Eaton Partners Acts as Exclusive Placement Agent for 3 Boomerang Capital’s First Fund

06 Février 2024 - 7:30PM

Eaton Partners, one of the largest placement agents and fund

advisory firms and a wholly-owned subsidiary of Stifel Financial

Corp. (NYSE: SF), is pleased to have acted as the exclusive

placement agent for 3 Boomerang Capital (“3 Boomerang” or the

“Firm”), for its flagship private equity fund, 3 Boomerang Capital

I, LP (the “Fund”). The oversubscribed Fund closed over $375

million of commitments from a diverse investor group, including

leading endowments, foundations, pensions, insurers, fund of funds,

family offices, and 3 Boomerang professionals.

Founded by industry veterans Adam Dolder and Adam Elberg, 3

Boomerang executed an efficient and successful fundraise,

demonstrating strong investor confidence in its differentiated

approach to value creation in the healthcare industry. This

milestone marks a significant achievement for the Firm, showcasing

its commitment to supporting healthcare entrepreneurs and

businesses in pursuit of growth and innovation.

3 Boomerang is backed by a distinguished team of 11

professionals with expertise spanning North America and Western

Europe. 3 Boomerang’s investment focus areas are four key

healthcare sectors: BioPharma outsourcing, medical device and

diagnostic manufacturing, information technology and tech-enabled

services, and alternate site care. The firm specializes in backing

founder-led businesses, providing the guidance and resources needed

for successful growth in the healthcare market. By strategically

concentrating on these areas, 3 Boomerang is well equipped to

deliver on its mission of propelling healthcare businesses to new

heights.

Adam Dolder, a career healthcare investor, expressed his

enthusiasm for the recent achievement, stating, "We are thrilled

with the success of our inaugural private equity fund and are

grateful for the partnership and trust of our Limited Partners.

This accomplishment reinforces our commitment to fostering creative

investment partnerships with healthcare entrepreneurs that bolsters

the growth of their businesses."

“3 Boomerang’s thematic investment focus and proven track record

of partnering with founder-led businesses resonated well with

investors,” said Eric Deyle, Managing Director at Eaton Partners.

“We greatly value our partnership with the 3 Boomerang team and we

wish them continued success.”

About Eaton Partners Eaton Partners, a

Stifel Company, is one of the world’s largest capital placement

agents and fund advisory firms, having raised more than $140

billion across more than 190 highly differentiated alternative

investment funds and offerings. Founded in 1983, Eaton advises and

raises institutional capital for investment managers across

alternative strategies – private equity, private credit, real

assets, real estate, and hedge funds/public market – in both the

primary and secondary markets. Eaton Partners maintains offices and

operates throughout North America, Europe, and Asia.

Eaton Partners is a division of Stifel, Nicolaus & Company,

Incorporated, Member SIPC and NYSE. Eaton Partners subsidiary Eaton

Partners (UK) LLP is authorized and regulated by the Financial

Conduct Authority (FCA). Eaton Partners subsidiary Stifel Hong Kong

Limited, doing business as Eaton Partners Hong Kong, is approved as

a Type 1-licensed company under the Securities and Futures

Commission (SFC) in Hong Kong. Eaton Partners and the Eaton

Partners logo are trademarks of Eaton Partners, LLC, a limited

liability company. ® Eaton Partners, 2024. For more information,

please visit https://eaton-partners.com/.

About 3 Boomerang Capital3

Boomerang Capital, LP (“3BC”) is an emerging healthcare investment

firm with 11 professionals investing in North American and Western

Europe. 3BC is a thematic investor in lower middle market

healthcare businesses with a deep focus on the following

subsectors: (i) Biopharmaceutical Outsourcing, (ii) Medical Device

and Diagnostic Contract Manufacturing, (iii) Health Care

Information Technology & Technology Enabled Services, and (iv)

Alternate Site Care. The firm pursues a preemptive and proprietary

approach to sourcing investments and has a control investment bias.

Additionally, the firm seeks to be an active and aligned partner to

management, leveraging industry expertise and operational

excellence to build leading businesses with strong organic and

inorganic growth profiles.

Stifel Company

InformationStifel Financial Corp. (NYSE: SF) is a

financial services holding company headquartered in St. Louis,

Missouri, that conducts its banking, securities, and financial

services business through several wholly owned subsidiaries.

Stifel’s broker-dealer clients are served in the United States

through Stifel, Nicolaus & Company, Incorporated, including its

Eaton Partners and Miller Buckfire business divisions; Keefe,

Bruyette & Woods, Inc.; and Stifel Independent Advisors, LLC;

in Canada through Stifel Nicolaus Canada Inc.; and in the United

Kingdom and Europe through Stifel Nicolaus Europe Limited. The

Company’s broker-dealer affiliates provide securities brokerage,

investment banking, trading, investment advisory, and related

financial services to individual investors, professional money

managers, businesses, and municipalities. Stifel Bank and Stifel

Bank & Trust offer a full range of consumer and commercial

lending solutions. Stifel Trust Company, N.A. and Stifel Trust

Company Delaware, N.A. offer trust and related services. To learn

more about Stifel, please visit the Company’s website at

www.stifel.com. For global disclosures, please visit

https://www.stifel.com/investor-relations/press-releases.

Media Contacts Neil Shapiro, +1 (212) 271-3447

shapiron@stifel.com

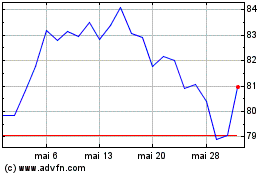

Stifel Financial (NYSE:SF)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Stifel Financial (NYSE:SF)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024