UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 5, 2023

ALTC ACQUISITION CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-40583 |

86-2292473 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

640 Fifth Avenue, 12th Floor

New York, NY 10019

(Address of principal executive offices, including

zip code)

(212) 380-7500

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

x Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Shares of Class A common stock, par value $0.0001 per share |

|

ALCC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 5.07 Submission of Matters to a Vote of Security Holders.

At the special meeting of the stockholders of

AltC Acquisition Corp. (the “Company”) held on October 5, 2023 (the “Special Meeting”), a total of

49,463,254 (77.35%) of the Company’s issued and outstanding common stock, which consists of all Class A and Class B common

stock held of record at the close of business on September 1, 2023, the record date for the Special Meeting, were represented in

person online or by proxy, which constituted a quorum.

The stockholders of the Company (the “Stockholders”)

voted on the proposal to adopt an amendment (the “Extension Amendment Proposal”), which is described in more detail in the

definitive proxy statement of the Company filed with the Securities and Exchange Commission on September 14, 2023 (the “Proxy Statement”),

to the Company’s amended and restated certificate of incorporation to extend the date by which the Company has to consummate a business

combination (the “Extension”) from October 12, 2023 to July 12, 2024 (or such earlier date as determined by the Company’s

board of directors) (the “Charter Amendment”).

The final voting results for the Extension Amendment Proposal were

as follows:

| For | |

Against | |

Abstain | |

Broker Non-Votes |

| 49,258,435 | |

22,326 | |

182,493 | |

N/A |

As there were sufficient votes to approve the Extension

Amendment Proposal, the “Adjournment Proposal” described in the Proxy Statement was not presented to the Stockholders.

The Extension will not be effective until the Charter

Amendment has been filed with the Secretary of State of the State of Delaware. The board of directors of the Company retains the right

to abandon and not implement the Extension at any time without any further action by the Stockholders.

Item 8.01. Other Events.

On October 5, 2023, the Company issued a press

release announcing that (i) the Stockholders have approved the Extension Amendment Proposal and (ii) the Company has determined to extend

the time redeeming Stockholders have to reverse their redemption elections from 5:00 p.m. on October 3, 2023 until 5:00 p.m., Eastern Time, on October

11, 2023.

The press release is attached as Exhibit 99.1 to this Current Report

on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements

and Exhibits.

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 5, 2023

| |

ALTC ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Jay Taragin |

| |

Name: |

Jay Taragin |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

AltC Acquisition Corp. Announces Stockholder Approval of Extension

Amendment Proposal at Special Meeting and Extends the Redemption Reversal Deadline

In Excess of $300 Million Will Remain in AltC’s Trust

Account after Stockholder Redemptions

Deadline for Redemption Reversals is Extended to 5:00 p.m. Eastern

Time on October 11, 2023

NEW YORK, NY (October 5, 2023) – AltC Acquisition Corp.

(NYSE: ALCC) (“AltC”), a publicly-traded special purpose acquisition company, today announced that in a special meeting

of AltC’s stockholders held today at 11:00 a.m. Eastern Time, its stockholders voted to approve a proposal to extend the date by

which AltC may consummate a business combination from October 12, 2023, to July 12, 2024.

AltC will have in excess of $300 million remaining in its trust

account (the “Trust Account”) after taking into account redemptions by AltC stockholders. In order to allow AltC stockholders

an opportunity to reverse redemption elections (an “Election Reversal”), AltC has determined to extend the deadline

to do so until 5:00 p.m. Eastern Time, on October 11, 2023. To effectuate an Election Reversal, stockholders must submit a written

request to AltC’s transfer agent, Continental Stock & Transfer Company. If shares are held in street name, stockholders will

need to instruct their bank or broker to request the Election Reversal from the transfer agent.

As announced on July 11, 2023, AltC has entered into a definitive

agreement to enter into a business combination (the “proposed transaction”) with Oklo Inc. (“Oklo”),

an advanced fission technology and nuclear fuel recycling company. Upon closing, this transaction will result in Oklo being the first

publicly traded advanced fission company focused on selling clean, reliable energy directly to customers and nuclear fuel recycling services

to the U.S. market.

Since announcing the proposed transaction with AltC, Oklo has announced

its tentative selection as the contractor awardee to provide power and heat to the Eielson Air Force Base in Alaska and the signing of

a new Memorandum of Understanding with Centrus Energy Corp. (“Centrus”). Under this new Memorandum of Understanding,

Oklo and Centrus intend to enter into definitive agreements on a broad scope of collaboration activities supporting the development and

operation of Oklo’s Aurora powerhouses, including collaboration related to supply of HALEU and Centrus’ purchase of power

from Oklo to power its HALEU Production Facility. Additionally, Oklo appointed Craig Bealmear, an experienced public energy company executive,

as CFO.

