Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-273432

PROSPECTUS SUPPLEMENT

(To Prospectus dated July

26, 2023)

COMPANHIA PARANAENSE DE ENERGIA

(ENERGY COMPANY OF PARANÁ)

549,171,000 Common Shares

We and the State of Paraná,

a State of the Federative Republic of Brazil (the “Selling Shareholder”), are offering an

aggregate of 549,171,000 Common Shares, without par value, of Companhia Paranaense de Energia (“Copel”), in

a global offering (the “global offering”) that includes (1) a public offering

in Brazil (the “Brazilian offering”) and (2) a registered offering in the United

States pursuant to this prospectus supplement and the accompanying prospectus.

All

Common Shares sold in the global offering will be settled

and delivered in Brazil and paid for in reais pursuant to the Contrato de Coordenação,

Distribuição e Garantia Firme de Liquidação de Ações Ordinárias de Emissão da

Companhia Paranaense de Energia (the “Brazilian Underwriting Agreement”)

We and the selling shareholder

have the right to sell, solely for the purpose of covering over-allotments (greenshoe), if any, pursuant to the Brazilian

Underwriting Agreement, subject of the agreement of Banco Itaú BBA S.A. upon notice to the other Brazilian underwriters,

up to an additional 82,375,650 Common Shares at any time for a period of 30 days from the date of the Announcement of the Initiation of

the Public Offering (Anúncio de Início da Oferta Pública) at the offering price referenced on the cover page

of this prospectus supplement, in aggregate representing up to 15% of the Common Shares initially offered in the global offering.

The Brazilian offering was

subject to a priority offering in Brazil pursuant to which our existing shareholders have the right to purchase our common shares. The

price per common share under the priority offering was the same as the price per common share under this global offering, as indicated

below. The subscription rights in the priority offering have not been and will not be registered under the United States Securities Act

of 1933, as amended (“Securities Act”) or under any U.S. state securities laws. Accordingly, the priority offering was made

only as part of the Brazilian offering in reliance upon certain exemptions from, or in transactions not subject to, the registration requirements

of the Securities Act and will not be made available or included as part of the international offering. This prospectus supplement is

not being provided in connection with the priority offering and this prospectus supplement does not constitute an offer to subscribe for

any securities in the priority offering. The exercise of rights in the priority offering occurred, and the settlement of the priority

offering will occur, only in Brazil. Holders of Unit ADSs (as defined below) and the shareholders that hold our Common Shares outside

of B3 were not permitted to participate in the priority offering. See “Summary — The Offering — Priority

offering in Brazil.”

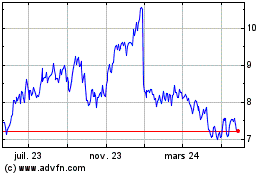

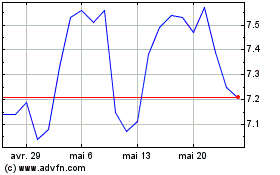

The Common Shares are listed

on the São Paulo Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão), or B3, under the ticker symbol “CPLE3.”

The closing price of our Common Shares on B3 on August 7, 2023 was R$8.21 per Common Shares. Our Common Shares are also listed on the

Mercado de Valores Latinoamericanos en Euros (Latibex) under the ticker symbol “XCOPO.”

The international offering

contemplated herein consists of a U.S. offering and a non-U.S. offering made outside the United States in compliance with applicable law.

We are registering and will pay a registration fee for all Common Shares initially offered and sold in the United States, as well as for

Common Shares offered and sold outside the United States in the global offering that may be resold from time to time into the United States.

We and the Selling Shareholder are not offering Common Shares in the form of American Depositary Shares. Although American Depositary

Shares representing our units (“Unit ADSs”), which represent four of our class B preferred shares and one of our Common Shares,

are listed on The New York Stock Exchange, our Common Shares offered hereby are not fungible with, or directly convertible into, such

Unit ADSs. A holder of Common Share may not convert its Common Share into our Unit ADSs, unless such holder first combines such Common

Share with four of our class B preferred shares, convert these securities into a unit, and then convert such unit into a Unit ADS.

See

“Risk Factors“ beginning on page S-25 of this prospectus supplement and the “Risk Factors” section beginning

on page 4 of our 2022 Form 20-F/A (as defined below), which is incorporated by reference herein, to read about factors you should consider

before investing in the securities offered in this prospectus supplement and the accompanying prospectus.

Neither the U.S. Securities

and Exchange Commission, or the SEC, nor any state or foreign securities commission, including the

Brazilian Securities Commission (Comissão

de Valores Mobiliarios, or CVM), has approved or disapproved of these securities or determined if this prospectus supplement is truthful

or complete. Any representation to the contrary is a criminal offense.

| |

Per Common

Share |

| Public offering price |

R$8.25 |

| Underwriting discounts, fees and commissions paid by us (1) |

R$0.02 |

| Underwriting discounts, fees and commissions paid by the Selling Shareholder(1) |

R$0.02 |

| Proceeds, before expenses, to us (2) |

R$8.23 |

| Proceeds, before expenses, to the Selling Shareholder (2) |

R$8.23 |

| (1) | See

“Underwriting” beginning on page S-38

of this prospectus supplement for additional information regarding underwriting compensation. |

| (2) | Without

taking into consideration Common Shares to be sold in the over-allotment option. |

Investors residing outside

Brazil may purchase our Common Shares if they comply with the registration requirements of CVM Resolution No. 13 dated November 18, 2020,

as amended, or CVM Resolution No. 13, and CMN Resolution No. 4,373, dated September 29, 2014, as amended, or CMN Resolution No. 4,373,

of the Brazilian National Monetary Council (Conselho Monetário Nacional), or the CMN. For a description on how to comply

with these registration requirements, see “Investment in our Common Shares by Non-Residents of Brazil.”

Delivery of our Common Shares,

including Common Shares offered in the international offering, will be made in Brazil through the book-entry facilities of the B3 Central

Depository (Central Depositária da B3) on or about August

11, 2023.

| Global Coordinators |

| BTG Pactual |

Itaú BBA |

Banco Bradesco BBI |

Morgan Stanley |

UBS Investment Bank |

The date of this prospectus

supplement is August 8, 2023

TABLE OF

CONTENTS

PROSPECTUS

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This document consists of

two parts. The first part is this prospectus supplement, which describes the offering by us and the Selling Shareholder and certain other

matters relating to us and our business, financial condition and results of operation. The second part, the accompanying prospectus, gives

more general information about the Common Shares that we and the Selling Shareholder are offering. Generally, references to the prospectus

mean this prospectus supplement and the accompanying prospectus combined. If the information in this prospectus supplement differs from

the information in the accompanying prospectus, the information in this prospectus supplement supersedes the information in the accompanying

prospectus.

The term “Brazilian

underwriters” refers to Banco BTG Pactual S.A., Banco Itaú BBA S.A., Bradesco BBI S.A., Banco Morgan Stanley S.A. and UBS

Brasil Corretora de Câmbio, Títulos e Valores Mobiliários S.A., who will act collectively with respect to the sale

of the Common Shares in the global offering, under the terms of the Brazilian Underwriting Agreement.

The term “international

placement agents” refers to BTG Pactual US Capital, LLC, Itau BBA USA Securities, Inc., Bradesco Securities, Inc., Morgan Stanley

& Co. LLC, and UBS Securities LLC, whose participation in the offering is strictly limited to their role as agents appointed by the

respective Brazilian underwriters to facilitate the placement of Common Shares outside Brazil, under the terms of the Placement Facilitation

Agreement (as defined below). Please see “Underwriting” for more information.

