Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________________

LL FLOORING HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

27-1310817 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

4901 Bakers Mill Lane,

Richmond, Virginia 23230

(Address of principal executive offices, including zip code)

Restricted Stock Inducement Award Agreements

Performance Stock Unit Inducement Award Agreement

(Granted as Employment Inducement Awards Outside of a Plan)

(Full title of the plan)

___________________

Alice G. Givens

Senior Vice President,

Chief Legal, Ethics & Compliance Officer and Corporate Secretary

4901 Bakers Mill Lane,

Richmond, Virginia 23230

(Name and address of agent for service)

___________________

(804) 463-2000

(Telephone number, including area code, of agent for service

___________________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer ¨ |

|

Accelerated filer x |

|

Non-accelerated filer ¨ |

|

Smaller reporting company ¨ |

Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

___________________

EXPLANATORY NOTE

This registration statement is being filed solely for the registration of (i) 520,000 shares of common stock, par value $0.001 per share (“Common Stock”) of LL Flooring Holdings, Inc. (the “Company” or the “Registrant”) which may be issued upon (i) the vesting of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Robert L. Madore, (ii) the vesting and settlement of performance stock units, in accordance with the terms of the Performance Stock Unit Inducement Award Agreement, by and between the Company and Mr. Madore, (iii) the vesting of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Andrew Wadhams, (iv) the vesting of restricted stock, in accordance with the terms of the Restricted Stock Inducement

Award Agreement by and between the Company and Laura Massaro, and (v) the vesting of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Arthur Cheng (collectively, the “Employment Inducement Awards”). In each case, the Employment Inducement Awards are granted, effective as of August 11, 2023, to Mr. Madore, Mr. Wadhams, Ms. Massaro, and Mr. Cheng in reliance on the employment inducement award exemption under the New York Stock Exchange Listed Company Manual Rule 303A.08.

PART I. INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Items 1 and 2 of Part I of the Form S-8 is omitted from this filing in accordance with the provisions of Rule 428 under the Securities Act and the introductory note to Part I of the Form S-8. The document(s) containing the information specified in Part I of Form S-8 will be sent or given to the recipients of the applicable grants, as required by Rule 428 under the Securities Act. Such documents are not being filed with the Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II. INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

|

|

|

Item 3. |

Incorporation of Documents by Reference. |

The following documents filed with the Commission by the Registrant pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) are incorporated by reference herein:

|

|

|

|

a. |

The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the Commission on March 1, 2023 (the “Form 10-K”); |

|

b. |

The Registrant's Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed on August 9, 2023; |

|

c. |

The Registrant’s definitive Proxy Statement filed with the Commission on April 3, 2023 for the Annual Meeting of Stockholders held on May 10, 2023; |

|

d. |

All other reports and other documents filed by the Registrant pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), since the end of the fiscal year covered by the Registrant document referred to in (1) above and prior to the filing of a post-effective amendment to this Registration Statement, which indicates that all securities registered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such reports and other documents; and |

|

e. |

The description of the Registrant’s Common Stock as set forth in Exhibit 99.1 to the Registrant’s Current Report on Form 8-K, filed with the Commission on January 4, 2010. |

For purposes of this Registration Statement, any document or any statement contained in a document incorporated or deemed incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement. Nothing in this Registration Statement shall be deemed to incorporate information furnished but not filed with the Commission pursuant to Item 2.02 or Item 7.01 of Form 8-K.

|

|

|

|

Item 4. |

Description of Securities. |

Not Applicable.

|

|

|

|

Item 5. |

Interest of Named Experts and Counsel. |

None.

|

|

|

|

Item 6. |

Indemnification of Directors and Officers. |

Under Section 145 of the Delaware General Corporation Law (the “DGCL”), a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that the person is or was an officer, director, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful. In actions brought by or in the right of the corporation, a corporation may indemnify such person against expenses (including attorneys' fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper. To the extent that such person has been successful on the merits or otherwise in defense of any such action, suit or proceeding referred to above, or in defense of any claim, issue or matter therein, he or she is entitled to indemnification for expenses (including attorneys' fees) actually and reasonably incurred by such person in connection therewith. The indemnification and advancement of expenses provided for or granted pursuant to Section 145 of the DGCL is not exclusive of any other rights of indemnification or advancement of expenses to which those seeking indemnification or advancement may be entitled. Further, a corporation may purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of such person's status as such, whether or not the corporation would have the power to indemnify such person against such liability under Section 145 of the DGCL.

