Alcoa Corporation (“Alcoa”)

(NYSE:AA; ASX:AAI) announces (i) the expiration and expiration date

results of its previously announced offer to purchase for cash any

and all outstanding 5.500% senior unsecured notes due 2027 (the

“Any and All Notes”) issued by Alcoa

Nederland Holding B.V. (“ANHBV”),

fully guaranteed on an unsecured basis by Alcoa and certain of its

subsidiaries (the “Any and All

Offer”), and (ii) the early results of its previously

announced offer to purchase for cash outstanding 6.125% senior

unsecured notes due 2028 (the “Capped

Notes” and, together with the Any and All Notes, the

“Notes”) issued by ANHBV, fully

guaranteed on an unsecured basis by Alcoa, up to an aggregate

principal amount not to exceed US$250,000,000 (the “Maximum Principal Amount”) (the “Capped Offer” and, together with the Any and All

Offer, the “Offers”).

The Any and All Offer was made and the Capped Offer is being

made upon the terms and subject to the conditions set forth in the

offer to purchase dated March 3, 2025 (the “Offer to Purchase”) relating to the Notes and,

with respect to the Any and All Offer, the accompanying notice of

guaranteed delivery.

Information regarding the Any and All Notes and the expiration

date results of the Any and All Offer is summarized in the

following table:

Title of Security

CUSIP / ISIN

Principal Amount

Outstanding

Principal Amount Tendered and

Accepted for Purchase

Principal Amount Reflected in

Notices of Guaranteed Delivery

Principal Amount Outstanding

Following the Any and All Settlement Date (1)

Any and All Total

Consideration (2)

5.500% Senior Unsecured Notes due

2027

Rule 144A:

013822AE1 / US013822AE11

Regulation S:

N02175AD4 / USN02175AD40

US$750,000,000

US$609,101,000

US$1,542,000

US$140,899,000

US$1,002.47

________________

(1)

Has not been reduced by principal amount

of Any and All Notes reflected in Notices of Guaranteed Delivery,

which may be purchased on the Any and All Settlement Date.

(2)

Per US$1,000 principal amount of Any and

All Notes validly tendered and accepted for purchase. Holders will

also be paid accrued and unpaid interest from the applicable last

interest payment date up to, but not including, the Any and All

Settlement Date (as defined in the Offer to Purchase).

Information regarding the Capped Notes and the early results of

the Capped Offer is summarized in the following table:

Title of Security

CUSIP / ISIN

Principal Amount

Outstanding

Principal Amount

Tendered

Principal Amount Accepted for

Purchase

Principal Amount Outstanding

Following the Capped Early Settlement Date

Capped Early

Consideration

(1)(2)

6.125% Senior Unsecured Notes due

2028

Rule 144A: 013822AC5 /

US013822AC54 Regulation S: N02175AC6 / USN02175AC66

US$500,000,000

US$281,258,000

US$281,258,000

US$218,742,000

US$1,012.50

________________

(1)

Per US$1,000 principal amount of Capped

Notes validly tendered and accepted for purchase. Holders will also

be paid accrued and unpaid interest from the applicable last

interest payment date up to, but not including, the Capped Early

Settlement Date (as defined in the Offer to Purchase).

(2)

Includes the Early Tender Premium (as

defined in the Offer to Purchase).

Information on the Offers

The Any and All Offer expired at 5:00 p.m., New York City time,

on March 14, 2025 (the “Any and All

Expiration Date”). In order to be eligible to participate in

the Any and All Offer, holders of Any and All Notes reflected in

notices of guaranteed delivery received by ANHBV prior to the Any

and All Expiration Date must deliver such Any and All Notes to

ANHBV by 5:00 p.m., New York City time, on March 18, 2025 (the

“Guaranteed Delivery Date”).

On the terms and subject to the conditions set forth in the

Offer to Purchase, ANHBV expects that it will accept for purchase

all of the Any and All Notes tendered on or prior to the Any and

All Expiration Date, and all of the Any and All Notes delivered on

or prior to the Guaranteed Delivery Date. The principal amount of

Any and All Notes that will be purchased by ANHBV on the Any and

All Settlement Date is subject to change based on deliveries of Any

and All Notes pursuant to the guaranteed delivery procedures

described in the Offer to Purchase.

The Capped Offer is scheduled to expire at 5:00 p.m., New York

City time, on March 31, 2025, unless extended or earlier terminated

by ANHBV.

D.F. King & Co., Inc., the tender agent and the information

agent for the Offers (the “Tender and

Information Agent”), informed us that, as of 5:00 p.m., New

York City time, on March 14, 2025 (such time and date, the

“Capped Early Tender Date”),

US$281,258,000 in aggregate principal amount of Capped Notes had

been validly tendered and not validly withdrawn by holders of

Capped Notes.

As set forth in the Offer to Purchase, ANHBV may, in its sole

discretion, subject to applicable law, increase or decrease the

Maximum Principal Amount. As the aggregate principal amount of

Capped Notes validly tendered and not validly withdrawn by holders

of Capped Notes as of the Capped Early Tender Date exceeds the

Maximum Principal Amount, ANHBV has increased the Maximum Principal

Amount of Capped Notes that it will accept under the Capped Offer

from the previously announced US$250,000,000 to US$281,258,000. The

other terms of the Capped Offer remain unchanged.

All conditions described in the Offer to Purchase that had to be

satisfied on or prior to the Any and All Expiration Date, including

the Pricing Condition (as defined in the Offer to Purchase), have

been satisfied, and ANHBV has accepted for purchase all of the Any

and All Notes validly tendered and not validly withdrawn and

expects to accept for purchase all of the Any and All Notes

delivered on or prior to the Guaranteed Delivery Date pursuant to

the guaranteed delivery procedures described in the Offer to

Purchase. In addition, ANHBV has accepted for purchase all Capped

Notes validly tendered and not validly withdrawn at or prior to the

Capped Early Tender Date.

