Correction: Fourth quarter 2024 net income, excluding the impact of

adjustments, revised to $65.5 million and 2024 Class A diluted

earnings per share, excluding adjustments, revised to $1.13. In the

earnings release issued earlier today, the fourth quarter 2024 net

income, excluding the impact of adjustments, incorrectly presented

a $16.0 million income tax expense related to “(gain) loss on

disposal of businesses, net”. This resulted in stating net income,

excluding the impact of adjustments, for the period of $49.6

million and diluted Class A earnings per share, excluding

adjustments, for the period of $0.85. The corrected net income,

excluding the impact of adjustments, for the period is $65.5

million, and the corrected diluted Class A earnings per share,

excluding adjustments, for the period is $1.13.

Greif Reports Fourth Quarter and Fiscal

2024 Results

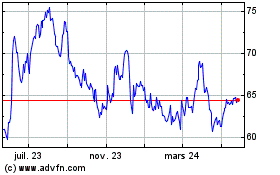

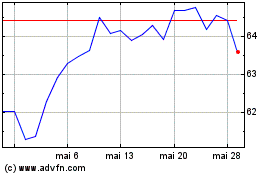

Greif, Inc. (NYSE: GEF, GEF.B), a world leader

in industrial packaging products and services, today announced

fourth quarter and fiscal 2024 results.

Fiscal Fourth

Quarter 2024 Financial

Highlights: (all results compared to the

fourth quarter

2023 unless otherwise noted)

-

Net income decreased 6.5% to $63.4 million or $1.08 per diluted

Class A share compared to net income of $67.8 million or $1.16 per

diluted Class A share. Net income, excluding the impact of

adjustments(1), decreased 29.3% to $65.5 million or $1.13 per

diluted Class A share compared to net income, excluding the impact

of adjustments, of $92.6 million or $1.59 per diluted Class A

share.

-

Adjusted EBITDA(2) decreased 2.0% to $197.6 million compared to

Adjusted EBITDA of $201.6 million.

-

Net cash provided by operating activities decreased by

$16.3 million to $187.2 million. Adjusted free cash flow(3)

increased by $8.5 million to $144.7 million.

Fiscal Year Results Include:(all results

compared to the fiscal year 2023

unless otherwise noted):

-

Net income decreased 27.0% to $262.1 million or $4.52 per diluted

Class A share compared to net income of $359.2 million or $6.15 per

diluted Class A share. Net income, excluding the impact of

adjustments, decreased 30.9% to $249.5 million or $4.31 per diluted

Class A share compared to net income, excluding the impact of

adjustments, of $361.2 million or $6.19 per diluted Class A

share.

-

Adjusted EBITDA decreased 15.6% to $694.2 million compared to

Adjusted EBITDA of $822.2 million.

-

Net cash provided by operating activities decreased by

$293.5 million to $356.0 million. Adjusted free cash flow

decreased by $291.4 million to $189.8 million.

- Total debt increased by

$525.5 million to $2,740.6 million. Net debt(4) increased by

$508.7 million to $2,542.9 million. The Company's leverage ratio(5)

increased to 3.53x from 2.2x in the prior year quarter, and

decreased from 3.64x sequentially.

Strategic Actions and

Announcements

-

Hosting Investor Day on December 11, 2024, at Convene: 75

Rockefeller Plaza in New York City.

-

Completed previously announced business model optimization project

to fully leverage our core competitive advantages and facilitate

accelerated growth. This operating model change will result in the

following four new reportable segments beginning in the first

quarter of 2025: Customized Polymer Solutions; Durable Metal

Solutions; Sustainable Fiber Solutions; and Integrated

Solutions.

- Related to our new segments, on

Thursday, December 5, 2024, we will be releasing online the

previous eight quarters of segment financial highlights to assist

our investor community in modeling our new reportable segments.

This information will be made available at our investor relations

site https://investor.greif.com/.

- Announcing targeted cost

optimization effort to eliminate $100 million of structural costs

from the business through a combination of SG&A

rationalization, network optimization, and operating efficiency

gains. More information on this effort will be provided at our

upcoming Investor Day.

Commentary from CEO Ole

Rosgaard

“I am pleased to report a solid fourth quarter

and full year 2024 result, particularly in light of the

continuation of this extended period of industrial contraction.

While managing the business for the present, we also made

significant strides under our Build to Last strategy towards the

future, and our executive team and I look forward to sharing more

information at our Investor Day next week. Our investors can expect

an interactive and engaging half day session, and we highly

encourage your in-person attendance as we look forward to 2025 and

beyond.”

Build to Last Mission

Progress

Recently completed our fourteenth wave NPS(6)

survey, receiving feedback from nearly five thousand customers

globally for a net score of 69, recognized as a world-class score

within the manufacturing industry. At our upcoming Investor Day, we

plan to further discuss the powerful correlation between NPS, an

indicator of our Legendary Customer Service, and financial

performance. We thank our customers for their continued feedback,

which is critical in helping us achieve our vision to be the best

performing customer service company in the world, and we are proud

to continue to earn positive feedback from our customers throughout

a difficult global operating environment.

|

(1) |

Adjustments that are excluded from net income before adjustments

and from earnings per diluted Class A share before adjustments are

acquisition and integration related costs, restructuring charges,

non-cash asset impairment charges, non-cash pension settlement

charges, (gain) loss on disposal of properties, plants and

equipment, net, (gain) loss on disposal of businesses, net, and

other costs. |

| |

|

| (2) |

Adjusted EBITDA is defined as net income, plus interest expense,

net, plus income tax (benefit) expense, plus depreciation,

depletion and amortization expense, plus acquisition and

integration related costs, plus restructuring charges, plus

non-cash asset impairment charges, plus non-cash pension settlement

charges, plus (gain) loss on disposal of properties, plants and

equipment, net, plus (gain) loss on disposal of businesses, net,

plus other costs. |

| |

|

| (3) |

Adjusted free cash flow is defined as net cash provided by

operating activities, less cash paid for purchases of properties,

plants and equipment, plus cash paid for acquisition and

integration related costs, plus cash paid for integration related

Enterprise Resource Planning ("ERP") systems and equipment, plus

cash paid for taxes related to Tama, Iowa mill divestment, plus

cash paid for fiscal year-end change costs. |

| |

|

| (4) |

Net debt is defined as total debt less cash and cash

equivalents. |

| |

|

| (5) |

Leverage ratio for the periods indicated is defined as adjusted net

debt divided by trailing twelve month EBITDA, each as calculated

under the terms of the Company's Second Amended and Restated Credit

Agreement dated as of March 1, 2022, filed as Exhibit 10.1 to the

Company's Quarterly Report on Form 10-Q for the fiscal quarter

ended January 31, 2022 (the "2022 Credit Agreement"). As calculated

under the 2022 Credit Agreement, adjusted net debt was $2,452.3

million, $2,608.5 million, and $1,856.8 million as of October 31,

2024, July 31, 2024 and October 31, 2023, respectively, and

trailing twelve month credit agreement EBITDA was $695.0 million,

$717.2 million, and $845.9 million as of October 31, 2024,

July 31, 2024 and October 31, 2023, respectively. |

| |

|

| (6) |

Net Promoter Score ("NPS") is derived from a survey conducted by a

third party that measures how likely a customer is to recommend

Greif as a business partner. NPS scores are calculated by

subtracting the percentage of detractors a business has from the

percentage of its promoters. |

| |

|

Note: A reconciliation of the differences

between all non-GAAP financial measures used in this release with

the most directly comparable GAAP financial measures is included in

the financial schedules that are a part of this release. These

non-GAAP financial measures are intended to supplement, and should

be read together with, our financial results. They should not be

considered an alternative or substitute for, and should not be

considered superior to, our reported financial results.