Section 102(b)(7) of the DGCL enables a corporation in its certificate of incorporation to eliminate or limit monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of a director: (i) for any breach of the director's duty of loyalty to the corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) pursuant to Section 174 of the DGCL (providing for liability for directors for unlawful payment of dividends or unlawful stock purchases or redemptions); or (iv) for any transaction from which the director derived an improper personal benefit. Advancement or reimbursement of expenses prior to a final disposition requires a written affirmation that the foregoing criteria were met and an undertaking to repay any advances if it is ultimately determined that the criteria were not met.

The Registrant’s certificate of incorporation provides that a director will not be personally liable for monetary damages for breach of fiduciary duty as a director, except liability for (i) any breach of the director’s duty of loyalty to the Registrant or its shareholders; (ii) acts or omissions not in good faith or which involve intentional misconduct

or a knowing violation of law; (iii) unlawful payments of dividends or unlawful stock repurchases or redemptions; or (iv) any transaction from which the director derived an improper personal benefit.

Further, the Registrant’s certificate of incorporation and bylaws provide, among other things, that each person who was or is made a party or is threatened to be made a party to or is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she, or a person of whom he or she is the legal representative, is or was a director or officer of the Registrant or is or was serving at the request of the Registrant as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans, whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, shall be indemnified and held harmless by the Registrant to the fullest extent authorized by the DGCL, against all expense, liability and loss (including attorneys’ fees, judgments, liens, amounts paid or to be paid in settlement and excise taxes or penalties arising under the Employee Retirement Income Security Act of 1974) reasonably incurred or suffered by such person in connection therewith and such indemnification shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of his or her heirs, executors and administrators; provided, however, that the Registrant shall indemnify any such person seeking indemnification in connection with a proceeding (or part thereof) initiated by such person only if such proceeding (or part thereof) was authorized by the Registrant’s board of directors.

The Registrant’s certificate of incorporation and bylaws provide that the right to indemnification shall include the right to be paid by the Registrant the expenses (including attorneys’ fees) incurred in defending such proceeding in advance of its final disposition; provided, however, that if the DGCL requires, the payment of such expenses incurred by a director or officer in his or her capacity as such in advance of the final disposition of a proceeding shall be made only upon delivery to the Registrant of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal that such director or officer is not entitled to be indemnified under the certificate of incorporation, bylaws or otherwise; and provided, further, that such advancement of expenses incurred by any person other than a director or officer shall be made only upon the delivery of an undertaking to the foregoing effect and may be subject to such other conditions as the Registrant’s board of directors may deem advisable. The Registrant’s certificate of incorporation and bylaws also permit it to purchase and maintain insurance to protect itself and any director, officer, employee or agent of the Registrant or another corporation, partnership, joint venture, trust, employee benefit plan, or other enterprise against any such expense, liability or loss, whether or not the Registrant would have the power to indemnify such person against such expense, liability or loss under the DGCL.

The Registrant has in the past and may in the future enter into agreements to indemnify its directors, executive officers and other employees as determined by its board of directors. These agreements will provide for the indemnification of directors and officers to the fullest extent permitted by Delaware law, whether or not expressly provided for in the Registrant’s bylaws, and govern the process by which claims for indemnification are considered.

In addition, consistent with the terms and conditions of the Plan, to the maximum extent permitted by law, no member of the committee responsible for administering these awards, nor any person to whom duties have been delegated to administer these awards, shall be liable to any person for any action taken or omitted in connection with the interpretation and administration of the awards, except for if such member or person acts in bad faith and without reasonable belief that it was in the best interests of the Registrant.

|

|

|

|

Item 7. |

Exemption from Registration Claimed. |

Not applicable.

