0001840776false00018407762023-08-022023-08-020001840776us-gaap:CommonClassAMember2023-08-022023-08-020001840776hgty:HGTYWarrantsEachWholeWarrantExercisePriceof1150PerShareMemberMember2023-08-022023-08-02

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

August 2, 2023

Date of Report (date of earliest event reported)

HAGERTY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-40244 | 86-1213144 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

121 Drivers Edge

Traverse City, Michigan 49684

(Address of principal executive offices and zip code)

(800) 922-4050

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | HGTY | | The New York Stock Exchange |

Warrants, each whole warrant exercisable for one share

of Class A common stock, each at an exercise price of

$11.50 per share | | HGTY.WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors: Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 2, 2023, Hagerty, Inc. (the "Company") announced that Barbara Matthews, the Company’s Senior Vice President, General Counsel and Corporate Secretary will transition to an advisory role on or before October 31, 2023. The Company has named Diana Chafey as Chief Legal Officer and Corporate Secretary effective August 2, 2023. Ms. Matthews and the Company have entered into an Executive Retention, Transition and Release Agreement, dated July 31, 2023 (the "Transition Agreement"), whereby Ms. Matthews shall transition her responsibilities to Ms. Chafey on or before October 31, 2023, and continue to serve the Company as an senior legal advisory through January 1, 2024. Ms. Chafey previously served as the Chief Legal Officer and Corporate Secretary of ATI Physical Therapy (NYSE:ATIP), a publicly traded rehabilitation provider from 2018 until November 2022. From 2013 through 2018, Ms. Chafey was the Executive Vice President, General Counsel and Corporate Secretary of TWG Holdings Limited, a privately owned insurer and reinsurer. Ms. Chafey is also a former partner at DLA Piper US LLP, from their Chicago office.

Pursuant to the Transition Agreement, Ms. Matthews’s annual salary of $400,000 will not change through January 1, 2024. In addition, she will receive the following:

•The RSU Award Agreement dated April 1, 2022, by and between Ms. Matthews and the Company, granting her 92,678 restricted stock units will have an accelerated vesting of the remaining 46,339 unvested restricted stock units with a vesting date of January 1, 2024. The terms of Ms. Matthews’s remaining equity grants will remain unchanged and vest according to the terms of the Company’s 2021 Stock Incentive Plan and each award agreement;

•She will receive a cash payment of $19,256 in lieu of the RSUs that were due to vest on April 1, 2024 pursuant to the terms of her equity grants;

•She will be eligible for the Company’s annual cash incentive award payment for 2023 at a target of 50% of her annual salary, subject to Company performance; and

•She will receive a severance payment of $200,000 following her final day of employment with the Company.

The above description of the Agreement is not complete and is qualified in its entirety by reference to the text of the Agreement, which is filed with this report as Exhibit 10.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | HAGERTY, INC. |

| | |

| | /s/ Barbara E. Matthews |

Date: August 2, 2023 | | Barbara E. Matthews |

| | SVP, General Counsel and Corporate Secretary |

| | |

| | |

CONFIDENTIAL

EXECUTIVE RETENTION, TRANSITION AND RELEASE AGREEMENT

This is an Executive Retention, Transition and Release Agreement (“Agreement”), entered into between The Hagerty Group, LLC (“Hagerty” or “Company”), and Barbara Matthews (“Executive”).

1.Background and Purpose. Executive is currently employed as Hagerty’s Senior Vice President, General Counsel and Corporate Secretary. Hagerty previously asked Executive to stay employed through the executive transitions after Hagerty became publicly traded. Now that that is complete, Executive is separating her employment with Hagerty to pursue other passions and opportunities. Hagerty and Executive would like to work together to ensure a smooth and productive transition. Accordingly, the parties have created this Agreement to provide benefits to both parties and work amicably through the transition.

2.Separation. Executive’s separation from employment is effective on Executive’s last day of employment with Hagerty, which will be no later than January 1, 2024 (“Retention Date”). To provide an orderly transition, Executive has agreed to transition her job responsibilities to others on or before October 31, 2023. Thereafter, Executive will be on-call as a Senior Legal Advisor for support with minimal day-to-day responsibilities until January 1, 2024, when her employment with Hagerty will cease. If Executive’s employment is terminated before the Retention Date without Cause, the employment termination will not change the amounts due to Executive pursuant to the terms of this Agreement.