We are responsible for the

information contained and incorporated by reference in this prospectus supplement and in any related free-writing prospectus we prepare

or authorize. Neither we, the Selling Shareholder, the Brazilian underwriters nor the international placement agents, nor any of our or

their respective agents, have authorized anyone to provide any information other than that contained in this prospectus supplement, the

accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We, the

Selling Shareholder, the Brazilian underwriters, the international placement agents and our and their respective agents take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we, the Selling Shareholder,

the Brazilian underwriters nor the international placement agents have authorized any other person to provide you with different or additional

information. Neither we, the Selling Shareholder, the Brazilian underwriters nor the international placement agents are making an offer

to sell our Common Shares in any jurisdiction where the offer is not permitted.

You should not assume that

the information in this prospectus supplement, the accompanying prospectus or any document incorporated by reference is accurate as of

any date other than the date of the relevant document. See “Incorporation of Certain Documents by Reference” herein for the

documents we are incorporating by reference into this prospectus supplement.

We and the Selling Shareholder

are using this prospectus to offer our Common Shares outside Brazil. We and the Selling Shareholder are also offering our Common Shares

in Brazil by means of a Brazilian prospectus and accompanying reference form (formulário de referência) in Portuguese

(the Brazilian offering documents). The Portuguese language prospectus, which was registered before the CVM, is in a format different

from that of this prospectus supplement, and contains information not generally included in documents such as this prospectus supplement

and in the accompanying prospectus. This offering of common shares is made in the United States and elsewhere outside Brazil solely on

the basis of the information contained in this prospectus supplement and in the accompanying prospectus. You should not rely on the Brazilian

offering documents in making an investment decision in relation to our Common Shares offered hereby.

Any investors outside Brazil

purchasing Common Shares must be authorized to invest in Brazilian securities under the requirements established by Brazilian law, including

and especially those established by the Brazilian National Monetary Council (Conselho Monetário Nacional), or the CMN, the

CVM and the Central Bank, and the requirements set forth in Resolution No. 13, dated November 18, 2020, of the CVM, as amended, and Resolution

No. 4,373, dated September 29, 2014, as amended, of the CMN. No offer or sale of Common Shares may be made to the public in Brazil except

in circumstances that do not constitute a public offer or distribution under Brazilian laws and regulations or if an exemption has been

granted by the CVM in accordance with its regulations. Any offer or sale of Common Shares in Brazil to non-Brazilian residents may be

made only under circumstances that do not constitute a public offer or distribution under Brazilian laws and regulations

The subscription rights in

the priority offering have not been registered under the Securities Act. Accordingly, the priority offering was not available to investors

in the United States or to U.S. persons.

In this prospectus supplement,

unless the context otherwise requires, references to “Copel” are to Companhia Paranaense de Energia and references to “we,”

“us” and “our” are to Companhia Paranaense de Energia and its consolidated subsidiaries taken as a whole, unless

the context otherwise requires. The term “Selling Shareholder” refers to the State of Paraná.

References to (i) the “real,”

“reais” or “R$” are to Brazilian reais (plural) and the Brazilian real (singular)

and (ii) “U.S. dollars,” “dollars” or “US$” are to United States dollars. We maintain our books and

records in reais. Certain figures included in this prospectus supplement have been subject to rounding adjustments.

This prospectus supplement

and the accompanying prospectus are part of a registration statement that we filed with the SEC as a “well-known seasoned issuer”

(“WKSI”) as defined in Rule 405 under the Securities Act utilizing a “shelf” registration process.

EEA Public Offer Selling Restriction

This

prospectus supplement has been prepared on the basis

that any offer of the Common Shares in any Member

State of the EEA (a “Member State”) will be made pursuant to an exemption under the Prospectus Regulation from the

requirement to publish a prospectus for offers of Common Shares. Accordingly, any person

making or intending to make

any offer within a Member State of Common Shares which

are the subject of the offering contemplated

in this prospectus supplement may only

do so in circumstances in which no

obligation arises for us, the Selling Shareholder or any of the international placement agents to publish a prospectus pursuant

to Article 3 of the Prospectus Regulation or supplement

a prospectus pursuant to Article 23 of

the Prospectus Regulation, in each

case, in relation to such offer.

Neither we nor the Selling Shareholder nor the international placement agents have authorized, nor do they authorize, the making

of any offer of Common Shares in circumstances in which an obligation arises for us, the Selling Shareholder or the international placement

agents to publish a prospectus for such offer. Neither we nor the Selling Shareholder nor the international placement agents have authorized,

nor do they authorize, the making of any offer of Common Shares through any financial intermediary, other than offers made by the international

placement agents, which constitute the final placement of the Common Shares contemplated in this prospectus supplement.

Each person in a Member State

who receives any communication in respect of, or who acquires any Common Shares under, the offers to the public contemplated in this prospectus

supplement, or to whom the Common Shares are otherwise made available, will be deemed to have represented, warranted, acknowledged and

agreed to and with each international placement agent, us and the Selling Shareholder that it and any person on whose behalf it acquires

Common Shares is: (i) a qualified investor within the meaning of Article 2 of the Prospectus

Regulation; and (ii) in the case of any Common Shares acquired by it as a financial intermediary,

as that term is used in Article 5(1) of the Prospectus Regulation, (x) the Common Shares acquired by it in the offer have not been acquired

on behalf of, nor have they been acquired with a view

to their offer or

resale to, persons

in any Member State other than

qualified investors, as that

term is defined in the Prospectus Regulation,

or in circumstances in which the prior consent of the international placement agents has been given to the offer or resale; or (y)

where the Common Shares have been acquired by it on behalf of persons in any Member State other than qualified investors,

the offer of those Common Shares falls within one

of the exemptions listed in points (b) to (d) of Article 1(4) of the Prospectus Regulation. to it is not treated

under the Prospectus Regulation as having been made

to such persons.

We, the Selling Shareholder,

the international placement agents and their affiliates, and others will rely upon the truth and accuracy of the foregoing representation,

acknowledgment and agreement. Notwithstanding the above, a person who is not a qualified investor may, with the consent of the international

placement agents, be permitted to purchase our Common Shares in the international offering.

In this section, the expression

an “offer” in relation to any Common Shares in any Member State means the communication in any form and by any means of sufficient

information on the terms of the offer and our Common Shares to be offered so as to enable an investor to decide to purchase or subscribe

for our Common Shares and the expression “Prospectus Regulation” means Regulation (EU) 2017/1129 (as amended or superseded).

UK Public Offer Selling Restriction

This prospectus supplement

has been prepared on the basis that any offer of Common Shares in the UK will be made pursuant to an exemption under section 86 of the

Financial Services and Markets Act of 2020 (“FSMA”) from the requirement to publish a prospectus for offers of our Common

Shares. Accordingly, any person making or intending to make any offer within the UK of our Common Shares which are the subject of the

offering contemplated in this prospectus supplement may only do so in circumstances in which no obligation arises for us, the Selling

Shareholder or any of the international placement agents to publish a prospectus pursuant to section 85 of the FSMA or supplement a prospectus

pursuant to Article 23 of the UK Prospectus Regulation, in each case, in relation to such offer. Neither we nor the Selling Shareholder

nor the international placement agents have authorized, nor do they authorize, the making of any offer of our Common Shares in circumstances

in which an obligation arises for us, the Selling Shareholder or the international placement agents to publish a prospectus for such offer.

Neither we nor the Selling Shareholder nor the international placement agents have authorized, nor do they authorize, the making of any

offer of our Common Shares through any financial intermediary, other than offers made by the international placement agents, which constitute

the final placement of the Common Shares contemplated in this prospectus supplement.

