Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 Octobre 2023 - 10:58PM

Edgar (US Regulatory)

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

SCHEDULE OF INVESTMENTS

AUGUST 31, 2023

(amounts in 000’s, except number of option contracts)

(UNAUDITED)

|

Description

|

|

|

|

No. of

Shares/Units

|

|

Value

|

|

Long-Term Investments — 124.1%

|

|

|

|

|

|

|

Equity Investments(1) — 124.1%

|

|

|

|

|

|

|

Midstream Company(2) — 63.7%

|

|

|

|

|

|

|

Aris Water Solutions, Inc.

|

|

140

|

|

$

|

1,429

|

|

Enbridge Inc.(3)

|

|

404

|

|

|

14,155

|

|

Energy Transfer LP(4)

|

|

2,632

|

|

|

35,449

|

|

Energy Transfer LP, — Series A Preferred Units(4)(5)

|

|

2,000

|

|

|

1,840

|

|

EnLink Midstream, LLC

|

|

242

|

|

|

3,007

|

|

Enterprise Products Partners L.P.(4)

|

|

1,227

|

|

|

32,637

|

|

Enterprise Products Partners L.P. — Convertible Preferred Units(4)(6)(7)(8)

|

|

18

|

|

|

17,658

|

|

Hess Midstream LP(9)

|

|

275

|

|

|

7,960

|

|

MPLX LP(4)

|

|

673

|

|

|

23,484

|

|

ONEOK, Inc.(10)

|

|

363

|

|

|

23,698

|

|

Pembina Pipeline Corporation(3)

|

|

559

|

|

|

17,374

|

|

Plains GP Holdings, L.P.(9)

|

|

1,434

|

|

|

23,006

|

|

Plains GP Holdings, L.P. — Plains AAP, L.P.(6)(9)(11)

|

|

690

|

|

|

11,061

|

|

Targa Resources Corp.(12)

|

|

476

|

|

|

41,023

|

|

Western Midstream Partners, LP(4)

|

|

329

|

|

|

8,788

|

| |

|

|

|

|

262,569

|

|

Natural Gas & LNG Infrastructure Company(2)(13) — 31.3%

|

|

|

|

|

|

|

Antero Midstream Corporation

|

|

539

|

|

|

6,527

|

|

Cheniere Energy, Inc.

|

|

230

|

|

|

37,569

|

|

Cheniere Energy Partners, L.P.(4)

|

|

119

|

|

|

6,160

|

|

DT Midstream, Inc.

|

|

122

|

|

|

6,400

|

|

Kinder Morgan, Inc.

|

|

583

|

|

|

10,032

|

|

Streamline Innovations Holdings, Inc. — Series C Preferred Shares(6)(7)(14)(15)(16)

|

|

1,375

|

|

|

6,738

|

|

TC Energy Corporation(3)

|

|

289

|

|

|

10,427

|

|

The Williams Companies, Inc.

|

|

1,308

|

|

|

45,165

|

| |

|

|

|

|

129,018

|

|

Renewable Infrastructure Company(2)(13) — 13.5%

|

|

|

|

|

|

|

Atlantica Sustainable Infrastructure plc(3)

|

|

811

|

|

|

18,205

|

|

Brookfield Renewable Partners L.P.(3)(9)

|

|

421

|

|

|

10,710

|

|

Clearway Energy, Inc. — Class A

|

|

231

|

|

|

5,405

|

|

Clearway Energy, Inc. — Class C

|

|

258

|

|

|

6,403

|

|

NextEra Energy Partners, LP(9)

|

|

294

|

|

|

14,665

|

| |

|

|

|

|

55,388

|

See accompanying notes to financial statements.

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

SCHEDULE OF INVESTMENTS

AUGUST 31, 2023

(amounts in 000’s, except number of option contracts)

(UNAUDITED)

|

Description

|

|

|

|

No. of

Shares/Units

|

|

Value

|

|

Utility Company(2) — 11.7%

|

|

|

|

|

|

|

Duke Energy Corporation(13)

|

|

76

|

|

$

|

6,731

|

|

NextEra Energy, Inc.(13)

|

|

240

|

|

|

16,043

|

|

Sempra Energy(13)

|

|

248

|

|

|

17,400

|

|

TransAlta Corporation(3)(13)

|

|

439

|

|

|

4,212

|

|

Xcel Energy Inc.(13)

|

|

70

|

|

|

3,982

|

| |

|

|

|

|

48,368

|

|

Other Energy Company(2) — 3.9%

|

|

|

|

|

|

|

Exxon Mobil Corporation

|

|

120

|

|

|

13,310

|

|

Phillips 66(12)

|

|

24

|

|

|

2,751

|

| |

|

|

|

|

16,061

|

|

Total Long-Term Investments (Cost — $445,265)

|

|

|

|

|

511,404

|

| |

|

|

|

|

|

|

Short-Term Investment — Money Market Fund — 2.0%

|

|

|

|

|

|

|

JPMorgan 100% U.S. Treasury Securities Money Market

|

|

|

|

|

|

|

Fund — Capital Shares, 5.23%(18) (Cost — $8,294)

|

|

8,294

|

|

|

8,294

|

|

Total Investments — 126.1% (Cost — $453,559)

|

|

|

|

$

|

519,698

|

|

|

|

Strike

Price

|

|

Expiration

Date

|

|

No. of

Contracts

|

|

Notional

Amount(17)

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Call Option Contracts Written(16)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Midstream Company(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Targa Resources Corp.

|

|

$

|

82.50

|

|

9/15/23

|

|

240

|

|

$

|

2,070

|

|

(101

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Energy Company(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phillips 66

|

|

|

115.00

|

|

9/15/23

|

|

100

|

|

|

1,142

|

|

(17

|

)

|

|

Phillips 66

|

|

|

120.00

|

|

9/15/23

|

|

100

|

|

|

1,142

|

|

(3

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

(20

|

)

|

|

Total Call Option Contracts Written (Premiums Received — $63)

|

|

(121

|

)

|

|

|

|

|

|

|

|

Debt

|

|

|

(70,235

|

)

|

|

Mandatory Redeemable Preferred Stock at Liquidation Value

|

|

|

(41,491

|

)

|

|

Other Assets in Excess of Other Liabilities

|

|

|

4,282

|

|

|

Net Assets Applicable to Common Stockholders

|

|

$

|

412,133

|

|

See accompanying notes to financial statements.

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

SCHEDULE OF INVESTMENTS

AUGUST 31, 2023

(amounts in 000’s, except number of option contracts)

(UNAUDITED)

See accompanying notes to financial statements.

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

SCHEDULE OF INVESTMENTS

AUGUST 31, 2023

(amounts in 000’s, except number of option contracts)

(UNAUDITED)

At August 31, 2023, the Fund’s geographic allocation was as follows:

|

Geographic Location

|

|

|

|

% of Long-Term

Investments

|

|

United States

|

|

85.3%

|

|

Canada

|

|

11.1%

|

|

Europe/U.K.

|

|

3.6%

|

See accompanying notes to financial statements.

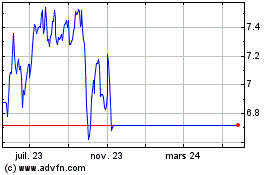

Kayne Anderson NextGen E... (NYSE:KMF)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Kayne Anderson NextGen E... (NYSE:KMF)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024