0001830210false00018302102023-11-092023-11-090001830210us-gaap:CommonClassAMember2023-11-092023-11-090001830210bhil:WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2023

BENSON HILL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39835 | | 85-3374823 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1001 North Warson Rd.

St. Louis, Missouri 63132

(Address of principal executive offices)

(314) 222-8218

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

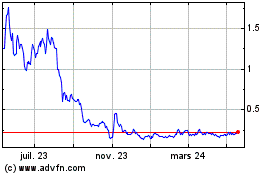

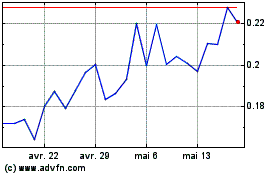

| Common stock, $0.0001 par value | | BHIL | | The New York Stock Exchange |

| Warrants exercisable for one share of common stock at an exercise price of $11.50 | | BHIL WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On November 9, 2023, Benson Hill, Inc. (the “Company”) issued a press release reporting the financial results of the Company for the quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein in its entirety by reference. In conjunction with the press release, the Company has posted a supplemental information presentation to its website (bensonhill.com) and a copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein in its entirety by reference.

Limitation on Incorporation by Reference. The information furnished in this Item 2.02, including the press release attached hereto as Exhibit 99.1 and the presentation attached hereto as Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended or the Exchange Act, except as set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements. Except for historical information contained in the press release and presentation attached as Exhibits 99.1 and 99.2 hereto, the press release and presentation contain forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. Please refer to the cautionary note in the press release and presentation, respectively, regarding these forward-looking statements.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| BENSON HILL, INC. |

| | |

| By: | /s/ Dean Freeman |

| Name: Dean Freeman |

| Title: Chief Financial Officer |

Date: November 9, 2023

Exhibit 99.1

Benson Hill Announces Third Quarter 2023 Financial Results, Improves 2023 Outlook, and Pays Down Debt

•Reported revenues decreased 8 percent year-over-year to approximately $113.1 million. Proprietary revenues increased by 27 percent year-over-year.

•Reported gross profit was $4.1 million (gross loss of $0.2 million when excluding an approximate $4.3 million impact from open mark-to-market timing differences).

•The Company ended the third quarter with $86.2 million of cash, restricted cash, and marketable securities.

•Management improves its 2023 financial guidance.

•The Company expects to pay down approximately 50 percent of the senior convertible debt in November.

ST. LOUIS, MO – Nov. 9, 2023 - Benson Hill, Inc. (NYSE: BHIL, the “Company” or “Benson Hill”), a food tech company unlocking the natural genetic diversity of plants, today announced operating and financial results for the quarter ended September 30, 2023.

“Our team effectively managed a challenging third quarter, addressing some softness in soy crush margins and reduced demand for proprietary products because of market headwinds,” said Deanie Elsner, Chief Executive Officer of Benson Hill. “The combination of the sale of certain non-core licensing technologies and higher-than-planned soy white flake ingredient sales expected in the fourth quarter positions us to end 2023 consistent with our prior guidance for gross profit. We expect these market challenges to persist, further supporting our decision to accelerate the shift to an asset-light business model designed to serve broadacre animal feed markets with our seed innovations enabled through the CropOS® platform.”

Third Quarter Results Compared to the Same Period of 2022

The following financial results exclude the completed divestiture of the Fresh business on June 30, 2023. The impact of open mark-to-market timing differences on the statement of operations and reconciliation of non-GAAP financial measures can be found in the accompanying financial tables.

•Reported revenues were $113.1 million, a decrease of $9.2 million, or 7.5 percent, driven by a 17 percent decline in non-proprietary revenues due to record-level crush margins for soy and yellow pea in the third quarter of last year. Proprietary revenues were $33.1 million, a 27.2 percent increase, driven by greater availability of products compared to the prior year and the sale of proprietary soybeans into the commodity market. Reported revenues included an unfavorable $0.1 million impact from open mark-to-market timing differences.

•Gross profit was $4.1 million, a decrease of $1.8 million. Excluding a favorable impact of $4.3 million from open mark-to-market timing differences, gross profit decreased by $4.7 million to a loss of $0.2 million due to the sale of proprietary products into the commodity markets at unfavorable margins and non-recurring factors affecting the supply chain, including logistics and unscheduled maintenance costs at our processing facilities.

•Operating expenses were $28.4 million, a decrease of $2 million. The decrease was driven by the Liquidity Improvement Plan actions to deliver an expected $15 million run rate reduction in 2023 partially offset by $2.5 million of non-recurring expenses. Excluding the non-recurring items, operating expenses declined by approximately 14.7 percent to $25.9 million.

◦Selling, general, and administrative expenses were $17.9 million, a decrease of $1 million or 5.5 percent inclusive of non-recurring costs.

◦R&D expenses were $10.5 million, a decrease of $0.9 million or 8 percent.

•Inclusive of open mark-to-market timing differences, net loss from continuing operations, net of income taxes, was $19.2 million, a decrease in reported loss of $7.2 million. Adjusted EBITDA was a loss of $14.2 million compared to a loss of $14.7 million in the prior year. Excluding the impact of open mark-to-market timing differences, the Adjusted EBITDA loss in the quarter was $18.5 million compared to a loss of $16.1 million for the same period last year.

•Cash, restricted cash, and marketable securities of $86.2 million were on hand as of September 30, 2023.

First Nine-Months Results Compared to the Same Period of 2022

The following financial results exclude the completed divestiture of the Fresh business on June 30, 2023. The impact of open mark-to-market timing differences on the statement of operations and reconciliation of non-GAAP financial measures can be found in the accompanying financial tables.

•Reported revenues were $356.7 million, an increase of $74.7 million, or 26.5 percent. Proprietary revenues were $77 million, an increase of 47.3 percent, driven by proprietary product sales into the aquaculture market and some limited soybean sales into the commodity markets. Reported revenues included a $6.3 million gain from open mark-to-market timing differences.

•Gross profit was $16.6 million, an increase in profitability of $13.9 million, and includes a $6.4 million gain related to open mark-to-market timing differences. Overall profitability increased in dollar and margin percentage terms due to the combination of partnership and licensing agreements and improved operating results compared to start-up costs incurred in the prior year.

•Operating expenses were $97.6 million, an increase of $2.4 million, or 2.5 percent, which include approximately $17.3 million of non-recurring costs, including a $19.2 million impairment of the carrying value of goodwill. Excluding these non-recurring items, operating expenses declined by 15.6 percent to $80.3 million due to cost reductions realized through the Company’s Liquidity Improvement Plan.

•Inclusive of the mark-to-market timing differences and goodwill impairment, the reported net loss from continuing operations, net of income taxes, was $73.2 million compared to a net loss of $68.9 million. Adjusted EBITDA was a loss of $41 million compared to a loss of $59.8 million.

2023 Outlook

Excludes the Fresh business which was divested on June 30, 2023.

