Current Report Filing (8-k)

10 Mai 2023 - 11:10PM

Edgar (US Regulatory)

BERKSHIRE HATHAWAY INC DE false 0001067983 --12-31 0001067983 2023-05-06 2023-05-06 0001067983 brka:ClassACommonStockMember 2023-05-06 2023-05-06 0001067983 brka:ClassBCommonStockMember 2023-05-06 2023-05-06 0001067983 brka:MOnePointThreeZeroZeroSeniorNotesDueTwoThousandTwentyFourMember 2023-05-06 2023-05-06 0001067983 brka:MZeroPointZeroZeroZeroSeniorNotesDueTwoThousandTwentyFiveMember 2023-05-06 2023-05-06 0001067983 brka:MOnePointOneTwoFiveSeniorNotesDueTwoThousandTwentySevenMember 2023-05-06 2023-05-06 0001067983 brka:MTwoPointOneFiveZeroSeniorNotesDueTwoThousandTwentyEightMember 2023-05-06 2023-05-06 0001067983 brka:MOnePointFiveZeroZeroSeniorNotesDueTwoThousandThirtyMember 2023-05-06 2023-05-06 0001067983 brka:MTwoPointZeroZeroZeroSeniorNotesDueTwoThousandThirtyFourMember 2023-05-06 2023-05-06 0001067983 brka:MOnePointSixTwoFiveSeniorNotesDueTwoThousandThirtyFiveMember 2023-05-06 2023-05-06 0001067983 brka:MTwoPointThreeSevenFiveSeniorNotesDueTwoThousandThirtyNineMember 2023-05-06 2023-05-06 0001067983 brka:MZeroPointFiveZeroZeroSeniorNotesDueTwoThousandFortyOneMember 2023-05-06 2023-05-06 0001067983 brka:MTwoPointSixTwoFiveSeniorNotesDueTwoThousandFiftyNineMember 2023-05-06 2023-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (D)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) May 6, 2023

BERKSHIRE HATHAWAY INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

|

|

|

|

| DELAWARE |

|

001-14905 |

|

47-0813844 |

| (STATE OR OTHER JURISDICTION OF INCORPORATION) |

|

(COMMISSION FILE NUMBER) |

|

(I.R.S. EMPLOYER IDENTIFICATION NO.) |

|

|

|

| 3555 Farnam Street Omaha, Nebraska |

|

68131 |

| (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) |

|

(ZIP CODE) |

(402) 346-1400

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbols |

|

Name of each exchange on which registered |

| Class A Common Stock |

|

BRK.A |

|

New York Stock Exchange |

| Class B Common Stock |

|

BRK.B |

|

New York Stock Exchange |

| 1.300% Senior Notes due 2024 |

|

BRK24 |

|

New York Stock Exchange |

| 0.000% Senior Notes due 2025 |

|

BRK25 |

|

New York Stock Exchange |

| 1.125% Senior Notes due 2027 |

|

BRK27 |

|

New York Stock Exchange |

| 2.150% Senior Notes due 2028 |

|

BRK28 |

|

New York Stock Exchange |

| 1.500% Senior Notes due 2030 |

|

BRK30 |

|

New York Stock Exchange |

| 2.000% Senior Notes due 2034 |

|

BRK34 |

|

New York Stock Exchange |

| 1.625% Senior Notes due 2035 |

|

BRK35 |

|

New York Stock Exchange |

| 2.375% Senior Notes due 2039 |

|

BRK39 |

|

New York Stock Exchange |

| 0.500% Senior Notes due 2041 |

|

BRK41 |

|

New York Stock Exchange |

| 2.625% Senior Notes due 2059 |

|

BRK59 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 2.02 |

Results of Operations and Financial Condition. |

On May 6, 2023, Berkshire Hathaway Inc. issued a press release announcing the Company’s earnings for the first quarter ended March 31, 2023. A copy of this press release is furnished with this report as an exhibit to this Form 8-K.

| ITEM 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year |

| |

(a) |

On May 7, 2023, the Board of Directors (the “Board”) of Berkshire Hathaway Inc., a Delaware corporation (the “Company”), voted to amend and restate the Company’s Bylaws effective immediately. Various sections of the Company’s Bylaws have been amended. The most significant bylaw changes were made to Section 2.10 – Advance Notice. Several of the changes to Section 2.10 were made in response to the SEC’s new Universal Proxy Rule, Rule 14a-19. Other changes to Section 2.10 related to various procedural matters required of shareholders proposing nominations and to certain information and assurances required of director nominees. Amendments to various other sections of the Bylaws were adopted to accommodate the possibility of virtual meetings; and to track certain provisions of Delaware General Corporate Law (“DGCL”) sections 222(a) and 222(c) regarding meeting notices, DGCL section 229 governing waiver of notices, DGCL section 141(c)(2-3) regarding the designation of committees of the Board, and to reflect the current provisions of DGCL section 158 allowing greater flexibility in permitted signatories. |

The foregoing description of the amendment and restatement of the Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Bylaws, attached hereto as Exhibit 3(ii) and incorporated herein by reference.