Accordingly, users of this financial information should not place

undue reliance on these non-GAAP financial measures.

Segment Results (all results compared to the

fourth quarter of

2023 unless otherwise noted)

Net sales are impacted mainly by the volume of

primary products(7) sold, selling prices, product mix and the

impact of changes in foreign currencies against the U.S. dollar.

The table below shows the percentage impact of each of these items

on net sales for our primary products for the fourth quarter of

2024 as compared to the prior year quarter for the business

segments with manufacturing operations. Net sales from completed

acquisitions of Reliance Products Ltd. (“Reliance”) and Ipackchem

Group SAS ("Ipackchem") primary products are not included in the

table below, but will be included in their respective segments

starting in the fiscal first quarter of 2025 for Reliance and

fiscal third quarter of 2025 for Ipackchem.

| Net Sales Impact -

Primary Products |

Global Industrial Packaging |

|

Paper Packaging &Services |

|

Currency Translation |

— |

% |

|

— |

% |

| Volume |

3.7 |

% |

|

0.7 |

% |

| Selling Prices and

Product Mix |

0.4 |

% |

|

5.0 |

% |

| Total Impact of Primary

Products |

4.1 |

% |

|

5.7 |

% |

| |

|

|

|

|

|

| |

|

|

|

|

|

Global Industrial Packaging

Net sales increased by $65.9 million to

$786.9 million primarily due to contributions from recent

acquisitions and higher volumes.

Gross profit increased by $12.6 million to

$167.0 million due to the same factors that impacted net sales,

partially offset by higher raw material, labor and manufacturing

costs.

Operating profit decreased by $0.1 million

to $75.0 million primarily due to higher SG&A expenses from

recent acquisitions, offset by the same factors that impacted gross

profit. Adjusted EBITDA increased by $4.0 million to $109.4

million primarily due to the same factors that impacted gross

profit, partially offset by higher SG&A expenses from recent

acquisitions.

Paper Packaging &

Services

Net sales increased by $42.9 million to

$624.5 million primarily due to higher average selling prices as a

result of higher published containerboard and boxboard prices.

Gross profit decreased by $0.1 million to

$118.7 million primarily due to higher raw material and labor

costs, offset by the same factors that impacted net sales.

Operating profit increased by $13.4 million

to $48.7 million primarily due to lower non-cash impairment charges

and restructuring charges related to optimizing and rationalizing

operations in the prior year, partially offset by the same factors

that impacted gross profit and higher SG&A expenses related to

higher health, medical, incentive and pension expenses. Adjusted

EBITDA decreased by $8.4 million to $85.3 million primarily

due to the same factors that impacted gross profit and higher

SG&A expenses related to higher health, medical, incentive and

pension expenses.

Tax Summary

During the fourth quarter, we recorded an income

tax rate of 21.8 percent and a tax rate excluding the impact of

adjustments of 21.9 percent. Note that the application of

accounting for income taxes often causes fluctuations in our

quarterly effective tax rates. For the full year, we recorded an

income tax rate of 10.6 percent and a tax rate excluding the impact

of adjustments of 7.4 percent.

Dividend Summary

On December 3, 2024, the Board of Directors

declared quarterly cash dividends of $0.54 per share of Class A

Common Stock and $0.80 per share of Class B Common Stock. Dividends

are payable on January 1, 2025, to stockholders of record at the

close of business on December 16, 2024.

|

(7) |

Primary products are manufactured steel, plastic and fibre drums;

new and reconditioned intermediate bulk containers; jerrycans and

other small plastics; linerboard, containerboard, corrugated sheets

and corrugated containers; and boxboard and tube and core

products. |

|

|

|

Company Outlook

Our markets have now experienced a multi-year

period of industrial contraction, and we have not identified any

compelling demand inflection on the horizon, despite slightly

improved year over year volumes. While we believe we are well

positioned for an eventual recovery of the industrial economy, at

this time we believe it is appropriate to provide only low-end

guidance based on the continuation of demand trends reflected in

the past year, current price/cost factors in Paper Packaging and

Services, and other identifiable discrete items which we will

discuss during our fourth quarter earnings release call. Call-in

details are provided below.

|

(in millions, except per share amounts) |

Fiscal 2025 Low-End

Guidance Estimate |

|

Adjusted EBITDA |

$675 |

| Adjusted free cash flow |

$225 |

|

|

|

Note: Fiscal 2025 net income guidance, the most

directly comparable GAAP financial measure to Adjusted EBITDA, is

not provided in this release due to the potential for one or more

of the following, the timing and magnitude of which we are unable

to reliably forecast: gains or losses on the disposal of businesses

or properties, plants and equipment, net; non-cash asset impairment

charges due to unanticipated changes in the business;

restructuring-related activities; acquisition and integration

related costs; and ongoing initiatives under our Build to Last

strategy. No reconciliation of the 2025 low-end guidance estimate

of Adjusted EBITDA, a non-GAAP financial measure which excludes

restructuring charges, acquisition and integration related costs,

non-cash asset impairment charges, and (gain) loss on the disposal

of properties, plants and equipment, (gain) loss on the disposal of

businesses, net, and other costs, is included in this release

because, due to the high variability and difficulty in making

accurate forecasts and projections of some of the excluded

information, together with some of the excluded information not

being ascertainable or accessible, we are unable to quantify

certain amounts that would be required to be included in net

income, the most directly comparable GAAP financial measure,

without unreasonable efforts. A reconciliation of 2025 low-end

guidance estimate of adjusted free cash flow to fiscal 2025

forecasted net cash provided by operating activities, the most

directly comparable GAAP financial measure, is included in this

release.

Conference Call

The Company will host a conference call to

discuss the fourth quarter and fiscal 2024 results on December 5,

2024, at 8:30 a.m. Eastern Time (ET). Participants may access the

call using the following online registration link:

https://register.vevent.com/register/BId6a2105d615e45438d7c615c6b1ce4d5.

Registrants will receive a confirmation email containing dial in

details and a unique conference call code for entry. Phone lines

will open at 8:00 a.m. ET on December 5, 2024. A digital

replay of the conference call will be available two hours following

the call on the Company's web site at

http://investor.greif.com.

Investor Relations contact

information

Bill D’Onofrio, Vice President, Corporate

Development & Investor Relations, 614-499-7233.

Bill.Donofrio@greif.com

About Greif

Greif is a global leader in industrial packaging

products and services and is pursuing its vision: to be the best

performing customer service company in the world. The Company

produces steel, plastic and fibre drums, intermediate bulk

containers, reconditioned containers, jerrycans and other small

plastics, containerboard, uncoated recycled paperboard, coated

recycled paperboard, tubes and cores and a diverse mix of specialty

products. The Company also manufactures packaging accessories and

provides other services for a wide range of industries. In

addition, the Company manages timber properties in the southeastern

United States. The Company is strategically positioned in over 35

countries to serve global as well as regional customers. Additional

information is on the Company's website at www.greif.com.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. The words “may,” “will,” “expect,” “intend,” “estimate,”

“anticipate,” “aspiration,” “objective,” “project,” “believe,”

“continue,” “on track” or “target” or the negative thereof and

similar expressions, among others, identify forward-looking

statements. All forward-looking statements are based on

assumptions, expectations and other information currently available

to management. Although the Company believes that the

expectations reflected in forward-looking statements have a

reasonable basis, the Company can give no assurance that these

expectations will prove to be correct. Such forward-looking

statements are subject to certain risks and uncertainties that

could cause the Company’s actual results to differ materially from

those forecasted, projected or anticipated, whether expressed or

implied.

