000183021012-312023Q3falseP1DP1DP1DP4M00018302102023-01-012023-09-300001830210us-gaap:CommonClassAMember2023-01-012023-09-300001830210bhil:WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockMember2023-01-012023-09-3000018302102023-11-07xbrli:shares00018302102023-09-30iso4217:USD00018302102022-12-31iso4217:USDxbrli:shares00018302102023-07-012023-09-3000018302102022-07-012022-09-3000018302102022-01-012022-09-300001830210us-gaap:CommonStockMember2022-12-310001830210us-gaap:AdditionalPaidInCapitalMember2022-12-310001830210us-gaap:RetainedEarningsMember2022-12-310001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001830210us-gaap:CommonStockMember2023-01-012023-03-310001830210us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100018302102023-01-012023-03-310001830210us-gaap:RetainedEarningsMember2023-01-012023-03-310001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001830210us-gaap:CommonStockMember2023-03-310001830210us-gaap:AdditionalPaidInCapitalMember2023-03-310001830210us-gaap:RetainedEarningsMember2023-03-310001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100018302102023-03-310001830210us-gaap:CommonStockMember2023-04-012023-06-300001830210us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000018302102023-04-012023-06-300001830210us-gaap:RetainedEarningsMember2023-04-012023-06-300001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001830210us-gaap:CommonStockMember2023-06-300001830210us-gaap:AdditionalPaidInCapitalMember2023-06-300001830210us-gaap:RetainedEarningsMember2023-06-300001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-3000018302102023-06-300001830210us-gaap:CommonStockMember2023-07-012023-09-300001830210us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001830210us-gaap:RetainedEarningsMember2023-07-012023-09-300001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001830210us-gaap:CommonStockMember2023-09-300001830210us-gaap:AdditionalPaidInCapitalMember2023-09-300001830210us-gaap:RetainedEarningsMember2023-09-300001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001830210us-gaap:CommonStockMember2021-12-310001830210us-gaap:AdditionalPaidInCapitalMember2021-12-310001830210us-gaap:RetainedEarningsMember2021-12-310001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100018302102021-12-310001830210us-gaap:CommonStockMember2022-01-012022-03-310001830210us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100018302102022-01-012022-03-310001830210us-gaap:RetainedEarningsMember2022-01-012022-03-310001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001830210us-gaap:CommonStockMember2022-03-310001830210us-gaap:AdditionalPaidInCapitalMember2022-03-310001830210us-gaap:RetainedEarningsMember2022-03-310001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-3100018302102022-03-310001830210us-gaap:CommonStockMember2022-04-012022-06-300001830210us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-3000018302102022-04-012022-06-300001830210us-gaap:RetainedEarningsMember2022-04-012022-06-300001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001830210us-gaap:CommonStockMember2022-06-300001830210us-gaap:AdditionalPaidInCapitalMember2022-06-300001830210us-gaap:RetainedEarningsMember2022-06-300001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-3000018302102022-06-300001830210us-gaap:CommonStockMember2022-07-012022-09-300001830210us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001830210us-gaap:RetainedEarningsMember2022-07-012022-09-300001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001830210us-gaap:CommonStockMember2022-09-300001830210us-gaap:AdditionalPaidInCapitalMember2022-09-300001830210us-gaap:RetainedEarningsMember2022-09-300001830210us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-3000018302102022-09-300001830210bhil:JJProduceIncMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-12-290001830210bhil:TermDebtAndNotesPayableMember2023-09-300001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:SubsequentEventMemberus-gaap:ConvertibleNotesPayableMember2023-10-012023-10-31xbrli:pure0001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2023-01-012023-09-300001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:SubsequentEventMemberus-gaap:ConvertibleNotesPayableMember2023-10-310001830210us-gaap:SubsequentEventMemberbhil:SoybeanProcessingFacilityInSeymourIndianaAndRelatedAssetsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-10-310001830210bhil:JJProduceIncMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-09-300001830210bhil:ZFSCrestonLLCMember2021-12-302021-12-300001830210bhil:ZFSCrestonLLCMember2022-01-012022-03-310001830210bhil:JJProduceIncMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-12-310001830210bhil:JJProduceIncMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-07-012023-09-300001830210bhil:JJProduceIncMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2023-01-012023-09-300001830210bhil:JJProduceIncMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-07-012022-09-300001830210bhil:JJProduceIncMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2022-01-012022-09-300001830210bhil:JJProduceIncMember2023-08-012023-08-300001830210us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberbhil:JJProduceIncNettingMember2023-07-012023-09-300001830210us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberbhil:JJProduceIncNettingMember2022-07-012022-09-300001830210us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberbhil:JJProduceIncNettingMember2023-01-012023-09-300001830210us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberbhil:JJProduceIncNettingMember2022-01-012022-09-300001830210us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001830210us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001830210us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001830210us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001830210us-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:PreferredStockMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:WarrantMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:WarrantMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:WarrantMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:FairValueInputsLevel1Memberbhil:ConversionOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210bhil:ConversionOptionLiabilityMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:FairValueInputsLevel3Memberbhil:ConversionOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210bhil:ConversionOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001830210us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001830210us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001830210us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001830210us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001830210us-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:PreferredStockMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:PreferredStockMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:WarrantMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:WarrantMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:WarrantMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:FairValueInputsLevel1Memberbhil:ConversionOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210bhil:ConversionOptionLiabilityMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:FairValueInputsLevel3Memberbhil:ConversionOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210bhil:ConversionOptionLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001830210us-gaap:DebtInstrumentRedemptionPeriodOneMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2023-03-012023-03-310001830210us-gaap:DebtInstrumentRedemptionPeriodTwoMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2023-03-102023-03-10bhil:day0001830210us-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-09-300001830210us