Each person in the UK who

receives any communication in respect of, or who acquires any of our Common Shares under, the offers to the public contemplated in this

prospectus supplement, or to whom our Common Shares are otherwise made available, will be deemed to have represented, warranted, acknowledged

and agreed to and with each international placement agent, us and the Selling Shareholder that it and any person on whose behalf it acquires

our Common Shares is: (i) a qualified investor within the meaning of Article 2(e) of the UK Prospectus Regulation; and (ii) in the

case of any of our Common Shares acquired by it as a financial intermediary, as that term is used in Article 5(1) of the UK Prospectus

Regulation, (x) our Common Shares acquired by it in the offer have not been acquired on behalf of, nor have they been acquired with a

view to their offer or resale to, persons in the UK other than qualified investors, as that term is defined in the UK Prospectus Regulation,

or in circumstances in which the prior consent of the international placement agents has been given to the offer or resale; or (y)

where our Common Shares have been acquired by it on behalf of persons in the UK other than qualified investors, the offer of those Common

Shares fall within one of the exemptions listed in points (b) and (d) to Article 1(4) of the UK Prospectus Regulation.

For the purposes of this

provision, the expression an “offer” of Common Shares to the public in relation to any Common Shares means the communication

in any form and by any means of sufficient information on the terms of the offer and the Common Shares to be offered so as to enable an

investor to decide to purchase or subscribe for the Common Shares.

This prospectus supplement

is only for distribution to and directed at: (i) in the United Kingdom, persons having professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended)

(the “Order”) and high net worth entities falling within Article 49(2)(a) to (d) of the Order; (ii) persons who are outside

the United Kingdom; and (iii) any other person to whom it can otherwise be lawfully distributed (all such persons together being referred

to as “Relevant Persons”). The Common Shares will only be available to, and any invitation, offer or agreement to subscribe

for, purchase or otherwise acquire such Common Shares will be engaged in only with, Relevant Persons. Any person who is not a Relevant

Person should not act or rely on this prospectus supplement or any of its contents.

FORWARD-LOOKING

STATEMENTS

This prospectus supplement

contains forward-looking statements. These statements are not historical facts and are based on management’s current view and estimates

of future economic circumstances, industry conditions, company performance and financial results. The words “anticipates,”

“believes,” “estimates,” “expects,” “plans” and similar expressions, as they relate to

us, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation

of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting the financial condition, liquidity or results of operations are examples of forward-looking statements. Forward-looking statements

speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or

future events.

Forward-looking statements

involve only the current view of management and are subject to a number of inherent risks and uncertainties. There is no guarantee that

the expected events, trends or results will actually occur. We caution you that a number of important factors could cause actual results

to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited to:

| · | general economic, regulatory, political and business conditions in Brazil and abroad, including the impact of the ongoing conflict

in Ukraine and the trade and monetary sanctions that have been imposed in connection with those developments and its impacts on the global

economy; |

| · | new policies and reforms implemented by the new presidential administration, such as changes to monetary, fiscal and social policies,

and political and popular responses thereto; |

| · | economic conditions in the State of Paraná; |

| · | technical, operational, legal and regulatory conditions related to the provision of electricity services; |

| · | our and the State of Paraná’s ability to successfully implement the proposed transaction to disperse our share ownership; |

| · | the outcome of lawsuits against us; |

| · | our ability to obtain financing; |

| · | developments in other emerging market countries; |

| · | changes in, or failure to comply with, governmental regulations; |

| · | unfavorable hydrological conditions; |

| · | climate-related developments; |

| · | international economic and political developments; and |

| · | the impact of the widespread health developments, epidemics, natural disasters and other catastrophes, such as the COVID 19 outbreak,

and the governmental, commercial, consumer and other responses thereto. |

For additional information on factors that could

cause our actual results to differ from expectations reflected in forward-looking statements, see the section entitled “Risk Factors”

in this prospectus supplement and in documents incorporated by reference in this prospectus supplement and the accompanying prospectus

and “Risk Factors” as set forth in the 2022 Form 20-F/A, which is incorporated by reference herein.

All forward-looking statements attributed to us or a

person acting on our behalf are qualified in their entirety by this cautionary statement, and you should not place undue reliance on any

forward-looking statement included in this prospectus supplement. We undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information or future events or for any other reason.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

We are incorporating by reference

into this prospectus supplement the following documents that we have filed with or furnished to the SEC:

| · | Any filings of Copel on Form 20-F made with the SEC after the date of this prospectus and prior to the termination of the offering

of the securities offered by this prospectus, and any future reports of Copel on Form 6-K furnished to the SEC during that period that

are identified in those forms as being incorporated by reference into this prospectus. |

We will provide without charge

to any person to whom a copy of this prospectus supplement is delivered, upon the written or oral request of any such person, a copy of

any or all of the documents referred to above which have been or may be incorporated herein by reference, other than exhibits

to such documents (unless such exhibits are specifically

incorporated by reference in such documents). Requests

should be directed to Copel’s Investor

Relations Department located at ri@copel.com.

WHERE

YOU CAN FIND MORE INFORMATION

Information that we file

with or furnish to the SEC after the date of this prospectus supplement, and that is incorporated by reference herein, will automatically

update and supersede the information in this prospectus supplement. You should review the SEC filings and reports that we incorporate

by reference to determine if any of the statements in this prospectus supplement, the accompanying prospectus or in any documents previously

incorporated by reference have been modified or superseded.

Documents incorporated by

reference in this prospectus supplement are available without charge. Each person to whom this prospectus supplement and the accompanying

prospectus are delivered may obtain documents incorporated by reference herein by requesting them either in writing or orally, by telephone

or by e-mail from us at the following address:

Investor Relations Department

Attn: Luiz Henrique de Mello

Telephone: +55 41 3331 4011

E-mail: ri@copel.com

We are subject to the information

requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), applicable to a foreign private

issuer, and accordingly file or furnish reports, including annual reports on Form 20-F, reports on Form 6-K and other information with

the SEC. Any filings we make electronically will be available to the public over the Internet at the SEC’s web site at http://www.sec.gov.

These reports and other information may also be inspected and copied at the offices of the NYSE at 11 Wall St, New York, New York 10005.

The information contained on, or accessible through, such website is not incorporated by reference into this prospectus supplement

and should not be considered a part of this prospectus supplement.

As a foreign private issuer,

we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements and

our executive officers, directors and principal shareholders are exempt from reporting and short swing profit recovery provisions contained

in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file periodic reports and financial

statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. You may

request a copy of our SEC filings, at no cost, by contacting us at our headquarters at Rua José Izidoro Biazetto, 158, block A,

81200-240, Curitiba, Paraná, Brazil. Our investor relations office can be reached at +55 41 3331 4011.

SUMMARY

This summary highlights

key information described in greater detail elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying

prospectus. This summary is not complete and does not contain all of the information you should consider before investing in our Common

Shares. You should read carefully the entire prospectus supplement, the accompanying prospectus, including “Risk Factors”

and the documents incorporated by reference herein, which are described under “Incorporation of Certain Documents by Reference”

and “Where You Can Find More Information.” For more information and the reconciliation of the Non-IFRS metrics included in

this summary, see “Non-IFRS Metrics” in the Disclosure 6-K.

Overview

We are a mixed-capital company,

created through State Law No. 1,384, of November 10, 1953 and Decree No. 14,947, on October 26, 1954, controlled by the State of Paraná.

Our operations are distributed across ten Brazilian states. We have been listed on the B3 for 29 years, on the NYSE for 26 years (the

first Brazilian energy company listed on the NYSE) and on LATIBEX (a Madrid-based stock exchange where securities of Latin American companies

are traded in euros) for 21 years.

