro-rated bonus would be paid in lieu of any other 2025 bonus contemplated by the

Employment Agreement.

If, during the Part-Time Term, Mr. Donnelly’s

employment is terminated by us without “cause” (which does not include the occurrence of the part-time end date, December 31,

2025), then, subject to his execution of a release of claims and his compliance with certain restrictive covenants contained in the Employment

Agreement, he will be entitled to receive any accrued payments and benefits, any 2025 pro-rated bonus, and the amount of any part-time

salary that he otherwise would have received through December 31, 2025.

The foregoing description is qualified in its entirety

by the transition letter attached as Exhibit 10.1 to this Current Report on Form 8-K.

| Item 9.01. | Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

SIRIUS XM HOLDINGS INC. |

| |

|

| |

By: |

/s/ Ruth A. Ziegler |

| |

|

Ruth A. Ziegler |

| |

|

Senior Vice President and Deputy General Counsel |

Dated: January 3, 2025

Exhibit 10.1

TRANSITION LETTER TO EMPLOYMENT

AGREEMENT

This Transition Letter (this “Letter”)

amends and supplements certain provisions set forth in the Employment Agreement by and between SIRIUS XM RADIO LLC, a Delaware limited

liability company (the successor to Sirius XM Radio Inc., the “Company”), and PATRICK L. DONNELLY (the “Executive”),

dated as of November 21, 2022 (the “Employment Agreement”). Terms used but not otherwise defined herein shall have

the respective meanings set forth in the Employment Agreement.

In consideration for the promises and the mutual

covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby

acknowledged, and intending to be legally bound hereby, the Company and Executive hereby agree as follows:

1.

Term. The Executive shall be employed on, and expected to perform his duties and responsibilities on, a full-time basis

from January 3, 2025 (the “Effective Date”) through April 4, 2025 (such date, the “Full-Time End Date”,

and such period of time from the Effective Date through the Full-Time End Date, the “Full-Time Term”). The Executive

shall be employed, and expected to perform his duties and responsibilities, on a part-time basis following the Full-Time End Date through

December 31, 2025 (the “Part-Time Term”, together with the Full-Time Term, the “Term”). Notwithstanding

Section 3 of the Employment Agreement, the Term shall end on the date on which the Executive’s employment with the Company terminates,

which last day of employment shall be the Termination Date for purposes of the Employment Agreement and this Letter.

2.

Title. During the Full-Time Term, the Executive shall retain his title as the Executive Vice President, General Counsel

and Secretary of the Company and Sirius XM Holdings Inc. (“Holdings”) until the Company hires a new officer to assume

his duties and responsibilities. Once the Company has hired such new officer, the Executive’s title for the remainder of the Full-Time

Term, and during the Part-Time Term, shall be Advisor to the General Counsel.

3.

Duties and Reporting Relationship. During the Full-Time Term, but until the Company has hired a new officer to assume the

Executive’s duties and responsibilities, Section 2 of the Employment Agreement shall continue in full force and effect. Once the

Company has hired a new officer to assume the Executive’s duties and responsibilities, and during the Part-Time Term, the Executive

shall assist the Company with any transition of the Executive’s duties and responsibilities and assist the Company’s Chief

Executive Officer and General Counsel with any special projects as reasonably requested by the Company. During the Part-Time Term, the

Executive shall work the equivalent of three full-time days per week.

4.

Compensation. Notwithstanding Section 4 of the Employment Agreement, starting on the Effective Date and continuing for the

remainder of the Full-Time Term, the Executive’s Base Salary will continue to be $1,025,000. During the Part-Time Term, the Executive’s

Base Salary shall be $615,000 (the “Part-Time Base Salary”).

5.

Bonus. During the Full-Time Term, the Executive will remain eligible to earn a Bonus in accordance with Section 5(c) of

the Employment Agreement. Notwithstanding Section 5(c) of the Employment Agreement, any Bonus earned by the Executive in respect of the

2025 fiscal year (the “2025 Bonus”) shall be prorated by multiplying any 2025 Bonus by a fraction, the numerator of

which is the number of days the Executive remained employed as a full-time employee of the Company during the 2025 calendar year and the

denominator of which is 365 (such amount, the “Pro-Rated 2025 Bonus”). Any Pro-Rated 2025 Bonus shall become payable

in 2026, when the Company’s bonuses are normally paid, but in no event later than March 15, 2026. The 2025 Bonus shall be subject

to the Executive’s individual performance and satisfaction of objectives established by the CEO or the Board or the Compensation

Committee, and further is subject to the exercise of discretion by the CEO and review and approval by the Compensation Committee.