The proposed transaction is currently expected to close in late 2023

or early 2024 and is subject to approval by AltC shareholders, the Registration Statement being declared effective by the U.S. Securities

and Exchange Commission (“SEC”), and other customary closing conditions. Upon completion of the transaction, the combined

company will operate as Oklo and is expected to be listed on the New York Stock Exchange under the ticker “OKLO.”

About Oklo Inc.

Oklo Inc. is developing fast fission power plants to provide clean,

reliable, and affordable energy at scale. Oklo received a site use permit from the U.S. Department of Energy, was awarded fuel material

from Idaho National Laboratory, submitted the first advanced fission custom combined license application to the Nuclear Regulatory Commission

(“NRC”), and is developing advanced fuel recycling technologies in collaboration with the U.S. Department of Energy

and U.S. national laboratories.

About AltC Acquisition Corp.

AltC Acquisition Corp. was formed for the purpose of effecting a merger,

capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

Additional Information and Where to Find It

On July 11, 2023, AltC entered

into an agreement to consummate the proposed transaction with Oklo. The proposed transaction will be submitted to shareholders of

AltC for their consideration. AltC filed a registration statement on Form S-4 (the “Registration Statement”) with

the SEC on September 27, 2023, which includes a preliminary proxy statement/prospectus/consent solicitation statement to be

distributed to AltC’s shareholders in connection with AltC’s solicitation for proxies for the vote by AltC’s

shareholders in connection with the proposed transaction and other matters described in the Registration Statement, as well as the

prospectus relating to the offer of the securities to be issued to Oklo’s shareholders in connection with the completion of

the proposed transaction. After the Registration Statement has been declared effective, AltC will mail a definitive proxy

statement/prospectus/consent solicitation statement and other relevant documents to its shareholders as of the record date

established for voting on the proposed transaction. AltC’s shareholders and other interested persons are advised to read the preliminary proxy statement/prospectus/consent solicitation statement and any amendments thereto and, once available,

the definitive proxy statement/prospectus/consent solicitation statement, in connection with AltC’s solicitation of proxies

for its special meeting of shareholders to be held to approve, among other things, the proposed transaction, as well as other

documents filed with the SEC by AltC in connection with the proposed transaction (the “proposed transaction Special

Meeting”), as these documents contain and will contain important information about AltC, the Company and the proposed

transaction. Shareholders may obtain a copy of the preliminary proxy statement/prospectus/consent solicitation statement and, once

available, the definitive proxy statement/prospectus/consent solicitation statement, as well as other documents filed by AltC with

the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to AltC Acquisition

Corp., 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Shareholders may obtain a copy of the

preliminary proxy statement/prospectus/consent solicitation statement and, once available, the definitive proxy statement/prospectus/consent

solicitation statement, as well as other documents filed by AltC with the SEC, without charge, at the SEC’s website located at www.sec.gov

or by directing a written request to AltC Acquisition Corp., 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Forward-Looking Statements

This communication includes

“forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as

“estimate,” “goal,” “plan,” “project,” “forecast,” “intend,”

“will,” “expect,” “anticipate,” “believe,” “seek,” “target,”

“continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict” or other similar expressions that predict or indicate future events or trends or that

are not statements of historical matters. We have based these forward looking statements on our current expectations and projections

about future events. These forward-looking statements include, but are not limited to, statements regarding, the amount of cash in

the Trust Account after stockholder redemptions, if any, redemption reversals by AltC's shareholders, the proposed transaction

between AltC and Oklo, including with respect to the timing of its closing and the listing of the combined company’s shares on

the New York Stock Exchange, the amount of redemptions by AltC’s shareholders, the amount of cash and cash equivalents held by

the combined company after closing, the competitive environment in which Oklo will operate following the proposed transaction, the

belief that Oklo will be the first publicly traded advanced fission company focused on selling reliable, commercial-scale energy

directly to customers and nuclear fuel recycling services to the U.S. market, the operations of the combined company, expectations

for the collaborative programs memorialized in the Memorandum of Understanding between Centrus and Oklo, including with respect to

the supply of HALEU to Oklo and any of the other components of the collaboration, Centrus’ purchase of electricity from Oklo,

the deployment and capabilities of Oklo’s powerhouses in southern Ohio, and statements regarding the U.S. Air Force’s

pilot micro-reactor program and Oklo’s potential selection for such program. These forward-looking statements are based on

information available to us as of the date of this communication and represent management’s current views and assumptions.

Forward-looking statements are not guarantees of future performance, events or results and involve known and unknown risks,

uncertainties and other factors, which may be beyond our control.

