CITIZENS FINANCIAL GROUP INC/RI0000759944DEF 14Afalse00007599442023-01-012023-12-31iso4217:USDcfg:pURE00007599442022-01-012022-12-3100007599442021-01-012021-12-3100007599442020-01-012020-12-310000759944ecd:PeoMembercfg:ReportedValueOfEquityAwardsMemberMember2023-01-012023-12-310000759944cfg:YearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberMemberecd:PeoMember2023-01-012023-12-310000759944ecd:PeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberMember2023-01-012023-12-310000759944cfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberMemberecd:PeoMember2023-01-012023-12-310000759944cfg:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberMemberecd:PeoMember2023-01-012023-12-310000759944ecd:PeoMembercfg:ReportedValueOfEquityAwardsMemberMember2022-01-012022-12-310000759944cfg:YearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberMemberecd:PeoMember2022-01-012022-12-310000759944ecd:PeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberMember2022-01-012022-12-310000759944cfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberMemberecd:PeoMember2022-01-012022-12-310000759944cfg:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberMemberecd:PeoMember2022-01-012022-12-310000759944ecd:PeoMembercfg:ReportedValueOfEquityAwardsMemberMember2021-01-012021-12-310000759944cfg:YearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberMemberecd:PeoMember2021-01-012021-12-310000759944ecd:PeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberMember2021-01-012021-12-310000759944cfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberMemberecd:PeoMember2021-01-012021-12-310000759944cfg:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberMemberecd:PeoMember2021-01-012021-12-310000759944ecd:PeoMembercfg:ReportedValueOfEquityAwardsMemberMember2020-01-012020-12-310000759944cfg:YearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberMemberecd:PeoMember2020-01-012020-12-310000759944ecd:PeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberMember2020-01-012020-12-310000759944cfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberMemberecd:PeoMember2020-01-012020-12-310000759944cfg:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberMemberecd:PeoMember2020-01-012020-12-310000759944ecd:NonPeoNeoMembercfg:ReportedValueOfEquityAwardsMemberMember2023-01-012023-12-310000759944cfg:ExclusionOfAverageReportedChangeInPensionValueMemberecd:NonPeoNeoMember2023-01-012023-12-310000759944cfg:YearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberMemberecd:NonPeoNeoMember2023-01-012023-12-310000759944ecd:NonPeoNeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberMember2023-01-012023-12-310000759944ecd:NonPeoNeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberMember2023-01-012023-12-310000759944cfg:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberMemberecd:NonPeoNeoMember2023-01-012023-12-310000759944ecd:NonPeoNeoMembercfg:ReportedValueOfEquityAwardsMemberMember2022-01-012022-12-310000759944cfg:ExclusionOfAverageReportedChangeInPensionValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000759944cfg:YearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberMemberecd:NonPeoNeoMember2022-01-012022-12-310000759944ecd:NonPeoNeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberMember2022-01-012022-12-310000759944ecd:NonPeoNeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberMember2022-01-012022-12-310000759944cfg:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberMemberecd:NonPeoNeoMember2022-01-012022-12-310000759944ecd:NonPeoNeoMembercfg:ReportedValueOfEquityAwardsMemberMember2021-01-012021-12-310000759944cfg:ExclusionOfAverageReportedChangeInPensionValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000759944cfg:YearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberMemberecd:NonPeoNeoMember2021-01-012021-12-310000759944ecd:NonPeoNeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberMember2021-01-012021-12-310000759944ecd:NonPeoNeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberMember2021-01-012021-12-310000759944cfg:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberMemberecd:NonPeoNeoMember2021-01-012021-12-310000759944ecd:NonPeoNeoMembercfg:ReportedValueOfEquityAwardsMemberMember2020-01-012020-12-310000759944cfg:ExclusionOfAverageReportedChangeInPensionValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000759944cfg:YearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberMemberecd:NonPeoNeoMember2020-01-012020-12-310000759944ecd:NonPeoNeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberMember2020-01-012020-12-310000759944ecd:NonPeoNeoMembercfg:YearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberMember2020-01-012020-12-310000759944cfg:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMemberMemberecd:NonPeoNeoMember2020-01-012020-12-31000075994412023-01-012023-12-31000075994422023-01-012023-12-31000075994432023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

| | | | | |

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

CITIZENS FINANCIAL GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

Payment of Filing Fee (Check all boxes that apply): |

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Letter from the Chairman and Chief Executive Officer

Dear Fellow Shareholder,

| | | | | |

On behalf of the Board of Directors, I am pleased to invite you to attend our annual meeting of shareholders to be held on Thursday, April 25, 2024 at 9:00 a.m. Eastern Time at our headquarters located at One Citizens Plaza, Providence, Rhode Island 02903. Positioned well for continued success This fall will mark 10 years since our IPO, and, in that time, we have worked hard to grow Citizens into a top-performing organization focused on performing our best every day for all of those we serve. The resilience of our business model, our ability to adapt and our customer-focused mindset enabled us to successfully navigate a challenging year in 2023. Our strategic investments in our business, technology and people have positioned us well for continued success, both today and over the longer-term. We remain committed to supporting our customers throughout their unique financial journeys, guided by our mission to help all of our stakeholders reach their potential. Your vote matters Your vote is important and, whether or not you plan to attend the meeting, we encourage you to access electronic voting via the Internet or utilize the automated telephone voting feature as described on your Notice of Internet Availability of Proxy Materials or proxy card. Alternatively, you may sign, date and return the proxy card in the envelope provided. You may also vote at the meeting if you plan to attend. Finally, I would like to thank Shivan Subramaniam for his service on our Board. Mr. Subramaniam will retire after his current term expires at the conclusion of the Annual Meeting. We appreciate the dedication he has shown to the Company and his extensive contributions during his time on the Board. We thank you for your support of Citizens Financial Group, Inc. Sincerely, Bruce Van Saun

Chairman of the Board and

Chief Executive Officer March 11, 2024 | |

|

|

“Our strategic investments in our business, technology and people have positioned us well for continued success” –Bruce Van Saun |

|

|

|

| | | | | |

| Citizens Financial Group | 1 |

Letter from the Lead Independent Director

Dear Fellow Shareholder,

2023 was a year that provided challenges and opportunities as we navigated a turbulent external environment. Throughout the year, the Board remained focused on the resiliency of the Company's business model, working closely with management and overseeing adjustments to our strategy to ensure we continue to deliver for our customers, colleagues, communities and shareholders.

Commitment to strong corporate governance

We are approaching our tenth year as a public company and our journey reflects our unwavering commitment to strong corporate governance. This commitment includes hearing from our shareholders. Understanding your perspectives helps us inform how we oversee the Company and, since becoming a public company, we have continually taken action to enhance our corporate governance in line with best practices. This has included strengthening shareholder rights, implementing additional practices to support board effectiveness, evolving our compensation program design and related disclosures, and ensuring compensation decisions remain aligned with Company performance.

Refreshed board composition

As Lead Independent Director, I am proud of the Board we have built. In preparation for my upcoming retirement, Tracy A. Atkinson joined the Board on March 1, 2024, and Edward J. Kelly III was named my successor as Lead Independent Director, and will be appointed to the position following the Annual Meeting, subject to his re-election. The nominees represent a strong, diverse board with an appropriate balance of long tenured directors with institutional knowledge and more recently elected directors with fresh new perspectives, collectively demonstrating the skills and experience necessary to oversee strong execution of the Company's long-term strategy.

Driving sustainable growth

We continue to focus on the environmental, social and governance matters most important to our Company and our stakeholders. This includes leading with robust corporate governance, driving positive climate impact, building the workforce of the future and fostering strong communities. In 2023, we made a sustainability announcement, which included a $50 billion Sustainable Finance Target, a commitment to engage corporate clients on climate-related matters, and our intention to be carbon neutral by 2035. We're committed to supporting our clients as they transition to a lower-carbon future.

