As filed with the Securities and Exchange Commission on May 18, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-10

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

| ELDORADO GOLD CORPORATION |

| (Exact name of Registrant as specified in its charter) |

| Canada | | 1041 | | N/A |

| (Province or other Jurisdiction of | | (Primary Standard Industrial | | (I.R.S. Employer Identification |

| Incorporation or Organization) | | Classification Code Number) | | Number, if applicable) |

1188 - 550 Burrard Street

Bentall 5

Vancouver, British Columbia

Canada V6C 2B5

(604) 687-4018

(Address and telephone number of Registrant’s principal executive offices)

CT Corporation System

1015 15th Street N.W., Suite 1000

Washington, DC 20005

(202) 572-3100

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

| Georald Ingborg | James Guttman |

| Samuel Li | Dorsey & Whitney LLP |

| Fasken Martineau DuMoulin LLP | Brookfield Place |

| 550 Burrard Street, Suite 2900 | 161 Bay Street |

| Vancouver, B.C. V6C 0A3 | Suite 4310 |

| Canada | Toronto, ON M5J 2S1 |

| (604) 631-3131 | Canada |

| (416) 367-7370 |

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this registration statement becomes effective

Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

| A. | ☐ upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

| | |

| B. | ☒ at some future date (check the appropriate box below) |

| 1. | ☐ pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). |

| | | |

| 2. | ☐ pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

| | | |

| 3. | ☒ pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| | | |

| | 4. | ☐ after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box. ☒

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the U.S. Securities Act or on such date as the Commission, acting pursuant to Section 8(a) of the U.S. Securities Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State.

This short form base shelf prospectus has been filed under legislation in each of the provinces and territories of Canada that permits certain information about these securities to be determined after this prospectus has become final and that permits the omission from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities, except in cases where an exemption from such delivery requirements is available. This short form prospectus is filed in reliance on an exemption from the preliminary base shelf prospectus requirements for a well-known seasoned issuer.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall be any sale of these securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State.

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Eldorado Gold Corporation at Suite 1188 – 550 Burrard Street, Vancouver, British Columbia, V6C 2B5, Telephone (604) 687-4018, and are also available electronically at www.sedar.com, and www.sec.gov.

SHORT FORM BASE SHELF PROSPECTUS

| New Issue | May 18, 2023 |

|

|

Common Shares

Debt Securities

Convertible Securities

Warrants

Rights

Subscription Receipts

Units

Eldorado Gold Corporation (“Eldorado” or the “Company”) may offer and issue from time to time common shares of the Company (“Common Shares”), debt securities (“Debt Securities”), securities convertible into or exchangeable for Common Shares and/or other securities (“Convertible Securities”), warrants to purchase Common Shares, or Debt Securities (collectively “Warrants”), rights exercisable to acquire, or convertible into, Common Shares and/or other securities (“Rights”), subscription receipts (“Subscription Receipts”), or units comprised of one or more of the other securities described in this prospectus (“Units”) (all of the foregoing collectively, the “Securities”) or any combination thereof during the 25-month period that this short form base shelf prospectus (the “Prospectus”), including any amendments hereto, remains effective. Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of sale and set forth in an accompanying prospectus supplement (a “Prospectus Supplement”). In addition, Securities may be offered in consideration for the acquisition of other businesses, assets or securities by the Company or a subsidiary of the Company. The consideration for any such acquisition may consist of any of the Securities separately, a combination of Securities or any combination of, among other things, Securities, cash and assumption of liabilities.

The specific terms of the Securities with respect to a particular offering will be set out in the applicable Prospectus Supplement and may include, where applicable: (i) in the case of Common Shares, the number of Common Shares offered, the offering price, whether the Common Shares are being offered for cash, and any other terms specific to the Common Shares being offered; (ii) in the case of Debt Securities, the specific designation, the aggregate principal amount, the currency or the currency unit for which the Debt Securities may be purchased, the maturity, the interest provisions, the authorized denominations, the offering price, whether the Debt Securities are being offered for cash, the covenants, the events of default, any terms for redemption or retraction, any exchange or conversion rights attached to the Debt Securities, whether the debt is senior or subordinated to the Company’s other liabilities and obligations, whether the Debt Securities will be secured by any of the Company’s assets or guaranteed by any other person and any other terms specific to the Debt Securities being offered; (iii) in the case of Convertible Securities, the number of Convertible Securities offered, the offering price, the procedures for the conversion or exchange of such Convertible Securities into or for Common Shares and/or other Securities and any other specific terms; (iv) in the case of Warrants, the offering price, whether the Warrants are being offered for cash, the designation, the number and the terms of the Common Shares, and/or Debt Securities purchasable upon exercise of the Warrants, any procedures that will result in the adjustment of these numbers, the exercise price, the dates and periods of exercise, the currency in which the Warrants are issued and any other terms specific to the Warrants being offered; (v) in the case of Subscription Receipts, the number of Subscription Receipts being offered, the offering price, whether the Subscription Receipts are being offered for cash, the procedures for the exchange of the Subscription Receipts for Common Shares, Debt Securities, Warrants, Rights and/or Units as the case may be, and any other terms specific to the Subscription Receipts being offered; (vi) in the case of Rights, the designation, number and terms of the Common Shares, Debt Securities and/or other Securities purchasable upon exercise of the Rights, any procedures that will result in the adjustment of these numbers, the date of determining the shareholders entitled to the Rights distribution, the exercise price, the dates and periods of exercise and any other terms specific to the Rights being offered; and (vii) in the case of Units, the number of Units offered, the offering price of the Units, the number, designation and terms of the Securities comprising the Units and any procedures that will result in the adjustment of those numbers and any other specific terms applicable to the offering of Units. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to the Securities will be included in the Prospectus Supplement describing the Securities.

All information permitted under applicable law to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which such Prospectus Supplement pertains.

An investment in the Securities is speculative and involves a high degree of risk. Only potential investors who are experienced in high risk investments and who can afford to lose their entire investment should consider an investment in the Company. See “Risk Factors” in this Prospectus, in the Company’s Annual Information Form for the year ended December 31, 2022, which is incorporated by reference in this Prospectus, and in all other documents incorporated by reference in this Prospectus.

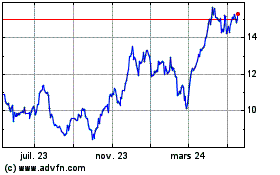

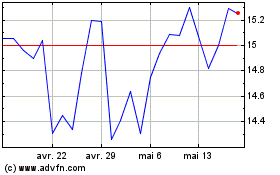

The outstanding Common Shares are listed on the Toronto Stock Exchange (the “TSX”) under the symbol “ELD” and on The New York Stock Exchange (the “NYSE”) under the symbol “EGO”. On May 17, 2023, the last trading day on the TSX prior to the date of this Prospectus, the closing price of the Common Shares on the TSX was $14.63. On May 17, 2023, the last trading day on the NYSE prior to the date of this Prospectus, the closing price of the Common Shares on the NYSE was US$10.87.

