ABOUT THIS PROSPECTUS

This prospectus relates to the resale, from time to time, by the selling stockholders identified in this prospectus under the caption “Selling stockholders,” of up to 10,692,704 shares of our common stock.

You should read this prospectus, any documents that we incorporate by reference in this prospectus and the information below under the caption “Where You Can Find More Information” and “Information Incorporated By Reference” before making an investment decision. You should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or incorporated by reference herein. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representation.

You should assume that the information in this prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

Unless the context indicates otherwise, references in this prospectus to the “Company,” “Troika,” “we,” “us,” “our” and similar terms refer to Troika Media Group, Inc. and its consolidated subsidiaries.

The distribution of this prospectus and the issuance of the securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the issuance of the securities and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in or incorporated by reference into this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus and the documents incorporated by reference herein carefully, including the information referenced under the heading “Risk Factors” and in our financial statements, together with any accompanying prospectus supplement.

Overview

The Company is a professional services company that architects and builds enterprise value in consumer facing brands to generate scalable performance-driven revenue growth through customer acquisition. The Company delivers three solutions pillars that: CREATE brands and experiences and CONNECT consumers through emerging technology products and ecosystems to deliver PERFORMANCE-based measurable business outcomes.

Business Solutions Pillars

The Company now provides the three brand and customer acquisition solutions through one unified organization that has three core “Business Solutions Pillars”:

•Brand Building and Activation

•Marketing Innovations and Enterprise Technology

•Performance and Customer Acquisition

The Company’s Business Solutions are designed to be executed as standalone or integrated activations with a unified go-to-market approach.

The Company generates revenue principally from two material revenue streams: Managed Services and Performance Solutions.

The Company’s Managed Services are typically orientated around the management of a customer’s marketing, data, and/or creative program. The Company’s deliverables relate to the planning, designing, and activating of a solution program or set of work products. The Company executes this revenue stream by leveraging internal and external creative, technical or media-based resources, third party advertising technology solutions, proprietary business intelligence systems, data delivery systems, and other key services required under the terms of a scope of work with a client.

The Company’s Performance Solutions are typically orientated around the delivery of a predetermined event or outcome to a client. Typically, the revenue associated with the event (as agreed upon in a scope of work) is based on a click, lead, call, appointment, qualified event, case, sale, or other defined business metric. The Company engages in a myriad of consumer engagement tactics, digital and offline ecosystems, and customer acquisition methods to generate a consumer’s interest in a particular service or product.

Enterprise Organization

The Company is structured as a matrixed organization with four operational and business quadrants:

•Enterprise Planning and Operations

•Knowledge and Technical Services

•Client Acquisition and Thought Leadership

•Business Consulting Solutions

This matrix structure is capable of delivering a financially efficient organization that democratizes technical and planning resources.

Scale

We excel at generating highly scalable customer acquisition and retention programs in high value products and services cross several strategic sectors. The Company generates resilient enterprise brand value and revenues for its clients, having orchestrated thousands of mass scale campaigns and sales programs for some of the leading companies in the United States.

Sector Expertise

The Company’s expertise is in large consumer sectors including Insurance, Financial Services, Home Improvement, Residential Services, Legal, Professional Services, Media and Entertainment.

The Company’s Business Solutions are architected to service other sectors that have a B2C focus with a need for high lifetime value customers.

Corporate Information

We were incorporated in Nevada in December 2003. Our corporate headquarters are located at 25 West 39th Street, 6th Floor, New York, NY 10018, and our main telephone number is (212) 213-0111. Our website address is www.thetmgrp.com. The information on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) since the market value of our shares held by non-affiliates is less than $250 million. We may continue to be a smaller reporting company after this offering if either (i) the market value of our shares held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our shares held by non-affiliates is less than $700 million. As a “smaller reporting company,” we have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies in this prospectus as well as our filings under the Exchange Act, including that we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and have reduced disclosure obligations regarding executive compensation.

Nasdaq Capital Market Rules

On May 20, 2022, the Company received notice from The Nasdaq Capital Market that it had failed to maintain a minimum bid price of $1 per share based on the closing bid price for the thirty (30) consecutive business days preceding May 20, 2022 (the “Minimum Bid Price Rule”). On November 17, 2022, the Company received a letter from The Nasdaq Capital Market and was provided 180 calendar days, or until May 15, 2023, to regain compliance with the Minimum Bid Price Rule. If we are not able to meet the Minimum Bid Price Rule by May 15, 2023, our common stock may be delisted.