The following exhibits are filed on behalf of the Registrant as part of this Registration Statement:

|

|

|

Exhibit

Number |

|

Description |

|

|

|

4.1 |

|

Amended and Restated Certificate of Incorporation of the Registrant (incorporated herein by reference to Exhibit 3.1 of the Company’s Form 8-K filed December 10, 2021) |

4.2 |

|

By-Laws of the Registrant (as revised effective September 29, 2022) (filed as Exhibit 3.2 to the Registrant’s current report on Form 8-K, filed on October 4, 2022 and incorporated herein by reference) |

4.3 |

|

LL Flooring Holdings, Inc. 2023 Equity Compensation Plan, (incorporated herein by reference to Annex B of the Company’s definitive proxy statement on Schedule 14A filed April 3, 2023) |

4.4 |

|

Form of Restricted Stock Inducement Award Agreement (incorporated herein by reference to the Company’s Form 10-Q filed August 9, 2023) |

4.5 |

|

Form of Performance Stock Unit Inducement Award Agreement, by and between the Company and Robert L. Madore (incorporated herein by reference to the Company’s Form 10-Q filed August 9, 2023) |

5.1* |

|

Opinion of Cleary Gottlieb Steen & Hamilton LLP |

23.1* |

|

Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm |

23.2* |

|

Consent of Cleary Gottlieb Steen & Hamilton (included in Exhibit 5.1 hereto) |

24.1* |

|

Power of Attorney (included as part of the signature page hereto) |

107* |

|

Calculation of Filing Fee Tables |

___________________________

* Filed herewith

(a)The undersigned Registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement;

(iii)To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, the paragraphs (1)(i) and 1(ii) of this section do not apply if the Registration Statement is on Form S-8, and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

(2)That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered that remain unsold at the termination of the offering.

(b)The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the County of James City, Commonwealth of Virginia, on this 9th day of August, 2023.

|

|

|

|

|

|

LL FLOORING HOLDINGS, INC. |

|

|

|

|

|

|

By: |

|

/s/ Charles E. Tyson |

|

|

|

|

Charles E. Tyson |

|

|

|

|

President and Chief Executive Officer |

|

|

|

|

(Principal Executive Officer) |

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Alice Givens such person’s true and lawful attorney-in-fact and agent, with full powers of substitution and resubstitution, for such person and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement (including any post-effective amendments thereto), and to file the same, with all exhibits thereto, and other documents in connection therewith with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority to do and to perform each and every act and thing requisite and necessary to be done in and about the premises, as fully and to all intents and purposes as he or she might or would do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the date indicated below.

|

|

|

Signature |

Title |

Date |

|

|

|

/s/ Charles E. Tyson |

President and Chief Executive Officer |

August 9, 2023 |

Charles E. Tyson |

(Principal Executive Officer) |

|

|

|

|

/s/ Robert L. Madore |

Chief Financial Officer |

August 9, 2023 |

Robert L. Madore |

(Principal Financial Officer) |

|

|

|

|

/s/ Chasity D. Grosh |

Chief Accounting Officer |

August 9, 2023 |

Chasity D. Grosh |

(Principal Accounting Officer) |

|

|

|

|

/s/ Nancy M. Taylor |

Chairperson of the Board |

August 9, 2023 |

Nancy M. Taylor |

|

|

|

|

|

/s/ Terri F. Graham |

Director |

August 9, 2023 |

Terri F. Graham |

|

|

|

|

|

/s/ David A. Levin |

Director |

August 9, 2023 |

David A. Levin |

|

|

|

|

|

/s/ Douglas T. Moore |

Director |

August 9, 2023 |

Douglas T. Moore |

|

|

|

|

|

/s/ Joseph M. Nowicki, Jr. |

Director |

August 9, 2023 |

Joseph M. Nowicki, Jr. |

|

|

|

|

|

/s/ Ashish Parmar |

Director |

August 9, 2023 |

Ashish Parmar |

|

|

|

|

|

/s/ Famous P. Rhodes |

Director |

August 9, 2023 |

Famous P. Rhodes |

|

|

|

|

|

/s/ Martin F. Roper |

Director |

August 9, 2023 |

Martin F. Roper |

|

|

Exhibit 5.1

|

|

|

|

|

|

|

|

|

|

CLEARY GOTTLIEB STEEN & HAMILTON LLP One Liberty Plaza New York, NY 10006-1470 T: +1212225 2000 F: +1212 225 3999 clearygottlieb.com |

