Form 8-K - Current report

23 Octobre 2023 - 2:00PM

Edgar (US Regulatory)

0001142750

false

0001142750

2023-10-23

2023-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

October 23, 2023

| AMN HEALTHCARE SERVICES, INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware |

001-16753 |

06-1500476 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

|

2999 Olympus Boulevard, Suite 500

Dallas, Texas 75019 |

| (Address of principal executive offices) (Zip Code) |

| |

| (866) 871-8519 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common Stock, par value $0.01 per share |

|

AMN |

|

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On October

23, 2023, AMN Healthcare Services, Inc. announced a definitive agreement to acquire Medical Search International and Dr. Wanted Healthcare

Staffing (together, “MSDR”), two healthcare staffing companies that specialize in Locum Tenens and Advanced Practice, for

aggregate cash consideration of approximately $300 million. The closing of the acquisition of MSDR is subject to certain customary conditions

and approval by regulatory authorities.

A copy of the press

release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AMN Healthcare Services, Inc. |

|

| |

|

|

|

| |

|

|

|

Date: October 23, 2023 |

By: |

/s/ Cary Grace |

|

| |

Name: |

Cary Grace |

|

| |

Title: |

Chief Executive Officer |

|

EXHIBIT

99.1

Date: Monday, October 23, 2023

Time: 8:00 a.m. ET

Owner: Randy Reece

Headline: AMN Healthcare to Acquire MSDR

DALLAS, Oct. 23, 2023 (GLOBE NEWSWIRE) -- AMN Healthcare (NYSE: AMN),

the leader and innovator in total talent solutions for healthcare organizations across the United States, today announced a definitive

agreement to acquire MSDR for a purchase price of $300 million. MSDR consists of two healthcare staffing companies that specialize in

locum tenens and advanced practices, Medical Search International (MSI) and DRW Healthcare Staffing (DRW).

MSI, founded in 2002, serves healthcare systems across the United

States by placing high-quality healthcare professionals that specialize in psychiatry, anesthesia, radiology, and surgery. DRW, founded

in 2011, specializes in psychiatry, anesthesia, and surgery. Both companies are valued leaders in the locums industry. Chris Wang, Chief

Executive Officer, Managing Partner of DRW, will remain with the business as President of MSDR.

“We are very excited to welcome the MSDR team into the AMN

Healthcare family and expand the workforce solutions available to our clients across the country,” said AMN Healthcare President

and Chief Executive Officer Cary Grace. “Now more than ever, it is critically important that healthcare systems have streamlined

access to the services, technologies, and healthcare professionals needed to support the patients and communities they serve. This acquisition

is the result of our continued dedication to meet the needs of our clients, who I am confident will see the breadth and value of our services

increased with this acquisition of MSDR.”

The acquisition positions AMN Healthcare for substantial revenue

growth in locum tenens. MSDR revenue was $104 million in 2022, and year-to-date annualized 2023 revenue is approximately $155 million.

We expect the deal will be modestly accretive to adjusted EPS in the first twelve months. The acquisition, subject to regulatory approvals

and customary closing conditions, is expected to close in the fourth quarter of 2023. This transaction is expected to be funded with a

combination of cash on hand and borrowings on our revolving credit facility.

For income tax reporting purposes, the acquisition of DRW will be

treated as an asset purchase, resulting in a step-up in the tax basis of the intangible assets acquired. This step-up in tax basis is

expected to result in an annual cash tax savings of approximately $2 million over the next 15 years from the amortization of these assets

for income tax purposes.

With the acquisition of MSDR, AMN Healthcare’s portfolio of

solutions will expand to provide clients with a larger and more diverse candidate pool that includes healthcare professionals that specialize

in some of the most needed, in-demand services. The acquisition also allows AMN Healthcare and clients to benefit from the expertise and

knowledge of the MSDR team in recruitment, placement, and operations, including candidate matching technology that is tailored for locum

tenens.

Advisors

Wells Fargo Securities served as exclusive financial advisor to AMN

for this transaction, and legal counsel was provided by Sheppard Mullin. Nolan & Associates acted as exclusive financial advisor to

MSDR, and Morgan Lewis provided legal counsel.

About AMN Healthcare

AMN Healthcare is the leader and innovator in healthcare total talent

solutions to healthcare facilities across the nation. The Company provides unparalleled access to the most comprehensive network of quality

healthcare professionals through its innovative recruitment and staffing strategies and breadth of career opportunities. With insights

and expertise, AMN Healthcare helps providers optimize their workforce to successfully reduce complexity, increase efficiency and improve

patient outcomes. AMN delivers managed services programs, healthcare executive search solutions, vendor management systems, recruitment

process outsourcing, predictive labor analytics, revenue cycle management, credentialing solutions, and other services. AMN Healthcare

is committed to fostering and maintaining a diverse team that reflects the communities we serve. Our commitment to the inclusion of many

different backgrounds, experiences and perspectives enables our innovation and leadership in the healthcare services industry.

Contact

Randle Reece

Senior Director, Investor Relations

866.861.3229

v3.23.3

Cover

|

Oct. 23, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 23, 2023

|

| Entity File Number |

001-16753

|

| Entity Registrant Name |

AMN HEALTHCARE SERVICES, INC.

|

| Entity Central Index Key |

0001142750

|

| Entity Tax Identification Number |

06-1500476

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2999 Olympus Boulevard

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75019

|

| City Area Code |

866

|

| Local Phone Number |

871-8519

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

AMN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

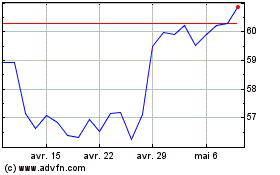

AMN Healthcare Services (NYSE:AMN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

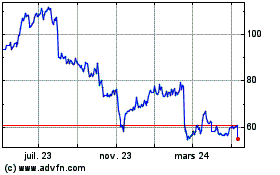

AMN Healthcare Services (NYSE:AMN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024