Settlement Agreements

Effective March 31, 2023, the Company entered into the Settlement Agreements with the selling stockholders hereunder.

The Company and the selling stockholders are party to (i) that certain Securities Purchase Agreement, dated as of March 16, 2022, pursuant to which the original purchasers of the Series E Preferred Stock (the “Original Purchasers”) acquired shares of Series E Preferred Stock and accompanying warrants, subject to the terms and conditions contained therein, and (ii) that certain Registration Rights Agreement, dated as of March 16, 2022 (the “Registration Rights Agreement”), pursuant to which the Company and the Original Purchasers agreed to certain requirements and conditions covering the resale of the Company’s common stock.

Under the terms of the Registration Rights Agreement, the Company, upon acquiring Converge Direct LLC in March 2022, was required to file a registration statement within ten (10) business days of such closing and for such registration statement to be declared effective by the SEC no later than forty five (45) business days thereafter (the “Registration Requirements”). The persons entitled to liquidated damages pursuant to the Registration Rights Agreement have alleged that the Company did not fulfill the Registration Requirements. In exchange for the selling stockholders’ agreement to terminate the Registration Rights Agreement and the Securities Purchase Agreement and all rights respectively thereunder (other than the piggy-back rights set forth in Section 6(d) thereof) and the release by such persons of any and all claims for liquidated damages under the Registration Rights Agreement, the Company has delivered to each selling stockholders a number of shares of Company common stock equal to the dollar amount of liquidated damages purportedly owed to each such selling stockholder multiplied by four (4) (the “Settlement Shares”), and the Company agreed to prepare and file a resale registration statement registering the Settlement Shares for resale. The parties to the Settlement Agreements are the selling stockholders hereunder, and the shares of Company common stock offered under this prospectus comprise the “Settlement Shares” issued to such selling stockholders under the terms of the Settlement Agreements.

This foregoing descriptions of the Settlement Agreements, the Securities Purchase Agreement and the Registration Rights Agreement do not purport to be complete and are qualified in their entirety by reference to, (i) in the case of the Settlement Agreements, the Form of Settlement Agreement filed as Exhibit 10.1 to the Company’s Form 8-K filed with the SEC on April 6, 2023, and (ii) in respect of the Registration Rights Agreement and the Securities Purchase Agreement, as applicable, Exhibits 4.2 and 4.3 of the Company’s Form 8-K filed March 18, 2022, each of which is incorporated by reference herein.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before making a decision to invest in our securities, you should carefully consider the risks described under the heading “Risk Factors” in any applicable prospectus supplement and any related free writing prospectus, and under “Part I, Item 1A. Risk Factors” contained in our most recent annual (or, if applicable, transitional) report on Form 10-K (or, if applicable, Form 10-K/T) and in subsequent quarterly reports on Form 10-Q, as well as any amendments thereto, which are incorporated by reference into this prospectus and the applicable prospectus supplement in their entirety, together with other information in this prospectus and the applicable prospectus supplement, the documents incorporated by reference herein and therein, and any free writing prospectus that we may authorize for use in connection with a specific offering. See “Where You Can Find Additional Information.”

FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and any related free writing prospectus, including the information incorporated by reference herein and therein, contain or may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. Forward-looking statements are not guarantees of future performance and the Company’s actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed in Part I, Item 1A. of our transition report on Form 10-K/T for the transition period from July 1, 2022 to December 31, 2022 under the heading “Risk Factors.”

We qualify all of the forward-looking statements contained in this prospectus, in the documents incorporated by reference herein and in any prospectus supplement by these cautionary statements. These forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Although we undertake no obligation to revise or update any forward- looking statements, whether as a result of new information, future events or otherwise, you are advised to review any additional disclosures we make in the documents we subsequently file with the SEC that are incorporated by reference in this prospectus and any prospectus supplement. See “Where You Can Find Additional Information.

USE OF PROCEEDS

All shares of our common stock offered by this prospectus are being registered for the account of the selling stockholders identified herein. We will not receive any of the proceeds from the sale of these shares. Any proceeds from the sale of shares of common stock under this prospectus will be received by the selling stockholders. Please see “Selling Stockholders” for a list of the persons receiving proceeds from the sale of the common stock covered by this prospectus.

SELLING STOCKHOLDERS

This prospectus covers an aggregate of up to 10,692,704 shares of our common stock.