6.

Benefits.

(a) During the Full-Time Term, the Executive

shall be entitled to participate fully in any other benefit plans, programs, policies and fringe benefits which may be made available

to the executive officers of the Company and/or Holdings generally, including, without limitation, disability, medical, dental and life

insurance and benefits under the Company’s and/or Holdings’ 401(k) savings plan and deferred compensation plan. During the

Part-Time Term, the Executive shall be entitled to participate in such plans to the extent eligible pursuant to the terms of such plan(s)

and the Company’s existing policies, and in accordance with applicable law. To the extent the Executive is not eligible for medical,

dental or vision insurance during the Part-Time Term, the Company shall pay, in a manner that will not be taxable to the Executive, the

Executive for the employer-portion of obtaining those benefits under COBRA (that is, an amount equal to the percentage of such costs that

the Company would have paid if the Executive remained a full time employee of the Company) while the Executive remains employed during

the Part-Time Term.

(b) In accordance with the Sirius XM Holdings

Inc. Deferred Compensation Plan (the “Plan”) which became effective July 1, 2015, the Company acknowledges that the

Executive will experience a Retirement (as solely defined in the Plan and not for any other purpose) and a Separation from Service (as

solely defined in the Plan and not for any other purpose) as of the last day of the Full-Time Term. The Company agrees that, on the first

day of the Part-Time Term, it shall irrevocably notify Fidelity, as administrator of the Plan, to commence distributions to the Executive

at the time(s) and in the amount(s) in accordance with the Plan and the Executive’s deferral elections.

7. Termination.

(a)

If during the Full-Time Term the employment of the Executive is terminated by the Company without Cause (which shall not include the occurrence

of the Full-Time End Date), the Executive shall be entitled to receive the severance payments and benefits described in Section 6(f)(ii)

of the Employment Agreement in accordance with the terms thereof, provided that the Pro-Rated 2025 Bonus shall be paid in

lieu of the pro-rated Bonus contemplated by Section 6(f)(ii)(C). The Company’s obligation to pay the foregoing severance payments

and benefits (other than the Accrued Payments and Benefits) shall be conditioned upon the Executive executing, delivering and not revoking

during the applicable revocation period a waiver and release of claims against the Company and Holdings substantially in the form attached

to this Letter as Exhibit A (the “Release”) within sixty (60) days following the Termination Date.

(b)

If during the Part-Time Term, the employment of the Executive is terminated by the Company without Cause (which shall not include the

occurrence of the last day of the Part-Time Term on December 31, 2025), the Executive shall be entitled to receive (i) the Accrued Payments

and Benefits; (ii) the Pro-Rated 2025 Bonus, to the extent earned pursuant to Section 5 of this Letter; and (iii) the amount of the Part-Time

Base Salary that the Executive would have otherwise received had the Executive remained employed through the last day of the Part-Time

Term on December 31, 2025 (such amount, the “Part-Time Severance Payment”). The Part-Time Severance Payment

shall be paid in a lump sum on the sixtieth (60th) day following the Termination Date. The Company’s obligation to pay

the Part-Time Severance Payment shall be conditioned upon the Executive executing, delivering and not revoking during the applicable revocation

period the Release within sixty (60) days following the Termination Date.

(c) The Executive understands and acknowledges

that the implementation of the modifications described herein shall not constitute “Good Reason” under the Employment Agreement

or any other agreement. Notwithstanding Section 6 of the Employment Agreement, the Executive understands and acknowledges that by signing

this Letter, the Executive is waiving any right he may have to resign for “Good Reason” during the Term (including under Section

6(f)(ii) of the Employment Agreement).

(d) Nothing in this Letter shall limit the Company’s

ability to terminate the Executive for Cause during the Term in accordance with the terms of the Employment Agreement.

(e) Except as set forth in this Letter, the Executive

shall not be entitled to receive any severance payments or benefits under the Employment Agreement upon his termination of employment

with the Company for any reason (including as a result of a termination by the Company without Cause), including on the last day of the

Term.