|

CRAIG B. BROD

RICHARD J. COOPER

JEFFREYS. LEWIS

PAULJ.SHIM

STEVEN L. WILNER

DAVID C. LOPEZ

MICHAELA. GERSTENZANG

LEV L. DASS IN

JORGE U. JUANTORENA

MICHAEL D. WEINBERGER

DAVID LEINWAND

JEFFREY A. ROSENTHAL

MICHAEL D. DAYAN

CARMINE D. BOCCUZZI, JR. JEFFREY D. KARPF FRANCISCO L. CESTERO FRANCESCA L. ODELL WILLIAM L. MCRAE JASON FACTOR JOON H. KIM MARGARET S. PEPONIS LISA M. SCHWEITZER JUAN G. GIRALDEZ DUANE MCLAUGHLIN CHANTAL E. KORDULA BENET J. O'REILLY ADAME. FLEISHER SEAN A. O'NEAL GLENN P. MCGRORY DEBORAH NORTH MATTHEW P. SALERNO MICHAEL J. ALBANO VICTOR L. HOU |

ROGER A. COOPER

LILLIAN TSU

AMY R. SHAPIRO

JENNIFER KENNEDY PARK

ELIZABETH LENAS

LUKE A. BAREFOOT

JONATHAN S. KOLODNER

DANIEL ILAN

MEYER H. FEDIDA

ADRIAN R. LEIPSIC

ELIZABETH VICENS

ADAM J. BRENNEMAN

ARID. MACKINNON JAMES E. LANGSTON JARED GERBER RISHI ZUTSHI JANE VAN LARE AUDRY X. CASUSOL ELIZABETH DYER DAVID H. HERRINGTON KIMBERLY R. SPOERRI AARON J. MEYERS DANIEL C. REYNOLDS ABENAA. MAINOO HUGH C. CONROY, JR. JOHN A. KUPIEC JOSEPH LANZKRON MAURICE R. GINDI KATHERINE R. REAVES RAHUL MUKHI ELANAS. BRONSON MANUEL SILVA KYLE A. HARRIS |

LINA BENSMAN

ARON M. ZUCKERMAN

KENNETH S. BLAZEJEWSKI

MARKE. MCDONALD

F. JAMAL FULTON

PAUL V. IMPERATORE

CLAYTON SIMMONS

CHARLES W. ALLEN

JULIA L. PETTY

HELENAK. GRANNIS

SUSANNA E. PARKER

THOMAS S. KESSLER RESIDENT PARTNERS JUDITH KASSEL PENELOPE L. CHRISTOPHOROU BOAZ S. MORAG HEIDE H. ILGENFRITZ ANDREW WEAVER JOHN V. HARRISON MATTHEW BRIGHAM EMILIO MINVIELLE LAURA BAGARELLA JONATHAN D.W. GIFFORD DAVID W.S. YUDIN KARA A. HAILEY ANNA KOGAN BRANDON M. HAMMER BRIAN J. MORRIS CARINA S. WALLANCE ALEXANDER JANGHORBANI RESIDENT COUNSEL

|

AMERICAS |

|

ASIA |

|

EUROPE & MIDDLE EAST |

NEW YORK SAN FRANCISCO SAO PAULO SILICON VALLEY WASHINGTON, D.C. |

|

BEIJING HONG KONG SEOUL |

|

ABU DHABI BRUSSELS COLOGNE FRANKFURT |

LONDON MILAN PARIS ROME |

Writer’s Direct Dial: +1 212 225 2438

E-Mail: malbano@cgsh.com

|

August 9, 2023

LL Flooring Holdings, Inc.

4901 Bakers Mill Lane

Richmond, Virginia 23230

Re: LL Flooring Holdings, Inc. Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel to LL Flooring Holdings, Inc., a Delaware corporation (the “Company”), in connection with a registration statement on Form S-8 (the “Registration Statement”) to be filed today with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), for the registration of 520,000 shares of the Company’s common stock, par value $0.001 per share (the “Shares”), to be issued by the Company upon (i) the vesting and settlement of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Robert L. Madore, (ii) the vesting and settlement of performance stock units, in accordance with the terms of the Performance Stock Unit Inducement Award Agreement, by and between the Company and Mr. Madore, (iii) the vesting and settlement of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Andrew Wadhams, (iv) the vesting and settlement of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Laura Massaro, and (v) the vesting and settlement of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Arthur Cheng, pursuant to employment inducement awards within the meaning of the New York Stock Exchange Listed Company Manual 303A.08 (collectively, the “Employment Inducement Award Agreements”).

Cleary Gottlieb Steen & Hamilton LLP or an affiliated entity has an office in each of the locations listed above.