We are a vertically integrated

company, operating in the generation, transmission, distribution and commercialization of electric energy segments. We are one of the

largest electricity companies in Brazil, with a strong business profile, diversification and relevance of our operating assets in the

Brazilian electric energy sector. We care for preserving and optimizing our long-term economic value. We are the largest distributor in

the State of Paraná, serving 394 of the State’s 399 municipalities, and we operate a concession in one municipality in the

State of Santa Catarina. For the last twelve months ended March 31, 2023, our net income from continuing operations was R$1,115.0 million

and our EBITDA was R$4,293 million. For information on how we calculate our net income from continuing operations and our EBITDA for the

last twelve months ended March 31, 2023 and for a reconciliation of our EBITDA to net income from continuing operations, please see section

“Non-IFRS Measures” in our Disclosure 6-K.

Our operations in Brazil

comprise the following segments:

| · | Generation: in this segment, we are present in four Brazilian states

and have 6,967 MW of total installed capacity (adjusted for our equity stake in each asset) and a physical guaranteed average of 3,157

MW (adjusted for our equity stake in each asset), through 75 generating units. |

| · | Transmission: in this segment, we have 9,685 km of transmission lines

and 51 substations in nine Brazilian states. Our transmission lines have an estimated Annual Permitted Revenue (Receita Annual Permitida,

or “APR”) of approximately R$1.4 billion in the 2022-2023 cycle. |

| · | Distribution: this segment consists of the distribution of electricity

in a concession area of 194,854 km² in the State of Paraná, serving more than 5 million consumers over 208,000 km of distribution

lines, and a base concession compensation (Base Remunaratória) of R$8.4 billion, considering the tariff adjustment of June

2021. |

| · | Power sale: this segment consists of the purchase and sale of energy,

as well as the provision of services in the free contracting environment (ACL) (“Free Market”). Through Copel Comercialização,

we sold more than 24,544 GWh of energy in the last twelve months ended March 31, 2023. |

Generation segment

Our generation segment is

present in four states (Rio Grande do Norte, Mato Grosso, Paraná and Rio Grande do Sul), with a total of 6,967 MW of installed

capacity, a physical guarantee average of 3,157 MW and 75 generation units. Our generating park is composed of 94% renewable sources such

as hydroelectric (77%) and wind (17%). Other energy sources account for 6% of our generating park.

Compared to 2018, there was

an increase in the importance of wind energy, which represented 9% of the installed capacity in 2018, while the installed capacity of

hydroelectric energy (84% in 2018), and thermal power plants (7% in 2018) decreased compared to 2018.

For the last twelve months

ended March 31, 2023, the net income of our generation segment was R$697.2 million and the EBITDA of our generation segment was R$2,188

million.

Source: Company. Note: (1) Considers values

proportional to Copel's equity stake; (2) Considers solar and thermoelectric plants.

We operate in the two electricity

contracting environments in Brazil, namely: the Free Market, which gives its consumers the freedom to negotiate the purchase of energy

with the generators and traders they choose, and the Regulated Contracting Environment (ACR), also called the regulated market or captive

market, in which consumers buy energy exclusively from the local distributor and are called captive consumers. For 2023, the ACR represents

approximately 33% of our total contracted energy, while the ACL represents 56% of the contracted energy. The chart below illustrates the

evolution of the energy contracted by us and its availability for the indicated periods:

Source: Company. Foz do

Areia (FDA) Hydroelectric Power Plant (Governador Bento Munhoz da Rocha Netto), which will have its concession contract ended in December/2024

Transmission segment

We own more than 9,685 km

of transmission lines in eight Brazilian states (Maranhão, Mato Grosso, Bahia, Goiás, Minas Gerais, São Paulo, Paraná

and Santa Catarina) and 51 substations, considering our own assets and in partnership with other companies. We build, maintain and operate

a wide grid of energy transmission.

This segment has about 20

remaining years of concession and has an APR Cycle 22-23 of R$1.4 billion. APR is the annual revenue established by ANEEL to be charged

by a transmission concessionaire for the use of its transmission lines by third parties. The APR is established by ANEEL

in biannual cycles.

Source: Company. Note: (1)

Considers values proportional to Copel's equity stake

For the last twelve months

ended March 31, 2023, the net income for our transmission segment was R$939.3 million in the last twelve months ended March 31, 2023 and

the EBITDA of our transmission segment was R$1,237 million. We added 53.6 km of new 138kv transmission lines in the 3-month period

ended March 31, 2023.

Distribution segment

We are the fourth largest

distribution concession in Brazil (according to ANEEL) and the main electricity distributor in the state of Paraná, which has the

fourth largest GDP in Brazil and which has a GDP per capita above the country average (R$42.4 thousand per capita for the

state of Paraná, compared to R$35.9 thousand per capita for Brazil). Additionally, the state of Paraná has a higher

HDI (Human Development Index) than the Brazilian average (0.749 for the state of Paraná compared to 0.699 for Brazil).

We have a concession that

expires in 22 years for the distribution of energy in the State of Paraná and we operate in a concession area of 194,854 km2.

In addition, we have a low default rate on the payment of energy bills of 0.9% (calculated as the percentage of energy bills issued during

the last twelve months and which are 16 to 360 days overdue).

We also adopt the following

quality indices required by applicable regulations: Equivalent Duration per Consumer (“DEC”), which measures the average time

in hours during which households remained disconnected throughout the year, and Average Frequency per Consumer (“FEC”), which

calculates the average number of disconnections in the year. Our DEC and FEC meet the applicable regulatory standards: as of the end of

2022 our DEC was 8.0 (within the regulatory threshold of 9.2) and our FEC was 5.3 (within the regulatory threshold of 6.8).

The geographical presence,

the evolution of default rates, DEC and FEC indicators and the Regulatory Asset Base (Base de Ativos Regulatórios

or “RAB”) of the distribution segment are illustrated below:

Source: Company. Note: (1)

Nominal values

For the last twelve months

ended March 31, 2023, the net loss of our distribution segment was R$318.1 million in the last twelve months ended March 31, 2023 and

the EBITDA of our distribution segment was R$920 million.

We are continuously investing

in our distribution grid to grow organically. In the last tariff cycle, between July 2016 and June 2021, our RAB increased by 71.4% (in

current values), from R$ 4.9 billion to R$ 8.4 billion. RAB represents the value of the assets a concessionaire installed for

the purposes of providing the concession’s services and is a component used by ANEEL to establish the concessionaire’s APR.

The chart below sets forth our capital expenditures for the indicated periods:

Source: Company

Total losses in our distribution

system are segmented between (i) losses in the basic grid (tension equal to or greater than 230kV), which are external to our distribution

grid and have a technical cause, and (ii) losses in the distribution grid (internal to our distribution grid), which are usually caused

by both technical and non-technical reasons. The table below sets forth our historical energy distribution losses for the indicated periods:

| Energy Losses |

2023(1) |

2022 |

2021 |

2020 |

2019 |

2018 |

| Technical Losses |

5.7% |

5.7% |

5.8% |

6.0% |

6.0% |

5.9% |

| Non-Technical Losses |

2.2% |

1.9% |

1.9% |

1.8% |

1.0% |

2.4% |

| Losses in the Basic Grid |

1.2% |

1.4% |

1.5% |

1.6% |

1.4% |

1.4% |

| Total |

9.1% |

9.0% |

9.2% |

9.4% |

8.4% |

9.7% |

__________

(1) As

of March 31, 2023

Power sale segment

We are pioneers in the commercialization

of energy in the Free Market. We were the first company to sell energy to Brazilian free consumers in the 1990s, having managed to maintain

our prominence as one of the main sellers in this segment. With the benefit of the integrated structure of one of the largest companies

in the electricity sector in Brazil, we offer our customers simplified access to services and solutions, flexible and customized energy

models, as well as management to companies in all stages of qualification and purchase of energy in the segment. We have more than 1.5

thousand customers across 23 states in Brazil and sold more than 24,544 GWh in the last twelve months ended March 31, 2023.