8. Restrictive Covenants; Survival.

(a) Upon the termination of the Term or termination

of the Executive’s employment with the Company, except as set forth in Section 7(e) of this Letter, the respective rights and obligations

of the parties under the Employment Agreement shall survive, including the provisions of Section 6(j) of the Employment Agreement relating

to the Executive’s right to participate in the Company’s medical and dental insurance plans until the third anniversary of

the date of termination of the Executive’s employment, to the extent necessary to carry out the intentions of the parties under

the Employment Agreement.

(b) Without limiting the generality of the foregoing,

Sections 7 and 8 of the Employment Agreement will continue in full force and effect.

(c) For purposes of Section 8 of the Employment

Agreement, the Restricted Period shall mean a period of one (1) year beginning on the last day of the Full-Time Term.

9. Governing

Law. This Letter shall in all respects be governed by and construed in accordance with the laws of the State of New York as to all

matters, including but not limited to matters of validity, construction, effect and performance.

10. Severability.

If any provision of this Letter shall be declared to be invalid or unenforceable, in whole or in part, such invalidity or unenforceability

shall not affect the remaining provisions hereof, which shall remain in full force and effect.

IN WITNESS WHEREOF, the parties hereto

have executed this Letter effective as of January 2, 2025.

| |

SIRIUS XM RADIO LLC |

| |

|

| |

By: |

/s/

Faye Tylee |

| |

|

Faye Tylee |

| |

|

Chief People + Culture Officer |

| |

|

| |

/s/

Patrick L. Donnelly |

| |

|

PATRICK L. DONNELLY |

Exhibit A

AGREEMENT AND RELEASE

This

Agreement and Release, dated as of _________, 2025 (this “Agreement”), is entered into by and between PATRICK L. DONNELLY

(the “Executive”) and SIRIUS XM RADIO LLC (the successor to Sirius XM Radio Inc., the “Company”).

The purpose of this Agreement is to completely and

finally settle, resolve, and forever extinguish all obligations, disputes and differences arising out of the Executive’s employment

with and separation from the Company.

NOW, THEREFORE, in consideration of the mutual promises

and covenants contained in this Agreement, the Executive and the Company hereby agree as follows:

1. The Executive’s employment with the

Company is terminated as of _____________, 2025 (the “Termination Date”).

2. The Company and the Executive agree that

the Executive shall be provided severance pay and other benefits, less all legally required and authorized deductions, in accordance with

the terms of [Section 7(a) or Section 7(b)] of the Transition Letter to Employment Agreement dated January 2, 2025 (the “Transition

Agreement”); provided that no such severance benefits shall be paid or provided if the Executive revokes this

Agreement pursuant to Section 4 below. The Executive acknowledges and agrees that the Executive is entering into this Agreement in consideration

of such severance benefits and the Company’s agreements set forth herein. All vacation pay earned and unused as of the Termination

Date will be paid to the Executive to the extent required by law. Except as set forth above, the Executive will not be eligible for any

other compensation or benefits following the Termination Date other than (i) any vested accrued benefits under the Company’s compensation

and benefit plans, (ii) the rights, if any, granted to the Executive under the terms of any stock option, restricted stock, performance-based

restricted stock or other equity award agreements or plans, and (iii) the rights to indemnification and to directors’ and officers’

liability insurance under (w) the Employment Agreement (as defined in the Transition Agreement), (x) the Certificates of Incorporation

and Bylaws of Sirius XM Holdings Inc. (“Holdings”) and the Company and their affiliates (or similar constituent documents

of affiliates), (y) the Indemnification Agreement dated as of September 9, 2024 between the Executive and Holdings or (z) the provisions

of Delaware law.

3. The Executive, with the intention of binding

the Executive and the Executive’s heirs, attorneys, agents, spouse and assigns, hereby waives, releases and forever discharges Holdings,

the Company and their respective parents, subsidiaries, and affiliated companies and its and their predecessors, successors, and assigns,

if any, as well as all of their officers, directors and employees, stockholders, agents, servants, representatives, and attorneys, and

the predecessors, successors, heirs and assigns of each of them (collectively “Released Parties”), from any and all

grievances, claims, demands, causes of action, obligations, damages and/or liabilities of any nature whatsoever, whether known or unknown,

suspected or claimed, which the Executive ever had, now has, or claims to have against the Released Parties, by reason of any act or omission

