Owlet Announces Proposed Public Offering

11 Septembre 2024 - 11:22PM

Business Wire

Owlet, Inc. (“Owlet” or the “Company”) (NYSE:OWLT), the pioneer

of smart infant monitoring, today announced it intends to offer and

sell its Class A common stock in an underwritten public offering.

In addition, the Company intends to grant the underwriter a 30-day

option to purchase up to an additional 15% of the gross proceeds of

its Class A common stock at the public offering price per share,

before underwriting discounts and commissions. All of the shares in

the proposed offering are to be sold by the Company.

Owlet intends to use the net proceeds from the proposed public

offering for general corporate purposes, capital expenditures,

working capital and general and administrative expenses.

Titan Partners Group, a division of American Capital Partners,

is acting as the sole bookrunner for the offering.

The proposed public offering is subject to market and other

conditions, and there can be no assurance as to whether or when the

offering may be completed, or as to the actual size or terms of the

offering.

The securities described above are being offered by Owlet

pursuant to an effective shelf registration statement on Form S-3

that was previously filed with the U.S. Securities and Exchange

Commission, or the SEC. The offering will be made only by means of

a written prospectus and a prospectus supplement that form a part

of the registration statement. A preliminary prospectus supplement

and accompanying prospectus relating to and describing the terms of

the offering will be filed with the SEC and will be available on

the SEC’s website. When available, copies of the preliminary

prospectus supplement and the accompanying prospectus relating to

these securities may also be obtained by request from: Titan

Partners Group LLC, a division of American Capital Partners, LLC, 4

World Trade Center, 29th Floor, New York, NY 10007, by phone at

(929) 833-1246 or by email at prospectus@titanpartnersgrp.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such state or other jurisdiction.

About Owlet, Inc.

Owlet’s digital health infant monitoring platform is

transforming the journey of parenting. Owlet, Inc. (NYSE:OWLT), a

small-cap healthcare growth equity, offers FDA-authorized medical

and consumer pediatric wearables and an integrated HD visual and

audio camera that provide real-time data and insights to parents

who safeguard health, optimize wellness, and ensure peaceful sleep,

for their children.

Since 2012, over 2 million parents worldwide have used Owlet’s

platform contributing to one of the largest collections of consumer

infant health and sleep data. The Company continues to develop

software and digital data solutions to bridge the current

healthcare gap between hospital and home and bring new insights to

parents and caregivers globally. Owlet believes that every child

deserves to live a long, happy, and healthy life. To learn more,

visit www.owletcare.com.

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements. All

statements other than statements of historical facts contained

herein including, without limitation, statements regarding the

completion, timing and size of the proposed public offering and the

grant to the underwriter of an option to purchase additional shares

are forward-looking statements reflecting the current beliefs and

expectations of Owlet’s management made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements represent Owlet’s current expectations

regarding future events and are subject to known and unknown risks

and uncertainties that could cause actual results to differ

materially from those implied by the forward-looking statements.

Among those risks and uncertainties are market conditions,

including market interest rates, the trading price and volatility

of Owlet’s Class A common stock, the satisfaction of closing

conditions related to the proposed public offering, and risks

relating to Owlet’s business, including those risks described in

periodic reports that Owlet files from time to time with the SEC,

as well as the preliminary prospectus supplement and accompanying

prospectus relating to the proposed public offering. The

forward-looking statements included in this press release speak

only as of the date of this press release, and Owlet does not

undertake to update the statements included in this press release

for subsequent developments, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911270241/en/

Investor Relations: Jay Gentzkow

jgentzkow@owletcare.com

Media: pr@owletcare.com

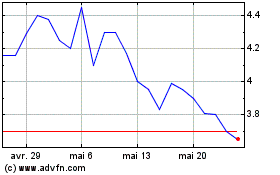

Sandbridge Aquisition (NYSE:OWLT)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Sandbridge Aquisition (NYSE:OWLT)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024