Management improved its guidance for 2023, driven by expectations for improved performance in the fourth quarter and continued benefits from the Liquidity Improvement Plan.

| | | | | | | | |

| 2023 Guidance1 |

| $ USD Millions | November 9 | August 9 |

| Consolidated revenues | $440 - $450 | $390 - $430 |

| Proprietary revenues | $100 - $110 | $100 - $110 |

| Gross profit | $20 - $25 | $20 - $25 |

| Operating expenses | $122 - $127 | $122 - $127 |

Operating expenses, as adjusted2 | $101 - $106 | $110 - $115 |

| Net loss from continuing operations, net of income taxes | $(100) - $(105) | $(127) - $(137) |

Adjusted EBITDA2 | $(50) - $(55) | $(53) - $(58) |

| Capital expenditures | $10 - $15 | $15 - $20 |

Free cash flow2 | $(102) - $(107) | $(110) - $(118) |

1 Categories such as income tax expense (benefit) and changes in fair value of warrants and conversion option, stock-based compensation and significant non-recurring items may impact the actual full-year non-GAAP reconciliation for both Adjusted EBITDA and Free Cash Flow. These amounts cannot be estimated at this time.

2 Reconciliation of non-GAAP financial measures can be found in the accompanying financial tables.

Webcast

Management will hold an earnings conference call webcast at 8:30 a.m. ET today. The link to participate is available on the Investor Relations page of the Company’s website.

About Benson Hill

Benson Hill moves food forward with the CropOS® platform, a cutting-edge food innovation engine that combines data science and machine learning with biology and genetics. Benson Hill empowers innovators to unlock nature’s genetic diversity from plant to plate, with the purpose of creating nutritious, great-tasting food and ingredient options that are both widely accessible and sustainable. More information can be found at bensonhill.com or on X, formerly known as Twitter at @bensonhillinc.

Use of Non-GAAP Financial Measures

In this press release, the Company includes references to non-GAAP performance measures. The Company uses these non-GAAP financial measures to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results. The Company’s management believes these non-GAAP measures are useful in evaluating the Company’s operating performance and are similar measures reported by publicly listed U.S. competitors, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. By referencing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s performance for the periods presented. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The Company’s definition of these non-GAAP measures may differ from similarly titled measures of performance used by other companies in other industries or within the same industry. In addition, the Company has and may in the future modify how it calculates non-GAAP performance measures. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of

operations, management strongly encourages investors to review the Company’s condensed consolidated financial statements and publicly filed reports in their entirety. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the tables accompanying this press release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance and may be identified by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words, as well as the negative of such statements. These forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements include, among other things, statements regarding the Company’s current guidance regarding certain expected 2023 financial and operating results, including guidance regarding consolidated, proprietary and non-proprietary revenues, consolidated gross profit, net loss from continuing operations, Adjusted EBITDA, run rate cash savings, operating expenses and operating expenses adjustments, and free cash flow; statements regarding the Company’s current expectations and assumptions regarding the industries and markets in which it operates, including its transition to an asset-light business model to serve broadacre animal feed markets; macro-economic trends, including regarding commodity and proprietary markets and inflationary pressures; projections of market opportunity; statements regarding asset sales; statements regarding the Company’s Liquidity Improvement Plan and other cost-saving measures, actions to implement such plan, and the anticipated benefits of and timeline to implement such plans; expectations regarding revenue and gross profit mix; the Company’s ability to identify and evaluate its strategic alternatives and effect potential strategic opportunities in ways that maximize shareholder value; expectations regarding the Company’s ability to continue as a going concern; statements regarding the execution of the Company’s business plan, the strategic review of the Company’s business, and the Company’s executive leadership transition; expectations regarding future costs and uses of free cash flow; expectations regarding the unwinding of mark-to-market timing differences and the Company’s assessment of its futures contracts; any financial or other information based upon or otherwise incorporating judgments or estimates relating to future performance, events or expectations; expectations regarding the Company’s hedging and other risk management strategies, including expectations about future sales and purchases that relate to the Company’s mark-to-market adjustments and the fair valuation of futures contracts; the Company’s strategies, positioning, resources, capabilities, and expectations for future performance; estimates and forecasts of financial and other performance metrics; the Company’s outlook and financial and other guidance. Factors that may cause actual results to differ materially from current expectations and guidance include, but are not limited to: risks associated with the Company’s Liquidity Improvement Plan and other cost saving measures, including potentially adverse impacts on the Company’s business and prospects even if such plans are successful; the risk that the Company’s actions relating to its Liquidity Improvement Plan and other cost saving measures may be insufficient to achieve the objectives of such plans; liquidity and other risks relating to the Company’s ability to continue as a going concern; the risk that the Company may fail to achieve its guidance; risks associated with the Company’s ability to grow and achieve growth profitably, including continued access to the capital resources necessary for growth; risks relating to the Company’s plans to sell certain assets; the risk that the Company will be unable to renegotiate or retire any of its existing debt on favorable terms, or at all; risks relating to the failure to realize the anticipated benefits of the Company’s shelf registration statement, including its at-the-market facility, or otherwise failing to raise equity or other capital to supplement its cash needs; risks associated with the Company’s execution of its executive leadership transition, including, among others, risks relating to maintaining key employee, customer, partner and supplier relationships; risks relating to the Company’s hedging and other risk management strategies, including expectations about future sales and purchases that relate to the Company’s mark-to-market adjustments and the

fair valuation of futures contracts; the risk that the Company will not realize the anticipated benefits of the divestiture of the Fresh business; risks associated with managing capital resources; risks associated with maintaining relationships with customers and suppliers and developing and maintaining partnering and licensing relationships; risks associated with changing industry conditions and consumer preferences; risks associated with the Company’s ability to generally execute on its business strategy, including its transition to an asset-light business model to serve broadacre animal feed markets; risks associated with the effects of global and regional economic, agricultural, financial and commodities market, political, social and health conditions; the effectiveness of the Company’s risk management strategies; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our filings with the SEC, which are available on the SEC’s website at www.sec.gov. Forward-looking statements are also subject to the risks and other issues described above under “Use of Non-GAAP Financial Measures,” which could cause actual results to differ materially from current expectations included in the Company’s forward-looking statements included in this press release. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved, including without limitation, any expectations about our operational and financial performance or achievements. There may be additional risks about which the Company is presently unaware or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company expressly disclaims any duty to update these forward-looking statements, except as otherwise required by law.

###

Contacts

Investors: Ruben Mella: (314) 714-6313 / rmella@bensonhill.com

Media: Christi Dixon: (636) 359-0797 / cdixon@bensonhill.com

Benson Hill, Inc.

Material Items Included in Consolidated Revenues and Cost of Sales

(In Thousands)

Currently, the Company does not seek cash flow hedge accounting treatment for its derivative financial instruments; thus changes in fair value are reflected in current earnings.

Mark-to-market timing difference comprises the estimated net temporary impact resulting from unrealized period-end gains/losses associated with the fair valuation of futures contracts associated with the Company’s committed future operating capacity. These mark-to-market timing differences are not indicative of the Company’s operating performance.

The table below summarizes the pre-tax gains and losses related to derivatives and contract assets and liabilities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| | | Open Mark-to-Market Timing Differences |

| In Thousands | YTD Reported | | Q1 Impact | | Q2 Impact | | Q3 Impact | | YTD Impact | | YTD Excluding |

| Revenues | $ | 356,747 | | | $ | 6,725 | | | $ | (275) | | | $ | (131) | | | $ | 6,319 | | | $ | 350,428 | |

| Gross profit | $ | 16,630 | | | $ | 5,229 | | | $ | (3,110) | | | $ | 4,298 | | | $ | 6,417 | | | $ | 10,213 | |

| Total operating expenses | $ | 97,598 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 97,598 | |

| Net loss from continuing operations, net of income taxes | $ | (73,203) | | | $ | 5,229 | | | $ | (3,110) | | | $ | 4,298 | | | $ | 6,417 | | | $ | (79,620) | |

| Adjusted EBITDA | $ | (40,981) | | | $ | 5,229 | | | $ | (3,110) | | | $ | 4,298 | | | $ | 6,417 | | | $ | (47,398) | |

•See Adjusted EBITDA reconciliation in the accompanying financial tables.