3.Executive’s Duties. From the date of this Agreement through the Retention Date, Executive must: perform her duties to the best of her ability; take direction from Hagerty’s Chief Executive Officer; and assist Hagerty in the full transition of her position. Executive will continue as Hagerty’s General Counsel unless and until a new Chief Legal Officer begins employment with Hagerty, which is expected to occur before October 31, 2023. Executive’s title would then transition from General Counsel to Senior Legal Advisor.

4.Executive’s Benefits. As consideration for the commitments and releases in this Agreement, Hagerty will provide Executive with the following benefits to which Executive is not otherwise entitled. All payments will be less required deductions and tax withholdings.

a.Employment Continuation. Through the Retention Date, Executive’s annual salary will be $400,000 and Executive will be eligible for an Annual Incentive Award Payment for 2023, with the target award based on 50% of Executive’s annual salary, in accordance with the terms of that Plan at no less than the actual result calculated based on the Company performance measures. By way of example, if the actual performance calculates to 100% of the targeted payout, Executive would be awarded 100% of her targeted award and not a lesser amount than what other comparable executives receive

b.Early Vesting of Staking Grant. The 92,678 Restricted Stock Units awarded to Executive under the Restricted Stock Unit Award Agreement dated April 1, 2022 will become 100% vested on the Retention Date.

c.Other Deferred Compensation. Hagerty will pay Executive the Deferred Incentive Awards Plan payments she is entitled to in accordance with the schedule

and terms outlined in the plan document and any election properly made thereunder by Executive on the basis that Executive’s employment is terminating on January 1, 2024 due to Retirement. All equity awards pursuant to Restricted Stock and Restricted Stock Unit Award Agreements between Executive and Hagerty, other than the Staking Grant award referenced above, shall vest in accordance with the terms of those agreements on the basis that Executive’s employment is terminating on January 1, 2024 due to Retirement. The parties agree that a total of 122,610 out of 147,257 restricted stock units awarded to Executive accurately reflects the number of units Executive will be vested and entitled to on January 1, 2024.

d.Cash Payment in Lieu of Unvested Equity. In lieu of the shares that could have vested to Executive on April 1, 2024, Hagerty will provide Executive with a cash payment of $19,256, less applicable tax withholdings, on the first payroll period after the Retention Date.

e.Cash Payment in Lieu of Health Insurance. In lieu of health insurance continuation, Hagerty will provide Executive with a cash payment of $21,125, less applicable tax withholdings, on the first payroll period after the Retention Date. While this payment is intended to offset the cost of health insurance, Executive can use this money as she sees fit.

f.Severance. On the first payroll period after the Retention Date, Hagerty will provide Executive with a six (6) month severance payable in a single lump sum of $200,000.

g.Letter of Reference. Hagerty’s CEO will provide Executive with a positive and truthful letter of reference that describes Executive’s contributions to Hagerty and her retirement from Hagerty. Executive will provide a draft reference letter for Hagerty’s CEO to review.

If Hagerty discharges Executive for Cause or Executive voluntarily resigns her position before the Retention Date, however, Executive will not be eligible for the benefits outlined in this Section. For purposes of this Agreement, “Cause” is defined as: any material embezzlement, theft, or other misappropriation by Executive of the funds or other property of Hagerty or its affiliates, tangible or intangible (including confidential information); any material act of dishonesty or fraud by Executive that occurs in the course of or is substantially connected with Executive’s employment; any material violation of this Agreement or any other agreements Executive has signed with Hagerty; any material act of competition with Hagerty; or any material action(s) that constitute a willful or continuing disregard of Executive’s duties after notice and an opportunity to cure.

5.Other Benefits. Except as specifically noted in this Agreement, all other pay and benefits shall cease as of the Retention Date.