There is currently no market through which the Securities, other than the Common Shares, may be sold and purchasers may not be able to resell such securities purchased under this Prospectus. This may affect the pricing of these Securities in the secondary market, the transparency and availability of trading prices, the liquidity of the Securities, and the extent of issuer regulation. See “Risk Factors”. Unless otherwise specified in the applicable Prospectus Supplement, the Debt Securities, Convertible Securities, the Warrants, the Rights and the Subscription Receipts will not be listed on any securities exchange.

This Prospectus may qualify an “at-the-market distribution” (as such term is defined in National Instrument 44-102 - Shelf Distributions).

This Prospectus does not qualify the issuance of Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to one or more underlying interests, including, for example, an equity or debt security, or a statistical measure of economic or financial performance (including, but not limited to, any currency, consumer price or mortgage index, or the price or value of one or more commodities, indices or other items, or any other item or formula, or any combination or basket of the foregoing items).

Eldorado is a foreign private issuer under United States securities laws and is permitted under the multijurisdictional disclosure system adopted by the United States and Canada to prepare this Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. Eldorado has prepared its financial statements, included or incorporated herein by reference, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) which is incorporated within Part 1 of the CPA Canada Handbook - Accounting, and Eldorado’s consolidated financial statements are subject to Canadian generally accepted auditing standards and auditor independence standards, in addition to the standards of the Public Company Accounting Oversight Board (United States) and the United States Securities and Exchange Commission (“SEC”) independence standards. Thus, they may not be comparable to the financial statements of United States companies.

Prospective investors should be aware that the acquisition of securities described herein may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States or who are resident in Canada may not be described fully herein or in any applicable Prospectus Supplement. Prospective investors should read the tax discussion contained in the applicable Prospectus Supplement with respect to a particular offering of Securities.

The ability of investors to enforce civil liabilities under United States federal securities laws may be affected adversely because Eldorado is incorporated in Canada, most of Eldorado’s officers and directors and most of the experts named in this Prospectus are not residents of the United States, and all of our assets and all or a substantial portion of the assets of such persons are located outside of the United States. See “Enforceability of Civil Liabilities by U.S. and Canadian Investors”.

NONE OF THE CANADIAN SECURITIES REGULATORY AUTHORITIES, THE SEC NOR ANY UNITED STATES STATE SECURITIES COMMISSION OR OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

As of the date hereof, the Company has determined that it qualifies as a “well-known seasoned issuer” under the WKSI Blanket Orders (as defined below). See “Well-Known Seasoned Issuer”. All information permitted under applicable law, including as permitted under the WKSI Blanket Orders, to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus, except in cases where an exemption from such delivery requirements is available. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains. You should read this Prospectus and any applicable Prospectus Supplement carefully before you invest in any Securities.

This Prospectus constitutes a public offering of the Securities only in those jurisdictions where they may be lawfully offered for sale and only by persons permitted to sell the Securities in those jurisdictions. The Company may offer and sell Securities to, or through, underwriters or dealers and also may offer and sell certain Securities directly to other purchasers or through agents pursuant to exemptions from registration or qualification under applicable securities laws. A Prospectus Supplement relating to each issue of Securities offered thereby will set forth the names of any underwriters, dealers, agents or selling securityholders involved in the offering and sale of the Securities and will set forth the terms of the offering of the Securities, the method of distribution of the Securities including, to the extent applicable, the proceeds to the Company and any fees, discounts or any other compensation payable to underwriters, dealers or agents and any other material terms of the plan of distribution.

No underwriter has been involved in the preparation of this Prospectus nor has any underwriter performed any review of the contents of this Prospectus.

In connection with any offering of Securities, other than an “at-the-market distribution” (as defined under applicable Canadian securities legislation), unless otherwise specified in a Prospectus Supplement, the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a higher level than that which might exist in the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution”.

No underwriter of any at-the-market distribution, and no person or company acting jointly or in concert with any such underwriter, may, in connection with such distribution, enter into any transaction that is intended to stabilize or maintain the market price of the securities or securities of the same class as the securities distributed under any at-the-market prospectus supplement, including selling an aggregate number or principal amount of securities that would result in the underwriter creating an over-allocation position in the securities.

Our head office is located at Suite 1188 – 550 Burrard Street, Vancouver, British Columbia, V6C 2B5 and our registered office is at 2900 – 550 Burrard Street, Vancouver, British Columbia, Canada, V6C 0A3.

Pamela Gibson and Judith Mosley, each directors of the Company, reside outside of Canada. Pamela Gibson and Judith Mosley have each appointed the following agent for service of process:

| Name and Address of Agent |

| Eldorado Gold Corporation Suite 1188 – 550 Burrard Street Vancouver, British Columbia V6C 2B5 |

In addition, Richard Kiel, a person named as having prepared or certified a portion of a report, being the Skouries Report (as defined below), valuation, statement or opinion in this Prospectus, either directly or in a document incorporated by reference and whose profession or business gives authority to such report, valuation, statement or opinion, resides outside of Canada.

Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person that resides outside of Canada, even if the party has appointed an agent for service of process.

Any investment in Securities being offered is highly speculative and involves significant risks that you should consider before purchasing such Securities. You should carefully review the risks outlined in this Prospectus (including any Prospectus Supplement) and in the documents incorporated by reference as well as the information under the heading “Forward-Looking Statements” and consider such risks and information in connection with an investment in the Securities. See “Risk Factors”.

Investors should rely only on the information contained or incorporated by reference in the Prospectus and any applicable Prospectus Supplement. The Company has not authorized anyone to provide investors with different or additional information. If anyone provides investors with different or additional information, investors should not rely on it. The Company is not making an offer to sell or seeking an offer to buy Securities in any jurisdiction where the offer or sale is not permitted. Investors should assume that the information contained in the Prospectus and any applicable Prospectus Supplement is accurate only as at the date of those documents and that information contained in any document incorporated by reference is accurate only as at the date of that document, regardless of the time of delivery of the Prospectus and any applicable Prospectus Supplement or of any sale of the Company’s securities. The Company’s business, financial condition, results of operations and prospects may have changed since those dates.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

Certain of the statements made and information provided in this Prospectus, including any documents incorporated by reference herein, are forward-looking statements or information within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. Often, these forward-looking statements and forward-looking information can be identified by the use of words such as “believes”, “continue”, “estimates”, “expected”, “expects”, “forecast”, “foresee”, “future”, “goal”, “guidance”, “intends”, “opportunity”, “outlook”, “plans”, “project”, “scheduled”, “strive”, or “target” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “can”, “could”, “may”, “might”, “will” or “would” be taken, occur or be achieved.