Such risks and uncertainties that might cause a

difference include, but are not limited to, the following: (i)

historically, our business has been sensitive to changes in general

economic or business conditions, (ii) our global operations subject

us to political risks, instability and currency exchange that could

adversely affect our results of operations, (iii) the current and

future challenging global economy and disruption and volatility of

the financial and credit markets may adversely affect our business,

(iv) the continuing consolidation of our customer base and

suppliers may intensify pricing pressure, (v) we operate in highly

competitive industries, (vi) our business is sensitive to changes

in industry demands and customer preferences, (vii) raw material

shortages, price fluctuations, global supply chain disruptions and

increased inflation may adversely impact our results of operations,

(viii) energy and transportation price fluctuations and shortages

may adversely impact our manufacturing operations and costs, (ix)

we may encounter difficulties or liabilities arising from

acquisitions or divestitures, (x) we may incur additional

rationalization costs and there is no guarantee that our efforts to

reduce costs will be successful, (xi) several operations are

conducted by joint ventures that we cannot operate solely for our

benefit, (xii) certain of the agreements that govern our joint

ventures provide our partners with put or call options, (xiii) our

ability to attract, develop and retain talented and qualified

employees, managers and executives is critical to our success,

(xiv) our business may be adversely impacted by work stoppages and

other labor relations matters, (xv) we may be subject to losses

that might not be covered in whole or in part by existing insurance

reserves or insurance coverage and general insurance premium and

deductible increases, (xvi) our business depends on the

uninterrupted operations of our facilities, systems and business

functions, including our information technology and other business

systems, (xvii) a cyber-attack, security breach of customer,

employee, supplier or Company information and data privacy risks

and costs of compliance with new regulations may have a material

adverse effect on our business, financial condition, results of

operations and cash flows, (xviii) we could be subject to changes

in our tax rates, the adoption of new U.S. or foreign tax

legislation or exposure to additional tax liabilities, (xix) we

have a significant amount of goodwill and long-lived assets which,

if impaired in the future, would adversely impact our results of

operations, (xx) changing climate, global climate change

regulations and greenhouse gas effects may adversely affect our

operations and financial performance, (xxi) we may be unable to

achieve our greenhouse gas emission reduction target by 2030,

(xxii) legislation/regulation related to environmental and health

and safety matters could negatively impact our operations and

financial performance, (xxiii) product liability claims and other

legal proceedings could adversely affect our operations and

financial performance, and (xxiv) we may incur fines or penalties,

damage to our reputation or other adverse consequences if our

employees, agents or business partners violate, or are alleged to

have violated, anti-bribery, competition or other laws.

The risks described above are not all-inclusive,

and given these and other possible risks and uncertainties,

investors should not place undue reliance on forward-looking

statements as a prediction of actual results. For a detailed

discussion of the most significant risks and uncertainties that

could cause our actual results to differ materially from those

forecasted, projected or anticipated, see “Risk Factors” in Part I,

Item 1A of our most recently filed Form 10-K and our other filings

with the Securities and Exchange Commission.

All forward-looking statements made in this news

release are expressly qualified in their entirety by reference to

such risk factors. Except to the limited extent required by

applicable law, we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

| |

|

GREIF, INC. AND SUBSIDIARY

COMPANIESCONDENSED CONSOLIDATED STATEMENTS OF

INCOMEUNAUDITED |

| |

| |

Three Months EndedOctober

31, |

|

Twelve Months EndedOctober

31, |

|

(in millions, except per share amounts) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net sales |

$ |

1,417.1 |

|

|

$ |

1,308.4 |

|

|

$ |

5,448.1 |

|

|

$ |

5,218.6 |

|

| Cost of products sold |

|

1,128.4 |

|

|

|

1,032.7 |

|

|

|

4,377.3 |

|

|

|

4,072.5 |

|

|

Gross profit |

|

288.7 |

|

|

|

275.7 |

|

|

|

1,070.8 |

|

|

|

1,146.1 |

|

| Selling, general and

administrative expenses |

|

157.5 |

|

|

|

136.8 |

|

|

|

634.5 |

|

|

|

549.1 |

|

| Acquisition and integration

related costs |

|

2.4 |

|

|

|

3.5 |

|

|

|

18.5 |

|

|

|

19.0 |

|

| Restructuring charges |

|

3.8 |

|

|

|

5.2 |

|

|

|

5.4 |

|

|

|

18.7 |

|

| Non-cash asset impairment

charges |

|

0.7 |

|

|

|

16.9 |

|

|

|

2.6 |

|

|

|

20.3 |

|

| (Gain) loss on disposal of

properties, plants and equipment, net |

|

(2.4 |

) |

|

|

0.8 |

|

|

|

(8.8 |

) |

|

|

(2.5 |

) |

| (Gain) loss on disposal of

businesses, net |

|

0.1 |

|

|

|

0.1 |

|

|

|

(46.0 |

) |

|

|

(64.0 |

) |

|

Operating profit |

|

126.6 |

|

|

|

112.4 |

|

|

|

464.6 |

|

|

|

605.5 |

|

| Interest expense, net |

|

39.2 |

|

|

|

24.8 |

|

|

|

134.9 |

|

|

|

96.3 |

|

| Non-cash pension settlement

charges |

|

— |

|

|

|

3.5 |

|

|

|

— |

|

|

|

3.5 |

|

| Other (income) expense,

net |

|

0.6 |

|

|

|

1.4 |

|

|

|

10.1 |

|

|

|

11.0 |

|

|

Income before income tax expense and equity earnings of

unconsolidated affiliates, net |

|

86.8 |

|

|

|

82.7 |

|

|

|

319.6 |

|

|

|

494.7 |

|

| Income tax (benefit)

expense |

|

18.9 |

|

|

|

9.9 |

|

|

|

33.9 |

|

|

|

117.8 |

|

| Equity earnings of

unconsolidated affiliates, net of tax |

|

(0.9 |

) |

|

|

(0.5 |

) |

|

|

(3.0 |

) |

|

|

(2.2 |

) |

|

Net income |

|

68.8 |

|

|

|

73.3 |

|

|

|

288.7 |

|

|

|

379.1 |

|

| Net income attributable to

noncontrolling interests |

|

(5.4 |

) |

|

|

(5.5 |

) |

|

|

(26.6 |

) |

|

|

(19.9 |

) |

|

Net income attributable to Greif, Inc. |

$ |

63.4 |

|

|

$ |

67.8 |

|

|

$ |

262.1 |

|

|

$ |

359.2 |

|

| Basic earnings per

share attributable to Greif, Inc. common

shareholders: |

|

|

|

|

|

|

|

| Class A common stock |

$ |

1.09 |

|

|

$ |

1.19 |

|

|

$ |

4.54 |

|

|

$ |

6.22 |

|

| Class B common stock |

$ |

1.64 |

|

|

$ |

1.78 |

|

|

$ |

6.80 |

|

|

$ |

9.32 |

|

| Diluted earnings per

share attributable to Greif, Inc. common

shareholders: |

|

|

|

|

|

|

|

| Class A common stock |

$ |

1.08 |

|

|

$ |

1.16 |

|

|

$ |

4.52 |

|

|

$ |

6.15 |

|

| Class B common stock |

$ |

1.64 |

|

|

$ |

1.78 |

|

|

$ |

6.80 |

|

|

$ |

9.32 |

|

| Shares used to

calculate basic earnings per share attributable to Greif, Inc.

common shareholders: |

|

|

|

|

|

|

|

| Class A common stock |

|

25.8 |

|

|

|

25.5 |

|

|

|

25.8 |

|

|

|

25.6 |

|

| Class B common stock |

|

21.3 |

|

|

|

21.3 |

|

|

|

21.3 |

|

|

|

21.5 |

|

| Shares used to

calculate diluted earnings per share attributable to Greif, Inc.

