Filed Pursuant to Rule 424(b)(5)

Registration No. 333-264391

AMENDMENT NO. 1 DATED JULY 31, 2024

(To Prospectus Supplement dated July 19, 2023 (filed pursuant to Rule 424(b)(5))

and Prospectus dated April 20, 2022)

$1,000,000,000

Class A Common Stock

This prospectus supplement amendment no. 1 (this “amendment”) amends the prospectus supplement, dated July 19, 2023 (filed pursuant to Rule 424(b)(5), the “prospectus supplement”). This amendment should be read in conjunction with the prospectus supplement and the accompanying prospectus, dated April 20, 2022 (the “prospectus”), each of which are to be delivered with this amendment. This amendment amends only those sections of the prospectus supplement listed in this amendment; all other sections of the prospectus supplement remain unchanged.

We are party to an amended and restated distribution agreement (as it may be further amended, restated or otherwise modified, the “Distribution Agreement”) with Barclays Capital Inc. (“Barclays”), Citigroup Global Markets Inc. (“Citigroup”), Moelis & Company LLC (“Moelis”) and Virtu Americas LLC (“Virtu” and, together with Barclays, Citigroup and Moelis, the “Sales Agents”), relating to shares of our Class A common stock, par value $0.001 per share (our “Class A common stock”), offered by this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus pursuant to a continuous offering program. In accordance with the terms of the Distribution Agreement, we may offer and sell from time to time up to the greater of (i) shares of our Class A common stock representing an aggregate offering price of $1,000,000,000 and (ii) an aggregate number of 35,000,000 shares of our Class A common stock through a Sales Agent, acting as our sales agent, or directly to a Sales Agent, acting as principal (excluding, and in addition to, any amount or number of shares of our Class A common stock offered and sold pursuant to the Distribution Agreement before such agreement was amended and restated on July 31, 2024). Pursuant to this amendment, we are offering shares of our Class A common stock representing an aggregate offering price of up to $1,000,000,000.

We are filing this amendment to amend the prospectus supplement to (i) increase the dollar amount of shares of Class A common stock to be sold from time to time under this amendment to shares of our Class A common stock representing an aggregate offering price of up to $1,000,000,000, which consists of shares of our Class A common stock representing an aggregate offering price of up to $314,067,103 remaining as originally registered under the prospectus supplement and additional shares of our Class A common stock representing an aggregate offering price of up to $685,932,897 as registered under this amendment, and (ii) include Barclays and Virtu as Sales Agents.

Sales of our Class A common stock, if any, pursuant to the prospectus supplement, as amended by this amendment, any additional prospectus supplement and the accompanying prospectus will be made in sales deemed to be “at the market offerings” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), including sales made in ordinary brokers’ transactions, transactions directly on The New York Stock Exchange (“NYSE”) or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices (including block transactions). The Sales Agents are not required to sell any specific number or dollar amount of our Class A common stock, but the Sales Agents will use their commercially reasonable efforts consistent with their normal trading and sales practices and applicable law and regulation to sell shares designated by us in accordance with the Distribution Agreement. We will pay the Sales Agents a commission not to exceed 2.0% of the actual sales price of such shares of Class A common stock sold under the Distribution Agreement. In connection with the sale of shares of Class A common stock on our behalf, the Sales Agents may be deemed to be “underwriters” within the meaning of the Securities Act and the compensation of the Sales Agents may be deemed to be underwriting commissions or discounts. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. See “Plan of Distribution” for further information.

Under the terms of the Distribution Agreement, we may also sell shares of our Class A common stock to the Sales Agents, acting severally and as principals for their own accounts, at a price per share to be agreed upon at the time of sale. If we sell shares to any of the Sales Agents as principals, we will enter into a separate terms agreement with such Sales Agents.

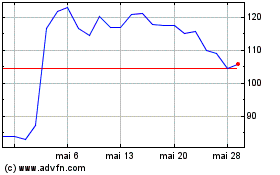

Our Class A common stock is listed on the NYSE under the symbol “CVNA.” The last reported sale price of our Class A common stock on the NYSE on July 30, 2024, was $126.78 per share.

We have two classes of common stock: Class A common stock and Class B common stock, par value $0.001 per share (“Class B common stock”). Holders of the Class A common stock are entitled to one vote per share. Ernest Garcia, II, Ernest Garcia, III, and entities controlled by one or both of them (collectively, the “Garcia Parties”) are entitled to ten votes per share of Class B common stock they beneficially own, for so long as the Garcia Parties maintain, in the aggregate, direct or indirect beneficial ownership of at least 25% of the outstanding shares of Class A common stock (determined on an as-exchanged basis assuming that all of the Class A common units (the “Class A Units”) and Class B common units (“Class B Units”, and together with the Class A Units (the “LLC Units”)) of Carvana Group, LLC (“Carvana Group”) were exchanged for Class A common stock). All other holders of Class B common stock are each entitled to one vote per share. All holders of Class A and Class B common stock vote together as a single class except as otherwise required by applicable law. Holders of the Class B common stock do not have any right to receive dividends or distributions upon the liquidation or winding up of us.

We will contribute net proceeds we receive from this offering to our wholly owned subsidiary, Carvana Co. Sub LLC (“Carvana Sub”), that will in turn use such net proceeds to purchase newly issued Class A Units in Carvana Group. The purchase price for the Class A Units will be equal to 0.8 times the public offering price of the shares of Class A common stock less the commissions and offering expenses payable by us referred to below. Carvana Group will use the net proceeds it receives in connection with this offering as described under “Use of Proceeds.”

See “Risk Factors” beginning on page S-4, along with the risk factors incorporated by reference herein, to read about factors you should consider before buying shares of our Class A common stock. Neither the United States Securities and Exchange Commission (the “SEC”), nor any state securities commission, has approved or disapproved of the securities that may be offered under the prospectus supplement, as amended by this amendment, nor have any of these regulatory authorities determined if the prospectus supplement, as amended by this amendment, or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | |

| | | |

| Barclays | Citigroup | Moelis | Virtu |

July 31, 2024

TABLE OF CONTENTS

| | | | | | | | | | | | | | |

| | | | |

| | | Page | |

Prospectus Supplement | | | | |

| | | S-ii | |

| | | S-iii | |

| | | S-1 | |

| | | S-2 | |

| | | S-4 | |

| | | S-14 | |

| | | S-15 | |

| | | S-21 | |

| | | S-25 | |

| | | S-27 | |

| | | S-28 | |

| | | S-29 | |

ABOUT THIS PROSPECTUS SUPPLEMENT AMENDMENT

This amendment, the prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we originally filed with the SEC on April 20, 2022. The prospectus supplement, as amended by this amendment, describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference. The base prospectus, as amended by the prospectus supplement and this amendment (together, the “accompanying prospectus”) describes more general information, some of which may not apply to this offering. You should read this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus, together with the documents incorporated by reference (as described below under the heading “Incorporation of Certain Information by Reference”).