The following table sets forth certain information with respect to each selling stockholder, including (i) the shares of our common stock beneficially owned by the selling stockholder prior to this offering, (ii) the number of shares being offered by the selling stockholder pursuant to this prospectus and (iii) the selling stockholder’s beneficial ownership after completion of this offering, assuming that all of the shares covered hereby (but none of the other shares, if any, held by the selling stockholders) are sold. The registration of the shares of common stock does not necessarily mean that the selling stockholders will sell all or any of such shares.

The table is based on information supplied to us by the selling stockholders, with beneficial ownership and percentage ownership determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to shares of stock. This information does not necessarily indicate beneficial ownership for any other purpose. In computing the number of shares beneficially owned by a selling stockholder and the percentage ownership of that selling stockholder, shares of common stock subject to warrants held by that selling stockholder that are exercisable within 60 days after the date hereof, are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. The percentage of beneficial ownership after this offering is based on 413,121,717 shares outstanding on May 10, 2023.

The registration of these shares of common stock does not mean that the selling stockholders will sell or otherwise dispose of all or any of those securities. The selling stockholders may sell or otherwise dispose of all, a portion or none of such shares from time to time. We do not know the number of shares, if any, that will be offered for sale or other disposition by any of the selling stockholders under this prospectus. Furthermore, the selling stockholders may have sold, transferred or disposed of the shares of common stock covered hereby in transactions exempt from the registration requirements of the Securities Act since the date on which we filed this prospectus.

To our knowledge and except as noted below, none of the selling stockholders has, or within the past three years has had, any position, office or other material relationship with us or any of our predecessors or affiliates.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Shares of common stock beneficially owned after sale of all shares of common stock offered pursuant to this prospectus (3) |

Selling stockholder (1) | Number of shares of common stock beneficially owned prior to this offering (2) | | Number of shares of common stock offered | | Number of Shares | | Percent of class |

| Alta Partners LLC | 288,992 | | | 288,992 | | | — | | | * |

| Altium Growth Fund LP | 1,444,960 | | | 1,444,960 | | | — | | | * |

Alto Opportunity Master Fund (4) | 577,984 | | | 577,984 | | | — | | | * |

| Anson Investments Master Fund | 1,271,565 | | | 1,271,565 | | | — | | | * |

Anson East Master Fund LP (5) | 317,891 | | | 317,891 | | | — | | | * |

| Bigger Capital Fund LP | 216,744 | | | 216,744 | | | — | | | * |

| Cavalry Fund LP | 288,992 | | | 288,992 | | | — | | | * |

| District 2 Capital Fund LP | 216,744 | | | 216,744 | | | — | | | * |

Empery Asset Master LTD (6) | 9,237,507 | | | 1,315,058 | | | 7,922,449 | | | 1.9% |

Empery Tax Efficient, LP (7) | 2,545,823 | | | 362,425 | | | 2,183,398 | | | * |

Empery Tax Efficient III, LP (8) | 3,441,653 | | | 489,957 | | | 2,951,969 | | | * |

| FirstFire Global Opportunities Fund LLC | 577,984 | | | 577,984 | | | — | | | * |

| Great Point Capital, LLC | 577,984 | | | 577,984 | | | — | | | * |

HB Fund LLC (9) | 906,976 | | | 866,976 | | | 40,000 | | | * |

Intracoastal Capital LLC (10) | 361,240 | | | 361,240 | | | — | | | * |

| Sabby Volatility Warrant Master Fund, Ltd. | 1,444,960 | | | 1,444,960 | | | — | | | * |

| SG3 Capital LLC | 72,248 | | | 72,248 | | | — | | | * |

______________

*Less than 1%.

(1)The information in this table and the related notes is based upon information supplied by the selling stockholders.

(2)Represents the total number of shares of our common stock beneficially owned by each selling stockholder as of the date of this prospectus, including (i) all of the shares offered hereby, and (ii) to our knowledge, all other shares of common stock held by each of the selling stockholders as of the date hereof.

(3)Assumes that, after the date of this prospectus and prior to completion of this offering, none of the selling stockholders (i) acquires additional shares of our common stock or other securities or (ii) sells or otherwise disposes of shares of our common stock or other securities held by such selling stockholders as of the date hereof and not offered hereby.

