VANCOUVER, British Columbia, Oct. 31, 2024 (GLOBE NEWSWIRE) --

Eldorado Gold Corporation (“Eldorado” or “the Company”) today

reports the Company’s financial and operational results for the

third quarter of 2024. For further information, please see the

Company’s Consolidated Financial Statements and Management’s

Discussion and Analysis ("MD&A") filed on SEDAR+ at

www.sedarplus.com under the Company’s profile.

Third Quarter

2024 Highlights

Operations

- Gold production:

125,195 ounces were produced in the quarter. Production increased

3% from Q3 2023, reflecting increased gold production of 13% at

Olympias due to higher gold grades processed and 10% at Kisladag as

a result of increased heap leach inventory drawdown.

- Gold sales:

123,828 ounces at an average realized gold price per ounce

sold1 of $2,492. Gold sales increased 4% from Q3 2023

primarily as a result of increased production at Olympias and

Kisladag.

- Production costs:

$141.2 million in Q3 2024, compared to $115.5 million in Q3 2023.

The increase was due primarily to higher sales volumes, as well as

higher cash costs, the latter impacted by higher royalty expense

due to higher gold sales and higher gold price, as well as

increases in labour costs.

- Total cash

costs1: $953 per ounce gold

sold compared to $794 per ounce gold sold in Q3 2023, with the

increases primarily due to higher royalties (driven by higher gold

prices) and higher labour costs.

- All-in sustaining costs

("AISC")1: $1,335 per ounce

sold compared to $1,177 per ounce sold in Q3 2023, with the

increase due to higher total cash costs combined with higher

sustaining capital.

- Total capital

expenditures: $158.1 million, including $82.7 million of

growth capital1 invested at Skouries, with activity

focused on infrastructure construction. Growth capital at the

operating mines totalled $39.0 million and was primarily related to

Kisladag for continued waste stripping, construction of the North

Heap Leach Pad and related infrastructure.

- Production and cost

outlook: The Company is tightening its 2024 guidance for

gold production, costs, depreciation and capital expenditure,

reflecting updated full-year expectations given the operational and

financial performance to date. Gold production is expected to be

505,000 to 530,000 ounces, from 505,000 to 555,000 ounces. Total

cash costs per ounce sold is expected to be $910 to $940 per ounce

sold, from $840 to $940 per ounce sold, primarily due to lower

production and increased royalties in Greece and Turkiye related to

higher gold price. AISC per ounce sold is expected to be $1,260 to

$1,290 per ounce sold, from $1,190 to $1,290 per ounce sold,

primarily due to higher total cash costs, partially offset by lower

sustaining capital expenditure.

Financial

- Revenue: $331.8

million in Q3 2024, an increase of 36% from $244.8 million in Q3

2023, primarily due to the higher averaged realized gold price and

higher sales volumes.

- Net cash generated from

operating activities from continuing operations: $180.9

million compared to $108.1 million in Q3 2023, primarily due

to higher revenue, partially offset by higher cash costs.

- Cash flow from operating

activities before changes in working

capital2:

$166.5 million compared to $97.5 million in Q3 2023, primarily due

to higher revenue, partially offset by higher cash costs.

- Cash, cash equivalents and

term deposits: $676.6 million, as at September 30,

2024 as compared to $595.1 million as at June 30, 2024, with the

cash increase attributable to strong operating cashflows combined

with the planned Skouries Term Facility drawdown, partially offset

by the significant investing activities, particularly at

Skouries.

- Net earnings (loss)

attributable to shareholders from continuing operations:

$101.1 million, or $0.49 per share, compared to $6.6 million loss

or $0.03 loss per share in Q3 2023, with the increase driven by

higher revenue.

- Adjusted net earnings

before interest, taxes, depreciation and amortization ("Adjusted

EBITDA")2:

$169.0 million compared to $108.7 million in Q3 2023, with the

increase driven by higher revenue, partially offset by the

adjustment of a gain on recognition of deferred consideration.

- Adjusted net

earnings2: $71.0 million or

$0.35 per share compared to $35.0 million or $0.17 per share in Q3

2023. Adjustments in Q3 2024 include a $33.1 million unrealized

loss on derivative instruments, a $50.1 million gain on recognition

of deferred consideration net of tax impacts related to commercial

production being declared at the Tocantinzinho Mine, which was

divested to G Mining Ventures in 2021, and a $15.3 million gain on

foreign exchange due to the translation of deferred tax balances

and Turkiye inflation accounting.

- Free cash

flow2:

Negative $4.8 million in Q3 2024 compared to negative $19.3 million

in Q3 2023, with the increase in higher operating cash flow,

primarily due to the higher average realized gold price and higher

sales volumes, partially offset by continued investment at

Skouries.

- Free cash flow excluding

Skouries2:

$98.3 million in Q3 2024 compared to $37.3 million in Q3 2023, with

the increase driven by higher operating cash flow, primarily due to

the higher average realized gold price and higher sales

volumes.

- Project Facility:

Drawdowns on the Skouries Term Facility during Q3 2024 totalled

€83.7 million and year to date as at September 30, 2024

totalled €201.8 million.

Corporate

“As gold prices reached record highs during the

quarter we continued to realize margin expansion and strong cash

flow generation across our operations,” said George Burns,

President and Chief Executive Officer. “Free cash flow before

Skouries investment totalled $98.3 million.”

“At Olympias, we successfully concluded the CBA

negotiations and reached a mutually beneficial agreement with the

union workforce in early August. This three-year agreement combined

with increased productivity in our underground operations, and as

contemplated in our guidance, supports the 650ktpa expansion, an

increase from 500ktpa, positioning Olympias for long-term

profitability over its current mine life of 15 years. In Canada, at

Lamaque, progress continued on the Ormaque bulk sample. We have

begun stockpiling material ahead of processing it through the mill

in the fourth quarter and remain on track to declare an inaugural

reserve later this year.”

“At Kisladag, we encountered a few operational

challenges including lower tonnes stacked, slightly lower recovery

and a longer leach cycle than planned. Throughout the quarter, we

implemented a number of improvements to address these issues. This

included improving the stacking sequence where we have started to

see positive results. In addition, we have begun to see improved

solution management through various innovative methods that are

being deployed to help draw down the gold inventory.”

“Production reached 364,625 ounces in the first

nine months of the year, an increase of 7% compared to 2023, and

12% compared to 2022, respectively. We are on track to meet our

2024 production and cost guidance. We have tightened the gold

production range to between 505,000 to 530,000 ounces. As gold

prices hit record highs in the third quarter, we continued to

experience increased royalty costs, which has impacted our overall

costs, and we expect full year all-in sustaining costs to be near

the upper end of guidance of between $1,260 and $1,290 per

ounce."

"Our transformational Skouries project continues

to track on budget and on schedule with first production expected

in the third quarter of 2025. Solid progress was made during the

third quarter, with overall project completion currently at 79%. As

anticipated, the contract was awarded for the steel and mechanical

installations for the filter building during the quarter, which is

part of the critical path. Thus far the construction workforce

productivity is slightly beating our assumptions. With

approximately 1,000 personnel working, we are making steady

progress towards our year-end target of 1,300. Our focus once we

have the additional personnel onsite will turn to integrating them

at our assumed productivity levels to maintain the schedule and

budget. We are managing this closely and taking proactive measures

to mitigate potential challenges in a tight construction labour

market. To view the progress see our Q3 2024 progress update video

linked below."