common shareholders: |

|

|

|

|

|

|

|

| Class A common stock |

|

26.3 |

|

|

|

26.0 |

|

|

|

26.0 |

|

|

|

26.0 |

|

| Class B

common stock |

|

21.3 |

|

|

|

21.3 |

|

|

|

21.3 |

|

|

|

21.5 |

|

| |

|

GREIF, INC. AND SUBSIDIARY

COMPANIESCONDENSED CONSOLIDATED BALANCE

SHEETS UNAUDITED |

| |

| (in

millions) |

October 31, 2024 |

|

October 31, 2023 |

|

ASSETS |

|

|

|

| CURRENT ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

197.7 |

|

$ |

180.9 |

| Trade accounts receivable |

|

757.1 |

|

|

659.4 |

| Inventories |

|

396.8 |

|

|

338.6 |

| Other current assets |

|

197.1 |

|

|

190.2 |

| |

|

1,548.7 |

|

|

1,369.1 |

| LONG-TERM ASSETS |

|

|

|

| Goodwill |

|

1,953.7 |

|

|

1,693.0 |

| Intangible assets |

|

937.1 |

|

|

792.2 |

| Operating lease assets |

|

284.5 |

|

|

290.3 |

| Other long-term assets |

|

270.3 |

|

|

253.6 |

| |

|

3,445.6 |

|

|

3,029.1 |

| PROPERTIES, PLANTS AND

EQUIPMENT, NET |

|

1,652.1 |

|

|

1,562.6 |

| |

$ |

6,646.4 |

|

$ |

5,960.8 |

| LIABILITIES AND

EQUITY |

|

|

|

| CURRENT LIABILITIES |

|

|

|

| Accounts payable |

$ |

530.4 |

|

$ |

497.8 |

| Short-term borrowings |

|

18.6 |

|

|

5.4 |

| Current portion of long-term

debt |

|

95.8 |

|

|

88.3 |

| Current portion of operating

lease liabilities |

|

56.5 |

|

|

53.8 |

| Other current liabilities |

|

310.6 |

|

|

294.0 |

| |

|

1,011.9 |

|

|

939.3 |

| LONG-TERM LIABILITIES |

|

|

|

| Long-term debt |

|

2,626.2 |

|

|

2,121.4 |

| Operating lease

liabilities |

|

230.2 |

|

|

240.2 |

| Other long-term

liabilities |

|

537.4 |

|

|

548.3 |

| |

|

3,393.8 |

|

|

2,909.9 |

| REDEEMABLE NONCONTROLLING

INTERESTS |

|

129.9 |

|

|

125.3 |

| EQUITY |

|

|

|

| Total Greif, Inc. equity |

|

2,075.7 |

|

|

1,947.9 |

| Noncontrolling interests |

|

35.1 |

|

|

38.4 |

| |

|

2,110.8 |

|

|

1,986.3 |

| |

$ |

6,646.4 |

|

$ |

5,960.8 |

| |

|

GREIF, INC. AND SUBSIDIARY

COMPANIESCONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWSUNAUDITED |

| |

| |

Three Months EndedOctober

31, |

|

Twelve Months EndedOctober

31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

| Net income |

$ |

68.8 |

|

|

|

73.3 |

|

|

$ |

288.7 |

|

|

$ |

379.1 |

|

| Depreciation, depletion and

amortization |

|

67.9 |

|

|

|

61.2 |

|

|

|

261.3 |

|

|

|

230.6 |

|

| Asset impairments |

|

0.7 |

|

|

|

16.9 |

|

|

|

2.6 |

|

|

|

20.3 |

|

| Pension settlement

charges |

|

— |

|

|

|

3.5 |

|

|

|

— |

|

|

|

3.5 |

|

| Deferred income tax expense

(benefit) |

|

(23.2 |

) |

|

|

(27.8 |

) |

|

|

(76.8 |

) |

|

|

(28.7 |

) |

| Gain on disposal of

businesses, net |

|

0.1 |

|

|

|

— |

|

|

|

(46.0 |

) |

|

|

(64.0 |

) |

| Other non-cash adjustments to

net income |

|

8.9 |

|

|

|

15.7 |

|

|

|

50.9 |

|

|

|

50.4 |

|

| Operating working capital

changes |

|

52.4 |

|

|

|

57.7 |

|

|

|

(49.9 |

) |

|

|

151.5 |

|

| Increase (decrease) in cash

from changes in other assets and liabilities |

|

11.6 |

|

|

|

3.0 |

|

|

|

(74.8 |

) |

|

|

(93.2 |

) |

|

Net cash (used in) provided by operating activities |

|

187.2 |

|

|

|

203.5 |

|

|

|

356.0 |

|

|

|

649.5 |

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

| Acquisitions of companies, net

of cash acquired |

|

(1.2 |

) |

|

|

(94.9 |

) |

|

|

(568.8 |

) |

|

|

(542.4 |

) |

| Purchases of properties,

plants and equipment |

|

(45.1 |

) |

|

|

(77.2 |

) |

|

|

(186.5 |

) |

|

|

(213.6 |

) |

| Proceeds from the sale of

properties, plants and equipment and businesses, net of impacts

from the purchase of acquisitions |

|

93.4 |

|

|

|

0.6 |

|

|

|

103.9 |

|

|

|

113.9 |

|

| Payments for deferred purchase

price of acquisitions |

|

— |

|

|

|

(0.4 |

) |

|

|

(1.7 |

) |

|

|

(22.1 |

) |

| Other |

|

(1.6 |

) |

|

|

(1.6 |

) |

|

|

(5.2 |

) |

|

|

(6.0 |

) |

|

Net cash (used in) provided by investing activities |

|

45.5 |

|

|

|

(173.5 |

) |

|

|

(658.3 |

) |

|

|

(670.2 |

) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

| Payments on long-term debt,

net |

|

(171.8 |

) |

|

|

47.6 |

|

|

|

489.4 |

|

|

|

290.7 |

|

| Dividends paid to Greif, Inc.