Forward-looking statements or information include, but are not limited to, statements or information with respect to:

| | ◦ | the duration, extent and other implications of the coronavirus (“COVID-19”) and any restrictions and suspensions with respect to our operations; |

| | | |

| | ◦ | Eldorado Gold’s capital resources and business objectives; |

| | | |

| | ◦ | Eldorado Gold’s guidance and outlook, including expected production, cost guidance and recoveries of ore, including: |

| | ▪ | increased heap leach recoveries; |

| | | |

| | ▪ | the underground decline at the Triangle mine and the associated benefits; |

| | | |

| | ▪ | expansion at the Lamaque project (“Lamaque”); |

| | | |

| | ▪ | sustaining and growth capital expenditures, including the sources thereof; and |

| | | |

| | ▪ | statements regarding the Company restarting construction and development at its Skouries project; |

| | ◦ | operations at the Kışladağ project (“Kışladağ”), including expected gold production resulting from a ramp-up of the high-pressure grinding roll circuit; |

| | | |

| | ◦ | Eldorado Gold’s strategy and expectations with respect to currency holdings, hedging and inflation; |

| | | |

| | ◦ | the Company’s compliance with the Sustainability Integrated Management System; |

| | | |

| | ◦ | operations at the Lamaque project, including the Company’s compliance with ISO 45001 and its certification thereunder and the timing of the site’s verification under the Towards Sustainable Mining standards; |

| | | |

| | ◦ | the Company’s strategy with respect to Human Rights Impact Assessments at its Greek and Turkish operations, including the timing thereof; |

| | | |

| | ◦ | the Company’s intentions with respect to its response to the Carbon Disclosure Project’s Climate Change and Water surveys, including the timing and frequency thereof; |

| | | |

| | ◦ | the Company’s strategy with respect to The Voluntary Principles on Security and Human Rights; |

| | | |

| | ◦ | favourable economics for the Company’s heap leaching plan and the ability to extend mine life at Eldorado’s projects; |

| | | |

| | ◦ | sales from the Olympias project (“Olympias”), including the imposition of the value-added tax thereon; |

| | | |

| | ◦ | modification to the Kassandra Mines Environmental Impact Assessment, including the approval and timing thereof; |

| | | |

| | ◦ | the Company’s strategy with respect to the Kassandra Mines, including the anticipated results therefrom; |

| | ◦ | the potential sale of any of our non-core assets, including the Certej project; |

| | | |

| | ◦ | planned capital and exploration expenditures; |

| | | |

| | ◦ | conversion of mineral resources to mineral reserves; |

| | | |

| | ◦ | Eldorado Gold’s expectation as to its future financial and operating performance, including expectations around generating free cash flow; |

| | | |

| | ◦ | expected metallurgical recoveries and improved concentrate grade and quality; |

| | | |

| | ◦ | intentions and expectations regarding non-IFRS financial measures and ratios; |

| | | |

| | ◦ | gold price outlook and the global concentrate market; |

| | | |

| | ◦ | Eldorado’s targets, intentions and expectations related to greenhouse gas emissions, including the timing thereof and operations related thereto; |

| | | |

| | ◦ | Eldorado’s strategy, plans and goals, including its proposed exploration, development, construction, permitting and operating plans and priorities and related timelines and schedules; |

| | | |

| | ◦ | nomination of the Company’s directors in 2023; and |

| | | |

| | ◦ | results of litigation and arbitration proceedings. |

Forward-looking statements or information is based on a number of assumptions, that management considers reasonable, however, if such assumptions prove to be inaccurate, then actual results, activities, performance or achievements may be materially different from those described in the forward-looking statements or information. These include assumptions concerning: our 2023 outlook; results from drilling at Ormaque; advancement of technical work in respect of Lamaque; advancement of technical work and construction at Skouries; benefits of the improvements at Kışladağ; how the world-wide economic and social impact of COVID-19 is managed and the duration and extent of the COVID-19 pandemic; the associated benefits of the completed underground decline at the Triangle mine; the benefits of using dry stack tailings; timing of advancement and completion of construction, technical work and receipt of approvals, at Skouries and/or other development projects in Greece; the results of our exploration programs; the geopolitical, economic, permitting and legal climate that Eldorado operates in; the future price of gold and other commodities; the global concentrate market; exchange rates; anticipated values, costs and expenses; production and metallurgical recoveries; mineral reserves and resources; and the impact of acquisitions, dispositions, suspensions or delays on the Company’s business and the Company’s ability to achieve its goals. In addition, except where otherwise stated, Eldorado has assumed a continuation of existing business operations on substantially the same basis as exists at the time of this Prospectus.

Forward-looking statements or information is subject to known and unknown risks, uncertainties and other important factors that may cause actual results, activities, performance or achievements to be materially different from those described in the forward-looking statements or information. These risks, uncertainties and other factors include, among others: inability to meet production guidance; inability to realize the benefits of the decline between Sigma mill and the Triangle underground mine; poor results from drilling at Ormaque; inability to complete expansion and optimization at Kışladağ or to meeting expected timing thereof, or to achieve the benefits thereof; inability to assess taxes in Türkiye or depreciation expenses; inability to conduct Olympias stakeholder discussions; risks relating to the ongoing COVID-19 pandemic and any future pandemic, epidemic, endemic or similar public health threats; risks relating to our operations being located in foreign jurisdictions; community relations and social license; climate change; liquidity and financing risks; development risks at Skouries and other development projects; indebtedness, including current and future operating restrictions, implications of a change of control, ability to meet debt service obligations, the implications of defaulting on obligations and change in credit ratings; environmental matters; waste disposal; the global economic environment; government regulation; reliance on a limited number of smelters and off-takers; commodity price risk and the use of derivatives; mineral tenure; permits; risks relating to environmental, sustainability and governance practices and performance; non-governmental organizations; corruption, bribery and sanctions; litigation and contracts; information technology systems; estimation of mineral reserves and mineral resources; production and processing estimates; credit risk; actions of activist shareholders; price volatility, volume fluctuations and dilution risk in respect of Eldorado Gold shares; reliance on infrastructure, commodities and consumables; currency risk; inflation risk; interest rate risk; tax matters; dividends; financial reporting, including relating to the carrying value of the Company’s assets and changes in reporting standards; labour, including relating to employee/union relations, employee misconduct, key personnel, skilled workforce, expatriates and contractors; reclamation and long-term obligations; regulated substances; necessary equipment; co-ownership of the Company’s properties; acquisitions, including integration risks, and dispositions; the unavailability of insurance; conflicts of interest; compliance with privacy legislation; reputational issues; competition; and those risk factors discussed under the heading “Risk Factors”, as well as the risks, uncertainties and other factors referred to in the AIF (as defined below), and any other documents incorporated by reference under the heading “Risk Factors”, which include a discussion of material and other risks that could cause actual results to differ significantly from Eldorado’s current expectations.