Benson Hill, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(In Thousands, Except Per Share Data)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 12,041 | | | $ | 25,053 | |

| Restricted cash | 20,438 | | | 17,912 | |

| Marketable securities | 53,524 | | | 132,121 | |

| Accounts receivable, net | 37,553 | | | 28,591 | |

| Inventories, net | 30,419 | | | 62,110 | |

| Prepaid expenses and other current assets | 13,883 | | | 11,434 | |

| Current assets of discontinued operations | 555 | | | 23,507 | |

| Total current assets | 168,413 | | | 300,728 | |

| Property and equipment, net | 99,628 | | | 99,759 | |

| Finance lease right-of-use assets, net | 61,511 | | | 66,533 | |

| Operating lease right-of-use assets | 5,542 | | | 1,660 | |

| Goodwill and intangible assets, net | 7,587 | | | 27,377 | |

| Other assets | 9,838 | | | 4,863 | |

| Total assets | $ | 352,519 | | | $ | 500,920 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 14,134 | | | $ | 36,717 | |

| Finance lease liabilities, current portion | 3,935 | | | 3,318 | |

| Operating lease liabilities, current portion | 1,456 | | | 364 | |

| Long-term debt, current portion | 35,581 | | | 2,242 | |

| Accrued expenses and other current liabilities | 18,639 | | | 33,435 | |

| Current liabilities of discontinued operations | 871 | | | 16,441 | |

| Total current liabilities | 74,616 | | | 92,517 | |

| Long-term debt, less current portion | 73,596 | | | 103,991 | |

| Finance lease liabilities, less current portion | 75,399 | | | 76,431 | |

| Operating lease liabilities, less current portion | 6,333 | | | 1,291 | |

| Warrant liabilities | 1,694 | | | 24,285 | |

| Conversion option liabilities | 21 | | | 8,091 | |

| Deferred income taxes | 155 | | | 283 | |

| Other non-current liabilities | 231 | | | 129 | |

| Total liabilities | 232,045 | | | 307,018 | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value, 440,000 and 440,000 shares authorized, 207,981 and 206,668 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 21 | | | 21 | |

| Additional paid-in capital | 609,554 | | | 609,450 | |

| Accumulated deficit | (485,939) | | | (408,474) | |

| Accumulated other comprehensive loss | (3,162) | | | (7,095) | |

| Total stockholders’ equity | 120,474 | | | 193,902 | |

| Total liabilities and stockholders’ equity | $ | 352,519 | | | $ | 500,920 | |

Benson Hill, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(In Thousands, Except Per Share Data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | 113,066 | | | $ | 122,296 | | | $ | 356,747 | | | $ | 282,053 | |

| Cost of sales | 108,927 | | | 116,365 | | | 340,117 | | | 279,315 | |

| Gross profit (loss) | 4,139 | | | 5,931 | | | 16,630 | | | 2,738 | |

| Operating expenses: | | | | | | | |

| Research and development | 10,525 | | | 11,438 | | | 33,480 | | | 35,739 | |

| Selling, general and administrative expenses | 17,874 | | | 18,912 | | | 44,892 | | | 59,448 | |

| Impairment of goodwill | — | | | — | | | 19,226 | | | — | |

| Total operating expenses | 28,399 | | | 30,350 | | | 97,598 | | | 95,187 | |

| Loss from operations | (24,260) | | | (24,419) | | | (80,968) | | | (92,449) | |

| Other (income) expense: | | | | | | | |

| Interest expense, net | 7,179 | | | 6,200 | | | 20,425 | | | 16,030 | |

| | | | | | | |

| Changes in fair value of warrants and conversion option | (12,001) | | | (4,036) | | | (30,661) | | | (41,676) | |

| Other expense, net | (201) | | | (181) | | | 2,588 | | | 2,104 | |

| Total other (income) expense, net | (5,023) | | | 1,983 | | | (7,648) | | | (23,542) | |

| Net loss from continuing operations before income taxes | (19,237) | | | (26,402) | | | (73,320) | | | (68,907) | |

| Income tax expense (benefit) | 6 | | | 13 | | | (117) | | | 30 | |

| Net loss from continuing operations, net of income taxes | (19,243) | | | (26,415) | | | (73,203) | | | (68,937) | |

| Net (loss) income from discontinued operations, net of tax | 1,673 | | | (3,754) | | | (4,262) | | | (5,362) | |

| Net loss attributable to common stockholders | $ | (17,570) | | | $ | (30,169) | | | $ | (77,465) | | | $ | (74,299) | |

| | | | | | | |

| Net loss per common share: | | | | | | | |

| Basic and diluted net loss per common share from continuing operations | $ | (0.10) | | | $ | (0.14) | | | $ | (0.39) | | | $ | (0.39) | |

| Basic and diluted net loss per common share from discontinued operations | $ | 0.01 | | | $ | (0.02) | | | $ | (0.02) | | | $ | (0.03) | |

| Basic and diluted total net loss per common share | $ | (0.09) | | | $ | (0.16) | | | $ | (0.41) | | | $ | (0.42) | |

| Weighted average shares outstanding: | | | | | | | |

| Basic and diluted weighted average shares outstanding | 188,223 | | | 186,097 | | | 187,691 | | | 177,539 | |

Benson Hill, Inc.

Condensed Consolidated Statements of Comprehensive Loss (Unaudited)

(In Thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss attributable to common stockholders | $ | (17,570) | | | $ | (30,169) | | | $ | (77,465) | | | $ | (74,299) | |

| Foreign currency: | | | | | | | |

| Comprehensive income (loss) | — | | | (1) | | | — | | | (46) | |

| — | | | (1) | | | — | | | (46) | |

| Marketable securities: | | | | | | | |

| Comprehensive income (loss) | 395 | | | (1,759) | | | 875 | | | (9,918) | |

| Adjustment for net loss (income) realized in net loss | 14 | | | (97) | | | 3,058 | | | 2,132 | |

| 409 | | | (1,856) | | | 3,933 | | | (7,786) | |

| Total other comprehensive income (loss) | 409 | | | (1,857) | | | 3,933 | | | (7,832) | |

| Total comprehensive loss | $ | (17,161) | | | $ | (32,026) | | | $ | (73,532) | | | $ | (82,131) | |

