SDCL EDGE Acquisition Corporation Announces Letter of Intent for a Business Combination with Magnet Joint Venture GmbH and Certain Assets of KME SE Comprising the KME Specialty Aerospace Business

21 Août 2023 - 12:30PM

Business Wire

SDCL EDGE Acquisition Corporation (“SEDA” or the “Company”)

announced today that it has executed a non-binding letter of intent

(the “LOI”) with Magnet Joint Venture GmbH (“JV GmbH”), KME SE

(“KME”) and The Paragon Fund III GmbH & Co. geschlossene

Investment KG (“Paragon”), for a proposed business combination (the

“Business Combination”) relating to the special product business of

Cunova GmbH, a wholly-owned subsidiary of JV GmbH (“Cunova”) and

certain assets of KME comprising the KME Specialty Aerospace

Business (“KME Aerospace” and, together with Cunova, the

“Target”).

Under the terms of the LOI, KME is expected to hold a majority

stake in the post-Business Combination entity whose share capital

will be listed on the New York Stock Exchange. The Company

anticipates announcing additional details at the time of execution

of the definitive agreements (“Definitive Agreements”) for the

Business Combination.

The completion of the Business Combination is subject to, among

other things, the completion of due diligence, the negotiation of

the Definitive Agreements, satisfaction of the conditions

negotiated therein, approval of the transaction by the board and

shareholders of both the Company and Target, as well as regulatory

approvals and other customary conditions. There can be no assurance

that Definitive Agreements will be entered into or that the

Business Combination will be consummated on the terms or timeframe

currently contemplated, or at all.

About SDCL EDGE Acquisition Corporation

SDCL EDGE Acquisition Corporation is a blank check company

formed for the purpose of effecting a merger, capital stock

exchange, asset acquisition, stock purchase, reorganization or

similar business combination with one or more businesses. The

Company intends to focus on opportunities created by the rapid

shift towards energy efficient and decentralized energy solutions

for a lower carbon economy and, in particular, for the built

environment and transport sectors.

About Cunova GmbH and KME Specialty Aerospace

Business

Cunova and KME Aerospace are two specialty metals businesses,

producing critical components for the processes of offtakers in the

industrials and maritime, and aerospace sectors, respectively.

Cunova is a wholly-owned subsidiary of JV GmbH and KME Aerospace is

entirely owned by KME. For KME Aerospace, the LOI contemplates that

the same will be transferred to Cunova or an affiliate of the

post-Business Combination entity prior to the consummation of the

Business Combination.

Additional Information and Where to Find It

If a legally binding definitive agreement with respect to the

Business Combination is executed, SEDA intends to file preliminary

and definitive proxy statements/prospectuses with the SEC. The

preliminary and definitive proxy statements/prospectuses and other

relevant documents will be sent or given to the SEDA’s shareholders

as of the record date established for voting on the proposed

transaction. Shareholders will also be able to obtain copies of the

proxy statement/prospectus, without charge, once available, at the

SEC’s website at www.sec.gov or by directing a request to: SDCL

EDGE Acquisition Corporation, 60 East 42nd Street, Suite 1100, New

York, NY. The information contained on, or that may be accessed

through, the websites referenced in this press release is not

incorporated by reference into, and is not a part of, this press

release.

SEDA urges investors, shareholders and other interested persons

to read, when available, the preliminary and definitive proxy

statements/prospectuses as well as other documents filed with the

SEC because these documents will contain important information

about SEDA, Target and the proposed transaction.

No Offer or Solicitation

This press release shall not constitute a solicitation of a

proxy, consent, or authorization with respect to any securities or

in respect of the proposed transaction. This press release shall

also not constitute an offer to sell or the solicitation of an

offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of the U.S. Securities Act of

1933, as amended, or an exemption therefrom.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical fact

included in this press release are forward-looking statements. When

used in this press release, words such as “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “will,” and similar expressions, as

they relate to us or our management team, identify forward-looking

statements. Such forward-looking statements are based on the

beliefs of management, as well as assumptions made by, and

information currently available to, the Company’s management.

Actual results could differ materially from those contemplated by

the forward-looking statements as a result of certain risks and

uncertainties that include, but are not limited to, the Company’s

ability to enter into the Definitive Agreements within the time

provided in the Company’s amended and restated memorandum and

articles of association; the performance of the Target’s business;

the risk that the approval of the Company’s shareholders for the

Business Combination is not obtained; failure to realize the

anticipated benefits of the Business Combination, including as a

result of a delay in consummating the Business Combination; the

amount of redemption requests made by the Company’s shareholders

and the amount of funds remaining in the Company’s trust account

after satisfaction of such requests; the Company’s, Paragon’s,

KME’s and Target’s ability to satisfy the conditions to closing the

Business Combination; and those other factors set forth in the

Company’s filings with the SEC. All subsequent written or oral

forward-looking statements attributable to us or persons acting on

our behalf are qualified in their entirety by this paragraph.

Forward-looking statements are subject to numerous conditions, many

of which are beyond the control of the Company, including those set

forth in the Risk Factors section of the Company’s filings with the

SEC. Copies of such filings are available on the SEC’s website,

www.sec.gov. The Company undertakes no obligation to update these

statements for revisions or changes after the date of this release,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230821865398/en/

Ned Davis Chief Financial Officer, SDCL EDGE Acquisition

Corporation (212) 488-5509 info@sdclgroup.com

Francesca Lorenzini Investor Relations Director, SDCL EDGE

Acquisition Corporation (212) 488-5509 info@sdclgroup.com

Kelly McAndrew Financial Profiles, Inc. 310-622-8239

kmcandrew@finprofiles.com

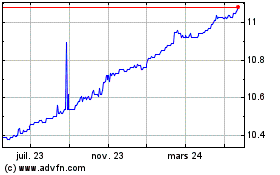

SDCL EDGE Acquisition (NYSE:SEDA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

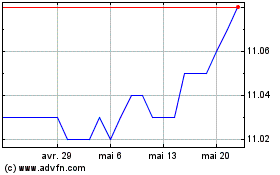

SDCL EDGE Acquisition (NYSE:SEDA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025