Forward-looking information is designed to help you understand management’s current views of Eldorado’s near and longer term prospects, and it may not be appropriate for other purposes. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, you should not place undue reliance on the forward-looking information contained herein.

Eldorado will not necessarily update this information unless it is required to do so by applicable securities laws. All forward-looking information in this Prospectus or any applicable Prospectus Supplement and the documents incorporated by reference in this Prospectus or any applicable Prospectus Supplement is qualified by these cautionary statements.

GENERAL MATTERS

Unless otherwise noted or the context otherwise indicates, “Eldorado”, the “Company”, “we” or “us” refers to Eldorado Gold Corporation and its direct and indirect subsidiaries and “Eldorado Gold” refers to Eldorado Gold Corporation.

We prepare our financial statements in conformity with IFRS, and present such financial statements in United States dollars. All dollar amounts in this Prospectus are expressed in Canadian dollars, except as otherwise indicated. References to “$”, “dollars”, or “CAD$” are to Canadian dollars and references to “US$” are to United States dollars.

Market data and certain industry forecasts used in this Prospectus or any applicable Prospectus Supplement and the documents incorporated by reference in this Prospectus or any applicable Prospectus Supplement were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

The Securities being offered for sale under this Prospectus may only be sold in those jurisdictions in which offers and sales of the Securities are permitted. This Prospectus is not an offer to sell or a solicitation of an offer to buy the Securities in any jurisdiction where it is unlawful. The information contained in this Prospectus is accurate only as at the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of the Securities.

EXCHANGE RATE INFORMATION

The following table sets forth, for each of the periods indicated, the high, low and average spot rates and the spot rate at the end of the period for US$1.00 in terms of Canadian dollars, as reported by the Bank of Canada.

| | | Year ended December 31, | | | Three months ended March 31, | |

| | | 2020 | | | 2021 | | | 2022 | | | 2023 | |

| Rate at the end of period | | $ | 1.2732 | | | $ | 1.2678 | | | $ | 1.2678 | | | $ | 1.3533 | |

| Average rate during period | | $ | 1.3415 | | | $ | 1.2535 | | | $ | 1.3011 | | | $ | 1.3526 | |

| Highest rate during period | | $ | 1.4496 | | | $ | 1.2942 | | | $ | 1.3856 | | | $ | 1.3807 | |

| Lowest rate during period | | $ | 1.2718 | | | $ | 1.2040 | | | $ | 1.2451 | | | $ | 1.3312 | |

On May 17, 2023, the Bank of Canada spot exchange rate for the purchase of US$1.00 using Canadian dollars was $1.3463 ($1.00=US$0.7428).

NON-GAAP FINANCIAL MEASURES

In this Prospectus, including the documents incorporated or deemed incorporated by reference herein, we use the terms “cash operating costs”, “cash operating costs per ounce sold”, “total cash costs”, “total cash costs per ounce sold”, “all-in sustaining cost” (“AISC”), “AISC per ounce sold”, “sustaining and growth capital”, “average realized gold price per ounce sold”, “adjusted net earnings/(loss) attributable to shareholders”, “adjusted net earnings/(loss) per share attributable to shareholders”, “earnings before interest, taxes, depreciation and amortization”, “adjusted earnings before interest, taxes, depreciation and amortization”, “free cash flow”, “working capital”, and “cash flow from operations before changes in working capital”, which are considered “Non-GAAP financial measures” within the meaning of applicable Canadian securities laws and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. See “How we measure our costs” in the AIF (as defined below), “Non-IFRS and Other Financial Measures and Ratios” in the Annual MD&A (as defined below) and “Non-IFRS and Other Financial Measures and Ratios” in the Interim MD&A (as defined below) for an explanation of these measures.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with securities commissions or similar regulatory authorities in each of the provinces and territories in Canada and filed with, or furnished to, the SEC in the United States. Copies of the documents incorporated by reference herein may be obtained on request without charge from the Company’s Corporate Secretary at Suite 1188 – 550 Burrard Street, Vancouver, British Columbia, V6C 2B5, Telephone (604) 687-4018. Additionally, prospective investors may read and download any public document we have filed with the various securities commissions or similar authorities in each of the provinces and territories of Canada on SEDAR at www.sedar.com and the documents we have filed with, or furnished to, the SEC on the EDGAR website at www.sec.gov.

The following documents, filed by the Company with the securities commissions or similar regulatory authorities in all of the provinces and territories of Canada and filed with, or furnished to, the SEC are specifically incorporated by reference and form an integral part of this Prospectus:

| | (i) | the annual audited consolidated financial statements of the Company, the notes thereto and the reports of the independent registered public accounting firm thereon for the fiscal years ended December 31, 2022 and December 31, 2021 (the “Annual Financial Statements”), together with the Management’s Discussion and Analysis of the Company for the Annual Financial Statements (“Annual MD&A”); |

| | | |

| | (ii) | the interim unaudited consolidated financial statements of the Company, for the three month periods ended March 31, 2023 and March 31, 2022 (the “Interim Financial Statements”), together with the Management’s Discussion and Analysis of the Company for the Interim Financial Statements (“Interim MD&A”); |

| | | |

| | (iii) | the Annual Information Form of the Company dated March 30, 2023 for the fiscal year ended December 31, 2022 (the “AIF”); and |

| | | |

| | (iv) | the Management Information Circular of the Company dated April 24, 2023 prepared in connection with the annual meeting of shareholders of the Company to be held on June 8, 2023. |

Any document of the type referred to in the preceding paragraph and any interim financial statements, material change reports (excluding confidential reports), or other document of the type required by National Instrument 44-101 – Short Form Prospectus Distributions to be incorporated by reference in a short form prospectus, filed by the Company with a securities commission or similar regulatory authority in Canada after the date of this Prospectus shall be deemed to be incorporated by reference in this Prospectus. In addition, to the extent any such document is included in any report on Form 6-K furnished to the SEC or in any report on Form 40-F filed with the SEC, such document shall be deemed to be incorporated by reference as an exhibit to the registration statement on Form F-10 of which this Prospectus forms a part (in the case of any report on Form 6-K, if and to the extent expressly set forth in such report). In addition, the Company may incorporate by reference into the registration statement on Form F-10 of which this Prospectus forms a part, information from documents that the Company files with or furnishes to the SEC pursuant to Section 13(a) or 15(d) of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), to the extent that such documents expressly so state. The documents incorporated or deemed to be incorporated herein by reference contain meaningful and material information relating to the Company and readers should review all information contained in this Prospectus, the applicable Prospectus Supplement and the documents incorporated or deemed to be incorporated by reference herein and therein.