These statements are based on various assumptions,

whether or not identified in this communication, and on the current expectations of Oklo’s and, in certain cases, AltC’s management

and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not

intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of

fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Oklo and AltC. These forward-looking statements are subject to known and unknown risks,

uncertainties and assumptions about Oklo, AltC or the proposed transaction that may cause actual results, levels of activity, performance

or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied

by such forward-looking statements. Such risks and uncertainties, include the risk that there are significant redemptions by AltC's shareholders; the risk that no shareholders who previously exercised their redemption

rights reverse their decisions; risks related to the deployment of Oklo’s powerhouses,

including those that affect the success of each of the potential deployments at Eielson Air Force Base and with Centrus; the risks that

Centrus is the future is unable or unwilling to proceed with the collaboration programs discussed herein; the risk that Oklo and Centrus

do not ever enter into any definitive agreements relating to the purchase and sale of electricity or for any of the other related activities

noted in this communication; risks relating to Oklo’s final selection for the U.S Air Force’s pilot program herein; risks

relating to the safety and licensing of Oklo’s technology; the risks that the United States Department of Defense or the United

States Air Force in the future is unable or unwilling to proceed with the pilot program; the risk that Oklo and the Defense Logistics

Agency Energy do not ever enter into any definitive agreements relating to the purchase and sale of electricity or heat for the activities

discussed herein; the risk that Oklo is pursuing an emerging market, with no commercial project operating, regulatory uncertainties; the

potential need for financing to construct plants, market, financial, political and legal conditions; the inability of the parties to successfully

or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are

delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed

transaction or that the approval of the shareholders of AltC or Oklo is not obtained; the outcome of any legal proceedings that may be instituted against Oklo’s or AltC following announcement

of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction; risks relating to the uncertainty

of the projected financial information with respect to Oklo; the amount of actual transaction expenses incurred by AltC and Oklo; the

effects of competition; changes in applicable laws or regulations; the outcome of any government and regulatory proceedings, investigations

and inquiries; the impact of the global COVID-19 pandemic on Oklo, AltC, the combined company’s projected results of operations,

financial performance or other financial metrics, or on any of the foregoing risks; and the risks noted under the heading “Risk

Factors” in the Registration Statement filed by AltC on September 27, 2023, as it may be amended from time to time; and other documents

filed, or to be filed, with the SEC. If any of these risks materialize or Oklo’s or AltC’s assumptions prove incorrect, actual

results could differ materially from the results implied by the forward-looking statements. There may be additional risks that AltC and

Oklo do not presently know or that AltC and Oklo currently believe are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. In addition, forward-looking statements reflect Oklo’s and AltC’s expectations,

plans or forecasts of future events and views as of the date of this communication. Oklo and AltC anticipate that subsequent events and

developments will cause such assessments to change. However, while Oklo and/or AltC may elect to update these forward-looking statements

at some point in the future, Oklo and AltC specifically disclaim any obligation to do so. These forward-looking statements should not

be relied upon as representing assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should

not be placed upon the forward-looking statements. An investment in AltC is not an investment in any of AltC’s founders’ or

sponsors’ past investments or companies or any funds affiliated with any of the foregoing. The historical results of these investments

are not indicative of future performance of AltC, which may differ materially from the performance of the founders or sponsors past investments,

companies or affiliated funds.

No Offer or Solicitation

This communication does not constitute

an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be

any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. This communication is not, and under no circumstances is to be construed as, a prospectus,

an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions

therefrom. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY

AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

AltC, Oklo and certain of their respective

directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the

solicitation of proxies from AltC’s shareholders in connection with the proposed transaction Special Meeting. Information regarding

the persons who may, under SEC rules, be deemed participants in the solicitation of AltC’s shareholders in connection with the proposed

transaction Special Meeting, is set forth in the preliminary proxy statement/prospectus/consent solicitation statement. You can find more

information about AltC’s directors and executive officers in the Registration Statement, as it may be amended from time to time. Additional information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests is included in the preliminary proxy statement/prospectus/consent solicitation

statement. Shareholders, potential investors and other interested persons should read the preliminary proxy statement/prospectus/consent

solicitation statement and any amendments thereto carefully before making any voting or investment decisions. You may obtain free copies

of these documents from the sources indicated above.

Election Reversal Contact:

Attn: SPAC REDEMPTIONS

E-mail: spacredemptions@continentalstock.com

Media Contacts:

Bonita Chester

Oklo Inc.

Director of Communications and Media

media@oklo.com

Christina Stenson / Michael Landau

Gladstone Place Partners

(212) 230-5930

Investor Contact:

Caldwell Bailey / Eduardo Royes

ICR, Inc.

OkloIR@icrinc.com

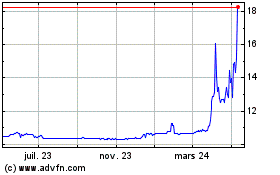

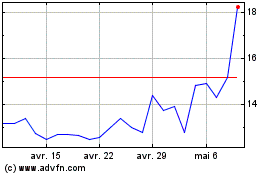

AltC Acquisition (NYSE:ALCC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

AltC Acquisition (NYSE:ALCC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024