Your support is important

In the accompanying proxy statement, we share essential information about your Board’s role in shaping Citizens’ Credo, values, governance, and strategy. Whether or not you can attend the Annual Meeting, we welcome your participation with Citizens and, on behalf of the Board, thank you for your continued support.

| | | | | |

| |

| Sincerely, Shivan Subramaniam Lead Independent Director and Chair, Nominating and Corporate Governance Committee March 11, 2024 |

| |

Notice of Annual Meeting of Shareholders

| | | | | | | | | | | |

Matters to be Voted On | | |

| Date and Time

April 25, 2024 at 9:00 a.m. Eastern Time Location

One Citizens Plaza, Providence, Rhode Island 02903. Record Date

February 28, 2024. Shareholders of record as of this date are entitled to notice of, and to vote at, the Annual Meeting. |

| | |

| | |

| 1 | Elect the Thirteen Named Director Nominees | |

| | |

| | |

| 2 | Approve the Amended & Restated 2014 Non-Employee Directors Compensation Plan | |

| | |

| | |

| 3 | Advisory Vote on Executive Compensation | |

| | |

| | |

| 4 | Approve the Amended & Restated 2014 Omnibus Incentive Plan | |

| | |

| | |

| 5 | Approve the Amended & Restated 2014 Employee Stock Purchase Plan | |

| | |

| | |

| 6 | Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year | |

| | |

| | |

| 7 | Any other business that may properly come before the Annual Meeting or any reconvened meeting following any adjournment or postponement thereof | |

| | |

| | |

Admission To attend the meeting you will need proof of your stock ownership as of the record date and a form of government-issued photo identification. If you are the legal representative of a shareholder, you must also bring a letter from the shareholder certifying (a) the beneficial ownership you represent and (b) your status as a legal representative. We will determine in our sole discretion whether the letter presented for admission meets the above requirements. Admission is limited to shareholders and guests are not permitted to attend the meeting. Notice For our Annual Meeting, we have elected to use the Internet as the primary means of providing our proxy materials to shareholders. We will send to shareholders of record a Notice of Annual Meeting of Shareholders (the "Notice") with instructions for accessing the proxy materials and for voting via the Internet. The Notice provides the information above on how to vote, how to attend the meeting and vote in person, and information on how shareholders may obtain paper copies of our proxy materials free of charge. By Order of the Board of Directors

Robin S. ElkowitzExecutive Vice President, Deputy General Counsel and Secretary

Stamford, Connecticut

March 11, 2024 | |

| How to Vote The address of the website for Internet voting can be found on your Notice or proxy card. Dial the number listed on your Notice or proxy card. Mark your proxy card, date and sign it, and return it in the postage-paid envelope provided. Attend the meeting and vote. |

| | |

Important notice regarding the availability of proxy materials for the Annual Meeting of Shareholders to be held on April 25, 2024: We will first mail the Notice to shareholders on or about March 11, 2024. On or about the same day, we will begin mailing hard copies of this Notice of the Annual Meeting of Shareholders and Proxy Statement, our 2023 Annual Report on Form 10-K and our 2023 Annual Review to those shareholders who have requested them. Copies of these materials will be available at www.edocumentview.com/CFG | |

| | | | | |

| Citizens Financial Group | 3 |

Table of Contents to Proxy Statement

| | | | | | | | |

| |

| | |

| | |

| | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| |

| | |

| FREQUENTLY REQUESTED INFORMATION |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

About Citizens

Our Business

| | | | | | | | | | | | | | | | | | | | |

Citizens Financial Group, Inc. is one of the nation’s oldest and largest financial institutions, with $222.0 billion in assets as of December 31, 2023. Headquartered in Providence, Rhode Island, Citizens offers a broad range of retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions. Citizens helps its customers reach their potential by listening to them and by understanding their needs in order to offer tailored advice, ideas, and solutions. In Consumer Banking, Citizens provides an integrated experience that includes mobile and online banking, a full-service customer contact center, and the convenience of approximately 3,200 ATMs and more than 1,100 branches in 14 states and the District of Columbia. Consumer Banking products and services include a full range of banking, lending, savings, wealth management, and small business offerings. In Commercial Banking, Citizens offers a broad complement of financial products and solutions, including lending and leasing, deposit and treasury management services, foreign exchange, and interest rate and commodity risk management solutions, as well as loan syndication, corporate finance, merger and acquisition, and debt and equity capital markets capabilities. | | | | | | |

| | $222.0 billion in assets | | $177.3 billion in deposits | |

| | | | | |

| | $146.0 billion in loans and leases | | 17,570 full-time equivalent colleagues | |

| | | | | |

| | 1,100 branches | | 3,200 ATMs | |

| | | | | |

| | | | | |

| Data as of December 31, 2023. |

| | | | | | | | |

| | |

Deposits in all 50 states with Citizens Access | | Approximately 6 million retail customers across all 50 states |

| | |

Our Strategic Priorities

• Solidify and deepen customer relationships

• Drive scale in growth markets, verticals and high-opportunity businesses

•Deliver high-quality, integrated solutions and advice

•Optimize business mix, drive efficiencies and invest in the future

| | | | | |

| Citizens Financial Group | 5 |

Our 2023 Performance

The Company delivered solid financial results in 2023 demonstrating the strength, resilience and adaptability of our business in the face of challenges from the economy, the impact of bank failures, increased regulatory pressures and intense competition. In this environment we focused on playing strong defense, bolstering a strong liquidity position and maintaining capital levels near the top of our regional bank peer group. We also made good progress against key objectives and advanced our strategic priorities while successfully supporting our customers, colleagues, and communities during the course of 2023.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| 2023 Highlights* |

| | | | | | |

$222.0B Assets | $146.0B Loans & Leases | $177.3B Deposits | 13.5% ROTCE | 60.8% Efficiency Ratio | 3.09% Net Interest Margin | 10.6% CET1 Ratio |

| | | | | | |

The Company has been substantially transformed over the ten years since our initial public offering in 2014. Our strong leadership team and investments to modernize our technology and operations have enabled both the Consumer and Commercial Banking businesses to successfully execute on their strategic initiatives. Consumer Banking has developed differentiated lending capabilities, enhanced our Wealth offering, invested in digitization and data analytics to deepen relationships in targeted segments and solidified our East Coast presence building on our acquisitions of the HSBC branches and Investors Bancorp, Inc.

In 2023, we were well positioned to invest opportunistically in and launch Citizens Private Bank, a significant step forward in our strategy to accelerate growth in Wealth Management, improve capabilities in the high net-worth segment and expand in key geographies.

Commercial Banking has broadened its capabilities to grow fees through organic investments and acquisitions, strengthened its client coverage model while developing expertise in targeted industry verticals and capabilities to serve the private capital ecosystem, and built on its expansion into markets such as the Southeast and West. Both Consumer and Commercial Banking have significantly improved the quality and capabilities of our deposit franchise which is evident in our improved performance in terms of stability and costs through the turmoil of 2023.

As a result of these investments and the successful execution of our strategic initiatives, as well as disciplined programs such as Balance Sheet Optimization and Tapping Our Potential, we are laying a strong foundation and positioning the bank for improving performance over the medium-term.

The accompanying chart reflects our long-term results on two of the core financial metrics, Diluted EPS and ROTCE, which anchor our strategic plan. While our results were impacted by rising funding costs and muted capital markets and mortgage banking activity, we strengthened our balance sheet and advanced our strategic initiatives throughout the year, positioning us well for strong medium-term performance. In addition, the Company’s Total Shareholder Return has outperformed that of our peer group since our initial public offering as well as during the most recent five-year period. For additional detail, see “Compensation Matters—Compensation Discussion and Analysis.”

| | |

Core Financial Metrics |

* Results are presented on an Underlying basis, as applicable. See Appendix A for more information on Non-GAAP Financial Measures and Reconciliations. Unless otherwise noted, references to balance sheet items above are on a period-end basis and any comparisons are on a year-over-year basis versus 2022. For information on how we define Diluted EPS and ROTCE, see page 60. |

Driving Sustainable Growth

Strategy

An extension of our Credo, Citizens’ integrated, enterprise-wide strategy on environmental, social, and governance matters helps us unite our values and purpose to build a more diverse and sustainable future for all those we serve. Led by robust corporate governance, this strategy guides the decisions we make. It means serving our customers and clients, engaging shareholders, reducing our environmental impact and empowering our colleagues and communities to thrive.

This work is aligned with the needs, interests, and expectations of our stakeholders. Our four focus areas, described below, speak to the strengths of our Company, align with our business priorities, and define how we can drive sustainable growth and have a positive impact on our business, society, and the planet.