One or more Prospectus Supplements containing the specific variable terms for an issue of Securities and other information in relation to those Securities will be delivered or made available to purchasers of such Securities together with this Prospectus to the extent required by applicable securities laws and will be deemed to be incorporated by reference into this Prospectus as of the date of the Prospectus Supplement solely for the purposes of the offering of the Securities covered by any such Prospectus Supplement.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded, for purposes of this Prospectus, to the extent that a statement contained herein or in any other subsequently-filed document which also is, or is deemed to be, incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed in its unmodified or superseded form to constitute part of this Prospectus.

Upon our filing of a new annual information form and the related annual financial statements and management’s discussion and analysis with applicable securities regulatory authorities in Canada, and with the SEC, during the currency of this Prospectus, the previous annual information form, the previous annual financial statements and management’s discussion and analysis and all interim financial statements, supplemental information, material change reports and information circulars filed prior to the commencement of our financial year in which the new annual information form is filed will be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of our securities under this Prospectus. Upon interim consolidated financial statements and the accompanying management’s discussion and analysis and material change report being filed by us with the applicable securities regulatory authorities in Canada, and with the SEC, during the duration of this Prospectus, all interim consolidated financial statements and the accompanying management’s discussion and analysis filed prior to the new interim consolidated financial statements shall be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of securities under this Prospectus.

FINANCIAL INFORMATION

The financial statements of the Company included or incorporated by reference herein and in any Prospectus Supplement are reported in United States dollars. Eldorado’s financial statements included or incorporated by reference in this Prospectus are prepared in accordance with IFRS, which differs from accounting principles generally accepted in the United States (“U.S. GAAP”). The SEC has adopted rules to allow foreign private issuers, such as Eldorado, to prepare and file financial statements prepared in accordance with IFRS without reconciliation to U.S. GAAP. Accordingly, we will not be providing a description of the principal differences between U.S. GAAP and IFRS. Unless otherwise indicated, all financial information contained and incorporated or deemed incorporated by reference in this Prospectus and any Prospectus Supplement is presented in accordance with IFRS. As a result, our financial statements and other financial information included or incorporated by reference in this Prospectus and any Prospectus Supplement may not be comparable to financial statements and financial information of United States companies.

AVAILABLE INFORMATION

The Company files reports and other information with the securities commissions and similar regulatory authorities in each of the provinces and territories of Canada. These reports and information are available to the public free of charge under the Company’s profile on SEDAR at www.sedar.com.

The Company is concurrently filing with the SEC a registration statement (the “Registration Statement”) on Form F-10 under the U.S. Securities Act of 1933, as amended, relating to the Securities. This Prospectus, which constitutes a part of the Registration Statement, does not contain all of the information contained in the Registration Statement, certain items of which are contained in the exhibits to the Registration Statement pursuant to the rules and regulations of the SEC. Information omitted from this Prospectus but contained in the Registration Statement is available on the SEC’s website under the Company’s profile at www.sec.gov. Please refer to the Registration Statement and exhibits for further information.

The Company is subject to the reporting requirements of the U.S. Exchange Act as the Common Shares are registered under Section 12(b) of the U.S. Exchange Act. Accordingly, the Company is required to publicly file reports and other information with the SEC. Under the multijurisdictional disclosure system adopted by Canada and the United States, the Company is permitted to prepare such reports and other information in accordance with Canadian disclosure requirements, which are different from United States disclosure requirements. In addition, as a foreign private issuer, the Company is exempt from the rules under the U.S. Exchange Act prescribing the furnishing and content of proxy statements, and the Company’s officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act.

Investors may read and download the documents the Company has filed with the SEC’s Electronic Data Gathering and Retrieval system at www.sec.gov. Investors may read and download any public document that the Company has filed with the securities commissions or similar regulatory authorities in Canada at www.sedar.com.

CAUTIONARY NOTE FOR UNITED STATES INVESTORS

Technical disclosure regarding our properties included herein, or in documents incorporated by reference into this Prospectus and any Prospectus Supplement, (the “Technical Disclosure”) has not been prepared in accordance with the requirements of United States securities laws. Without limiting the foregoing, the Technical Disclosure uses terms that comply with reporting standards in Canada and certain estimates are made in accordance with National Instrument 43-101 — Standard of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the Technical Disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ from the requirements of the SEC applicable to domestic United States reporting companies, and any mineral reserve or resource information contained in the Technical Disclosure may not be comparable to similar information disclosed by United States companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

ENFORCEABILITY OF CIVIL LIABILITIES BY U.S. AND CANADIAN INVESTORS

The Company is a corporation existing under the Canada Business Corporations Act (“CBCA”). All of the Company’s directors, and all of the experts except Richard Kiel, named in the Prospectus, reside outside the United States, and all or a substantial portion of their assets, and all of the Company’s assets, are located outside the United States. The Company has appointed an agent for service of process in the United States, but it may be difficult for purchasers of Securities who reside in the United States to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for purchasers of Securities who reside in the United States to realize upon judgments of courts of the United States predicated upon the Company’s civil liability and the civil liability of its directors, officers and experts under the United States federal securities laws.

The Company will file with the SEC, concurrently with its registration statement on Form F-10, an appointment of agent for service of process on Form F-X. Under the Form F-X, the Company is appointing CT Corporation System, 1015 15th Street N.W., Suite 1000, Washington, DC 20005 as its agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC, and any civil suit or action brought against or involving the Company in a United States court arising out of, related to, or concerning any offering of Securities under this Prospectus and the applicable Prospectus Supplement.

Pamela Gibson and Judith Mosely, each directors of the Company, reside outside of Canada. Pamela Gibson and Judith Mosely have each appointed the following agent for service of process:

| Name and Address of Agent |

| Eldorado Gold Corporation Suite 1188 – 550 Burrard Street Vancouver, British Columbia V6C 2B5 |

In addition, Richard Kiel, a person named as having prepared or certified a portion of a report, being the Skouries Report (as defined below), valuation, statement or opinion in this Prospectus, either directly or in a document incorporated by reference and whose profession or business gives authority to such report, valuation, statement or opinion, resides outside of Canada.

Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person that resides outside of Canada, even if the party has appointed an agent for service of process.

THE COMPANY

Eldorado Gold is a corporation governed by the CBCA. The Company’s head office is located at Suite 1188 – 550 Burrard Street, Vancouver, British Columbia, V6C 2B5 and its registered office is located at 2900 – 550 Burrard Street, Vancouver, British Columbia, V6C 0A3.

Eldorado owns and operates mines around the world, primarily gold mines, but also produces silver-lead-zinc by-products. Its activities involve all facets of the mining industry, including exploration, acquisition, financing, development, production, sale of mineral products, and reclamation. The Company’s business is currently focused in Türkiye, Greece, and Canada.

