0001567683FALSE--12-312024Q154.9145.09http://fasb.org/us-gaap/2023#Revenueshttp://fasb.org/us-gaap/2023#Revenueshttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesutr:MWxbrli:pureiso4217:USDutr:MWhiso4217:USDutr:Btuutr:MWhutr:Btucwen:subsidiary00015676832024-01-012024-03-310001567683us-gaap:CommonClassAMember2024-01-012024-03-310001567683us-gaap:CommonClassCMember2024-01-012024-03-310001567683us-gaap:CommonClassAMember2024-04-300001567683us-gaap:CommonClassBMember2024-04-300001567683us-gaap:CommonClassCMember2024-04-300001567683cwen:CommonClassDMember2024-04-3000015676832023-01-012023-03-310001567683us-gaap:CommonClassAMember2023-01-012023-03-310001567683us-gaap:CommonClassCMember2023-01-012023-03-3100015676832024-03-3100015676832023-12-310001567683us-gaap:NonrelatedPartyMember2024-03-310001567683us-gaap:NonrelatedPartyMember2023-12-310001567683srt:AffiliatedEntityMember2024-03-310001567683srt:AffiliatedEntityMember2023-12-310001567683us-gaap:CommonClassCMember2024-03-310001567683cwen:CommonClassDMember2024-03-310001567683us-gaap:CommonClassBMember2024-03-310001567683us-gaap:CommonClassAMember2023-12-310001567683us-gaap:CommonClassCMember2023-12-310001567683us-gaap:CommonClassAMember2024-03-310001567683us-gaap:CommonClassBMember2023-12-310001567683cwen:CommonClassDMember2023-12-3100015676832022-12-3100015676832023-03-310001567683us-gaap:PreferredStockMember2023-12-310001567683us-gaap:CommonStockMember2023-12-310001567683us-gaap:AdditionalPaidInCapitalMember2023-12-310001567683us-gaap:RetainedEarningsMember2023-12-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001567683us-gaap:NoncontrollingInterestMember2023-12-310001567683us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001567683cwen:CEGMemberus-gaap:NoncontrollingInterestMember2024-01-012024-03-310001567683cwen:CEGMember2024-01-012024-03-310001567683cwen:TaxEquityInvestorsMemberus-gaap:NoncontrollingInterestMember2024-01-012024-03-310001567683cwen:TaxEquityInvestorsMember2024-01-012024-03-310001567683us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001567683us-gaap:RetainedEarningsMembercwen:CEGMember2024-01-012024-03-310001567683us-gaap:PreferredStockMember2024-03-310001567683us-gaap:CommonStockMember2024-03-310001567683us-gaap:AdditionalPaidInCapitalMember2024-03-310001567683us-gaap:RetainedEarningsMember2024-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001567683us-gaap:NoncontrollingInterestMember2024-03-310001567683us-gaap:PreferredStockMember2022-12-310001567683us-gaap:CommonStockMember2022-12-310001567683us-gaap:AdditionalPaidInCapitalMember2022-12-310001567683us-gaap:RetainedEarningsMember2022-12-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001567683us-gaap:NoncontrollingInterestMember2022-12-310001567683us-gaap:RetainedEarningsMember2023-01-012023-03-310001567683us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001567683cwen:CEGMemberus-gaap:NoncontrollingInterestMember2023-01-012023-03-310001567683cwen:CEGMember2023-01-012023-03-310001567683cwen:TaxEquityInvestorsMemberus-gaap:NoncontrollingInterestMember2023-01-012023-03-310001567683cwen:TaxEquityInvestorsMember2023-01-012023-03-310001567683us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001567683cwen:CEGMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001567683us-gaap:RetainedEarningsMembercwen:CEGMember2023-01-012023-03-310001567683us-gaap:PreferredStockMember2023-03-310001567683us-gaap:CommonStockMember2023-03-310001567683us-gaap:AdditionalPaidInCapitalMember2023-03-310001567683us-gaap:RetainedEarningsMember2023-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001567683us-gaap:NoncontrollingInterestMember2023-03-310001567683cwen:ConventionalGenerationUtilityScaleSolarDistributedSolarandWindMember2024-03-310001567683cwen:GenerationalFacilitiesAndDistrictEnergySystemsMember2024-03-310001567683cwen:ClearwayEnergyInc.Membercwen:ClearwayEnergyLLCMember2024-01-012024-03-310001567683cwen:CEGMembercwen:ClearwayEnergyLLCMember2024-01-012024-03-310001567683cwen:ClearwayEnergyInc.Membercwen:CEGMember2024-01-012024-03-310001567683cwen:ClearwayEnergyInc.Membercwen:PublicShareholdersMember2024-01-012024-03-310001567683cwen:ProjectLevelSubsidiariesMember2024-03-310001567683cwen:ProjectLevelSubsidiariesMember2023-12-310001567683cwen:OperatingFundsMember2024-03-310001567683cwen:LongTermDebtCurrentMember2024-03-310001567683cwen:DebtServiceObligationsMember2024-03-310001567683us-gaap:CashDistributionMember2024-03-310001567683cwen:DropDownMember2024-01-012024-03-310001567683cwen:DropDownMember2023-01-012023-03-310001567683us-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2024-05-092024-05-090001567683us-gaap:SubsequentEventMemberus-gaap:CommonClassCMember2024-05-092024-05-090001567683us-gaap:CommonClassBMembercwen:ClearwayEnergyLLCMember2024-01-012024-03-310001567683cwen:CommonClassDMembercwen:ClearwayEnergyLLCMember2024-01-012024-03-310001567683cwen:CommonClassDMemberus-gaap:SubsequentEventMember2024-05-092024-05-090001567683us-gaap:SubsequentEventMemberus-gaap:CommonClassBMember2024-05-092024-05-090001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMembercwen:ConventionalGenerationMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMembercwen:RenewablesMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMembercwen:ConventionalGenerationMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMembercwen:RenewablesMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:ConventionalGenerationMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:RenewablesMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMembercwen:ConventionalGenerationMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMembercwen:RenewablesMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMembercwen:ConventionalGenerationMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMembercwen:RenewablesMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:ConventionalGenerationMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:RenewablesMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2023-01-012023-03-310001567683us-gaap:OperatingSegmentsMember2023-01-012023-03-310001567683us-gaap:CustomerContractsMember2024-03-310001567683us-gaap:CustomerContractsMember2023-12-310001567683us-gaap:LeaseAgreementsMember2024-03-310001567683us-gaap:LeaseAgreementsMember2023-12-310001567683cwen:CedarCreekDropDownMemberus-gaap:SubsequentEventMembercwen:CedarCreekTEHoldcoLLCMembercwen:CedarCreekWindHoldcoLLCMemberus-gaap:AlternativeEnergyMember2024-04-160001567683cwen:CedarCreekDropDownMemberus-gaap:SubsequentEventMembercwen:CedarCreekTEHoldcoLLCMembercwen:CedarCreekWindHoldcoLLCMemberus-gaap:AlternativeEnergyMember2024-04-162024-04-160001567683cwen:TaxEquityInvestorsMembercwen:CedarCreekDropDownMemberus-gaap:SubsequentEventMembercwen:CedarCreekTEHoldcoLLCMember2024-04-162024-04-160001567683cwen:TexasSolarNova2DropDownMembercwen:LighthouseRenewableHoldco2LLCMembercwen:TSN1TEHoldcoLLCMemberus-gaap:AlternativeEnergyMember2024-03-150001567683cwen:TexasSolarNova2DropDownMembercwen:LighthouseRenewableHoldco2LLCMembercwen:TSN1TEHoldcoLLCMemberus-gaap:AlternativeEnergyMember2024-03-152024-03-150001567683cwen:TexasSolarNova2DropDownMembercwen:ClearwayRenewLLCMember2024-03-152024-03-150001567683cwen:TexasSolarNova2DropDownMembercwen:TSN1TEHoldcoLLCMembercwen:CashEquityInvestorMember2024-03-152024-03-150001567683cwen:TexasSolarNova2DropDownMember2024-03-152024-03-150001567683cwen:TexasSolarNova2DropDownMembercwen:CEGMember2024-03-152024-03-150001567683cwen:TexasSolarNova2DropDownMembercwen:TermLoanMember2024-03-152024-03-150001567683cwen:TexasSolarNova2DropDownMembercwen:TaxEquityBridgeLoanMember2024-03-152024-03-150001567683cwen:TexasSolarNova2DropDownMember2024-03-150001567683cwen:AvenalMember2024-03-310001567683cwen:DesertSunlightMember2024-03-310001567683cwen:ElkhornRidgeMember2024-03-310001567683cwen:GenConnEnergyLlcMember2024-03-310001567683cwen:RosieCentralBESSMember2024-03-310001567683cwen:SanJuanMesaMember2024-03-310001567683cwen:BuckthornHoldingsLLCMember2024-03-310001567683cwen:DGPVFundsMember2024-03-310001567683cwen:LangfordTEPartnershipLLCMember2024-03-310001567683cwen:DaggettRenewableHoldcoLLCMember2024-03-310001567683cwen:LighthouseRenewableHoldcoLLCMember2024-03-310001567683cwen:LighthouseRenewableHoldco2LLCMember2024-03-310001567683cwen:OahuSolarLLCMember2024-03-310001567683cwen:RattlesnakeTEHoldcoLLCMember2024-03-310001567683cwen:RosieTargetCoLLCMember2024-03-310001567683cwen:VPAricaTEHoldcoLLCMember2024-03-310001567683cwen:WildoradoTEHoldcoMember2024-03-310001567683cwen:OtherConsolidatedVariableInterestEntitiesMember2024-03-310001567683us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-03-310001567683us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001567683us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001567683us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001567683us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001567683us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMember2024-03-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMember2023-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMember2023-12-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMember2024-03-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMember2023-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMember2023-12-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001567683cwen:ElSegundoMarshLandingAndWalnutCreekNotesMemberus-gaap:CallOptionMember2024-03-310001567683cwen:ElSegundoMarshLandingAndWalnutCreekNotesMemberus-gaap:CallOptionMember2023-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-01-012024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-03-310001567683us-gaap:FairValueMeasurementsRecurringMember2024-03-310001567683us-gaap:FairValueMeasurementsRecurringMember2023-03-310001567683us-gaap:FairValueMeasurementsRecurringMember2024-01-012024-03-310001567683us-gaap:FairValueMeasurementsRecurringMember2023-01-012023-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMembersrt:MinimumMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMemberus-gaap:MeasurementInputCommodityForwardPriceMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMembersrt:WeightedAverageMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputCommodityForwardPriceMemberus-gaap:CommodityOptionMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputCommodityForwardPriceMembersrt:MinimumMemberus-gaap:CommodityOptionMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMembersrt:MaximumMemberus-gaap:MeasurementInputCommodityForwardPriceMemberus-gaap:CommodityOptionMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputCommodityForwardPriceMembersrt:WeightedAverageMemberus-gaap:CommodityOptionMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputCommodityForwardPriceMembersrt:MinimumMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMembersrt:MaximumMemberus-gaap:MeasurementInputCommodityForwardPriceMember2024-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputCommodityForwardPriceMembersrt:WeightedAverageMember2024-03-310001567683us-gaap:FairValueInputsLevel3Membercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2024-03-310001567683us-gaap:FairValueInputsLevel3Membercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMembersrt:MinimumMember2024-03-310001567683us-gaap:FairValueInputsLevel3Membercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MaximumMemberus-gaap:MeasurementInputCommodityForwardPriceMember2024-03-310001567683us-gaap:FairValueInputsLevel3Membercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMembersrt:WeightedAverageMember2024-03-310001567683cwen:PowerMemberus-gaap:ShortMemberus-gaap:CommodityOptionMember2024-01-012024-03-310001567683cwen:PowerMemberus-gaap:ShortMemberus-gaap:CommodityOptionMember2023-01-012023-12-310001567683us-gaap:ShortMemberus-gaap:CommodityOptionMembersrt:NaturalGasReservesMember2024-01-012024-03-310001567683us-gaap:ShortMemberus-gaap:CommodityOptionMembersrt:NaturalGasReservesMember2023-01-012023-12-310001567683cwen:InterestMemberus-gaap:LongMember2024-03-310001567683cwen:InterestMemberus-gaap:LongMember2023-12-310001567683cwen:InterestRateContractCurrentMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001567683cwen:InterestRateContractCurrentMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001567683cwen:InterestRateContractNonCurrentMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001567683cwen:InterestRateContractNonCurrentMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001567683us-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001567683us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001567683cwen:InterestRateContractCurrentMemberus-gaap:NondesignatedMember2024-03-310001567683cwen:InterestRateContractCurrentMemberus-gaap:NondesignatedMember2023-12-310001567683cwen:InterestRateContractNonCurrentMemberus-gaap:NondesignatedMember2024-03-310001567683cwen:InterestRateContractNonCurrentMemberus-gaap:NondesignatedMember2023-12-310001567683cwen:CommodityContractCurrentMemberus-gaap:NondesignatedMember2024-03-310001567683cwen:CommodityContractCurrentMemberus-gaap:NondesignatedMember2023-12-310001567683cwen:CommodityContractLongTermMemberus-gaap:NondesignatedMember2024-03-310001567683cwen:CommodityContractLongTermMemberus-gaap:NondesignatedMember2023-12-310001567683us-gaap:NondesignatedMember2024-03-310001567683us-gaap:NondesignatedMember2023-12-310001567683us-gaap:CommodityContractMember2024-03-310001567683us-gaap:InterestRateContractMember2024-03-310001567683us-gaap:CommodityContractMember2023-12-310001567683us-gaap:InterestRateContractMember2023-12-310001567683us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001567683us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001567683us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-03-310001567683us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-03-310001567683us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-03-310001567683us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-03-310001567683us-gaap:InterestRateContractMember2024-01-012024-03-310001567683us-gaap:InterestRateContractMember2023-01-012023-03-310001567683us-gaap:EnergyRelatedDerivativeMember2024-01-012024-03-310001567683us-gaap:EnergyRelatedDerivativeMember2023-01-012023-03-310001567683us-gaap:CommodityOptionMember2024-01-012024-03-310001567683us-gaap:CommodityOptionMember2023-01-012023-03-310001567683cwen:A475SeniorNotesDue2028Member2024-03-310001567683cwen:A475SeniorNotesDue2028Member2023-12-310001567683cwen:SeniorNotes3Point750PercentDue2031Member2024-03-310001567683cwen:SeniorNotes3Point750PercentDue2031Member2023-12-310001567683cwen:SeniorNotes3Point750PercentDue2032Member2024-03-310001567683cwen:SeniorNotes3Point750PercentDue2032Member2023-12-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMember2024-03-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMember2023-12-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMembercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683cwen:AguaCalienteSolarLLCDue2037Member2024-03-310001567683cwen:AguaCalienteSolarLLCDue2037Member2023-12-310001567683cwen:AguaCalienteSolarLLCDue2037Membersrt:MinimumMember2024-03-310001567683cwen:AguaCalienteSolarLLCDue2037Membersrt:MaximumMember2024-03-310001567683cwen:AguaCalienteSolarLLCDue2037Memberus-gaap:LetterOfCreditMember2024-03-310001567683cwen:AltaWindAssetManagementLLCDue2031Member2024-03-310001567683cwen:AltaWindAssetManagementLLCDue2031Member2023-12-310001567683cwen:AltaWindAssetManagementLLCDue2031Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:AltaWindAssetManagementLLCDue2031Member2024-03-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2024-03-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2023-12-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Membersrt:MinimumMember2024-03-310001567683srt:MaximumMembercwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2024-03-310001567683us-gaap:LetterOfCreditMembercwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2024-03-310001567683cwen:AltaWindRealtyInvestmentsLLCDue2031Member2024-03-310001567683cwen:AltaWindRealtyInvestmentsLLCDue2031Member2023-12-310001567683us-gaap:LetterOfCreditMembercwen:AltaWindRealtyInvestmentsLLCDue2031Member2024-03-310001567683cwen:BorregoDue2024And2038Member2024-03-310001567683cwen:BorregoDue2024And2038Member2023-12-310001567683us-gaap:LetterOfCreditMembercwen:BorregoDue2024And2038Member2024-03-310001567683cwen:BrokenBowDue2031Member2024-03-310001567683cwen:BrokenBowDue2031Member2023-12-310001567683cwen:BrokenBowDue2031Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:BrokenBowDue2031Member2024-03-310001567683cwen:BuckthornSolardue2025Member2024-03-310001567683cwen:BuckthornSolardue2025Member2023-12-310001567683cwen:BuckthornSolardue2025Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:BuckthornSolardue2025Member2024-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2027Member2024-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2027Member2023-12-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2027Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:CarlsbadEnergyHoldingsLLCDue2027Member2024-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2038Member2024-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2038Member2023-12-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2038Memberus-gaap:LetterOfCreditMember2024-03-310001567683cwen:CarlsbadHoldcoLLCDue2038Member2024-03-310001567683cwen:CarlsbadHoldcoLLCDue2038Member2023-12-310001567683us-gaap:LetterOfCreditMembercwen:CarlsbadHoldcoLLCDue2038Member2024-03-310001567683cwen:CedroHillMember2024-03-310001567683cwen:CedroHillMember2023-12-310001567683cwen:CedroHillMembercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:CedroHillMember2024-03-310001567683cwen:CroftonBluffMember2024-03-310001567683cwen:CroftonBluffMember2023-12-310001567683cwen:SecuredOvernightFinancingRateSOFRMembercwen:CroftonBluffMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:CroftonBluffMember2024-03-310001567683cwen:CvsrFinancingAgreementMember2024-03-310001567683cwen:CvsrFinancingAgreementMember2023-12-310001567683cwen:CvsrFinancingAgreementMembersrt:MinimumMember2024-03-310001567683srt:MaximumMembercwen:CvsrFinancingAgreementMember2024-03-310001567683us-gaap:LetterOfCreditMembercwen:CvsrFinancingAgreementMember2024-03-310001567683cwen:CVSRHoldcodue2037Member2024-03-310001567683cwen:CVSRHoldcodue2037Member2023-12-310001567683us-gaap:LetterOfCreditMembercwen:CVSRHoldcodue2037Member2024-03-310001567683cwen:Daggett2Due2023And2028Member2024-03-310001567683cwen:Daggett2Due2023And2028Member2023-12-310001567683us-gaap:LetterOfCreditMembercwen:Daggett2Due2023And2028Member2024-03-310001567683cwen:Daggett3Due2023And2028Member2024-03-310001567683cwen:Daggett3Due2023And2028Member2023-12-310001567683cwen:Daggett3Due2023And2028Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:Daggett3Due2023And2028Member2024-03-310001567683cwen:DGCSMasterBorrowerLLCDue2040Member2024-03-310001567683cwen:DGCSMasterBorrowerLLCDue2040Member2023-12-310001567683us-gaap:LetterOfCreditMembercwen:DGCSMasterBorrowerLLCDue2040Member2024-03-310001567683cwen:MililaniClassBHoldcoDue2028Member2024-03-310001567683cwen:MililaniClassBHoldcoDue2028Member2023-12-310001567683cwen:MililaniClassBHoldcoDue2028Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683cwen:MililaniClassBHoldcoDue2028Memberus-gaap:LetterOfCreditMember2024-03-310001567683cwen:NIMHSolarDue2024Member2024-03-310001567683cwen:NIMHSolarDue2024Member2023-12-310001567683cwen:NIMHSolarDue2024Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:NIMHSolarDue2024Member2024-03-310001567683cwen:OahuSolarHoldingsLLCdue2026Member2024-03-310001567683cwen:OahuSolarHoldingsLLCdue2026Member2023-12-310001567683cwen:OahuSolarHoldingsLLCdue2026Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683cwen:OahuSolarHoldingsLLCdue2026Memberus-gaap:LetterOfCreditMember2024-03-310001567683cwen:RosieClassBLLCDue2024And2029Member2024-03-310001567683cwen:RosieClassBLLCDue2024And2029Member2023-12-310001567683cwen:RosieClassBLLCDue2024And2029Membercwen:SecuredOvernightFinancingRateSOFRMembersrt:MinimumMember2024-01-012024-03-310001567683srt:MaximumMembercwen:RosieClassBLLCDue2024And2029Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:RosieClassBLLCDue2024And2029Member2024-03-310001567683cwen:TexasSolarNova1Due2028Member2024-03-310001567683cwen:TexasSolarNova1Due2028Member2023-12-310001567683cwen:TSN1ClassBMemberLLCDue2029Member2024-01-012024-03-310001567683cwen:TexasSolarNova1Due2028Memberus-gaap:LetterOfCreditMember2024-03-310001567683cwen:TSN1ClassBMemberLLCDue2029Member2024-03-310001567683cwen:TSN1ClassBMemberLLCDue2029Member2023-12-310001567683us-gaap:LetterOfCreditMembercwen:TSN1ClassBMemberLLCDue2029Member2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:TSN1ClassBMemberLLCDue2029Member2024-03-310001567683cwen:UtahSolarHoldingsDue2036Member2024-03-310001567683cwen:UtahSolarHoldingsDue2036Member2023-12-310001567683us-gaap:LetterOfCreditMembercwen:UtahSolarHoldingsDue2036Member2024-03-310001567683cwen:VientoFundingIILLCDue2023And2029Member2024-03-310001567683cwen:VientoFundingIILLCDue2023And2029Member2023-12-310001567683cwen:VientoFundingIILLCDue2023And2029Membercwen:SecuredOvernightFinancingRateSOFRMember2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:VientoFundingIILLCDue2023And2029Member2024-03-310001567683cwen:VictoryPassAndAricaDue2024Member2024-03-310001567683cwen:VictoryPassAndAricaDue2024Member2023-12-310001567683cwen:SecuredOvernightFinancingRateSOFRMembercwen:VictoryPassAndAricaDue2024Member2024-01-012024-03-310001567683us-gaap:LetterOfCreditMembercwen:VictoryPassAndAricaDue2024Member2024-03-310001567683cwen:OtherDebtMember2024-03-310001567683cwen:OtherDebtMember2023-12-310001567683us-gaap:LetterOfCreditMembercwen:OtherDebtMember2024-03-310001567683cwen:ProjectLevelDebtMember2024-03-310001567683cwen:ProjectLevelDebtMember2023-12-310001567683us-gaap:RevolvingCreditFacilityMember2024-03-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMemberus-gaap:LetterOfCreditMember2024-03-310001567683cwen:ClearwayRenewLLCMembercwen:VictoryPassAndAricaDue2024Memberus-gaap:SubsequentEventMembercwen:VPAricaTargetCoLLCMember2024-05-012024-05-010001567683cwen:TaxEquityInvestorsMembercwen:VictoryPassAndAricaDue2024Member2024-01-012024-03-310001567683cwen:VictoryPassAndAricaDue2024Memberus-gaap:SubsequentEventMembercwen:CashEquityInvestorMember2024-05-012024-05-010001567683cwen:TaxEquityInvestorsMembercwen:VictoryPassAndAricaDue2024Memberus-gaap:SubsequentEventMember2024-05-012024-05-010001567683cwen:VictoryPassAndAricaDue2024Membercwen:CEGMemberus-gaap:SubsequentEventMember2024-05-012024-05-010001567683cwen:CashEquityBridgeLoanMembercwen:VictoryPassAndAricaDue2024Memberus-gaap:SubsequentEventMember2024-05-012024-05-010001567683cwen:VictoryPassAndAricaDue2024Membercwen:TaxEquityBridgeLoanMemberus-gaap:SubsequentEventMember2024-05-012024-05-010001567683cwen:VictoryPassAndAricaDue2024Memberus-gaap:SubsequentEventMember2024-05-012024-05-010001567683cwen:TermLoanMembercwen:TexasSolarNova2Member2024-03-152024-03-150001567683cwen:TaxEquityBridgeLoanMembercwen:TexasSolarNova2Member2024-03-152024-03-150001567683cwen:TexasSolarNova2Member2024-03-150001567683cwen:TaxEquityInvestorsMembercwen:TexasSolarNova2Member2024-03-152024-03-150001567683cwen:CEGMembercwen:TexasSolarNova2Member2024-03-152024-03-150001567683cwen:TexasSolarNova2Member2024-03-152024-03-150001567683us-gaap:CorporateNonSegmentMember2024-01-012024-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMember2024-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2024-03-310001567683us-gaap:CorporateNonSegmentMember2024-03-310001567683us-gaap:CorporateNonSegmentMember2023-01-012023-03-310001567683cwen:RENOMMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001567683cwen:RENOMMemberus-gaap:RelatedPartyMember2023-01-012023-03-310001567683cwen:RENOMMemberus-gaap:RelatedPartyMember2024-03-310001567683cwen:RENOMMemberus-gaap:RelatedPartyMember2023-12-310001567683srt:AffiliatedEntityMembercwen:AdministrativeServicesAgreementMember2024-03-310001567683srt:AffiliatedEntityMembercwen:AdministrativeServicesAgreementMember2024-01-012024-03-310001567683srt:AffiliatedEntityMembercwen:AdministrativeServicesAgreementMember2023-01-012023-03-310001567683srt:AffiliatedEntityMembercwen:AdministrativeServicesAgreementMember2023-12-310001567683us-gaap:RelatedPartyMembercwen:CEGMember2023-01-012023-03-310001567683us-gaap:RelatedPartyMembercwen:CEGMember2024-01-012024-03-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q | | | | | | | | |

