cunova to simultaneously acquire KME Group’s

aerospace specialty metals business

- The proposed business combination is expected to create a

scaled, global manufacturer of mission-critical specialty copper

alloy products with growth opportunities across diverse end markets

including casting, aerospace, maritime, industrial and energy.

- The combined company will have a compelling and proven business

model with historically high recurring revenue and attractive

margins, dynamic competitive positioning and barriers to entry, and

limited exposure to commodity price variation risk.

- If the proposed business combination is consummated, the

combined company is expected to have an enterprise value of

approximately US$736 million.

cunova GmbH (“cunova”) a leading global manufacturer of high-end

specialty copper alloy products, and SDCL EDGE Acquisition

Corporation (NYSE: SEDA) (“SEDA”), a special purpose acquisition

company, today announced that they have entered into a definitive

business combination agreement that is expected to result in cunova

becoming a publicly listed company on the New York Stock Exchange

(“NYSE”).

Headquartered in Osnabrück, Germany, cunova is a leading global

producer of mission‑critical copper alloy products and related

services and solutions for a diverse array of end markets including

casting, maritime, industrial and energy.

cunova has an established reputation and long-term relationships

with a loyal base of blue-chip customers, including a majority of

the 25 largest steel companies across four continents. cunova’s

products are often both mission-critical and integrated into

clients’ processes. Copper is one of the most widely used metals

today, and it is anticipated that the combined company will be well

positioned to capitalize on a sustained global demand for copper

alloys with high conductivity performance in thermal or electrical

applications, driven by new emerging markets and technological

advancements. cunova’s acquisition of the whole aerospace specialty

metals business of KME Group (“KME Aerospace”) would enable the

combined company to also serve the space exploration and general

aerospace markets.

cunova is dedicated to resource efficiency and the circular

economy, and supports the transition to energy conservation.

cunova’s products offer high levels of endurance, including

temperature and pressure resistance, allowing them to last longer

without replacement and enabling critical components to be

recycled. In 2023, over half of the copper used to make cunova’s

products was sourced from recycled scrap.

“We are thrilled to partner with SEDA. They have a deep

understanding of our business, vision, and growth opportunities,”

said Werner Stegmüller, CEO of cunova. “As a global leader in the

copper industry with an extensive history of success, cunova is

relentlessly committed to understanding and anticipating our

customers’ needs. We strive to be constantly innovative so as to

deliver high-end, value-added products and solutions that are both

mission-critical and specific to our customers’ processes. As a

result, we have built exceptionally close relationships with our

customers and an attractive business model with recurring revenues.

We believe we are well-positioned to deliver sustained, profitable

growth and returns to shareholders by leveraging our world‑class

platform to expand into new markets, driven by emerging technology

and trends, including space exploration.”

“We are excited to join forces with KME Aerospace, which we

believe will give us access to a new, exciting, and high-growth end

market. Space exploration activity is currently outpacing the

reusability rate of engines and we expect this could triple our

addressable copper component market opportunity from 2023 to 2030.

As an established provider of mission-critical rocket engine

components to nearly all the western tier one companies in the

space exploration sector, we believe KME Aerospace currently has a

first mover advantage in this end market,” added Werner Stegmüller,

CEO of cunova.

“We are extremely pleased to be partnering with cunova to help

them advance their vision and growth strategy,” said Jonathan

Maxwell, Chairman and Co-CEO of SEDA. “We set out to acquire a

company with a proven business model and strong growth prospects

that is poised to create long-term value for shareholders, and we

believe cunova meets these criteria. Finally, as a provider of

critical components that support the transition to energy

conservation and resource efficiency in the maritime and steel

industries and, following its acquisition of KME Aerospace, the

aerospace industry, the combined company is expected to contribute

meaningfully to its customers’ sustainability initiatives.”

“As part of cunova, we believe KME Aerospace will be well

positioned to capitalize on growth opportunities in space

exploration. As the anticipated majority shareholder of cunova

following the listing, KME Group will also have a vested interest

in cunova’s long-term growth and success,” said Vincenzo Manes,

Chairman of KME Group.