occurring before the Executive’s execution hereof, including, without limiting the generality of the foregoing, (a) any act, cause,

matter or thing stated, claimed or alleged, or which was or which could have been alleged in any manner against the Released Parties prior

to the execution of this Agreement and (b) all claims for any payment under the Employment Agreement and the Transition Agreement; provided that

nothing contained in this Agreement shall affect the Executive’s rights (i) to indemnification from Holdings, the Company or their

affiliates as provided in the Employment Agreement or otherwise; (ii) to coverage under the insurance policies of the Company, Holdings

or their affiliates covering officers and directors; (iii) to other benefits which by their express terms extend beyond the Executive’s

separation from employment (including, without limitation, the Executive’s rights under [Section 7(a) or Section 7(b) of the Transition

Agreement] and 6(j) of the Employment Agreement); and (iv) under this Agreement, and (c) all claims for discrimination, harassment and/or

retaliation, under Title VII of the Civil Rights Act of 1964, as amended, the Civil Rights Act of 1991, as amended, the New York State

Human Rights Law, as amended, as well as any and all claims arising out of any alleged contract of employment, whether written, oral,

express or implied, or any other federal, state or local civil or human rights or labor law, ordinances, rules, regulations, guidelines,

statutes, common law, contract or tort law, arising out of or relating to the Executive’s employment with and/or separation from

the Company, including but not limited to the termination of the Executive’s employment on the Termination Date, and/or any events

occurring prior to the execution of this Agreement.

4. The Executive specifically waives all rights

or claims that the Executive has or may have under the Age Discrimination In Employment Act of 1967, 29 U.S.C. §§ 621-634, as

amended (“ADEA”), including, without limitation, those arising out of or relating to the Executive’s employment

with and/or separation from the Company, the termination of the Executive’s employment on the Termination Date, and/or any events

occurring prior to the execution of this Agreement. In accordance with the ADEA, the Company specifically hereby advises the Executive

that: (1) the Executive may and should consult an attorney before signing this Agreement, (2) the Executive has twenty-one (21) days to

consider this Agreement, and (3) the Executive has seven (7) days after signing this Agreement to revoke this Agreement.

5. Notwithstanding the above, nothing in this

Agreement prevents or precludes the Executive from (a) challenging or seeking a determination of the validity of this Agreement under

the ADEA; or (b) filing an administrative charge of discrimination under any applicable statute or participating in any investigation

or proceeding conducted by a governmental agency.

6. This release does not affect or impair the

Executive’s rights with respect to workers’ compensation or similar claims under applicable law or any claims under medical,

dental, disability, life or other insurance arising prior to the date hereof.

7. The Executive warrants that the Executive

has not made any assignment, transfer, conveyance or alienation of any potential claim, cause of action, or any right of any kind whatsoever,

including but not limited to, potential claims and remedies for discrimination, harassment, retaliation, or wrongful termination, and

that no other person or entity of any kind has had, or now has, any financial or other interest in any of the demands, obligations, causes

of action, debts, liabilities, rights, contracts, damages, costs, expenses, losses or claims which could have been asserted by the Executive

against the Company or any other Released Party.

8. The Executive shall not make any disparaging

remarks about any of Holdings, the Company or any of their directors, officers, agents or employees (collectively, the “Nondisparagement

Group”) and/or any of their respective practices or products; provided that the Executive may provide truthful

and accurate facts and opinions about any member of the Nondisparagement Group where required to do so by law or in proceedings to enforce

or defend the Executive’s rights under this Agreement or any other written agreement between the Executive and a member of the Nondisparagement

Group and may respond to disparaging remarks about the Executive made by any member of the Nondisparagement Group. The Company and Holdings

shall not, and they shall instruct their officers not to, make any disparaging remarks about the Executive; provided that

any member of the Nondisparagement Group may provide truthful and accurate facts and opinions about the Executive where required to do

so by law and may respond to disparaging remarks made by the Executive or the Executive’s agents or family members.

9. The Company hereby represents and warrants

that, except as previously disclosed in writing to the Executive, it is not aware of any facts or circumstances as of the date of this

Agreement that would give rise to or serve as a basis for any claim against the Executive in connection with the employment and termination

of employment of the Executive.