Benson Hill, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In Thousands)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Operating activities | | | |

| Net loss | $ | (77,465) | | | $ | (74,299) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 16,056 | | | 16,504 | |

| Stock-based compensation expense | (347) | | | 15,771 | |

| Bad debt expense | (263) | | | 724 | |

| Changes in fair value of warrants and conversion option | (30,661) | | | (41,676) | |

| Accretion and amortization related to financing activities | 6,624 | | | 8,481 | |

| | | |

| Realized losses on sale of marketable securities | 3,058 | | | 2,132 | |

| Impairment of goodwill | 19,226 | | | — | |

| Other | 1,815 | | | 4,180 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (3,073) | | | (7,208) | |

| Inventories | 43,323 | | | 6,441 | |

| Other assets and other liabilities | (4,170) | | | 8,052 | |

| Accounts payable | (32,306) | | | (6,093) | |

| Accrued expenses | (15,685) | | | 2,604 | |

| Net cash used in operating activities | (73,868) | | | (64,387) | |

| Investing activities | | | |

| Purchases of marketable securities | (87,619) | | | (350,333) | |

| Proceeds from maturities of marketable securities | 66,193 | | | 109,514 | |

| Proceeds from sales of marketable securities | 99,838 | | | 170,217 | |

| Purchase of property and equipment | (10,127) | | | (11,835) | |

| Acquisition, net of cash acquired | — | | | (1,044) | |

| Proceeds from divestiture of discontinued operations | 2,378 | | | — | |

| Proceeds from an insurance claim from a prior business acquisition | 1,533 | | | — | |

| Other | 41 | | | — | |

| Net cash provided by (used in) investing activities | 72,237 | | | (83,481) | |

| Financing activities | | | |

Contributions from PIPE Investment, net of transaction costs $3,761 in 2022 | — | | | 80,825 | |

| | | |

| Repayments of long-term debt | (4,874) | | | (6,736) | |

| Proceeds from issuance of long-term debt | — | | | 24,078 | |

| Payments of debt issuance costs | (2,000) | | | (38) | |

| Borrowing under revolving line of credit | — | | | 18,970 | |

| Repayments under revolving line of credit | — | | | (19,017) | |

| Payments of finance lease obligations | (2,428) | | | (1,103) | |

| Proceeds from exercise of stock awards, net of withholding taxes | 249 | | | 1,950 | |

| | | |

| Net cash (used in)/provided by financing activities | (9,053) | | | 98,929 | |

| Effect of exchange rate changes on cash | — | | | (46) | |

| Net decrease in cash and cash equivalents | (10,684) | | | (48,985) | |

| Cash, cash equivalents and restricted cash, beginning of period | 43,321 | | | 78,963 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 32,637 | | | $ | 29,978 | |

| | | | | | | | | | | | | | |

| Supplemental disclosure of cash flow information | | | | |

| Cash paid for taxes | | $ | 35 | | | $ | 1 | |

| Cash paid for interest | | $ | 14,523 | | | $ | 9,864 | |

| Supplemental disclosure of non-cash activities | | | | |

| | | | |

| | | | |

| PIPE Investment issuance costs included in accrued expenses and other current liabilities | | | | |

| Purchases of property and equipment included in liabilities | | $ | 125 | | | $ | 2,710 | |

| | | | |

| Financing leases commencing in the period | | $ | — | | | $ | 806 | |

Benson Hill, Inc.

Non-GAAP Reconciliation

(In Thousands)

This press release contains financial measures not derived in accordance with generally accepted accounting principles (“GAAP”). Reconciliations to the most comparable GAAP measures are provided below. The Company defines Adjusted EBITDA as net loss from continuing operations excluding income taxes, interest, depreciation, amortization, stock-based compensation, changes in fair value of warrants and conversion options, realized (gains) losses on marketable securities, goodwill, and long-lived asset impairment, restructuring-related costs (including severance costs) and the impact of significant non-recurring items. The Company defines free cash flow as net cash used in (provided by) operating activities minus capital expenditures. The Company defines operating expenses, as adjusted as operating expenses excluding expenses incurred in relation to the transition to an asset-light business model and significant non-recurring items.

Adjustments to reconcile net loss from our continuing operations to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss from continuing operations, net of income taxes | $ | (19,243) | | | $ | (26,415) | | | $ | (73,203) | | | $ | (68,937) | |

| Interest expense, net | 7,179 | | | 6,200 | | | 20,425 | | | 16,030 | |

| Income tax expense (benefit) | 6 | | | 13 | | | (117) | | | 30 | |

| Depreciation and amortization | 5,460 | | | 5,052 | | | 16,056 | | | 14,992 | |

| Stock-based compensation | 867 | | | 4,412 | | | (392) | | | 15,771 | |

| Changes in fair value of warrants and conversion option | (12,001) | | | (4,036) | | | (30,661) | | | (41,676) | |

| Impairment of goodwill | — | | | — | | | 19,226 | | | — | |

| Severance | 386 | | | 185 | | | 1,624 | | | 474 | |

| Other | 3,187 | | | (95) | | | 6,061 | | | 3,489 | |

| Total Adjusted EBITDA | $ | (14,159) | | | $ | (14,684) | | | $ | (40,981) | | | $ | (59,827) | |

Adjustments to reconcile estimated 2023 net loss from continuing operations to the estimated Adjusted EBITDA:

| | | | | | | | | | | |

| 2023 Estimate* |

| Consolidated net loss from continuing operations | $ | (100,000) | | to | $ | (105,000) | |

| Interest expense, net | 36,000 | | to | 38,000 | |

| Depreciation and amortization | 21,000 | | to | 25,000 | |

| Stock-based compensation | 3,000 | | to | 5,000 | |

| Change in fair value of warrants and conversion option | (31,000) | | to | (31,000) | |

| Impairment of goodwill | 19,000 | | to | 19,000 | |

| Severance | 2,000 | | | 4,000 | |

| Other | — | | | (10,000) | |

| Total Adjusted EBITDA | $ | (50,000) | | to | $ | (55,000) | |

Adjustments to reconcile the estimated 2023 free cash flow:

| | | | | | | | | | | |

| 2023 Estimate* |

| Consolidated net loss from continuing operations | $ | (100,000) | | to | $ | (105,000) | |

| Depreciation and amortization | 21,000 | | to | 25,000 | |

| Stock-based compensation | 3,000 | | to | 5,000 | |

| Impairment of goodwill | 19,000 | | to | 19,000 | |

| Change in fair value of warrants and conversion option | (31,000) | | | (31,000) | |

| Changes in working capital | (1,000) | | to | (5,000) | |

| Other | (3,000) | | to | — | |

| Net Cash Used in Operating Activities | $ | (92,000) | | to | $ | (92,000) | |

| Payments for the acquisition of property and equipment | (10,000) | | to | (15,000) | |

| Free Cash Flow | $ | (102,000) | | to | $ | (107,000) | |

*

* Categories such as income tax expense (benefit) and changes in fair value of warrants and conversion option, stock-based compensation and significant non-recurring items may impact the actual full-year non-GAAP reconciliation for both Adjusted EBITDA and Free Cash Flow. These amounts cannot be estimated at this time.

Adjustments to reconcile operating expenses to operating expenses, as adjusted:

| | | | | | | | | | | |

| 2023 Estimate |

| Operating expenses | $ | 122,000 | | to | $ | 127,000 | |

| Non-cash stock-based compensation | 8,000 | | to | 8,000 | |

| Goodwill impairment | (19,000) | | to | (19,000) | |

| Exit costs related to divestiture of Seymour facility | (4,000) | | to | (4,000) | |

