Statement of Changes in Beneficial Ownership (4)

21 Décembre 2021 - 11:17PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Kelly Martin |

2. Issuer Name and Ticker or Trading Symbol

Apollo Global Management, Inc.

[

APO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Financial Officer |

|

(Last)

(First)

(Middle)

C/O APOLLO GLOBAL MANAGEMENT, INC., 9 WEST 57TH STREET, 43RD FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/17/2021 |

|

(Street)

NEW YORK, NY 10019

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 12/17/2021 | | A | | 48451 (1) | A | $70.16 | 446560 (2) | D | |

| Class A Common Stock | 12/17/2021 | | F | | 27801 (3) | D | $70.16 | 418759 (2) | D | |

| Class A Common Stock | 12/17/2021 | | A | | 29634 (4) | A | $0.00 | 448393 (5) | D | |

| Class A Common Stock | 12/17/2021 | | A | | 42514 (6) | A | $70.16 | 490907 (5) | D | |

| Class A Common Stock | 12/17/2021 | | A | | 43917 (7) | A | $0.00 | 534824 (5) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Consists of fully vested shares of Class A Common Stock of the Issuer ("Class A shares") granted under the Apollo Global Management, Inc. 2019 Omnibus Equity Incentive Plan (the "Plan") in connection with the reporting person's election to exchange his rights to distributions of incentive income under his outstanding limited partner interests and rights under global carry pool awards previously received from affiliates of the Issuer (such exchange, the "GCP exchange"). |

| (2) | Reported amount includes 278,816 vested and unvested restricted stock units ("RSUs") granted under the Plan. Each RSU represents the contingent right to receive, in accordance with the issuance schedule set forth in the applicable RSU award agreement, one share of Class A common stock of the Issuer for each vested RSU. The unvested RSUs vest in installments in accordance with the terms of the applicable RSU award agreement, provided the reporting person remains in service through the applicable vesting date. |

| (3) | Consists of Class A shares withheld by the Issuer in order to satisfy the minimum tax withholding obligations of the reporting person arising in connection

with the delivery of Class A shares that were granted under the Plan. |

| (4) | Represents vested RSUs granted under the Plan in connection with the GCP exchange. |

| (5) | Reported amount includes 308,450 vested and unvested RSUs granted under the Plan. |

| (6) | Represents the right to receive vested Class A shares issued under the Plan in January 2022 in connection with the GCP exchange. |

| (7) | Represents the right to receive vested Class A shares issued under the Plan to be delivered in the future in accordance with the terms of the GCP Exchange. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Kelly Martin

C/O APOLLO GLOBAL MANAGEMENT, INC.

9 WEST 57TH STREET, 43RD FLOOR

NEW YORK, NY 10019 |

|

| Chief Financial Officer |

|

Signatures

|

| /s/ Jessica L. Lomm, as attorney-in-fact | | 12/21/2021 |

| **Signature of Reporting Person | Date |

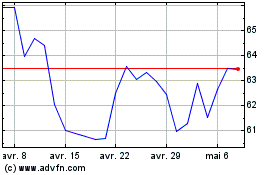

Apollo Global Management (NYSE:APO-A)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

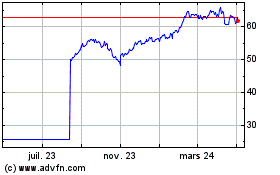

Apollo Global Management (NYSE:APO-A)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025

Real-Time news about Apollo Global Management Inc (New York Stock Exchange): 0 recent articles

Plus d'articles sur Apollo Global Management, Inc.