10. The parties expressly agree that this Agreement

shall not be construed as an admission by any of the parties of any violation, liability or wrongdoing, and shall not be admissible in

any proceeding as evidence of or an admission by any party of any violation or wrongdoing. The Company expressly denies any violation

of any federal, state, or local statute, ordinance, rule, regulation, order, common law or other law in connection with the employment

and termination of employment of the Executive.

11. In the event of a dispute concerning the

enforcement of this Agreement, the finder of fact shall have the discretion to award the prevailing party reasonable costs and attorneys’

fees incurred in bringing or defending an action, and shall award such costs and fees to the Executive in the event the Executive prevails

on the merits of any action brought hereunder. All other requests for relief or damages awards shall be governed by Sections 20(a) and

20(b) of the Employment Agreement.

12. The parties declare and represent that

no promise, inducement, or agreement not expressed herein has been made to them.

13. This Agreement in all respects shall be

interpreted, enforced and governed under the laws of the State of New York and any applicable federal laws relating to the subject matter

of this Agreement. The language of all parts of this Agreement shall in all cases be construed as a whole, according to its fair meaning,

and not strictly for or against any of the parties. This Agreement shall be construed as if jointly prepared by the Executive and the

Company. Any uncertainty or ambiguity shall not be interpreted against any one party.

14. This Agreement, the Employment Agreement, the

Transition Agreement, and [and list any outstanding award agreements] between the Executive and the Company contain the entire

agreement of the parties as to the subject matter hereof. No modification or waiver of any of the provisions of this Agreement shall be

valid and enforceable unless such modification or waiver is in writing and signed by the party to be charged, and unless otherwise stated

therein, no such modification or waiver shall constitute a modification or waiver of any other provision of this Agreement (whether or

not similar) or constitute a continuing waiver.

15. The Executive and the Company represent

that they have been afforded a reasonable period of time within which to consider the terms of this Agreement (including but not limited

to the foregoing release), that they have read this Agreement, and they are fully aware of its legal effects. The Executive and the Company

further represent and warrant that they enter into this Agreement knowingly and voluntarily, without any mistake, duress, coercion or

undue influence, and that they have been provided the opportunity to review this Agreement with counsel of their own choosing. In making

this Agreement, each party relies upon their own judgment, belief and knowledge, and has not been influenced in any way by any representations

or statements not set forth herein regarding the contents hereof by the entities who are hereby released, or by anyone representing them.

16. This Agreement may be executed in counterparts,

all of which shall be considered one and the same agreement, and shall become effective when one or more counterparts have been signed

by each of the parties and delivered to the other parties. The parties further agree that delivery of an executed counterpart by facsimile

or pdf shall be as effective as delivery of an originally executed counterpart. This Agreement shall be of no force or effect until executed

by all the signatories.

17. The Executive warrants that the Executive

will return to the Company all software, computers, computer-related equipment, keys and all materials (including, without limitation,

copies) obtained or created by the Executive in the course of the Executive’s employment with the Company on or before the Termination

Date; provided that the Executive will be able to keep the Executive’s cell phones, personal computers, personal

contact list and the like so long as any Confidential Information (as defined in the Employment Agreement) is removed from such items.

18. Any existing obligations the Executive

has with respect to confidentiality, nonsolicitation of clients, nonsolicitation of employees and noncompetition, in each case with the

Company or its subsidiaries or affiliates, shall remain in full force and effect, including, but not limited to, Sections 7 and 8 of the

Employment Agreement (subject to any modifications expressly provided for under the Transition Agreement).

19. Any disputes arising from or relating to

this Agreement shall be subject to arbitration pursuant to Section 20 of the Employment Agreement.

20. Should any provision of this Agreement

be declared or be determined by a forum with competent jurisdiction to be illegal or invalid, the validity of the remaining parts, terms

or provisions shall not be affected thereby and said illegal or invalid part, term, or provision shall be deemed not to be a part of this

Agreement.

IN WITNESS WHEREOF, the parties hereto have executed

this Agreement as of the date set forth above.

SIRIUS XM RADIO LLC

| By: |

|

|

|

| |

Name: |

|

PATRICK L. DONNELLY |

| |

Title: |

|

|

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

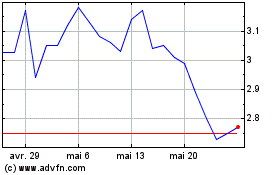

SiriusXM (NASDAQ:SIRI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

SiriusXM (NASDAQ:SIRI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025