| Advisory fees related to business evolution | (4,000) | | to | (4,000) | |

| Severance and other | (2,000) | | to | (2,000) | |

| Operating expenses, as adjusted | $ | 101,000 | | to | $ | 106,000 | |

NOVEMBER 9, 2023 THIRD QUARTER EARNINGS UPDATE Exhibit 99.2

2 CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS Certain statements in this presentation may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or the future financial or operating performance of Benson Hill Inc. (the “Company” or “Benson Hill”) and may be identified by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. These forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements include, among other things, statements regarding the Company’s current business model and go-to- market strategy, its plans to transition that business model and go-to-market strategy and the anticipated benefits, challenges, and potential timeline associated with such transition; statements regarding management’s strategy and plans for growth; statements regarding the Company’s plans to improve the Company’s capital structure and liquidity position, including by divesting assets, reducing operating and capital expenses, and paying off its debt, and the anticipated timeline to achieve such objectives; projections of market opportunity and statements regarding potential market capture; statements regarding planned sources and uses of cash; statements regarding projected CAPEX, OPEX, and working capital and guidance for 2023 operating and financial results; statements regarding the Company’s liquidity improvement plans and other cost-saving measures, actions to implement such plans, and the anticipated benefits of such plans; the Company’s ability to identify and evaluate its strategic alternatives and effect potential strategic opportunities in ways that maximize shareholder value; expectations regarding the Company’s ability to continue as a going concern; statements regarding the Company’s current expectations and assumptions regarding the industries and markets in which it currently and may operate, and macro-economic trends; statements regarding the traits and benefits of the Company’s current product pipeline and anticipated product portfolio; statements regarding anticipated acreage needs, and the benefits from and costs of acreage growth; anticipated benefits of the Company’s existing and potential future strategic partnerships and licensing strategies; the Company’s plans to achieve profitability and potential timeline therefor; expectations regarding sources of consolidated revenue and gross profit, and expectations for gross margin growth, including with respect to current and new product categories, such as animal feed; the Company’s positioning, resources, capabilities, and expectations for future performance; the projected environmental impact and sustainability of the Company’s operations; and projections of consumer preferences, industry trends and market opportunity, including with respect to the animal feed market. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, risks associated with the Company’s transition of its business model and go-to-market strategy, its liquidity improvement plans and other cost saving measures; the risk that the Company’s may be unable to successfully implement its plans relating to its business model and go-to-market transition, and liquidity improvement plans and other cost saving measures, or that, even if such transition and plans are successfully implemented, such plans may be insufficient to achieve the objectives of such plans, or that there may be adverse impacts on the Company’s business and prospects from such plans; liquidity and other risks relating to the Company’s ability to continue as a going concern; risks associated with the Company’s ability to grow and achieve growth profitably, including continued access to the capital resources necessary for growth and to implement its transition and other plans in a timely manner; the risk that the Company will be unable to service, renegotiate or retire any of its existing debt, or to maintain compliance with applicable debt covenants; the risk that the Company’s actions intended to achieve profitability are insufficient; the risk that the Company fails to achieve its provided guidance; risks associated with the successfully developing new products and commercializing the Company’s product pipeline, entry into new markets and expansion of current markets; the risk that the Company will not complete, or realize the anticipated benefits of, the divestiture of its processing assets; risks associated with managing capital resources; risks associated with financial forecasts; risks associated with maintaining relationships with customers and suppliers and developing and maintaining partnership and licensing relationships; risks associated with changing industry and market conditions and consumer preferences; risks associated with the Company’s ability to generally execute on its business strategy; risks associated with the effects of global and regional economic, agricultural, financial and commodities markets; the effectiveness of the Company’s risk management strategies; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our filings with the SEC, which are available on the SEC’s website at www.sec.gov. There may be additional risks about which the Company is presently unaware or that the Company currently believes are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved. The Company expressly disclaims any duty to update these forward-looking statements, except as otherwise required by law. USE OF NON-GAAP FINANCIAL MEASURES In this presentation, the Company includes references to non-GAAP performance measures. The Company uses these non-GAAP financial measures to facilitate management’s financial and operational decision making, including evaluation of the Company’s historical operating results. The Company’s management believes these non-GAAP measures are useful in evaluating the Company’s operating performance and are similar measures reported by publicly listed U S competitors, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. By referencing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s performance for the periods presented. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The Company’s definition of these non-GAAP measures may differ from similarly titled measures of performance used by other companies in other industries or within the same industry. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, the Company's management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the tables accompanying this presentation. Disclaimers

The current ag industry model cannot address the increase in demand More efficient sources of nutrition are needed across the food chain Failing to leverage more efficient sources of nutrition will have significant emissions implications Plant-based proteins will play a pivotal role in providing sustainable nutrition for a growing population Sources: 1 Zintinus, Bain & Co. “Food Tech: Turning Promise into Opportunity”, JUNE 2022 ; World Resources Institute 2 Good Food Institute, Plant-Based Meat for a Growing World 3 Henchion et. al, “Future Protein Supply and Demand”, Foods 2017, 6, 53; doi:10.3390/foods6070053 Addressing Key Global Nutrition Security and Climate Goals Presents a Significant Opportunity for Plant-Based Proteins We need to increase food production globally by 56% to feed approximately 10 billion people by 20501 56% Up To 70% Agriculture emissions could reach 4x by 2050, missing our chance at a 2°C level world1 4x Plant-based protein alternatives use 47%–99% less land, emit 30%–90% less GHG, use 72%– 99% less water2 30-90% Protein needs to increase by up to 70% to keep up with exponential demand3 3

Partners enable instant market access and global reach Genetic Innovation has a Multiplier Effect on Value 4

5 Benson Hill is taking proactive action to retire debt, ensure liquidity, and extend runway…These measures will fully fund the business for 24-36 months Product-market fit / value proposition Poultry - Broiler Poultry - Layer Turkey Swine - Grower Swine - Nursery Aqua Pet SPC - Meat extension Soy Flour ISP - Alt. meat ISP - Sports / nutrition High oleic oil Biofuels1 NEW STRATEGIC PRIORITIESEXISTING MARKETS AND ADDITIONAL OPPORTUNITIES Market attractiveness SECONDARY OPPORTUNITIES ~28M ~5M Total addressable US acres in new strategic priorities Additional addressable acres in secondary opportunities Relative TAM, 2030 M acres 1. Scaled down for illustration purpose Animal Oil Human ISP=Isolate Soy Protein; SPC=Soy Protein Concentrate Source: USDA, FAOSTAT, Industry reports, Expert interviews, Press search Our innovation portfolio provides a compelling value proposition to expand our footprint into the largest soy protein markets

6 * UHP-LO’s value proposition is particularly pronounced for mono-gastric animals (not ruminants) including turkey, chicken, and swine UHP-LO is a game-changer for animal producers and ready today Source: Expert Interviews, UHP-LO trials with animal producers Reduced cost of feed – less soybean meal required to meet nutritional requirements Low oligosaccharide content* (Oligosaccharides are sugars that are hard to break down during digestion) Improved energy density of soybean meal by replacing undigestible sugars with sucrose Improved digestibility of feed – especially for development of young animals Improved amino acid profile (Part of trait pipeline) Higher relative share of critical amino acids for growth – reducing dependence on synthetic additives ~20% higher protein content Reduces animal producer total formula costs - Demand is real, and UHP-LO is uniquely advantaged TAM - U.S. Soybean acres in poultry and swine28M ACRES Current UHP-LO output traits exceed nearest competitor targets Trait 2023 UHP-LO 2027 UHP-LO Projected Increased Protein Content ~20% 20-25% Enhanced Amino Acids ✔ ✔ Reduced Anti-Nutritionals (Low Oligosaccharides - Raffinose, Stachyose) <0.5% <0.5% Yield (% commodity) 93% ~97% Herbicide Tolerance (HT) Non-GMO HT Specialty protein with enhanced amino acids target Achieving greater than 10% increase protein content. Increased Methionine, reduced anti-nutritionals. — Corteva Agriscience R&D Innovation update – May 9, 2023 The companies expect to commercialize these soybean varieties by late this decade. — Corteva Agriscience and Bunge – March 9, 2022 ”“ 1 2 INNOVATION PLATFORM EXAMPLE