Transaction Overview

Under the terms of the proposed business combination agreement,

cunova will be indirectly acquired by a publicly-listed, successor

entity of SDCL EDGE Acquisition Corporation. Also as part of the

proposed business combination, cunova will acquire KME Aerospace

from KME Group. The combined company is expected to be listed on

the NYSE. Paragon Partners, the current majority shareholder of

cunova through its vehicle The Paragon Fund III GmbH & Co.

geschlossene Investment KG (“Paragon”), is expected to exit cunova

as a result of the proposed business combination, and KME Group is

expected to become the majority shareholder of cunova.

At closing, the combined company is expected to have a pro-forma

enterprise value of approximately US$736 million comprised of pro

forma net debt of US$289 million and an equity value of

approximately US$447 million. Existing SEDA shareholders and any

potential investors agreeing to commit to any equity transaction

that may be completed prior to the closing of the proposed business

combination are expected to own approximately 39.9% of the shares

outstanding of the combined company and KME Group is expected to

own the approximate remaining 60.1%. These estimates are subject to

certain assumptions as well as market conditions and the final

transaction structure.

The business combination values cunova and KME Aerospace at an

enterprise value of approximately 9.4 times cunova’s pro forma 2023

Adjusted EBITDA of US$78 million.

The board of SEDA and the shareholders of cunova have approved

the proposed business combination subject to customary closing

conditions. The closing conditions include, but are not limited to,

obtaining all required regulatory approvals, the approval of the

shareholders of SEDA, securing minimum cash of US$140 million,

refinancing cunova’s current debt, and the registration statement

to be filed in connection with the proposed business combination

being declared effective by the U.S. Securities and Exchange

Commission (the “SEC”). Assuming satisfaction of all closing

conditions, the proposed business combination is expected to close

in the second quarter of 2024.

Adjusted EBITDA Reconciliation

cunova

US$m1

2021

2022

2023P

Net income

22

15

6

Income taxes

4

8

9

Interest expense

10

20

33

Depreciation & Amortization

10

9

8

EBITDA

47

52

56

Exceptional Items (carve-out cost)

8

7

5

Adjusted EBITDA

55

59

61

1. Assumes 2023 average EUR/USD exchange rate of 1.081; values

may not add up due to rounding

Aerospace

US$m1

2021

2022

2023P

Net income

-

4

12

Income taxes

-

2

5

Interest expense

-

-

-

Depreciation & Amortization

-

-

-

EBITDA

-

6

18

Exceptional Items (carve-out cost)

-

-

-

Adjusted EBITDA

-

6

18

1. Assumes 2023 average EUR/USD exchange rate of 1.081; values

may not add up due to rounding

Advisors

Rothschild & Co is serving as sole financial and capital

markets advisor to SEDA. Skadden, Arps, Slate, Meagher & Flom

(UK) LLP is serving as counsel to SEDA. Latham & Watkins LLP is

serving as counsel to Paragon and cunova. Morgan, Lewis &

Bockius LLP is serving as counsel to KME. Davis Polk & Wardwell

LLP is acting as legal advisor to Rothschild & Co.

About cunova

Headquartered in Osnabrück, Germany, cunova (previously KME

Special Products and Solutions) has an extensive history as a

leading global producer of mission-critical copper alloy products

and solutions for a diverse set of end markets including casting,

maritime, and industrial & energy. cunova has a

well-established reputation for high quality products and solutions

and a demonstrated commitment to continuous innovation. For more

information about cunova, please visit https://www.cunova.com.

About KME Aerospace

KME Aerospace is a leading engineering business that supplies

high-tolerance copper alloy components to major players in the

aerospace industry. Through the expected acquisition of KME

Aerospace by cunova, the combined company would also serve the

space exploration market.

About SDCL EDGE Acquisition Corp.

SEDA is a special purpose acquisition company formed for the

purpose of effecting a merger, capital stock exchange, asset

acquisition, stock purchase, reorganization, or similar business

combination with one or more businesses. For more information above

SEDA, please visit https://www.sdcledge.com.