(4)In addition to the common shares being registered, Alto Opportunity Master Fund owns warrants to purchase 15,000 shares of common stock and owns 10 shares of preferred stock. Ayrton Capital LLC, the investment manager to Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B, has discretionary authority to vote and dispose of the shares held by Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B and may be deemed to be the beneficial owner of these shares. Waqas Khatri, in his capacity as Managing Member of Ayrton Capital LLC, may also be deemed to have investment discretion and voting power over the shares held by Alto Opportunity Master Fund, SPC - Segregated Master Portfolio B. Ayrton Capital LLC and Mr. Khatri each disclaim any beneficial ownership of these shares. The address of Ayrton Capital LLC is 55 Post Rd West, 2nd Floor, Westport, CT 06880.

(5)Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of Anson East Master Fund LP (“Anson”), hold voting and dispositive power over the Common Shares held by Anson. Bruce Winson is the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these Common Shares except to the extent of their pecuniary interest therein. The principal business address of Anson is Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

(6)Also includes 7,922,449 shares of Common Stock issuable upon exercise of warrants that were previously registered. Empery Asset Management LP, the authorized agent of Empery Asset Master Ltd ("EAM"), has discretionary authority to vote and dispose of the shares held by EAM and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by EAM. EAM, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

(7)Also includes 2,183,398 shares of Common Stock issuable upon exercise of warrants that were previously registered. Empery Asset Management LP, the authorized agent of Empery Tax Efficient, LP ("ETE"), has discretionary authority to vote and dispose of the shares held by ETE and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE. ETE, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

(8)Also includes 2,951,696 shares of Common Stock issuable upon exercise of warrants that were previously registered. Empery Asset Management LP, the authorized agent of Empery Tax Efficient III, LP ("ETE III"), has discretionary authority to vote and dispose of the shares held by ETE III and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE III. ETE III, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares.

(9)Hudson Bay Capital Management LP, the investment manager of HB Fund LLC, has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of HB Fun LLC and Sander Gerber disclaims beneficial ownership over these securities.

(10)Mitchell P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of the securities reported herein that are held by Intracoastal. In addition to the common shares being registered, Intracoastal owns warrants to purchase 100,000 shares of common stock and owns 2 shares of preferred stock.

DESCRIPTION OF OUR COMMON STOCK

The following description of our capital stock and provisions of our Amended and Restated Articles of Incorporation and Amended and Restated Bylaws are summaries and are qualified by reference to the Amended and Restated Articles of Incorporation and the Amended and Restated Bylaws that have been filed with the SEC as exhibits to filings at www.sec.gov.

We are currently authorized to issue 800,000,000 shares of common stock, $0.001 par value per share, and 25,000,000 shares of preferred stock, $0.01 par value per share. Holders of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders, and do not have cumulative voting rights. Subject to preferences that may be applicable to any outstanding shares of preferred stock, holders of common stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by our Board of Directors out of funds legally available for dividend payments. All outstanding shares of common stock are fully paid and nonassessable, and the shares of common stock to be issued upon completion of this offering will be fully paid and nonassessable. The holders of common stock have no preferences or rights of conversion, exchange, pre-emption or other subscription rights. There is no redemption or sinking fund provisions applicable to the common stock. In the event of any liquidation, dissolution or winding-up of our affairs, holders of common stock will be entitled to share ratably in our assets that are remaining after payment or provision for payment of all of our debts and obligations and after liquidation payments to holders of outstanding shares of preferred stock, if any.

PLAN OF DISTRIBUTION

Each selling stockholder of the securities and any of their pledges, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the Trading Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more of the following methods when selling securities:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales;

•in transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such securities at a stipulated price per security;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•a combination of any such methods of sale; or

•any other method permitted pursuant to applicable law.

The selling stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in tum engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in tum may sell these securities. The selling stockholders may also enter into option or other transactions with broker dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each selling stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the selling stockholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

Unless the applicable prospectus supplement indicates otherwise, the validity of the capital stock being offered by this prospectus will be passed upon by Brownstein Hyatt Farber Schreck, LLP, Las Vegas, Nevada. Additional legal matters may be passed upon for us or any underwriters, dealers or agents by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting incorporated in this prospectus by reference to the Company’s transition report on Form 10-K/T for the six months ended December 31, 2022 have been so incorporated in reliance on the report of RBSM LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

The financial statements of Converge Direct, LLC and its affiliates, Converge Marketing Services, LLC, Converge Direct Interactive, LLC, and Lacuna Ventures, LLC for the fiscal years ended December 31, 2021 and 2020 (the “Converge Financial Statements”) included in the Company’s Amendment No. 1 to Form 8-K filed on June 6, 2022, have been audited by RBSM LLP, an independent registered public accounting firm, as set forth in their report thereon included therein and incorporated by reference herein. The Converge Financial Statements are incorporated herein by reference in reliance on RBSM LLP’s report, given the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC as required by the Exchange Act. You can read our SEC filings, including this prospectus, over the Internet at the SEC’s website at http://www.sec.gov.