Our power sale segment continues

to be one of the most active in Brazil in the ACL and has continuously grown. Our energy trading history is illustrated below for the

indicated periods:

Source: Company

The net income of our power

sale segment was R$174.2 million in the last twelve months ended March 31, 2023 and the EBITDA of our power sale segment was R$222 million

in the last twelve months ended March 31, 2023.

For the three-month period

ended on March 31, 2023, we had approximately 5.01 million captive consumers, representing an increase of 1.7%, or 85,000 new consumers,

compared to the same period in 2022.

As of March 31, 2023, the

energy consumption of the captive market, in turn, decreased by 3.2% compared to the same period in 2022, as illustrated below:

|

|

Three-month period

ended March 31, |

Year ended December

31, |

| Energy Sales (GWh) |

2023 |

2022 |

2022 |

2021 |

2020 |

| Residential |

2,254 |

2,267 |

8,212 |

8,068 |

7,910 |

| Industrial |

474 |

516 |

2,102 |

2,275 |

2,314 |

| Commercial |

1,167 |

1,207 |

4,294 |

4,149 |

4,172 |

| Rural |

640 |

712 |

2,357 |

2,461 |

2,451 |

| Others |

614 |

618 |

2,405 |

2,359 |

2,333 |

| Total (Captive) |

5,150 |

5,319 |

19,370 |

19,312 |

19,180 |

|

Grid Market (Number

of Consumers) |

Three-month period

ended March 31, |

Year ended December

31, |

| |

2023 |

2022 |

2022 |

2021 |

2020 |

| Captive Market |

5,033,019 |

4,949,803 |

5,011,555 |

4,926,608 |

4,835,852 |

| Concessionaires and Permissionaires |

2 |

2 |

2 |

2 |

2 |

| Free Consumers |

2,722 |

2,394 |

2,629 |

2,318 |

1,871 |

| Local Grid Concessionaires |

5 |

5 |

5 |

5 |

5 |

| Total |

5,035,748 |

4,952,204 |

5,014,191 |

4,928,933 |

4,837,730 |

As of March 31, 2023, the

grid market (TUSD) consumption (distributed energy - GWh), which considers all consumers who accessed the distributor’s grid, decreased

by 1.1% compared to the same period in 2022, as illustrated below:

|

|

Three-month period

ended March 31, |

Year ended December

31, |

| Energy Sales (GWh) |

2023 |

2022 |

2022 |

2021 |

2020 |

| Captive Market |

5,150 |

5,319 |

19,370 |

19,312 |

19,180 |

| Concessionaires and Permissionaires |

22 |

23 |

91 |

86 |

76 |

| Free Consumers |

3,046 |

2,960 |

12,244 |

11,531 |

10,025 |

| Local Grid Concessionaires |

199 |

207 |

834 |

846 |

798 |

| Total |

8,418 |

8,510 |

32,539 |

31,755 |

30,079 |

Process of Transformation into a Company without a Controlling

Shareholder

We are constantly seeking

to improve our corporate governance, and in November 2022, the Government of the State of Paraná, our controlling shareholder,

announced its intention to transform us into a dispersed capital company without a controlling shareholder. Below are the main milestones

of this process:

| · | November 2022: The Legislative Assembly of the State of Paraná State approved the Law No. 21,272

of November 24, 2022 (“Law 21,272”), authorizing our transformation into a company without a controlling shareholder; |

| · | December 2022: We announced a study for the Comprehensive Renewal of the concessions of the Governador

Bento Munhoz da Rocha Netto (Foz do Areia), Governador Ney Braga (Segredo) and Governador José Richa (Salto Caxias) hydroelectric

power plants and disclosed our intention to conduct this offering to raise funds for the payment of the respective concession premiums; |

| · | January 2023: We entered into a collective bargaining agreement for the period 2022/2024 and announced

the hiring of specialized advisory services to structure a possible public offering of shares or units for our transformation into a company

without a controlling shareholder; |

| · | April 2023: The Ministry of Mines and Energy set the value of the concession premiums of the of the Governador

Bento Munhoz da Rocha Netto (Foz do Areia), Governador Ney Braga (Segredo) and Governador José Richa (Salto Caxias) hydroelectric

power plants at R$3.7 billion to be paid upon the renewal of the concession contract. In addition, the revision of the physical guarantees

of these plants was approved, subject to the validity of the new concession contract; |

| · | May 2023: We started the process of obtaining the required approvals to conduct this offering, including

waivers from our debenture holders and other creditors. We also initiated the valuation and due diligence work. We forwarded the completed

assessment to our controlling shareholder and the Paraná State Court of Auditors (Tribunal de Contas do Estado do Paraná

– TCE-PR) for analysis. The TCE-PR is an entity of the the Paraná State Legislative power tasked with auditing state accounts.;

and |

| · | July 2023: In a shareholder meeting, our shareholders approved this offering and a proposal to reform

our bylaws, which will become effective upon our transformation into a company without a controlling shareholder. For more information

on the changes, see “Amendments to our Bylaws” in the Disclosure 6-K. |

Following this offering,

we will be able to renew the concessions of Governador Bento Munhoz da Rocha Netto (Foz do Areia), Governador Ney Braga (Segredo) and

Governador José Richa (Salto Caxias) plants, through the payment of the concession premiums of R$3.7 billion. The table below provides

additional information on the installed capacity and concession terms of the Governador Bento Munhoz da Rocha Netto (Foz do Areia), Governador

Ney Braga (Segredo) and Governador José Richa (Salto Caxias) plants:

| Hydroelectric Plant |

Installed Capacity

(MW) |

End of Current

Concession |

End of New Concession(1) |

| |

|

|

| Foz do Areia |

1,676 |

2024 |

2053 |

| Segredo |

1,260 |

2032 |

2053 |

| Salto Caxias |

1,240 |

2033 |

2053 |

______________

(1) Assuming

renewal of current concession in 2023.

Value creation opportunities

Concession renewal

We will have to pay R$3.7

billion for the concession premiums to renew the concessions of Foz do Areia, Segredo and Salto Caxias. The payment of such premiums will

be made with the proceeds of this offering and a potential issuance of debt instruments. The hydroelectric plants are assets that make

up a significant part of our generating park, totaling 4,176 megawatts of installed capacity. Among our plants, these three hydroelectric

plants are the closest to the expiration of their concession, but the renewal of those concessions will grant us a 30-year extension.

Our hydroelectric powerplants

(“HPP”) are operational and represent approximately 60% of our installed capacity.

The renewal demonstrates our long-term plan for our generation business and our commitment to maintaining our position

as a leading energy player in Brazil.

Source: Company. Note: (1)

Considers the remaining years for the end of the concession of all plants, except Marumbi, Chopim I, Melissa, Salto do Vau and Pitangui,

which are exempt from concession, and UTE Figueira, which entered into test operation in 2022, according to ANEEL Order No. 1,047/2022;

(2) Considers average weighted by Installed Capacity; (3) Considers the participation in Copel's total installed capacity of 6,966 MW.