The information contained on, or that may be accessed through,

the websites referenced in this press release is not incorporated

by reference into, and is not a part of, this press release.

Additional Information and Where to Find It

In connection with the proposed business combination, the

combined company will file a registration statement with the SEC,

of which a proxy statement/prospectus will form a part. The

definitive proxy statement/prospectus and other relevant documents

will be sent or given to SEDA’s shareholders as of a record date to

be established for voting at SEDA’s shareholder meeting relating to

the proposed business combination. SEDA and the combined company

may also file other documents regarding the proposed business

combination with the SEC. This press release does not contain all

of the information that should be considered concerning the

proposed business combination and is not intended to form the basis

of any investment decision or any other decision in respect of the

proposed business combination. SEDA’s shareholders and other

interested persons are advised to read, when available, the

registration statement of the combined company and the proxy

statement/prospectus which will form a part thereof and any

amendments thereto and all other relevant documents filed or that

will be filed in connection with the proposed business combination,

as these materials will contain important information about cunova,

KME Aerospace, SEDA, the combined company and the proposed business

combination. The registration statement of the combined company and

the proxy statement/prospectus which will form a part thereof and

other documents that are filed with the SEC, once available, may be

obtained without charge at the SEC’s website at www.sec.gov or by

directing a written request to: SDCL EDGE Acquisition Corporation,

60 East 42nd Street, Suite 1100, New York, NY, Attn: Francesca

Lorenzini.

NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY AGENCY HAS

APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PRESS

RELEASE, PASSED UPON THE MERITS OR FAIRNESS OF THE PROPOSED

BUSINESS COMBINATION OR ANY RELATED TRANSACTIONS OR PASSED UPON THE

ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PRESS RELEASE. ANY

REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

Participants in the Solicitation

SEDA, cunova, certain shareholders of SEDA, KME Group, and

certain of SEDA’s, cunova’s, and KME Group’s respective directors,

executive officers and other members of management and employees

may, under SEC rules, be deemed to be participants in the

solicitation of proxies from the shareholders of SEDA with respect

to the proposed business combination. A list of the names of such

persons and information regarding their interests in the proposed

business combination will be contained in the registration

statement of the combined company and the proxy

statement/prospectus which will form a part thereof, when

available. Shareholders, potential investors and other interested

persons should read the registration statement of the combined

company and the proxy statement/prospectus which will form a part

thereof carefully when they become available and before making any

voting or investment decisions. Free copies of these documents may

be obtained from the sources indicated above, when available.

No Offer or Solicitation

This press release is for informational purposes only and shall

not constitute a solicitation of a proxy, consent, or authorization

with respect to any securities or in respect of the proposed

business combination. This press release shall also not constitute

an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any states

or jurisdictions in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of the U.S. Securities Act of 1933, as amended, or an

exemption therefrom.

Forward-Looking Statements

This press release includes certain statements that are not

historical facts but are forward-looking statements for purposes of

the applicable U.S. securities laws. Forward-looking statements

generally are accompanied by words such as “anticipate,” “believe,”

“continue,” “estimate,” “expect,” “intend,” “may,” “plan,”

“predict,” “potential,” “seek,” “seem,” “should,” “will,” “would,”

and similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements are based on various assumptions,