Neither we nor the Sales Agents have authorized anyone to give any information other than that contained or incorporated by reference in this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus or any free writing prospectus prepared by or on behalf of us to which we have referred you. Neither we nor the Sales Agents take any responsibility for, or can provide any assurance as to the reliability of, any other information that others give you. In the prospectus supplement, as amended by this amendment, any reference to an applicable prospectus supplement may refer to or include a free writing prospectus, unless the context otherwise requires. This amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities to which they relate, nor do this amendment, the prospectus supplement, any additional prospectus supplement or the accompanying prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus is accurate on any date subsequent to the date set forth on the front of the applicable document.

For investors outside the United States: neither we nor the Sales Agents have done anything that would permit this offering or possession or distribution of this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of our Class A common stock and the distribution of the prospectus supplement, as amended by this amendment, and the accompanying prospectus outside of the United States.

If the description of the offering varies between this amendment, the prospectus supplement, any additional prospectus supplement the accompanying prospectus and the information incorporated by reference herein or therein filed prior to the date of the prospectus supplement, as amended by this amendment, you should rely on the information in the prospectus supplement, as amended by this amendment, and, if applicable, the additional prospectus supplement(s); provided that, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement. Any statements so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of the prospectus supplement, as amended by this amendment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus, along with the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to other characterizations of future events or circumstances, such as statements about our future financial performance, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Examples of forward-looking statements include, among others statements we make regarding:

| | | | | | | | | | | |

| • | | short-term and long-term liquidity;

|

| | • | | expectations relating to the automotive market and our industry;

|

| | | | | | | | | | | |

| | • | | macroeconomic conditions, economic slowdown or recessions;

|

| | | | | | | | | | | |

| | • | | future financial position;

|

| | | | | | | | | | | |

| | • | | business strategy;

|

| • | | operational efficiency;

|

| | | | | | | | | | | |

| • | | efficiency gains and opportunities to improve our results, including opportunities to increase our margins and reduce our expenses;

|

| • | | normalization of inventory;

|

| • | | benefits from new technology;

|

| • | | long-term financial goals and growth opportunities;

|

| | • | | budgets, projected costs, and plans;

|

| | | | | | | | | | | |

| | • | | future industry growth;

|

| | | | | | | | | | | |

| | • | | potential sales of our Class A common stock, including through use of the at-the-market program;

|

| | | | | | | | | | | |

| | • | | the impact of litigation, government inquiries, and investigations; and

|

| | | | | | | | | | | |

| | • | | all other statements regarding our intent, plans, beliefs, or expectations or those of our directors or officers.

|

The forward-looking statements contained or incorporated by reference in this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. You should not place undue reliance on these forward-looking statements in deciding whether to invest in our securities. We cannot assure you that future developments affecting us will be those that we have anticipated. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sections entitled “Risk Factors” in the prospectus supplement, as amended by this amendment, and the accompanying prospectus and “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K, which is incorporated by reference herein, as updated by our subsequent

quarterly reports on Form 10-Q and other filings we make with the SEC. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date the statements were made, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should read this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus, along with the documents incorporated by reference herein and therein, with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Forward-looking statements speak only as of the date they were made. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

PROSPECTUS SUPPLEMENT AMENDMENT SUMMARY

This summary does not contain all of the information that you should consider in making your investment decision. You should read this summary together with the entire amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus, along with the information incorporated by reference, including the more detailed information regarding our company, the Class A common stock being sold by us in this offering and our consolidated financial statements and the related notes thereto appearing elsewhere or incorporated by reference in this amendment, the prospectus supplement, any additional prospectus supplement and the accompanying prospectus. Some of the statements in this summary constitute forward-looking statements, with respect to which you should review the section of this amendment entitled “Cautionary note regarding forward-looking statements.”

Unless we state otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “our business” and “our company” refer to and similar references refer to Carvana Co. (“Carvana”) and its consolidated subsidiaries, including Carvana Group, LLC (“Carvana Group”).

Our Company

Carvana is the leading e-commerce platform for buying and selling used cars. We are transforming the used car buying and selling experience by giving consumers what they want—a wide selection, great value and quality, transparent pricing, and a simple, no pressure transaction. Each element of our business, from inventory procurement to fulfillment and overall ease of the online transaction, has been built for this singular purpose.

We provide refreshingly different and convenient experiences for used car buying and selling that can save customers time and money. On our platform, consumers can research and identify a vehicle, inspect it using our patented 360-degree vehicle imaging technology, obtain financing and warranty coverage, purchase the vehicle, and schedule delivery or pick-up, all from their desktop or mobile device. Additionally, a customer can obtain a conditional offer online for their vehicle by answering a few questions without needing to provide service records. Our transaction technologies and online platform transform a traditionally time-consuming process by allowing customers to secure financing, complete a purchase or sale, and schedule delivery or pick-up online in as little as 10 minutes.

Our technology and infrastructure allow us to seamlessly and cost-efficiently deliver this experience to our customers. We use proprietary algorithms to optimize our nationally pooled inventory of over 37,000 total website units, inspect and recondition our vehicles based on our inspection process, and operate our own logistics network to deliver cars directly to customers in our markets as soon as the same day in certain markets. Customers in certain markets also have the option to pick up their vehicle at one of our patented vending machines, which provides an exciting pick-up experience for the customer while decreasing our variable costs, increasing scalability and building brand awareness.

The automotive retail industry’s large size, fragmentation, and lack of differentiated offerings present an opportunity for disruption. We have demonstrated that our custom-built business model can capitalize on this opportunity. From the launch of our first market in January 2013 through June 30, 2024, we purchased, reconditioned, sold, and delivered approximately 1.9 million vehicles to customers through our website, cumulatively generating approximately $56.5 billion in revenue. Our sales have grown since our inception as we have increased our market penetration in our existing markets and added new markets. As of June 30, 2024, our in-house distribution network serviced 81.1% of the U.S. population, and in the long-term we plan to continue to expand our population coverage.

THE OFFERING

| | | | | |

Class A common stock offered | Shares of our Class A common stock representing an aggregate offering price of up to $1,000,000,000.