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMemberus-gaap:PrivatePlacementMember2023-09-300001830210bhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2023-09-300001830210bhil:ConversionLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2023-09-300001830210us-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-09-300001830210us-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMemberus-gaap:MeasurementInputSharePriceMember2023-09-300001830210bhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2023-09-300001830210bhil:ConversionLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2023-09-300001830210us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMember2023-09-300001830210us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMember2023-09-300001830210bhil:ConvertibleNotesPayableWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Member2023-09-300001830210bhil:ConversionLiabilityMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Member2023-09-300001830210us-gaap:MeasurementInputExpectedTermMemberus-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMember2023-09-300001830210us-gaap:MeasurementInputExpectedTermMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMember2023-09-300001830210us-gaap:MeasurementInputExpectedTermMemberbhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Member2023-09-300001830210us-gaap:MeasurementInputExpectedTermMemberbhil:ConversionLiabilityMemberus-gaap:FairValueInputsLevel3Member2023-09-300001830210us-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-09-300001830210us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:PrivatePlacementMember2023-09-300001830210bhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-09-300001830210bhil:ConversionLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-09-300001830210us-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMember2023-09-300001830210us-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMember2023-09-300001830210us-gaap:MeasurementInputExpectedDividendRateMemberbhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Member2023-09-300001830210bhil:ConversionLiabilityMemberus-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:FairValueInputsLevel3Member2023-09-300001830210us-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2022-12-310001830210us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMemberus-gaap:PrivatePlacementMember2022-12-310001830210bhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2022-12-310001830210bhil:ConversionLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2022-12-310001830210us-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMemberus-gaap:MeasurementInputSharePriceMember2022-12-310001830210us-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMemberus-gaap:MeasurementInputSharePriceMember2022-12-310001830210bhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2022-12-310001830210bhil:ConversionLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2022-12-310001830210us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMember2022-12-310001830210us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMember2022-12-310001830210bhil:ConvertibleNotesPayableWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Member2022-12-310001830210bhil:ConversionLiabilityMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Member2022-12-310001830210us-gaap:MeasurementInputExpectedTermMemberus-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMember2022-12-310001830210us-gaap:MeasurementInputExpectedTermMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMember2022-12-310001830210us-gaap:MeasurementInputExpectedTermMemberbhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001830210us-gaap:MeasurementInputExpectedTermMemberbhil:ConversionLiabilityMemberus-gaap:FairValueInputsLevel3Member2022-12-310001830210us-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001830210us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:PrivatePlacementMember2022-12-310001830210bhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001830210bhil:ConversionLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001830210us-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:FairValueInputsLevel3Memberbhil:PIPEInvestmentWarrantsMember2022-12-310001830210us-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMember2022-12-310001830210us-gaap:MeasurementInputExpectedDividendRateMemberbhil:ConvertibleNotesPayableWarrantsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001830210bhil:ConversionLiabilityMemberus-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:FairValueInputsLevel3Member2022-12-310001830210bhil:WarrantLiabilitiesMember2023-06-300001830210bhil:WarrantLiabilitiesMember2022-12-310001830210bhil:WarrantLiabilitiesMember2023-07-012023-09-300001830210bhil:WarrantLiabilitiesMember2023-01-012023-09-300001830210bhil:WarrantLiabilitiesMember2023-09-300001830210bhil:WarrantLiabilitiesMember2022-06-300001830210bhil:WarrantLiabilitiesMember2021-12-310001830210bhil:WarrantLiabilitiesMember2022-07-012022-09-300001830210bhil:WarrantLiabilitiesMember2022-01-012022-09-300001830210bhil:WarrantLiabilitiesMember2022-09-300001830210us-gaap:FairValueInputsLevel3Member2023-09-300001830210us-gaap:FairValueInputsLevel3Member2022-12-310001830210us-gaap:USTreasuryAndGovernmentMember2023-09-300001830210us-gaap:CorporateDebtSecuritiesMember2023-09-300001830210us-gaap:PreferredStockMember2023-09-300001830210us-gaap:USTreasuryAndGovernmentMember2022-12-310001830210us-gaap:CorporateDebtSecuritiesMember2022-12-310001830210us-gaap:PreferredStockMember2022-12-310001830210bhil:CommodityContractSoybeansMember2023-01-012023-09-30utr:bu0001830210bhil:CommodityContractToBeSettledRemainderOfFiscalYearMember2023-01-012023-09-300001830210bhil:CommodityContractToBeSettledYearOneMember2023-01-012023-09-30utr:lbutr:T0001830210bhil:CommodityContractSoybeansMember2023-09-300001830210bhil:CommodityContractSoybeansMember2022-12-310001830210bhil:CommodityContractsSoybeanOilMember2023-09-300001830210bhil:CommodityContractsSoybeanOilMember2022-12-310001830210bhil:CommodityContractsSoybeanMealMember2023-09-300001830210bhil:CommodityContractsSoybeanMealMember2022-12-310001830210bhil:CommodityContractSoybeansMember2023-07-012023-09-300001830210bhil:CommodityContractSoybeansMember2022-07-012022-09-300001830210bhil:CommodityContractsSoybeanOilMember2023-07-012023-09-300001830210bhil:CommodityContractsSoybeanOilMember2022-07-012022-09-300001830210bhil:CommodityContractsSoybeanMealMember2023-07-012023-09-300001830210bhil:CommodityContractsSoybeanMealMember2022-07-012022-09-300001830210bhil:CommodityContractSoybeansMember2022-01-012022-09-300001830210bhil:CommodityContractsSoybeanOilMember2023-01-012023-09-300001830210bhil:CommodityContractsSoybeanOilMember2022-01-012022-09-300001830210bhil:CommodityContractsSoybeanMealMember2023-01-012023-09-300001830210bhil:CommodityContractsSoybeanMealMember2022-01-012022-09-300001830210bhil:TermLoanDueApril2025Memberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-09-300001830210bhil:TermLoanDueApril2025Memberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2022-12-310001830210us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberbhil:EquipmentLoanDueJuly2024Member2023-09-300001830210us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberbhil:EquipmentLoanDueJuly2024Member2022-12-310001830210bhil:ConvertibleNotesPayableDueMarch2024Memberus-gaap:ConvertibleNotesPayableMember2023-09-300001830210bhil:ConvertibleNotesPayableDueMarch2024Memberus-gaap:ConvertibleNotesPayableMember2022-12-310001830210bhil:EquipmentFinancingDueMarch2025Memberus-gaap:SecuredDebtMember2023-09-300001830210bhil:EquipmentFinancingDueMarch2025Memberus-gaap:SecuredDebtMember2022-12-310001830210bhil:NotesPayableDueThroughJune2026Memberus-gaap:NotesPayableOtherPayablesMember2023-09-300001830210bhil:NotesPayableDueThroughJune2026Memberus-gaap:NotesPayableOtherPayablesMember2022-12-310001830210us-gaap:LongTermDebtMember2023-09-300001830210us-gaap:LongTermDebtMember2022-12-310001830210bhil:TermLoanDueApril2025Memberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2019-04-300001830210bhil:TermLoanDueApril2025Memberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2019-04-302019-04-300001830210us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberbhil:EquipmentLoanDueJuly2024Member2019-04-300001830210us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberbhil:EquipmentLoanDueJuly2024Member2019-04-302019-04-300001830210us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberbhil:FloatingRateRevolvingCreditFacilityMember2019-04-300001830210us-gaap:PrimeRateMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberbhil:TermLoanAndEquipmentLoanMember2023-01-012023-09-300001830210us-gaap:PrimeRateMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberbhil:FloatingRateRevolvingCreditFacilityMember2023-01-012023-09-300001830210us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2019-04-300001830210bhil:TermLoanDueApril2025Memberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2019-04-012019-04-300001830210us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMemberbhil:EquipmentLoanDueJuly2024Member2019-04-012019-04-300001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2021-12-310001830210bhil:ConvertibleLoanAndSecurityAgreementSecondTrancheMemberus-gaap:ConvertibleNotesPayableMember2022-06-300001830210bhil:ConvertibleLoanAndSecurityAgreementMembersrt:MinimumMemberus-gaap:ConvertibleNotesPayableMember2022-09-302022-09-300001830210srt:MaximumMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2022-09-302022-09-300001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2022-09-302022-09-300001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2021-12-012021-12-310001830210us-gaap:PrimeRateMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2021-12-012021-12-310001830210us-gaap:DebtInstrumentRedemptionPeriodTwoMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2021-12-310001830210us-gaap:DebtInstrumentRedemptionPeriodTwoMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2021-12-012021-12-310001830210us-gaap:DebtInstrumentRedemptionPeriodThreeMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2021-12-012021-12-310001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2022-10-312022-10-310001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2022-11-012022-11-300001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2022-11-300001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2023-03-012023-03-310001830210us-gaap:PrimeRateMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2023-02-282023-02-280001830210us-gaap:PrimeRateMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2023-03-012023-03-310001830210bhil:ConvertibleLoanAndSecurityAgreementMembersrt:MinimumMemberus-gaap:ConvertibleNotesPayableMember2021-12-012021-12-310001830210srt:MaximumMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2021-12-012021-12-310001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:ConvertibleNotesPayableMember2023-09-300001830210us-gaap:NotesPayableOtherPayablesMember2022-03-310001830210us-gaap:NotesPayableOtherPayablesMember2022-01-012022-03-310001830210us-gaap:AccumulatedTranslationAdjustmentMember2023-06-300001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-06-300001830210us-gaap:AccumulatedTranslationAdjustmentMember2023-07-012023-09-300001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-07-012023-09-300001830210us-gaap:AccumulatedTranslationAdjustmentMember2023-09-300001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-09-300001830210us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001830210us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-09-300001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-09-300001830210us-gaap:AccumulatedTranslationAdjustmentMember2022-06-300001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-06-300001830210us-gaap:AccumulatedTranslationAdjustmentMember2022-07-012022-09-300001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-07-012022-09-300001830210us-gaap:AccumulatedTranslationAdjustmentMember2022-09-300001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-09-300001830210us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001830210us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-09-300001830210us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-09-300001830210us-gaap:WarrantMember2023-07-012023-09-300001830210us-gaap:WarrantMember2022-07-012022-09-300001830210us-gaap:WarrantMember2023-01-012023-09-300001830210us-gaap:WarrantMember2022-01-012022-09-300001830210us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001830210us-gaap:EmployeeStockOptionMember2022-07-012022-09-300001830210us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001830210us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001830210us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001830210us-gaap:RestrictedStockUnitsRSUMember2022-07-012022-09-300001830210us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001830210us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-3000018302102022-01-012022-12-31bhil:segment0001830210us-gaap:GeographicDistributionDomesticMember2023-07-012023-09-300001830210us-gaap:GeographicDistributionDomesticMember2022-07-012022-09-300001830210us-gaap:GeographicDistributionDomesticMember2023-01-012023-09-300001830210us-gaap:GeographicDistributionDomesticMember2022-01-012022-09-300001830210us-gaap:GeographicDistributionForeignMember2023-07-012023-09-300001830210us-gaap:GeographicDistributionForeignMember2022-07-012022-09-300001830210us-gaap:GeographicDistributionForeignMember2023-01-012023-09-300001830210us-gaap:GeographicDistributionForeignMember2022-01-012022-09-300001830210us-gaap:TransferredAtPointInTimeMember2023-07-012023-09-300001830210us-gaap:TransferredAtPointInTimeMember2022-07-012022-09-300001830210us-gaap:TransferredAtPointInTimeMember2023-01-012023-09-300001830210us-gaap:TransferredAtPointInTimeMember2022-01-012022-09-300001830210us-gaap:TransferredOverTimeMember2023-07-012023-09-300001830210us-gaap:TransferredOverTimeMember2022-07-012022-09-300001830210us-gaap:TransferredOverTimeMember2023-01-012023-09-300001830210us-gaap:TransferredOverTimeMember2022-01-012022-09-300001830210bhil:ProprietaryTransactionsMember2023-07-012023-09-300001830210bhil:ProprietaryTransactionsMember2022-07-012022-09-300001830210bhil:ProprietaryTransactionsMember2023-01-012023-09-300001830210bhil:ProprietaryTransactionsMember2022-01-012022-09-300001830210bhil:NonProprietaryTransactionMember2023-07-012023-09-300001830210bhil:NonProprietaryTransactionMember2022-07-012022-09-300001830210bhil:NonProprietaryTransactionMember2023-01-012023-09-300001830210bhil:NonProprietaryTransactionMember2022-01-012022-09-300001830210bhil:CorporateAndReconcilingItemsMember2023-07-012023-09-300001830210bhil:CorporateAndReconcilingItemsMember2022-07-012022-09-300001830210bhil:CorporateAndReconcilingItemsMember2023-01-012023-09-300001830210bhil:CorporateAndReconcilingItemsMember2022-01-012022-09-300001830210us-gaap:SubsequentEventMemberbhil:SoybeanProcessingFacilityInSeymourIndianaAndRelatedAssetsMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-10-312023-10-310001830210bhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:SubsequentEventMembersrt:MinimumMemberus-gaap:ConvertibleNotesPayableMember2023-10-012023-10-310001830210srt:MaximumMemberbhil:ConvertibleLoanAndSecurityAgreementMemberus-gaap:SubsequentEventMemberus-gaap:ConvertibleNotesPayableMember2023-10-012023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One) | | | | | |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| | | | | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to ______