We have participated in the preparation of the Registration Statement and have reviewed the originals or copies certified or otherwise identified to our satisfaction of all such corporate records of the Company and such other instruments and other certificates of public officials, officers and representatives of the Company and such other persons, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinion expressed below.

In rendering the opinion expressed below, we have assumed the authenticity of all documents submitted to us as originals and the conformity to the originals of all documents submitted to us as copies. In addition, we have assumed and have not verified the accuracy as to factual matters of each document we have reviewed.

Based on the foregoing, and subject to the further assumptions and qualifications set forth below, it is our opinion that the Shares have been duly authorized by all necessary corporate action of the Company and, upon execution of the Employment Inducement Award Agreements and when the Shares are issued in accordance with the terms and conditions of the Employment Inducement Award Agreements, at prices not less than the par value thereof, will be validly issued, fully paid and non-assessable.

The foregoing opinion is limited to the General Corporation Law of the State of Delaware.

We hereby consent to the use of this opinion as a part (Exhibit 5.1) of the Registration Statement. In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations of the Commission thereunder. The opinion expressed herein is rendered on and as of the date hereof, and we assume no obligation to advise you, or to make any investigations, as to any legal developments or factual matters arising subsequent to the date hereof that might affect the opinion expressed herein.

|

|

|

|

|

|

|

|

Very truly yours, |

|

|

|

|

|

|

|

|

|

CLEARY GOTTLIEB STEEN & HAMILTON LLP |

|

|

|

|

|

|

By: |

|

/s/ Michael J. Albano |

|

|

|

|

Michael J. Albano, a Partner |

|

Cleary Gottlieb Steen & Hamilton LLP or an affiliated entity has an office in each of the locations listed above.

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the Restricted Stock Inducement Award Agreements and Performance Stock Unit Inducement Award Agreement of LL Flooring Holdings, Inc. of our reports dated March 1, 2023, with respect to the consolidated financial statements of LL Flooring Holdings, Inc. and the effectiveness of internal control over financial reporting of LL Flooring Holdings, Inc. included in its Annual Report (Form 10-K) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Richmond, Virginia

August 9, 2023

Exhibit 107

CALCULATION OF FILING FEE TABLES

Form S-8

(Form Type)

LL Flooring Holdings, Inc.

(Exact name of Registrant as specified in its charter)

Table 1: Newly Registered Securities

|

|

|

|

|

|

|

|

Security Type |

Security Class Title |

Fee Calculation Rule |

Amount Registered |

Proposed Maximum Offering Price Per Unit |

Maximum Aggregate Offering Price |

Fee Rate |

Amount of Registration Fee |

Equity |

Common Stock, par value $0.001 per share |

Rule 457(h) |

520,000 shares (1) |

$3.42 |

$1,778,400 (2) |

0.00011020 |

$195.98 |

Total Offering Amounts |

|

|

$195.98 |

Total Fee Offsets |

|

|

N/A |

Net Fee Due |

|

|

$195.98 |

(1) Represents common stock, nominal value $0.001 per share (the “Common Stock”) of the Registrant, which may be issued upon (i) the vesting of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Robert L. Madore, (ii) the vesting and settlement of performance stock units, in accordance with the terms of the Performance Stock Unit Inducement Award Agreement by and between the Company and Robert L. Madore, (iii) the vesting of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Andrew Wadhams, (iv) the vesting of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Laura Massaro, and (v) the vesting of restricted stock, in accordance with the terms of the Restricted Stock Inducement Award Agreement by and between the Company and Arthur Cheng, in each case, granted as material inducement for these individuals to accept their respective offers of employment with the Company. Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of Common Stock that become issuable to prevent dilution in the event of any stock dividend, stock split, recapitalization or other similar transactions in accordance with the adjustment provisions of the award agreements evidencing the employment inducement award.

(2) Pursuant to Rule 457(h) under the Securities Act, the proposed maximum offering price is estimated, solely for the purpose of determining the registration fee, on the basis of the average high and low prices of LL Flooring’s Common Stock on August 8, 2023, as reported on the New York Stock Exchange.

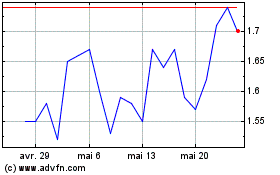

LL Flooring (NYSE:LL)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

LL Flooring (NYSE:LL)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024