As of July 31, 2024, the date on which the Distribution Agreement was amended and restated, we had offered and sold 10,204,306 shares of our Class A common stock pursuant to the Distribution Agreement for an aggregate offering price of $685,932,897. In accordance with the terms of the amended and restated Distribution Agreement, we may offer and sell from time to time up to the greater of (i) shares of our Class A common stock representing an aggregate offering price of $1,000,000,000 and (ii) an aggregate number of 35,000,000 shares of our Class A common stock through a Sales Agent, acting as our sales agent, or directly to a Sales Agent, acting as principal (excluding, and in addition to, any amount or number of shares of our Class A common stock offered and sold pursuant to the Distribution Agreement before July 31, 2024). |

| | | | | |

Class A common stock outstanding immediately prior to this offering | 123,824,087 shares. If all outstanding LLC Units held by the holders of the LLC Units (the “LLC Unitholders”) were exchanged for newly-issued shares of Class A common stock in accordance with the exchange agreement among us, Carvana Sub and the LLC Unitholders (the “Exchange Agreement”), 208,801,430 shares of Class A common stock would be outstanding. |

| | | | | |

Class B common stock outstanding immediately prior to this offering | 83,119,471 shares. Immediately after this offering, the LLC Unitholders will continue to own 100% of the outstanding shares of our Class B common stock. |

| | | | | |

Manner of offering | Sales of our Class A common stock, if any, pursuant to the prospectus supplement, as amended by this amendment, any additional prospectus supplement and the accompanying prospectus will be made in sales deemed to be “at the market offerings” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”), including sales made in ordinary brokers’ transactions on the New York Stock Exchange (“NYSE”) or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. The Sales Agents are not required to sell any specific number or dollar amount of our Class A common stock, but each Sales Agent will use its commercially reasonable efforts consistent with its normal trading and sales practices and applicable laws and regulations to sell shares designated by us in accordance with the Distribution Agreement. |

| | | | | |

| | Under the terms of the Distribution Agreement, we may also sell shares of our Class A common stock to a Sales Agent, acting as principal for its own account, at a price per share to be agreed upon at the time of sale. If we sell shares to any Sales Agent as principal, we will enter into a separate terms agreement with such Sales Agent. See “Plan of Distribution.” |

| | | | | |

Ratio of shares of Class A common stock to LLC Units | We are required to, at all times, maintain a four-to-five ratio between the number of shares of Class A common stock issued by us and the number of LLC Units owned by us (subject to certain exceptions for treasury shares and shares underlying certain convertible or exchangeable securities and subject to adjustment as set forth in the Exchange Agreement, and taking into account Carvana Sub’s 0.1% ownership interest in Carvana, LLC). |

| | | | | |

Voting | Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. |

| | | | | |

| | LLC Unitholders hold a number of shares of Class B common stock equal to 0.8 times the number of Class A Units held by the LLC Unitholders (other than Carvana Sub). Each share of our Class B common stock held by the Garcia Parties entitles its holder to ten votes on all matters to be voted on by stockholders generally for so long as the Garcia Parties maintain direct or indirect beneficial ownership of at least 25% of the outstanding shares of our Class A common stock (determined on an as-exchanged basis assuming that all of the LLC Units were exchanged for Class A common stock). |

| | | | | |

| | Holders of our Class A and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law. We are controlled by the Garcia Parties. Immediately prior to this offering, the Garcia Parties controlled approximately 86.1% of the voting interest in us. |

| | | | | |

Use of proceeds | We intend to contribute the net proceeds, if any, to our wholly owned subsidiary, Carvana Sub, that will in turn acquire newly-issued Class A Units in Carvana Group. In turn, Carvana Group intends to apply the net proceeds it receives from us in this offering for general corporate purposes. |

| | | | | |

| | See “Use of Proceeds” in this amendment and “Organizational Structure” in the accompanying prospectus. |

| | | | | |

Risk factors | Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page S-4 of this amendment and any risk factors described in the documents we incorporate by reference, as well as all the other information set forth in this amendment, the prospectus supplement, any additional prospectus supplement, the accompanying prospectus and in the documents we incorporate by reference, before investing in our Class A common stock. |

RISK FACTORS

An investment in our securities involves a high degree of risk. In addition to the other information included or incorporated by reference in this amendment, including the risk factors associated with our business included in Item 1A under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as updated by our subsequent filings with the SEC, you should carefully consider the following risk factors set forth below before making an investment in our Class A common stock. See “Where You Can Find More Information.” Our business, prospects, financial condition or operating results could be harmed by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our Class A common stock could decline due to any of these risks, and, as a result, you may lose all or part of your investment. As used in the risks described in this subsection, references to “we,” “us” and “our” are intended to refer to Carvana Co. unless the context clearly indicates otherwise.

Risks Related to Our Liquidity

Our substantial indebtedness could adversely affect our financial flexibility, ability to incur additional debt, and our competitive position and prevent us from fulfilling our obligations under our credit agreement and other debt instruments.

As of June 30, 2024, we had outstanding, on a consolidated basis (1) $205 million aggregate principal amount of our 5.625% senior unsecured notes due 2025 (the “2025 Senior Unsecured Notes”), 5.500% senior unsecured notes due 2027 (the “2027 Senior Unsecured Notes”), 5.875% senior unsecured notes due 2028 (the “2028 Senior Unsecured Notes”), 4.875% senior unsecured notes due 2029 (the “2029 Senior Unsecured Notes”), and 10.250% senior unsecured notes due 2030 (together with the 2025 Senior Unsecured Notes, the 2027 Senior Unsecured Notes, the 2028 Senior Unsecured Notes, and the 2029 Senior Unsecured Notes, the “Senior Unsecured Notes”), (2) $4.4 billion aggregate principal amount of our 9.0%/12.0% cash/PIK senior secured notes due 2028 (the “2028 Senior Secured Notes”), 9.0%/11.0%/13.0% cash/PIK senior secured notes due 2030 (the “2030 Senior Secured Notes”), and 9.0%/14.0% cash/PIK senior secured notes due 2031 (together with the 2028 Senior Secured Notes and 2030 Senior Secured Notes, the “Senior Secured Notes”), which includes $210 million aggregate principal amount representing payment-in-kind interest, (3) $72 million aggregate principal amount of borrowings under our amended and restated inventory financing and security agreement with the Ally Bank (Ally Capital in Hawaii, Mississippi, Montana and New Jersey) and Ally Financial Inc., effective November 1, 2023 (the “Floor Plan Facility”), and the applicable finance receivable facilities, (4) $223 million aggregate principal amount of indebtedness represented by our finance lease agreements between us and providers of equipment financing, (5) and an outstanding balance of $334 million relating to a secured borrowing facility through which we finance certain retained beneficial interests in our securitizations. Also, as of June 30, 2024, we had, on a consolidated basis, $485 million of other long-term debt related to our sale leaseback transactions. Our substantial indebtedness could have significant effects on our business. For example, it could:

| | | | | | | | | | | |

| | • | | make it more difficult for us to satisfy our obligations with respect to our current and future indebtedness, including our Senior Secured Notes and Senior Unsecured Notes (collectively, the “Senior Notes”) and the Floor Plan Facility; |

| | | | | | | | | | | |

| | • | | increase our vulnerability to adverse changes in prevailing economic, industry, and competitive conditions; |

| | | | | | | | | | | |

| | • | | require us to dedicate a substantial portion of our cash flow from operations to make payments on our indebtedness, thereby reducing the availability of our cash flow, or limit our ability to incur additional debt, to fund working capital, capital expenditures, acquisitions, the execution of our business strategy, and other general corporate purposes; |

| | | | | | | | | | | |

| | • | | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| | | | | | | | | | | |

| | • | | increase our cost of borrowing; |

| | | | | | | | | | | |

| | • | | restrict us from exploiting business opportunities; and |

| | | | | | | | | | | |

| | • | | place us at a disadvantage compared to our competitors that have fewer debt obligations. |

We expect to use cash flow from operations to meet current and future financial obligations, including funding our operations, debt service requirements, and capital expenditures. The ability to make these payments depends on our financial and operating performance, which is subject to prevailing economic, industry, and competitive conditions, including the interest rate environment, and to certain financial, business, economic, and other factors beyond our control.