Reduction in PMSO

We have shown a steady improvement

in the reduction of Personnel, Material, Services and Other (“PMSO”) expenses. In the two-year period between 2020 and 2022,

our workforce was reduced by 792 people, reaching a total of 5,875 employees at the end of 2022, while PMSO reduced at a rate of 6.1%

per year over the same period, as illustrated in the chart below:

Source: Company

In addition, by becoming

a company without a controlling shareholder, we expect to be able to gain advantages to optimize our PMSO expenses, including: the possibility

to increase efficiency due to business process optimization and profit orientation based on leading industry players.

Increased operational efficiency in the distribution

segment

Operational efficiency in the distribution segment

Our DEC in 2022 was 7.98

hours, a 26% decrease compared to our DEC in 2016, and our FEC in 2022 was 5.29 hours, a decrease of 27% compared to 2016, in each case

always within the regulatory thresholds. The historical evolution of our DEC and FEC indices are illustrated below:

Source: Company

We intend to optimize the

rural distribution system, our operations, implement new digital services, create potential integration opportunities for our generation

and transmission teams and continue to invest in the distribution grid to modernize it.

Investments in digitalization and new technologies

We always strive to enhance

our distribution and deliver high-quality energy to our customers. Conscious of the increasing demand for energy and more demanding consumers,

we are heavily investing in business optimization and promoting automation processes through innovative technologies, as detailed below.

Paraná Three-Phase.

The Paraná Three-Phase Project establishes the replacement of 25,000 km of single-phase and two-phase grid by three-phase distribution

grid in the rural area. The project guarantees higher quality and safer energy for rural producers and other customers served in these

regions.

The new cables with a protective

cover have an enhanced level of resistance when hit by tree branches or other objects. The program also removes old poles from the middle

of plantations and places new poles on rural roads, which facilitates access for technicians and reduces operational and maintenance costs.

As of March 31, 2023, this

project had already delivered more than 11,700 km of reinforced and modernized grid. For the three-month period ended March 31, 2023,

we have invested R$149 million in the project and expect to invest an additional R$351 million during 2023. The initiative is renewing

the rural grid, which means increased supply quality and security to meet agricultural production, an economic engine of the state.

Smart Grid. Our Intelligent

Electricity Grid (“REI”) continues to meet scheduled deadlines, with the first stage having been delivered in early 2023,

and the second stage already underway. The improvements in remote sensing and the replacement of electromechanical and electronic meters

with smart equipment represent an unprecedented leap in the automation of the state’s energy grid. The REI ensures more assertiveness

in identifying defects and reduces the unavailability of the distribution system, allowing for a new energy model that meets the needs

of consumers, which we believe is fundamental to reducing our costs.

We expect that this project

will impact approximately 1.6 million consumers and will involve an investment of approximately R$820 million, in addition to reducing

our operation and maintenance costs. The chart below highlights the three stages of the project and their expected execution timeline,

as well as the amount of consumers we expect will benefit in each stage.

Source: Company

Digitization. The

investments aim at the possible integration of generation and transmission systems, as well as optimization of operations located in different

states.

Our investments also include

the modernization and digitization of our drone fleet, which is the second largest fleet of drones in Brazil. These drones are mainly

used to carry out inspection, surveillance, inventory, field research and cable launches.

Operational efficiency in the Generation and Transmission

segments

We continuously work on increasing

operational efficiency in the Generation and Transmission segments. We also have the ability to develop our own assets, such as the Jandaíra

Wind Complex (“Jandaíra Complex”). The Jandaíra Complex is located in the municipality of Jandaíra, in

the state of Rio Grande do Norte, and consists of four wind farms, totaling 90.1 MW of installed capacity. The Jandaíra Complex

is part of the Facilities Modernization Plan (PMI) that we are implementing in several of our assets. The start of operations was brought

forward by two years before the start of energy sales in the Regulated Contracting Environment (ACR).

In addition to developing

our own assets, we are constantly monitoring the market for possible acquisitions of new assets. We recently completed the acquisition

of the Aventura and Santa Rosa & Novo Mundo Wind Complexes, adding another 260 MW in installed capacity to our total installed capacity.

These wind complexes are approximately 30 km away from the Jandaíra Complex.

Growth avenues

Growth avenues within operating segments

We believe we have multiple

and clear avenues of growth to be explored. In the Distribution segment, we can grow organically by increasing investments in the depreciated

distribution grid, or inorganically through expansion into new concession areas.

In the Generation segment,

we plan to renew the Foz do Areia, Segredo and Salto Caxias concessions. In addition, we will also increase our focus on growth in wind

and solar generation, with the goal of having a 100% renewable portfolio by 2030. Finally, we continuously consider auctions and mergers

and acquisitions (“M&A”) opportunities.

In the Transmission segment,

we may explore opportunities in upcoming power transmission auctions. We will also consider M&A opportunities if they fit within our

investment policy.

In the commercialization

segment, we intend to remain among the largest in the Free Market, with a continuous focus on increasing profitability and providing more

accessibility to consumers. Additionally, we believe we will have more flexibility after our transformation into a company without a controlling

shareholder.

Asset divestments

We intend to divest assets

such as Compagas and Usina Elétrica a Gás de Araucária (“UEGA”). We currently hold 51% of Compagas (24.5%

is held by Mitsui Gás and 24.5% is held by Commit), a natural gas distribution concessionaire in Paraná, which had its concession

renewed in December 2022 for another 30 years (until 2054). The concession premium paid is R$508 million, with an expected Capex of R$2.5

billion to be realized within 30 years of the renewed concession. The new concession contract establishes a Price Cap model and has remuneration

based on the weighted average cost of capital defined in the concession contract (regulatory WACC) of 9.125%.

UEGA, the regulatory authorization

for which expires in 2029 (subject to renewal), is also in our divestment plans. Currently, we hold 81% of UEGA and Petrobras holds 19%.

We have entered into a Joint Sale Agreement with Petrobras in connection with the sale process. The thermal power plant has a total installed

capacity of 484 MW, with two gas turbines and one steam turbine.

Copel Ventures

Copel Ventures is an initiative

to make strategic and financial investments in companies in our sector. The Corporate Venture Capital model is part of our strategy for

the 2030 horizon. It seeks to foster, with a commitment of R$150 million to be invested over the next few years, innovative proposals

within the energy sector that are suitable for our innovation and investment thesis. According to our model, we expect our investments

to vary between R$2 million and R$10 million per investment.

Source: Company

ESG Day

We prioritize ESG (Environmental,

Social and Governance) practices. We believe we are an ethical and responsible company that has established itself as an organization

that provides energy and solutions to society, continuously seeking to integrate environmental, social and governance concerns into our

actions and strategic decisions. The reflection of what we aim to consolidate in the coming years has resulted in the “Vision 2030”

program, a plan created in 2022 that defines our ambition in business and in strengthening our sustainable development. It is guided by

three main pillars: decarbonization of our energy matrix, business integration on a large scale and discipline in capital allocation.

We produced our first Environmental

Impact Report for a generation project in 1987. We were also the first company in the energy sector in Brazil to become a signatory to

the UN Global Compact in 2000. We promote actions for the dissemination of the UN 2030 Agenda and the implementation of the SDGs in the

electricity sector. We adhered to the “Pact for Water and Energy Resilience” Commitment and received the Pro-Gender and Race

Equality Seal from the Federal Government. We received the Pro-Ethics Seal, 2018-2019 and 2020-2021 editions, granted by CGU and Instituto

ETHOS, for the voluntary adoption of integrity measures, with public recognition for the commitment to implement measures aimed at the

prevention, detection and remediation of acts of corruption and fraud.

