Par Pacific Announces Amendment to ABL Credit Facility and Credit Rating Upgrade by Moody’s Investors Service

25 Mars 2024 - 1:00PM

Par Pacific Holdings, Inc. (NYSE: PARR) (“Par

Pacific”) today announced that, on March 22, 2024, it

entered into the previously announced amendment to its asset-based

revolving credit facility (“ABL”). The ABL amendment will increase

the size of the Company’s ABL from $900 million to $1.4 billion and

is conditioned upon the termination of the Company’s existing

intermediation agreement, which is expected to occur on or about

May 31, 2024. The increase is based, in part, on the addition of

certain collateral assets in Hawaii, including refined product

inventory and accounts receivable.

In addition, the Company today announced that

Moody’s Investors Service has upgraded its corporate family rating

to Ba3 from B1.

About Par PacificPar Pacific Holdings, Inc.

(NYSE: PARR), headquartered in Houston, Texas, is a growing energy

company providing both renewable and conventional fuels to the

western United States. In the Pacific Northwest and the Rockies,

Par Pacific owns and operates 125,000 bpd of combined refining

capacity across three locations and an extensive energy

infrastructure network, including 7.6 million barrels of storage,

and marine, rail, rack, and pipeline assets. In addition, Par

Pacific operates the “nomnom” convenience store chain and supplies

ExxonMobil-branded fuel retail stations in the region. Par Pacific

owns and operates one of the largest energy infrastructure networks

in Hawaii with 94,000 bpd of operating refining capacity, a

logistics system supplying the major islands of the state and

Hele-branded retail locations. Par Pacific also owns 46% of Laramie

Energy, LLC, a natural gas production company with operations and

assets concentrated in Western Colorado. More information is

available at www.parpacific.com.

For more information contact:Ashimi PatelVP,

Investor Relations and Sustainability(832)

916-3355apatel@parpacific.com

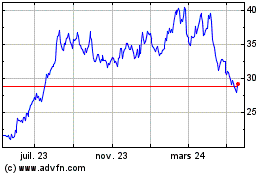

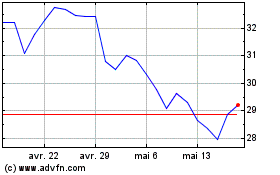

Par Pacific (NYSE:PARR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Par Pacific (NYSE:PARR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024