This prospectus does not contain all the information in the registration statement of which this prospectus forms a part. Other documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement or documents incorporated by reference in the registration statement.

Whenever a reference is made in this prospectus to a contract or other document of ours, the reference is only a summary, and you should refer to the exhibits that are a part of the registration statement for a copy of the contract or other document. You may review a copy of the registration statement through the SEC’s website, as provided above.

Our website address is www.thetmgrp.com. Through our website, we make available, free of charge, the following documents as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC, including our Annual Reports on Form 10-K (including our Transition Report on Form 10-K/T and any amendments thereto); our proxy statements for our annual and special stockholder meetings; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; Forms 3, 4 and 5 and Schedules 13D with respect to our securities filed on behalf of our directors and our executive officers; and amendments to those documents. The information contained on, or that may be accessed through, our website is not a part of, and is not incorporated into, this prospectus.

INFORMATION INCORPORATED BY REFERENCE

This registration statement incorporates by reference important business and financial information about our Company that is not included in or delivered with this document. The information incorporated by reference is considered to be part of this prospectus, and the SEC allows us to “incorporate by reference” the information we file with it, which means that we can disclose important information to you by referring you to those documents instead of having to repeat the information in this prospectus. Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. We incorporate by reference:

•Our Transition Report on Form 10-K/T for the transition period from July 1, 2022 to December 31, 2022, filed on March 7, 2023 (as amended by Amendment No. 1 thereto filed with the SEC on April 14, 2023). •Our Current Reports on Form 8-K, filed on June 6, 2022 (only with respect to Exhibit 99.2), January 19, 2023, February 6, 2023, February 10, 2023, February 16, 2023, March 7, 2023 (with respect to item 9.01), March 21, 2023, April 6, 2023, April 11, 2023 and May 5, 2023. We also incorporate by reference into this prospectus any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the “Exchange Act” (other than portions of those made pursuant to Item 2.02 or Item 7.01 of Form 8-K or other information “furnished” and not filed with the SEC), including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of the registration statement.

We will furnish without charge to each person, including any beneficial owner, to whom a prospectus is delivered, upon written or oral request, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. Any such request may be made by writing or telephoning us at the following address or phone number:

Troika Media Group, Inc.

25 West 39th Street, 6th Floor

New York, NY 10018

investorrelations@troikamedia.com

(212) 213-0111

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following is an estimate of the expenses (all of which are to be paid by us) that we may incur in connection with the securities being registered hereby.

| | | | | | | | |

| | Amount |

SEC registration fee | $ | 223.29 | |

Legal fees and expenses | | * |

Accounting fees and expenses | | * |

Miscellaneous | | * |

Total | $ | 223.29 |

__________________

*These fees are calculated based on the securities offered and the number of issuances and accordingly cannot be defined at this time.

Item 15. Indemnification of Directors and Officers.

Our Articles of Incorporation limits the liability of our directors and provides that our directors will not be personally liable for monetary damages for breach of their fiduciary duties as directors, except liability for: (i) breach of a director’s duty of loyalty, (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law, (iii) the unlawful payment of a dividend or an unlawful stock purchase or redemption, and (iv) any transaction from which a director derives an improper personal benefit. Our Articles of Incorporation also provides that we shall indemnify our directors to the fullest extent permitted under the Nevada Revised Statutes. In addition, our Bylaws provide that we shall indemnify our directors to the fullest extent authorized under the laws of the State of Nevada. Our By-laws also provide that our Board of Directors shall have the power to indemnify any other person that is a party to an action, suit or proceeding by reason of the fact that the person is an officer or employee of our company.

Under Section 78.7502 of the Nevada Revised Statutes, we have the power to indemnify our directors, officers, employees or agents who are parties or threatened to be made parties to any threatened, pending or completed civil, criminal, administrative or investigative action, suit or proceeding (other than an action by or in the right of the Company) arising from that person’s role as our director, officer, employee or agent against expenses, including attorney’s fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person (a) acted in good faith and in a manner the person reasonably believed to be in or not opposed to our best interests, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful, and (b) is not liable pursuant to Nevada Revised Statutes Section 78.138, and performed his powers in good faith and with a view to the interests of the Corporation.