whether or not identified in this press release, and on the current

expectations of the respective management of SEDA, cunova and KME

Group and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on

as, a guarantee, an assurance, a prediction or a definitive

statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from

assumptions. Many actual events and circumstances are beyond the

control of SEDA, cunova or KME Group. Potential risks and

uncertainties that could cause the actual results to differ

materially from those expressed or implied by forward-looking

statements include, but are not limited to: the outcome of any

legal proceedings that may be instituted in connection with the

proposed business combination; delays in obtaining, adverse

contained in, or the inability to obtain necessary regulatory

approvals or complete regulatory reviews required to complete the

proposed business combination; the risk that the proposed business

combination disrupts cunova’s or KME Aerospace’s current plans and

operations; the inability of cunova to recognize the anticipated

benefits of the proposed business combination, including its

acquisition of KME Aerospace, which may be affected by, among other

things, competition, the ability of the combined company to grow

and manage growth profitably with customers and suppliers and

retain key employees; the risk that cunova’s or KME Aerospace’s

projected pipeline of projects and production capacity do not meet

cunova’s or KME Aerospace’s proposed timeline or that such pipeline

fails to be met at all; costs related to the proposed business

combination; the risk that the proposed business combination does

not close in the second quarter of 2024 or does not close at all;

changes in the applicable laws or regulations; the possibility that

cunova, KME Aerospace, or the combined company may be adversely

affected by other economic, business, and/or competitive factors;

economic uncertainty caused by the impacts of geopolitical

conflicts, including Russia’s invasion of Ukraine and the ongoing

conflicts in the Middle East; economic uncertainty due to rising

levels of inflation and interest rates; the risk that the approval

of the shareholders of SEDA for the proposed business combination

is not obtained; the risk that any current or future equity or debt

transactions are not completed prior to the closing of the proposed

business combination; the risk that even if any current or future

equity or debt transactions are completed, they will not be

sufficient to satisfy the minimum cash condition set forth in the

definitive documentation in connection with the proposed business

combination and/or fund the combined company’s execution on its

near-term project pipeline allowing the combined company to scale

its operations; the amount of redemption requests made by SEDA’s

shareholders and the amount of funds remaining in SEDA’s trust

account after satisfaction of such requests prior to the closing of

the proposed business combination; SEDA’s, cunova’s, KME

Aerospace’s and the other parties to the definitive documentation

in connection with the proposed business combination ability to

satisfy the conditions to closing the proposed business

combination; the ability to maintain listing of SEDA’s securities

on the NYSE; and those factors discussed in SEDA’s public reports

filed with the SEC, including its Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K,

the proxy statement relating to SEDA’s extension, as well as the

registration statement on Form F-4 of the combined company, and the

proxy statement/prospectus which will form a part thereof that the

parties intend to file with the SEC in connection with the proposed

business combination. If any of these risks materialize or SEDA’s,

cunova’s or KME Group’s assumptions prove incorrect, actual results

could differ materially from the results implied by these

forward-looking statements. There may be additional risks that

neither SEDA, cunova nor KME Group presently know, or that SEDA,

cunova and KME Group currently believe are immaterial, that could

also cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect SEDA’s, cunova’s and KME Group’s expectations, plans or

forecasts of future events and views as of the date of this press

release. SEDA, cunova and KME Group anticipate that subsequent

events and developments may cause their assessments to change.

SEDA, cunova and KME Group specifically disclaim any obligation to

update or revise any forward-looking statements, except as required

by law. These forward-looking statements should not be relied upon

as representing SEDA’s, cunova’s or KME Group’s assessments as of

any date subsequent to the date of this press release. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240220283857/en/

Investor and Media Contacts

Ned Davis Chief Financial Officer SDCL EDGE Acquisition

Corporation (917) 941-8334 ned.davis@sdclgroup.com

Francesca Lorenzini Investor Relations Director SDCL EDGE

Acquisition Corporation (512) 632-0292

francesca.lorenzini@sdclgroup.com

Financial Profiles, Inc. Moira Conlon mconlon@finprofiles.com

(310) 622-8220 Kelly McAndrew (310) 622-8239

kmcandrew@finprofiles.com

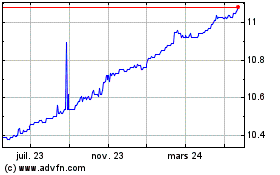

SDCL EDGE Acquisition (NYSE:SEDA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

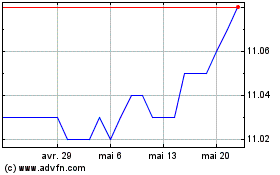

SDCL EDGE Acquisition (NYSE:SEDA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024