In 2023, Citizens announced a $50 billion Sustainable Finance Target to finance and facilitate green and social initiatives. This includes affordable housing, support for small businesses, and community development projects. It also includes $5 billion in financing and facilitation for green initiatives that support a lower-carbon future. The Company also announced that it will engage corporate clients in high-emitting sectors on climate-related topics. To start, it will engage 100% of its Oil & Gas clients by the end of 2024. In addition, Citizens announced its intention to be carbon neutral by 2035.

| | | | | |

| |

| Leading with Robust Corporate Governance Strong corporate governance is foundational to how we do business. Having a robust corporate governance framework strengthens Board and management accountability and is essential to ensuring we make sound business decisions. Our key corporate governance practices are described in more detail throughout this Proxy Statement. |

| |

| |

| Driving Positive Climate Impact The impacts of climate change and the transition to a lower carbon economy present risks and opportunities for our business and our stakeholders. We believe banks will play a key role in leading the transition. At Citizens, we’re committed to driving positive climate impact by reducing our operational emissions, supporting our clients, empowering communities, and disclosing our progress along the way. |

| |

| |

| Building the Workforce of the Future Developing the workforce of the future is critical to meet the accelerating needs of the economy. We are expanding the pipeline for diverse talent, ensuring opportunities for growth and leadership, and building a culture of belonging. We help the communities we serve by investing in organizations that provide upskilling and reskilling services. |

| |

| |

| Fostering Strong Communities We work to strengthen communities and catalyze positive change by expanding supplier diversity, creating innovative products, offering better access to capital, and helping small businesses thrive. Our work helps address critical economic needs by increasing home ownership and providing financial resources and capital to reduce wealth and opportunity gaps. |

| |

Recognition

We continue to be recognized externally for our diversity and inclusion efforts through new accolades including: Certified Age Friendly Employer, NOD 2023 Leading Disability Employer, and DiversityInc - Top 50 Regional Companies. In recognition of our Board's knowledge, leadership, and excellence in corporate governance, it was named 2023 Top Public Company Board of the Year by the National Association of Corporate Directors New England Chapter.

| | | | | |

| Citizens Financial Group | 7 |

Highlights

We continue to accelerate our efforts and evolve our approach to meet stakeholder expectations.

| | | | | | | | |

| | |

| Leading with Robust Corporate Governance | | Driving Positive Climate Impact |

| | |

| | |

•Our corporate governance framework aligns with best practices which support robust oversight and sound decision-making, in turn promoting the creation of long-term value for our shareholders. •12 out of 13 director nominees are independent in accordance with NYSE requirements, and the Board has an independent Lead Director with a formally defined role and responsibilities. •Our nominated Board is 38% gender diverse, and regularly refreshed. 8 new directors have been appointed in the past 5 years. Our diverse Board composition with varied director experiences and perspectives informs discussions and supports sound decision making. •Our enhanced shareholder rights support our shareholder voice. This includes providing shareholders with proxy access, the right to call a special meeting, and a simple majority vote standard to amend our Certificate of Incorporation and Bylaws and elect directors. Through various forums, we also make available opportunities for shareholders to engage with executive management and the Board. | | •In 2023, we announced a $50 billion Sustainable Finance Target, including $5 billion for green initiatives that support a lower-carbon future such as renewable energy, clean technologies, and green buildings. •We also made enhancements to the way the Company manages its climate-related risks, including completion of an enterprise-wide climate risk assessment, expansion of bottoms-up client review for evaluation of climate-related risks and opportunities, advancement of financed emission estimation capabilities, and heightened awareness of climate risk organizationally. •The Sunflower Wind project is a 200-Megawatt (MW) wind generation facility in Marion County, Kansas. It is a result of a virtual power purchase agreement between Citizens and Ørsted. The Sunflower Wind project became operational in 2023. |

| | |

| | |

| | |

| Building the Workforce of the Future | | Fostering Strong Communities |

| | |

| | |

•We foster a culture where all stakeholders feel respected, valued, and heard. Our business resource groups (“BRGs”) are integral to identifying and formulating solutions to issues that are most important to our diverse customers, colleagues, and the community. Each BRG is sponsored by a member of our Executive Committee and approximately 3,500 colleagues belonged to at least one BRG as of December 31, 2023. •We continue to expand development programs and learning experiences that support colleagues and build skills for the future. In 2023, 82% of colleagues spent time in the Citizens Learning Hub (completing over 452,000 hours of development and training) and more than 5,100 colleagues attended our academies, which include learning experiences to build select critical skills. •We engage colleagues to help prioritize areas most important to them using an organizational health survey. In 2023, 87% of colleagues participated in the survey, which is our all-time highest participation rate. •We remain committed to pay equity with an annual pay equity analysis conducted by a third-party firm. Our 2023 analysis indicated that women are paid 99% of what men in similar roles are paid and that people of color are paid 100% of what white colleagues in similar roles are paid. | | •Through our flagship portfolio mortgage program: Destination Home Mortgage, targeting low- to moderate income and minority communities, we provided $129 million in loans during 2023, our largest volume ever. •Since 2019 Citizens has provided $14 million in Closing Cost Assistance grants for first-time homebuyers in low-to moderate and minority communities •Citizens also developed an innovative home equity line of credit, GoalBuilder to serve low- to moderate income communities and has originated $42 million since 2020. •Since 2012, we’ve provided nearly $8 billion in debt and equity to support the creation or rehabilitation of nearly 50,000 affordable housing units, impacting an estimated 565,000 individuals. •Since 2020 through our Small Business Opportunity Fund, we’ve provided $65 million in capital, and made $210,000 in cash grants to aspiring entrepreneurs from underserved communities. •We enable and equip our colleagues as brand ambassadors, sharing their time, talent and resources in areas of greatest need. In 2023, our colleagues logged 232,000+ volunteer hours to benefit 3,000+ nonprofits, served on 1,000+ non-profit boards or committees, and contributed $1.1 million to community organizations through the bank’s matching gifts donation program (funded by the Citizens Charitable Foundation). |

| | |

Proxy Statement Summary

Matters to be Voted at the Annual Meeting

| | | | | | | | | | | | | | |

| | | | |

PROPOSAL 1 | Elect the following nominees as directors: | |

•Bruce Van Saun •Lee Alexander •Tracy A. Atkinson •Christine M. Cumming •Kevin Cummings | •William P. Hankowsky •Edward J. Kelly III •Robert G. Leary •Terrance J. Lillis •Michele N. Siekerka | •Christopher J. Swift •Wendy A. Watson •Marita Zuraitis | |

| | | |

BOARD VOTE RECOMMENDATION  FOR ALL FOR ALLOur Board believes that its director nominees represent an appropriate mix of experience and skills relevant to the size and nature of our business. | |

| | | | |

| | | | | | | | |

| | |

PROPOSAL 2 | Approve the Amended & Restated 2014 Non-Employee Directors Compensation Plan We are asking shareholders to approve this plan to provide the Company with the continued ability to grant non-employee directors equity-based compensation following the upcoming expiration of the current plan in September 2024 on the tenth anniversary of its effective date. | |

| BOARD VOTE RECOMMENDATION  FOR FOROur Board believes that continuing to grant non-employee director compensation partially in the form of equity-based awards promotes the long-term growth and success of the Company and furthers the best interests of our shareholders. | |

| | |

| | | | | | | | |

| | |

PROPOSAL 3 | Advisory Vote on Executive Compensation We are asking shareholders to approve, on an advisory basis, the 2023 compensation of our executive officers named in the 2023 Summary Compensation Table, as disclosed in the Compensation Discussion and Analysis, the compensation tables, and accompanying narrative. | |

| BOARD VOTE RECOMMENDATION  FOR FOROur Board believes our executive compensation closely aligns the interests of our named executive officers with those of our shareholders and continues to demonstrate a strong link between executive pay and Company performance. | |

| | |

| | | | | |

| Citizens Financial Group | 9 |

| | | | | | | | |

| | |

PROPOSAL 4 | Approve the Amended & Restated 2014 Omnibus Incentive Plan We are asking shareholders to approve this plan to provide the Company with the continued ability to grant employees equity-based awards following the upcoming expiration of the current plan in September 2024 on the tenth anniversary of its effective date. | |

|

BOARD VOTE RECOMMENDATION  FOR FOROur Board believes that continuing to grant equity-based awards to employees, most notably including our senior executives, is integral to maintaining alignment of executives' interests with those of our shareholders and the Company's ability to attract, retain, and motivate employees. | |

| | |

| | | | | | | | |

| | |

PROPOSAL 5 | Approve the Amended & Restated 2014 Employee Stock Purchase Plan We are asking shareholders to approve this plan to provide the Company with the continued ability to allow employees to purchase shares of our common stock at a discount through an employee stock purchase plan following the upcoming expiration of the current plan in September 2024 on the tenth anniversary of its effective date. | |