shareholders |

|

(31.2 |

) |

|

|

(29.8 |

) |

|

|

(121.0 |

) |

|

|

(116.5 |

) |

| Payments for share

repurchases |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(63.9 |

) |

| Tax withholding payments for

stock-based awards |

|

— |

|

|

|

— |

|

|

|

(10.6 |

) |

|

|

(13.7 |

) |

| Other |

|

(14.4 |

) |

|

|

(10.1 |

) |

|

|

(33.5 |

) |

|

|

(26.9 |

) |

|

Net cash (used in) provided by for financing activities |

|

(217.4 |

) |

|

|

7.7 |

|

|

|

324.3 |

|

|

|

69.7 |

|

| Effects of exchange rates on

cash |

|

(11.8 |

) |

|

|

(14.5 |

) |

|

|

(5.2 |

) |

|

|

(15.2 |

) |

| Net increase (decrease) in

cash and cash equivalents |

|

3.5 |

|

|

|

23.2 |

|

|

|

16.8 |

|

|

|

33.8 |

|

| Cash and cash equivalents,

beginning of period |

|

194.2 |

|

|

|

157.7 |

|

|

|

180.9 |

|

|

|

147.1 |

|

| Cash and cash equivalents, end

of period |

$ |

197.7 |

|

|

$ |

180.9 |

|

|

$ |

197.7 |

|

|

$ |

180.9 |

|

| |

|

GREIF, INC. AND SUBSIDIARY

COMPANIESFINANCIAL HIGHLIGHTS BY

SEGMENTUNAUDITED |

| |

| |

Three Months EndedOctober

31, |

|

Twelve Months EndedOctober

31, |

|

(in millions) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net sales: |

|

|

|

|

|

|

|

|

Global Industrial Packaging |

$ |

786.9 |

|

$ |

721.0 |

|

$ |

3,124.3 |

|

$ |

2,936.8 |

|

Paper Packaging & Services |

|

624.5 |

|

|

581.6 |

|

|

2,303.5 |

|

|

2,260.5 |

|

Land Management |

|

5.7 |

|

|

5.8 |

|

|

20.3 |

|

|

21.3 |

|

Total net sales |

$ |

1,417.1 |

|

$ |

1,308.4 |

|

$ |

5,448.1 |

|

$ |

5,218.6 |

| Gross

profit: |

|

|

|

|

|

|

|

|

Global Industrial Packaging |

$ |

167.0 |

|

$ |

154.4 |

|

$ |

669.4 |

|

$ |

634.4 |

|

Paper Packaging & Services |

|

118.7 |

|

|

118.8 |

|

|

391.6 |

|

|

502.5 |

|

Land Management |

|

3.0 |

|

|

2.5 |

|

|

9.8 |

|

|

9.2 |

|

Total gross profit |

$ |

288.7 |

|

$ |

275.7 |

|

$ |

1,070.8 |

|

$ |

1,146.1 |

| Operating

profit: |

|

|

|

|

|

|

|

|

Global Industrial Packaging |

$ |

75.0 |

|

$ |

75.1 |

|

$ |

341.1 |

|

$ |

334.3 |

|

Paper Packaging & Services |

|

48.7 |

|

|

35.3 |

|

|

115.6 |

|

|

264.1 |

|

Land Management |

|

2.9 |

|

|

2.0 |

|

|

7.9 |

|

|

7.1 |

|

Total operating profit |

$ |

126.6 |

|

$ |

112.4 |

|

$ |

464.6 |

|

$ |

605.5 |

|

EBITDA(8): |

|

|

|

|

|

|

|

|

Global Industrial Packaging |

$ |

108.0 |

|

$ |

96.2 |

|

$ |

454.8 |

|

$ |

415.7 |

|

Paper Packaging & Services |

|

83.3 |

|

|

70.4 |

|

|

253.9 |

|

|

398.8 |

|

Land Management |

|

3.5 |

|

|

2.6 |

|

|

10.1 |

|

|

9.3 |

|

Total EBITDA |

$ |

194.8 |

|

$ |

169.2 |

|

$ |

718.8 |

|

$ |

823.8 |

| Adjusted

EBITDA(9): |

|

|

|

|

|

|

|

|

Global Industrial Packaging |

$ |

109.4 |

|

$ |

105.4 |

|

$ |

423.6 |

|

$ |

425.4 |

|

Paper Packaging & Services |

|

85.3 |

|

|

93.7 |

|

|

261.5 |

|

|

387.9 |

|

Land Management |

|

2.9 |

|

|

2.5 |

|

|

9.1 |

|

|

8.9 |

|

Total Adjusted EBITDA |

$ |

197.6 |

|

$ |

201.6 |

|

$ |

694.2 |

|

$ |

822.2 |

(8) EBITDA is defined as net income, plus

interest expense, net, plus income tax (benefit) expense, plus

depreciation, depletion and amortization. However, because the

Company does not calculate net income by segment, this table

calculates EBITDA by segment with reference to operating profit by

segment, which, as demonstrated in the table of Consolidated

EBITDA, is another method to achieve the same result. See the

reconciliations in the table of Segment EBITDA.

(9) Adjusted EBITDA is defined as net income,

plus interest expense, net, plus income tax (benefit) expense, plus

depreciation, depletion and amortization expense, plus acquisition

and integration related costs, plus restructuring charges, plus

non-cash asset impairment charges, plus non-cash pension settlement

charges, plus gain (loss) on disposal of properties, plants and

equipment, (gain) loss on disposal of businesses, net, plus other

costs.

| |

|

GREIF, INC. AND SUBSIDIARY COMPANIESGAAP

TO NON-GAAP RECONCILIATIONCONSOLIDATED ADJUSTED

EBITDAUNAUDITED |

| |

| |

Three Months EndedOctober

31, |

|

Twelve Months EndedOctober

31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income |

$ |

68.8 |

|

|

$ |

73.3 |

|

|

$ |

288.7 |

|

|

$ |

379.1 |

|

|

Plus: Interest expense, net |

|

39.2 |

|

|

|

24.8 |

|

|

|

134.9 |

|

|

|

96.3 |

|

|

Plus: Income tax (benefit) expense |

|

18.9 |

|

|

|

9.9 |

|

|

|

33.9 |

|

|

|

117.8 |

|

|

Plus: Depreciation, depletion and amortization expense |

|

67.9 |

|

|

|

61.2 |

|

|

|

261.3 |

|

|

|

230.6 |

|

| EBITDA |

$ |

194.8 |

|

|

$ |

169.2 |

|

|

$ |

718.8 |

|

|

$ |

823.8 |

|

| Net income |

$ |

68.8 |

|

|

$ |

73.3 |

|

|

$ |

288.7 |

|

|

$ |

379.1 |

|

|

Plus: Interest expense, net |

|

39.2 |

|

|

|

24.8 |

|

|

|

134.9 |

|

|

|

96.3 |

|

|

Plus: Non-cash pension settlement charges |

|

— |

|

|

|

3.5 |

|

|

|

— |

|

|

|

3.5 |

|

|

Plus: Other (income) expense, net |

|

0.6 |

|

|

|

1.4 |

|

|

|

10.1 |

|

|

|

11.0 |

|

|

Plus: Income tax (benefit) expense |

|

18.9 |

|

|

|

9.9 |

|

|

|

33.9 |

|

|

|

117.8 |

|

|

Plus: Equity earnings of unconsolidated affiliates, net of tax |

|

(0.9 |

) |

|

|

(0.5 |

) |

|

|

(3.0 |

) |

|

|

(2.2 |

) |

| Operating profit |

|

126.6 |

|

|

|

112.4 |

|

|

|

464.6 |

|

|

|

605.5 |

|

|

Less: Non-cash pension settlement charges |

|

— |

|

|

|

3.5 |

|

|

|

— |

|

|

|

3.5 |

|

|

Less: Other (income) expense, net |

|

0.6 |

|

|

|

1.4 |

|

|

|

10.1 |

|

|

|

11.0 |

|

|

Less: Equity earnings of unconsolidated affiliates, net of tax |

|

(0.9 |

) |

|

|

(0.5 |

) |

|

|

(3.0 |

) |

|

|

(2.2 |

) |

|

Plus: Depreciation, depletion and amortization expense |

|

67.9 |

|

|

|

61.2 |

|

|

|

261.3 |

|

|

|

230.6 |

|

| EBITDA |

$ |

194.8 |

|

|

$ |

169.2 |

|

|

$ |

718.8 |

|

|

$ |

823.8 |

|

|

Plus: Acquisition and integration related costs |

|

2.4 |

|

|

|

3.5 |

|

|

|

18.5 |

|

|

|

19.0 |

|

|

Plus: Restructuring charges |

$ |

3.8 |

|

|

$ |

5.2 |

|

|

$ |

5.4 |

|

|

$ |

18.7 |

|

|

Plus: Non-cash asset impairment charges |

|

0.7 |

|

|

|

16.9 |

|

|

|

2.6 |

|

|

|

20.3 |

|

|

Plus: (Gain) loss on disposal of properties, plants and equipment,

net |

|

(2.4 |

) |

|

|

0.8 |

|

|

|

(8.8 |

) |

|

|

(2.5 |

) |

|

Plus: (Gain) loss on disposal of businesses, net |

|

0.1 |

|

|

|

0.1 |

|

|

|

(46.0 |

) |

|

|

(64.0 |

) |

|

Plus: Non-cash pension settlement charges |

|

— |

|

|

|

3.5 |

|

|

|

— |

|

|

|

3.5 |

|

|

Plus: Other costs* |

|

(1.8 |

) |

|

|

2.4 |

|

|

|

3.7 |

|

|

|

3.4 |

|

| Adjusted EBITDA |

$ |

197.6 |

|

|

$ |

201.6 |

|

|

$ |

694.2 |

|

|

$ |

822.2 |

|

| *includes fiscal

year-end change costs and share-based compensation impact of

disposals of businesses |

| |

|

GREIF, INC. AND SUBSIDIARY COMPANIESGAAP

TO NON-GAAP RECONCILIATIONSEGMENT ADJUSTED

EBITDA(10) UNAUDITED |

| |

| |

Three Months EndedOctober

31, |

|

Twelve Months EndedOctober

31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Global Industrial Packaging |

