false

0001509589

0001509589

2023-11-28

2023-11-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

Current

Report

Pursuant

to Section 13 or 15(D)

of the Securities Exchange Act of 1934

Date of report (date

of earliest event reported): November 28, 2023

Civitas Resources, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-35371 |

|

61-1630631 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 410 17th Street, Suite 1400 |

|

| Denver, Colorado |

80202 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone

number, including area code: (720) 440-6100

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each

exchange

on which registered |

| Common

Stock, par value $0.01 per share |

|

CIVI |

|

New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Kayla D. Baird as Chief

Accounting Officer

On November 28, 2023,

the board of directors of Civitas Resources, Inc. (the “Company”) appointed Kayla D. Baird as the new Senior Vice President

and Chief Accounting Officer of the Company, effective January 3, 2024, reporting to the Company’s Chief Financial Officer.

She will succeed Sandra K. Garbiso, who has served as the Company’s Chief Accounting Officer since November 2017.

Ms. Baird, age 52,

joins the Company from Baytex Energy Corp. (TSX: BTE) (“Baytex”), where she served as Vice President, U.S. Accounting and

Corporate Services since June 2023 when Baytex acquired Ranger Oil Corporation (“Ranger”), where she had served as Vice

President, Chief Accounting Officer and Controller since February 2021. Prior to joining Ranger, Ms. Baird served as served

as the Vice President, Chief Accounting Officer and Controller of EnVen Energy Corporation (“Enven”) from September 2017

through April 2020. Prior to joining Enven, she served as Chief Accounting Officer at Permian Resources, LLC (“Permian Resources”)

from September 2014 until August 2017. Prior to Permian Resources, she served in various executive positions at ConocoPhillips,

including Director of Lower 48 Strategy & Portfolio Management and Reserves Reporting & Compliance; Manager of Commercial

Gas, Crude & NGL; and Manager of Upstream & Corporate Accounting Policy. Ms. Baird has 24 years of experience in

the oil & gas industry. Previously, she worked for 13 years in public accounting, primarily for Ernst & Young, LLP,

auditing large public oil and gas companies. Ms. Baird holds a bachelor’s degree in Accounting from Langston University and

is a Certified Public Accountant.

There are no arrangements

or understandings between Ms. Baird and any other person pursuant to which Ms. Baird was appointed as Senior Vice President

and Chief Accounting Officer, and there are no family relationships among any of the Company’s directors or executive officers and

Ms. Baird. Ms. Baird does not have any direct or indirect material interest in any transaction or proposed transaction required

to be reported under Item 404(a) of Regulation S-K.

Employment Letter with Kayla D. Baird

In connection with her

appointment, the Company and Ms. Baird have entered into an employment letter (the “Employment Letter”) providing the

following compensation terms: (i) an annualized base salary of $500,000 per year; (ii) eligibility to participate in the Company’s

long term incentive program with a target award equal to $1,000,000 per year, with the number of shares of the Company’s common

stock subject to Ms. Baird’s 2024 long term incentive awards (the “LTIP Awards”) equal to the quotient of (a) $1,000,000

divided by (b) the volume-weighted average price of the Company’s common stock for the 30 trading days immediately preceding

the applicable grant date in early 2024 when long term incentive awards are granted to the Company’s executive officers (the “LTIP

Grant Date”), which are expected to consist of: (1) 30% of the total target value in Restricted Stock Units (“RSUs”),

subject to three-year ratable time vesting from the LTIP Grant Date; and (2) 70% of the total target value in Performance Share Units

(“PSUs”) based on the Company’s absolute total shareholder return relative to pre-established goals during a measurement

period of January 1, 2024 to December 31, 2026; (iii) a one-time grant of RSUs (the “Sign-On Award”) equal

in number to the quotient of (a) $150,000 divided by (b) the volume-weighted average price of the Company’s common stock

for the 30 trading days immediately preceding January 3, 2024 (the “Sign-On Grant Date”), subject to three-year ratable

time vesting from the Sign-On Grant Date; (iv) a one-time cash signing bonus (the “Signing Bonus”) in an amount equal

to $250,000, subject to certain clawback requirements in the event of a voluntary resignation by Ms. Baird or termination by the

Company for Cause (as defined in the Severance Plan) within two years of the Sign-On Grant Date; and (v) participation in the Company’s

Executive Change in Control and Severance Plan (the “Severance Plan”) as a Tier 3 Executive (as such term is defined in the

Severance Plan). The RSUs and PSUs described above will be subject to the terms and conditions of award agreements that are substantially

consistent with the award agreements issued to the other executive officers of the Company in respect of, for the Sign-On Award, the RSUs

issued in 2023, and, for the LTIP Awards, the RSUs and PSUs issued in 2024.