Below are the main ESG initiatives

we have taken in recent years:

| · | 2017: Creation of the Governance, Risks and Compliance Committee |

| · | 2018: Installation of Brazil’s first electrified highway and revamp of the whistleblowing

channel |

| · | 2019: Achieved maximum score in B3's Outstanding State Governance Program. |

| · | 2020: Received the “Pro-Ethics” certificate, stipulated as concept B by CDP and stipulated

the Human Rights Policy. |

| · | 2021: Carbon Neutrality Plan, migration to Level 2 of B3 governance and insertion of ESG targets

in variable remuneration. |

| · | 2022: Revision of the Code of Conduct, creation of the Vision 2030 plan and adherence to the Decarbonization

Plan, the Transparency Movement and the Net Zero Ambition Movement, both of the UN Global Compact. |

We have plans for the future

across all ESG segments. On the Environmental side, we have developed our Carbon Neutrality Plan for 2021, which we expect could result

in the reduction of greenhouse gas (GHG) emissions and the offsetting of residual scope one emissions by 2030 for assets under our operational

control.

As part of this neutrality

plan, we have started implementing an electric vehicle fleet with electric modernization and fleet leasing, providing greater efficiency,

keeping up with technological updates and reducing pollutant emissions.

We will carry out this objective

based on four steps:

| · | Alternatives and opportunities for compensation (I-REC) |

| · | Carbon neutralization intrinsic to the Company's strategy |

In the Social aspect, a wide

range of activities were conducted with society in 2022. The focus was on workshops and training sessions held for both internal audiences

(employees and third parties) and external public (communities, social and educational institutions). Various topics were addressed during

these sessions, including human rights, diversity, environment, child labor, health, SDGs (Sustainable Development Goals). We prioritize

the most relevant SDGs (Sustainable Development Goals) for companies in the electricity sector based on the document “Integration

of SDGs in the Brazilian Electricity Sector” (SEB), prepared in 2018. These goals are: quality education, clean and affordable energy,

decent work and economic growth, industry, innovation & infrastructure, sustainability for cities and communities and actions against

global climate change.

Finally, in the realm of

Governance, we are listed at B3 Governance level 2. We have established the following statutory advisory committees that report to the

Board of Directors: Statutory Audit Committee (CAE); Statutory Sustainable Development Committee (CDS), Investment and Innovation Committee

(CII) and Minority Committee (CDM). Moreover, our Board of Directors primarily consists of independent members.

Over the past few years,

we have been recognized by the market for our sustainability initiatives. Some of the awards we have won include “Best Electricity

Company in Brazil” by Valor 1000 - 1st place - 2022; “Best in Management Award” for Copel G&T - 1st place by the

National Quality Foundation - Management Excellence - 2023, “Best Energy Distributor Award” - Abradee - 1st place - 2021,

and “Best Energy Distributor in Southern Brazil Award” - Abradee - 1st place - 2022.

Sustainable Value Generation

Our financial management

is based on four pillars:

| · | Focus on Cash: we seek divestments from non-core segments, operational efficiencies, cost reductions and

gains in scale; |

| · | Efficient Capital Allocation: clear and defined Investment policy, constant governance improvements, risk

diversification, RAB investment and M&A opportunities; |

| · | Balanced Capital Structure: investments and dividends aiming at capital structure optimization and target

leverage level, reflecting mainly our business profile; and |

| · | Return on Invested Capital and Value Creation: established dividend policy, compatible dividend yield

and investments that potentially increase our enterprise value. |

In 2022, we invested R$2,330

million across our operating segments with a focus on efficiency and value creation, R$1,848 million of which was invested in the distribution

segment and R$473 million of which was invested in the generation and transmission segment.

Source: Company. Note: Investment

program does not include acquisitions of the Vilas, Aventura and SRMN wind farms.

We believe that our strong

cash flow generation and robust opportunity selection process allow for an efficient allocation of capital. Going forward, we intend to

focus our capital allocation primarily on the distribution and renewable energy segments.

Dividend Policy

Our Dividend Policy establishes

the guidelines for the distribution of proceeds to shareholders through dividends and/or interest on equity. For the calculation of regular

dividends, we use financial parameters established at the end of each year, considering our financial leverage and with the objective

of preserving our sustainable investment capacity. We have at least two dividend payments per year.

In 2022, we declared dividends equivalent to a total of 84% of our net income for the year, which represented 5.16%

of our share price of that same period considering the closing price of our shares weighted by the volume of shares for the year (“dividend

yield”). On November 30, 2022, we declared the distribution of R$970 million in dividends, which we paid in two installments: one

of R$600 million on November 30, 2022 and another of R$370 million on June 30, 2023. The chart below outlines the historical percentage

of our net income we distributed each year (“payout”), total values distributed (in R$ million) and dividend yield for the

indicated periods.

Source: Company

THE

OFFERING

In November 2022, we received

a communication from the State of Paraná, our controlling shareholder, that it intended to implement a transaction to sell its

controlling stake and have Copel become a company without a controlling shareholder, subject to the creation of the Golden Share and certain

other amendments to our bylaws described under “Recent Developments―Amendment to our Bylaws” above. In December 2022,

our controlling shareholder requested our involvement in the structuring of such transaction pursuant to a recently enacted state law.

In May 2023, we engaged certain external financial advisors to assist us in evaluating and structuring this offering. In June 2023, our

Board of Directors approved submitting to our shareholders the required resolutions and bylaw amendments to enable this offering pursuant

to the state law authorizing and determining the conditions under which the State of Parana, our controlling shareholder, would be allowed

sell its controlling stake in us. In July 2023, our shareholders approved such resolutions and bylaw amendments, as further described

in the Disclosure 6-K.

| Issuer |

Companhia Paranaense de Energia. |

| Selling Shareholder |

The State of Paraná, a State of the Federative Republic of Brazil |

| Common Shares offered by us |

229,886,000 common shares, without taking into consideration the common shares to be sold in the over-allotment option. |

| Common Shares offered by the selling shareholder |

319,285,000 common shares, without taking into consideration the common shares to be sold in the over-allotment option. |

| International placement agents |

BTG Pactual US Capital, LLC, Itau BBA USA Securities, Inc., Bradesco Securities, Inc., Morgan Stanley & Co. LLC, and UBS Securities LLC |

| Brazilian Underwriters |

Banco BTG Pactual S.A., Banco Itaú BBA S.A., Bradesco BBI S.A., Banco Morgan Stanley S.A. and UBS Brasil Corretora de Câmbio, Títulos e Valores Mobiliários S.A. |

| Global offering |

The global offering includes the Brazilian offering and the international offering. The global offering also includes a secondary offering by the Selling Shareholder. |

| International offering |

The international offering is being conducted outside Brazil and includes an offering registered with the SEC. The international placement agents are acting as placement agents on behalf of the Brazilian underwriters for sales of Common Shares to investors outside Brazil in the international offering. |

| Brazilian offering |

As part of the Brazilian offering, the Brazilian underwriters are placing Common Shares to retail investors (the “Brazilian retail offering”) and to qualified non-institutional investors (the “Brazilian qualified non-institutional offering”) in Brazil. The offering to investors in Brazil is exempt from registration with the SEC under Regulation S. The securities placed to investors in Brazil are being offered by means of a “Prospecto da Oferta Pública de Distribuição Primária e Secundária de Ações Ordinárias de Emissão da Companhia Paranaense de Energia” and the Brazilian Underwriting Agreement. |

| Purchases of Common Shares |

All Common Shares purchased in the global offering (including in the United States) will be settled and delivered in Brazil and paid for in reais. Any investor outside Brazil purchasing our Common Shares must be authorized to invest in Brazilian securities pursuant to the applicable rules and regulations of the Brazilian National Monetary Council (Conselho Monetário Nacional, or CMN), the Brazilian Securities Commission (Comissão de Valores Mobiliários, or CVM), and the Central Bank of Brazil (Banco Central do Brasil). |

| Offering price |

The public offering price is set forth on the cover page of this prospectus supplement. |

| |

|

| Over-allotment option |

We and the Selling Shareholder have the right to sell, solely for the purpose of covering over-allotments, if any, pursuant to the Brazilian Underwriting Agreement, subject of the agreement of Banco Itaú BBA S.A. upon notice to the other Brazilian underwriters, up to an additional 82,375,650 Common Shares, 18,518,650 of which will be sold by us and 63,857,000 of which will be sold by the Selling Shareholder, at the offering price referenced on the cover page of this prospectus supplement, in aggregate representing up to 15% of the Common Shares initially offered in the global offering |

| Use of proceeds |

We estimate that the net proceeds

to us from the sale of our Common Shares in the global offering (excluding the over-allotment option) will be R$1,867.1 million, after

deduction of discounts and commissions and estimated expenses payable by us. Allocation of the net proceeds will be made as described

under “Use of Proceeds” below.