6.Release and Waiver. In consideration of the additional benefit payments and other benefits set forth in this Agreement, Executive releases, waives and forever discharges Hagerty, its affiliates and successors, past, present and future, and their owners, shareholders, officers, directors, agents, employees, insurers and benefit plans, both present and former, from all claims, demands, obligations, damages and liabilities of every kind and nature and from all actions and causes of action which Executive may now have or may have or maintain hereafter, whether in law or in equity, known or unknown, arising in any way on or before the date Executive signs this Agreement,

including all claims arising out of Executive’s employment or separation from employment with Hagerty.

a.Included Statutes. This Release and Waiver includes, but is not limited to, any and all claims, including claims for attorney fees, arising under the Civil Rights Act of 1964, the Employee Retirement Income Security Act of 1974, the Age Discrimination in Employment Act of 1967, the Americans with Disabilities Act, the Family and Medical Leave Act, the Uniformed Services Employment and Reemployment Rights Act, the Michigan Elliott-Larsen Civil Rights Act, the Michigan Persons with Disabilities Civil Rights Act, all as amended, and all other relevant local, state and federal statutes, rules and regulations.

b.Included Claims. Except those benefits expressly set forth in this Agreement, this Release and Waiver also includes, but is not limited to, all claims for past or future wages, severance pay, bonuses, incentive pay, commissions, vacation pay, sick pay, paid time off, medical benefits, life or disability insurance, and other benefits and all claims for violation of any express or implied agreement, written or verbal, that occurred before the execution of this Agreement, or for any violation of any common law duty or statute, including all claims for attorney fees.

c.Excluded Claims. Executive is not waiving and releasing: Executive’s right to the payments or benefits called for under this Agreement; Executive’s right to any vested qualified retirement plan benefit attributable to Executive’s service up to the Retention Date; or Executive’s right to continue (at Executive’s expense) COBRA continuation coverage; or any claim that cannot be waived by applicable law.

d.Mutual Release. Likewise, Hagerty releases, waives and forever discharges Executive from all claims, demands, obligations, damages and liabilities of every kind and nature and from all actions and causes of action which Hagerty may now have or may have or maintain hereafter, whether in law or in equity, known or unknown, arising in any way on or before the date Executive signs this Agreement, including all claims arising out of Executive’s employment or separation from employment with the Company. This release does not, however, waive any claims related to enforcement of this Agreement. The Parties will exchange a supplemental release of claims on or after Executive’s last day of employment, January 1, 2024.

7.Full Review and Knowing and Voluntary Agreement. Executive agrees that she has been given the opportunity to fully review this Agreement, has thoroughly reviewed it, fully understands its terms, and knowingly and voluntarily agrees to all of its provisions including, but not limited to, the release and other provisions listed above. Executive acknowledges that Hagerty provided Executive with up to twenty-one (21) days to deliberate whether to sign this Agreement and that such period was a reasonable time for deliberation. Executive acknowledges that Hagerty advised Executive to consult with an attorney regarding this Agreement, and that she has either consulted with an attorney regarding this Agreement or has intentionally chosen not to exercise Executive’s right to consult with an attorney regarding this Agreement. Executive further acknowledges that if this Agreement is executed prior to the expiration of the twenty-one (21) day deliberation period, such execution was knowing and voluntary and without coercion or duress by Hagerty. If Executive fails to sign and return this Agreement within the twenty-one (21) day deliberation period, this Agreement is withdrawn and is null and void.

8.Revocation. Executive shall have the right to revoke this Agreement for a period of seven (7) days following the date of execution. Notice of revocation shall be in a signed writing and delivered to Coco Champagne before expiration of the revocation period. This Agreement shall not become effective or enforceable until this revocation period has expired (“Effective Date”).

9.Non-Disclosure. Executive agrees that as a material condition of this Agreement, Executive shall not disclose the existence of this Agreement, nor the terms or conditions of this Agreement to any third party or entity. However, this paragraph shall not prohibit Executive from disclosing the terms and conditions of this Agreement to Executive’s spouse, attorneys and/or accountants, or as may be lawfully required or ordered by any state or federal administrative agency, tribunal, or court of law.

10.Non-Disparagement. Executive agrees not to make or publish in verbal, written or any other form (including social media or any other internet forum), any disparaging remarks or negative comments to any third party nor shall Executive knowingly encourage or assist any third party to make such disparaging remarks or negative comments regarding, concerning or alluding to in any manner, Hagerty, its affiliates and successors, past, present and future, and their owners, shareholders, officers, directors, agents and employees. Hagerty agrees that all inquiries about Executive regarding potential Employment shall be directed to its Human Resources Department. Unless otherwise authorized by Executive in writing, only the agreed upon letter of recommendation and dates of employment and positions held will be released by Human Resources representatives.