As a Tier 3 Executive

under the Severance Plan, upon the termination of Ms. Baird’s employment without Cause (as defined in the Severance Plan) or

due to her resignation for Good Reason (as defined in the Severance Plan) (a “Qualifying Termination”), she will be eligible

to receive (i) a cash severance payment equal to her then-current base salary, paid in equal monthly installments over a 12-month

period following her termination and (ii) reimbursement for the cost of any COBRA premiums incurred by her during the 12-month period

following her termination. If a Qualifying Termination occurs within 12 months following a Change in Control (as defined in the Severance

Plan), she will be eligible to receive (i) a lump sum cash severance payment equal to 2.0x her then-current base salary and (ii) reimbursement

for the cost of any COBRA premiums incurred by her during the 18 months following her termination.

The description of the

Employment Letter is qualified in its entirety by the terms of the Employment Letter, a copy of which is attached as Exhibit 10.1

and incorporated by reference herein. Additionally, the description of the Severance Plan is qualified in its entirety by the terms of

the Severance Plan, a copy of which is attached as Exhibit 10.2 and incorporated by reference herein.

In connection with her

appointment, the Company will enter into its standard form of indemnity agreement with Ms. Baird, a copy of which is attached as

Exhibit 10.3 and incorporated by reference herein.

Sandra K. Garbiso Departure

In connection with the Chief Accounting Officer

transition, on November 29, 2023, Ms. Garbiso’s employment with the Company was terminated, effective January 3,

2024.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit

Number |

|

Description |

| 10.1 |

|

Employment Letter, dated as of November 28, 2023, by and between Civitas Resources, Inc. and Kayla D. Baird. |

| 10.2 |

|

Civitas Resources, Inc. Eighth Amended and Restated Executive Change in Control and Severance Benefit Plan (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K (File No. 001-35371) filed with the Commission on January 25, 2022). |

| 10.3 |

|

Form of Indemnity Agreement between Civitas Resources, Inc. and the directors and executive officers of Civitas Resources, Inc. (incorporated by reference to Exhibit 10.9 to the Company’s Current Report on Form 8-K (File No. 001-35371) filed with the Commission on November 3, 2021). |

| 104 |

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: November 29, 2023 |

CIVITAS RESOURCES, INC. |

| |

|

| |

By: |

/s/ Travis L. Counts |

| |

Name: |

Travis L. Counts |

| |

Title: |

Chief Administrative Officer and Corporate Secretary |

Exhibit 10.1

| |  |

555

17th Street, Suite 3700

Denver, CO 80202

(303) 293-9100 phone |

November 28, 2023

PRIVATE & CONFIDENTIAL

Ms. Kayla D. Baird

323 W. 32nd Street

Houston, Texas 77018

via email – bairdkayla123@gmail.com

Re: Employment Terms and Conditions – Senior Vice President,

Chief Accounting Officer

Dear Kayla:

Civitas Resources, Inc. (the “Company”)

is pleased to offer you an employment position as Senior Vice President, Chief Accounting Officer (“CAO”), reporting

to the Company’s Chief Financial Officer, effective as of January 3, 2024 (the “Start Date”). In summary, as

CAO, your compensation will be:

| · | An annualized base salary of $500,000, subject

to annual review and periodic increases at the discretion of the Company’s Board of Directors (the “Board”) and

its Compensation Committee, to be paid in accordance with the Company’s payroll practices in effect from time to time, subject to

all applicable withholdings and deductions; |

| · | Participation in the Company’s long term

incentive plan (“LTIP”), subject to the terms and conditions of the LTIP and the award agreement(s) to be entered into

thereunder, at the discretion of the Board and its Compensation Committee as further discussed below. The LTIP is administered by the

Board and its Compensation Committee. Your annual “target” LTIP award will be equal to $1,000,000 per year. Your first LTIP

award will be granted in early 2024, consistent in timing with the rest of the Company’s executive officers (the “Grant

Date”), and the total number of Restricted Stock Units (“RSUs”) and Performance Stock Units (“PSUs”)

included in your 2024 LTIP awards will be equal to the quotient of (i) $1,000,000 divided by (ii) the volume-weighted average price of

the Company’s common stock for the 30 trading days immediately preceding the Grant Date. Your 2024 LTIP awards are expected to consist

of the following mix of award vehicles (each of which will be subject to award agreements consistent with the 2024 grants that will be

made to other executive officers of the Company): |

| o | 30% of total target value in RSUs, subject to three-year ratable time vesting from the Grant Date; and |

| o | 70% of total target value in PSUs based on the Company’s absolute total shareholder return relative

to pre-established goals during the measurement period 1/1/2024 to 12/31/2026; |

| · | A one-time grant of RSUs on the first day of

your employment, using the form of award agreement consistent with the 2023 RSUs that have been granted to other executive officers of