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 2024

| | | | | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 001-36002

Clearway Energy, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | |

| Delaware | | 46-1777204 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 300 Carnegie Center, Suite 300 | Princeton | New Jersey | 08540 |

| (Address of principal executive offices) | (Zip Code) |

(609) 608-1525

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

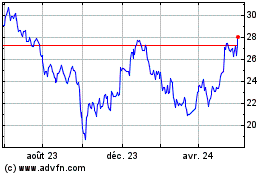

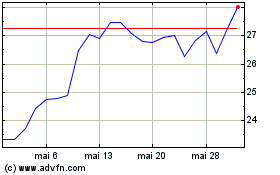

| Class A Common Stock, par value $0.01 | CWEN.A | New York Stock Exchange |

| Class C Common Stock, par value $0.01 | CWEN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of April 30, 2024, there were 34,613,853 shares of Class A common stock outstanding, par value $0.01 per share, 42,738,750 shares of Class B common stock outstanding, par value $0.01 per share, 82,454,344 shares of Class C common stock outstanding, par value $0.01 per share, and 42,336,750 shares of Class D common stock outstanding, par value $0.01 per share.

TABLE OF CONTENTS

Index | | | | | |

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION | |

GLOSSARY OF TERMS | |

PART I — FINANCIAL INFORMATION | |

ITEM 1 — FINANCIAL STATEMENTS AND NOTES | |

ITEM 2 — MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

ITEM 3 — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

ITEM 4 — CONTROLS AND PROCEDURES | |

PART II — OTHER INFORMATION | |

ITEM 1 — LEGAL PROCEEDINGS | |

ITEM 1A — RISK FACTORS | |

ITEM 2 — UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |

ITEM 3 — DEFAULTS UPON SENIOR SECURITIES | |

ITEM 4 — MINE SAFETY DISCLOSURES | |

ITEM 5 — OTHER INFORMATION | |

ITEM 6 — EXHIBITS | |

SIGNATURES | |

| |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q of Clearway Energy, Inc., together with its consolidated subsidiaries, or the Company, includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The words “believes,” “projects,” “anticipates,” “plans,” “expects,” “intends,” “estimates” and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These factors, risks and uncertainties include the factors described under Item 1A — Risk Factors in Part I of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as well as the following:

•The Company’s ability to maintain and grow its quarterly dividend;

•Potential risks related to the Company's relationships with CEG and its owners;

•The Company’s ability to successfully identify, evaluate and consummate acquisitions from, and dispositions to, third parties;

•The Company’s ability to acquire assets from CEG;

•The Company’s ability to borrow additional funds and access capital markets, as well as the Company’s substantial indebtedness and the possibility that the Company may incur additional indebtedness going forward;

•Changes in law, including judicial decisions;

•Hazards customary to the power production industry and power generation operations such as fuel and electricity price volatility, unusual weather conditions (including wind and solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to fuel supply costs or availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission or gas pipeline system constraints and the possibility that the Company may not have adequate insurance to cover losses as a result of such hazards;

•The Company’s ability to operate its businesses efficiently, manage maintenance capital expenditures and costs effectively, and generate earnings and cash flows from its asset-based businesses in relation to its debt and other obligations;

•The willingness and ability of counterparties to the Company’s offtake agreements to fulfill their obligations under such agreements;

•The Company’s ability to enter into contracts to sell power and procure fuel on acceptable terms and prices;

•Government regulation, including compliance with regulatory requirements and changes in market rules, rates, tariffs and environmental laws;

•Operating and financial restrictions placed on the Company that are contained in the facility-level debt facilities and other agreements of certain subsidiaries and facility-level subsidiaries generally, in the Clearway Energy Operating LLC amended and restated revolving credit facility and in the indentures governing the Senior Notes; and

•Cyber terrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss and the possibility that the Company may not have adequate insurance to cover losses resulting from such hazards or the inability of the Company’s insurers to provide coverage.

Forward-looking statements speak only as of the date they were made, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing review of factors that could cause the Company’s actual results to differ materially from those contemplated in any forward-looking statements included in this Quarterly Report on Form 10-Q should not be construed as exhaustive.

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| | | | | | |

| | |

| | |

| 2028 Senior Notes | $850 million aggregate principal amount of 4.75% unsecured senior notes due 2028, issued by Clearway Energy Operating LLC | |

| 2031 Senior Notes | $925 million aggregate principal amount of 3.75% unsecured senior notes due 2031, issued by Clearway Energy Operating LLC | |

| 2032 Senior Notes | $350 million aggregate principal amount of 3.75% unsecured senior notes due 2032, issued by Clearway Energy Operating LLC | |

| Adjusted EBITDA | A non-GAAP measure, represents earnings before interest (including loss on debt extinguishment), tax, depreciation and amortization adjusted for mark-to-market gains or losses, asset write offs and impairments; and factors which the Company does not consider indicative of future operating performance | |

| | |

| | |

| ASC | The FASB Accounting Standards Codification, which the FASB established as the source of authoritative GAAP | |