Q3 2024 progress update video link: https://youtu.be/js0MxV8Dgdo

Skouries Highlights

Growth capital invested totalled $82.7 million

in Q3 2024 and $227.1 million during the nine months ended

September 30, 2024. At September 30, 2024, the growth capital

invested towards the overall capital estimate of $920 million

totalled $411.9 million.

In 2024, the expected capital spend has been

lowered to between $350 and $380 million from the original guidance

of $375 and $425 million. The lowered capital is not expected to

impact first production as it is primarily related to rescheduled

work that has been shifted to a later phase of the project that is

not on the critical path, and reflects a slower than expected

ramp-up of contractor mobilization during the first three quarters

of 2024.

First production of the copper-gold concentrate

is expected in Q3 2025, with expected 2025 gold production of

50,000 to 60,000 ounces and copper production of 15 to 20 million

pounds. The project remains on track for commercial production at

the end of 2025.

Table 1: Skouries Project – Project

Expenditures (January 1, 2023 to September 30, 2024)

|

Millions of US$ |

As of September 30, 2024 |

|

Total capital estimate |

$920 |

|

Expenditures incurred since project restart |

412 |

|

Remaining spend |

508 |

|

Committed expenditures - including expenditures incurred |

788 |

|

Uncommitted expenditures |

132 |

Construction

Activities

Overall construction progress is 79% when

including the first phase of construction.

Work continues to advance on the filtered

tailings building which is on the critical path. In September, the

first contract for the filtered tailings building was awarded for

the structure and mechanical installations. For efficiency, the

contract was split into two components:

|

|

1) |

filtered tailings building structure and mechanical installations,

and |

|

|

2) |

piping, electrical and instrumentation. |

|

|

|

|

Piling has been completed for the filtered

tailings building and concrete work is progressing to enable

construction of the structural steel. With three active drills on

site, the piles for the filtered tailings facility ancillary

buildings continue to progress. To date, 388 piles have been

completed out of a total of 871. As previously announced, the

fabricated frames for the filter press plates arrived on site

during Q2 2024, and all filter press components have now been

delivered to site.

Primary Crusher Building

Progress continued to advance on the foundation

construction of the primary crusher with retaining walls and

stabilized excavations nearing completion. Construction of the

crusher building structure will commence in November.

Process plant

Work in the process plant continues to progress.

Re-lining of the flotation tanks was completed as planned and

structural and mechanical work is in progress. Off-site pipe spool

fabrication continues and delivery of high-density polyethylene

piping to site has commenced. Scaffolding is advancing to support

electrical cable tray and piping installations and the contractor

continues to ramp up to support increasing levels of activity. Work

has also commenced on support infrastructure including the process

control room building, process plant sub-station, water pump

station, lime plant, air blowers building, compressor building and

flotation reagent areas.

Thickeners

Construction of the three thickeners progressed

on plan during the quarter. Major concrete pours are complete for

the foundations of the first two thickeners. Support columns are

complete on the first thickener and over 50% complete for the

second thickener. Construction of the third thickener will start in

Q4 2024 following completion of the first thickener.

Integrative Extractive Waste Management

Facility (the "IEWMF")

During Q3 2024, construction continued to

progress at the coffer dam site with excavation of the spillway and

foundation preparation. By the end of 2024, the Company expects to

have completed the first of two water management ponds, coffer dam

and significantly advanced the earthworks. Work continues to

progress with foundation preparation for the KL Embankment

(tailings embankment) and the fill placement for water management

pond 2 has advanced on plan for completion at year end. Excavations

for water management pond 1 continue and development of the

low-grade ore stockpile advanced with foundation preparation, drain

construction and fill placement.

Underground Development

Progress has been made on the underground with

expansion of the underground services for water management,

ventilation and electrical distribution. Approximately 70% of the

equipment and operator licenses have been received to date and

development mining is ramping up. Access to the test stopes is

advancing at the upper level as planned and the priority for the

balance of the year is to advance the main decline and gain access

to the bottom elevations of the test stopes. The schedule to

receive all licenses and permits was later than planned and while

the contractor is ramping up, it has delayed the completion of the

expected 2,200 metres of underground development for 2024. The

underground development for 2024 is now expected to be between 500

and 600 metres. While the metres are not on track with guidance the

underground is not on the critical path for first production, in

addition, this does not impact the overall timing for the two test

stopes which are expected to be completed in Q3 2025.

Engineering, Procurement and

Operational Readiness

Engineering

As engineering works are now at 78% and are

nearing substantial completion, the focus has been on finalizing

engineering to support the construction schedule. The release of

structural steel for fabrication is nearing completion and steel

deliveries have commenced to site to support steel construction in

the process plant and filtered tailings building.

Procurement

At the end of Q3 2024, procurement is

substantially complete, with all long-lead items procured and the

focus on managing fabrication and deliveries.

Operational Readiness

A key focus of the operational readiness team is

to establish a strong, risk-based operational readiness plan. Key

departmental plans have been developed, an overarching governance

framework established, and weekly leadership forums and monthly

steering committee reviews established. Specialized support has

been engaged to focus on processing operationalization, and

readiness support. Further work is ongoing to establish detailed

readiness plans for support and shared services. Priority focus

areas have been identified and resource allocation adjusted

accordingly.

The development of the Management Operating

System (MOS) is currently focused on providing frontline supervisor

and worker practices and procedures to the open pit operations

team. These practices and procedures are established to ensure

adherence to standards as well as establishing best practices and

overall transparency across planning, execution, reporting and

remediation to the frontline team. Several workshops were held with

the heads of functions and initial departmental workflows were

established.

The training department’s short-term priority

was developing a training plan for the open pit excavation

activities in line with the recently adopted competency-based

framework. The competency-based framework identifies specific

competencies per role and then assesses the employee’s performance

against specific performance criteria on knowledge, skills and

attitude. This competency-based framework will ensure improved

individual performance compared to the previous time in role-based

competency framework only. Training material as well as training

providers are in place and four (4) CAT 6020B hydraulic excavator

operators commenced training during October 2024. This program will

be expanded with the arrival of additional mining equipment in H1

2025. The Mavres Petres main training building structural upgrade

has been completed and the focus for the coming quarter will be to

equip practical training workbenches for basic skills training and

assessment as well as for refresher training.

Operations

The operations team completed their labour

strategy and associated organizational designs. Recruitment is

underway at local and national levels. Several local and national

job fairs are planned for Q4 2024 to attract as many as possible

potential employees.

The CAT 6020B hydraulic excavator was assembled

during the quarter and training of operators commenced in October

2024. Most of the remaining open pit mining fleet will arrive

during H1 2025. The first operational plan was prepared that

combines the completion of construction pre-stripping and the start

of open pit mining in H1 2025. A similar plan is being prepared for

the underground mine and the expectation is that both the surface

and underground mining will be operationalized during Q4 2024.

Other operational, commercial and administrative

departments made progress in recruiting their leadership and

supervision employees and setting up operating and commercial

processes.

Workforce

In addition to the Operational Readiness team,

as at September 30, 2024, there were approximately 1,000 personnel

working. Thus far the construction workforce productivity is

slightly ahead of our assumptions. We are making steady progress

towards our year-end target of 1,300 workers on site. Our focus

once we have the additional personnel onsite will turn to

integrating them at our assumed productivity levels to maintain the

schedule and budget. We are managing this closely and taking

proactive measures to mitigate potential challenges in a tight

construction labour market.