the Company, equal in number to the quotient of (i) $150,000 divided by (ii) the volume-weighted average price of the Company’s

common stock for the 30 trading days immediately preceding your Start Date. The RSUs will vest ratably over a three-year period, one-third

on each of the first three anniversaries of your Start Date; |

CORPORATE OFFICE

555 17th Street, Suite 3700

Denver, CO 80202

Office: 303.293.9100

| · | A one-time cash signing bonus (the “Signing

Bonus”) in an amount equal to $250,000, subject to all applicable withholdings and deductions, payable upon the Company’s

first regular payroll date following your Start Date. Notwithstanding the foregoing, you acknowledge and agree that if you voluntarily

resign or the Company terminates your employment for Cause (as defined in the Severance Plan) (each, a “Termination Event”)

(i) prior to the first anniversary of your Start Date, you shall repay to the Company the Signing Bonus in full and (ii) following the

first but prior to the second anniversary of your Start Date, you shall repay to the Company 50% of the Signing Bonus, both within 30

days of such Termination Event; |

| · | Eligibility to participate in the Company’s

401(k) Plan, in accordance with such plan; |

| · | Eligibility to participate in the Company’s

health insurance plans upon your election subject to the terms and conditions of the plans; |

| · | Eligibility to participate in the Company’s

flexible benefit plan (Section 125 Plan); and |

| · | Participation in the Company’s Executive

Change in Control and Severance Plan (the “Severance Plan”) as a Tier 3 Executive (as such term is defined in the Severance

Plan). |

Your participation in all Company compensation

and benefit plans will be subject to the terms and conditions of such plans. The Company may modify compensation and benefits from time

to time as it deems necessary in accordance with the terms and conditions of the plans set forth above and the Company’s policies.

All forms of compensation paid to you as an employee of the Company will be paid less all applicable taxes and withholdings.

The terms and conditions of employment set forth

in this Employment Letter are contingent upon your signing the Company’s Employee Restrictive Covenants, Proprietary Information

and Inventions Agreement (the “PIIA”) attached hereto as Exhibit A.

You will be expected to abide by the Company’s

rules and regulations, as such may be modified by the Company from time to time. This offer is contingent upon there not being any contractual

impediments or obligations that would restrict your acceptance of this offer.

Notwithstanding anything to the contrary, your

employment with the Company is AT WILL. You may terminate your employment with the Company at any time and for any reason whatsoever simply

by notifying the Company, subject only to any rights or obligations that may be required by the Severance Plan or the PIIA, each as may

be amended from time to time. Likewise, the Company may terminate your employment at any time and for any reason whatsoever, with or without

cause or advance notice, subject only to any rights and obligations that may be required by the Severance Plan or the PIIA, as each may

be amended from time to time.

In consideration for the benefits to be provided

to you under this Employment Letter to which you are not currently entitled, by executing this Employment Letter, you hereby (i) accept

the terms of employment outlined in this Employment Letter and (ii) acknowledge and agree that this Employment Letter constitutes the

entire agreement between you and the Company concerning your employment (except as otherwise may be set forth in the LTIP and any agreements

entered into thereunder, the Severance Plan, the PIIA or any Indemnification Agreement entered into between you and the Company (collectively,

the “Additional Agreements”)), and supersedes and terminates all prior and contemporaneous agreements and understandings,

both written and oral, between the parties with respect to its subject matters, except for the Additional Agreements. You agree that the

Company has not made any promise or representation to you concerning this Employment Letter not expressed in this Employment Letter, and

that, in signing this Employment Letter, you are not relying on any prior oral or written statement or representation by the Company,

but are instead relying solely on your own judgment and the judgment of your legal and tax advisors, if any.

If you have any questions or need additional information,

please feel free to contact me.

| |

Sincerely, |

| |

|

| |

/s/ M. Christopher Doyle |

| |

Name: |

M. Christopher Doyle |

| |

Title: |

President and Chief Executive Officer |

| Accepted and agreed: |

|

| |

|

| /s/ Kayla D. Baird |

|

| Kayla D. Baird |

|

| Date: November 28, 2023 |

|

Exhibit A

Employee Restrictive Covenants, Proprietary

Information and Inventions Agreement

v3.23.3

Cover

|

Nov. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 28, 2023

|

| Entity File Number |

001-35371

|

| Entity Registrant Name |

Civitas Resources, Inc.

|

| Entity Central Index Key |

0001509589

|

| Entity Tax Identification Number |

61-1630631

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

410 17th Street

|

| Entity Address, Address Line Two |

Suite 1400

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

720

|

| Local Phone Number |

440-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

CIVI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

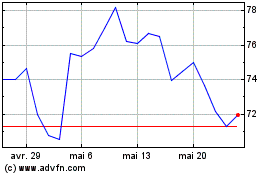

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025