Despite current indebtedness levels, we may incur substantially more indebtedness, which could further exacerbate the risks associated with our substantial indebtedness.

We may incur significant additional indebtedness in the future, subject to the restrictions in the agreements governing our indebtedness and the Floor Plan Facility. We may also pursue investments in joint ventures or acquisitions, which may increase our indebtedness. If new debt is added to our currently anticipated indebtedness levels, the related risks that we face could intensify.

We may not be able to generate sufficient cash flow to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under such indebtedness, which may not be successful, or may harm our business.

Our ability to make scheduled payments or to refinance outstanding debt obligations depends on our financial and operating performance, which will be affected by prevailing economic, industry, and competitive conditions and by financial, business, and other factors beyond our control. Additionally, some of our debt accrues interest at a variable rate that is based on SOFR or other market rates; if those market rates rise, so too will the amount we need to pay to satisfy our debt obligations. Further, we have and may again enter into hedging agreements to help mitigate our interest rate risk, including with respect to increases in SOFR We may not be able to maintain a sufficient level of cash flow from operating activities to permit us to pay the principal, premium, if any, and interest on our indebtedness. Any failure to make payments of interest and principal on our outstanding indebtedness on a timely basis would likely result in a reduction of our credit rating, which would also adversely affect our ability to incur additional indebtedness.

We may not be able to refinance any of our indebtedness on commercially reasonable terms or at all. Additionally, in the future we may need to obtain additional financing from banks or other lenders, through public offerings or private placements of debt or equity, through strategic relationships or other arrangements, or from a combination of these sources. If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or seek to restructure or refinance our indebtedness. Any refinancing of our indebtedness could be at higher interest rates and may require us to comply with more onerous covenants. These alternative measures may not be successful, and we may be unable to meet our scheduled debt service obligations.

In the absence of such cash flows and resources, we could face substantial liquidity problems and might be required to sell material assets or operations to attempt to meet our debt service obligations. We may not be able to consummate these asset sales to raise capital or sell assets at prices and on terms that we believe are fair, and any proceeds that we do receive may not be adequate to meet any debt service obligations then due. If we cannot meet our debt service obligations, the holders of our indebtedness may accelerate such indebtedness and, to the extent such indebtedness is secured, foreclose on our assets. In such an event, we may not have sufficient assets to repay our indebtedness. If any of these risks are realized, our business and financial condition would be adversely affected. Further, in the event of our bankruptcy, dissolution, or liquidation, the holders our Senior Notes and our other indebtedness would be paid in full before any distribution can be made to the holders of our Class A common stock.

Our principal asset is our indirect interest in Carvana Group, and, accordingly, we depend on distributions from Carvana Group to pay our taxes and expenses, including payments under the Senior Notes and Tax Receivable Agreement. Carvana Group’s ability to make such distributions may be subject to various limitations and restrictions.

Carvana Group and its subsidiaries are separate and distinct legal entities and may be restricted from making distributions by, among other things, applicable corporate laws, other laws and regulations and the terms of agreements to which they are or may become a party. In the event that we do not receive distributions from Carvana Group and its subsidiaries, we may be unable to pay our taxes, expenses, debt obligations and operating expenses.

We are a holding company and have no material assets other than our indirect ownership of LLC Units of Carvana Group. As a result, we have no independent means of generating revenue or cash flow, and our ability to pay our taxes, debt obligations and operating expenses depends on the financial results and cash flows of Carvana Group and its subsidiaries and distributions we receive from Carvana Group and its subsidiaries. These taxes, obligations, and expenses include the following:

Taxes. Carvana Group, LLC is treated as a partnership for U.S. federal income tax purposes and, as such, is not subject to any entity-level U.S. federal income tax. Instead, taxable income of Carvana Group is allocated to the LLC Unitholders, including Carvana Co. Sub LLC (“Carvana Co. Sub”), our wholly owned subsidiary. Accordingly, we incur income taxes on our allocable share of any net taxable income of Carvana Group. Under the terms of Carvana Group’s Fifth Amended and Restated Limited Liability Company Agreement (the “LLC Agreement”), Carvana Group is obligated to make tax distributions to LLC Unitholders, including us.

Debt obligations. We have payment obligations under our Senior Notes. Under the terms of the LLC Agreement, Carvana Group is obligated to make distributions to us for the payment of obligations under the Senior Notes.

Operating expenses and other expenses. We also incur expenses related to our operations, including payments under the Tax Receivable Agreement, dated April 27, 2017, by and among us, Carvana Group and the TRA Holders (as defined therein) (the “Tax Receivable Agreement”). Due to the uncertainty of various factors, we cannot estimate the likely tax benefits we may realize as a result of LLC Unit exchanges, and the resulting amounts we are likely to pay out to LLC Unitholders pursuant to the Tax Receivable Agreement; however, it is possible that such payments may be substantial. Under the terms of the LLC Agreement, Carvana Group is obligated to make distributions to us for our payment obligations under the Tax Receivable Agreement.

There can be no assurance that Carvana Group makes any of the above distributions or otherwise funds any of our payment obligations. Any lack of such distributions or funding could have a material adverse effect of our ability to satisfy our debt and other obligations.

Changes in capital markets could adversely affect our business, sales, results of operations, and financial condition.

Changes in the availability or cost of the financing to support the origination and sale of automotive finance receivables could adversely affect sales and results of operations. Among other programs, we may use securitization programs to fund many automotive finance receivables we originate. Changes in the condition of the securitization market could lead us to incur higher costs to access funds in this market or lose access to the market, requiring us to seek alternative means to finance those originations that could be more expensive, or retain residual certificates in excess of those required under the Risk Retention Rules (as defined below), which could have a material adverse effect on our business, sales, and results of operations.

Our access to structured finance, securitization, or derivative markets at competitive rates and in sufficient amounts may decline in the future; any material reduction could harm our business, results of operations, and financial condition.