Commission file number 001-39835

Benson Hill, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | | 85-3374823 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

1001 North Warson Rd | St. Louis, | Missouri | 63132 |

(Address of Principal Executive Offices) | | (Zip Code) |

(314) 222-8218

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

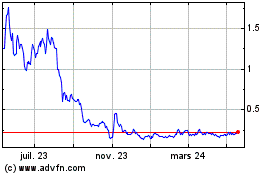

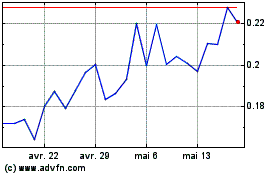

Common Stock, $0.0001 par value | BHIL | The New York Stock Exchange |

Warrants exercisable for one share of common stock at an exercise price of $11.50 | BHIL WS | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

Large accelerated filer | o | | Accelerated filer | x |

Non-accelerated filer | o | | Smaller reporting company | o |

| | | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of November 7, 2023, 208,379,035 shares of the registrant’s Common Stock, par value $0.0001, were issued and outstanding.

Benson Hill, Inc.

TABLE OF CONTENTS

Part I - Financial Information

Item 1. Financial Statements

Benson Hill, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(In Thousands, Except Per Share Data) | | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 12,041 | | | $ | 25,053 | |

| Restricted cash | 20,438 | | | 17,912 | |

| Marketable securities | 53,524 | | | 132,121 | |

| Accounts receivable, net | 37,553 | | | 28,591 | |

| Inventories, net | 30,419 | | | 62,110 | |

| Prepaid expenses and other current assets | 13,883 | | | 11,434 | |

| Current assets of discontinued operations | 555 | | | 23,507 | |

| Total current assets | 168,413 | | | 300,728 | |

| Property and equipment, net | 99,628 | | | 99,759 | |

| Finance lease right-of-use assets, net | 61,511 | | | 66,533 | |

| Operating lease right-of-use assets | 5,542 | | | 1,660 | |

| Goodwill and intangible assets, net | 7,587 | | | 27,377 | |

| Other assets | 9,838 | | | 4,863 | |

| Total assets | $ | 352,519 | | | $ | 500,920 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 14,134 | | | $ | 36,717 | |

| Finance lease liabilities, current portion | 3,935 | | | 3,318 | |

| Operating lease liabilities, current portion | 1,456 | | | 364 | |

| Long-term debt, current portion | 35,581 | | | 2,242 | |

| Accrued expenses and other current liabilities | 18,639 | | | 33,435 | |

| Current liabilities of discontinued operations | 871 | | | 16,441 | |

| Total current liabilities | 74,616 | | | 92,517 | |

| Long-term debt, less current portion | 73,596 | | | 103,991 | |

| Finance lease liabilities, less current portion | 75,399 | | | 76,431 | |

| Operating lease liabilities, less current portion | 6,333 | | | 1,291 | |

| Warrant liabilities | 1,694 | | | 24,285 | |

| Conversion option liabilities | 21 | | | 8,091 | |

| Deferred income taxes | 155 | | | 283 | |

| Other non-current liabilities | 231 | | | 129 | |

| Total liabilities | 232,045 | | | 307,018 | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value, 440,000 and 440,000 shares authorized, 207,981 and 206,668 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 21 | | | 21 | |

| Additional paid-in capital | 609,554 | | | 609,450 | |

| Accumulated deficit | (485,939) | | | (408,474) | |

| Accumulated other comprehensive loss | (3,162) | | | (7,095) | |

| Total stockholders’ equity | 120,474 | | | 193,902 | |

| Total liabilities and stockholders’ equity | $ | 352,519 | | | $ | 500,920 | |

See accompanying notes to the condensed consolidated financial statements (unaudited).

Benson Hill, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(In Thousands, Except Per Share Data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | 113,066 | | | $ | 122,296 | | | 356,747 | | | 282,053 | |

| Cost of sales | 108,927 | | | 116,365 | | | 340,117 | | | 279,315 | |

| Gross profit (loss) | 4,139 | | | 5,931 | | | 16,630 | | | 2,738 | |

| Operating expenses: | | | | | | | |

| Research and development | 10,525 | | | 11,438 | | | 33,480 | | | 35,739 | |

| Selling, general and administrative expenses | 17,874 | | | 18,912 | | | 44,892 | | | 59,448 | |

| Impairment of goodwill | — | | | — | | | 19,226 | | | — | |

| Total operating expenses | 28,399 | | | 30,350 | | | 97,598 | | | 95,187 | |

| Loss from operations | (24,260) | | | (24,419) | | | (80,968) | | | (92,449) | |

| Other (income) expense: | | | | | | | |

| Interest expense, net | 7,179 | | | 6,200 | | | 20,425 | | | 16,030 | |

| | | | | | | |

| Changes in fair value of warrants and conversion option | (12,001) | | | (4,036) | | | (30,661) | | | (41,676) | |

| Other expense, net | (201) | | | (181) | | | 2,588 | | | 2,104 | |

| Total other (income) expense, net | (5,023) | | | 1,983 | | | (7,648) | | | (23,542) | |

| Net loss from continuing operations before income taxes | (19,237) | | | (26,402) | | | (73,320) | | | (68,907) | |

| Income tax expense (benefit) | 6 | | | 13 | | | (117) | | | 30 | |

| Net loss from continuing operations, net of income taxes | (19,243) | | | (26,415) | | | $ | (73,203) | | | $ | (68,937) | |

Net income (loss) from discontinued operations, net of income taxes (refer to Note 4, Discontinued Operations) | 1,673 | | | (3,754) | | | (4,262) | | | (5,362) | |

| Net loss attributable to common stockholders | $ | (17,570) | | | $ | (30,169) | | | $ | (77,465) | | | $ | (74,299) | |

| | | | | | | |

| Net loss per common share: | | | | | | | |

| Basic and diluted net loss per common share from continuing operations | $ | (0.10) | | | $ | (0.14) | | | $ | (0.39) | | | $ | (0.39) | |

| Basic and diluted net loss per common share from discontinued operations | $ | 0.01 | | | $ | (0.02) | | | $ | (0.02) | | | $ | (0.03) | |

| Basic and diluted total net loss per common share | $ | (0.09) | | | $ | (0.16) | | | $ | (0.41) | | | $ | (0.42) | |

| Weighted average shares outstanding: | | | | | | | |

| Basic and diluted weighted average shares outstanding | 188,223 | | | 186,097 | | | 187,691 | | | 177,539 | |

See accompanying notes to the condensed consolidated financial statements (unaudited).

Benson Hill, Inc.

Condensed Consolidated Statements of Comprehensive Loss (Unaudited)

(In Thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss attributable to common stockholders | $ | (17,570) | | | $ | (30,169) | | | $ | (77,465) | | | $ | (74,299) | |

| Foreign currency: | | | | | | | |

| Comprehensive income (loss) | — | | | (1) | | | — | | | (46) | |

| — | | | (1) | | | — | | | (46) | |

| Marketable securities: | | | | | | | |

| Comprehensive income (loss) | 395 | | | (1,759) | | | 875 | | | (9,918) | |

| Adjustment for net loss (income) realized in net loss | 14 | | | (97) | | | 3,058 | | | 2,132 | |

| 409 | | | (1,856) | | | 3,933 | | | (7,786) | |

| Total other comprehensive income (loss) | 409 | | | (1,857) | | | 3,933 | | | (7,832) | |

| Total comprehensive loss | $ | (17,161) | | | $ | (32,026) | | | $ | (73,532) | | | $ | (82,131) | |

See accompanying notes to the condensed consolidated financial statements (unaudited).

Benson Hill, Inc.

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited)

(In Thousands, Except Per Share Data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance as of December 31, 2022 | 206,668 | | | $ | 21 | | | $ | 609,450 | | | $ | (408,474) | | | $ | (7,095) | | | $ | 193,902 | |

| Stock option exercises, net | 791 | | | — | | | 121 | | | — | | | — | | | 121 | |

| Stock-based compensation expense | — | | | — | | | 2,814 | | | — | | | — | | | 2,814 | |

| | | | | | | | | | | |

| Comprehensive income (loss) | — | | | — | | | — | | | (3,054) | | | 856 | | | (2,198) | |

| Balance as of March 31, 2023 | 207,459 | | | $ | 21 | | | $ | 612,385 | | | $ | (411,528) | | | $ | (6,239) | | | $ | 194,639 | |

| Stock option exercises, net | 8 | | | — | | | 19 | | | — | | | — | | | 19 | |

| Stock-based compensation expense | — | | | — | | | (3,882) | | | — | | | — | | | (3,882) | |

| Comprehensive income (loss) | — | | | — | | | — | | | (56,841) | | | 2,668 | | | (54,173) | |

| Balance as of June 30, 2023 | 207,467 | | | $ | 21 | | | $ | 608,522 | | | $ | (468,369) | | | $ | (3,571) | | | $ | 136,603 | |

| Stock option exercises, net | 514 | | | — | | | 109 | | | – | | – | | 109 | |

| | | | | | | | | | | |

| Stock-based compensation expense | — | | | – | | 923 | | | – | | – | | 923 | |

| Comprehensive income (loss) | — | | | – | | – | | (17,570) | | | 409 | | | (17,161) | |

| Balance at Balance as of September 30, 2023 | 207,981 | | | $ | 21 | | | $ | 609,554 | | | $ | (485,939) | | | $ | (3,162) | | | $ | 120,474 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance as of December 31, 2021 | 178,089 | | | $ | 18 | | | $ | 533,101 | | | $ | (280,569) | | | $ | (1,103) | | | $ | 251,447 | |

| Stock option exercises, net | 830 | | | — | | | 636 | | | — | | | — | | | 636 | |

| Stock-based compensation expense | — | | | — | | | 5,683 | | | — | | | — | | | 5,683 | |