| | |

| ATM Program | At-The-Market Equity Offering Program | |

| BESS | Battery energy storage system | |

| BlackRock | BlackRock, Inc. | |

| | |

| CAFD | A non-GAAP measure, Cash Available for Distribution is defined as of March 31, 2024 as Adjusted EBITDA plus cash distributions/return of investment from unconsolidated affiliates, cash receipts from notes receivable, cash distributions from noncontrolling interests, adjustments to reflect sales-type lease cash payments and payments for lease expenses, less cash distributions to noncontrolling interests, maintenance capital expenditures, pro-rata Adjusted EBITDA from unconsolidated affiliates, cash interest paid, income taxes paid, principal amortization of indebtedness, changes in prepaid and accrued capacity payments and adjusted for development expenses | |

| | |

| CEG | Clearway Energy Group LLC (formerly Zephyr Renewables LLC) | |

| CEG Master Services Agreement | Amended and Restated Master Services Agreement, dated as of April 30, 2024, among the Company, Clearway Energy LLC, Clearway Energy Operating LLC and CEG | |

| | |

| Clearway Energy LLC | The holding company through which the facilities are owned by Clearway Energy Group LLC, the holder of Class B and Class D units, and Clearway Energy, Inc., the holder of the Class A and Class C units | |

| Clearway Energy Group LLC | The holder of all shares of the Company’s Class B and Class D common stock and Clearway Energy LLC’s Class B and Class D units and, from time to time, possibly shares of the Company’s Class A and/or Class C common stock | |

| Clearway Energy Operating LLC | The holder of facilities that are owned by Clearway Energy LLC | |

| Clearway Renew | Clearway Renew LLC, a subsidiary of CEG, and its wholly-owned subsidiaries | |

| | |

| Company | Clearway Energy, Inc., together with its consolidated subsidiaries | |

| CVSR | California Valley Solar Ranch | |

| CVSR Holdco | CVSR Holdco LLC, the indirect owner of CVSR | |

| | |

| | |

| | |

| | |

| Distributed Solar | Solar power facilities, typically less than 20 MW in size (on an alternating current, or AC, basis), that primarily sell power produced to customers for usage on site, or are interconnected to sell power into the local distribution grid | |

| Drop Down Assets | Assets under common control acquired by the Company from CEG | |

| ERCOT | Electric Reliability Council of Texas, the ISO and the regional reliability coordinator of the various electricity systems within Texas | |

| Exchange Act | The Securities Exchange Act of 1934, as amended | |

| FASB | Financial Accounting Standards Board | |

| | |

| GAAP | Accounting principles generally accepted in the U.S. | |

| GenConn | GenConn Energy LLC | |

| GIM | Global Infrastructure Management, LLC, the manager of GIP | |

| GIP | Global Infrastructure Partners | |

| HLBV | Hypothetical Liquidation at Book Value | |

| | | | | | |

| IRA | Inflation Reduction Act of 2022 | |

| IRS | Internal Revenue Service | |

| ISO | Independent System Operator, also referred to as an RTO | |

| ITC | Investment Tax Credit | |

| | |

| | |

| Mesquite Star | Mesquite Star Special LLC | |

| MMBtu | Million British Thermal Units | |

| Mt. Storm | NedPower Mount Storm LLC | |

| MW | Megawatt | |

| MWh | Saleable megawatt hours, net of internal/parasitic load megawatt-hours | |

| | |

| Net Exposure | Counterparty credit exposure to Clearway Energy, Inc. net of collateral | |

| NOLs | Net Operating Losses | |

| | |

| | |

| | |

| OCI | Other comprehensive income | |

| O&M | Operations and Maintenance | |

| PG&E | Pacific Gas and Electric Company | |

| PJM | PJM Interconnection, LLC | |

| PPA | Power Purchase Agreement | |

| PTC | Production Tax Credit | |

| | |

| RA | Resource adequacy | |

| RENOM | Clearway Renewable Operation & Maintenance LLC, a wholly-owned subsidiary of CEG | |

| Rosie Central BESS | Rosie BESS Devco LLC | |

| | |

| RTO | Regional Transmission Organization | |

| SCE | Southern California Edison | |

| SEC | U.S. Securities and Exchange Commission | |

| Senior Notes | Collectively, the 2028 Senior Notes, the 2031 Senior Notes and the 2032 Senior Notes | |

| SOFR | Secured Overnight Financing Rate | |

| SPP | Solar Power Partners | |

| SREC | Solar Renewable Energy Credit | |

| | |

| | |

| TotalEnergies | TotalEnergies SE | |

| U.S. | United States of America | |

| Utah Solar Portfolio | Seven utility-scale solar farms located in Utah, representing 530 MW of capacity | |

| Utility Scale Solar | Solar power facilities, typically 20 MW or greater in size (on an alternating current, or AC, basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level | |

| VIE | Variable Interest Entity | |

PART I — FINANCIAL INFORMATION

ITEM 1 — FINANCIAL STATEMENTS

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| (In millions, except per share amounts) | | | | | 2024 | | 2023 |

| Operating Revenues | | | | | | | |

| Total operating revenues | | | | | $ | 263 | | | $ | 288 | |

| Operating Costs and Expenses | | | | | | | |

| Cost of operations, exclusive of depreciation, amortization and accretion shown separately below | | | | | 126 | | | 108 | |

| Depreciation, amortization and accretion | | | | | 154 | | | 128 | |

| | | | | | | |

| General and administrative | | | | | 11 | | | 10 | |

| Transaction and integration costs | | | | | 1 | | | — | |

| | | | | | | |

| Total operating costs and expenses | | | | | 292 | | | 246 | |

| | | | | | | |

| Operating (Loss) Income | | | | | (29) | | | 42 | |

| Other Income (Expense) | | | | | | | |

| Equity in earnings (losses) of unconsolidated affiliates | | | | | 12 | | | (3) | |

| | | | | | | |

| | | | | | | |

| Other income, net | | | | | 16 | | | 8 | |

| Loss on debt extinguishment | | | | | (1) | | | — | |

| Interest expense | | | | | (57) | | | (99) | |

| Total other expense, net | | | | | (30) | | | (94) | |

| Loss Before Income Taxes | | | | | (59) | | | (52) | |

| Income tax benefit | | | | | (13) | | | (12) | |

| Net Loss | | | | | (46) | | | (40) | |

| Less: Net loss attributable to noncontrolling interests and redeemable noncontrolling interests | | | | | (44) | | | (40) | |

Net Loss Attributable to Clearway Energy, Inc. | | | | | $ | (2) | | | $ | — | |

Loss Per Share Attributable to Clearway Energy, Inc. Class A and Class C Common Stockholders | | | | | | | |

Weighted average number of Class A common shares outstanding - basic and diluted | | | | | 35 | | | 35 | |

| | | | | | | |

Weighted average number of Class C common shares outstanding - basic and diluted | | | | | 82 | | | 82 | |

| | | | | | | |

Loss Per Weighted Average Class A and Class C Common Share - Basic and Diluted | | | | | $ | (0.02) | | | $ | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Dividends Per Class A Common Share | | | | | $ | 0.4033 | | | $ | 0.3745 | |

| Dividends Per Class C Common Share | | | | | $ | 0.4033 | | | $ | 0.3745 | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| (In millions) | | | | | 2024 | | 2023 |

| Net Loss | | | | | $ | (46) | | | $ | (40) | |

| Other Comprehensive Loss | | | | | | | |

Unrealized loss on derivatives and changes in accumulated OCI, net of income tax benefit, of $—, and $1 | | | | | (1) | | | (3) | |

| Other comprehensive loss | | | | | (1) | | | (3) | |

| Comprehensive Loss | | | | | (47) | | | (43) | |

| Less: Comprehensive loss attributable to noncontrolling interests and redeemable noncontrolling interests | | | | | (43) | | | (42) | |

| Comprehensive Loss Attributable to Clearway Energy, Inc. | | | | | $ | (4) | | | $ | (1) | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| (In millions, except shares) | March 31, 2024 | | December 31, 2023 |

| ASSETS | (Unaudited) | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 478 | | | $ | 535 | |