We provide financing to customers and typically sell the receivables related to the financing contract. For example, we have entered into various arrangements to pledge or sell automotive finance receivables that we originate, including through committed structured finance arrangements, term securitizations and fixed pool loan sales to financing partners, and plan to enter into new arrangements in the future. Our ability to obtain funding through those channels is subject to having sufficient assets eligible for use as collateral for the related programs and our ability to obtain derivatives to manage interest rate risk among other considerations. If we are unable to continue obtaining funding through those channels, including because we reached our capacity under these or future arrangements, our financing partners exercised constructive or other termination rights before we reached capacity or we reached the scheduled expiration date of the commitment, or because of changes in the condition of the securitization market that result in higher costs to access funds in the market or loss of access to the market, or if we are unable to enter into new arrangements on similar terms, we may not have adequate liquidity and our business, financial condition, and results of operations may be adversely affected. Furthermore, if our financing partners cease to purchase these receivables, we could be subject to the risk that some of these receivables are not paid when due and we are forced to incur unexpected asset write-offs and bad-debt expense.

In addition, the value of any securities that we may retain in our securitizations, including securities retained to comply with the Risk Retention Rules, might be reduced or, in some cases, eliminated as a result of an adverse change in economic conditions or the financial markets.

We may experience greater credit losses or prepayment rates that exceed our expectations.

Until we sell automotive finance receivables, and to the extent we retain interests in automotive finance receivables, after we sell them, whether pursuant to securitization transactions or otherwise, we are exposed to the risk that applicable customers will be unable or unwilling to repay their loans according to their terms and that the vehicle collateral securing the payment of their loans may not be sufficient to ensure full repayment, including as a result of economic slowdown or recession. Credit losses are inherent in the automotive finance receivables business and could have a material adverse effect on our results of operations.

We make various assumptions and judgments about the automotive finance receivables we originate and may provide an allowance for loan losses, value beneficial ownership interests, and estimate prepayment rates based on a number of factors. Although management may establish an allowance for loan losses, value beneficial ownership interests, and estimate prepayment rates based on analysis it believes is appropriate, this may not be adequate. For example, if economic conditions were to deteriorate unexpectedly, additional loan losses not incorporated in the existing allowance or valuation may occur. Losses or prepayments in excess of expectations could have a material adverse effect on our business, results of operations, and financial condition.

Risk retention rules may increase our compliance costs, limit our liquidity and otherwise adversely affect our operating results.

Effective as of December 24, 2016, “risk retention” rules promulgated by U.S. federal regulators under the Dodd-Frank Act (the “Risk Retention Rules”) require a “securitizer” or “sponsor” of a securitization transaction to retain, directly or through a “majority-owned affiliate” (each defined in the Risk Retention Rules), in one or more prescribed forms, at least 5% of the credit risk of the securitized assets. For the securitization transactions for which we have acted as “sponsor,” we have sought and will likely continue to seek to satisfy the Risk Retention Rules by retaining a “vertical interest” (as defined in the Risk Retention Rules) through either a majority-owned affiliate (MOA) or directly on our balance sheet. In addition, we have and will likely continue to enter into arrangements to finance a portion of the retained credit risk in one or more prescribed forms under the Risk Retention Rules.

We have also participated in other structured finance transactions that we have determined are not securitizations requiring risk retention, and accordingly, we have not sought to comply with any Risk Retention Rules that would be applicable to securitization transactions. The Risk Retention Rules are subject to varying interpretations, and one or more regulatory or governmental authorities could take positions with respect to the Risk Retention Rules that conflict with, or are inconsistent with, the Risk Retention Rules as understood by or interpreted by us, the securitization industry generally, or past or current regulatory or governmental authorities. There can be no assurance that applicable regulatory or governmental authorities will agree with any of our determinations described above, and if such authorities disagree with such determinations, we may be exposed to additional costs and expenses, in addition to potential liability. We have implemented procedures to comply with the Risk Retention Rules (and other related laws and regulations), as currently understood by us. Maintenance and adherence to these procedures may be costly and may adversely affect our operating results.

In addition to the costs generated by our efforts to comply with applicable Risk Retention Rules, which may be significant, compliance with any applicable Risk Retention Rules may require capital, which could potentially have been deployed in other ways that could have generated better value. Holding risk retention interests or finance receivables in contemplation of structured financing increases our exposure to the performance of the finance receivables that underlie or are expected to underlie those transactions. Accordingly, although compliance with applicable Risk Retention Rules would be expected to more closely align our incentives with those of the investors in our finance receivables, it is also expected that poor performance may have a heightened adverse effect on our results of operations, financial condition, and liquidity.

Risks Related to this Offering and Ownership of Our Class A Common Stock

Our Class A common stock price has been and may continue to be volatile or may decline regardless of our operating performance.

Volatility in the market price of our Class A common stock may prevent you from being able to sell your shares at or above the price you paid for them. The market price of our Class A common stock has fluctuated, and may continue to fluctuate widely due to many factors, some of which may be beyond our control. The closing price of our Class A common stock between June 30, 2023 and June 30, 2024 has ranged from a low of $24.32 to a high of $132.88. Many factors may cause the market price of our Class A common stock to fluctuate significantly, including those described elsewhere in this “Risk Factors” section and the documents incorporated by reference in this amendment, as well as the following:

| | | | | | | | | | | |

| | • | | the risks related to the larger automotive ecosystem, including consumer demand, global supply chain challenges, and other macroeconomic issues; |

| | | | | | | | | | | |

| | • | | our operating and financial performance and prospects; |

| | | | | | | | | | | |

| | • | | our quarterly or annual earnings or those of other companies in our industry compared to market; |

| | | | | | | | | | | |

| | • | | future announcements or press coverage concerning our business or our competitors’ businesses; |

| | | | | | | | | | | |

| | • | | the public’s reaction to our press releases, other public announcements, and filings with the SEC; |

| | | | | | | | | | | |

| | • | | the size of our public float; |

| | | | | | | | | | | |

| | • | | coverage by or changes in financial estimates by securities analysts or failure to meet their expectations; |

| | | | | | | | | | | |

| | • | | market and industry perception of our success, or lack thereof, in pursuing our growth strategy; |

| | | | | | | | | | | |

| | • | | strategic actions by us or our competitors, such as acquisitions or restructurings; |

| | | | | | | | | | | |

| | • | | changes in laws or regulations which adversely affect our industry or us; |

| | | | | | | | | | | |

| | • | | changes in accounting standards, policies, guidance, interpretations, or principles; |

| | | | | | | | | | | |

| | • | | changes in senior management or key personnel; |

| | | | | | | | | | | |

| | • | | issuances, exchanges or sales, or expected issuances, exchanges, or sales of our capital stock; |

| | | | | | | | | | | |

| | • | | pandemics and other crises or disasters; |

| | | | | | | | | | | |

| • | | adverse resolution of new or pending litigation against us; and |

| | | | | | | | | | | |

| | • | | changes in general market, economic, and political conditions in the United States and global economies or financial markets, including those resulting from natural disasters, terrorist attacks, acts of war, and responses to such events. |

As a result, volatility in the market price of our Class A common stock may prevent investors from being able to sell their shares of Class A common stock at or above their purchase price or at all. These broad market and industry factors may materially reduce the market price of our Class A common stock, regardless of our operating performance. In addition, price volatility may be greater if the public float and trading volume of our Class A common stock is low.