|

|

|

|

|

|

|

| Operating profit |

$ |

75.0 |

|

|

$ |

75.1 |

|

|

$ |

341.1 |

|

|

$ |

334.3 |

|

|

Less: Non-cash pension settlement charges |

|

— |

|

|

|

3.5 |

|

|

|

— |

|

|

|

3.5 |

|

|

Less: Other (income) expense, net |

|

0.9 |

|

|

|

1.7 |

|

|

|

11.6 |

|

|

|

12.6 |

|

|

Less: Equity earnings of unconsolidated affiliates, net of tax |

|

(0.9 |

) |

|

|

(0.5 |

) |

|

|

(3.0 |

) |

|

|

(2.2 |

) |

|

Plus: Depreciation and amortization expense |

|

33.0 |

|

|

|

25.8 |

|

|

|

122.3 |

|

|

|

95.3 |

|

| EBITDA |

$ |

108.0 |

|

|

$ |

96.2 |

|

|

$ |

454.8 |

|

|

$ |

415.7 |

|

|

Plus: Acquisition and integration related costs |

|

1.1 |

|

|

|

3.4 |

|

|

|

17.2 |

|

|

|

12.2 |

|

|

Plus: Restructuring charges |

|

3.0 |

|

|

|

— |

|

|

|

(2.8 |

) |

|

|

4.2 |

|

|

Plus: Non-cash asset impairment charges |

|

0.8 |

|

|

|

0.4 |

|

|

|

1.3 |

|

|

|

1.9 |

|

|

Plus: (Gain) loss on disposal of properties, plants and equipment,

net |

|

(2.6 |

) |

|

|

0.2 |

|

|

|

(2.9 |

) |

|

|

(4.4 |

) |

|

Plus: (Gain) loss on disposal of businesses, net |

|

0.1 |

|

|

|

0.5 |

|

|

|

(46.0 |

) |

|

|

(9.4 |

) |

|

Plus: Non-cash pension settlement charges |

|

— |

|

|

|

3.5 |

|

|

|

— |

|

|

|

3.5 |

|

|

Plus: Other costs* |

|

(1.0 |

) |

|

|

1.2 |

|

|

|

2.0 |

|

|

|

1.7 |

|

| Adjusted EBITDA |

$ |

109.4 |

|

|

$ |

105.4 |

|

|

$ |

423.6 |

|

|

$ |

425.4 |

|

| Paper

Packaging & Services |

|

|

|

|

|

|

|

| Operating profit |

$ |

48.7 |

|

|

$ |

35.3 |

|

|

$ |

115.6 |

|

|

$ |

264.1 |

|

|

Less: Other (income) expense, net |

|

(0.3 |

) |

|

|

(0.3 |

) |

|

|

(1.5 |

) |

|

|

(1.6 |

) |

|

Plus: Depreciation and amortization expense |

|

34.3 |

|

|

|

34.8 |

|

|

|

136.8 |

|

|

|

133.1 |

|

| EBITDA |

$ |

83.3 |

|

|

$ |

70.4 |

|

|

$ |

253.9 |

|

|

$ |

398.8 |

|

|

Plus: Acquisition and integration related costs |

|

1.3 |

|

|

|

0.1 |

|

|

|

1.3 |

|

|

|

6.8 |

|

|

Plus: Restructuring charges |

|

0.8 |

|

|

|

5.2 |

|

|

|

8.2 |

|

|

|

14.5 |

|

|

Plus: Non-cash asset impairment charges |

|

(0.1 |

) |

|

|

16.5 |

|

|

|

1.3 |

|

|

|

18.4 |

|

|

Plus: (Gain) loss on disposal of properties, plants and equipment,

net |

|

0.8 |

|

|

|

0.7 |

|

|

|

(4.9 |

) |

|

|

2.3 |

|

|

Plus: (Gain) loss on disposal of businesses, net |

|

— |

|

|

|

(0.4 |

) |

|

|

— |

|

|

|

(54.6 |

) |

|

Plus: Other costs* |

|

(0.8 |

) |

|

|

1.2 |

|

|

|

1.7 |

|

|

|

1.7 |

|

| Adjusted EBITDA |

$ |

85.3 |

|

|

$ |

93.7 |

|

|

$ |

261.5 |

|

|

$ |

387.9 |

|

| Land

Management |

|

|

|

|

|

|

|

| Operating profit |

$ |

2.9 |

|

|

$ |

2.0 |

|

|

$ |

7.9 |

|

|

$ |

7.1 |

|

|

Plus: Depreciation, depletion and amortization expense |

|

0.6 |

|

|

|

0.6 |

|

|

|

2.2 |

|

|

|

2.2 |

|

| EBITDA |

$ |

3.5 |

|

|

$ |

2.6 |

|

|

$ |

10.1 |

|

|

$ |

9.3 |

|

|

Plus: (Gain) loss on disposal of properties, plants and equipment,

net |

|

(0.6 |

) |

|

|

(0.1 |

) |

|

|

(1.0 |

) |

|

|

(0.4 |

) |

| Adjusted EBITDA |

$ |

2.9 |

|

|

$ |

2.5 |

|

|

$ |

9.1 |

|

|

$ |

8.9 |

|

| Consolidated EBITDA |

$ |

194.8 |

|

|

$ |

169.2 |

|

|

$ |

718.8 |

|

|

$ |

823.8 |

|

| Consolidated Adjusted

EBITDA |

$ |

197.6 |

|

|

$ |

201.6 |

|

|

$ |

694.2 |

|

|

$ |

822.2 |

|

| *includes fiscal

year-end change costs and share-based compensation impact of

disposals of businesses |

(10) Adjusted EBITDA is defined as net

income, plus interest expense, net, plus income tax (benefit)

expense, plus depreciation, depletion and amortization expense,

plus acquisition and integration related costs, plus restructuring

charges, plus non-cash asset impairment charges, plus non-cash

pension settlement charges, plus (gain) loss on disposal of

properties, plants and equipment, plus (gain) loss on disposal of

businesses, net, plus other costs. However, because the Company

does not calculate net income by segment, this table calculates

adjusted EBITDA by segment with reference to operating profit by

segment, which, as demonstrated in the table of consolidated

adjusted EBITDA, is another method to achieve the same result.

| |

|

GREIF, INC. AND SUBSIDIARY COMPANIESGAAP

TO NON-GAAP RECONCILIATIONADJUSTED FREE CASH

FLOW(11)UNAUDITED |

| |

| |

Three Months EndedOctober

31, |

|

Twelve Months EndedOctober

31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net cash provided by operating activities |