| BOARD VOTE RECOMMENDATION  FOR FOROur Board believes that providing an opportunity for broad-based employee stock ownership is important so that employees have an opportunity to share in our long-term success and are further incentivized to work toward our long-term goals. | |

| | |

| | | | | | | | |

| | |

PROPOSAL 6 | Ratify the appointment of Deloitte & Touche LLP We are asking our shareholders to ratify Deloitte & Touche LLP as our independent registered public accounting firm for the 2024 fiscal year. | |

| BOARD VOTE RECOMMENDATION  FOR FORBased on the Audit Committee’s most recent evaluation, the Board believes it is in the best interests of the Company and its shareholders to retain Deloitte & Touche LLP as our independent registered public accounting firm for the 2024 fiscal year. | |

| | |

Our Board and Governance

Board Nominees

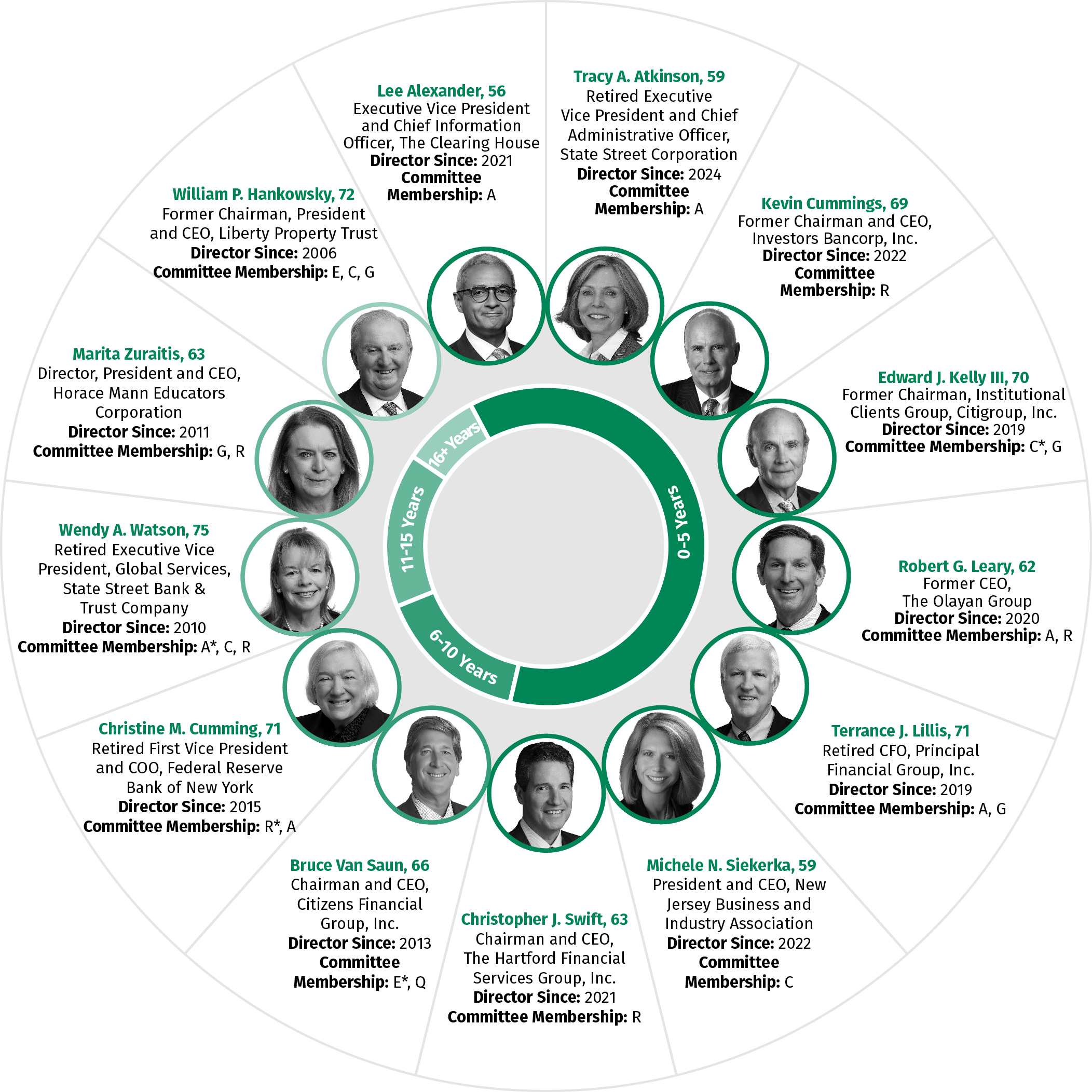

In accordance with the Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws of Citizens Financial Group, Inc. (the “Company” or “we” or “us” or “our”), our board of directors (the “Board”) will consist of not less than five nor more than twenty-five directors, excluding any directors elected by holders of preferred stock pursuant to provisions applicable only in the case of nonpayment of dividends under the terms of our preferred stock. The exact number of directors is fixed from time to time by resolution of our Board which currently has 14 directors. The terms of office of all directors expire at the Annual Meeting and all current directors are standing for re-election with the exception of Mr. Subramaniam who has reached our mandatory retirement age of 75. While Ms. Watson has also reached our mandatory retirement age of 75, the Board decided to grant a waiver in this instance and further information is provided on page 28. Additional information about the director nominees can be found beginning on page 17. The nominees for director are as follows:

| | | | | | | | | | | |

* Chair | E – Executive | A – Audit | C – Compensation & Human Resources |

| Q – Equity | R – Risk | G – Nominating & Corporate Governance |

| | | | | |

| Citizens Financial Group | 11 |

Board Skills and Diversity

The Board values diverse perspectives and experiences which it believes are critical to robust discussion and effective decision-making. When reviewing the composition of our Board and its committees, the Nominating and Corporate Governance Committee considers self-identified diverse characteristics of directors and nominees in addition to each person’s background, experience, independence and tenure.

54% of our Board nominees represent diverse groups—five women, one person of color and one veteran. The composition of our nominated Board includes long-tenured directors which allows for continuity as well as new directors who bring fresh insights and perspectives. Over half of our Board nominees have a tenure of less than five years. We believe that the Board nominees as a whole represent an appropriate and diverse mix of experience, skills and demographics relevant to the size and nature of our business, and our long-term strategy.

| | | | | | | | |

| | |

| Nominee Skills and Experience | |

| | |

| | |

| | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| Nominee Diversity | | | Nominee Tenure | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Age 66 Years Average Age of Director Nominees Age Range: 56-75 | | | Independence 92% of all Director Nominees are Independent | |

| | | | | |

Key Corporate Governance Practices

| | | | | |

| |

Board Independence and Oversight | •All director nominees are independent except for the Chairman who also serves as the CEO of the Company •Non-classified board structure •Independent Lead Director with formally defined role and responsibilities •Executive sessions of independent directors held at every regularly scheduled meeting •Key committees are fully independent (Audit, Risk, Compensation and Human Resources and Nominating and Corporate Governance) |

| |

| |

Board Qualifications and Evaluations | •Board skills and experience aligned to strategy •Board orientation and continuing education program supports ongoing director development •Board, committee and individual self-assessments conducted annually with an external facilitator •Board mentoring program and informal feedback sessions with senior management facilitates engagement and deeper understanding of the organization |

| |

| |

Board Refreshment and Diversity | •Mandatory retirement age of 75 for directors promotes Board refreshment •Gender and racial diversity represented on the Board •Diversity of tenure provides balance of historical knowledge and new perspectives •Diversity of age provides balance of extensive experience and fresh outlooks •Director recruitment and selection process prioritizes leadership, relevant experience and skills, independence and diversity |

| |

| |

Board Practices | •Service on other public company boards limited in accordance with our Corporate Governance Guidelines •Stock ownership guidelines for directors and executive officers include mandatory stock retention requirements and align directors’ and executives’ interests with those of shareholders •Annual review of Corporate Governance Guidelines ensures alignment with best practices •Succession planning discussions for CEO and senior management conducted throughout the year |

| |

| |

Board Oversight of Risk | •Board oversight of risk led by the Risk and Audit Committees •Risk Committee responsible for reviewing and approving the Enterprise Risk Management Governance Framework and ensuring risks are properly managed to the risk appetites set for each material risk category •Updates on cybersecurity risk presented to the Risk Committee at each meeting with additional reporting provided regularly to the Board and Audit Committee |