Short sellers of our stock may be manipulative and may have driven down and may again drive down the market price of our Class A common stock.

Short selling is the practice of selling securities that the seller does not own but rather has borrowed or intends to borrow from a third party with the intention of buying identical securities at a later date to return to the lender. A short seller hopes to profit from a decline in the value of the securities, as the short seller expects to pay less in the covering purchase than it received in the sale. It is therefore in the short seller’s interest for the price of the stock to decline, and some short sellers publish, or arrange for the publication of, opinions or characterizations regarding the relevant issuer, often involving deliberate misrepresentations of the issuer’s business prospects and similar matters calculated to create negative market momentum.

As a public entity in a highly digital world, we have been and in the future may be the subject of concerted efforts by profiteering short sellers to spread misinformation and misrepresentations in order to gain an illegal market advantage. In the past, the publication of intentional misinformation concerning Carvana by a disclosed short seller could be associated with the selling of shares of our Class A common stock in the market on a large scale, resulting in a precipitous decline in the market price per share of our Class A common stock. In addition, the publication of intentional misinformation may also result in lawsuits, the uncertainty and expense of which could adversely impact our business, financial condition and reputation.

While utilizing all available tools to defend ourselves and our assets against these short seller efforts, there is limited regulatory control, making such efforts an ongoing concern for any public company. While we move forward in our business development strategies in good faith, there are no assurances that we will not face more of these short sellers’ efforts or similar tactics by adverse actors in the future, and the market price of our Class A common stock may decline as a result of their actions or the action of other short sellers.

A “short squeeze” due to a sudden increase in demand for shares of our Class A common stock that largely exceeds supply has led to, and may continue to lead to, extreme price volatility in shares of our Class A common stock.

Speculation with respect to the price of our Class A common stock may involve long and short exposures. To the extent aggregate short exposure exceeds the number of shares of our Class A common stock available for purchase on the open market, investors with short exposure may have to pay a premium to repurchase shares of our Class A common stock for delivery to lenders of our Class A common stock. Those repurchases may in turn, dramatically increase the price of shares of our Class A common stock until additional shares of our Class A common stock are available for trading or borrowing. This is often referred to as a “short squeeze.”

A large proportion of our Class A common stock has been and may again be traded by short sellers which may increase the likelihood that our Class A common stock will be the target of a short squeeze. A short squeeze has led and could continue to lead to volatile price movements in shares of our Class A common stock that are unrelated or disproportionate to our operating performance or prospects and, once investors purchase the shares of our Class A common stock necessary to cover their short positions, the price of our Class A common stock may rapidly decline. Investors that purchase shares of our Class A common stock during a short squeeze may lose a significant portion of their investment.

We have broad discretion in how we use the net proceeds from this offering, and we may not use these proceeds effectively or in ways with which our stockholders agree.

We have not designated any portion of the net proceeds from this offering to be used for any particular purpose. Our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the execution of the Distribution Agreement. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase the market price of our Class A common stock. See “Use of Proceeds” in this amendment for more detailed information.

The Garcia Parties control us and will continue to control us following this offering and their interests may conflict with ours or yours in the future.

The Garcia Parties together hold approximately 86.1% of the voting power of our outstanding capital stock through their beneficial ownership of our Class A common stock and Class B common stock as of July 30, 2024. Immediately following this offering of Class A common stock, assuming all of the shares offered hereby are sold, the Garcia Parties would together hold approximately 85.3% of the voting power of our outstanding capital stock through their beneficial ownership of our Class A common stock and Class B common stock. The Garcia Parties are entitled to ten votes per share of Class B common stock they beneficially own, for so long as the Garcia Parties maintain, in the aggregate, direct or indirect beneficial ownership of at least 25% of the outstanding shares of Class A common stock (determined on an as-exchanged basis assuming that all of the LLC Units were

exchanged for Class A common stock). Our Class A common stock, which is the stock we are selling in this offering, has one vote per share. So long as the Garcia Parties continue to beneficially own a sufficient number of shares of Class B common stock, even if they beneficially own significantly less than 50% of the shares of our outstanding capital stock, the Garcia Parties will continue to be able to effectively control our decisions. For example, if the Garcia Parties hold Class B common stock amounting to 25% of our outstanding capital stock, they would collectively control 71% of the voting power of our capital stock.

As a result, the Garcia Parties have the ability to elect all of the members of our board of directors (the “Board”) and thereby effectively control our policies and operations, including the appointment of management, future issuances of our Class A common stock or other securities, the payment of dividends, if any, on our Class A common stock, the incurrence of debt by us, amendments to our amended and restated certificate of incorporation (our “certificate of incorporation”) and our amended and restated bylaws (our “bylaws”), and the entering into of extraordinary transactions. The interests of the Garcia Parties may not in all cases be aligned with your interests.

In addition, the Garcia Parties can determine the outcome of all matters requiring stockholder approval, cause or prevent a change of control of our company or a change in the composition of our Board, and preclude any acquisition of our company. This concentration of voting control could deprive you of an opportunity to receive a premium for your shares of Class A common stock as part of a sale of our company and ultimately might affect the market price of our Class A common stock.

In addition, the Garcia Parties may have an interest in pursuing acquisitions, divestitures, and other transactions that, in their judgment, could enhance their investment, even though such transactions might involve risks. For example, the Garcia Parties could cause us to make acquisitions that increase our indebtedness or cause us to sell revenue-generating assets. The Garcia Parties may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. The Garcia Parties control and own substantially all interest in DriveTime Automotive Inc., which could compete more directly with us in the future. Our amended and restated certificate of incorporation provides that none of the Garcia Parties or any director who is not employed by us (including any non-employee director who serves as one of our officers in both his or her director and officer capacities) or his or her affiliates has any duty to refrain from engaging, directly or indirectly, in the same business activities or similar business activities or lines of business in which we operate. The Garcia Parties also may pursue acquisition opportunities that may otherwise be complementary to our business, and, as a result, those acquisition opportunities may not be available to us.

For a description of the dual class structure, see the section “Description of Capital Stock.”

Our actual operating results may differ significantly from our guidance.

From time to time, we plan to release earnings guidance in our quarterly earnings conference calls, quarterly earnings releases, or otherwise, regarding our future performance that represents our management’s estimates as of the date of release. This guidance, which will include forward-looking statements, will be based on projections prepared by our management. Projections are based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and are based upon specific assumptions with respect to future business decisions, some of which will change. The principal reason that we release guidance is to provide a basis for our management to discuss our business outlook with analysts and investors. We do not accept any responsibility for any projections or reports published by any such third parties.

Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the guidance furnished by us will not materialize or will vary significantly from actual results. Actual results may vary from our guidance and the variations may be material. In light of the foregoing, investors are urged not to place undue reliance upon our guidance in making an investment decision regarding our Class A common stock.

Any failure to successfully implement our operating strategy or the occurrence of any of the events or circumstances set forth in the “Risk Factors” section in this amendment and our most recent Annual Report on Form 10-K, which is incorporated by reference herein, could result in the actual operating results being different from our guidance, and the differences may be adverse and material.

We do not intend to pay dividends on our Class A common stock for the foreseeable future.

We currently have no intention to pay dividends on our Class A common stock at any time in the foreseeable future. Any decision to declare and pay dividends in the future will be made at the discretion of our Board and will depend on, among other things, our results of operations, financial condition, cash requirements, contractual restrictions, and other factors that our Board may deem relevant. Certain of our debt instruments contain covenants that restrict our ability and the ability of our subsidiaries to pay dividends and in the future we may enter into new instruments with similar covenants. In addition, despite our current indebtedness, we may still

be able to incur additional debt in the future, and such indebtedness may restrict or prevent us from paying dividends on our Class A common stock.

Delaware law and certain provisions in our certificate of incorporation may prevent efforts by our stockholders to change the direction or management of our company.

We are a Delaware corporation, and the anti-takeover provisions of Delaware law impose various impediments to the ability of a third party to acquire control of us, even if a change of control would be beneficial to our existing stockholders. In addition, our certificate of incorporation and our bylaws contain provisions that may make the acquisition of our company more difficult without the approval of our Board, including, but not limited to, the following:

| | | | | | | | | | | |

| | • | | the Garcia Parties are entitled to ten votes for each share of our Class B common stock they hold of record on all matters submitted to a vote of stockholders for so long as the Garcia Parties maintain direct or indirect beneficial ownership of at least 25% of the outstanding shares of Class A common stock (determined on an as-exchanged basis assuming that all of the LLC Units were exchanged for Class A common stock); |

| | | | | | | | | | | |

| | • | | at such time as there are no outstanding shares of Class B common stock, only our Board may call special meetings of our stockholders; |

| | | | | | | | | | | |

| | • | | we have authorized undesignated preferred stock, the terms of which may be established and shares of which may be issued without stockholder approval; and |

| | | | | | | | | | | |

| | • | | we require advance notice and duration of ownership requirements for stockholder proposals. |

Our certificate of incorporation also contains a provision that provides us with protections similar to Section 203 of the Delaware General Corporation Law (the “DGCL”), and prevents us from engaging in a business combination with a person (excluding the Garcia Parties and their transferees) who acquires at least 15% of our common stock for a period of three years from the date such person acquired such common stock, unless board or stockholder approval is obtained prior to the acquisition. See “Description of Capital Stock—Anti-Takeover Provisions” for more information. These provisions could discourage, delay, or prevent a transaction involving a change in control of our company. These provisions could also discourage proxy contests and make it more difficult for you and other stockholders to elect directors of your choosing and cause us to take other corporate actions you desire, including actions that you may deem advantageous, or negatively affect the trading price of our Class A common stock. In addition, because our Board is responsible for appointing the members of our management team, these provisions could in turn affect any attempt by our stockholders to replace current members of our management team.

These and other provisions in our certificate of incorporation, bylaws and Delaware law could make it more difficult for stockholders or potential acquirers to obtain control of our Board or to initiate actions that are opposed by our then-current Board, including a merger, tender offer or proxy contest involving our company. The existence of these provisions could negatively affect the price of our common stock and limit opportunities for you to realize value in a corporate transaction.

For information regarding these and other provisions, see “Description of Capital Stock.”

With limited exceptions, the Court of Chancery of the State of Delaware is the sole and exclusive forum for certain stockholder litigation matters, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, employees, or stockholders.

Pursuant to our certificate of incorporation, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware is the sole and exclusive forum for (1) any derivative action or proceeding brought on our behalf, (2) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers, or other employees to us or our stockholders, (3) any action asserting a claim against us arising pursuant to any provision of the DGCL, our certificate of incorporation or our bylaws or (4) any other action asserting a claim against us that is governed by the internal affairs doctrine. The forum selection clause in our certificate of incorporation may have the effect of discouraging lawsuits against us or our directors and officers and may limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, employees, or stockholders.

We may issue shares of preferred stock in the future, which could make it difficult for another company to acquire us or could otherwise adversely affect holders of our Class A common stock, which could depress the price of our Class A common stock.

Our certificate of incorporation authorizes us to issue one or more series of preferred stock. Our Board has the authority to determine the preferences, limitations and relative rights of the shares of preferred stock and to fix the number of shares constituting any series and the designation of such series, without any further vote or action by our stockholders. Our preferred stock could be issued with voting, liquidation, dividend and other rights superior to the rights of our Class A common stock. The potential issuance of preferred stock may delay or prevent a change in control of us, discouraging bids for our Class A common stock at a premium to the market price, and materially adversely affect the market price and the voting and other rights of the holders of our Class A common stock.

It is not possible to predict the aggregate number of shares to be sold under the Distribution Agreement.

Subject to certain limitations in the Distribution Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the Sales Agents at any time and from time to time throughout the term of the Distribution Agreement. In addition, the number of shares that are sold through the Sales Agents after delivering a placement notice will fluctuate based on a number of factors, including the market price of our Class A common stock during the sales period, any limits we may set with the Sales Agents in any applicable placement notice, and the demand for our Class A common stock. Because the price per share of each share sold pursuant to the Distribution Agreement will fluctuate over time, it is not currently possible to predict the aggregate number of shares to be sold under the Distribution Agreement.

Our stock may be diluted by future issuances of additional Class A common stock or LLC Units in connection with our incentive plans, acquisitions or otherwise; future sales of such shares in the public market, or the expectations that such sales may occur could lower our stock price.

We may issue additional shares of Class A common stock in several ways:

By the Board. Our certificate of incorporation authorizes us to issue shares of our Class A common stock and options, rights, warrants and appreciation rights relating to our Class A common stock or the consideration of and on the terms and conditions established by our Board in its sole discretion, whether in connection with acquisitions or otherwise. In 2023, in connection with offerings of Class A common stock to other investors, we issued additional Class A Units to the Garcia Parties, which are exchangeable for shares of our Class A common stock.