$ |

187.2 |

|

|

$ |

203.5 |

|

|

$ |

356.0 |

|

|

$ |

649.5 |

|

|

Cash paid for purchases of properties, plants and equipment |

|

(45.1 |

) |

|

|

(77.2 |

) |

|

|

(186.5 |

) |

|

|

(213.6 |

) |

| Free Cash

Flow |

$ |

142.1 |

|

|

$ |

126.3 |

|

|

$ |

169.5 |

|

|

$ |

435.9 |

|

|

Cash paid for acquisition and integration related costs |

|

2.4 |

|

|

|

3.5 |

|

|

|

18.5 |

|

|

|

19.0 |

|

|

Cash paid for integration related ERP systems and

equipment(12) |

|

0.2 |

|

|

|

1.0 |

|

|

|

1.3 |

|

|

|

4.6 |

|

|

Cash paid for taxes related to Tama, Iowa mill divestment |

|

— |

|

|

|

5.4 |

|

|

|

— |

|

|

|

21.7 |

|

|

Cash paid for fiscal year-end change costs |

|

— |

|

|

|

— |

|

|

|

0.5 |

|

|

|

— |

|

| Adjusted Free Cash

Flow |

$ |

144.7 |

|

|

$ |

136.2 |

|

|

$ |

189.8 |

|

|

$ |

481.2 |

|

(11)Adjusted free cash flow is defined as net

cash provided by operating activities, less cash paid for purchases

of properties, plants and equipment, plus cash paid for acquisition

and integration related costs, net, plus cash paid for integration

related ERP systems and equipment, plus cash paid for taxes related

to Tama, Iowa mill divestment, plus cash paid for fiscal year-end

change costs.

(12) Cash paid for integration related ERP

systems and equipment is defined as cash paid for ERP systems and

equipment required to bring the acquired facilities to Greif’s

standards.