| Restricted cash | 485 | | | 516 | |

| Accounts receivable — trade | 184 | | | 171 | |

| | | |

| Inventory | 58 | | | 55 | |

| Derivative instruments | 54 | | | 41 | |

Note receivable — affiliate | 178 | | | 174 | |

| | | |

| Prepayments and other current assets | 60 | | | 68 | |

| Total current assets | 1,497 | | | 1,560 | |

| Property, plant and equipment, net | 9,746 | | | 9,526 | |

| Other Assets | | | |

| Equity investments in affiliates | 349 | | | 360 | |

| | | |

| Intangible assets for power purchase agreements, net | 2,259 | | | 2,303 | |

| Other intangible assets, net | 72 | | | 71 | |

| | | |

| Derivative instruments | 111 | | | 82 | |

| Right-of-use assets, net | 615 | | | 597 | |

| | | |

| Other non-current assets | 213 | | | 202 | |

| Total other assets | 3,619 | | | 3,615 | |

| Total Assets | $ | 14,862 | | | $ | 14,701 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current Liabilities | | | |

| Current portion of long-term debt | $ | 565 | | | $ | 558 | |

| | | |

| Accounts payable — trade | 123 | | | 130 | |

| | | |

| Accounts payable — affiliates | 28 | | | 31 | |

| Derivative instruments | 52 | | | 51 | |

| Accrued interest expense | 42 | | | 57 | |

| | | |

| Accrued expenses and other current liabilities | 64 | | | 79 | |

| Total current liabilities | 874 | | | 906 | |

| Other Liabilities | | | |

| Long-term debt | 7,579 | | | 7,479 | |

| Deferred income taxes | 111 | | | 127 | |

| Derivative instruments | 309 | | | 281 | |

| Long-term lease liabilities | 642 | | | 627 | |

| Other non-current liabilities | 300 | | | 286 | |

| Total other liabilities | 8,941 | | | 8,800 | |

| Total Liabilities | 9,815 | | | 9,706 | |

| Redeemable noncontrolling interest in subsidiaries | 2 | | | 1 | |

| Commitments and Contingencies | | | |

| Stockholders’ Equity | | | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized; none issued | — | | | — | |

Class A, Class B, Class C and Class D common stock, $0.01 par value; 3,000,000,000 shares authorized (Class A 500,000,000, Class B 500,000,000, Class C 1,000,000,000, Class D 1,000,000,000); 202,080,794 shares issued and outstanding (Class A 34,613,853, Class B 42,738,750, Class C 82,391,441, Class D 42,336,750) at March 31, 2024 and 202,080,794 shares issued and outstanding (Class A 34,613,853, Class B 42,738,750, Class C 82,391,441, Class D 42,336,750) at December 31, 2023 | 1 | | | 1 | |

| Additional paid-in capital | 1,741 | | | 1,732 | |

| Retained earnings | 311 | | | 361 | |

| Accumulated other comprehensive income | 5 | | | 7 | |

| Noncontrolling interest | 2,987 | | | 2,893 | |

| Total Stockholders’ Equity | 5,045 | | | 4,994 | |

| Total Liabilities and Stockholders’ Equity | $ | 14,862 | | | $ | 14,701 | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| Three months ended March 31, |

| (In millions) | 2024 | | 2023 |

| Cash Flows from Operating Activities | | | |

| Net Loss | $ | (46) | | | $ | (40) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Equity in (earnings) losses of unconsolidated affiliates | (12) | | | 3 | |

| Distributions from unconsolidated affiliates | 9 | | | 6 | |

| Depreciation, amortization and accretion | 154 | | | 128 | |

| Amortization of financing costs and debt discounts | 4 | | | 3 | |

| Amortization of intangibles | 46 | | | 47 | |

| Loss on debt extinguishment | 1 | | | — | |

| | | |

| Reduction in carrying amount of right-of-use assets | 4 | | | 4 | |

| | | |

| | | |

| Changes in deferred income taxes | (10) | | | (11) | |

| Changes in derivative instruments and amortization of accumulated OCI | 2 | | | 3 | |

| | | |

| Cash used in changes in other working capital: | | | |

| Changes in prepaid and accrued liabilities for tolling agreements | (10) | | | (39) | |

| Changes in other working capital | (61) | | | (29) | |

| Net Cash Provided by Operating Activities | 81 | | | 75 | |

| Cash Flows from Investing Activities | | | |

| | | |

| | | |

| Acquisition of Drop Down Assets, net of cash acquired | (111) | | | (7) | |

| | | |

| | | |

| | | |

| | | |

| Capital expenditures | (98) | | | (88) | |

| | | |

| Return of investment from unconsolidated affiliates | 4 | | | 9 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other | 2 | | | — | |

| Net Cash Used in Investing Activities | (203) | | | (86) | |

| Cash Flows from Financing Activities | | | |

| Contributions from noncontrolling interests, net of distributions | 207 | | | 273 | |

| | | |

| | | |

| Payments of dividends and distributions | (81) | | | (76) | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from the issuance of long-term debt | 74 | | | 42 | |

| Payments of debt issuance costs | — | | | (7) | |

| Payments for long-term debt | (166) | | | (204) | |

| | | |

| Net Cash Provided by Financing Activities | 34 | | | 28 | |

| | | |

| Net (Decrease) Increase in Cash, Cash Equivalents and Restricted Cash | (88) | | | 17 | |

| Cash, Cash Equivalents and Restricted Cash at Beginning of Period | 1,051 | | | 996 | |

| Cash, Cash Equivalents and Restricted Cash at End of Period | $ | 963 | | | $ | 1,013 | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the Three Months Ended March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Preferred Stock | | Common Stock | | Additional

Paid-In

Capital | | Retained Earnings | | Accumulated

Other

Comprehensive Income | | Noncontrolling

Interest | | Total

Stockholders’

Equity |

| Balances at December 31, 2023 | $ | — | | | $ | 1 | | | $ | 1,732 | | | $ | 361 | | | $ | 7 | | | $ | 2,893 | | | $ | 4,994 | |

| Net loss | — | | | — | | | — | | | (2) | | | — | | | (45) | | | (47) | |

| Unrealized (loss) gain on derivatives and changes in accumulated OCI, net of tax | — | | | — | | | — | | | — | | | (2) | | | 1 | | | (1) | |

| Distributions to CEG, net of contributions, cash | — | | | — | | | — | | | — | | | — | | | (1) | | | (1) | |

| | | | | | | | | | | | | |

| Contributions from noncontrolling interests, net of distributions, cash | — | | | — | | | — | | | — | | | — | | | 215 | | | 215 | |

| | | | | | | | | | | | | |

| Transfers of assets under common control | — | | | — | | | 2 | | | — | | | — | | | (42) | | | (40) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-cash adjustments for change in tax basis | — | | | — | | | 6 | | | — | | | — | | | — | | | 6 | |

| Stock-based compensation | — | | | — | | | 1 | | | — | | | — | | | — | | | 1 | |

| Common stock dividends and distributions to CEG unit holders | — | | | — | | | — | | | (47) | | | — | | | (34) | | | (81) | |

| Other | — | | | — | | | — | | | (1) | | | — | | | — | | | (1) | |

| Balances at March 31, 2024 | $ | — | | | $ | 1 | | | $ | 1,741 | | | $ | 311 | | | $ | 5 | | | $ | 2,987 | | | $ | 5,045 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Preferred Stock | | Common Stock | | Additional

Paid-In

Capital | | Retained Earnings | | Accumulated

Other

Comprehensive Income | | Noncontrolling

Interest | | Total

Stockholders’

Equity |

| Balances at December 31, 2022 | $ | — | | | $ | 1 | | | $ | 1,761 | | | $ | 463 | | | $ | 9 | | | $ | 1,792 | | | $ | 4,026 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (43) | | | (43) | |

| Unrealized loss on derivatives and changes in accumulated OCI, net of tax | — | | | — | | | — | | | — | | | (1) | | | (2) | | | (3) | |

| Contributions from CEG, net of distributions, cash | — | | | — | | | — | | | — | | | — | | | 30 | | | 30 | |

| | | | | | | | | | | | | |

| Contributions from noncontrolling interests, net of distributions, cash | — | | | — | | | — | | | — | | | — | | | 215 | | | 215 | |

| | | | | | | | | | | | | |

| Transfers of assets under common control | — | | | — | | | (52) | | | — | | | — | | | 46 | | | (6) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Non-cash adjustments for change in tax basis | — | | | — | | | 9 | | | — | | | — | | | — | | | 9 | |

| Stock based compensation | — | | | — | | | 1 | | | — | | | — | | | — | | | 1 | |

| Common stock dividends and distributions to CEG unit holders | — | | | — | | | — | | | (44) | | | — | | | (32) | | | (76) | |

| Balances at March 31, 2023 | $ | — | | | $ | 1 | | | $ | 1,719 | | | $ | 419 | | | $ | 8 | | | $ | 2,006 | | | $ | 4,153 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 — Nature of Business

Clearway Energy, Inc., together with its consolidated subsidiaries, or the Company, is a publicly-traded energy infrastructure investor with a focus on investments in clean energy and owner of modern, sustainable and long-term contracted assets across North America. The Company is sponsored by GIP and TotalEnergies through the portfolio company, Clearway Energy Group LLC, or CEG, which is equally owned by GIP and TotalEnergies. GIP is an independent infrastructure fund manager that makes equity and debt investments in infrastructure assets and businesses. TotalEnergies is a global multi-energy company. CEG is a leading developer of renewable energy infrastructure in the U.S.

The Company is one of the largest renewable energy owners in the U.S. with approximately 6,200 net MW of installed wind, solar and battery energy storage system, or BESS, facilities. The Company’s approximately 8,700 net MW of assets also includes approximately 2,500 net MW of environmentally-sound, highly efficient natural gas-fired generation facilities. Through this environmentally-sound, diversified and primarily contracted portfolio, the Company endeavors to provide its investors with stable and growing dividend income. The majority of the Company’s revenues are derived from long-term contractual arrangements for the output or capacity from these assets.

The Company consolidates the results of Clearway Energy LLC through its controlling interest, with CEG’s interest shown as noncontrolling interest in the consolidated financial statements. The holders of the Company’s outstanding shares of Class A and Class C common stock are entitled to dividends as declared. CEG receives its distributions from Clearway Energy LLC through its ownership of Clearway Energy LLC Class B and Class D units. From time to time, CEG may also hold shares of the Company’s Class A and/or Class C common stock.

As of March 31, 2024, the Company owned 57.90% of the economic interests of Clearway Energy LLC, with CEG owning 42.10% of the economic interests of Clearway Energy LLC.

The following table represents a summarized structure of the Company as of March 31, 2024:

Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with the SEC’s regulations for interim financial information and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. The following notes should be read in conjunction with the accounting policies and other disclosures as set forth in the notes to the consolidated financial statements included in the Company’s 2023 Form 10-K. Interim results are not necessarily indicative of results for a full year.

In the opinion of management, the accompanying unaudited interim consolidated financial statements contain all material adjustments consisting of normal and recurring accruals necessary to present fairly the Company’s consolidated financial position as of March 31, 2024, and results of operations, comprehensive loss and cash flows for the three months ended March 31, 2024 and 2023.

Note 2 — Summary of Significant Accounting Policies

Use of Estimates

The preparation of consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions. These estimates and assumptions impact the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the consolidated financial statements. They also impact the reported amounts of net earnings during the reporting periods. Actual results could be different from these estimates.

Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include highly liquid investments with an original maturity of three months or less at the time of purchase. Cash and cash equivalents held at subsidiary facilities was $141 million and $125 million as of March 31, 2024 and December 31, 2023, respectively.

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the consolidated statements of cash flows:

| | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| | (In millions) |

| Cash and cash equivalents | $ | 478 | | | $ | 535 | |

| Restricted cash | 485 | | | 516 | |

| Cash, cash equivalents and restricted cash shown in the consolidated statements of cash flows | $ | 963 | | | $ | 1,051 | |

Restricted cash consists primarily of funds held to satisfy the requirements of certain debt agreements and funds held within the Company’s facilities that are restricted in their use. As of March 31, 2024, these restricted funds were comprised of $173 million designated to fund operating expenses, $187 million designated for current debt service payments and $87 million restricted for reserves including debt service, performance obligations and other reserves as well as capital expenditures. The remaining $38 million is held in distributions reserve accounts.

Supplemental Cash Flow Information

The following table provides a disaggregation of the amounts classified as Acquisition of Drop Down Assets, net of cash acquired, shown in the consolidated statements of cash flows:

| | | | | | | | | | | | | | |

| | Three months ended March 31, |

| | 2024 | | 2023 |

| | (In millions) |

| Cash paid to acquire Drop Down Assets | | $ | (112) | | | $ | (21) | |

| Cash acquired from the acquisition of Drop Down Assets | | 1 | | | 14 | |

| Acquisition of Drop Down Assets, net of cash acquired | | $ | (111) | | | $ | (7) | |

Accumulated Depreciation and Accumulated Amortization

The following table presents the accumulated depreciation included in property, plant and equipment, net, and accumulated amortization included in intangible assets, net:

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (In millions) |

| Property, Plant and Equipment Accumulated Depreciation | $ | 3,633 | | | $ | 3,485 | |

| Intangible Assets Accumulated Amortization | 1,055 | | | 1,009 | |

Dividends to Class A and Class C Common Stockholders

The following table lists the dividends paid on the Company's Class A and Class C common stock during the three months ended March 31, 2024:

| | | | | | | | | | | | | |

| | | | | | | First Quarter 2024 |

| Dividends per Class A share | | | | | | | $ | 0.4033 | |

| Dividends per Class C share | | | | | | | 0.4033 | |

Dividends on the Class A and Class C common stock are subject to available capital, market conditions, and compliance with associated laws, regulations and other contractual obligations. The Company expects that, based on current circumstances, comparable cash dividends will continue to be paid in the foreseeable future.

On May 9, 2024, the Company declared quarterly dividends on its Class A and Class C common stock of $0.4102 per share payable on June 17, 2024 to stockholders of record as of June 3, 2024.

Noncontrolling Interests

Clearway Energy LLC Distributions to CEG

The following table lists distributions paid to CEG during the three months ended March 31, 2024 on Clearway Energy LLC’s Class B and D units:

| | | | | | | | | | | | |

| | | | | | First Quarter 2024 |

| Distributions per Class B Unit | | | | | | $ | 0.4033 | |

| Distributions per Class D Unit | | | | | | 0.4033 | |

On May 9, 2024, Clearway Energy LLC declared a distribution on its Class B and Class D units of $0.4102 per unit payable on June 17, 2024 to unit holders of record as of June 3, 2024.