PIPE Investment, net of issuance cost of $3,456 | 26,150 | | | 3 | | | 54,925 | | | — | | | — | | | 54,928 | |

| Comprehensive loss | — | | | — | | | — | | | (16,576) | | | (2,624) | | | (19,200) | |

| Balance as of March 31, 2022 | 205,069 | | | $ | 21 | | | $ | 594,345 | | | $ | (297,145) | | | $ | (3,727) | | | $ | 293,494 | |

| Stock option exercises, net | 547 | | | — | | | 715 | | | — | | | — | | | 715 | |

| Stock-based compensation expense | — | | | — | | | 5,676 | | | — | | | — | | | 5,676 | |

| Comprehensive loss | — | | | — | | | — | | | (27,554) | | | (3,351) | | | (30,905) | |

| Balance as of June 30, 2022 | 205,616 | | | $ | 21 | | | $ | 600,736 | | | $ | (324,699) | | | $ | (7,078) | | | $ | 268,980 | |

| Stock option exercises, net | 727 | | | — | | | 736 | | | — | | | — | | | 736 | |

| Vesting of restricted stock units, net | 94 | | | — | | | — | | | $ | — | | | $ | — | | | — | |

| Stock-based compensation expense | — | | | — | | | 4,412 | | | $ | — | | | $ | — | | | 4,412 | |

| | | | | | | | | | | |

| Comprehensive loss | — | | | — | | | — | | | (30,169) | | | (1,857) | | | (32,026) | |

| Balance as of September 30, 2022 | 206,437 | | | $ | 21 | | | $ | 605,884 | | | $ | (354,868) | | | $ | (8,935) | | | $ | 242,102 | |

See accompanying notes to the condensed consolidated financial statements (unaudited).

Benson Hill, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In Thousands)

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2023 | | 2022 |

| Operating activities | | | | |

| Net loss | | $ | (77,465) | | | $ | (74,299) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Depreciation and amortization | | 16,056 | | | 16,504 | |

| Stock-based compensation expense | | (347) | | | 15,771 | |

| Bad debt expense | | (263) | | | 724 | |

| Changes in fair value of warrants and conversion option | | (30,661) | | | (41,676) | |

| Accretion and amortization related to financing activities | | 6,624 | | | 8,481 | |

| Realized losses on sale of marketable securities | | 3,058 | | | 2,132 | |

| Impairment of goodwill | | 19,226 | | | — | |

| | | | |

| Other | | 1,815 | | | 4,180 | |

| Changes in operating assets and liabilities: | | | | |

| Accounts receivable | | (3,073) | | | (7,208) | |

| Inventories | | 43,323 | | | 6,441 | |

| Other assets and other liabilities | | (4,170) | | | 8,052 | |

| Accounts payable | | (32,306) | | | (6,093) | |

| Accrued expenses | | (15,685) | | | 2,604 | |

| Net cash used in operating activities | | (73,868) | | | (64,387) | |

| Investing activities | | | | |

| Purchases of marketable securities | | (87,619) | | | (350,333) | |

| Proceeds from maturities of marketable securities | | 66,193 | | | 109,514 | |

| Proceeds from sales of marketable securities | | 99,838 | | | 170,217 | |

| Purchase of property and equipment | | (10,127) | | | (11,835) | |

| Acquisition, net of cash acquired | | — | | | (1,044) | |

| Proceeds from divestiture of discontinued operations | | 2,378 | | | — | |

| Proceeds from an insurance claim from a prior business acquisition | | 1,533 | | | — | |

| Other | | 41 | | | — | |

| Net cash provided by (used in) investing activities | | 72,237 | | | (83,481) | |

| Financing activities | | | | |

Contributions from PIPE Investment, net of transaction costs $3,761 in 2022 | | — | | | 80,825 | |

| Repayments of long-term debt | | (4,874) | | | (6,736) | |

| Proceeds from issuance of long-term debt | | — | | | 24,078 | |

| Payments of debt issuance costs | | (2,000) | | | (38) | |

| Borrowing under revolving line of credit | | — | | | 18,970 | |

| Repayments under revolving line of credit | | — | | | (19,017) | |

| Payments of finance lease obligations | | (2,428) | | | (1,103) | |

| Proceeds from exercise of stock awards, net of withholding taxes | | 249 | | | 1,950 | |

| | | | |

| Net cash (used in)/provided by financing activities | | (9,053) | | | 98,929 | |

| Effect of exchange rate changes on cash | | — | | | (46) | |

| Net decrease in cash and cash equivalents | | (10,684) | | | (48,985) | |

| Cash, cash equivalents and restricted cash, beginning of period | | 43,321 | | | 78,963 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 32,637 | | | $ | 29,978 | |

| | | | | | | | | | | | | | |

| Supplemental disclosure of cash flow information | | | | |

| Cash paid for taxes | | $ | 35 | | | $ | 1 | |

| Cash paid for interest | | $ | 14,523 | | | $ | 9,864 | |

| Supplemental disclosure of non-cash activities | | | | |

| | | | |

| Purchases of property and equipment included in liabilities | | $ | 125 | | | $ | 2,710 | |

| Financing leases commencing in the period | | $ | — | | | $ | 806 | |

See accompanying notes to the condensed consolidated financial statements (unaudited).

Benson Hill, Inc.

Notes to the Condensed Consolidated Financial Statements

(Unaudited)

(In Thousands, Except Per Share Data)

1. Description of Business

Benson Hill, Inc. and subsidiaries (collectively, “Benson Hill”, the “Company”, “we”, “us”, or “our”) is a food technology company on a mission to lead the pace of innovation in food. We have a vision to build a healthier and happier world by unlocking the natural genetic diversity of plants with our leading technology platform, CropOS®. Starting with consumer demand, we leverage CropOS® and advanced breeding techniques to design food that’s better from the beginning: more nutritious, more functional, and more accessible, while enabling efficient production and delivering novel sustainability benefits to food and feed customers. We are headquartered in St. Louis, Missouri, where the majority of our research and development activities are managed. We operate a soy crushing and food-grade white flake and soy flour manufacturing operation in Creston, Iowa, and we process dry peas in North Dakota. We recently sold our soy crushing facility in Seymour, Indiana. We sell our products throughout North America, in Europe and in several countries globally.