| ITEM 5.07 |

Submission of Matters to a Vote of Security Holders |

On May 6, 2023, Berkshire Hathaway Inc. held an annual meeting of its shareholders. The agenda items for the meeting along with the vote of the Company’s Class A and Class B common shareholders voting together as a single class with respect to each of the agenda items are shown below. There were nine items acted on at that meeting as follows: 1) Election of Directors; 2) A non-binding resolution to approve the compensation of Berkshire’s Named Executive Officers; 3) A non-binding resolution to determine the frequency with which shareholders shall be entitled to have an advisory vote on executive compensation; 4) A shareholder proposal regarding how the Company manages physical and transitional climate-related risks and opportunities; 5) A shareholder proposal regarding how climate-related risks are being governed by the Company; 6) A shareholder proposal regarding how the Company intends to measure, disclose and reduce GHG emissions associated with its underwriting, insuring and investment activities; 7) A shareholder proposal regarding the reporting on the effectiveness of the Corporation’s diversity, equity and inclusion efforts; 8) A shareholder proposal regarding the adoption of a policy requiring that two separate people hold the offices of the Chairman and the CEO; 9) A shareholder proposal requesting that the Company avoid supporting or taking a public policy position on controversial social and political issues. Following are the votes cast for and against each director.

|

|

|

|

|

|

|

|

|

| Proposal 1 – Election of Directors |

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Against |

|

| Warren E. Buffett |

|

|

471,669 |

|

|

|

18,143 |

|

| Charles T. Munger |

|

|

467,976 |

|

|

|

21,836 |

|

| Gregory E. Abel |

|

|

469,705 |

|

|

|

20,108 |

|

| Howard G. Buffett |

|

|

468,639 |

|

|

|

21,173 |

|

| Susan A. Buffett |

|

|

468,772 |

|

|

|

21,040 |

|

| Stephen B. Burke |

|

|

436,067 |

|

|

|

53,745 |

|

| Kenneth I. Chenault |

|

|

439,527 |

|

|

|

50,285 |

|

| Christopher C. Davis |

|

|

471,441 |

|

|

|

18,371 |

|

| Susan L. Decker |

|

|

422,181 |

|

|

|

67,631 |

|

| Charlotte Guyman |

|

|

422,688 |

|

|

|

67,124 |

|

| Ajit Jain |

|

|

469,601 |

|

|

|

20,211 |

|

| Thomas S. Murphy, Jr. |

|

|

476,525 |

|

|

|

13,287 |

|

| Ronald L. Olson |

|

|

468,578 |

|

|

|

21,234 |

|

| Wallace R. Weitz |

|

|

474,346 |

|

|

|

15,466 |

|

| Meryl B. Witmer |

|

|

476,508 |

|

|

|

16,904 |

|

The results of the other matters acted upon at the meeting were as follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Against |

|

|

Abstain |

|

| Proposal 2 – Advisory vote on executive compensation |

|

|

441,544 |

|

|

|

42,536 |

|

|

|

5,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 year |

|

|

2 years |

|

|

3 years |

|

|

Abstain |

|

| Proposal 3 – Advisory vote on the frequency of an advisory vote on executive compensation |

|

|

148,043 |

|

|

|

1,412 |

|

|

|

339,527 |

|

|

|

830 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Against |

|

|

Abstain |

|

| Proposal 4 – Shareholder proposal |

|

|

130,435 |

|

|

|

356,907 |

|

|

|

2,470 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Against |

|

|

Abstain |

|

| Proposal 5 – Shareholder proposal |

|

|

87,525 |

|

|

|

399,897 |

|

|

|

2,390 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Against |

|

|

Abstain |

|

| Proposal 6– Shareholder proposal |

|

|

110,983 |

|

|

|

376,345 |

|

|

|

2,484 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Against |

|

|

Abstain |

|

| Proposal 7– Shareholder proposal |

|

|

97,741 |

|

|

|

369,628 |

|

|

|

2,443 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Against |

|

|

Abstain |

|

| Proposal 8– Shareholder proposal |

|

|

53,287 |

|

|

|

433,434 |

|

|

|

3,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For |

|

|

Against |

|

|

Abstain |

|

| Proposal 9– Shareholder proposal |

|

|

4,038 |

|

|

|

484,363 |

|

|

|

1,412 |

|

| ITEM 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| May 10, 2023 |

|

|

|

BERKSHIRE HATHAWAY INC. |

|

|

|

|

|

|

|

/s/ Marc D. Hamburg |

|

|

|

|

By: |

|

Marc D. Hamburg |

|

|

|

|

Senior Vice President and Chief Financial Officer |

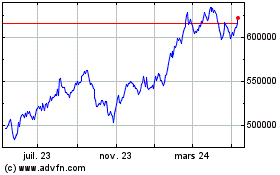

Berkshire Hathaway (NYSE:BRK.A)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

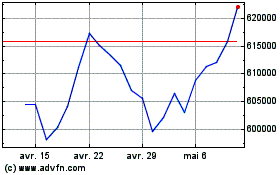

Berkshire Hathaway (NYSE:BRK.A)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024