Eldorado believes that its international expertise in mining, finance and project development places Eldorado in a strong position to grow in value and deliver good returns for stakeholders as it creates and pursues new opportunities. Eldorado is focused on building a successful and profitable, intermediate gold company. Eldorado’s strategy is to actively manage its portfolio of projects, including pursuing growth opportunities by discovering deposits through grassroots exploration and acquiring advanced exploration, development or low-cost production assets with a focus on the regions where Eldorado already has a presence.

Each operation has a general manager and operates as a decentralized business unit within the Company. Eldorado manages exploration properties, merger and acquisition strategies, corporate financing, global tax planning, consolidated financial reporting, regulatory compliance, commodity price and currency risk management programs, investor relations, engineering for capital projects and general corporate matters centrally, at the Company’s head office in Vancouver. Eldorado’s risk management program is developed by senior management and monitored by the Board of Directors.

Further information regarding the business of the Company, its operations and mines can be found in the documents incorporated herein by reference.

RECENT DEVELOPMENTS

There have been no material developments in the business of the Company since March 30, 2023, the date of the Company’s AIF, which have not been disclosed in this Prospectus or the documents incorporated by reference herein.

USE OF PROCEEDS

Unless otherwise specified in a Prospectus Supplement, we currently intend to use the net proceeds from the sale of our securities to advance our business objectives outlined herein, including working capital requirements and capital projects, acquiring additional mineral properties, for exploration and development of the Company’s mineral properties in Türkiye, Canada and Greece, and for the repayment of outstanding debt of the Company. More detailed information regarding the use of proceeds from the sale of securities, including any determinable milestones at the applicable time, will be described in any applicable Prospectus Supplement. We may also, from time to time, issue securities otherwise than pursuant to a Prospectus Supplement to this Prospectus.

DIVIDENDS OR DISTRIBUTIONS

The Eldorado board of directors established a dividend policy in May 2010. Any dividend payment, if declared, is expected to be derived from a dividend fund calculated on an amount, determined at the discretion of the directors at the time of any decision to pay a dividend, multiplied by the number of ounces of gold sold by Eldorado in the preceding two quarters. In 2011, the board of directors amended the dividend policy to provide additional step-ups as the average realized gold price increases. The board of directors further amended the dividend policy in 2013 to revise the gradation of the fixed dollar amounts per ounce of gold sold.

The amount of any dividend fund would be divided among all the issued Common Shares to yield the dividend payable per share. Accordingly, the calculation of any dividends, if declared, would also be dependent on gold prices, among other things.

The Company has not declared dividends since March 2017. The declaration and payment of dividends is at the sole discretion of the Eldorado board of directors, and is subject to and dependent upon, among other things, the financial condition of, and outlook for the Company, general business conditions, satisfaction of all applicable legal and regulatory restrictions regarding the payment of dividends by Eldorado and the Company’s cash flow and financing needs.

In addition, the Company’s outstanding 6.250% Senior Notes due 2029 (the “Notes”) and its Amended and Restated Senior Secured Credit Facility (the “Facility”) contain certain covenants and restrictions limiting the ability of the Company to pay dividends.

PLAN OF DISTRIBUTION

The Company may sell Securities (i) to underwriters or dealers purchasing as principal, (ii) directly to one or more purchasers pursuant to applicable statutory exemptions, (iii) through agents for cash or other consideration, or (iv) in connection with an acquisition of other businesses, assets or securities by the Company or a subsidiary of the Company. The Securities may be sold from time to time in one or more transactions at fixed prices or non-fixed prices, such as prices determined by reference to the prevailing price of Securities in a specified market, at market prices prevailing at the time of sale or at prices to be negotiated with purchasers, including sales in transactions that are deemed to be “at the market distributions” as defined in National Instrument 44-102 - Shelf Distributions, including sales made directly on the TSX, NYSE or other existing trading markets for the securities. Prices may also vary as between purchasers and during the period of distribution of Securities. If, in connection with the offering of securities at a fixed price or prices, the underwriters have made a bona fide effort to sell all of the securities at the initial offering price fixed in the applicable Prospectus Supplement, the public offering price may be decreased and thereafter further changed, from time to time, to an amount not greater than the initial offering price fixed in such Prospectus Supplement, in which case the compensation realized by the underwriters will be decreased by the amount that the aggregate price paid by purchasers for the securities is less than the gross proceeds paid by the underwriters to the Company.

The Prospectus Supplement for any Securities being offered will set forth the terms of the offering of those Securities, including the name or names of any underwriters, dealers or agents, the purchase price of Securities, the proceeds to the Company from the sale if determinable, any underwriting or agency fees or discounts and other items constituting underwriters’ or agents’ compensation, any public offering price including the manner of determining such public offering price in the case of a non-fixed price distribution, and any discounts or concessions allowed or re-allowed or paid to dealers or agents. Only underwriters named in the relevant Prospectus Supplement are deemed to be underwriters in connection with Securities offered by that Prospectus Supplement.

Underwriters, dealers or agents may make sales of Securities in privately negotiated transactions and/or any other method permitted by law, including sales deemed to be an “at-the-market” offering as defined in National Instrument 44-102 - Shelf Distributions, which includes sales made directly on an existing trading market for the Common Shares, or sales made to or through a market maker other than on an exchange. In connection with any offering of Securities, except with respect to "at-the-market" offerings, the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the offered Securities at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be commenced, interrupted or discontinued at any time. No underwriter of any at-the-market distribution, and no person or company acting jointly or in concert with any such underwriter, may, in connection with such distribution, enter into any transaction that is intended to stabilize or maintain the market price of the securities or securities of the same class as the securities distributed under any at-the-market prospectus supplement, including selling an aggregate number or principal amount of securities that would result in the underwriter creating an over-allocation position in the securities.

If underwriters purchase Securities as principals, such Securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. The obligations of the underwriters to purchase those Securities will be subject to certain conditions precedent, and the underwriters will be obligated to purchase all Securities offered by the Prospectus Supplement if any of such Securities are purchased. Any public offering price and any discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

Securities may also be sold directly by the Company at prices and upon terms agreed to by the purchaser and the Company through agents designated by the Company from time to time. Any agent involved in the offering and sale of Securities pursuant to this Prospectus will be named, and any commissions payable by the Company to that agent will be set forth, in the applicable Prospectus Supplement. Unless otherwise indicated in the Prospectus Supplement, any agent would be acting on a best efforts basis for the period of its appointment.

The Company may agree to pay the underwriters a commission, or the dealers or agents a fee, for various services relating to the issue and sale of any Securities offered by this Prospectus. Any such commission or fee will be paid out of the proceeds of a particular offering or the Company’s general funds. Underwriters, dealers and agents who also participate in the distribution of Securities may be entitled under agreements to be entered into with the Company to indemnification by the Company against certain liabilities, including liabilities under securities legislation, or to contribution with respect to payments that those underwriters, dealers or agents may be required to make in respect thereof. Such underwriters, dealers and agents may be customers of, engage in transactions with, or perform services for the Company in the ordinary course of business.