11.Binding Effect. This Agreement shall be binding on and inure to the benefit of Executive, her spouse, heirs, administrators and assigns. This Agreement and its releases apply not only to the Company, but to all divisions, affiliated entities, and purchasers of substantially all of the stock or assets of the Company, and to the predecessors, assigns, agents, officers, directors, shareholders, executives and other representatives of each.

12.Separability. The invalidity of any paragraph or subparagraph of this Agreement shall not affect the validity of any other paragraph or subparagraph of this Agreement.

13.Applicable Law and Venue. The validity, interpretation, and construction of this Agreement are to be governed by Michigan law, without regard to choice of law rules. The parties agree that any judicial action involving a dispute arising under this Agreement will be filed, heard and decided in either the 13th Judicial Circuit Court of the State of Michigan or the U.S. District Court for the Western District of Michigan. The parties agree that they will subject themselves to the personal jurisdiction and venue of either court, regardless of where Executive or the Company may be located at the time any action may be commenced. The parties agree that Grand Traverse County is a mutually convenient forum and that each of the parties conducts business in Grand Traverse County.

14.Compliance with Code Section 409A. Notwithstanding any other provision of this Agreement to the contrary, if any payment hereunder is subject to Section 409A of the Code and if such payment is to be paid on account of Executive’s separation from service (within the meaning of Section 409A of the Code), if Executive is a specified employee (within the meaning of Section 409A(a)(2)(B) of the Code), and if any such payment is required to be made prior to the first day of the seventh month following Executive’s separation from service, such payment shall be delayed until the first day of the seventh month following Executive’s separation from service. To the extent that any payments or benefits under this Agreement are subject to Section 409A of the Code and are paid or

provided on account of the Retention Date, the determination as to whether Executive has had a termination of employment (or separation from service) shall be made in accordance with Section 409A of the Code and the guidance issued thereunder. All payments under this Agreement are intended to either be exempt from or comply with Section 409A and the regulations and guidance promulgated thereunder and this Agreement will be interpreted and operated consistently with those intentions. The times and schedules of payment under this Agreement may not be accelerated or delayed for any reason except as permitted by Section 409A. In addition to any other restriction in this Agreement, the Agreement may not be amended or terminated except in compliance with Section 409A.

15.Entire Agreement. Except for the Employee Confidentiality and Non-Solicitation Agreement dated January 30, 2014, the Restricted Stock Unit Award Agreement dated April 1, 2022 (as amended by this Agreement), the Deferred Incentive Awards Plan agreements and all other applicable Restricted Stock Unit awards and agreements, which will remain in full force and effect and are reaffirmed by this Agreement, this Agreement contains the entire understanding of the parties and supersedes all previous verbal and written agreements. There are no other agreements, representations or warranties not referenced or set forth in this Agreement.

IN WITNESS WHEREOF, the parties have signed this Agreement on the day and year set forth below.

| | | | | | | | |

| | BARBARA MATTHEWS |

| | |

| | /s/ Barbara E. Matthews |

Date: July 31, 2023 | | Barbara E. Matthews |

| | | | | | | | |

| | HAGERTY GROUP, LLC |

| | |

| | /s/ McKeel Hagerty |

Date: July 31, 2023 | | McKeel Hagerty |

| | Chief Executive Officer |

v3.23.2

Cover

|

Aug. 02, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 02, 2023

|

| Entity Registrant Name |

HAGERTY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40244

|

| Entity Address, Address Line One |

121 Drivers Edge

|

| Entity Address, City or Town |

Traverse City

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

49684

|

| City Area Code |

(800)

|

| Local Phone Number |

922-4050

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001840776

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

86-1213144

|

| Common Class A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

HGTY

|

| Security Exchange Name |

NYSE

|

| HGTY:WarrantsEachWholeWarrantExercisePriceof11.50PerShareMember |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one shareof Class A common stock, each at an exercise price of$11.50 per share

|

| Trading Symbol |

HGTY.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hgty_HGTYWarrantsEachWholeWarrantExercisePriceof1150PerShareMemberMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

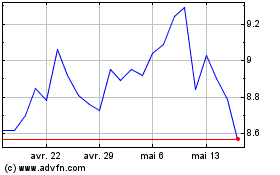

Hagerty (NYSE:HGTY)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Hagerty (NYSE:HGTY)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024