Fresh Business Segment Divestiture

On December 29, 2022, we entered into a Stock Purchase Agreement (the “Stock Sale”) to sell J&J Produce, Inc. (“J&J”) and all of the outstanding equity securities of J&J’s subsidiaries for aggregate cash consideration of $3,000, subject to certain adjustments. J&J was the main component of the former Fresh segment. In connection with the Stock Purchase Agreement, on December 29, 2022, J&J entered into a Purchase and Sale Agreement, pursuant to which J&J sold certain real and personal property comprising an agricultural production and processing facility located in Vero Beach, Florida, for an aggregate purchase price of $18,000, subject to certain adjustments. Certain property was leased back to J&J pursuant to a separate agricultural and facility lease for a short period of time. On June 30, 2023, we closed the Stock Sale. Our strategic shift to exit the Fresh segment met the criteria to be classified as businesses held for sale and to be presented as a discontinued operation. Refer to Note 4, Discontinued Operations for further details on the divestiture of the former Fresh segment. Liquidity and Going Concern

The accompanying unaudited condensed consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial reporting and Securities and Exchange Commission (“SEC”) regulations, assuming we will continue as a going concern.

For the three and nine months ended September 30, 2023, we incurred a net loss from continuing operations of $19,243 and $73,203, respectively, and for the nine months ended September 30, 2023, we had negative cash flows from operating activities of $73,868 and had capital expenditures of $10,127. As of September 30, 2023, we had cash and marketable securities of $65,565 and restricted cash of $20,438. Furthermore, as of September 30, 2023, we had an accumulated deficit of $485,939 and term debt and notes payable of $109,177, which are subject to repayment terms and covenants further described in Note 9, Debt and Note 16, Subsequent Events. Specifically, as of the fourth quarter of 2023, the Convertible Notes Payable becomes due and payable in full on March 1, 2024. Further, there is a risk to our compliance with the financial covenants on the Convertible Notes Payable. We have incurred significant losses since our inception, primarily to fund investment into technology and costs associated with early-stage commercialization of products. These factors, coupled with expected debt repayments and capital expenditures indicated that, without further action, our forecasted cash flows would not be sufficient for us to meet our contractual commitments and obligations as they came due in the ordinary course of business for 12 months after the date the condensed consolidated financial statements are issued. Therefore, there is substantial doubt about our ability to continue as a going concern within one year after the date the financial statements are issued.

During the first quarter of 2023, we entered into a third amendment to our existing Convertible Loan and Security Agreement, which among other things, extended the interest-only period by six months through the second quarter of 2024, and allowed the restricted cash to be counted towards the required minimum liquidity covenant calculation. During the fourth quarter of 2023, we entered into a fourth amendment to the Convertible Loan and Security Agreement, which among other things, changed the maturity date to March 1, 2024, updated the prepayment fee to be equal to 1% of any prepayments made prior to January 14, 2024, and the “final payment” was increased from 12.70% to 17.70% of the original Commitment amount of $100,000. Refer to Note 16, Subsequent Events for further details. Further, during the fourth quarter of 2023, we sold our soybean processing facility located in Seymour, Indiana, together with certain related assets, for approximately $36,000 of total gross proceeds, which includes $25,900 for the facility assets and the remainder for net working capital, subject to certain adjustments,

Benson Hill, Inc.

Notes to the Condensed Consolidated Financial Statements (continued)

(Unaudited)

(In Thousands, Except Per Share Data)

including an adjustment for inventory and other working capital. The Company utilized funds from the proceeds of the sale of the Seymour facility, in combination with restricted cash, to pay down a portion of the Convertible Notes Payable subsequent to the close date. Refer to Note 16, Subsequent Events for further details. In addition, our liquidity plans and operating budget include further actions that management believes are probable of being achieved in the 12 months after the date the condensed consolidated financial statements were issued. These actions include improving operating efficiencies by reducing certain operating costs and restructuring certain parts of the organization. Further, we are considering additional actions to allow us to meet our obligations as they come due including exploring options to divest our processing assets, supplementing cash needs by selling additional shares of our common stock, or securities convertible into common stock, to the public through our shelf registration statement, or otherwise, or obtaining alternative forms of financing which may or may not be dilutive. There are no guarantees that we will achieve any of these plans, which involve risks and uncertainties.

For the three and nine months ended September 30, 2023, we recognized severance charges of $386 and $1,624, respectively, within selling, general and administrative expenses on the Condensed Consolidated Statement of Operations.

2. Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with U.S. GAAP for interim financial reporting and SEC regulations. The unaudited condensed consolidated financial statements include the accounts of the Company and our wholly-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation. In the opinion of management, all adjustments considered necessary for a fair presentation have been included. Results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year ended December 31, 2023. A description of our significant accounting policies is included in the notes to our audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2022. These unaudited condensed consolidated financial statements should be read in conjunction with the December 31, 2022 audited consolidated financial statements and the notes thereto.

Any reference in these notes to applicable guidance is meant to refer to the authoritative U.S. GAAP as found in the Accounting Standards Codification (“ASC”) and an Accounting Standards Update (“ASU”) of the Financial Accounting Standards Board (“FASB”).

Certain prior period balances have been reclassified to conform to the current period presentation in the unaudited condensed consolidated financial statements and the accompanying notes.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act and have elected to take advantage of the benefits of the extended transition period for new or revised financial accounting standards. We expect to remain an emerging growth company at least through December 31, 2023 and expect to continue to take advantage of the benefits of the extended transition period, although we may decide to early adopt such new or revised accounting standards to the extent permitted by such standards. We expect to use this extended transition period for complying with new or revised accounting standards that have different effective dates for public and non-public companies until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). This may make it difficult or impossible to compare our financial results with the financial results of another public company that is either not an emerging growth company or is an emerging growth company that has chosen not to take advantage of the extended transition period exemptions because of the potential differences in accounting standards used.

Benson Hill, Inc.

Notes to the Condensed Consolidated Financial Statements (continued)

(Unaudited)

(In Thousands, Except Per Share Data)

In addition, we intend to rely on the other exemptions and reduced reporting requirements provided by the JOBS Act. Subject to certain conditions set forth in the JOBS Act, if, as an emerging growth company, we intend to rely on such exemptions, we are not required to, among other things: (a) provide an auditor’s attestation report on our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; (b) provide all of the compensation disclosures that may be required of non-emerging growth public companies under the Dodd-Frank Wall Street Reform and Consumer Protection Act; (c) comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis); and (d) disclose certain executive compensation-related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive Officer’s compensation to median employee compensation.

We will remain an emerging growth company under the JOBS Act until the earliest of (a) December 31, 2026, (b) the last date of our fiscal year in which we have total annual gross revenue of at least $1.235 billion, (c) the date on which we are deemed to be a “large accelerated filer” under the rules of the SEC with at least $700.0 million of outstanding securities held by non-affiliates or (d) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the previous three years.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in our condensed consolidated financial statements and accompanying notes. Actual results could differ from those estimates. Significant management estimates include those with respect to allowance for doubtful accounts, reserves for inventory obsolescence, the recoverability of long-lived assets, intangibles and goodwill and the estimated value of our warrant liabilities and conversion option liabilities.