The plan of distribution with respect to an offering of Securities under this Prospectus will be described in the Prospectus Supplement for the applicable distribution of Securities.

CONSOLIDATED CAPITALIZATION

Since March 31, 2023, the date of our most recently published financial statements, there have been no material changes in our consolidated share and loan capital, other than an increase in the loan capital of the Company totaling €32.3 million due to the initial drawdown on April 5, 2023 in such amount of the €680 million project financing facility with National Bank of Greece S.A. and Piraeus Bank S.A. as lead arrangers as more particularly described in the Interim MD&A. Information relating to any issuances of our Common Shares within the previous twelve month period will be provided as required in the Prospectus Supplement under the heading “Prior Sales”.

EARNINGS COVERAGE RATIO

If we offer Debt Securities having a term to maturity in excess of one year under this Prospectus and any applicable Prospectus Supplement, the applicable Prospectus Supplement will include earnings coverage ratios giving effect to the issuance of such Securities.

DESCRIPTION OF SHARE CAPITAL

Our authorized share capital consists of an unlimited number of Common Shares. As of the date of this Prospectus, there are 185,470,752 Common Shares issued and outstanding.

DESCRIPTION OF COMMON SHARES

The following is a summary of the special rights and restrictions that attach to the Common Shares. Any alteration of the special rights and restrictions attached to the Common Shares must be approved by at least two-thirds of the shareholders voting at a meeting of our shareholders and, if required, approval of at least two-thirds of the shareholders voting separately by class or series.

The holders of the Common Shares are entitled to receive notice of, and to attend and vote at, all meetings of shareholders (other than meetings at which only holders of another class or series of shares are entitled to vote). Each Common Share carries the right to one vote. The holders of the Common Shares are entitled to receive dividends declared by the board of directors in respect of the Common Shares and all dividends shall be declared and paid in equal amounts per Common Share. In the event of the liquidation, dissolution or winding-up of the Company, the holders of the Common Shares will be entitled to receive all of the remaining property and assets of the Company available for distribution, subject to the rights of holders of other classes ranking in priority to the Common Shares with respect to the payment upon liquidation, dissolution or winding-up, on a pro rata basis. There are no pre-emptive rights attached to the Common Shares.

DESCRIPTION OF DEBT SECURITIES

The Debt Securities may be issued in one or more series under an indenture (the “Indenture”) to be entered into between the Company and one or more trustees (the “Trustee”) that may be named in a Prospectus Supplement for a series of Debt Securities. To the extent applicable, the Indenture will be subject to and governed by the United States Trust Indenture Act of 1939, as amended. A copy of the form of the Indenture to be entered into has been or will be filed with the SEC as an exhibit to the registration statement and will be filed with the securities commissions or similar authorities in Canada when it is entered into. The Company may issue Debt Securities, separately or together, with Common Shares, Convertible Securities, Warrants, Rights, Subscription Receipts or Units or any combination thereof, as the case may be.

The description of certain provisions of the Indenture in this section do not purport to be complete and are subject to, and are qualified in their entirety by reference to, the provisions of the Indenture. The following sets forth certain general terms and provisions of the Debt Securities. The particular terms and provisions of a series of Debt Securities offered pursuant to this Prospectus will be set forth in the applicable Prospectus Supplement, and the extent to which the general terms and provisions described below may apply to such Debt Securities will be described in the applicable Prospectus Supplement. This description may include, but may not be limited to, any of the following, if applicable:

| | · | the specific designation of the Debt Securities; |

| | | |

| | · | any limit on the aggregate principal amount of the Debt Securities; |

| | | |

| | · | the date or dates, if any, on which the Debt Securities will mature and the portion (if less than all of the principal amount) of the Debt Securities to be payable upon declaration of acceleration of maturity; |

| | | |

| | · | the rate or rates (whether fixed or variable) at which the Debt Securities will bear interest, if any, the date or dates from which any such interest will accrue and on which any such interest will be payable and the record dates for any interest payable on the Debt Securities; |

| | | |

| | · | the terms and conditions under which the Company may be obligated to redeem, repay or purchase the Debt Securities pursuant to any sinking fund or analogous provisions or otherwise; |

| | | |

| | · | the terms and conditions upon which the Company may redeem the Debt Securities, in whole or in part, at its option; |

| | | |

| | · | the covenants applicable to the Debt Securities; |

| | | |

| | · | the terms and conditions for any conversion or exchange of the Debt Securities for any other securities; |

| | | |

| | · | the extent and manner, if any, to which payment on or in respect of the Debt Securities of the series will be senior or will be subordinated to the prior payment of other liabilities and obligations of the Company; |

| | | |

| | · | whether the Debt Securities will be secured or unsecured; |

| | | |

| | · | whether the Debt Securities will be issuable in the form of global securities (“Global Securities”), and, if so, the identity of the depositary for such Global Securities; |

| | | |

| | · | the denominations in which Debt Securities will be issuable, if other than denominations of US$1,000 or integral multiples of US$1,000; |

| | | |

| | · | each office or agency where payments on the Debt Securities will be made and each office or agency where the Debt Securities may be presented for registration of transfer or exchange; |

| | | |

| | · | if other than United States dollars, the currency in which the Debt Securities are denominated or the currency in which we will make payments on the Debt Securities; |

| | | |

| | · | material Canadian federal income tax consequences and United States federal income tax consequences of owning the Debt Securities; |

| | · | any index, formula or other method used to determine the amount of payments of principal of (and premium, if any) or interest, if any, on the Debt Securities; and |

| | | |

| | · | any other terms, conditions, rights or preferences of the Debt Securities which apply solely to the Debt Securities. |

If the Company denominates the purchase price of any of the Debt Securities in a currency or currencies other than United States dollars or a non-United States dollar unit or units, or if the principal of and any premium and interest on any Debt Securities is payable in a currency or currencies other than United States dollars or a non-United States dollar unit or units, the Company will provide investors with information on the restrictions, elections, general tax considerations, specific terms and other information with respect to that issue of Debt Securities and such non-United States dollar currency or currencies or non-United States dollar unit or units in the applicable Prospectus Supplement.

Each series of Debt Securities may be issued at various times with different maturity dates, may bear interest at different rates and may otherwise vary.

The terms on which a series of Debt Securities may be convertible into or exchangeable for Common Shares or other securities of the Company will be described in the applicable Prospectus Supplement. These terms may include provisions as to whether conversion or exchange is mandatory, at the option of the holder or at the option of the Company, and may include provisions pursuant to which the number of Common Shares or other securities to be received by the holders of such series of Debt Securities would be subject to adjustment.

To the extent any Debt Securities are convertible into Common Shares or other securities of the Company, prior to such conversion the holders of such Debt Securities will not have any of the rights of holders of the securities into which the Debt Securities are convertible, including the right to receive payments of dividends or the right to vote such underlying securities.