We will not receive any of

the proceeds from the secondary offering involving the selling shareholder. |

| Distributions |

In accordance with our bylaws and Brazilian Corporate Law, we are required to (except as described below) regularly pay annual dividends for each fiscal year within sixty days of the declaration of the dividends at the annual shareholders’ meeting or by the board of directors of Copel (the “Board of Directors”). Pursuant to our dividend policy, we have at least two dividend payments per year; see “Summary―Dividend Policy.” To the extent amounts are available for distribution, we are required to distribute as a mandatory dividend an aggregate amount equal to at least 25.0% of our adjusted net profit. Under Brazilian Corporate Law, we are not permitted to suspend the mandatory dividend payable for any year, except for retaining part of the mandatory dividend in a special reserve for unrealized profits when the realized part of the net profit is smaller than the mandatory dividend. Brazilian Corporate Law permits, however, a company to suspend the payment of all dividends if our management, with the approval of the supervisory board, reports at the shareholders’ meeting that the distribution would be detrimental to the Company given its financial circumstances. |

| Voting rights |

Of the three classes of our

stock traded in the market (Common Shares, Class A preferred shares and Class B preferred shares), only the common stock carries full

voting rights. Under the terms of our bylaws, however, specific rights apply to the non-voting preferred stock: our preferred shares are

entitled to vote on certain matters described in our bylaws pursuant to B3’s Nível 2 listing requirements and such shares

may acquire full voting rights under certain conditions described in our bylaws.

In our shareholders meeting

held on July 10, 2023, our shareholders approved certain changes to our bylaws, which will come into effect if this offering is consummated.

If such changes come into effect:

·

the State of Paraná will hold a special class of preferred share (“Golden Share”), which will give it veto power

over certain corporate resolutions, subject to it holding 10% of our capital stock;

·

our bylaws will provide for a limitation to the effect that no shareholder or group of shareholders shall be allowed to cast votes

corresponding to more than 10% of the total votes that could be cast by the then-outstanding voting shares in each resolution; and

·

our bylaws will provide for a poison-pill provision in the Company’s bylaws seeking to protect the dispersion of shares,

which would require that a shareholder or group of shareholders that directly or indirectly becomes the holder of common shares that,

together, representing more than 25% of Copel’s voting capital must make a tender offer for the acquisition of all the other common

shares, for a price of at least 100% more than the highest price of the common shares in the last 504 trading sessions prior to the acquisition,

updated by the SELIC rate. The tender offer of a shareholder or group of shareholders holding shares representing more than 50% of Copel’s

voting capital must be for a price of at least 200% under the same criteria mentioned above, provided, however, that shareholder or group

of shareholders does not reduce its shareholding to at least 50% of Copel’s voting capital within a 120-day period.

For more information on voting

rights see our bylaws and “Amendments to our Bylaws” in the Disclosure 6-K. |

| Listings |

Our Common Shares are publicly

traded in Brazil on B3 under the symbol “CPLE3.”

Our Common Shares trade on

the Latibex under the symbol “XCOPO.”

Our Common Shares will not

be listed on a U.S. national securities exchange.

For more information, see

“Trading Markets.” |

| Lock-up agreements |

We, the Selling Shareholder and our directors and officers who currently own our shares have agreed not to sell our Common Shares or securities convertible into, exchangeable for, exercisable for, or repayable with common or preferred shares, for 180 days after the date of this prospectus supplement without first obtaining the written consent of BTG Pactual US Capital, LLC. |

| Priority Offering in Brazil |

Holders of our Common Shares,

Class A preferred shares and Class B preferred shares (including in the form of units) at B3 as of July 25, 2023 were given the opportunity

to subscribe for Common Shares in the Brazilian offering on a priority basis at the public offering price.

Holders of Unit ADSs and the

shareholders that hold our shares outside of B3 were not be permitted to participate in the priority offering. See “Underwriting — Priority

Offering in Brazil.”

The subscription rights in

the priority offering were not registered under the Securities Act or under any U.S. state securities laws. Accordingly, the priority

offering was made only as part of the Brazilian offering in reliance upon certain exemptions from, or in transactions not subject to,

the registration requirements of the Securities Act, and the priority offering were not made available to investors in the United States

or to any U.S. person (as defined in Rule 902 of Regulation S under the Securities Act, as such regulation may be amended from time to

time (“Regulation S”)), and were not available or included as part of the international offering. For the avoidance of doubt,

(i) all references to the issuance, offer, placement or sale of the Common Shares in the context of the international offering shall not

include the priority offering, and (ii) all references to the Common Shares in the context of the international offering shall not include

the Common Shares issued, offered or sold by the Company in connection with the priority offering (which shall only be made available

as part of the Brazilian offering). |

| Capital stock before and after the offering |

Before the global offering, we had 1,054,090,460 common shares outstanding. After the global offering, we will have 1,283,976,460 Common Shares outstanding (not considering the exercise of the over-allotment option). For more information on the potential effect of this offering in our capital stock, see “Principal Shareholders.” |

| Risk factors |

You should carefully consider the risk factors discussed beginning on page S-25, the sections entitled “Risk Factors” in our 2022 Form 20-F/A, which is incorporated by reference in this prospectus supplement, and the other information included or incorporated by reference in this prospectus supplement, before deciding to invest in our Common Shares. |

RISK

FACTORS

Our 2022 Form 20-F/A includes

extensive risk factors relating to our operations, our compliance and control risks, our relationship with the Brazilian federal government,

and to Brazil. You should carefully consider those risks and the risks described below, as well as the other information included or incorporated

by reference in this prospectus supplement and the accompanying prospectus, before making a decision to invest in our Common Shares.

After the closing of this offering, the state of Paraná

will no longer be our controlling shareholder.

After the closing of this

offering, the State of Paraná will no longer be our controlling shareholder. As such, if no other shareholder obtains control,

we may be more exposed to takeover attempts, group of shareholders coordinating votes and the resulting conflicts of interests. Not having

a controlling shareholder may also make it more likely for a shareholder deadlock or for our shareholder meetings not being convened due

to a lack of quorum, as well as less likely for us to identify conflicts of interest from our shareholders or voting right abuses.

If, as a result of this offering

or in the future, another shareholder becomes our controlling shareholder, such shareholder will be able to substantially influence our

business strategy, management and even the terms of our bylaws, any of which could adversely affect the price of our Common Shares.

The market price of our Common Shares may be volatile.

The market price of our Common

Shares may be volatile. Broad general economic, political, market and industry factors, many of which are beyond our control, may adversely

affect the market price of our Common Shares, regardless of our actual operating performance. Factors that could cause fluctuation in

the price of our Common Shares include:

| · | actual or anticipated variations in quarterly operating results and the results of competitors; |