Cash, Cash Equivalents and Restricted Cash

We consider all short-term, highly liquid investments with maturities of 90 days or less at the acquisition date to be cash equivalents. Restricted cash primarily represents cash proceeds from the sale of certain assets pursuant to the covenants with a lender. Restricted cash is classified as non-current if we expect that the cash will remain restricted for a period greater than one year. Current restricted cash is included in the prepaid expenses and other current assets on the condensed consolidated balance sheets.

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets, inclusive of $158 of cash and cash equivalents reported within current assets of discontinued operations as of September 30, 2023 to the amount shown in the condensed consolidated statements of cash flows. There was no restricted cash as of September 30, 2022.

| | | | | | | |

| September 30,

2023 | | |

| Cash and cash equivalents | $ | 12,199 | | | |

| Restricted cash, current | 20,438 | | | |

| Total cash, cash equivalents and restricted cash shown in the condensed consolidated statements of cash flows | $ | 32,637 | | | |

Goodwill and Intangible Assets

Goodwill, arising from a business combination as the excess of purchase price and related costs over the fair value of identifiable assets acquired and liabilities assumed is not amortized and is subject to an annual impairment test as of December 1, unless events indicate an interim test is required. In performing this impairment test, management will first qualitatively assess indicators of a reporting unit’s fair value. If, after completing the qualitative assessment, management believes it is likely that a reporting unit is impaired, a discounted cash flow analysis is prepared to estimate the fair value of the reporting unit.

Critical estimates in the determination of the fair value of each reporting unit include, but are not limited to, future expected cash flows based on estimates of future sales volumes, sales prices, production costs, and discount rates. These estimates

Benson Hill, Inc.

Notes to the Condensed Consolidated Financial Statements (continued)

(Unaudited)

(In Thousands, Except Per Share Data)

generally constitute unobservable Level 3 inputs under the fair value hierarchy. An adjustment to goodwill will be recorded for any goodwill that is determined to be impaired.

During the second quarter of 2023, we identified an indicator of impairment and determined it was no longer more likely than not that the fair value of our sole reporting unit was in excess of the carrying value. As a result, a quantitative goodwill and separately identifiable intangible asset impairment assessment was performed as of June 30, 2023, and we recorded an impairment of the carrying value of goodwill of $19,226, which represented the entire goodwill balance prior to the impairment charge. The goodwill impairment charge had an immaterial impact on the provision for income taxes.

We performed an interim impairment analysis for the Ingredients reporting unit as of June 30, 2023, using a discounted cash flow model (a form of the income approach), utilizing Level 3 unobservable inputs. Our estimates in this analysis included, but were not limited to, future cash flow projections, the weighted average cost of capital, the terminal growth rate, and the tax rate. The impairment charge reflects an ongoing assessment of current market conditions and potential strategic investments to continue commercializing our proprietary products and pursue other strategic investments in the industry.

For the quarter ended September 30, 2023, we determined there was no impairment of our intangible assets. However, we are currently exploring a broad strategic review of our business which could result in us being unable to recover all or a portion of the carrying value of our intangible assets. The amount and timing of any impairment charge would depend on a number of factors including the structure, timing, and scope of any assets disposed in any future transactions.

Impairment of Long-lived Assets

We review long-lived assets, including lease right-of-use assets, for impairment whenever events or changes in circumstances indicate that an asset group’s carrying amount may not be recoverable. We conduct our long-lived asset impairment analysis in accordance with ASC 360-10, Impairment or Disposal of Long-Lived Assets, which requires us to group assets and liabilities at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities and evaluate the asset group against the sum of the undiscounted future cash flows. If the undiscounted cash flows do not indicate the carrying amount of the asset group is recoverable, an impairment charge is measured as the amount by which the carrying amount of the asset group exceeds its fair value. We conducted a review of our long-lived assets as of September 30, 2023 and determined that the carrying value of our assets is recoverable and no impairment charge was necessary. However, we are currently exploring a broad strategic review of our business which could result in us being unable to recover all or a portion of the carrying value of our long-lived assets. The amount and timing of any impairment charge would depend on a number of factors including the structure, timing, and scope of any assets disposed in any future transactions.

Stock Award Modifications

In June 2023, we announced that our former Chief Executive Officer (CEO) agreed to resign from our Company effective June 15, 2023, and entered into a consulting agreement to provide transition support through June 15, 2024. In connection with the separation, we modified the terms of our former CEO’s outstanding stock awards to (1) continue vesting over the consulting period through June 15, 2024, if continuous service is achieved with us; (2) extend the period during which the vested stock options may be exercised for a period of 90 days following the termination of consultancy, if continuous service is achieved with us; and (3) extend the period in which performance-based vesting conditions for restricted stock units may be achieved through June 15, 2024, if continuous service is achieved with us. As a result of the stock award modifications, we recorded a $6.2 million decrease to stock-based compensation expense for the nine months ended September 30, 2023.

Recently Issued Accounting Guidance Not Yet Effective

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (“ASU 2020-04”). ASU 2020-04 provides optional expedients and exceptions for applying U.S. GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria are met. In December 2022, the FASB issued ASU 2022-06 and deferred the sunset date of the Reference Rate Reform (Topic 848) from December 31, 2022 to December 31, 2024, after which entities will no longer be permitted to apply the relief in Topic 848. The amendments apply to all entities that have contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate

Benson Hill, Inc.

Notes to the Condensed Consolidated Financial Statements (continued)

(Unaudited)

(In Thousands, Except Per Share Data)

reform. We have a floating rate revolving credit facility, a term loan and an equipment loan due in 2024 and plans on phasing out LIBOR as a reference rate before December 31, 2024.

In August 2020, the FASB issued ASU 2020-06, Debt (“ASU 2020-06”). ASU 2020-06 reduces the number of accounting models for convertible debt instruments and convertible preferred stock. For convertible instruments with conversion features that are not required to be accounted for as derivatives under ASC 815, Derivatives and Hedging, or that do not result in substantial premiums accounted for as paid-in capital, the embedded conversion features no longer are separated from the host contract. ASU 2020-06 is effective for annual reporting periods beginning after December 15, 2023, and interim periods within those years, and early adoption is permitted. We are currently evaluating the impact ASU 2020-06 will have on our condensed consolidated financial statements.

3. Business Combinations

ZFS Creston

On December 30, 2021, we completed the acquisition of a food-grade white flake and soy flour manufacturing operation and related assets through the acquisition of ZFS Creston, LLC, a Delaware limited liability company (“ZFS Creston”), for aggregate cash consideration of $103,099, which included a working capital adjustment payment of $1,034 in the first quarter of 2022.