| |

|

GREIF, INC. AND SUBSIDIARY COMPANIESGAAP

TO NON-GAAP RECONCILIATIONNET INCOME, CLASS A

EARNINGS PER SHARE, AND TAX RATE BEFORE

ADJUSTMENTSUNAUDITED |

| |

| (in

millions, except for per share amounts) |

|

Income before Income Tax Expense and Equity Earnings of

Unconsolidated Affiliates, net |

|

Income Tax (Benefit) Expense |

|

Equity Earnings |

|

Noncontrolling Interest |

|

Net Income Attributable to Greif, Inc. |

|

Diluted Class A Earnings Per Share |

Tax Rate |

|

Three Months Ended October 31, 2024 |

|

$ |

86.8 |

|

|

$ |

18.9 |

|

|

$ |

(0.9 |

) |

|

$ |

5.4 |

|

$ |

63.4 |

|

|

$ |

1.08 |

|

21.8 |

% |

|

Acquisition and integration related costs |

|

|

2.4 |

|

|

|

0.5 |

|

|

|

— |

|

|

|

— |

|

|

1.9 |

|

|

|

0.03 |

|

|

|

Restructuring charges |

|

|

3.8 |

|

|

|

1.0 |

|

|

|

— |

|

|

|

— |

|

|

2.8 |

|

|

|

0.05 |

|

|

|

Non-cash asset impairment charges |

|

|

0.7 |

|

|

|

0.2 |

|

|

|

— |

|

|

|

— |

|

|

0.5 |

|

|

|

0.01 |

|

|

|

(Gain) loss on disposal of properties, plants and equipment,

net |

|

|

(2.4 |

) |

|

|

(0.5 |

) |

|

|

— |

|

|

|

— |

|

|

(1.9 |

) |

|

|

(0.03 |

) |

|

|

(Gain) loss on disposal of businesses, net |

|

|

0.1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

0.1 |

|

|

|

0.01 |

|

|

|

Other costs* |

|

|

(1.8 |

) |

|

|

(0.5 |

) |

|

|

— |

|

|

|

— |

|

|

(1.3 |

) |

|

|

(0.02 |

) |

|

|

Excluding Adjustments |

|

$ |

89.6 |

|

|

$ |

19.6 |

|

|

$ |

(0.9 |

) |

|

$ |

5.4 |

|

$ |

65.5 |

|

|

$ |

1.13 |

|

21.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended

October 31, 2023 |

|

$ |

82.7 |

|

|

$ |

9.9 |

|

|

$ |

(0.5 |

) |

|

$ |

5.5 |

|

$ |

67.8 |

|

|

$ |

1.16 |

|

12.0 |

% |

|

Acquisition and integration related costs |

|

|

3.5 |

|

|

|

0.8 |

|

|

|

— |

|

|

|

— |

|

|

2.7 |

|

|

|

0.04 |

|

|

|

Restructuring charges |

|

|

5.2 |

|

|

|

1.2 |

|

|

|

— |

|

|

|

— |

|

|

4.0 |

|

|

|

0.08 |

|

|

|

Non-cash asset impairment charges |

|

|

16.9 |

|

|

|

4.1 |

|

|

|

— |

|

|

|

— |

|

|

12.8 |

|

|

|

0.22 |

|

|

|

(Gain) loss on disposal of properties, plants and equipment,

net |

|

|

0.8 |

|

|

|

0.3 |

|

|

|

— |

|

|

|

— |

|

|

0.5 |

|

|

|

0.01 |

|

|

|

(Gain) loss on disposal of businesses, net |

|

|

0.1 |

|

|

|

0.3 |

|

|

|

— |

|

|

|

— |

|

|

(0.2 |

) |

|

|

(0.01 |

) |

|

|

Non-cash pension settlement charges |

|

|

3.5 |

|

|

|

0.2 |

|

|

|

— |

|

|

|

— |

|

|

3.3 |

|

|

|

0.06 |

|

|

|

Other costs* |

|

|

2.4 |

|

|

|

0.7 |

|

|

|

— |

|

|

|

— |

|

|

1.7 |

|

|

|

0.03 |

|

|

|

Excluding Adjustments |

|

$ |

115.1 |

|

|

$ |

17.5 |

|

|

$ |

(0.5 |

) |

|

$ |

5.5 |

|

$ |

92.6 |

|

|

$ |

1.59 |

|

15.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Twelve Months Ended

October 31, 2024 |

|

$ |

319.6 |

|

|

$ |

33.9 |

|

|

$ |

(3.0 |

) |

|

$ |

26.6 |

|

$ |

262.1 |

|

|

$ |

4.52 |

|

10.6 |

% |

|

Acquisition and integration related costs |

|

|

18.5 |

|

|

|

4.5 |

|

|

|

— |

|

|

|

— |

|

|

14.0 |

|

|

|

0.24 |

|

|

|

Restructuring charges |

|

|

5.4 |

|

|

|

1.3 |

|

|

|

— |

|

|

|

— |

|

|

4.1 |

|

|

|

0.07 |

|

|

|

Non-cash asset impairment charges |

|

|

2.6 |

|

|

|

0.7 |

|

|

|

— |

|

|

|

— |

|

|

1.9 |

|

|

|

0.03 |

|

|

|

(Gain) loss on disposal of properties, plants and equipment,

net |

|

|

(8.8 |

) |

|

|

(2.1 |

) |

|

|

— |

|

|

|

— |

|

|

(6.7 |

) |

|

|

(0.11 |

) |

|

|

(Gain) loss on disposal of businesses, net |

|

|

(46.0 |

) |

|

|

(17.3 |

) |

|

|

— |

|

|

|

— |

|

|

(28.7 |

) |

|

|

(0.49 |

) |

|

|

Other costs* |

|

|

3.7 |

|

|

|

0.9 |

|

|

|

— |

|

|

|

— |

|

|

2.8 |

|

|

|

0.05 |

|

|

|

Excluding Adjustments |

|

$ |

295.0 |

|

|

$ |

21.9 |

|

|

$ |

(3.0 |

) |

|

$ |

26.6 |

|

$ |

249.5 |

|

|

$ |

4.31 |

|

7.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Twelve Months Ended

October 31, 2023 |

|

$ |

494.7 |

|

|

$ |

117.8 |

|

|

$ |

(2.2 |

) |

|

$ |

19.9 |

|

$ |

359.2 |

|

|

$ |

6.15 |

|

23.8 |

% |

|

Acquisition and integration related costs |

|

|

19.0 |

|

|

|

4.6 |

|

|

|

— |

|

|

|

— |

|

|

14.4 |

|

|

|

0.24 |

|

|

|

Restructuring charges |

|

|

18.7 |

|

|

|

4.4 |

|

|

|

— |

|

|

|

0.1 |

|

|

14.2 |

|

|

|

0.25 |

|

|

|

Non-cash asset impairment charges |

|

|

20.3 |

|

|

|

4.9 |

|

|

|

— |

|

|

|

— |

|

|

15.4 |

|

|

|

0.26 |

|

|

|

(Gain) loss on disposal of properties, plants and equipment,

net |

|

|

(2.5 |

) |

|

|

(0.3 |

) |

|

|

— |

|

|

|

— |

|

|

(2.2 |

) |

|

|

(0.04 |

) |

|

|

(Gain) loss on disposal of businesses, net |

|

|

(64.0 |

) |

|

|

(18.4 |

) |

|

|

— |

|

|

|

— |

|

|

(45.6 |

) |

|

|

(0.78 |

) |

|

|

Non-cash pension settlement charges |

|

|

3.5 |

|

|

|

0.2 |

|

|

|

— |

|

|

|

— |

|

|

3.3 |

|

|

|

0.06 |

|

|

|

Other costs* |

|

|

3.4 |

|

|

|

0.9 |

|

|

|

— |

|

|

|

— |

|

|

2.5 |

|

|

|

0.05 |

|

|

|

Excluding Adjustments |

|

$ |

493.1 |

|

|

$ |

114.1 |

|

|

$ |

(2.2 |

) |

|

$ |

20.0 |

|

$ |

361.2 |

|

|

$ |

6.19 |

|

23.1 |

% |

| *includes fiscal

year-end change costs and share-based compensation impact of

disposals of businesses |

The impact of income tax (benefit) expense and

noncontrolling interest on each adjustment is calculated based on

tax rates and ownership percentages specific to each applicable

entity.

| |

|

GREIF INC. AND SUBSIDIARY COMPANIES GAAP

TO NON-GAAP RECONCILIATION NET DEBT

UNAUDITED |

| |

| (in

millions) |

October 31, 2024 |

|

July 31, 2024 |

|

October 31, 2023 |

|

Total Debt |

$ |

2,740.6 |

|

|

$ |

2,909.5 |

|

|

$ |

2,215.1 |

|

| Cash and cash equivalents |

|

(197.7 |

) |

|

|

(194.2 |

) |

|

|

(180.9 |

) |

| Net Debt |

$ |

2,542.9 |

|

|

$ |

2,715.3 |

|

|

$ |

2,034.2 |

|

| |

|

GREIF, INC. AND SUBSIDIARY COMPANIES GAAP

TO NON-GAAP RECONCILIATION LEVERAGE

RATIOUNAUDITED |

| |

|

Trailing Twelve Month Credit Agreement EBITDA(in

millions) |

|

Trailing Twelve Months Ended 10/31/2024 |

Trailing Twelve Months Ended 7/31/2024 |

Trailing Twelve Months Ended 10/31/2023 |

|

Net income |

|

$ |

288.7 |

|

$ |

293.2 |

|

$ |

379.1 |

|

|

Plus: Interest expense, net |

|

|

134.9 |

|

|

120.5 |

|

|

96.3 |

|

|

Plus: Income tax expense |

|

|

33.9 |

|

|

24.9 |

|

|

117.8 |

|

|

Plus: Depreciation, depletion and amortization expense |

|

|

261.3 |

|

|

254.6 |

|

|

230.6 |

|

| EBITDA |

|

$ |

718.8 |

|

$ |

693.2 |

|

$ |

823.8 |

|

|

Plus: Acquisition and integration related costs |

|

|

18.5 |

|

|

19.6 |

|

|

19.0 |

|

|

Plus: Restructuring charges |

|

|

5.4 |

|

|

6.8 |

|

|

18.7 |

|

|

Plus: Non-cash asset impairment charges |

|

|

2.6 |

|

|

18.8 |

|

|

20.3 |

|

|

Plus: (Gain) loss on disposal of properties, plants and equipment,

net |

|

|

(8.8 |

) |

|

(5.6 |

) |

|

(2.5 |

) |

|

Plus: (Gain) loss on disposal of businesses, net |

|

|

(46.0 |

) |

|

(46.0 |

) |

|

(64.0 |

) |

|

Plus: Non-cash pension settlement charges |

|

|

— |

|

|

3.5 |

|

|

3.5 |

|

|

Plus: Other costs* |

|

|

3.7 |

|

|

5.5 |

|

|

3.4 |

|

| Adjusted EBITDA |

|

$ |

694.2 |

|

$ |

695.8 |

|

$ |

822.2 |

|

|

Credit Agreement adjustments to EBITDA(13) |

|

|

0.8 |

|

|

21.4 |

|

|

23.7 |

|

| Credit Agreement EBITDA |

|

$ |

695.0 |

|

$ |

717.2 |

|

$ |

845.9 |

|

| |

|

|

|

|

|

Adjusted Net Debt(in millions) |

|

For the Period Ended 10/31/2024 |

Trailing Twelve Months Ended 7/31/2024 |

For the Period Ended 10/31/2023 |

|

Total debt |

|

$ |

2,740.6 |

|

$ |

2,909.5 |

|

$ |

2,215.1 |

|

|

Cash and cash equivalents |

|

|

(197.7 |

) |

|

(194.2 |

) |

|

(180.9 |

) |

| Net debt |

|

$ |

2,542.9 |

|

$ |

2,715.3 |

|

$ |

2,034.2 |

|

|

Credit Agreement adjustments to debt(14) |

|

|

(90.6 |

) |

|

(106.8 |

) |

|

(177.4 |

) |

| Adjusted net debt |

|

$ |

2,452.3 |

|

$ |

2,608.5 |

|

$ |

1,856.8 |

|

| |

|

|

|

|

| Leverage

Ratio(15) |

|

|

3.53x |

|

|

3.64x |

|

|

2.2x |

|

| *includes fiscal

year-end change costs and share-based compensation impact of

disposals of businesses |

(13)Adjustments to EBITDA are specified by the

2022 Credit Agreement and include certain timberland gains, equity

earnings of unconsolidated affiliates, net of tax, certain

acquisition savings, deferred financing costs, capitalized

interest, income and expense in connection with asset dispositions,

and other items.

(14)Adjustments to net debt are specified by the

2022 Credit Agreement and include the European accounts receivable

program, letters of credit, and balances for swap contracts.

(15) Leverage ratio is defined as Credit

Agreement adjusted net debt divided by Credit Agreement adjusted

EBITDA.

The following table presents net sales by

reportable segments and geographic operating segments,

depreciation, depletion and amortization expenses by reportable

segments, and capital expenditures by reportable segments for

fiscal years 2024 and 2023. The following information is

unaudited:

|

|

Twelve Months Ended October 31, 2024 |

|

Twelve Months Ended October 31, 2023 |

|

(in millions) |

United States |

|

Europe, Middle East and Africa |

|

Asia Pacific and Other Americas |

|

United States |

|

Europe, Middle East and Africa |

|