STIFEL TO ACQUIRE FINANCE 500 and CB RESOURCE

14 Mars 2024 - 1:30PM

Stifel Financial Corp. (NYSE: SF) today announced it has signed a

definitive agreement to acquire Finance 500, Inc. (“Finance 500”)

and CB Resource, Inc. (“CBR”). Terms of the transaction were not

disclosed.

The Irvine-based companies, which operate as

strategic partners under common ownership, are market leaders in

the underwriting and issuance of certificates of deposits, having

assisted more than 1,200 depository institutions in raising over

$200 billion to support near and long-term funding needs. CBR

offers an advanced technology-enabled platform to deliver

enterprise risk management, strategic planning, capital planning,

and interactive performance-based analytics for community banks

nationwide.

“We are always looking for opportunities to

enhance our offering and better serve our clients,” said Brant

McDuffie, Global Co-Head of Stifel Fixed Income Capital Markets.

“The addition of Finance 500 and CBR provides Stifel a

technology-driven platform that will ensure our existing brokered

CD funding business, our institutional CD investment offerings, and

our community bank balance sheet risk management practice, are

scalable and sustainable for the future. We all share the same

client-driven approach and expect the Finance 500 and CBR teams to

seamlessly integrate into our platform.”

“Finance 500 and CBR, with our 40 years of

experience, joined forces to deliver industry-leading CD funding,

trading, ERM, planning, and performance-based analytics on a

scalable platform,” stated Jeff Rigsby, Chairman and CEO of both

companies. “We couldn’t be more excited to join Stifel’s solutions

and growth-driven team. Our clients will benefit from Stifel’s

market presence, financial strength, and access to the firm’s

comprehensive suite of products and services.”

Keefe, Bruyette & Woods, A Stifel Company,

acted as exclusive financial advisor and Bryan Cave Leighton

Paisner LLP acted as legal advisor to Stifel in the transaction.

Houlihan Lokey acted as exclusive financial advisor and Calfee,

Halter & Griswold LLP acted as legal advisor to Finance 500 and

CB Resource.

Stifel Company InformationStifel

Financial Corp. (NYSE: SF) is a financial services holding company

headquartered in St. Louis, Missouri, that conducts its banking,

securities, and financial services business through several wholly

owned subsidiaries. Stifel’s broker-dealer clients are served in

the United States through Stifel, Nicolaus & Company,

Incorporated, including its Eaton Partners and Miller Buckfire

business divisions; Keefe, Bruyette & Woods, Inc.; and Stifel

Independent Advisors, LLC; in Canada through Stifel Nicolaus Canada

Inc.; and in the United Kingdom and Europe through Stifel Nicolaus

Europe Limited. The Company’s broker-dealer affiliates provide

securities brokerage, investment banking, trading, investment

advisory, and related financial services to individual investors,

professional money managers, businesses, and municipalities. Stifel

Bank and Stifel Bank & Trust offer a full range of consumer and

commercial lending solutions. Stifel Trust Company, N.A. and Stifel

Trust Company Delaware, N.A. offer trust and related services. To

learn more about Stifel, please visit the Company’s website at

www.stifel.com. For global disclosures, please visit

https://www.stifel.com/investor-relations/press-releases.

Finance 500, Inc. and CB Resource, Inc.

InformationFinance 500, Inc. (“Finance 500”) is a

brokerage and investment services provider focused on underwriting

FDIC-insured Certificates of Deposits and fixed income securities

trading. CB Resource, Inc. (“CBR”) also operating as F500

Performance Management Group (“PMG”) seamlessly integrates ERM,

strategic and capital plan solutions, and robust industry analytics

through its fully integrated tech-enabled platform. For more

information go to www.finance500.com and

www.cb-resource.com.

Cautionary Note Regarding

Forward-Looking Statements The information contained in

this press release contains certain statements that may be deemed

to be “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements in this report not dealing

with historical results are forward-looking and are based on

various assumptions. The forward-looking statements in this report

are subject to risks and uncertainties that could cause actual

results to differ materially from those expressed in or implied by

the statements. Material factors and assumptions could cause actual

results to differ materially from current expectations. The Company

does not undertake to update forward-looking statements to reflect

circumstances or events that occur after the date the

forward-looking statements are made. The Company disclaims any

intent or obligation to update these forward-looking

statements.

Media ContactNeil Shapiro,

(212) 271-3447shapiron@stifel.com

Investor Relations Contact Joel

Jeffrey, (212) 271-3610 investorrelations@stifel.com

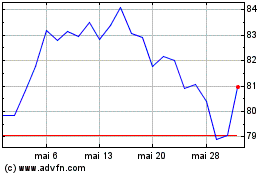

Stifel Financial (NYSE:SF)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Stifel Financial (NYSE:SF)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024