4.Discontinued Operations

On December 29, 2022, we entered into a Stock Purchase Agreement (the “Stock Sale”) to sell J&J Produce, Inc. (“J&J”) and all of the outstanding equity securities of J&J’s subsidiaries for aggregate cash consideration of $3,000, subject to certain adjustments. In connection with the Stock Purchase Agreement, on December 29, 2022, J&J entered into a Purchase and Sale Agreement, pursuant to which J&J sold certain real and personal property comprising an agricultural production and processing facility located in Vero Beach, Florida, for an aggregate purchase price of $18,000, subject to certain adjustments. Certain property was leased back to J&J pursuant to a separate agricultural and facility lease for a short period of time. On June 30, 2023, we closed the Stock Sale. As of September 30, 2023, the carrying value of assets and liabilities in discontinued operations approximated their fair value due to their short maturities.

J&J was the main component of our former Fresh segment. Our strategic shift to exit the Fresh segment met the criteria to be classified as businesses held for sale and presented as a discontinued operation. Accordingly, we reclassified the results of operations of the Fresh segment to discontinued operations in our condensed consolidated statements of operations for all periods presented. The carrying amounts of the assets and liabilities of the discontinued operations were as follows:

Benson Hill, Inc.

Notes to the Condensed Consolidated Financial Statements (continued)

(Unaudited)

(In Thousands, Except Per Share Data)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 158 | | | $ | 356 | |

| Accounts receivable, net | 232 | | | 9,808 | |

| Inventories, net | — | | | 11,633 | |

| Prepaid expenses and other current assets | 165 | | | 1,710 | |

| Total assets from discontinued operations | $ | 555 | | | $ | 23,507 | |

| | | |

| Liabilities | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 79 | | | $ | 9,743 | |

| Current lease liability | — | | | 1,890 | |

| Current maturities of long-term debt | — | | | 3,194 | |

| Accrued expenses and other liabilities | 792 | | | 1,614 | |

| Total liabilities from discontinued operations | $ | 871 | | | $ | 16,441 | |

As of December 31, 2022, the fair value of the debt included in the liabilities from discontinued operations was $3,305. Fair values are based upon valuation models using market information, which fall into Level 3 in the fair value hierarchy. We capitalized no interest costs into property and equipment for the three and nine months ended September 30, 2023. We capitalized interest costs of $456 and $1,236, respectively, into property and equipment for the three and nine months ended September 30, 2022.

In August 2023, we received an insurance claim reimbursement of $1,533 related to the J&J acquisition. The operating results of the discontinued operations, net of tax, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | — | | | $ | 7,883 | | | $ | 32,237 | | | $ | 51,318 | |

| Cost of sales | (26) | | | 9,447 | | | 34,105 | | | 49,335 | |

| Gross profit (loss) | 26 | | | (1,564) | | | (1,868) | | | 1,983 | |

| Operating expenses: | | | | | | | |

| Research and development | — | | | (5) | | | — | | | 17 | |

| Selling, general and administrative expenses | (164) | | | 2,130 | | | 3,173 | | | 7,212 | |

| | | | | | | |

| Total operating expenses | (164) | | | 2,125 | | | 3,173 | | | 7,229 | |

| Interest expense | — | | | 78 | | | 14 | | | 160 | |

| Other income, net | (1,483) | | | (13) | | | (793) | | | (44) | |

| Net income (loss) from discontinued operations, before income taxes | 1,673 | | | (3,754) | | | (4,262) | | | (5,362) | |

| | | | | | | |

| Net income (loss) from discontinued operations, net of income taxes | $ | 1,673 | | | $ | (3,754) | | | $ | (4,262) | | | $ | (5,362) | |

Benson Hill, Inc.

Notes to the Condensed Consolidated Financial Statements (continued)

(Unaudited)

(In Thousands, Except Per Share Data)

Depreciation, amortization and significant operating and investing items in the condensed consolidated statements of cash flows for the discontinued operations are as follows:

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Operating activities | | | |

| Depreciation and amortization | $ | — | | | $ | 1,512 | |

| Bad debt expense | 53 | | | 135 | |

| | | |

| Net loss on divestiture | 172 | | | — | |

| Investing activities | | | |

| Payments for acquisitions of property and equipment | — | | | (4,348) | |

| Net proceeds from divestiture | 2,378 | | | — | |

5. Fair Value Measurements

Assets and liabilities recorded at fair value on a recurring basis on the balance sheets are categorized based upon the level of judgment associated with the inputs used to measure their fair values. The authoritative guidance on fair value measurements establishes a three-tier fair value hierarchy for disclosure of fair value measurements as follows:

Level 1 — Observable inputs such as unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

Level 2 — Inputs (other than quoted prices included in Level 1) are either directly or indirectly observable for the asset or liability. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active.

Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Our financial instruments consist of cash and cash equivalents, restricted cash, marketable securities, accounts receivable, commodity derivatives, commodity contracts, accounts payable, accrued liabilities, warrant liabilities, conversion option liabilities, and notes payable. As of September 30, 2023 and December 31, 2022, we had cash and cash equivalents of $12,041 and $25,053, respectively, which include money market funds with maturities of less than three months. As of September 30, 2023 and December 31, 2022, we had restricted cash of $20,438 and $17,912. At September 30, 2023 and December 31, 2022, the carrying values of cash and cash equivalents, restricted cash, accounts receivable, accounts payable, and accrued liabilities approximated fair value due to their short maturities.

The following tables provide the financial instruments measured at fair value on a recurring basis based on the fair value hierarchy:

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2023 |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Assets | | | | | | | |

| U.S. treasury securities | $ | 8,901 | | | $ | — | | | $ | — | | | $ | 8,901 | |

| Corporate bonds | $ | — | | | $ | 32,281 | | | $ | — | | | $ | 32,281 | |

| Preferred stock | — | | | 12,342 | | | — | | | 12,342 | |

| Marketable securities | $ | 8,901 | | | $ | 44,623 | | | $ | — | | | $ | 53,524 | |

| Liabilities | | | | | | | |

| Warrant liabilities | $ | 716 | | | $ | — | | | $ | 978 | | | $ | 1,694 | |

| Conversion option liabilities | — | | | — | | | 21 | | | 21 | |

| Total liabilities | $ | 716 | | | $ | — | | | $ | 999 | | | $ | 1,715 | |

Benson Hill, Inc.

Notes to the Condensed Consolidated Financial Statements (continued)

(Unaudited)

(In Thousands, Except Per Share Data)

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2022 |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Assets | | | | | | | |

| U.S. treasury securities | $ | 1,059 | | | $ | — | | | $ | — | | | $ | 1,059 | |

| Corporate bonds | — | | | 116,616 | | | — | | | 116,616 | |

| Preferred stock | — | | | 14,446 | | | — | | | 14,446 | |

| Marketable securities | $ | 1,059 | | | $ | 131,062 | | | $ | — | | | $ | 132,121 | |

| Liabilities | | | | | | | |

| Warrant liabilities | $ | 5,469 | | | $ | — | | | $ | 18,816 | | | $ | 24,285 | |

| Conversion option liabilities | — | | | — | | | 8,091 | | | 8,091 | |

| Total liabilities | $ | 5,469 | | | $ | — | | | $ | 26,907 | | | $ | 32,376 | |

There were no transfers of financial assets or liabilities into or out of Level 1, Level 2, or Level 3 for 2023 or 2022.