Under the Nevada Revised Statutes, we have the power to indemnify our directors, officers, employees and agents who are parties or threatened to be made parties to any threatened, pending or completed action or suit by or in the right of the Company to procure a judgment in our favor arising from that person’s role as our director, officer, employee or agent against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person (a) acted in good faith and in a manner the person reasonably believed to be in or not opposed to our best interests and (b) is not liable pursuant to Section 73.138 of the Nevada Revised Statutes.

These limitations of liability, indemnification and expense advancements may discourage a stockholder from bringing a lawsuit against directors for breach of their fiduciary duties. The provisions may also reduce the likelihood of derivative litigation against directors and officers, even though an action, if settlement and damage awards against directors and officers pursuant to these limitations of liability and insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons

pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of expenses incurred or paid by a director, officer or controlling person in a successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to the court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Insurance. The registrant maintains directors’ and officers’ liability insurance, which covers directors and officers of the registrant against certain claims or liabilities arising out of the performance of their duties.

Any underwriting agreement or distribution agreement that the registrant enters into with any underwriters or agents involved in the offering or sale of any securities registered hereby may require such underwriters or dealers to indemnify the registrant, some or all of its directors and officers and its controlling persons, if any, for specified liabilities, which may include liabilities under the Securities Act of 1933.

Item 16. Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 2.1 | | |

| | |

| 2.2 | | |

| | |

| 2.3 | | |

| | |

| 2.4 | | |

| | |

| 2.5 | | |

| | |

| 2.6 | | |

| | |

| 2.7 | | |

| | |

| 2.8 | | Escrow Agreement, dated as of March 21, 2022, between Alter Domus (US) LLC, , Blue Torch Finance LLC, Troika Media Group, Inc., and Maarten Terry, Michael Carrano, Sadiq Toama, and Thomas Marianacci as the sellers, with Thomas Marianacci as the representative for the aforenamed sellers. (incorporated by reference to the registrant’s Form 10-K filed on September 28, 2022, as amended on November 22, 2022) |

| | |

| 3.1 | | |

| | |

| 3.2 | | |

| | |

| 3.3 | | |

| | |

| 5.1* | | |

| | |

| 23.1* | | |

| | |

| 23.2* | | |

| | |

| 24.1* | | |

| | |

| 107* | | |

__________________

*Filed herewith

Item 17. Undertakings.

(a)The undersigned registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that: Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act, that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)That, for the purpose of determining liability under the Securities Act to any purchaser:

(i)Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5)That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary

offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6)The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7)Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

(8)The undersigned registrant hereby undertakes to file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the Commission under Section 305(b)(2) of the Trust Indenture Act.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York, on May 12, 2023.

| | | | | |

| TROIKA MEDIA GROUP, INC. |

| |

| By: | /s/ Sid Toama |

| Sid Toama |

| Chief Executive Officer |

| (Principal Executive Officer) |

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Sid Toama and Erica Naidrich, and each of them, his or her true and lawful attorneys-in-fact and agents, each with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this registration statement, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully for all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents, or his or her substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

| Signature | Title | Date |

/s/ Sid Toama | Chief Executive Officer

(Principal Executive Officer) | May 12, 2023 |

| Sid Toama |

/s/ Erica Naidrich | Chief Financial Officer

(Principal Financial Officer and

Principal Accounting Officer) | May 12, 2023 |

| Erica Naidrich |

/s/ Randall Miles | Chairman of the Board | May 12, 2023 |

| Randall Miles |

/s/ Thomas Ochocki | Director | May 12, 2023 |

| Thomas Ochocki |

/s/ Grant Lyon | Director | May 12, 2023 |

| Grant Lyon |

/s/ Martin Pompadur | Director | May 12, 2023 |

| Martin Pompadur |

/s/ Jeffrey S. Stein | Director | May 12, 2023 |

| Jeffrey S. Stein |

/s/ Wendy Parker | Director | May 12, 2023 |

| Wendy Parker |

/s/ Sabrina Yang | Director | May 12, 2023 |

| Sabrina Yang |

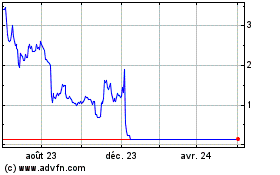

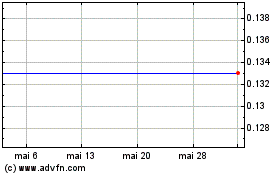

Troika Media (NASDAQ:TRKA)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Troika Media (NASDAQ:TRKA)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024