State Revenue Growth Slows, but Most States Classified as ‘Stable’

05 Février 2025 - 5:00PM

Business Wire

Morgan Stanley Investment Management releases annual State of

the States Report

Morgan Stanley Investment Management (MSIM) today released the

12th annual State of the States Report, which highlights slowing

revenue growth after two years of expedited growth related to

pandemic-era government stimulus. Furthermore, the State of the

States Analysis indicates a stable credit outlook for most states

with many planning for budget cuts of approximately 6% in the next

fiscal year.

Commenting on the report’s finding, Craig Brandon, co-head of

Municipal Investing for MSIM, said: “While we believe most states

are on solid footing, there are several critical factors looming

that will have long-term implications for states’ creditworthiness

and ability to respond to shifting market dynamics. Unfunded

pension liabilities and increasing Medicaid costs continue to

challenge state budgets, while natural disasters continue to have

an outsized impact not only on budgets but also future planning.

Additionally, out-migration and demographic shifts are two issues

that warrant close examination.”

The States of the States Report reveals that state debt

generally remains low as many states curtailed borrowing after the

Great Recession and experienced increasing state gross domestic

product (GDP). Rainy day fund balances, a strong indicator of how

prepared each state is for recessions and economic downturns, are

at all-time highs with the median state at 13% of expenditures in

2024 while projections indicate a potential increase to 15% in

2025. However, five states have less in reserves now than they did

in 2007.

“Understanding how states rank from a credit standpoint

influences portfolio decisions,” said Brandon. “With a new

Presidential Administration and uncertainty related to the

potential extension of the Tax Cuts and Jobs Act, this analysis

pinpoints areas of strength and deficiencies, and helps us identify

which states are positioned to address policy changes, demographic

shifts and unforeseen events that tap into state agencies and

budgets and leverage infrastructure resources.”

Key findings:

- Debt and unfunded pension burdens largely declined due to GDP

growth, investment returns and pension reforms. However, overall

pension liabilities remain large despite many states

over-contributing to their plans in recent years.

- Most state budgets are well-positioned to address debt, pension

and Other Post-Employment Benefits (OPEB) expenses, however these

expenses could crowd out other spending initiatives if paid in

full.

- Puerto Rico remains a significant outlier; its 59%

liabilities-to-GDP ratio is nearly double that of any other

state.

- Medicaid costs play a significant role in state budgets and

dwarf other fixed-cost spending; this is particularly acute for

Colorado, Missouri, Arizona, Pennsylvania, Connecticut and

Kentucky.

- Only one quarter of states have better funded pensions now than

they did in 2018, which means less well-funded pensions states have

less flexibility for other necessary spending.

Developed by the municipal research team, this comprehensive

report details what the team sees as the biggest issues facing the

50 states and Puerto Rico and ranks the states based on their

creditworthiness, ability to pay back obligations, and overall

financial health. The State of the States report leverages a

proprietary ratings methodology that is based on both quantitative

factors like overall state wealth, financial performance and

outstanding debt as well as qualitative analysis, including

projected budget shortfalls or surpluses, track records of meeting

budget projections, and pension reform initiatives.

Read the full State of the States Report.

About Morgan Stanley Investment Management Morgan Stanley

Investment Management, together with its investment advisory

affiliates, has more than 1,400 investment professionals around the

world and $1.7 trillion in assets under management or supervision

as of December 31, 2024. Morgan Stanley Investment Management

strives to provide outstanding long-term investment performance,

service, and a comprehensive suite of investment management

solutions to a diverse client base, which includes governments,

institutions, corporations and individuals worldwide. For further

information about Morgan Stanley Investment Management, please

visit www.morganstanley.com/im.

About Morgan Stanley Morgan Stanley (NYSE: MS) is a

leading global financial services firm providing a wide range of

investment banking, securities, wealth management and investment

management services. With offices in 42 countries, the Firm's

employees serve clients worldwide including corporations,

governments, institutions and individuals. For more information

about Morgan Stanley, please visit www.morganstanley.com.

RISK CONSIDERATIONS: Investing involves risk including

the risk of loss.

Municipal Risk: There generally is limited public

information about municipal issuers. Investments in income

securities may be affected by changes in the creditworthiness of

the issuer and are subject to the risk of non-payment of principal

and interest. The value of income securities also may decline

because of real or perceived concerns about the issuer's ability to

make principal and interest payments. As interest rates rise, the

value of certain income investments is likely to decline.

Investments rated below investment grade (sometimes referred to as

"junk") are typically subject to greater price volatility and

illiquidity than higher rated investments.

This material is a general communication, which is not

impartial, is for informational and educational purposes only, not

a recommendation to purchase or sell specific securities, or to

adopt any particular investment strategy. Information does not

address financial objectives, situation or specific needs of

individual investors.

This material is only intended for and will be only

distributed to persons resident in jurisdictions where such

distribution or availability would not be contrary to local laws or

regulations. MSIM, the asset management division of Morgan Stanley

(NYSE: MS), and its affiliates have arrangements in place to market

each other’s products and services. Each MSIM affiliate is

regulated as appropriate in the jurisdiction it operates. MSIM’s

affiliates are: Eaton Vance Management (International) Limited,

Eaton Vance Advisers International Ltd, Calvert Research and

Management, Eaton Vance Management, Parametric Portfolio Associates

LLC, and Atlanta Capital Management LLC.

NOT FDIC INSURED | OFFER NO BANK GUARANTEE | MAY LOSE VALUE |

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A

DEPOSIT

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205013234/en/

Colleen McElhinney 617.672.8995

Colleen.McElhinney@morganstanley.com

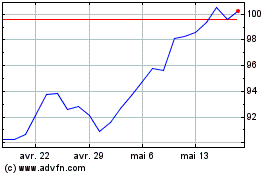

Morgan Stanley (NYSE:MS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

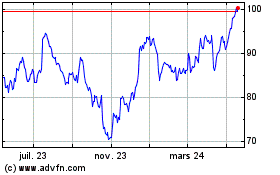

Morgan Stanley (NYSE:MS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025