| |

| |

Shareholder Rights and Engagement | •Annual election of directors with majority vote standard for uncontested elections •Annual advisory vote on executive compensation •Capital structure with one vote per common share •Shareholders have proxy access •Shareholders have the right to call a special meeting •No poison pill •Annual Board review of Charter and Bylaw provisions •Annual shareholder outreach program with feedback from engagements shared with and discussed by the Board •Simple majority vote to amend Certificate of Incorporation |

| |

| |

Oversight of Environmental, Social and Governance Matters | •Board oversight of environmental, social and governance matters •Management structure with cross-functional executive steering council •Annual voluntary reporting aligned to Global Reporting Initiative ("GRI") and Sustainability Accounting Standards Board ("SASB") reporting frameworks •Dedicated climate reporting aligned to industry standards (e.g., the Task Force on Climate-Related Financial Disclosures ("TCFD") framework) •Annual analysis of pay equity |

| |

| |

Culture and Ethics | •Code of Business Conduct and Ethics which establishes core standards of ethical conduct •Conduct Office overseen by the Audit Committee and provides the Board and executive management with an independent and objective view of the Company’s conduct risk profile •Annual organizational health survey •Strong Diversity, Equity and Inclusion program overseen by the Compensation and Human Resources Committee |

| |

| | | | | |

| Citizens Financial Group | 13 |

Our Executive Compensation Program

The Compensation and Human Resources Committee (the “Compensation and HR Committee”) is responsible for our executive compensation program and determining appropriate compensation for our CEO and other executives. The Compensation and HR Committee has designed and administered a program that has a demonstrated history of maintaining appropriate alignment between executive compensation and Company performance, considers and has been responsive to shareholder feedback, and is supported by effective corporate governance and risk management. Our executive compensation program has strong shareholder support, with our say-on-pay proposal receiving over 93% support from shareholders in April 2023.

Pay Mix

More than 80% of our named executive officers’ ("NEOs") total compensation is at-risk variable compensation, which is illustrated below along with the portion of pay delivered in cash, restricted stock units ("RSUs") and performance stock units ("PSUs") for the 2023 performance year. At least 50% of long-term awards are granted in the form of performance awards with a three-year performance period, which increases to nearly two-thirds for our CEO, CFO, and the Heads of our Consumer and Commercial businesses.

How We Make Compensation Decisions

Executive compensation is determined by the Compensation and HR Committee following a comprehensive evaluation of Company and individual performance from a variety of perspectives – financial, customer, strategic, human capital, and risk. As part of its process, the Compensation and HR Committee specifically considers the risk performance of each executive as assessed annually by our Chief Risk Officer. In addition, compensation decisions are informed by peer data, compensation history, input from the Compensation and HR Committee’s independent consultant, feedback from each of the CEO and Chief Human Resources Officer regarding executives other than themselves, and shareholder feedback.

Once all of those factors have been considered, the Compensation and HR Committee exercises structured discretion to make executive compensation decisions that are aligned with performance, from both qualitative and quantitative perspectives. Maintaining a discretionary program also mitigates the risk of disproportionate focus on certain elements of performance and allows the Compensation and HR Committee to be nimble in its decision-making to ensure continued alignment of executive compensation with Company performance and shareholders' interests.

Pay and Performance Alignment

The Company has grown in size and scope and has made strong progress relative to our strategic plan. 2023 was a highly challenging year given macroeconomic conditions and bank failures, which resulted in heightened scrutiny for regional banks. Under Mr. Van Saun's leadership, during 2023 the senior management team effectively pivoted to items within management's control, including maintaining strong capital and liquidity positions, execution of several balance sheet optimization initiatives, and the launch of Citizens Private Bank. As a result, the Company emerged from 2023 in an even stronger position for long-term growth.

Despite strong execution of the Company's long-term strategic plan under Mr. Van Saun's leadership during 2023, the Compensation and HR Committee understands the importance of aligning executive pay with key financial outcomes. As can be seen below, CEO pay decisions by the Compensation and HR Committee during the past several years have been aligned with our key financial metrics, Diluted Earnings Per Share ("Diluted EPS") and Return on Average Tangible Common Equity ("ROTCE").

| | | | | | | | | | | | | | | | | | | | | | | |

| Asset Size (billions) | n | CEO Total Direct Comp (millions) | – | ROTCE* | – | Diluted EPS* |

* Results are presented on an Underlying basis, as applicable. See Appendix A for more information on Non-GAAP Financial Measures and Reconciliations. Unless otherwise noted, references to balance sheet items above are on a period-end basis and any comparisons are on a year-over-year basis versus 2022. For information on how we define Diluted EPS and ROTCE, see page 60. The Compensation and HR Committee is also conscious of stock price performance when evaluating performance and determining pay. Company one-year Total Shareholder Return ("TSR") was down 11%. Ultimately, the Compensation and HR Committee delivered 2023 total compensation to Mr. Van Saun which was down 17% year-over-year, and which represented a 33% reduction in variable cash compensation year-over-year.

| | | | | |

| Citizens Financial Group | 15 |

Corporate Governance Matters

| | | | | | | | | | | |

| | | |

PROPOSAL 1 | | Elect the Thirteen Named Director Nominees |

| | |

| Elect each of the director nominees nominated by the Board to serve until the 2025 annual meeting or until their respective successor is duly elected and qualified. |

| | |

| | The Board recommends a vote FOR each director nominee. |

| | | |

Our Amended and Restated Certificate of Incorporation, or Charter, and Amended and Restated Bylaws provide that the Board shall consist of between five and twenty-five directors, excluding any directors elected by holders of preferred stock pursuant to provisions applicable only in the case of nonpayment of dividends under the terms of our preferred stock. The Board fixes the exact number of directors from time to time and has fixed the number at 14 until the conclusion of the Annual Meeting when Mr. Subramaniam will retire, following which it will decrease to 13. At each annual meeting, directors are elected to hold office for a term of one year expiring at the next annual meeting.

The Board has nominated 13 of the 14 directors currently serving on the Board for election at the Annual Meeting to serve until the 2025 annual meeting or until their respective successors are duly elected and qualified. If any nominee is unable to serve as a director, the Board by resolution may reduce the number of directors or choose a substitute nominee. We are not aware of any nominee who will be unable to or will not serve as a director.

| | |

|

Majority Voting and Director Resignation Policy Our Bylaws provide for the election of directors by a majority of the votes cast in an uncontested election. This means that the 13 individuals nominated for election to the Board must receive more “FOR” than “AGAINST” votes (among votes properly cast at the meeting, electronically or by proxy) to be elected. Abstentions and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the election of nominees. Proxies cannot be voted for a greater number of persons than the number of nominees named. There is no cumulative voting. If any nominee for any reason is unable to serve or will not serve, proxies may be voted for such substitute nominee as the proxy holder may determine. If the election of directors is a contested election, directors are elected by a plurality of the votes cast. Our Bylaws also provide that directors may be removed, with or without cause, by an affirmative vote of shares representing a majority of the outstanding shares then entitled to vote at an election of directors. Any vacancy occurring on our Board and any newly created directorship may be filled only by a vote of a majority of the remaining directors in office. If a nominee does not receive a majority of “FOR” votes, he or she shall tender to the Board, via the Chair of the Nominating and Corporate Governance Committee, his or her resignation. The Nominating and Corporate Governance Committee will consider the resignation and make a recommendation to the Board whether to accept or reject the tendered resignation no later than 60 days following the date of the Annual Meeting in accordance with the specific requirements outlined in our Corporate Governance Guidelines. |

|

Corporate Governance Matters

Director Nominees

Board Skills, Demographics and Diversity

We believe that the Board nominees as a whole represent an appropriate and diverse mix of experience, skills and demographics relevant to the size and nature of our business, and our long-term strategy. The table below indicates the specific skills and experience for each director which are most relevant to their board service and which the Nominating and Corporate Governance Committee considers to be key in making its nomination recommendations. Not having such a designation does not mean the director does not possess that skill or experience.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Skills and Experience | | | | | | | | | | | | | |