DESCRIPTION OF CONVERTIBLE SECURITIES

This description sets forth certain general terms and provisions that could apply to any Convertible Securities that the Company may issue pursuant to this Prospectus. The Company will provide particular terms and provisions of a series of Convertible Securities, and a description of how the general terms and provisions described below may apply to that series, in a Prospectus Supplement.

The Convertible Securities will be convertible or exchangeable into Common Shares and/or other Securities. The Convertible Securities convertible or exchangeable into Common Shares and/or other Securities may be offered separately or together with other Securities, as the case may be. The applicable Prospectus Supplement will include details of the agreement, indenture or other instrument to which such Convertible Securities will be created and issued. The following sets forth the general terms and provisions of such Convertible Securities under this Prospectus.

The particular terms of each issue of such Convertible Securities will be described in the related Prospectus Supplement. This description will include, where applicable: (i) the number of such Convertible Securities offered; (ii) the price at which such Convertible Securities will be offered; (iii) the procedures for the conversion or exchange of such Convertible Securities into or for Common Shares and/or other Securities; (iv) the number of Common Shares and/or other Securities that may be issued upon the conversion or exchange of such Convertible Securities; (v) the period or periods during which any conversion or exchange may or must occur; (vi) the designation and terms of any other Convertible Securities with which such Convertible Securities will be offered, if any; (vii) the gross proceeds from the sale of such Convertible Securities; and (viii) any other material terms and conditions of such Convertible Securities.

DESCRIPTION OF WARRANTS

This section describes the general terms that will apply to any Warrants for the purchase of Common Shares (the “Equity Warrants”) or for the purchase of Debt Securities (the “Debt Warrants”) that may be offered by the Company pursuant to this Prospectus.

Warrants may be offered separately or together with other Securities, as the case may be. Each series of Warrants may be issued under a separate warrant indenture or warrant agency agreement to be entered into between the Company and one or more banks or trust companies acting as Warrant agent or may be issued as stand-alone contracts. The applicable Prospectus Supplement will include details of the Warrant agreements governing the Warrants being offered. The Warrant agent is expected to act solely as the agent of the Company and will not assume a relationship of agency with any holders of Warrant certificates or beneficial owners of Warrants. The following sets forth certain general terms and provisions of the Warrants offered under this Prospectus. The specific terms of the Warrants, and the extent to which the general terms described in this section apply to those Warrants, will be set forth in the applicable Prospectus Supplement. A copy of any warrant indenture or any warrant agency agreement relating to an offering of Warrants will be filed by us with the relevant securities regulatory authorities in Canada after it has been entered into by the Company.

Equity Warrants

The particular terms of each issue of Equity Warrants will be described in the related Prospectus Supplement. This description will include, where applicable:

| | · | the designation and aggregate number of the Equity Warrants; |

| | | |

| | · | the price at which the Equity Warrants will be offered; |

| | | |

| | · | the currency or currencies in which the Equity Warrants will be offered; |

| | | |

| | · | the date on which the right to exercise the Equity Warrants will commence and the date on which the right will expire; |

| | | |

| | · | the class and/or number of Common Shares that may be purchased upon exercise of each Equity Warrant and the price at which and currency or currencies in which the Common Shares may be purchased upon exercise of each Equity Warrant; |

| | | |

| | · | the terms of any provisions allowing for adjustment in (i) the class and/or number of Common Shares or other securities or property that may be purchased, (ii) the exercise price per Common Share, or (iii) the expiry of the Equity Warrants; |

| | | |

| | · | whether the Company will issue fractional shares; |

| | | |

| | · | the designation and terms of any Securities with which the Equity Warrants will be offered, if any, and the number of the Equity Warrants that will be offered with each security; |

| | | |

| | · | the date or dates, if any, on or after which the Equity Warrants and the related Securities will be transferable separately; |

| | | |

| | · | any minimum or maximum number of Equity Warrants that may be exercised at any one time; |

| | | |

| | · | whether the Equity Warrants will be subject to redemption and, if so, the terms of such redemption provisions; |

| | | |

| | · | whether the Company has applied to list the Equity Warrants and/or the related Common Shares on a stock exchange; and |

| | | |

| | · | any other material terms or conditions of the Equity Warrants. |

Debt Warrants

The particular terms of each issue of Debt Warrants will be described in the related Prospectus Supplement. This description will include, where applicable:

| | · | the designation and aggregate number of Debt Warrants; |

| | | |

| | · | the price at which the Debt Warrants will be offered; |

| | | |

| | · | the currency or currencies in which the Debt Warrants will be offered; |

| | | |

| | · | the designation and terms of any Securities with which the Debt Warrants are being offered, if any, and the number of the Debt Warrants that will be offered with each security; |

| | · | the date or dates, if any, on or after which the Debt Warrants and the related Securities will be transferable separately; |

| | | |

| | · | the principal amount of Debt Securities that may be purchased upon exercise of each Debt Warrant and the price at which and currency or currencies in which that principal amount of Debt Securities may be purchased upon exercise of each Debt Warrant; |

| | | |

| | · | the date on which the right to exercise the Debt Warrants will commence and the date on which the right will expire; |

| | | |

| | · | the minimum or maximum amount of Debt Warrants that may be exercised at any one time; |

| | | |

| | · | whether the Debt Warrants will be subject to redemption, and, if so, the terms of such redemption provisions; and |

| | | |

| | · | any other material terms or conditions of the Debt Warrants. |

DESCRIPTION OF RIGHTS

The Company may issue Rights to its shareholders for the purchase of Debt Securities, Common Shares or other Securities. These Rights may be issued independently or together with any other Security offered hereby and may or may not be transferable by the shareholder receiving the Rights in such offering. In connection with any offering of such Rights, the Company may enter into a standby arrangement with one or more underwriters or other purchasers pursuant to which the underwriters or other purchasers may be required to purchase any Securities remaining unsubscribed for after such offering.

Each series of Rights will be issued under a separate rights agreement which the Company will enter into with a bank or trust company, as rights agent, all as set forth in the applicable Prospectus Supplement. The rights agent will act solely as the Company’s agent in connection with the certificates relating to the Rights and will not assume any obligation or relationship of agency or trust with any holders of Rights certificates or beneficial owners of Rights.

The applicable Prospectus Supplement will describe the specific terms of any offering of Rights for which this Prospectus is being delivered, including the following:

| | · | the date of determining the shareholders entitled to the Rights distribution; |

| | | |

| | · | the number of Rights issued or to be issued to each shareholder; |

| | | |

| | · | the exercise price payable for each share of Debt Securities, Common Shares or other Securities upon the exercise of the Rights; |

| | | |

| | · | the number and terms of the shares of Debt Securities, Common Shares or other Securities which may be purchased per each Right; |

| | | |

| | · | the extent to which the Rights are transferable; |

| | | |