At its core, Benson Hill is a leader in AI driven seed innovation utilizing proprietary genetics Proprietary protein, genomic, and strategic data layers for predictive breeding using Artificial Intelligence (AI) and Machine Learning (ML) World-leading eMerge soy and proprietary yellow-pea protein germplasm Acquired 2019 Launched 2016 Launched 2021 Indoor year-round speed breeding and rapid prototyping facility …resulting in a complete and market leading toolbox to deliver seed innovations of the future. 7

8 Actions expected over the coming months 1 DIVEST MANUFACTURING ASSETS Sold Seymour, IN soy crush facility for $36M in total gross proceeds, subject to adjustments 2 CREATE 12-MONTH+ LIQUIDITY RUNWAY Expect $170M-$200M of cash from Liquidity Improvement actions to retire senior convertible debt and help fund the business FORM PARTNERSHIPS AND LICENSING AGREEMENTS 3 Enable entry into U.S. animal feed markets

Confidential Information – Not For Distribution 9 2023 harvest nearly complete

10 2.0 0.5 1.0 1.5 3.5 4.0 2.5 3.0 4.5 5.0 5.5 6.0 6.5 7.0 2024 2025 2026 2027 2028 2029 2030 Licensing parter for animal feed1 Licensing partner for food ingredients BH direct sale for food ingedients BH direct sale for animal feed Commercial piloting in turkey and “all-veg” chicken “Inflection point” and commercial launch for broilers & layers 1. Includes aquaculture and pet food Introduction of herbicide tolerance <20% <20% 20% 30% 50% 60% 70% Share of revenue from animal feed New licensing model expected to unlock growth through broadacre access Peak ramp-up UHP-LO US Acres (M) for Domestic Consumption Accessed by Benson Hill Technology U S Ac re s f or D om es tic C on su m pt io n (M ) Acre adoption outlook for Benson Hill genetics to enter animal feed

11 Benson Hill’s obtainable acres long term End market value creation per acre 6.5M acres $100-230 per acre3 1. Includes US end markets for broilers, layers, turkey, swine, salmon, pet food, human ingredients, and high-oleic oil 2. E.g., based on share of production under consolidated, commercial-scale processing and animal systems 3. Value creation varies by end market; In animal feed in particular, value creation varies by species (e.g., Turkey vs. Broiler) and type of feed/diet (e.g., Grower vs. Nursery) Source: USDA, FAOSTAT, Industry reports, Expert interviews, Press search Potential total market value created long-term $0.7-1.5 billion Value of Benson Hill genetics in the US soy market for domestic consumption Accessing only a share of serviceable acres could create total long-term value

12 3Q’23 Financial Results 3Q’23 Performance Adequate liquidity position as of 9/30/23 Revenue Proprietary revenues increased because of soybean sales into the commodity markets, while non- proprietary revenues declined approximately 17% due to an unfavorable comparison to peak crush margins in 3Q’22 Gross Profit Gross profit impacted by unfavorable proprietary margins and non- recurring repair and maintenance costs Operating Expense Recurring OPEX decline was driven by actions taken through the Liquidity Improvement Plan Third Quarter Ended September 30, 2023 Prior Year Comparison (Excluding Timing Differences) (Unaudited) (USD in Millions) Excludes Fresh Business1 Reported Impact of Open Mark-to-Market Timing difference Excl Open Mark-to- Market Timing Differences 3Q ’22 Results2 3Q ’23 vs 3Q ’22 Consolidated Revenue $113.1 $0.1 $113.2 $119.0 (4.9)% Proprietary $33.1 $33.1 $26.0 27.2% Consolidated Gross Profit $4.1 $(4.3) $(0.2) $4.5 (103.5)% Operating Expenses $28.4 $28.4 $30.4 (6.4)% Operating Expenses, as Adjusted.2 $25.9 $25.9 $30.4 (6.4)% Net Loss from Continuing Operations (Net of Income Tax) $(19.2) $(4.3) $(23.5) $(27.8) $4.3 Total Adj. EBITDA2 $(14.2) $(4.3) $(18.5) $(16.1) $(2.4) Capital Expenditures $3.2 $3.2 $5.0 $(1.8) Free Cash Flow Loss2 $(29.1) $(29.1) $(5.4) $(23.7) Cash, Restricted Cash and Marketable Securities (as of September 30, 2023)3 $86.2 1. The Fresh business was divested on June 30, 2023. 2. See the reconciliation table in the Appendix. 3. Includes cash from both continuing and discontinued operations.

13 Liquidity Improvement actions enable efficient cash utilization * Subject to the timing of facility sales and excludes one-time costs in 2023 $102M $92M - $97M $55M - $60M (includes ~$10M in annual public company costs) Cash OPEX + CAPEX 2022 2023 2024 $64M $60M - $65M $35M - $40MNet Working Capital*

14 Improved 2023 Guidance 2023 Guidance ($ USD millions) Excludes Fresh Business1 November 9 August 9 Consolidated Revenue $440 - $450 $390 - $430 Proprietary $100 - $110 $100 - $110 Consolidated Gross Profit $20 - $25 $20 - $25 Operating Expenses $122 - $127 $122 - $127 Operating Expenses, as Adjusted $101 - $106 $110 - $115 Net Loss from Continuing Operations (Net of Income Tax) $(100) - $(105) $(127) - $(137) Total Adjusted EBITDA2 $(50) - $(55) $(53) - $(58) Capital Expenditures $10 - $15 $15 - $20 Free Cash Flow Loss2 $(102) - $(107) $(110) - $(118) 2023 Performance Drivers Revenue Upside driven by short-term supply agreement for soy white flake ingredients and the sale of certain non-core licensing technologies Gross profit Maintaining range as non-recurring items in the quarter offset impacts from market headwinds Operating Expense Realizing cost savings from the Liquidity Improvement Plan 1. The Fresh business was divested on June 30, 2023. 2. See the reconciliation table in the Appendix.

15 Closing comments: Improved guidance for 2023 Paying down approximately 50% of senior convertible debt in November, 2023 Market headwinds reinforce the strategy to accelerate the transition to an asset-light business and entry into the attractive animal feed markets

APPENDIX 16

17 Nine Months Financial Results 1. The Fresh business was divested on June 30, 2023. 2. See the reconciliation table in the Appendix. First Nine Months Performance Revenue Year-over-year increase driven by proprietary sales into aquaculture market and grain sales into the commodity markets in response to weaker demand from market headwinds Gross Profit Gross profit performance was partially offset by unfavorable margins for proprietary sales into the commodity markets and unplanned repair and maintenance costs Operating Expenses Recurring OPEX decline driven by Liquidity Improvement Plan savings Nine Months Ended September 30, 2023 Prior Year Comparison (Excluding Timing Differences) (Unaudited) (USD in Millions) Excludes Fresh Business1 Reported Impact of Open Mark-to-Market Timing Differences Excluding Open Mark-to-Market Timing Differences 3Q '22 Results2 3Q'23 vs 3Q'22 Consolidated Revenue $356.7 $(6.3) $350.4 $279.9 25.2% Proprietary $77.0 $77.0 $52.3 47.3% Consolidated Gross Profit $16.6 $(6.4) $10.2 $4.3 136.9% Operating Expenses $97.6 $97.6 $95.2 2.5% Operating Expenses, as Adjusted2 $80.3 $80.3 $95.2 (15.7)% Net Loss from Continuing Operations (Net of Income Tax) $(73.2) $(6.4) $(79.6) $(67.4) $(12.3) Total Adj. EBITDA2 $(41.0) $(6.4) $(47.4) $(58.3) $10.9 Capital Expenditures $10.1 $10.1 $7.5 $2.6 Free Cash Flow Loss2 $(86.3) $(86.3) $(71.2) $(15.1)