| Executive Leadership | | | | | | | | | | | | | |

| Financial Services Industry | | | | | | | | | | | | | |

| Financial Reporting/Audit/Capital Planning | | | | | | | | | | | | | |

| Risk Management | | | | | | | | | | | | | |

| Compliance/Regulatory | | | | | | | | | | | | | |

| Technology | | | | | | | | | | | | | |

| Information Security/Cybersecurity | | | | | | | | | | | | | |

| Mergers & Acquisitions | | | | | | | | | | | | | |

| Corporate Governance | | | | | | | | | | | | | |

| Human Capital Management | | | | | | | | | | | | | |

| Sustainability Practices | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Independence and Committee Membership | | | | | | | | | | | | | |

| Independent | N | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y | Y |

| Committee Membership | | | | | | | | | | | | | |

| E* | | | | | E | | | | | | | |

| A | A | A | | | | A | A | | | A* | |

| | | | | | C | C* | | | C | | C | |

| | | | | | G | G | | G | | | | G |

| | | | R* | R | | | R | | | R | R | R |

| Q | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Tenure (years) | 10 | 3 | 0 | 8 | 2 | 17 | 5 | 4 | 5 | 2 | 3 | 13 | 12 |

| Board Demographics |

| Age | 66 | 56 | 59 | 71 | 69 | 72 | 70 | 62 | 71 | 59 | 63 | 75 | 63 |

| Gender | M | M | F | F | M | M | M | M | M | F | M | F | F |

| Race | White | Black/White | White | White | White | White | White | White | White | White | White | White | White |

| Veteran | - | - | - | - | - | - | - | - | Y | - | - | - | - |

| | | | | | | | | | | |

| * Committee Chair | E – Executive | A – Audit | C – Compensation and Human Resources |

| Q – Equity | R – Risk | G – Nominating and Corporate Governance |

| | | | | |

| Citizens Financial Group | 17 |

Corporate Governance Matters

Biographies of our Nominees

| | | | | | | | |

| | |

| Bruce Van Saun CHAIRMAN AND CHIEF EXECUTIVE OFFICER |

| |

Age: 66 Joined the Board: October 2013 | Board Committees: Executive (Chair); Equity Other Current Public Company Directorships: Moody’s Corporation |

| | |

Career Highlights

| | |

| 2013 to present |

Chairman and Chief Executive Officer, Citizens Financial Group, Inc. |

|

| 2009 to 2013 |

Finance Director and member of the board of directors, The Royal Bank of Scotland Group plc |

|

| 1997 to 2008 |

Vice Chairman and Chief Financial Officer, prior to which he held other senior positions, The Bank of New York Mellon |

|

| Prior to 1997 |

Held senior positions at Deutsche Bank, Wasserstein Perella Group, and Kidder Peabody & Co. |

Further Information

Mr. Van Saun currently serves on the board of directors of Moody’s Corporation (since 2016). He also serves on the board of the Bank Policy Institute, The Clearing House supervisory board (since 2013), the board of the Partnership for Rhode Island, and the board of our primary subsidiary, Citizens Bank, N.A. ("CBNA"). Previous directorships held by Mr. Van Saun in both the United Kingdom and United States include the Federal Reserve Bank of Boston (from 2019

to 2022), the Federal Advisory Council (from 2016 to 2018), the National Constitution Center (from 2015 to 2019), Lloyds of London (from 2012 to 2016), Direct Line Insurance Group plc (from 2012 to 2013), Worldpay (Ship Midco Limited) (from 2011 to 2013), and ConvergEx Inc. (from 2007 to 2013).

Mr. Van Saun received a B.S. in Business Administration from Bucknell University in 1979 and an M.B.A. in Finance and General Management from the University of North Carolina in 1983.

Relevant Skills and Experience

| | | | | | | | | | | |

| Executive Leadership | | Financial Reporting & Capital Planning |

| Financial Services | | Mergers & Acquisitions |

Mr. Van Saun has extensive experience with over 35 years in the financial services industry and service on the boards of other public companies.

He has financial expertise and leadership having served as a Chief Financial Officer at large global banks.

His additional role as our Chief Executive Officer brings management’s perspective to Board deliberations and provides valuable information about the status of day-to-day operations.

| | | | | | | | |

| | |

| Lee Alexander INDEPENDENT DIRECTOR |

| |

Age: 56 Joined the Board: February 2021 | Board Committees: Audit Other Current Public Company Directorships: None |

| | |

Career Highlights

| | |

| 2018 to Present |

Executive Vice President and Chief Information Officer, The Clearing House |

|

| 2015 to 2018 |

Executive Vice President, Chief Information Officer, Head of the Technology Group, and member of Management Committee, Federal Reserve Bank of New York |

|

| 2012 to 2015 |

Senior Vice President, Head of Application Development, Federal Reserve Bank of New York |

Further Information

Mr. Alexander currently serves as the Executive Vice President and Chief Information Officer for The Clearing House and is responsible for directing and coordinating all technology and operations across the company. Mr. Alexander also serves on the board of our primary subsidiary CBNA.

Mr. Alexander holds a B.Sc. in Computing Science and an M.B.A. from the University of Glasgow in Scotland.

Relevant Skills and Experience

| | | | | | | | | | | |

| Technology | | Financial Services |

| Information & Cybersecurity | | Regulations & Compliance |

Mr. Alexander has extensive technology expertise leading the Federal Reserve Bank of New York's application and development efforts, and was instrumental to development of a bank and system-wide architecture and for the development and completion of the Fedwire modernization project.

He has over 25 years of international management experience in the technology and financial services sectors.

He also has experience in cybersecurity and incident response from his service as Chief Information Officer at The Clearing House, and previously as Head of the Technology Group and Chief Information Officer at the Federal Reserve Bank of New York.

Corporate Governance Matters

| | | | | | | | |

| | |

| Tracy A. Atkinson INDEPENDENT DIRECTOR |

| |

Age: 59 Joined the Board: March 2024 | Board Committees: Audit Other Current Public Company Directorships: United States Steel Corp. RTX Corp. Affiliated Managers Group, Inc. |

| | |

Career Highlights

| | |

| 2019 to 2020 |

| Executive Vice President and Chief Administrative Officer, State Street Corporation |

|

| 2017 to 2019 |

| Executive Vice President, Chief Compliance Officer and Head of Operational Risk, State Street Corporation |

|

| 2010 to 2017 |

| Executive Vice President, Finance, and Treasurer (from 2016), State Street Corporation |

|

| 2008 to 2010 |

| Held positions as Executive Vice President and Chief Compliance Officer, State Street Corporation (from 2009 to 2010), and as Executive Vice President and Chief Compliance Officer, State Street Global Advisors (from 2008 to 2009) |

|

| Prior to 2008 |

| Served in various leadership positions at MFS Investment Management, and as a Partner at PricewaterhouseCoopers |

Further Information

Ms. Atkinson serves on the boards of directors of United States Steel Corporation (since 2020), RTX Corporation (formerly Raytheon Technologies) (since 2014), and Affiliated Managers Group (since 2020). She also serves on the board of our primary subsidiary CBNA.

Ms. Atkinson is a certified public accountant and received a bachelor’s degree in accounting from the University of Massachusetts.

Relevant Skills and Experience

| | | | | | | | | | | |

| Financial Services | | Regulations & Compliance |

| Financial Reporting & Capital Planning | | Risk Management |

Ms. Atkinson is an experienced financial services executive serving in various roles for State Street Corporation including Chief Administrative Officer and is a Certified Public Accountant.

She has extensive background in financial reporting and capital planning, and in regulations and compliance having served as Chief Compliance Officer, and Treasurer of State Street Corporation.

| | | | | | | | |

| | |

| Christine M. Cumming INDEPENDENT DIRECTOR |

| |

Age: 71 Joined the Board: October 2015 | Board Committees: Risk (Chair); Audit Other Current Public Company Directorships: None |

| | |

Career Highlights

| | |

| 2004 to 2015 (Retirement) |

First Vice President (2nd highest ranking officer), Chief Operating Officer and an alternate voting member of the Federal Open Market Committee, Federal Reserve Bank of New York |

|

| 1999 to 2003 |

Executive Vice President and Director for the Research and Market Analysis Group, Federal Reserve Bank of New York |

|

| 1994 to 1999 |

Senior Vice President for the Bank Supervision Group, Federal Reserve Bank of New York |

Further Information

Ms. Cumming currently serves on the board of American Family Insurance Mutual Holding Company (since 2016), and MIO Partners, Inc. (since 2018). She previously served on the board of the Financial Accounting Foundation (from 2016 to 2020). Ms. Cumming is an adjunct professor at Columbia University and serves as a trustee of the Columbia-Greene Community College Foundation (since 2022). She also serves on the board of our primary subsidiary CBNA.