Under the Exchange Agreement. LLC Unitholders may require Carvana Group to redeem all or a portion of their LLC Units in exchange for, at our election, (1) a cash payment by Carvana Group or (2) newly issued shares of Class A common stock, in each case in accordance with the terms and conditions of the Exchange Agreement. The LLC Agreement authorizes Carvana Group to issue additional LLC Units whether in connection with an acquisition or otherwise. We have entered into a Registration Rights Agreement with certain LLC Unitholders that would require us to register shares issued to them, and we may enter into similar agreements in the future. For more information with respect to the Exchange Agreement, see “Organizational Structure—Exchange Agreement” in the accompanying prospectus.

Under the 2017 Omnibus Incentive Plan. As of June 30, 2024, we had remaining 17.1 million shares of Class A common stock for issuance under our 2017 Omnibus Incentive Plan (the “2017 Incentive Plan”), as adjusted pursuant to the terms of the 2017 Incentive Plan. As of June 30, 2024, we granted 15.4 million restricted stock awards and units and options to purchase 5.3 million shares of Class A common stock to certain consultants, directors, and employees, net of forfeitures and expirations.

Under the Carvana Co. 2021 Employee Stock Purchase Plan. We have reserved 500,000 shares of Class A common stock for issuance under our 2021 Employee Stock Purchase Plan (the “ESPP”). As of June 30, 2024, we issued 127,772 shares of Class A common stock to certain employees. We have 372,228 shares of Class A common stock available for future issuance under our ESPP as of June 30, 2024.

Any stock that we issue or exchange would dilute the percentage ownership held by the investors who purchase Class A common stock. The market price of shares of our Class A common stock could decline as a result of newly issued or exchanged stock, or the perception that we might issue or exchange stock. A decline in the price of our Class A common stock might impede our ability to raise capital through the issuance of additional shares of Class A common stock or other equity securities. A decline in the price of our Class A common stock might impede our ability to raise capital through the issuance of additional shares of Class A common stock or other equity securities. In addition, in order to raise additional capital, we may in the future offer additional shares of our Class A common stock or other securities convertible into or exchangeable for our Class A common stock at various prices. Investors

purchasing shares or other securities in the future could have rights superior to existing stockholders, and any future equity offerings will result in further dilution for our existing stockholders.

Substantial blocks of our total outstanding shares may be sold into the market. If there are substantial sales of shares of our Class A common stock, the price of our Class A common stock could decline.

The price of our Class A common stock could decline if there are substantial sales of our Class A common stock (including sales of Class A common stock issuable upon exchange of LLC Units), particularly sales by our directors, executive officers, and significant stockholders, or if there is a large number of shares of our Class A common stock available for sale. As of June 30, 2024, we had 121.1 million shares of our Class A common stock outstanding. All the shares of Class A common stock sold in our initial public offering and various follow-on offerings are available for sale in the public market. Shares held by directors, executive officers and other affiliates are subject to volume limitations under Rule 144 under the Securities Act and various vesting agreements.

Certain of our LLC Unitholders have rights, subject to conditions, to require us to file registration statements covering Class A common stock issuable to them upon exchange of their LLC Units. We would be required to include certain Class A common shares in registration statements that we may file for ourselves or our stockholders, subject to market stand-off and lock-up agreements. These registration rights would facilitate the resale of such securities into the public market, and any such resale would increase the number of shares of our Class A common stock available for public trading. We also intend to register shares of Class A common stock that we have issued and may issue under our employee equity incentive plans. Once we register these shares, they will be able to be sold freely in the public market upon issuance, subject to existing market stand-off or lock-up agreements.

The market price of the shares of our Class A common stock could decline as a result of the sale of a substantial number of our shares of Class A common stock in the public market or the perception in the market that the holders of a large number of such shares intend to sell their shares.

USE OF PROCEEDS

Under this amendment, the prospectus supplement and the accompanying prospectus, we may issue and sell shares of our Class A common stock representing an aggregate offering price of up to $1,000,000,000 from time to time. The amount of proceeds we will receive from any offering under the Distribution Agreement, if any, will depend upon the actual number of shares of our Class A common stock sold and the market price at which such shares are sold. Because there is no minimum offering amount required as a condition to close any such offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any shares under or fully utilize the Distribution Agreement with the Sales Agents as a source of financing. We intend to contribute the net proceeds from any offering under the Distribution Agreement to our wholly owned subsidiary, Carvana Sub, that will in turn use such net proceeds to acquire newly-issued Class A Units in Carvana Group at a purchase price per Class A Unit based on the applicable public offering price, less commissions and offering expenses payable by us. In turn, Carvana Group intends to use the net proceeds for general corporate purposes and to pay any costs, fees and expenses incurred by it in connection with such offering.

We expect these general corporate purposes to include, without limitation, repayment of indebtedness, funding working capital, capital expenditures, operating expenses and the selective pursuit of business development opportunities, including to expand our current business through acquisitions of, or investments in, other businesses, products or technologies. At this time, we have not specifically identified a material single use for which we intend to use the net proceeds, and, accordingly, we are not able to allocate the net proceeds among any of these potential uses in light of the variety of factors that will impact how such net proceeds are ultimately utilized by us.

DESCRIPTION OF CAPITAL STOCK

The following is a summary description of the material terms of our amended and restated certificate of incorporation and amended and restated bylaws. This summary description is qualified by reference to our amended and restated certificate of incorporation and amended and restated bylaws, and by the provisions of applicable law. The following description may not contain all of the information that is important to you. To understand the material terms of our Class A common stock, you should read our amended and restated certificate of incorporation and amended and restated bylaws, which are filed as exhibits to the registration statement of which this amendment forms a part and our other filings with the SEC incorporated by reference in the existing base prospectus.

General

Our amended and restated certificate of incorporation (our “certificate”) authorizes capital stock consisting of:

| | | | | | | | | | | |

| | • | | 500,000,000 shares of Class A common stock, par value $0.001 per share; |

| | | | | | | | | | | |

| | • | | 125,000,000 shares of Class B common stock, par value $0.001 per share; and |

| | | | | | | | | | | |

| | • | | 50,000,000 shares of undesignated preferred stock, with a par value per share that may be established by the Board in the applicable certificate of designations. |

As of July 30, 2024, we had 123,824,087 and 83,119,471 shares of our Class A common stock and Class B common stock issued and outstanding, respectively.

The following summary describes the material provisions of our capital stock. We urge you to read our certificate and our amended and restated bylaws (our “bylaws”), which have been filed with the SEC.

Certain provisions of our certificate and our bylaws summarized below may be deemed to have an anti-takeover effect and may delay or prevent a tender offer or takeover attempt that a stockholder might consider in its best interest, including those attempts that might result in a premium over the market price for the shares of Class A common stock.

Class A Common Stock

Holders of shares of our Class A common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. The holders of our Class A common stock do not have cumulative voting rights in the election of directors.

Holders of shares of our Class A common stock will vote together with holders of our Class B common stock as a single class on all matters presented to our stockholders for their vote or approval, except for certain amendments to our certificate of incorporation described below or as otherwise required by applicable law or the certificate.