Settlement

Holders of Any and All Notes that have validly tendered and not

validly withdrawn their Any and All Notes at or prior to the Any

and All Expiration Date will receive the Any and All Total

Consideration on the Any and All Settlement Date, which date is

expected to be on March 19, 2025.

Holders of Capped Notes that have validly tendered and not

validly withdrawn their Capped Notes at or prior to the Capped

Early Tender Date will receive the Capped Early Consideration on

the Capped Early Settlement Date, which date is expected to be on

March 19, 2025.

For More Information

The terms and conditions of the Offers are described in the

Offer to Purchase. Copies of the Offer to Purchase are available at

www.dfking.com/alcoa and by request to D.F. King & Co., Inc.,

the Tender and Information Agent. Requests for copies of the Offer

to Purchase should be directed to the Tender and Information Agent

at +1 (800) 848-3409 (toll free) and +1 (212) 269-5550 (collect) or

by e-mail to alcoa@dfking.com.

ANHBV has engaged Morgan Stanley & Co. LLC and BofA

Securities, Inc. to act as the dealer managers (the “Dealer Managers”) in connection with the Offers.

The Dealer Managers can be contacted at their telephone numbers set

forth on the back cover page of the Offer to Purchase with

questions regarding the Offers.

Disclaimer

None of ANHBV, Alcoa, the Dealer Managers, the Tender and

Information Agent, the trustee for the Notes, or any of their

respective affiliates, is making any recommendation as to whether

holders should or should not tender any Notes in response to the

Offers or expressing any opinion as to whether the terms of the

Offers are fair to any holder. Holders of the Notes must make their

own decision as to whether to tender any of their Notes and, if so,

the principal amount of Notes to tender. Please refer to the Offer

to Purchase for a description of the offer terms, conditions,

disclaimers and other information applicable to the Offers.

This press release is for informational purposes only and does

not constitute an offer to purchase or the solicitation of an offer

to sell any securities. The Offers are being made solely by means

of the Offer to Purchase. The Offers are not being made to holders

of the Notes in any jurisdiction in which the making or acceptance

thereof would not be in compliance with the securities, blue sky or

other laws of such jurisdiction. In those jurisdictions where the

securities, blue sky or other laws require any tender offer to be

made by a licensed broker or dealer, the Offers will be deemed to

be made on behalf of ANHBV by the Dealer Managers or one or more

registered brokers or dealers licensed under the laws of such

jurisdiction.

Forward-Looking Statements

This press release may contain forward-looking statements within

the meaning of Section 27A of the U.S. Securities Act of 1933, as

amended, and Section 21E of the U.S. Securities Exchange Act of

1934, as amended, including those related to the Offers.

Forward-looking statements include those containing such words as

“aims,” “ambition,” “anticipates,” “believes,” “could,” “develop,”

“endeavors,” “estimates,” “expects,” “forecasts,” “goal,”

“intends,” “may,” “outlook,” “potential,” “plans,” “projects,”

“reach,” “seeks,” “sees,” “should,” “strive,” “targets,” “will,”

“working,” “would,” or other words of similar meaning. All

statements by Alcoa that reflect expectations, assumptions or

projections about the future, other than statements of historical

fact, are forward-looking statements, including, without

limitation, forecasts concerning global demand growth for bauxite,

alumina, and aluminum, and supply/demand balances; statements,

projections or forecasts of future or targeted financial results,

or operating performance (including our ability to execute on

strategies related to environmental, social and governance

matters); and statements about strategies, outlook, and business

and financial prospects. These statements reflect beliefs and

assumptions that are based on Alcoa’s perception of historical

trends, current conditions, and expected future developments, as

well as other factors that management believes are appropriate in

the circumstances. Forward-looking statements are not guarantees of

future performance and are subject to known and unknown risks,

uncertainties, and changes in circumstances that are difficult to

predict. Although Alcoa believes that the expectations reflected in

any forward-looking statements are based on reasonable assumptions,

it can give no assurance that these expectations will be attained

and it is possible that actual results may differ materially from

those indicated by these forward-looking statements due to a

variety of risks and uncertainties. Additional information

concerning factors that could cause actual results to differ

materially from those projected in the forward-looking statements

is contained in Alcoa’s filings with the Securities and Exchange

Commission. Alcoa disclaims any obligation to update publicly any

forward-looking statements, whether in response to new information,

future events or otherwise, except as required by applicable

law.

About Alcoa

Alcoa is a global industry leader in bauxite, alumina and

aluminum products with a vision to reinvent the aluminum industry

for a sustainable future. Our purpose is to turn raw potential into

real progress, underpinned by Alcoa Values that encompass

integrity, operating excellence, care for people and courageous

leadership. Since developing the process that made aluminum an

affordable and vital part of modern life, our talented Alcoans have

developed breakthrough innovations and best practices that have led

to improved safety, sustainability, efficiency, and stronger

communities wherever we operate.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250316357772/en/

Investor Contact: Yolande Doctor 412-992-5450

Yolande.B.Doctor@Alcoa.com

Media Contact: Courtney Boone 412-527-9792

Courtney.Boone@Alcoa.com

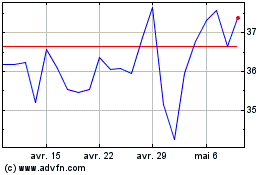

Alcoa (NYSE:AA)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

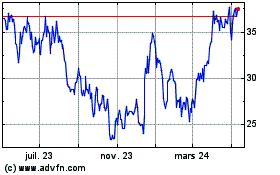

Alcoa (NYSE:AA)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025