18 Third Quarter 2022 Results Third Quarter Ended September 30, 2022 (Unaudited) (USD in millions) Excludes Fresh Business Reported Impact of Open Mark-to-Market Timing difference Excl Open Mark-to- Market Timing Differences Consolidated Revenue $122.3 $(3.3) $119.0 Proprietary $26.0 $26.0 Consolidated Gross Profit $5.9 $(1.4) $4.5 Operating Expenses $30.4 $30.4 Net Loss from Continuing Operations (Net of Income Tax) $(26.4) $(1.4) $(27.8) Total Adj. EBITDA $(14.7) $(1.4) $(16.1) Nine Months 2022 Results Nine Months Ended September 30, 2022 (Unaudited) (USD in millions) Excludes Fresh Business Reported Impact of Open Mark-to-Market Timing difference Excl Open Mark-to- Market Timing Differences Consolidated Revenue $282.1 $(2.2) $279.9 Proprietary $52.3 $52.3 Consolidated Gross Profit $2.7 $1.6 $4.3 Operating Expenses $95.2 $95.2 Net Loss from Continuing Operations (Net of Income Tax) $(68.9) $(1.6) $(67.4) Total Adj. EBITDA $(59.8) $(1.6) $(58.3)

• 19 Condensed Consolidated Statements of Operations (unaudited) (USD in thousands, except per share information) Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Revenues $ 113,066 $ 122,296 356,747 282,053 Cost of sales 108,927 116,365 340,117 279,315 Gross profit (loss) 4,139 5,931 16,630 2,738 Operating expenses: Research and development 10,525 11,438 33,480 35,739 Selling, general and administrative expenses 17,874 18,912 44,892 59,448 Impairment of goodwill — — 19,226 — Total operating expenses 28,399 30,350 97,598 95,187 Loss from operations (24,260) (24,419) (80,968) (92,449) Other (income) expense: Interest expense, net 7,179 6,200 20,425 16,030 Changes in fair value of warrants and conversion option (12,001) (4,036) (30,661) (41,676) Other expense, net (201) (181) 2,588 2,104 Total other (income) expense, net (5,023) 1,983 (7,648) (23,542) Net loss from continuing operations before income taxes (19,237) (26,402) (73,320) (68,907) Income tax expense (benefit) 6 13 (117) 30 Net loss from continuing operations, net of income taxes (19,243) (26,415) $ (73,203) $ (68,937) Net income (loss) from discontinued operations, net of income taxes 1,673 (3,754) (4,262) (5,362) Net loss attributable to common stockholders $ (17,570) $ (30,169) $ (77,465) $ (74,299) Net loss per common share: Basic and diluted net loss per common share from continuing operations $ (0.10) $ (0.14) $ (0.39) $ (0.39) Basic and diluted net loss per common share from discontinued operations $ 0.01 $ (0.02) $ (0.02) $ (0.03) Basic and diluted total net loss per common share $ (0.09) $ (0.16) $ (0.41) $ (0.42) Weighted average shares outstanding: Basic and diluted weighted average shares outstanding 188,223 186,097 187,691 177,539 19

20 Condensed Consolidated Balance Sheets (unaudited) September 30, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 12,041 $ 25,053 Restricted cash 20,438 17,912 Marketable securities 53,524 132,121 Accounts receivable, net 37,553 28,591 Inventories, net 30,419 62,110 Prepaid expenses and other current assets 13,883 11,434 Current assets of discontinued operations 555 23,507 Total current assets 168,413 300,728 Property and equipment, net 99,628 99,759 Finance lease right-of-use assets, net 61,511 66,533 Operating lease right-of-use assets 5,542 1,660 Goodwill and intangible assets, net 7,587 27,377 Other assets 9,838 4,863 Total assets $ 352,519 $ 500,920 September 30, 2023 December 31, 2022 Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 14,134 $ 36,717 Finance lease liabilities, current portion 3,935 3,318 Operating lease liabilities, current portion 1,456 364 Long-term debt, current portion 35,581 2,242 Accrued expenses and other current liabilities 18,639 33,435 Current liabilities of discontinued operations 871 16,441 Total current liabilities 74,616 92,517 Long-term debt, less current portion 73,596 103,991 Finance lease liabilities, less current portion 75,399 76,431 Operating lease liabilities, less current portion 6,333 1,291 Warrant liabilities 1,694 24,285 Conversion option liabilities 21 8,091 Deferred income taxes 155 283 Other non-current liabilities 231 129 Total liabilities 232,045 307,018 Stockholders’ equity: Common stock, $0.0001 par value, 440,000 and 440,000 shares authorized, 207,981 and 206,668 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively 21 21 Additional paid-in capital 609,554 609,450 Accumulated deficit (485,939) (408,474) Accumulated other comprehensive loss (3,162) (7,095) Total stockholders’ equity 120,474 193,902 Total liabilities and stockholders’ equity $ 352,519 $ 500,920

21 Condensed Consolidated Statements of Cash Flows (unaudited) Nine Months Ended September 30, 2023 2022 Operating activities Net loss $ (77,465) $ (74,299) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 16,056 16,504 Stock-based compensation expense (347) 15,771 Bad debt expense (263) 724 Changes in fair value of warrants and conversion option (30,661) (41,676) Accretion and amortization related to financing activities 6,624 8,481 Realized losses on sale of marketable securities 3,058 2,132 Impairment of goodwill 19,226 — Other 1,815 4,180 Changes in operating assets and liabilities: Accounts receivable (3,073) (7,208) Inventories 43,323 6,441 Other assets and other liabilities (4,170) 8,052 Accounts payable (32,306) (6,093) Accrued expenses (15,685) 2,604 Net cash used in operating activities (73,868) (64,387) Investing activities Purchases of marketable securities (87,619) (350,333) Proceeds from maturities of marketable securities 66,193 109,514 Proceeds from sales of marketable securities 99,838 170,217 Purchase of property and equipment (10,127) (11,835) Acquisition, net of cash acquired — (1,044) Proceeds from divestiture of discontinued operations 2,378 — Proceeds from an insurance claim from a prior business acquisition 1,533 — Other 41 — Net cash provided by (used in) investing activities 72,237 (83,481) Nine Months Ended September 30, 2023 2022 Financing activities Contributions from PIPE Investment, net of transaction costs $3,761 in 2022 — 80,825 Repayments of long-term debt (4,874) (6,736) Proceeds from issuance of long-term debt — 24,078 Payments of debt issuance costs (2,000) (38) Borrowing under revolving line of credit — 18,970 Repayments under revolving line of credit — (19,017) Payments of finance lease obligations (2,428) (1,103) Proceeds from exercise of stock awards, net of withholding taxes 249 1,950 Net cash (used in)/provided by financing activities (9,053) 98,929 Effect of exchange rate changes on cash — (46) Net decrease in cash and cash equivalents (10,684) (48,985) Cash, cash equivalents and restricted cash, beginning of period 43,321 78,963 Cash, cash equivalents and restricted cash, end of period $ 32,637 $ 29,978 Supplemental disclosure of cash flow information Cash paid for taxes $ 35 $ 1 Cash paid for interest $ 14,523 $ 9,864 Supplemental disclosure of non-cash activities PIPE Investment issuance costs included in accrued expenses and other current liabilities Purchases of property and equipment included in liabilities $ 125 $ 2,710 Financing leases commencing in the period $ — $ 806