Ms. Cumming holds both a B.S. and Ph.D in economics from the University of Minnesota.

Relevant Skills and Experience

| | | | | | | | | | | |

| Financial Services | | Regulations & Compliance |

| Financial Reporting & Capital Planning | | Risk Management |

Ms. Cumming is a seasoned bank regulatory executive with over 35 years at the Federal Reserve Bank of New York, including serving as First Vice President and Chief Operating Officer.

She has extensive background in risk management, monetary policy, and bank supervision having had responsibility for the Bank Analysis and Advisory and Technical Services functions during her service at the Federal Reserve Bank of New York.

She has experience in crisis management as chair of the Cross-Border Crisis Management Group, an international group of supervisors which coordinated recovery and resolution planning for large, global financial institutions for the Resolution Steering Group of the G-20’s Financial Stability Board.

| | | | | |

| Citizens Financial Group | 19 |

Corporate Governance Matters

| | | | | | | | |

| | |

| Kevin Cummings INDEPENDENT DIRECTOR |

| |

Age: 69 Joined the Board: April 2022 | Board Committees: Risk Other Current Public Company Directorships: None |

| | |

Career Highlights

| | |

| 2018 to 2022 (Retirement) |

Chairman and Chief Executive Officer, Investors Bancorp, Inc. and Investors Bank |

|

| 2008 to 2018 |

President and Chief Executive Officer, Investors Bancorp and Investors Bank |

|

| 2003 to 2008 |

Executive Vice President and Chief Operating Officer, Investors Bank |

|

| Prior to 2003 |

Spent 26 years at KPMG LLP, serving as a Partner for 14 years |

Further Information

Mr. Cummings joined our Board in 2022 upon the closing of the acquisition of Investors Bancorp, Inc. where he previously served as Chairman and Chief Executive Officer. He is the former Chairman of the Board of the New Jersey Bankers Association and sits on the

Board of Trustees of the Scholarship Fund for Inner-City Children and the Board of Trustees at St. Benedict’s Preparatory School. In addition, he is chair of the board of Greater Trenton and the Community Foundation of New Jersey. Mr. Cummings is a trustee of the Investors Charitable Foundation and the Citizens Philanthropic Foundation. He also serves on the board of our primary subsidiary CBNA. Mr. Cummings previously served on the board of the Federal Home Loan Bank of New York (from 2014 to 2022).

Mr. Cummings is a certified public accountant, has a bachelor’s degree in economics from Middlebury College, and a master’s degree in business administration from Rutgers University.

Relevant Skills and Experience

| | | | | | | | | | | |

| Financial Services | | Mergers & Acquisitions |

| Financial Reporting & Capital Planning | | Risk Management |

Mr. Cummings is a seasoned executive with 35 years experience in the financial services industry including service as Chief Executive Officer of a regional bank.

He is also an experienced auditor and Certified Public Accountant.

| | | | | | | | |

| | |

| William P. Hankowsky INDEPENDENT DIRECTOR |

| |

Age: 72 Joined the Board: November 2006 | Board Committees: Compensation & HR; Nominating & Corporate Governance; Executive Other Current Public Company Directorships: None |

| | |

Career Highlights

| | |

| 2003 to 2020 |

Chairman, President and Chief Executive Officer of Liberty Property Trust |

|

| 2002 to 2003 |

President, Liberty Property Trust |

|

| 2001 to 2002 |

Chief Investment Officer, Liberty Property Trust |

|

| 1990 to 2001 |

President, Philadelphia Industrial Development Corporation |

Further Information

Mr. Hankowsky is a Senior Advisor to the Alterra Property Group and President of Wayne Avenue Enterprises, LLC. He currently serves on the Investment Committee of High Real Estate Group, LLC (since September 2023), the Delaware River Waterfront Corporation, Greater Philadelphia Chamber of Commerce, Philadelphia Convention and Visitors Bureau, Pennsylvania

Academy of the Fine Arts, Philadelphia Shipyard Development Corporation, the Wetlands Institute, and the Philadelphia Foundation. He also serves on the board of our primary subsidiary CBNA. Mr. Hankowsky previously served on the board of Aqua America, Inc. (from 2004 to 2019).

Mr. Hankowsky received a B.A. in economics from Brown University.

Relevant Skills and Experience

| | | | | | | | | | | |

| Executive Leadership | | Mergers & Acquisitions |

| Financial Reporting & Capital Planning | | Risk Management |

Mr. Hankowsky has an extensive business and management expertise, particularly in the real estate sector from service as Chairman, President and Chief Executive Officer of Liberty Property Trust and President of the Philadelphia Industrial Development Corporation.

He also has experience serving on the boards of other public companies and numerous non-profit entities.

Corporate Governance Matters

| | | | | | | | |

| | |

| Edward J. Kelly III INDEPENDENT DIRECTOR |

| |

Age: 70 Joined the Board: February 2019 | Board Committees: Compensation & HR (Chair); Nominating & Corporate Governance Other Current Public Company Directorships: MetLife, Inc. Dollar Tree, Inc. |

| | |

Career Highlights

| | |

| 2011 to 2014 (Retirement) |

Chairman, Citigroup Inc.’s Institutional Clients Group |

|

| 2008 to 2011 |

Held senior positions at Citigroup including as Chairman of Global Banking (from 2010 to 2011), Chief Financial Officer (during 2009), Head of Global Banking (from 2008 to 2009), and President and Chief Executive Officer of Citi Alternative Investments (during 2008) |

|

| 2007 to 2008 |

Managing Director, The Carlyle Group |

|

| 2001 to 2007 |

Vice Chairman, PNC Financial Services Group, following PNC’s 2007 acquisition of Mercantile Bankshares Corporation, which he joined as President and Chief Executive Officer in 2001 before also being appointed Chairman in 2003. |

|

| Prior to 2001 |

Held various positions at J.P. Morgan including managing director within the investment banking business, and General Counsel and Secretary, prior to which he was Partner at the law firm of Davis Polk & Wardwell |

Further Information

Mr. Kelly currently serves on the board of MetLife, Inc (since 2015), and Dollar Tree, Inc. (since 2022). He previously served as chairman of the board of directors at CSX Corporation until January 2019, and on the board of XL Catlin (from 2014 to 2018). He also serves on the board of our primary subsidiary CBNA.

Mr. Kelly received his J.D. from the University of Virginia School of Law in 1981 and A.B. from Princeton University in 1975.

Relevant Skills and Experience

| | | | | | | | | | | |

| Financial Services | | Corporate Governance |

| Financial Reporting & Capital Planning | | Regulations & Compliance |

Mr. Kelly has an extensive background in the financial services industry including serving in executive positions at major financial institutions, and on the boards of other public companies including MetLife, Dollar Tree and CSX Corporation.

He has regulatory, compliance and governance expertise having served as General Counsel and Secretary of J.P. Morgan, and as a Partner at the law firm of Davis Polk & Wardwell.

| | | | | | | | |

| | |

| Robert G. Leary INDEPENDENT DIRECTOR |

| |

Age: 62 Joined the Board: April 2020 | Board Committees: Audit; Risk Other Current Public Company Directorships: Intact Financial Corporation Voya Financial, Inc. |

| | |

Career Highlights

| | |

| 2017 to 2019 |

Chief Executive Officer, The Olayan Group |

|

| 2014 to 2017 |

Chief Executive Officer, Nuveen and TIAA Global Asset Management |

|

| 2013 to 2014 |

President, Asset Management, TIAA |

|

| 2007 to 2012 |

Served in executive roles at ING including as Chief Executive Officer of ING Investment Management Americas and ING Insurance U.S. |

|

| Prior to 2007 |

Served in leadership roles at J.P. Morgan & Co. and AIG Financial Products, prior to which he was an attorney at law firm of White & Case. |

Further Information

Mr. Leary currently serves as a Senior Advisor to LeapFrog Investments (since 2022). He currently serves on the board of Intact Financial Corporation (since 2015), a major insurer publicly listed in Canada and Voya Financial, Inc. (since January 2024). He also serves as Board Chair of Arrow Global Group Ltd. (since January 2024), on

the board of Wilton Re Ltd. (since January 2023), a subsidiary of the Canadian Pension Plan Investment Board, and on the advisory board of RMG Acquisitions III. In addition, Mr. Leary serves on the non-profit boards of the National Forest Foundation, the Center for Climate and Energy Solutions, and the Friends of Acadia (National Park). He previously served on the board of RSA Group plc, a subsidiary of Intact (from 2021 to 2023) and as an advisor to The Council Advisors, a business consulting consortium. Mr. Leary also serves on the board of our primary subsidiary CBNA.

Mr. Leary holds a bachelor’s degree in political science from Union College and a law degree from Fordham University.

Relevant Skills and Experience

| | | | | | | | | | | |

| Financial Services | | Mergers & Acquisitions |

| Financial Reporting & Capital Planning | | Sustainability Practices |

Mr. Leary has over 30 years experience in the financial services industry. He has expertise in business transformation and mergers and acquisitions having been instrumental in the acquisition and invigoration of Nuveen by TIAA-CREF.

Mr. Leary has experience in sustainability through his service on numerous non-for-profit boards, and as CEO of Nuveen, where he oversaw the expansion of TIAA/Nuveen’s socially responsible and ESG assets under management.

| | | | | |

| Citizens Financial Group | 21 |

Corporate Governance Matters

| | | | | | | | |

| | |

| Terrance J. Lillis INDEPENDENT DIRECTOR |

| |

Age: 71 Joined the Board: February 2019 | Board Committees: Audit; Nominating & Corporate Governance Other Current Public Company Directorships: None |

| | |

Career Highlights

| | |

| 2008 to 2017 (Retirement) |

Chief Financial Officer, Principal Financial Group, Inc. |

|

| 1982 to 2008 |

Joined Principal Financial Group, Inc. as an actuarial student, and held various senior actuarial, risk management and product-pricing roles |

Further Information

Mr. Lillis currently serves on the board of American Enterprise Mutual Holding Company (since 2020). He also serves on the Mercy Medical Center Board of Directors and the Command and General Staff College Foundation Board of Trustees. He serves on the Simpson College Board of Trustees and as Trustee for the Diocese of Southwest Iowa. Mr. Lillis also serves on the board of our primary subsidiary CBNA. He is a member of the American Academy of Actuaries and a Fellow of the Society of Actuaries.

Mr. Lillis received a bachelor’s degree from Simpson College after serving in the U.S. Army in the Republic of Korea, and an M.S. degree in actuarial science from the University of Iowa in 1982.

Relevant Skills and Experience

| | | | | | | | | | | |

| Financial Services | | Risk Management |

| Financial Reporting & Capital Planning | | Regulations & Compliance |

Mr. Lillis is a seasoned executive with 35 years experience in the financial services industry.

He has extensive financial expertise including experience in capital allocation, portfolio management and strategic transactions serving as Executive Vice President and Chief Financial Officer of Principal Financial Group, Inc. for nearly 10 years, and in various senior actuarial, risk management and product-pricing roles prior to that.

| | | | | | | | |

| | |

| Michele N. Siekerka INDEPENDENT DIRECTOR |

| |

Age: 59 Joined the Board: April 2022 | Board Committees: Compensation & HR Other Current Public Company Directorships: None |

| | |

Career Highlights

| | |

| 2014 to Present |

President and Chief Executive Officer, New Jersey Business and Industry Association |

|

| 2010 to 2014 |

Served as Assistant Commissioner before becoming Deputy Commissioner, New Jersey Department of Environmental Protection |

|

| 2004 to 2010 |

President and Chief Executive Officer, Mercer Regional Chamber of Commerce |

|

| Prior to 2004 |

Served in roles including Vice President of Human Resources and Senior Counsel, AAA Mid-Atlantic, and as President and former member of the Robbinsville Township Board of Education |

Further Information

Ms. Siekerka joined our Board in 2022 upon the closing of the acquisition of Investors Bancorp, Inc., which she joined in 2013 upon the consummation of Investors Bancorp's acquisition of Roma Financial Corporation where she served as Chair.

Ms. Siekerka serves on the board of Choose New Jersey, New Jersey Innovation Institute, Junior Achievement of New Jersey, the National

Association of Corporate Directors NJ Chapter, the National Association of Manufacturers, and the Council of State Manufacturing Associations where she is also an Executive Committee member. She also serves on the board of our primary subsidiary CBNA.

Ms. Siekerka received a bachelor's degree from Rutgers University and a law degree from Temple University School of Law. She also holds the NACD Directorship Certification and is a designated NACD Board Leadership Fellow.

Relevant Skills and Experience

| | | | | | | | | | | |

| Corporate Governance | | Mergers & Acquisitions |

| Financial Services | | Sustainability Practices |

Ms. Siekerka is an experienced business professional with extensive market knowledge serving as President and Chief Executive Officer of the New Jersey Business and Industry Association. She also has experience in sustainability practices serving as Deputy Commissioner at the New Jersey Department of Environmental Protection.

She is a licensed attorney with legal and government affairs expertise.

Ms. Siekerka also has prior experience serving on the boards of regional banks Roma Financial Corporation and Investors Bancorp, Inc.

Corporate Governance Matters

| | | | | | | | |

| | |

| Christopher J. Swift INDEPENDENT DIRECTOR |

| |

Age: 63 Joined the Board: February 2021 | Board Committees: Risk Other Current Public Company Directorships: The Hartford Financial Services Group, Inc |

| | |

Career Highlights

| | |

| 2014 to Present |

Chairman (since 2015) and Chief Executive Officer, The Hartford Financial Services Group, Inc. |

|

| 2010 to 2014 |

Executive Vice President and Chief Financial Officer, The Hartford Financial Services Group, Inc. |

|

| 2003 to 2010 |

Held various senior leadership and finance roles at American International Group, Inc. |

|

| Prior to 2003 |

Head of the Global Insurance Industry Practice at KPMG LLP which he joined as a certified public accountant focused on financial services |

Further Information

Mr. Swift is on the executive committee and the board of directors of the American Property Casualty Insurance Association.

He is a member of the Chief Executives for Corporate Purpose, Council on Foreign Relations, and The Geneva Association. He also serves on the board of our primary subsidiary CBNA.

Mr. Swift holds a bachelor’s degree in accounting from Marquette University, where he is also a trustee.

Relevant Skills and Experience

| | | | | | | | | | | |

| Executive Leadership | | Financial Reporting & Capital Planning |

| Risk Management | | Sustainability Practices |

Mr. Swift is a seasoned executive with 35 years experience in the insurance industry and expertise in risk management.

He has extensive background in financial reporting and capital planning having served as a chief financial officer and certified public accountant. He also has experience in global restructuring and mergers and acquisitions.

Mr. Swift serves on numerous industry associations, and has experience in sustainability practices as a member of Chief Executives for Corporate Purpose.

| | | | | | | | |

| | |

| Wendy A. Watson INDEPENDENT DIRECTOR |

| |

Age: 75 Joined the Board: October 2010 | Board Committees: Audit (Chair); Compensation & HR; Risk Other Current Public Company Directorships: None |

| | |

Career Highlights

| | |

| 2005 to 2009 (Retirement) |

Executive Vice President, Global Services, State Street Bank & Trust Company |

|

| 2000 to 2005 |

| Managing Director, Investment Manager Solutions, State Street Bank & Trust Company |

|

| Prior to 2000 |

Served as Head of the Global Banking and Trust business and President and CEO, Finance, Canadian Imperial Bank of Commerce. Prior to which she served as Chief Information Officer and Head of Internal Audit, Confederation Life Insurance Company |

Further Information

Ms. Watson serves as a director of the Independent Order of the Foresters Life Insurance Company (since 2013), and is a member of the Community Service Committee of Boston Children’s Hospital (since 2011), the Advisory Board of EMpathways (since 2011), and the Expert Advisory Panel of McGill University Management School (since 2008). She previously served on the boards of DAS Canada Insurance Company, Ltd. (from 2010 to 2018), MD Financial Holdings (from 2010 to 2018) and MD Private Trust, a subsidiary of MD Financial Holdings (from 2015 to October 2023). Ms. Watson also serves on the board of our primary subsidiary CBNA.

Ms. Watson is a graduate of McGill University in Montreal with a Bachelor of Commerce degree with majors in Accounting and Law.

Relevant Skills and Experience

| | | | | | | | | | | |

| Financial Services | | Regulations & Compliance |

| Financial Reporting & Capital Planning | | Risk Management |

Ms. Watson is an experienced executive in the financial services industry with extensive financial background, including serving as Executive Vice President, Global Services for State Street Bank & Trust Company.