Skouries key milestones in 2024,

which include:

|

Area of Focus |

Key Milestone |

Status |

|

Procurement and Engineering |

- Substantial completion of procurement and engineering

|

- Substantial completion of engineering on track for Q4

2024

- Procurement substantially complete

|

|

Process Plant |

- Construction of the control room and electrical room

building

|

- Q1 2024 commenced

- Electrical room building on track for completion in Q4

2024

|

- Construction of the tailings thickeners

|

|

|

Filtered Tailings Facility |

- Awarding of the first filter facility construction

contract

|

- Q3 2024 first contract awarded

|

|

Integrated Extractive Waste Management Facility

("IEWMF") |

- Completion of the coffer dam

|

- On track for completion in Q4 2024

|

|

Underground |

- Awarding of the underground development and test stoping

contract

|

- Contract awarded and approximately 70% of the equipment

and operator licenses have been received to date and development is

ramping up

|

- Completion of approximately 2,200 metres of underground

development

|

- Expected completion lowered to between 500 and 600 metres (see

section titled 'Underground Development')

- Ore from test stopes still on track for delivery during plant

commissioning period in 2025

|

| |

|

|

Consolidated Financial and Operational

Highlights

|

|

3 months ended September

30,

|

|

|

9 months ended September

30,

|

|

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$331.8 |

|

|

$244.8 |

|

|

|

$886.9 |

|

|

$701.6 |

|

|

Gold produced (oz) |

|

125,195 |

|

|

121,030 |

|

|

|

364,625 |

|

|

341,973 |

|

|

Gold sold (oz) |

|

123,828 |

|

|

119,200 |

|

|

|

361,062 |

|

|

339,151 |

|

|

Average realized gold price ($/oz sold) (2) |

|

$2,492 |

|

|

$1,879 |

|

|

|

$2,309 |

|

|

$1,920 |

|

|

Production costs |

|

141.2 |

|

|

115.5 |

|

|

|

392.0 |

|

|

341.3 |

|

|

Total cash costs ($/oz sold) (2,3) |

|

953 |

|

|

794 |

|

|

|

939 |

|

|

858 |

|

|

All-in sustaining costs ($/oz sold) (2,3) |

|

1,335 |

|

|

1,177 |

|

|

|

1,310 |

|

|

1,225 |

|

|

Net earnings (loss) for the period (1) |

|

95.0 |

|

|

(8.0 |

) |

|

|

184.1 |

|

|

12.2 |

|

|

Net earnings (loss) per share – basic ($/share) (1) |

|

0.46 |

|

|

(0.04 |

) |

|

|

0.90 |

|

|

0.06 |

|

|

Net earnings (loss) per share – diluted ($/share)

(1) |

|

0.46 |

|

|

(0.04 |

) |

|

|

0.90 |

|

|

0.06 |

|

|

Net earnings (loss) for the period continuing operations

(1,4) |

|

101.1 |

|

|

(6.6 |

) |

|

|

192.7 |

|

|

14.4 |

|

Net earnings (loss) per share continuing operations –

basic ($/share)(1,4) |

|

0.49 |

|

|

(0.03 |

) |

|

|

0.95 |

|

|

0.07 |

|

Net earnings (loss) per share continuing operations –

diluted ($/share)(1,4) |

|

0.49 |

|

|

(0.03 |

) |

|

|

0.94 |

|

|

0.07 |

|

|

Adjusted net earnings continuing operations – basic

(1,2,4) |

|

71.0 |

|

|

35.0 |

|

|

|

192.9 |

|

|

61.4 |

|

Adjusted net earnings per share continuing operations

($/share)(1,2,4) |

|

0.35 |

|

|

0.17 |

|

|

|

0.95 |

|

|

0.32 |

|

|

Net cash generated from operating activities (4) |

|

180.9 |

|

|

108.1 |

|

|

|

388.4 |

|

|

223.3 |

|

|

Cash flow from operating activities before changes in working

capital (2,4) |

|

166.5 |

|

|

97.5 |

|

|

|

407.0 |

|

|

273.1 |

|

|

Free cash flow (2,4) |

|

(4.8 |

) |

|

(19.3 |

) |

|

|

(67.8 |

) |

|

(76.4 |

) |

|

Free cash flow excluding Skouries (2,4) |

|

98.3 |

|

|

37.3 |

|

|

|

165.8 |

|

|

30.7 |

|

|

Cash, cash equivalents and term deposits (4) |

|

676.6 |

|

|

476.6 |

|

|

|

676.6 |

|

|

476.6 |

|

|

Total assets |

|

5,565.1 |

|

|

4,812.2 |

|

|

|

5,565.1 |

|

|

4,812.2 |

|

|

Debt (4) |

|

849.2 |

|

|

596.5 |

|

|

|

849.2 |

|

|

596.5 |

|

|

|

(1) |

Attributable to shareholders of the Company. |

|

|

(2) |

These financial measures or ratios are non-IFRS financial

measures or ratios. See the section 'Non-IFRS and Other Financial

Measures and Ratios' of our MD&A for explanations and

discussions of these non-IFRS financial measures or

ratios. |

|

|

(3) |

Revenues from silver, lead and zinc sales are off-set against

total cash costs. |

|

|

(4) |

Amounts presented for 2024 and 2023 are from continuing

operations only and exclude the Romania segment. See Note 4 of our

condensed consolidated interim financial statements for the three

and nine months ended September 30, 2024. |

|

|

|

|

Total revenue increased to $331.8 million in Q3

2024 from $244.8 million in Q3 2023 and to $886.9 million in the

nine months ended September 30, 2024, from $701.6 million in

the nine months ended September 30, 2023. The increases in

both three and nine-month periods were primarily due to the higher

average realized gold price as well as the higher sales

volumes.

Production costs increased to $141.2 million in

Q3 2024 from $115.5 million in Q3 2023 and to $392.0 million in the

nine months ended September 30, 2024 from $341.3 million in

the nine months ended September 30, 2023. Increases in both

periods were driven primarily by higher sales volume as well as

higher cash costs, the latter impacted by higher royalty expense

due to higher gold sales and higher gold price, as well as

increases in labour costs.

Total cash costs3 averaged $953 per

ounce sold in Q3 2024, an increase from $794 in Q3 2023, and $939

the nine months ended September 30, 2024 from $858 in the nine

months ended September 30, 2023. The increases in both the

three and nine-month periods were primarily due to higher royalties

(driven by higher gold prices) and labour costs.

In the quarter, AISC4 averaged $1,335

per ounce sold in Q3 2024, an increase from $1,177 in Q3 2023, and

$1,310 the nine months ended September 30, 2024 from $1,225 in

the nine months ended September 30, 2023, with the increases

in both the three and nine-month periods due to higher total cash

costs combined with higher sustaining capital.

Eldorado reported net earnings attributable to

shareholders from continuing operations of $101.1 million ($0.49

earnings per share) in Q3 2024 compared to a net loss of $6.6

million ($0.03 loss per share) in Q3 2023 and net earnings of

$192.7 million ($0.95 earnings per share) in the nine months ended

September 30, 2024 compared to net earnings of $14.4 million

($0.07 earnings per share) in the nine months ended

September 30, 2023. The increases in net earnings in both the

three and nine-month periods were driven by higher operating income

due primarily to higher average realized gold price as well as

stronger gold sales and the gain on deferred consideration,

partially offset by higher unrealized derivative losses.