Non-GAAP Reconciliation1 1 The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its divestiture. The following financial measures used in this presentation are not derived in accordance with generally accepted accounting principles (“GAAP”). Reconciliations to the most comparable GAAP measures are provided below. e define Adjusted EBITDA as net loss from continuing operations excluding income taxes, interest, depreciation, amortization, stock-based compensation, changes in fair value of warrants and conversion option, realized (gains) losses on marketable securities, goodwill and long-lived asset impairment, restructuring-related costs (including severance costs) and the impact of significant non-recurring items. The Company defines free cash flow as net cash used in (provided by) operating activities minus capital expenditures. Categories such as income tax expense (benefit), changes in fair value of warrants and conversion option, and significant non-recurring items may impact the actual full-year non-GAAP reconciliation for Adjusted EBITDA and Free Cash Flow. These amounts cannot be estimated at this time. Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Net loss from continuing operations, net of income taxes $ (19,243) $ (26,415) $ (73,203) $ (68,937) Depreciation and amortization 5,460 5,052 16,056 14,992 Stock-based compensation 867 4,412 (392) 15,771 Changes in fair value of warrants and conversion option (12,001) (4,036) (30,661) (41,676) Impairment of goodwill 0 0 19,226 0 Change in working capital (3,501) 17,957 (19,792) 1,592 Other 2,442 2,651 12,587 14,498 Net Cash Used on Operating Activities (25,976) (379) (76,179) (63,760) Purchase of property and equipment (3,171) (4,979) (10,127) (7,487) Free Cash Flow $ (29,147) $ (5,358) $ (86,306) $ (71,247) Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Net loss from continuing operations, net of income taxes $ (19,243) $ (26,415) $ (73,203) $ (68,937) Interest expense, net 7,179 6,200 20,425 16,030 Income tax expense (benefit) 6 13 (117) 30 Depreciation and amortization 5,460 5,052 16,056 14,992 Stock-based compensation 867 4,412 (392) 15,771 Changes in fair value of warrants and conversion option (12,001) (4,036) (30,661) (41,676) Impairment of goodwill — — 19,226 — Severance 386 185 1,624 474 Other 3,187 (95) 6,061 3,489 Total Adjusted EBITDA $ (14,159) $ (14,684) $ (40,981) $ (59,827) (USD in thousands) 22

Non-GAAP Reconciliation1 1 The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its divestiture. (USD in thousands) The following financial measures used in this presentation are not derived in accordance with generally accepted accounting principles (“GAAP”). Reconciliations to the most comparable GAAP measures are provided below. The Company defines operating expenses, as adjusted as operating expenses excluding expenses incurred in relation to the transition to an asset-light business model and significant non-recurring items Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Operating Expenses $ 28,399 $ 30,350 $ 97,598 $ 95,187 Non-cash stock-based compensation 1,600 — 7,800 — Goodwill impairment — — (19,200) — Exit costs related to divestiture of Seymour facility — — — — Advisory fees related to business evolution (1,200) — (1,200) — Severance and other (2,908) — (4,715) — Operating expenses, as adjusted $ 25,891 $ 30,350 $ 80,283 $ 95,187 23

2023E Consolidated net loss from continuing operations $ (100) – $ (105) Interest expense, net 36 – 38 Depreciation and amortization 21 – 25 Stock-based compensation 3 – 5 Change in fair value of warrants and conversion option (31) -31 Impairment of goodwill 19 19 Severance 2 – 4 Other — – (10) Total Adjusted EBITDA $ (50) – $ (55) Non-GAAP Reconciliation1 This presentation contains financial measures not derived in accordance with generally accepted accounting principles (“GAAP”). Reconciliations to the most comparable GAAP measures are provided below. The Company defines Adjusted EBITDA as net loss from continuing operations excluding income taxes, interest, depreciation, amortization, stock-based compensation, changes in fair value of warrants and conversion option, realized (gains) losses on marketable securities, goodwill and long-lived asset impairment, restructuring-related costs (including severance costs) and the impact of significant non-recurring items. The Company defines free cash flow as net cash used in (provided by) operating activities minus capital expenditures. Categories such as income tax expense (benefit), changes in fair value of warrants and conversion option, and significant non-recurring items may impact the actual full-year non-GAAP reconciliation for Adjusted EBITDA and Free Cash Flow. These amounts cannot be estimated at this time. ($ USD millions) 1 The expected and actual results in 2023 and preliminary 2024 outlook exclude the Fresh business divested on June 30, 2023. 24

2023E Consolidated net loss from continuing operations $ (100) – $ (105) Depreciation and amortization 21 – 25 Stock-based compensation 3 – 5 Impairment of goodwill 19 – 19 Change in fair value of warrants and conversion option (31) – (31) Changes in working capital (1) -5 Other (3) – 0 Net Cash Used in Operating Activities $ (92) – $ (92) Payments for the acquisition of property and equipment (10) – (15) Free Cash Flow $ (102) – $ (107) 2023E Operating expenses $ 122 – $ 127 Non-cash stock-based compensation 8 – 8 Goodwill impairment (19) – -19 Exit costs related to divestiture of Seymour facility (4) – (4) Advisory fees related to business evolution (4) – (4) Severance (2) – -2 Operating expenses with adjustments $ 101 – $ 106 Non-GAAP Reconciliation1 This presentation contains financial measures not derived in accordance with generally accepted accounting principles (“GAAP”). Reconciliations to the most comparable GAAP measures are provided below. The Company defines Adjusted EBITDA as net loss from continuing operations excluding income taxes, interest, depreciation, amortization, stock-based compensation, changes in fair value of warrants and conversion option, realized (gains) losses on marketable securities, goodwill and long-lived asset impairment, restructuring-related costs (including severance costs) and the impact of significant non-recurring items. The Company defines free cash flow as net cash used in (provided by) operating activities minus capital expenditures. Categories such as income tax expense (benefit), changes in fair value of warrants and conversion option, and significant non-recurring items may impact the actual full-year non-GAAP reconciliation for Adjusted EBITDA and Free Cash Flow. These amounts cannot be estimated at this time. ($ USD millions) 1 The expected and actual results in 2023 and preliminary 2024 outlook exclude the Fresh business divested on June 30, 2023. 25

v3.23.3

Cover

|

Nov. 09, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

BENSON HILL, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39835

|

| Entity Tax Identification Number |

85-3374823

|

| Entity Address, Address Line One |

1001 North Warson Rd.

|

| Entity Address, City or Town |

St. Louis

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63132

|

| City Area Code |

314

|

| Local Phone Number |

222-8218

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Central Index Key |

0001830210

|

| Amendment Flag |

false

|

| Entity Ex Transition Period |

false

|

| Common stock, $0.0001 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, $0.0001 par value

|

| Trading Symbol |

BHIL

|

| Security Exchange Name |

NYSE

|

| Warrants exercisable for one share of common stock at an exercise price of $11.50 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants exercisable for one share of common stock at an exercise price of $11.50

|

| Trading Symbol |

BHIL WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |