DHI Group Adopts Tax Benefit Preservation Plan to Protect Capital Loss Carryforwards and Stockholder Value

28 Janvier 2025 - 10:15PM

Business Wire

DHI Group, Inc. (NYSE: DHX) (“DHI” or the “Company”) announced

today that it has adopted a shareholder rights plan designed to

protect stockholder value by preserving the availability of the

Company’s net capital loss carryforwards (“Carryforwards”) and

other tax attributes under the Internal Revenue Code of 1986, as

amended (the “Code”) (such plan, the “Section 382 Rights

Plan”).

The Company estimates that as of September 30, 2024, the Company

had Carryforwards of approximately $109 million, which

Carryforwards represent a valuable asset to the Company and its

stockholders and are available to reduce the Company's future

federal income tax expense relating to capital gains.

The Company’s ability to utilize its Carryforwards would be

substantially limited if it experienced an "ownership change"

within the meaning of Section 382 of the Code. In general, a

company would undergo an ownership change if its "5-percent

shareholders" (determined under Section 382) increased their

ownership of such company's stock by more than 50 percentage points

over a rolling three-year period. The Section 382 Rights Plan is

intended to reduce the likelihood of such an ownership change at

DHI by deterring any person or group from acquiring beneficial

ownership of 4.99% or more of DHI's outstanding common stock.

The Section 382 Rights Plan aims to preserve the Company's

Carryforwards by creating a disincentive for any stockholder to

accumulate beneficial ownership of 4.99% or more of the Company’s

outstanding common stock, or to further accumulate the Company’s

common stock if the stockholder's beneficial ownership already

exceeds 4.99%, in each case without the approval of the Company’s

Board of Directors (the “Board”). If a stockholder beneficially

owns 4.99% or more of the outstanding shares of the Company’s

common stock prior to today's announcement of the Plan, then that

stockholder's existing ownership percentage may be exempted by the

Board. Any such stockholder will not be permitted under the Section

382 Rights Plan to acquire any additional shares without approval

of the Board. The Board also has the authority to exempt certain

stockholders and acquisitions from triggering the Section 382

Rights Plan.

In connection with its adoption of the Section 382 Rights Plan,

the Board declared a dividend of one "right" under the Section 382

Rights Plan for each outstanding share of the Company’s common

stock. The dividend will be made to stockholders of record as of

the close of business on February 7, 2025. Any shares of the

Company’s common stock issued after the record date will be issued

together with a right. The rights will initially trade with the

Company’s common stock and will generally become exercisable only

if a person (or any persons acting as a group) acquires 4.99% or

more of the Company’s outstanding common stock. If the rights

become exercisable, all holders of rights (other than any

triggering person) will be entitled to acquire additional shares of

common stock at a 50% discount.

The rights will expire on January 28, 2028, provided that if the

Company’s stockholders do not ratify the Section 382 Rights Plan at

the Company's 2025 Annual Meeting of Stockholders, the rights will

expire at 5:00 p.m. eastern time on the day following the

certification of the voting results of such meeting. The rights may

also expire on an earlier date upon the occurrence of certain

events, including a determination by the Board that the Section 382

Rights Plan is no longer necessary or desirable for the

preservation of the Company's Carryforwards or that no

Carryforwards may be carried forward.

The Section 382 Rights Plan is similar to those adopted by

numerous other public companies with significant tax assets, such

as net operating loss or capital loss carryforwards. Because the

rights may be redeemed under certain circumstances by the Board,

the Section 382 Rights Plan should not interfere with any action

that the Board determines to be in the best interests of the

Company and its stockholders.

There is no assurance, however, that the Section 382 Rights Plan

will prevent an "ownership change" within the meaning of Section

382, and it is possible that acquisitions or sales of the Company’s

common stock by other persons or groups, not yet publicly

disclosed, may already have resulted in an "ownership change".

Further details about the Section 382 Rights Plan will be

contained in a Form 8-K and in a Registration Statement on Form 8-A

to be filed with the Securities and Exchange Commission by the

Company.

About DHI Group, Inc.

DHI Group, Inc (NYSE: DHX) is a provider of AI-powered career

marketplaces that focus on technology roles. DHI’s two brands, Dice

and ClearanceJobs, enable recruiters and hiring managers to

efficiently search for and connect with highly skilled technology

professionals based on the skills requested. The Company’s patented

algorithm manages over 100,000 unique technology skills.

Additionally, our marketplaces allow tech professionals to find

their ideal next career opportunity, with relevant advice and

personalized insights. Learn more at www.dhigroupinc.com.

Forward-Looking Statements

This press release and oral statements made from time to time by

our representatives contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. You should

not place undue reliance on those statements because they are

subject to numerous uncertainties and factors relating to our

operations and business environment, all of which are difficult to

predict and many of which are beyond our control. Forward-looking

statements include, without limitation, statements concerning our

plan to seek stockholder ratification of the Section 382 Rights

Plan at our 2025 Annual Meeting of Stockholders; our ability to use

our Carryforwards; the expected expiration of our existing

Carryforwards; whether our Carryforwards would become substantially

limited if we were to experience an "ownership change" as defined

under Section 382 of the Internal Revenue Code; and whether the

Section 382 Rights Plan will reduce the risk of such an "ownership

change" occurring. These statements often include words such as

“may,” “will,” “should,” “believe,” “expect,” “anticipate,”

“intend,” “plan,” “estimate” or similar expressions. These

statements are based on assumptions that we have made in light of

our experience in the industry as well as our perceptions of

historical trends, current conditions, expected future developments

and other factors we believe are appropriate under the

circumstances. Although we believe that these forward-looking

statements are based on reasonable assumptions, you should be aware

that many factors could affect our actual financial results or

results of operations and could cause actual results to differ

materially from those in the forward-looking statements. These

factors include, but are not limited to, the factors discussed in

the Company’s filings with the Securities and Exchange Commission,

all of which are available on the Investors page of our website at

www.dhigroupinc.com, including the Company’s most recently filed

periodic reports on Form 10-K and Form 10-Q and subsequent filings

under the headings “Risk Factors,” “Forward-Looking Statements” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations.” You should keep in mind that any

forward-looking statement made by the Company or its

representatives herein, or elsewhere, speaks only as of the date on

which it is made. New risks and uncertainties come up from time to

time, and it is impossible to predict these events or how they may

affect us. We have no obligation to update any forward-looking

statements after the date hereof, except as required by applicable

federal securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128825284/en/

Investor Contact Todd Kehrli or Jim Byers

PondelWilkinson, Inc. 212-448-4181 ir@dhigroupinc.com

Media Contact Rachel Ceccarelli VP Engagement

212-448-8288 media@dhigroupinc.com

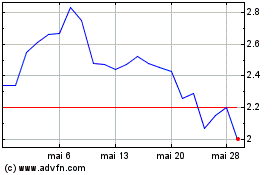

DHI (NYSE:DHX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

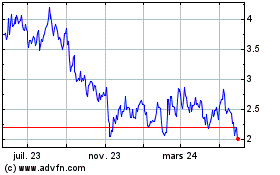

DHI (NYSE:DHX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025