Adjusted net earnings4 was $71.0

million ($0.35 earnings per share) in Q3 2024 compared to adjusted

net earnings of $35.0 million ($0.17 earnings per share) in Q3

2023. Adjustments in Q3 2024 include a $33.1 million unrealized

loss on derivative instruments, a $50.1 million gain on recognition

of deferred consideration net of tax impacts related to commercial

production being declared at the Tocantinzinho Mine, which was

divested to G Mining Ventures in 2021, and a $15.3 million gain on

foreign exchange due to the translation of deferred tax balances

and Turkiye inflation accounting.

Adjusted net earnings was $192.9 million ($0.95

earnings per share) in the nine months ended September 30,

2024 compared to adjusted net earnings of $61.4 million ($0.32

earnings per share) in the nine months ended September 30,

2023. Adjustments in the nine months ended September 30, 2024

include a $61.9 million unrealized loss on derivative instruments,

a $50.1 million gain on recognition of deferred consideration net

of tax impacts mentioned above, and a $11.9 million gain on foreign

exchange due to the translation of deferred tax balances net of

Turkiye inflation accounting.

Quarterly Operations Update

|

|

3 months ended September

30,

|

|

|

9 months ended September

30,

|

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ounces produced |

|

125,195 |

|

|

121,030 |

|

|

|

364,625 |

|

|

341,973 |

|

|

Ounces sold |

|

123,828 |

|

|

119,200 |

|

|

|

361,062 |

|

|

339,151 |

|

|

Production costs |

|

$141.2 |

|

|

$115.5 |

|

|

|

$392.0 |

|

|

$341.3 |

|

|

Total cash costs ($/oz sold) (1,2) |

|

$953 |

|

|

$794 |

|

|

|

$939 |

|

|

$858 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

|

$1,335 |

|

|

$1,177 |

|

|

|

$1,310 |

|

|

$1,225 |

|

|

Sustaining capital expenditures (2) |

|

$33.3 |

|

|

$31.8 |

|

|

|

$93.2 |

|

|

$83.9 |

|

|

Kisladag |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ounces produced |

|

41,084 |

|

|

37,219 |

|

|

|

117,597 |

|

|

108,558 |

|

|

Ounces sold |

|

40,724 |

|

|

38,732 |

|

|

|

117,068 |

|

|

108,405 |

|

|

Production costs |

|

$37.3 |

|

|

$28.6 |

|

|

|

$106.5 |

|

|

$86.7 |

|

|

Total cash costs ($/oz sold) (1,2) |

|

$899 |

|

|

$722 |

|

|

|

$889 |

|

|

$778 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

|

$1,028 |

|

|

$884 |

|

|

|

$1,002 |

|

|

$897 |

|

|

Sustaining capital expenditures (2) |

|

$3.7 |

|

|

$5.5 |

|

|

|

$8.9 |

|

|

$10.5 |

|

|

Lamaque |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ounces produced |

|

43,106 |

|

|

43,821 |

|

|

|

132,796 |

|

|

120,450 |

|

|

Ounces sold |

|

44,531 |

|

|

40,908 |

|

|

|

132,776 |

|

|

119,455 |

|

|

Production costs |

|

$32.8 |

|

|

$26.9 |

|

|

|

$101.6 |

|

|

$84.4 |

|

|

Total cash costs ($/oz sold) (1,2) |

|

$728 |

|

|

$648 |

|

|

|

$755 |

|

|

$697 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

|

$1,189 |

|

|

$1,099 |

|

|

|

$1,228 |

|

|

$1,143 |

|

|

Sustaining capital expenditures (2) |

|

$20.0 |

|

|

$18.0 |

|

|

|

$61.1 |

|

|

$52.0 |

|

|

Efemcukuru |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ounces produced |

|

19,794 |

|

|

21,142 |

|

|

|

60,692 |

|

|

63,714 |

|

|

Ounces sold |

|

19,741 |

|

|

21,364 |

|

|

|

60,817 |

|

|

63,581 |

|

|

Production costs |

|

$26.4 |

|

|

$20.6 |

|

|

|

$73.0 |

|

|

$58.7 |

|

|

Total cash costs ($/oz sold) (1,2) |

|

$1,325 |

|

|

$990 |

|

|

|

$1,185 |

|

|

$947 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

|

$1,578 |

|

|

$1,205 |

|

|

|

$1,336 |

|

|

$1,137 |

|

|

Sustaining capital expenditures (2) |

|

$4.7 |

|

|

$3.7 |

|

|

|

$10.7 |

|

|

$9.6 |

|

|

Olympias |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ounces produced |

|

21,211 |

|

|

18,848 |

|

|

|

53,540 |

|

|

49,251 |

|

|

Ounces sold |

|

18,833 |

|

|

18,196 |

|

|

|

50,401 |

|

|

47,710 |

|

|

Production costs |

|

$44.7 |

|

|

$39.3 |

|

|

|

$110.9 |

|

|

$111.6 |

|

|

Total cash costs ($/oz sold) (1,2) |

|

$1,210 |

|

|

$1,048 |

|

|

|

$1,241 |

|

|

$1,325 |

|

|

All-in sustaining costs ($/oz sold) (1,2) |

|

$1,513 |

|

|

$1,319 |

|

|

|

$1,520 |

|

|

$1,614 |

|

|

Sustaining capital expenditures (2) |

|

$4.9 |

|

|

$4.7 |

|

|

|

$12.5 |

|

|

$11.8 |

|

|

|

(1) |

Revenues from silver, lead and zinc sales are off-set against

total cash costs. |

|

|

(2) |

These financial measures or ratios are non-IFRS financial

measures or ratios. See the section 'Non-IFRS and Other Financial

Measures and Ratios' of our MD&A for explanations and

discussions of these non-IFRS financial measures or

ratios. |

|

|

|

|

Kisladag

Kisladag produced 41,084 ounces of gold in Q3

2024, a 10% increase from 37,219 ounces produced in Q3 2023.

Production in the quarter benefited from both higher average grade

and higher stacking rates from earlier in the year. Grade slightly

increased from 0.85 grams per tonne in Q3 2023 to 0.86 grams per

tonne in Q3 2024 as a result of mine planning changes and positive

grade reconciliation.

Availability of the crushing circuit has been

impacted due to maintenance issues, leading to slightly lower

tonnes stacked compared to plan. We are working on a solution and

expect to install it in Q1 2025. In addition, a small portion of

the ore product coming from the high pressure grinding rolls

("HPGR") contains particles that are greater than 10mm which has

slightly reduced recovery due to the larger particle size. As we

continue to analyze data following the ramp-up of the HPGR and

agglomeration drum, we are seeing leach cycles extending beyond the

planned 220 days which leads to an increase in gold inventory.

We have responded to these operational

challenges through irrigation optimization activities, which have

demonstrated positive results through the drawdown of gold

inventory partially offsetting the longer leach cycle.

Additionally, as we have previously discussed, a geometallurgical

study has commenced with drilling currently underway. Starting in

Q4 2024, as the new Adsorption-Desorption facility goes into

operations we will also realize a number of benefits at Kisladag

including: reducing carbon handling requirements, realigning the

extraction cycle with the stacking cycle and decoupling the North

and South heap leach facilities.

Revenue increased to $102.2 million in Q3 2024

from $75.2 million in Q3 2023, reflecting the higher average

realized gold price as well as higher ounces sold.

Production costs increased to $37.3 million in

Q3 2024 from $28.6 million in Q3 2023, with more than half the

increase attributable to the higher sales volume, as well as higher

royalty expense due to both the higher average realized gold price

and higher gold sales. As a result, total cash costs per ounce

increased to $899 in Q3 2024 from $722 in Q3 2023.

AISC per ounce sold increased to $1,028 in Q3

2024 from $884 in Q3 2023, primarily due to the increase in total

cash costs per ounce sold.

Sustaining capital expenditures were $3.7

million in Q3 2024 and $8.9 million in the nine months ended

September 30, 2024, which primarily included equipment

rebuilds, mine equipment purchases and geotechnical drilling and

monitoring. Growth capital investment of $27.4 million and $85.1

million in the three and nine months ended September 30, 2024

and was primarily related to waste stripping and associated

equipment costs to support the mine life extension, continued

construction of the second phase of the North Heap Leach Pad and

adsorption-desorption-regeneration plant infrastructure, and

preparation work for building relocation due to pit expansion.

Lamaque

Lamaque produced 43,106 ounces of gold in Q3

2024, compared to 43,821 ounces in Q3 2023. The slight decrease was

primarily due to lower grades processed, partially offset by

increased throughput. Average grade decreased to 6.03 grams per

tonne in Q3 2024 from 7.04 grams per tonne in the comparative

quarter.

Revenue increased to $111.6 million in Q3 2024

from $79.1 million in Q3 2023, reflecting the higher average

realized gold price as well as higher ounces sold.

Production costs increased to $32.8 million in

Q3 2024 from $26.9 million in Q3 2023 due to higher sales volume,

as well as additional costs incurred in labour, contractors, and

equipment rentals. Total cash costs were also impacted by slightly

higher royalties due to the higher average realized gold price,

with total cash costs per ounce sold increasing to $728 in Q3 2024

from $648 in Q3 2023.

AISC per ounce sold increased to $1,189 in Q3

2024 from $1,099 in Q3 2023, primarily due to higher total cash

costs per ounce as well as higher sustaining capital.

Sustaining capital expenditures of $20.0 million

in Q3 2024 and $61.1 million in the nine months ended September 30,

2024 primarily included underground development, equipment rebuilds

and expenditure on the expansion of the tailings facility. Growth

capital investment of $6.4 million in Q3 2024 and $18.9 million in

the nine months ended September 30, 2024 was primarily related to

resource conversion drilling and initiation of the bulk sample

development at Ormaque.

The inaugural reserve at Ormaque is expected to

be announced by the end of 2024, and material for the bulk sample

is now being stockpiled in preparation for processing through the

mill in December.

Efemcukuru

Efemcukuru produced 19,794 ounces of gold in Q3

2024, a 6% decrease from 21,142 ounces in Q3 2023. The slight

decrease was primarily driven by lower throughput and lower

grade.

Revenue increased to $52.3 million in Q3 2024

from $39.1 million in Q3 2023, with the increase attributable to

the higher average realized gold price, partially offset by lower

sales volume.

Production costs increased to $26.4 million in

Q3 2024 from $20.6 million in Q3 2023, with the increase

attributable to higher unit costs, primarily a result of increased

royalty expense due to the higher average realized gold price

during the quarter. Additionally, labour and transportation costs

have increased compared to the comparative period of the prior

year. Overall, this resulted in an increase to total cash costs per

ounce sold to $1,325 in Q3 2024 from $990 in Q3 2023.

AISC per ounce sold increased to $1,578 in Q3

2024 from $1,205 in Q3 2023, primarily due to higher total cash

costs per ounce.

Sustaining capital expenditures of $4.7 million

in Q3 2024 and $10.7 million in the nine months ended September 30,

2024 were primarily related to underground development and

equipment rebuilds. Growth capital investment of $1.2 million in Q3

2024 and $3.3 million in the nine months ended September 30,

2024 supported underground development to Kokarpinar.

Olympias

Olympias produced 21,211 ounces of gold in Q3

2024, a 13% increase from 18,848 ounces in Q3 2023 primarily driven

by higher grade ore, which reflected stope sequencing in the

quarter.

Revenue increased to $65.7 million in Q3 2024

from $51.4 million in Q3 2023, primarily as a result of the higher

average realized gold price and slightly higher ounces sold.

Production costs increased to $44.7 million in

Q3 2024 from $39.3 million in Q3 2023 driven by higher labour costs

and higher royalty expenses as a result of higher realized gold

prices, as well as higher gold ounces sold. The increase in unit

costs, which were partially offset by higher by-product revenues,

resulted in an increase to total cash costs per ounce sold to

$1,210 in Q3 2024 from $1,048 in Q3 2023.

AISC per ounce sold increased to $1,513 in Q3

2024 from $1,319 in Q3 2023 primarily due to higher total cash

costs per ounce sold.

Sustaining capital expenditures of $4.9 million

in Q3 2024 and $12.5 million in the nine months ended

September 30, 2024 primarily included underground development

and process improvements. Growth capital investment of $4.1 million

in Q3 2024 and $6.7 million in the nine months ended

September 30, 2024 was primarily related to underground

development and investment towards the mill throughput

expansion.

During Q3 2024, the Collective Bargaining

Agreement was finalized. This three-year

agreement, combined with increased productivity in our

underground operations and as contemplated in our guidance,

supports the 650ktpa expansion, an increase from 500ktpa.

For further information on the Company's

operating results for the third quarter of 2024, please see the

Company’s MD&A filed on SEDAR+ at www.sedarplus.com

under the Company’s profile.

Conference Call

A conference call to discuss the details of the

Company’s Third Quarter 2024 Results will be held by senior

management on Friday, November 1, 2024 at 11:30 AM ET (8:30 AM PT).

The call will be webcast and can be accessed at Eldorado’s website:

www.eldoradogold.com or via this link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=EB9o82Zh.

Participants may elect to pre-register for the

conference call via this link: https://dpregister.com/sreg/10192246/fd5e1d8d60.

Upon registration, participants will receive a calendar invitation

by email with dial in details and a unique PIN. This will allow

participants to bypass the operator queue and connect directly to

the conference. Registration will remain open until the end of the

conference call.

|

Conference Call Details |

Replay (available until December 6

2024) |

|

Date: |

November 1, 2024 |

Vancouver: |

+1 412 317 0088 |

| Time: |

11:30 AM ET

(8:30 AM PT) |

Toll

Free: |

1 855 669

9658 |

| Dial

in: |

+1 647 484

8814 |

Access

code: |

6725564 |

| Toll

free: |

1 844 763

8274 |

|

|

| |

|

|

|

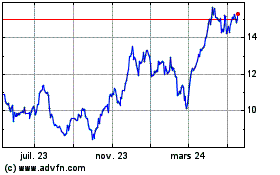

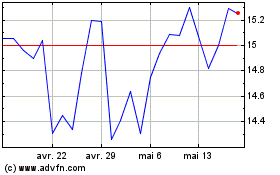

About Eldorado

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkiye, Canada

and Greece. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Lynette Gould, VP, Investor Relations,

Communications & External Affairs

647 271 2827 or 1 888 353 8166

lynette.gould@eldoradogold.com

Media

Chad Pederson, Director, Communications and

Public Affairs

236 885 6251 or 1 888 353 8166

chad.pederson@eldoradogold.com

Non-IFRS and Other Financial Measures and

Ratios

Certain non-IFRS financial measures and ratios

are included in this press release, including total cash costs and

total cash costs per ounce sold, all-in sustaining costs ("AISC")

and AISC per ounce sold, sustaining and growth capital, average

realized gold price per ounce sold, adjusted net earnings/(loss)

attributable to shareholders, adjusted net earnings/(loss) per

share attributable to shareholders, earnings before interest,

taxes, depreciation and amortization (“EBITDA”), adjusted earnings

before interest, taxes, depreciation and amortization ("Adjusted

EBITDA"), free cash flow, and free cash flow excluding

Skouries.

Please see the September 30, 2024 MD&A

for explanations and discussion of these non-IFRS and other

financial measures and ratios. The Company believes that these

measures and ratios, in addition to conventional measures and

ratios prepared in accordance with International Financial

Reporting Standards (“IFRS”), provide investors an improved ability

to evaluate the underlying performance of the Company. The non-IFRS

and other financial measures and ratios are intended to provide

additional information and should not be considered in isolation or

as a substitute for measures or ratios of performance prepared in

accordance with IFRS. These measures and ratios do not have any

standardized meaning prescribed under IFRS, and therefore may not

be comparable to other issuers. Certain additional disclosures for

these and other financial measures and ratios have been

incorporated by reference and can be found in the section 'Non-IFRS

and Other Financial Measures and Ratios' in the September 30,

2024 MD&A available on SEDAR+ at www.sedarplus.com and on the

Company's website under the 'Investors' section.

Reconciliation of Production Costs to Total

Cash Costs and Total Cash Costs per Ounce Sold:

|

|

|

Q3 2024 |

|

|

Q3 2023 |

|

|

|

YTD 2024 |

|

|

YTD 2023 |

|

|

Production costs |

|

$141.2 |

|

|

$115.5 |

|

|

|

$392.0 |

|

|

$341.3 |

|

| By-product credits

(1) |

|

(26.9 |

) |

|

(23.7 |

) |

|

|

(64.3 |

) |

|

(61.5 |

) |

|

Concentrate deductions (2) |

|

$3.7 |

|

|

$2.9 |

|

|

|

$11.2 |

|

|

$11.1 |

|

|

Total cash costs |

|

$118.0 |

|

|

$94.7 |

|

|

|

$339.0 |

|

|

$291.0 |

|

| Gold

ounces sold |

|

123,828 |

|

|

119,200 |

|

|

|

361,062 |

|

|

339,151 |

|

|

Total cash cost per ounce sold |

|

$953 |

|

|

$794 |

|

|

|

$939 |

|

|

$858 |

|

|

|

(1) |

Revenue from silver, lead and zinc sales. |

|

|

(2) |

Included in revenue. |

|

|

|

|

Reconciliation of Total Cash Costs and Total

Cash Cost per ounce sold, by asset, for the three months

ended September 30, 2024:

|

|

Direct

operating

costs |

|

By-product

credits |

|

Refining

and selling

costs |

|

Inventory

change (1) |

|

Royalty

expense |

|

Total cash

costs |

|

Gold oz

sold |

|

Total cash

cost/oz sold |

|

|

Kisladag |

|

$36.1 |

|

|

($0.7 |

) |

|

$0.1 |

|

|

($6.8 |

) |

|

$7.9 |

|

|

$36.6 |

|

|

40,724 |

|

|

$899 |

|

|

Lamaque |

|

32.4 |

|

|

(0.4 |

) |

|

0.1 |

|

|

(1.0 |

) |

|

1.3 |

|

|

32.4 |

|

|

44,531 |

|

|

728 |

|

|

Efemcukuru |

|

18.0 |

|

|

(1.4 |

) |

|

3.7 |

|

|

(0.2 |

) |

|

6.0 |

|

|

26.2 |

|

|

19,741 |

|

|

1,325 |

|

|

Olympias |

|

38.6 |

|

|

(24.4 |

) |

|

4.6 |

|

|

(1.8 |

) |

|

5.8 |

|

|

22.8 |

|

|

18,833 |

|

|

1,210 |

|

|

Total consolidated |

|

$125.2 |

|

|

($26.9 |

) |

|

$8.5 |

|

|

($9.8 |

) |

|

$21.0 |

|

|

$118.0 |

|

|

123,828 |

|

|

$953 |

|

|

|

(1) |

Inventory change adjustments result from timing differences

between when inventory is produced and when it is sold. |

|

|

|

|

Reconciliation of Total Cash Costs and Total

Cash Cost per ounce sold, by asset, for the nine months

ended September 30, 2024:

|

|

Direct

operating

costs |

|

By-product

credits |

|

Refining

and selling

costs |

|

Inventory

change (1) |

|

Royalty

expense |

|

Total cash

costs |

|

Gold oz

sold |

|

Total cash

cost/oz sold |

|

|

Kisladag |

|

$105.3 |

|

|

($2.5 |

) |

|

$0.6 |

|

|

($19.4 |

) |

|

$20.1 |

|

|

$104.0 |

|

|

117,068 |

|

|

$889 |

|

| Lamaque |

|

100.8 |

|

|

(1.3 |

) |

|

0.3 |

|

|

(3.3 |

) |

|

3.7 |

|

|

100.3 |

|

|

132,776 |

|

|

755 |

|

| Efemcukuru |

|

51.1 |

|

|

(4.7 |

) |

|

11.4 |

|

|

(0.6 |

) |

|

15.0 |

|

|

72.1 |

|

|

60,817 |

|

|

1,185 |

|

|

Olympias |

|

96.5 |

|

|

(55.8 |

) |

|

13.9 |

|

|

(6.2 |

) |

|

14.2 |

|

|

62.6 |

|

|

50,401 |

|

|

1,241 |

|

|

Total consolidated |

|

$353.7 |

|

|

($64.3 |

) |

|

$26.1 |

|

|

($29.5 |

) |

|

$53.0 |

|

|

$339.0 |

|

|

361,062 |

|

|

$939 |

|

|

|

(1) |

Inventory change adjustments result from timing differences

between when inventory is produced and when it is sold. |

|

|

|

|

Reconciliation of Total Cash Costs and Total

Cash Cost per ounce sold, by asset, for the three months

ended September 30, 2023:

|

|

Direct

operating

costs |

|

By-product

credits |

|

Refining

and selling

costs |

|

Inventory

change (1) |

|

Royalty

expense |

|

Total cash

costs |

|

Gold oz

sold |

|

Total cash

cost/oz sold |

|

|

Kisladag |

|

$32.7 |

|

|

($0.7 |

) |

|

$0.2 |

|

|

($8.1 |

) |

|

$3.9 |

|

|

$28.0 |

|

|

38,732 |

|

|

$722 |

|

| Lamaque |

|

27.0 |

|

|

(0.4 |

) |

|

0.1 |

|

|

(1.2 |

) |

|

1.0 |

|

|

26.5 |

|

|

40,908 |

|

|

648 |

|

| Efemcukuru |

|

14.3 |

|

|

(1.0 |

) |

|

3.8 |

|

|

0.3 |

|

|

3.7 |

|

|

21.2 |

|

|

21,364 |

|

|

990 |

|

|

Olympias |

|

32.2 |

|

|

(21.6 |

) |

|

4.5 |

|

|

1.0 |

|

|

3.0 |

|

|

19.1 |

|

|

18,196 |

|

|

1,048 |

|

|

Total consolidated |

|

$106.2 |

|

|

($23.7 |

) |

|

$8.6 |

|

|

($8.0 |

) |

|

$11.5 |

|

|

$94.7 |

|

|

119,200 |

|

|

$794 |

|

|

|

(1) |

Inventory change adjustments result from timing differences

between when inventory is produced and when it is sold. |

|

|

|

|

Reconciliation of Total Cash Costs and Total

Cash Cost per ounce sold, by asset, for the nine months

ended September 30, 2023:

|

|

Direct

operating

costs |

|

By-product

credits |

|

Refining

and selling

costs |

|

Inventory

change (1) |

|

Royalty

expense |

|

Total cash

costs |

|

Gold oz

sold |

|

Total cash

cost/oz sold |

|

|

Kisladag |

$90.6 |

|

($2.3 |

) |

$0.5 |

|

($16.0 |

) |

$11.6 |

|

$84.3 |

|

|

108,405 |

|

$778 |

|

|

Lamaque |

|

83.6 |

|

|

(1.2 |

) |

|

0.2 |

|

|

(2.3 |

) |

|

2.9 |

|

|

83.2 |

|

|

119,455 |

|

|

697 |

|

| Efemcukuru |

|

43.1 |

|

|

(3.3 |

) |

|

10.3 |

|

|

0.2 |

|

|

9.9 |

|

|

60.2 |

|

|

63,581 |

|

|

947 |

|

|

Olympias |

|

90.9 |

|

|

(54.7 |

) |

|

16.7 |

|

|

(0.6 |

) |

|

10.9 |

|

|

63.2 |

|

|

47,710 |

|

|

1,325 |

|

|

Total consolidated |

$308.1 |

|

($61.5 |

) |

$27.8 |

|

($18.7 |

) |

$35.3 |

|

$291.0 |

|

|

339,151 |

|

$858 |

|

|

|

(1) |

Inventory change adjustments result from timing differences

between when inventory is produced and when it is sold. |

|

|

|

|

Reconciliation of Total Cash Costs to All-in

Sustaining Costs and All-in Sustaining Costs per ounce

sold:

|

|

Q3 2024 |

|

Q3 2023 |

|

|

YTD 2024 |

|

YTD 2023 |

|

|

Total cash costs |

$118.0 |

|

$94.7 |

|

|

$339.0 |

|

$291.0 |

|

|

Corporate and allocated G&A |

|

10.9 |

|

|

11.5 |

|

|

|

35.3 |

|

|

32.6 |

|

| Exploration and evaluation

costs |

|

0.8 |

|

|

(0.1 |

) |

|

|

2.8 |

|

|

0.9 |

|

| Reclamation costs and

amortization |

|

2.3 |

|

|

2.4 |

|

|

|

2.8 |

|

|

7.1 |

|

|

Sustaining capital expenditure |

|

33.3 |

|

|

31.8 |

|

|

|

93.2 |

|

|

83.9 |

|

|

AISC |

$165.3 |

|

$140.3 |

|

|

$473.1 |

|

$415.6 |

|

| Gold

ounces sold |

|

123,828 |

|

|

119,200 |

|

|

|

361,062 |

|

|

339,151 |

|

|

AISC per ounce sold |

$1,335 |

|

$1,177 |

|

|

$1,310 |

|

$1,225 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of general and administrative

expenses included in All-in Sustaining Costs:

|

|

Q3 2024 |

|

Q3 2023 |

|

|

YTD 2024 |

|

YTD 2023 |

|

|

General and administrative expenses (from

consolidated statement of operations) |

$7.3 |

|

$9.3 |

|

|

$27.0 |

|

$29.3 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based payments

expense |

|

4.1 |

|

|

2.0 |

|

|

|

9.8 |

|

|

5.6 |

|

| Employee benefit plan expense

from corporate and operating gold mines |

|

1.1 |

|

|

1.3 |

|

|

|

3.2 |

|

|

3.5 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative

expenses related to non-gold mines and in-country offices |

|

(0.2 |

) |

|

(0.3 |

) |

|

|

(1.0 |

) |

|

(0.8 |

) |

| Depreciation in G&A |

|

(0.9 |

) |

|

(0.8 |

) |

|

|

(2.6 |

) |

|

(2.4 |

) |

| Business development |

|

(0.3 |

) |

|

(0.2 |

) |

|

|

(0.8 |

) |

|

(2.4 |

) |

|

Development projects |

|

(0.2 |

) |

|

— |

|

|

|

(0.7 |

) |

|

(0.3 |

) |

|

Adjusted corporate general and administrative

expenses |

$10.8 |

|

$11.4 |

|

|

$34.9 |

|

$32.5 |

|

|

Regional general and administrative costs allocated to gold

mines |

|

0.1 |

|

|

0.1 |

|

|

|

0.5 |

|

|

0.2 |

|

|

Corporate and allocated general and administrative expenses

per AISC |

$10.9 |

|

$11.5 |

|

|

$35.3 |

|

$32.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of exploration and evaluation

costs included in All-in Sustaining Costs:

|

|

Q3 2024 |

|

Q3 2023 |

|

|

YTD 2024 |

|

YTD 2023 |

|

|

Exploration and evaluation expense (from

consolidated statement of operations)(1) |

$8.3 |

|

$6.3 |

|

|

$16.1 |

|

$16.8 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capitalized sustaining

exploration cost related to operating gold mines |

|

0.8 |

|

|

(0.1 |

) |

|

|

2.8 |

|

|

0.9 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploration and evaluation expenses related to non-gold mines and

other sites |

|

(8.3 |

) |

|

(6.3 |

) |

|

|

(16.1 |

) |

|

(16.8 |

) |

|

Exploration and evaluation costs per AISC |

$0.8 |

|

($0.1 |

) |

|

$2.8 |

|

$0.9 |

|

|

|

(1) |

Amounts presented for 2024 and 2023 are from continuing

operations only and exclude the Romania segment. See Note

4 of our condensed consolidated interim financial statements for

the three and nine months ended September 30, 2024. |

|

|

|

|

Reconciliation of reclamation costs and

amortization included in All-in Sustaining Costs:

|

|

Q3 2024

|

|

Q3 2023

|

|

|

YTD 2024

|

|

YTD 2023

|

|

|

Asset retirement obligation accretion (from notes

to the condensed consolidated interim financial

statements)(1) |

$1.2 |

|

$1.1 |

|

|

$3.7 |

|

$3.2 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation related to asset

retirement obligation assets |

|

1.3 |

|

|

1.5 |

|

|

|

(0.2 |

) |

|

4.5 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset

retirement obligation accretion related to non-gold mines and other

sites |

|

(0.2 |

) |

|

(0.2 |

) |

|

|

(0.6 |

) |

|

(0.6 |

) |

|

Reclamation costs and amortization per AISC |

$2.3 |

|

$2.4 |

|

|

$2.8 |

|

$7.1 |

|

|

|

(1) |

Amounts presented for 2024 and 2023 are from continuing

operations only and exclude the Romania segment. See Note

4 of our condensed consolidated interim financial statements for

the three and nine months ended September 30, 2024. |

|

|

|

|

Reconciliation of All-in Sustaining Costs

and All-in Sustaining Costs per ounce sold, by operating asset and

corporate office, for the three months ended

September 30, 2024:

|

|

Total cash

costs

|

|

Corporate &

allocated

G&A

|

|

Exploration

costs

|

|

Reclamation

costs and

amortization

|

|

Sustaining

capital

|

|

Total

AISC

|

|

Gold oz sold |

|

Total AISC/

oz sold

|

|

|

Kisladag |

$36.6 |

|

|

$— |

|

|

$— |

|

$1.6 |

|

$3.7 |

|

$41.9 |

|

|

40,724 |

|

$1,028 |

|

|

Lamaque |

|

32.4 |

|

|

— |

|

|

0.4 |

|

|

0.1 |

|

|

20.0 |

|

|

53.0 |

|

|

44,531 |

|

|

1,189 |

|

|

Efemcukuru |

|

26.2 |

|

|

0.1 |

|

|

— |

|

|

0.2 |

|

|

4.7 |

|

|

31.2 |

|

|

19,741 |

|

|

1,578 |

|

|

Olympias |

|

22.8 |

|

|

— |

|

|

0.4 |

|

|

0.4 |

|

|

4.9 |

|

|

28.5 |

|

|

18,833 |

|

|

1,513 |

|

|

Corporate (1) |

|

— |

|

|

10.8 |

|

|

— |

|

|

— |

|

|

— |

|

|

10.8 |

|

|

— |

|

|

88 |

|

|

Total consolidated |

$118.0 |

|

$10.9 |

|

$0.8 |

|

$2.3 |

|

$33.3 |

|

$165.3 |

|

|

123,828 |

|

$1,335 |

|

|

|

(1) |

Excludes general and administrative expenses related to

business development activities and projects. Includes share based

payments expense and defined benefit pension plan expense. AISC per

ounce sold has been calculated using total consolidated gold ounces

sold. |

|

|

|

|

Reconciliation of All-in Sustaining Costs and

All-in Sustaining Costs per ounce sold, by operating asset and

corporate office, for the nine months ended

September 30, 2024:

|

|

Total cash

costs |

|

Corporate &

allocated

G&A |

|

Exploration

costs |

|

Reclamation

costs and

amortization |

|

Sustaining

capital |

|

Total

AISC |

|

Gold oz sold |

|

Total AISC/

oz sold |

|

|

Kisladag |

$104.0 |

|

|

$— |

|

|

$— |

|

$4.4 |

|

$8.9 |

|

$117.3 |

|

|

117,068 |

|

$1,002 |

|

|

Lamaque |

|

100.3 |

|

|

— |

|

|

1.2 |

|

|

0.4 |

|

|

61.1 |

|

|

163.1 |

|

|

132,776 |

|

|

1,228 |

|

|

Efemcukuru |

|

72.1 |

|

|

0.5 |

|

|

1.1 |

|

|

(3.2 |

) |

|

10.7 |

|

|

81.3 |

|

|

60,817 |

|

|

1,336 |

|

|

Olympias |

|

62.6 |

|

|

— |

|

|

0.5 |

|

|

1.1 |

|

|

12.5 |

|

|

76.6 |

|

|

50,401 |

|

|

1,520 |

|

|

Corporate (1) |

|

— |

|

|

34.9 |

|

|

— |

|

|

— |

|

|

— |

|

|

34.9 |

|

|

— |

|

|

97 |

|

|

Total consolidated |

$339.0 |

|

$35.3 |

|

$2.8 |

|

$2.8 |

|

$93.2 |

|

$473.1 |

|

|

361,062 |

|

$1,310 |

|

|

|

(1) |

Excludes general and administrative expenses related to

business development activities and projects. Includes share based

payments expense and defined benefit pension plan expense. AISC per

ounce sold has been calculated using total consolidated gold ounces

sold. |

|

|

|

|

Reconciliation of All-in Sustaining Costs

and All-in Sustaining Costs per ounce sold, by operating asset and

corporate office, for the three months ended

September 30, 2023:

|

|

Total cash

costs |

|

Corporate &

allocated

G&A |

|

Exploration

costs |

|

Reclamation

costs and

amortization |

|

Sustaining

capital |

|

Total

AISC |

|

Gold oz sold |

|

Total AISC/

oz sold |

|

|

Kisladag |

|

$28.0 |

|

|

$— |

|

|

$— |

|

|

$0.8 |

|

|

$5.5 |

|

|

$34.2 |

|

|

38,732 |

|

|

$884 |

|

|

Lamaque |

|

26.5 |

|

|

— |

|

|

0.3 |

|

|

0.1 |

|

|

18.0 |

|

|

44.9 |

|

|

40,908 |

|

|

1,099 |

|

|

Efemcukuru |

|

21.2 |

|

|

0.1 |

|

|

— |

|

|

0.8 |

|

|

3.7 |

|

|

25.7 |

|

|

21,364 |

|

|

1,205 |

|

|

Olympias |

|

19.1 |

|

|

— |

|

|

(0.4 |

) |

|

0.7 |

|

|

4.7 |

|

|

24.0 |

|

|

18,196 |

|

|

1,319 |

|

|

Corporate (1) |

|

— |

|

|

11.4 |

|

|

— |

|

|

— |

|

|

— |

|

|

11.4 |

|

|

— |

|

|

95 |

|

|

Total consolidated |

|

$94.7 |

|

|

$11.5 |

|

|

($0.1 |

) |

|

$2.4 |

|

|

$31.8 |

|

|

$140.3 |

|

|

119,200 |

|

|

$1,177 |

|

|

|

(1) |

Excludes general and administrative expenses related to

business development activities and projects. Includes share based

payments expense and defined benefit pension plan expense. AISC per

ounce sold has been calculated using total consolidated gold ounces

sold. |

|

|

|

|

Reconciliation of All-in Sustaining Costs

and All-in Sustaining Costs per ounce sold, by operating asset and

corporate office, for the nine months ended

September 30, 2023:

|

|

Total cash

costs |

|

Corporate &

allocated

G&A |

|

Exploration

costs |

|

Reclamation

costs and

amortization |

|

Sustaining

capital |

|

Total

AISC |

|

Gold oz sold |

|

Total AISC/

oz sold |

|

|

Kisladag |

|

$84.4 |

|

|

— |

|

|

— |

|

|

$2.4 |

|

|

$10.5 |

|

|

$97.2 |

|

|

108,405 |

|

|

$897 |

|

|

Lamaque |

|

83.2 |

|

|

— |

|

|

0.9 |

|

|

0.4 |

|

|

52.0 |

|

|

136.5 |

|

|

119,455 |

|

|

1,143 |

|

|

Efemcukuru |

|

60.2 |

|

|

0.2 |

|

|

— |

|

|

2.4 |

|

|

9.6 |

|

|

72.3 |

|

|

63,581 |

|

|

1,137 |

|

|

Olympias |

|

63.2 |

|

|

— |

|

|

— |

|

|

2.0 |

|

|

11.8 |

|

|

77.0 |

|

|

47,710 |

|

|

1,614 |

|

|

Corporate (1) |

|

— |

|

|

32.5 |

|

|

— |

|

|

— |

|

|

— |

|

|

32.5 |

|

|

— |

|

|

96 |

|

|

Total consolidated |

|

$291.0 |

|

|

$32.6 |

|

|

$0.9 |

|

|

$7.1 |

|

|

$83.9 |

|

|

$415.5 |

|

|

339,151 |

|

|

$1,225 |

|

|

|

(1) |

Excludes general and administrative expenses related to

business development activities and projects. Includes share based

payments expense and defined benefit pension plan expense. AISC per

ounce sold has been calculated using total consolidated gold ounces

sold. |

|

|

|

|

Reconciliation of Sustaining and Growth

Capital:

|

|

Q3 2024

|

|

Q3 2023

|

|

|

YTD 2024

|

|

YTD 2023

|

|

Additions to property, plant and equipment

(1)

(from segment note in the condensed consolidated interim financial

statements) |

$158.1 |

|

$91.1 |

|

|

$445.8 |

|

$273.9 |

|

|