Revenue Recognition

Disaggregated Revenues

The following tables represent the Company’s disaggregation of revenue from contracts with customers along with the reportable segment for each category:

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2024 |

| (In millions) | Conventional Generation | | Renewables | | | | | | Total |

Energy revenue (a) | $ | 22 | | | $ | 221 | | | | | | | $ | 243 | |

Capacity revenue (a) | 63 | | | 9 | | | | | | | 72 | |

| Other revenues | 2 | | | 14 | | | | | | | 16 | |

| Contract amortization | (5) | | | (41) | | | | | | | (46) | |

| Mark-to-market for economic hedges | 13 | | | (35) | | | | | | | (22) | |

| Total operating revenues | 95 | | | 168 | | | | | | | 263 | |

| Less: Mark-to-market for economic hedges | (13) | | | 35 | | | | | | | 22 | |

| Less: Lease revenue | (29) | | | (177) | | | | | | | (206) | |

| Less: Contract amortization | 5 | | | 41 | | | | | | | 46 | |

Total revenue from contracts with customers | $ | 58 | | | $ | 67 | | | | | | | $ | 125 | |

| | | | | | | | | |

| | | | | | | | | |

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | |

| (In millions) | Conventional Generation | | Renewables | | Total |

| Energy revenue | $ | 1 | | | $ | 169 | | | $ | 170 | |

| Capacity revenue | 28 | | | 8 | | | 36 | |

| | | | | |

Total | $ | 29 | | | $ | 177 | | | $ | 206 | |

| | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2023 |

| (In millions) | Conventional Generation | | Renewables | | | | Total |

Energy revenue (a) | $ | 1 | | | $ | 198 | | | | | $ | 199 | |

Capacity revenue (a) | 100 | | | 5 | | | | | 105 | |

| Other revenues | — | | | 12 | | | | | 12 | |

| Contract amortization | (6) | | | (41) | | | | | (47) | |

| Mark-to-market for economic hedges | — | | | 19 | | | | | 19 | |

| Total operating revenues | 95 | | | 193 | | | | | 288 | |

| Less: Mark-to-market for economic hedges | — | | | (19) | | | | | (19) | |

| Less: Lease revenue | (101) | | | (156) | | | | | (257) | |

| Less: Contract amortization | 6 | | | 41 | | | | | 47 | |

Total revenue from contracts with customers | $ | — | | | $ | 59 | | | | | $ | 59 | |

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | |

| (In millions) | Conventional Generation | | Renewables | | Total |

| Energy revenue | $ | 1 | | | $ | 152 | | | $ | 153 | |

| Capacity revenue | 100 | | | 4 | | | 104 | |

Total | $ | 101 | | | $ | 156 | | | $ | 257 | |

Contract Balances

The following table reflects the contract assets and liabilities included on the Company’s consolidated balance sheets:

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (In millions) |

| Accounts receivable, net - Contracts with customers | $ | 62 | | | $ | 66 | |

| Accounts receivable, net - Leases | 122 | | | 105 | |

| Total accounts receivable, net | $ | 184 | | | $ | 171 | |

Note 3 — Acquisitions

Cedar Creek Drop Down — On April 16, 2024, the Company, through its indirect subsidiary, Cedar Creek Wind Holdco LLC, acquired Cedar Creek Holdco LLC, a 160 MW wind facility that is located in Bingham County, Idaho, from Clearway Renew for cash consideration of $117 million. Cedar Creek Wind Holdco LLC consolidates as primary beneficiary, Cedar Creek TE Holdco LLC, a tax equity fund that owns the Cedar Creek wind facility. Also on April 16, 2024, a tax equity investor contributed $108 million to acquire the Class A membership interests in Cedar Creek TE Holdco LLC. Cedar Creek has a 25-year PPA with an investment-grade utility that commenced in March 2024. The acquisition was funded with existing sources of liquidity.

Texas Solar Nova 2 Drop Down — On March 15, 2024, the Company, through its indirect subsidiary, TSN1 TE Holdco LLC, acquired Texas Solar Nova 2, LLC, a 200 MW solar facility that is located in Kent County, Texas, from Clearway Renew for cash consideration of $112 million, $17 million of which was funded by the Company with the remaining $95 million funded through a contribution from the cash equity investor in Lighthouse Renewable Holdco 2 LLC, which is a partnership. Lighthouse Renewable Holdco 2 LLC indirectly consolidates as primary beneficiary, TSN1 TE Holdco LLC, a tax equity fund that owns the Texas Solar Nova 1 and Texas Solar Nova 2 solar facilities, as further described in Note 4, Investments Accounted for by the Equity Method and Variable Interest Entities. Texas Solar Nova 2 has an 18-year PPA with an investment-grade counterparty that commenced in March 2024. The Texas Solar Nova 2 operations are reflected in the Company’s Renewables segment and the Company’s portion of the purchase price was funded with existing sources of liquidity. The acquisition was determined to be an asset acquisition and the Company consolidates Texas Solar Nova 2 on a prospective basis in its financial statements. The assets and liabilities transferred to the Company relate to interests under common control and were recorded at historical cost in accordance with ASC 805-50, Business Combinations - Related Issues. The difference between the cash paid of $112 million and the historical cost of the Company’s net assets acquired of $72 million was recorded as an adjustment to CEG’s noncontrolling interest balance. In addition, the Company reflected $9 million of the Company’s purchase price, which was contributed back to the Company by CEG to pay down the acquired long-term debt, in the line item distributions to CEG, net of contributions in the consolidated statements of stockholders’ equity.

The following is a summary of assets and liabilities transferred in connection with the acquisition as of March 15, 2024:

| | | | | | | | |

| (In millions) | | Texas Solar Nova 2 |

| Cash | | $ | 1 | |

| Property, plant and equipment | | 280 | |

| Right-of-use assets, net | | 21 | |

| Derivative assets | | 6 | |

| Other current and non-current assets | | 4 | |

| | |

| Total assets acquired | | 312 | |

| | |

Long-term debt (a) | | 194 | |

| Long-term lease liabilities | | 19 | |

| Other current and non-current liabilities | | 27 | |

| Total liabilities assumed | | 240 | |

| Net assets acquired | | $ | 72 | |

(a) Includes an $80 million term loan and a $115 million tax equity bridge loan, offset by $1 million in unamortized debt issuance costs. See Note 7, Long-term Debt, for further discussion of the long-term debt assumed in the acquisition.

Note 4 — Investments Accounted for by the Equity Method and Variable Interest Entities

Entities that are not Consolidated

The Company has interests in entities that are considered VIEs under ASC 810, but for which it is not considered the primary beneficiary. The Company accounts for its interests in these entities and entities in which it has a significant investment under the equity method of accounting, as further described under Item 15 — Note 5, Investments Accounted for by the Equity Method and Variable Interest Entities, to the consolidated financial statements included in the Company’s 2023 Form 10-K.

The following table reflects the Company’s equity investments in unconsolidated affiliates as of March 31, 2024:

| | | | | | | | |

| Name | Economic Interest | Investment Balance (a) |

| | (In millions) |

| Avenal | 50% | $ | 6 | |

| Desert Sunlight | 25% | 219 | |

| Elkhorn Ridge | 67% | 13 | |

GenConn (b) | 50% | 76 | |

Rosie Central BESS (b) | 50% | 28 | |

| San Juan Mesa | 75% | 7 | |

| | |

| | $ | 349 | |

(a) The Company’s maximum exposure to loss is limited to its investment balances.

(b) GenConn and Rosie Central BESS are VIEs.

Entities that are Consolidated

As further described under Item 15 — Note 5, Investments Accounted for by the Equity Method and Variable Interest Entities, to the consolidated financial statements included in the Company’s 2023 Form 10-K, the Company has a controlling financial interest in certain entities which have been identified as VIEs under ASC 810, Consolidations, or ASC 810. These arrangements are primarily related to tax equity arrangements entered into with third parties in order to monetize certain tax credits associated with wind, solar and BESS facilities. The Company also has a controlling financial interest in certain partnership arrangements with third-party investors, which also have been identified as VIEs. Under the Company’s arrangements that have been identified as VIEs, the third-party investors are allocated earnings, tax attributes and distributable cash in accordance with the respective limited liability company agreements. Many of these arrangements also provide a mechanism to facilitate achievement of the investor’s specified return by providing incremental cash distributions to the investor at a specified date if the specified return has not yet been achieved.

The following is a summary of significant activity during the three months ended March 31, 2024 related to the Company’s consolidated VIEs:

Lighthouse Renewable Holdco 2 LLC